Global Market Comments

February 4, 2019

Fiat Lux

Featured Trade:

(THE MARKET FOR THE WEEK AHEAD, or FROM PANIC TO EUPHORIA),

(SPY), (TLT), (AAPL), (GLD),

Global Market Comments

February 4, 2019

Fiat Lux

Featured Trade:

(THE MARKET FOR THE WEEK AHEAD, or FROM PANIC TO EUPHORIA),

(SPY), (TLT), (AAPL), (GLD),

What a difference a month makes!

In a mere 31 days, we lurched from the worst December in history to the best January in 30 years. Traders have gone from lining up to jump off the Golden Gate Bridge to ordering Dom Perignon Champaign on Market Street.

However, not everything is as it appears. The suicide prevention hotline on the bridge has been broken for years, and you can now pick up Dom Perignon at Costco for only $120 a bottle.

Clearly, investors are enjoying the show but are keeping one eye on the exit. Perhaps that’s why gold (GLD) hit an 8-month high as nervous investors Hoover up a downside hedge against their long positions.

In fact, it has been the best January since 1987, with a ferocious start. The problem with that analogy is that I remember what followed that year (see chart below). After a robust first nine months of the year, the Dow Average (INDU) broke the 50-day moving average. It looked like just another minor correction and a buying opportunity.

The market ended up plunging 42% in weeks including a terrifying 20% capitulation swan dive on the last day. I tried actually to buy the stock at the close that day. The clerk just burst into tears and threw the handset on the floor. I didn’t get filled. Since the tape was running two hours late, NOBODY got filled on any orders entered after 12:00 PM.

It doesn’t help that markets have been rising in the face of a collapsing earnings picture. Look at the chart below and you’ll see that after peaking out at an annualized 26% a year ago in the wake the passage of the new tax bill, earnings have been rolling over like the Bismarck on their way to zero.

If you own stocks anywhere in the world, this chart should have made the hair on the back of your neck stand up. It’s almost as if the tax bill was delivering the OPPOSITE of its intended outcome.

How multiple expansion will we get in the face of fading earnings? How about none? How about negative!

A totally red-hot January Nonfarm payroll Report on Friday at 304,000 confirmed that the economy was still alive and well, at least on a trailing basis. Headline Unemployment Rate rose to 4.0%.

The Labor Department said that the government shutdown had no impact on the numbers because federal employees were furloughed and not unemployed. Tomato, tomahto.

However, 175,000 workers were laid off in the private sector and that is why the Unemployment Rate ticked up to a multi-month high. Noise from the shutdown is going to be affecting all data for months.

That’s also why part-time workers jumped 500,000 in January. A lot of federal employees started working as Uber drivers and pizza delivery guys to put food on the table without a paycheck.

Further confusing matters was the fact that December was revised down by 90,000.

Leisure & Hospitality led the way with 74,000 new jobs, followed by Construction with 52,000 and Health Care by 42,000 jobs.

The shutdown is over, but how much did it cost us? Standard & Poor’s says $6 billion but the restart costs will be greater. More recent estimates run as high as $11 billion.

Weekly Jobless Claims were up a stunning 53,000, to 253,000, an 18-month high. While government workers can’t claim, their private subcontractors can, hence the massive shutdown-driven jump.

Bitcoin hits a new one-year low at $3,400. Some $400 billion has gone to money Heaven since 2017. Only $113 billion in market capitalization remains. I told you it was a Ponzi scheme. US coal production hits a 39-year low as it is steadily replaced by natural gas and solar. Could there be a connection? Talk about data mining.

Earnings were mixed, with some companies coming out hero’s, others as goats.

Apple (AAPL) slightly beat expectations with revenues at $84.31 billion versus $83.97 billion expected, and earnings at $4.18 per share versus $4.17 expected. Guidance going forward is very cautious of a slowing China.

Good thing I saw the ambush coming and covered my short two days ago. A penny beat is the most managed earnings I have ever seen. To warn about earnings and then surprise to the upside is classic Tim Cook.

December Pending Home Sales cratered, down 2.2% in December and 9.8% YOY. Despite the dramatically lower mortgage interest rates, buyers fled the crashing stock market.

“PATIENCE” is still the order of the day at the Federal Reserve with its Open Market Committee Meeting ordering no interest rate rise. It was a trifecta for the doves. The free pass for stocks continues. That’s why I covered all my shorts starting from last week. Even a blind squirrel occasionally finds an acorn.

Tesla reported another profit for the second consecutive quarter, and the company is about to reach escape velocity. Model 3 production in 2019 is to reach 75% of the total output and we can expect a new pickup truck. A second factory in Shanghai will take the “3” to over a half million units a year. That $35,000 Tesla is just over the horizon.

Why are all major companies reporting good earnings but cautious guidance? Are they reading the newspapers, or do they know something we don’t? Not a great sign of a continuing bull market. Sell the next capitulation top.

This week was a classic example of how the harder I work, the luckier I get, and I have been working pretty hard lately.

I came out of a near money Apple (AAPL) put spread at cost, then rolled into a far money put spread just before the stock sold off. That little maneuver made me $1,030 in two days.

Then, I spotted a perfect “head and shoulders” top in the bond market set up by a three-point rally in the (TLT). When the red hot January Nonfarm Payroll report printed the next day at 5:30 AM PCT, bonds immediately gave back a full point.

It was all enough to boost my performance to a new all-time high after a hiatus of two months. Those who recently signed up for my service must think that I am some kind of freakin' genius! They’ll learn the truth soon enough.

My January and 2019 year-to-date return soared to +9.66%, boosting my trailing one-year return back up to +29.24%. The is my hottest start to a New Year in a decade. Sometimes you have to make a sacrifice to the trading gods to get rewarded and that is what December was all about.

My nine-year return climbed up to +309.80%, a new pinnacle. The average annualized return revived to +33.79%.

I am now 80% in cash, short the bond market, and short Apple.

The upcoming week is still iffy on the data front because of the government shutdown. Some government data may be delayed and other completely missing. Private sources will continue reporting on schedule. All of the data will be completely skewed for at least the next three months. You can count on the shutdown to dominate all media until it is over.

Jobs data will be the big events over the coming five days along with some important housing numbers. We also have several heavies reporting earnings.

On Monday, February 4 at 10:00 AM, we get the much delayed December Factory Orders. Alphabet (GOOGL) reports.

On Tuesday, February 5, 10:00 AM EST, we learn the January ISM Non-Manufacturing Index.

On Wednesday, February 6 at 8:30 AM EST, the November Trade Balance is published.

Thursday, February 7 at 8:30 AM EST, we get Weekly Jobless Claims. December Consumer Credit follows at 9:30 AM and should be a humdinger. Intercontinental Exchange (ICE) reports.

On Friday, February 8, at 10:00 AM EST, Wholesale Inventories are out. The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I’ll be sitting down with a case of Modelo Negro and a big bag of Cheetos to watch the commercials during the Super Bowl with my family. (My dad played for USC Varsity in 1948). I never forgave the Rams for defecting from Los Angeles, and Boston is too far away to care about.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

January 31, 2019

Fiat Lux

Featured Trade:

(MARKET GETS A FREE PASS FROM THE FED),

(SPY), ($INDU), (TLT), (GLD), (FXE), (UUP),

(APPLE SEIZES VICTORY FROM THE JAWS OF DEFEAT),

(AAPL)

When the Oxford English Dictionary considers the Word of the Year for 2019, I bet “PATIENCE” will be on the short list.

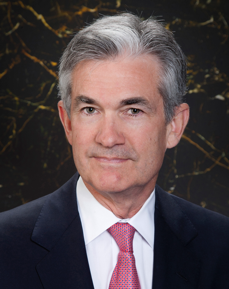

That was the noun that Federal Reserve governor Jerome Powell had in mind when describing the central bank's current stance on interest rates.

Not only did Powell say he was patient, he posited that the Fed was currently at a neutral interest rate. The last time he opened on this matter four months ago, the neutral rate was still 50 basis point higher, suggesting that more rate hikes were to come.

What a difference four months makes! The last time Powell spoke, the stock market crashed. Today, he might as well fire a flare gun signaling the beginning of a stampede by investors.

The Dow ($INDU) average at one point gained 500 points. Lower rates for longer term meant that bonds took it on the kisser. And gold (GLD) absolutely loved it as they now have less competition from interest-bearing instruments.

The US dollar (UUP) was taken out to the woodshed and beaten senseless paving the way for a nice pop in the euro (FXE). Even oil (USO) took the cue as cheaper interest rates mean a stronger global economy that will drink more Texas tea.

I believe that the Fed move today will definitely take a retest of the December 24 lows off the table for the time being. Now, if we can only get rid of that damn trade war with China, it will be off to the races for risk in general and stocks specifically.

Global Market Comments

January 29, 2019

Fiat Lux

Featured Trade:

(RISK CONTROL FOR DUMMIES),

(SPY), (AMZN), (TLT), (CRM), (VXX)

There is a method to my madness, although I understand that some new subscribers may need some convincing.

Whenever I change my positions, the market makes a major move or reaches a key crossroads, I look to stress test my portfolio by inflicting various extreme scenarios upon it and analyzing the outcome.

This is second nature for most hedge fund managers. In fact, the larger ones will use top of the line mainframes powered by $100 million worth of in-house custom programming to produce a real-time snapshot of their thousands of positions in all imaginable scenarios at all times.

If you want to invest with these guys feel free to do so. They require a $10-$25 million initial slug of capital, a one year lock up, charge a fixed management fee of 2% and a performance bonus of 20% or more.

You have to show minimum liquid assets of $2 million and sign 50 pages of disclosure documents. If you have ever sued a previous manager, forget it. The door slams shut. And, oh yes, the best performing funds are closed and have a ten-year waiting list to get in. Unless you are a major pension fund, they don’t want to hear from you.

Individual investors are not so sophisticated, and it clearly shows in their performance, which usually mirrors the indexes less a large haircut. So, I am going to let you in on my own, vastly simplified, dumbed down, seat of the pants, down and dirty style of risk management, scenario analysis, and stress testing that replicates 95% of the results of my vastly more expensive competitors.

There is no management fee, performance bonus, disclosure document, lock up, or upfront cash requirement. There’s just my token $3,000 a year subscription fee and that’s it. And I’m not choosy. I’ll take anyone whose credit card doesn’t get declined.

To make this even easier, you can perform your own analysis in the excel spreadsheet I post every day in the paid-up members section of Global Trading Dispatch. You can just download it and play around with it whenever you want, constructing your own best case and worst-case scenarios. To make this easy, I have posted this spreadsheet on my website for you to download by clicking here.

Since this is a “for dummies” explanation, I’ll keep this as simple as possible. No offense, we all started out as dummies, even me.

I’ll take Mad Hedge Model Trading Portfolio at the close of October 29, the date that the stock market bottomed and when I ramped up to a very aggressive 75% long with no hedges. This was the day when the Dow Average saw a 1,000 point intraday range, margin clerks were running rampant, and brokers were jumping out of windows.

I projected my portfolio returns in three possible scenarios: (1) The market collapses an additional 5% by the November 16 option expiration, some 15 trading days away, falling from $260 to $247, (2) the S&P 500 (SPY) rises 5% from $260 to $273 by November 16, and (3) the S&P 500 trades in a narrow range and remains around the then current level of $260.

Scenario 1 – The S&P 500 Falls 5%

A 5% loss and an average of a 5% decline in all stocks would take the (SPY) down to $247, well below the February $250 low, and off an astonishing 15.70% in one month. Such a cataclysmic move would have taken our year to date down to +11.03%. The (SPY) $150-$160 and (AMZN) $1,550-$1,600 call spreads would be total losses but are partly offset by maximum gains on all remaining positions, including the S&P 500 (SPY), Salesforce (CRM), and the United States US Treasury Bond Fund (TLT). My Puts on the iPath S&P 500 VIX Short Term Futures ETN (VXX) would become worthless.

However, with real interest rates at zero (3.1% ten-year US Treasury yield minis 3.1% inflation rate), the geopolitical front quiet, and my Mad Hedge Market Timing Index at a 30 year low of only 4, I thought there was less than a 1% chance of this happening.

Scenario 2 – S&P 500 rises 5%

The impact of a 5% rise in the market is easy to calculate. All positions expire at their maximum profit point, taking our model trading portfolio up 37.03% for 2018. It would be a monster home run. I would make back a little bit on the (VXX) but not much because of time decay.

Scenario 3 – S&P 500 Remains Unchanged

Again, we do OK, given the circumstances. The year-to-date stands at a still respectable 22.03%. Only the (AMZN) $1,550-$1,600 call spread is a total loss. The (VXX) puts would become nearly a total loss.

As it turned out, Scenario 2 played out and was the way to go. I stopped out of the losing (AMZN) $1,550-$1,600 call spread two days later for only a 1.73% loss, instead of -12.23% in the worst-case scenario. It was a case of $12.23 worth of risk control that only cost me $1.73. I’ll do that all day long, even though it cost me money. When running hedge funds, you are judged on how you manage your losses, not your gains, which are easy.

I took profit on the rest of my positions when they reached 88%-95% of their maximum potential profits and thus cut my risk to zero during these uncertain times. October finished with a gain of +1.24. By the time I liquidated my last position and went 95% cash, I was up 32.95% so far in 2018, against a Dow average that is up 2% on the year. It was a performance for the ages.

Keep in mind that these are only estimates, not guarantees, nor are they set in stone. Future levels of securities, like index ETFs, are easy to estimate. For other positions, it is more of an educated guess. This analysis is only as good as its assumptions. As we used to say in the computer world, garbage in equals garbage out.

Professionals who may want to take this out a few iterations can make further assumptions about market volatility, options implied volatility or the future course of interest rates. And let’s face it, politics was a major influence this year.

Keep the number of positions small to keep your workload under control. Imagine being Goldman Sachs and doing this for several thousand positions a day across all asset classes.

Once you get the hang of this, you can start projecting the effect on your portfolio of all kinds of outlying events. What if a major world leader is assassinated? Piece of cake. How about another 9/11? No problem. Oil at $150 a barrel? That’s a gimme.

What if there is an Israeli attack on Iranian nuclear facilities? That might take you all of two minutes to figure out. The Federal Reserve launches a surprise QE5 out of the blue? I think you already know the answer.

Now that you know how to make money in the options market, thanks to my Trade Alert service, I am going to teach you how to hang on to it.

There is no point in being clever and executing profitable trades only to lose your profits through some simple, careless mistakes.

So I have posted a training video on Risk Management. Note: you have to be logged in to the www.madhedgefundtrader.com website to view it.

The first goal of risk control is to preserve whatever capital you have. I tell people that I am too old to lose all my money and start over again as a junior trader at Morgan Stanley. Therefore, I am pretty careful when it comes to risk control.

The other goal of risk control is the art of managing your portfolio to make sure it is profitable no matter what happens in the marketplace. Ideally, you want to be a winner whether the market moves up, down, or sideways. I do this on a regular basis.

Remember, we are not trying to beat an index here. Our goal is to make absolute returns, or real dollars, at all times, no matter what the market does. You can’t eat relative performance, nor can you use it to pay your bills.

So the second goal of every portfolio manager is to make it bomb proof. You never know when a flock of black swans is going to come out of nowhere, or another geopolitical shock occurs, causing the market crash.

I’ll also show you how to use my Trade Alert service to squeeze every dollar out of your trading.

So, let’s get on with it!

To watch the Introduction to Risk Management, please click here.

Global Market Comments

January 28, 2019

Fiat Lux

Featured Trade:

(THE MARKET FOR THE WEEK AHEAD, or IT’S FINALLY OVER)

(SPY), (TLT), (FXE), (MSFT), (AAPL),

(PG), (F), (LRCX), (AMD), (XLNX)

Last week, I was too busy to cook dinner for my brood, so I ordered a pizza delivery. When an older man showed up with our dinner, I told the kids to tip him double. After all, he might be an unpaid federal air traffic controller.

It is a good thing I work late on Friday afternoon because that's when the government shutdown ended after 35 days. The bad news? The government stops getting paid again in only 18 more days. If you have to travel, you better do it quick as the open window may be short.

The most valuable thing we learned from all of this is that the weak point in America is the airline transportation system which relies on 4,000 flights to get the country’s business done.

Having once owned a European air charter company, I could have told you as much was coming. Every nut, bolt, and screw that goes into a US registered aircraft has to be inspected by the federal government. They are painted yellow when viewed which is called “yellow tagging”. No inspection, no screw. No screw, no airplane. No airplane, no flight. No flight, no economy. I can’t tell you how many times I have seen a $30 million aircraft grounded by a failed 50-cent part.

And here’s what most investors don’t get. We lost 75 basis points in GDP growth from the shutdown. We may lose another 75 basis points restarting. And if you lose 1.50% from a post-Christmas period that is normally weak anyway, Q1 GDP may well come in negative. Hello recession!

We won’t know for sure until the first advanced estimate of Q1 GDP from the US Department of Commerce’s Bureau of Economic Analysis is published on April 26. That’s when the sushi will hit the fan. That, by the way, is perilously close for the May 10 prediction of the end of the entire ten-year bull market.

How did investors fare during the shutdown? We clocked the best January in 32 years with the Dow Average up 7.55%. Maybe the government should stay closed all the time!

It is not like the government shutdown, the fading Chinese trade talks, and the arrest of the president’s pal were the only things happening last week.

A slowing China is freaking out investors everywhere. Even if a trade deal is cut tomorrow, it may not be enough to pull the economy out of a downward death spiral. Look out below! A 6.6% growth rate for 2018 is the slowest in 30 years.

Existing Home Sales were down a disastrous 6.4%, in December and 10% YOY, the worst read since 2012. The government shutdown is made closings nearly impossible.

The EC’s Mario Draghi said there would be no euro rate rises until 2020 and the US bond market took off like a rocket. Another point or two and we’ll be in short selling territory again. Don’t count on Europe to pull us out of the next recession. Whoever came up with the idea of putting an Italian in charge of Europe’s finances anyway? Like that was such a great idea.

Procter & Gamble (PG) beat with an upside earnings surprise. It must be all those people buying soap to wash their hands of our political system. But Ford (F) disappointed, dragged down by weak foreign earnings. The weakest big car company to get into electric cars is really starting to suffer. The last of the buggy whip makers is taking a swan dive

The semis have bottomed in the wake of spectacular earnings reports from (LRCX), (AMD), and (XLNX). The great artificial intelligence play is back in action after a severe spanking. I never had any doubt they would come back. Now for an entry point.

Farmers are leaving crops to rot in the field as the trade war with China destroys prices and the Mexicans needed to harvest them are trapped at the border. There’s got to be an easier way to earn a living. Avoid the ags and all ag plays. Short tofu stocks!

Investors are now sitting on pins and needles wondering if we get a repeat of the horrific February of 2018, or whether so far great earnings reports will drive us to higher highs. Earnings tail off right when the next government shutdown is supposed to start so our lives will be interesting, to say the least.

My January and 2019 year to date return soared to +7.24%, boosting my trailing one-year return back up to +30.23%.

My nine-year return climbed up to +308.14%, a mere 1.72% short of a new all time high. The average annualized return revived to +33.61%.

I have been dancing in between the raindrops using rallies to take profits on longs and big dips to cover shorts.

I started out the week using the 4 1/2 point plunge in the bond market (TLT) to cover the last of my shorts there, bring in a whopper of a $1,680 profit in only 13 trading days. To quote the Terminator (whose girlfriend I once dated, the Terminatrix), I’ll be back.”

I used the big 500-point swoon in the Dow on Monday to come out of my (SPY) short at cost. An unfortunate comment on interest rates by the European Central Bank forced me to stop out of my long in the Euro (FXE), also at cost.

That has whittled my portfolio down to only two positions, a long in Microsoft (MSFT) and a short in Apple (AAPL). As a pairs trade you could probably run this position for years. I am now 80% in cash.

The goal is to go 100% into cash into the February option expiration in 14 trading days, wait for a big breakout, and then fade it. Essentially, I am waiting for the market to tell me what to do. That will enable me to bank double-digit profits for the start of 2019, the best in a decade.

The upcoming week is very iffy on the data front because of the government shutdown. Some government data may be delayed and other completely missing. Private sources will continue reporting on schedule. All of the data will be completely skewed for at least the next three months. You can count on the shutdown to dominate all media until it is over.

Jobs data will be the big events over the coming five days along with some important housing numbers. We also have several heavies reporting earnings.

On Monday, January 28 at 8:30 AM EST, we get the Chicago Fed National Activity Index.

On Tuesday, January 29, 9:00 AM EST, the Case Shiller National Home Price Index for November is released. The ever important Apple (AAPL) earnings are out after the close, along with Juniper Networks (JNPR).

On Wednesday, January 30 at 8:15 AM EST, the ADP Private Employment Report is announced. Pending Home Sales for December follows. Boeing Aircraft (BA) and Facebook (FB), and PayPal (PYPL) announce.

Thursday, January 31 at 8:30 AM EST, we get Weekly Jobless Claims. We also get the all-important Consumer Spending Index for December. Amazon (AMZN) and General Electric (GE) announce.

On Friday, February 1 at 8:30 AM EST, the January NonFarm Payroll Report hits the tape.

The Baker-Hughes Rig Count follows at 1:00 PM. Schlumberger (SLB) announces earnings. Home Sales is released. AbbVie Inc (ABBV) and DR Horton (DHI) report.

As for me, I will be celebrating my birthday. Believe me, lighting 67 candles creates a real bonfire. I received the best birthday card ever from my daughter which I have copied below

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

January 22, 2019

Fiat Lux

Featured Trade:

(THE MARKET FOR THE WEEK AHEAD, or WHY I LOVE THE STOCK MARKET),

(SPY), (TLT), (MSFT), (CRM), (AMZN), (FXE)

(HOW TO EXECUTE A VERTICAL BULL CALL SPREAD),

(AAPL)

I love working in the stock market.

Not only can it be entertaining, it can be downright hilarious. All of the talking heads on TV who were ultra bearish on the December 24 Christmas Eve Massacre are now hyper bullish, stumbling over each other trying to buy back the shares they sold 20%-30% lower.

January is turning into a mirror image of December. Last month you never got the rally to sell into. This month you can’t get a decent dip to buy into. The worst December in history was followed by the best January in 30 years with the mere turning of a page of the calendar.

I suspected as much was coming. That’s why I lurched from 10% to 60% invested during the first few days of 2019. All that’s left now is to take profits.

We got a particularly nice 336-point gap up in the Dow Average ($INDU) on Friday with rumors of progress on the China trade talks. However, those who bought on such speculations over the past nine months have all been badly burned.

A few weeks ago, the biggest threat to the market was failure of the China trade talks and a new government shutdown. Now, with prices 3,250 points, or 15% higher, the biggest threat to the market is SUCCESS of the China trade talks and the END of the government shutdown. They could trigger a huge “buy the rumor, sell the news” market move.

And what if stocks rise virtually every day this month as they did during January a year ago? It could get followed by the February we saw last year which served up a horrific selloff.

Like a hot water heater with a corroded safety valve, pressure is building up in the stock market and it is just a matter of time before it explodes. The Volatility Index (VIX) has just halved from $36 to $17. The only question is whether the next big move will be to the upside or the downside.

Don’t get too bullish now. A ton of bad economic news will hit the market in February. China slowdown, European crash, Brexit, what’s not to hate?

Don’t forget that the deadline for the completion of the trade talks is March 1.

Special persecutor Robert Mueller could also drop his report on the market at any time. Just when you think that things can’t get any worse, they do so, in spades.

If nothing gets done, you can expect another Christmas Eve Massacre, except this time it will come nine months early. It could set up the double bottom for the entire correction.

On the other hand, if everything gets resolved all at once, you can count on share prices taking off to the upside and challenge the old highs. And it might all happen on the same day.

We started out the week discovering that Newmont Mining bought Goldcorp for $10 billion to create the world’s largest gold miner. That’s important because another classic sign of a long-term bottom for the barbarous relic is when the miners start taking over each other. I’ve seen it all before.

This was the week when economic data ceased to exist unless it comes from private sources. Entering the fifth week of the government shutdown, we are all now flying blind.

US Core Inflation rose only 2.2% YOY, after a miniscule 0.2% gain in December. Don’t count on that pay rise anytime soon. All your company’s money is going to share buybacks instead.

Apple’s Asian suppliers reported terrible numbers. iPhone prices in China were cut. Apple is also cutting back on hiring. Fewer iPhone sales mean fewer people are needed to make them. I think I’ll keep my Apple short position.

PG&E went Bankrupt in order to keep the lights on in the face of $30 billion in potential wildfire liabilities. It’s the second time in 20 years. Thank goodness for my solar panels. Power prices are about to spike up big time and I’m a net supplier to the grid.

Netflix raised prices and the stock soared. Their monthly take is jumping by 13%-18%. (NFLX) shares are now up by 50% since Christmas Eve. The Walking Dead and House of Cards just got more expensive.

Brexit went down in flames with a crushing 432 to 202 loss in the UK parliament, the worst in 100 years. The opposition tabled a vote of no confidence which failed by only ten votes, barely heading off a general election. Next to come is a new referendum on Brexit itself which will go down in flames. Buy the British pound (FXB).

What does the end of Brexit mean for the Global economy? It strengthens Europe, prevents Italy, Greece, Portugal, and France from leaving the European Community, preserves NATO, and stops the Russian hordes from overrunning Western Europe. Croissants will be cheaper in London too. That’s all.

The December Fed Beige Book came in moderate. “Trade war” was mentioned 20 times but “government shutdown" comes out only once. Inflation is low but companies can’t pass price increases on to consumers. Labor shortages are showing up everywhere, but with few wage increases. The auto industry is flatlining.

My January and 2019 year to date return exploded to +5.29%, boosting my trailing one-year return back up to +31.68%.

My nine-year return climbed up to +306.19%, just short of a new all-time high. The average annualized return revived to +34.00%.

I took profits on one of my big tech longs in Salesforce (CRM) which maxed out the gains in my options position. I love this stock and will be back in there again on the next dip.

I am keeping my option positions in Microsoft (MSFT) and Amazon (AMZN) to take advantage of the time decay over the four day weekend. I cashed in half of my short position in the bond market (TLT), taking advantage of the recent 4 ½ point decline there.

My long position in the Euro (FXE) survived the failure of Brexit and a no-confidence vote in Britain. It continues to bounce along the bottom.

I also kept my short positions in Apple (AAPL) and the S&P 500 (SPY). Happy days are definitely NOT here again, with a government shut down and a continuing trade war with China. I am now nearly neutral, with “RISK ON” positions “RISK OFF” ones.

We have recently seen a surge of new subscribers and for you I urge patience. In this kind of market the money is made on the “BUY”, so timing is everything. The goal is to make as much money you can, not to see how fast or how often you trade.

The upcoming week is very iffy on the data front because of the government shutdown. Some government data may be delayed and other completely missing. Private sources will continue reporting on schedule. All of the data will be completely skewed for at least the next three months. You can count on the shutdown to dominate all media until it is over.

Housing data will be the big events over the coming four days.

On Monday, January 21, markets are closed for Martin Luther King Day.

On Tuesday, January 22, 10:00 AM EST, the December Existing Home Sales are out. IBM (IBM) and Johnson & Johnson (JNJ) announce earnings.

On Wednesday, January 23 at 10:30 AM EST the Energy Information Administration announces oil inventory figures with its Petroleum Status Report. Lam Research (LRCX) and Procter & Gamble (PG) report.

Thursday, January 24 at 8:30 AM EST, we get Weekly Jobless Claims. At 10:00 AM, we learn December Leading Economic Indicators. Intel (INTC) and American Airlines (AA) report.

On Friday, January 25, at 10:00 AM EST, the latest read of December New Home Sales is released. The Baker-Hughes Rig Count follows at 1:00 PM. Schlumberger (SLB) announces earnings. Home Sales is released. AbbVie Inc (ABBV) and DR Horton (DHI) report.

As for me, I will be battling my way home from Lake Tahoe which received seven feet of snow last week. It was a real “snowmageddon.”

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.