Mad Hedge Technology Letter

June 19, 2020

Fiat Lux

Featured Trade:

(BET THE RANCH ON SQUARE),

(SQ), (XRT)

Mad Hedge Technology Letter

June 19, 2020

Fiat Lux

Featured Trade:

(BET THE RANCH ON SQUARE),

(SQ), (XRT)

Square (SQ) is one of those fintech companies that you buy and never sell.

The company’s recent stock performance has eclipsed many of the other cloud stocks that have done almost as well.

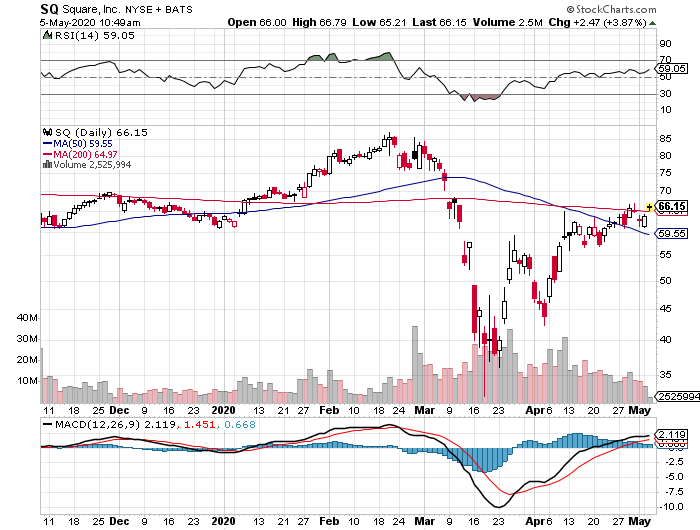

Shares of Square are up from the March lows of $36 and now trading a smidgeon below $100.

It is just a matter of time before the stock breaks $100 and this company is easily a $200 stock in the future.

Let us look at the reasons why shares have rebounded with extra zeal from the nadir.

First, they are an overwhelming recipient of the “re-opening” trade which is in full effect even with a reboot of coronavirus cases in the U.S.

The government has been adamant that there is only a way forward and not backwards - shutting down the economy again is not an option.

With people out of their houses, data points are up from zero like May’s retail sales numbers showing a sharp rise of 18% month on month. The SPDR S&P Retail ETF (XRT) is up 2.4%.

Square is a fintech payment service provider among other things and their addressable market worth $160 billion is expanding and they are perfectly positioned for sustained expansion in the years ahead.

The digitization of the economy has played into Square's hands and the pandemic has acted like a supercharger to a trend: the steady migration of most everyday banking activities to mobile apps and online portals.

Why is Square a legitimate long-term threat to the traditional banking system?

Square has siphoned accounts from banks and add up to 14 million in total including customers who direct deposited their stimulus checks and/or tax refunds and not necessarily their paychecks.

Square Capital’s 75,000 PPP borrowers give Square real skin in the game and combined with a growing base of larger merchants, intimate knowledge of their revenue flows, Square will win a good amount of new small business loan activity.

Its small business loan portfolio is already approximately 75,000 loans and were facilitated during the quarter with a total value of $548 million - an increase of 8% year-over-year.

One of Square’s massive growth drivers is its accessibility to buying bitcoin and the commission of payments on the Cash app.

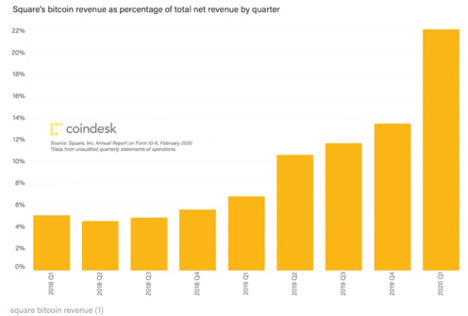

Square’s bitcoin revenue now accounts for 22% of total quarterly revenue.

In Q1, Cash App gross profit grew 115% year over year and gross profit on Cash App is dominated by Square’s $222 million in non-bitcoin revenue, $178 million of that was profit.

The bad news is already behind the fintech companies with the post-pandemic which saw Square’s payment volume crater 39% last month.

Even with such terrible data, Square still posted a positive earnings report with revenue for the quarter up 44% year-over-year. Gross Payment Value (GPV) was up 14% year-over-year. Gross profit was up 36% year-over-year.

Square also offers an online retail capability with Square Online Store, which competes with Shopify.

The company is a hotbed of new fintech innovation rolling out new products every quarter.

If a new product fails, management is quick to put out the flames and try something new.

They are not just a one-trick pony like Facebook and are one of Silicon Valley’s true innovation firms.

It is refreshing to see a company led with a bold CEO in Jack Dorsey who isn’t 99% marketing and 1% substance like many who make the decisions at these ultra-powerful firms.

Volatility in this stock makes this a terrible stock to trade – 6% down days are common.

Buy this stock and it will no doubt cross $200 in the next 3 years.

Global Market Comments

May 5, 2020

Fiat Lux

Featured Trade:

(FIVE STOCKS TO BUY AT THE BOTTOM),

(AAPL), (AMZN), (SQ), (ROKU), (MSFT)

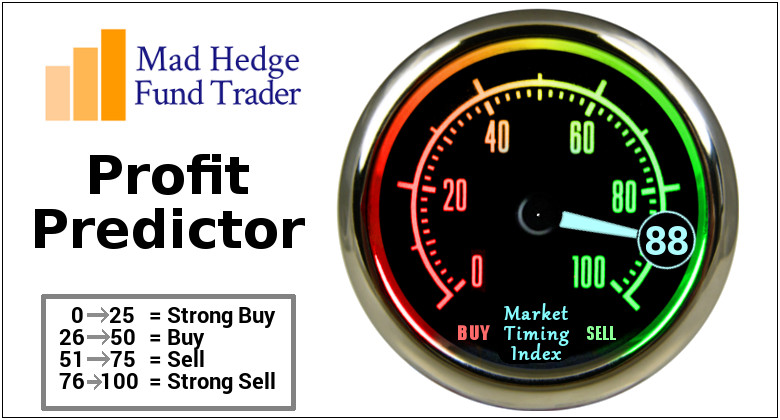

With the Dow Average down 1,400 points in three trading days, you are being given a second bite of the apple before the yearend tech-led rally begins.

So, it is with great satisfaction that I am rewriting Arthur Henry’s Mad Hedge Technology Letter’s list of recommendations.

By the way, if you want to subscribe to Arthur’s groundbreaking, cutting-edge service, please click here.

It’s the best read on technology investing in the entire market.

You don’t want to catch a falling knife, but at the same time, diligently prepare yourself to buy the best discounts of the year.

The Coronavirus has triggered a tsunami wave of selling, tearing apart the tech sector with a vicious profit-taking few trading days.

Here are the names of five of the best stocks to slip into your portfolio in no particular order once the madness subsides.

Apple

Steve Job’s creation is weathering the gale-fore storm quite well. Apple has been on a tear reconfirming its smooth pivot to a software services-tilted tech company. The timing is perfect as China has enhanced its smartphone technology by leaps and bounds.

Even though China cannot produce the top-notch quality phones that Apple can, they have caught up to the point local Chinese are reasonably content with its functionality.

That hasn’t stopped Apple from vigorously growing revenue in greater China 20% YOY during a feverishly testy political climate that has its supply chain in Beijing’s crosshairs.

The pivot is picking up steam and Apple’s revenue will morph into a software company with software and services eventually contributing 25% to total revenue.

They aren’t just an iPhone company anymore. Apple has led the charge with stock buybacks and gobbled up a total of $150 billion in shares by the end of 2019. Get into this stock while you can as entry points are few and far between.

Amazon (AMZN)

This is the best company in America hands down and commands 5% of total American retail sales or 49% of American e-commerce sales. The pandemic has vastly accelerated the growth of their business.

It became the second company to eclipse a market capitalization of over $1 trillion. Its Amazon Web Services (AWS) cloud business pioneered the cloud industry and had an almost 10-year head start to craft it into its cash cow. Amazon has branched off into many other businesses since then oozing innovation and is a one-stop wrecking ball.

The newest direction is the smart home where they seek to place every single smart product around the Amazon Echo, the smart speaker sitting nicely inside your house. A smart doorbell was the first step along with recently investing in a pre-fab house start-up aimed at building smart homes.

Microsoft (MSFT)

The optics in 2018 look utterly different from when Bill Gates was roaming around the corridors in the Redmond, Washington headquarter and that is a good thing in 2018.

Current CEO Satya Nadella has turned this former legacy company into the 2nd largest cloud competitor to Amazon and then some.

Microsoft Azure is rapidly catching up to Amazon in the cloud space because of the Amazon effect working in reverse. Companies don’t want to store proprietary data to Amazon’s server farm when they could possibly destroy them down the road. Microsoft is mainly a software company and gained the trust of many big companies especially retailers.

Microsoft is also on the vanguard of the gaming industry taking advantage of the young generation’s fear of outside activity. Xbox-related revenue is up 36% YOY, and its gaming division is a $10.3 billion per year business.

Microsoft Azure grew 87% YOY last quarter. The previous quarter saw Azure rocket by 98%. Shares are cheaper than Amazon and almost as potent.

Square (SQ)

CEO Jack Dorsey is doing everything right at this fin-tech company blazing a trail right to the doorsteps of the traditional banks.

The various businesses they have on offer makes me think of Amazon’s portfolio because of the supreme diversity. The Cash App is a peer-to-peer money transfer program that cohabits with a bitcoin investing function on the same smartphone app.

Square has targeted the smaller businesses first and is a godsend for these entrepreneurs who lack immense capital to create a financial and payment infrastructure. Not only do they provide the physical payment systems for restaurant chains, they also offer payroll services and other small loans.

The pipeline of innovation is strong with upper management mentioning they are considering stock trading products and other bank-like products. Wall Street bigwigs must be shaking in their boots.

The recently departed CFO Sarah Friar triggered a 10% collapse in share price on top of the market meltdown. The weakness will certainly be temporary, especially if they keep doubling their revenue every two years like they have been doing.

Roku (ROKU)

Benefitting from the broad-based migration from cable tv to online steaming and cord-cutting, Roku is perfectly placed to delectably harvest the spoils.

This uber-growth company offers an over-the-top (OTT) streaming platform along with the necessary hardware and picks up revenue by selling digital ads.

Founder and CEO Anthony Woods owns 21 million shares of his brainchild and insistently notes that he has no interest in selling his company to a Netflix or Apple.

Roku’s active accounts mushroomed 46% to 22 million in the second quarter. Viewers are reaffirming the obsession with on-demand online streaming content with hours streamed on the platform increasing 58% to 5.5 billion.

The Roku platform can be bought for just $30 and is easy to set-up. Roku enjoys the lead in the over-the-top (OTT) streaming device industry controlling 37% of the market share leading Amazon’s Fire Stick at 28%.

The runway is long as (OTT) boxes nestle cozily in only 40% of American homes with broadband, up from a paltry 6% in 2010.

They are consistently absent from the backbiting and jawboning the FANGs consistently find themselves in partly because they do not create original content and they are not an off-shoot from a larger parent tech firm.

This growth stock experiences the same type of volatility as Square.

Be patient and wait for 5-7% drops to pick up some shares.

Global Market Comments

April 15, 2020

Fiat Lux

Featured Trade:

(GOODBYE TO THE OLD WORLD, HELLO TO THE NEW)

(TGT), (WMT), (ZM), (NFLX), (PYPL), (SQ), (AMZN), (MSFT)

With the ongoing impacts of coronavirus, our world is suddenly changing beyond all recognition.

The WWII comparisons here are valid. Just as technological innovation accelerated tenfold from 1941-1945, bringing us computers, penicillin, jet engines, and the atomic bomb, the same kind of great leaps forward are happening now.

The end result will be a faster rate of innovation and economic growth, greater corporate profits in the right industries, and a hugely performing stock market. It perfectly sets up my coming Golden Age and the next Roaring Twenties.

Living in Silicon Valley for the last 25 years, I have gotten pretty used to change. But what is happening now is mind-boggling.

The bottom line for the impacts of the coronavirus pandemic has been to greatly accelerate all existing trends. The biggest one of these has been the movement of the economy online, which has been taking place since the eighties. Except that it is now happening lightning fast. Business models are hyper-evolving.

Legacy brick and mortar companies must move online or perish, as much of the restaurant business is now doing. Target (TGT) and Walmart (WMT) have accomplished this. Those with feet in both worlds are closing down their physical presence and going entirely digital. Pure digital companies, like Zoom (ZM), Netflix (NFLX), PayPal (PYPL), and Square (SQ) are booming.

The side effect of the virus may be to move an even greater share of America’s business activity to the San Francisco Bay area and Seattle. Almost all tech companies here are hiring like crazy. Amazon has announced plans for hiring a staggering 175,000 since the epidemic started, as millions shift to home delivery of everything.

The productivity of tech is also growing by leaps and bounds. Since everyone is working at home, no one wastes two hours a day commuting. Meetings in person are a thing of the past. Everything now happens on Zoom.

The whole mental health industry is now conducted on Zoom. So is much of non-Corona related medicine. And I haven’t seen my accountant in years. I think he died, replaced by a younger, cheaper clone.

Even my own Boy Scout troop has gone virtual. The National Council is offering 58 online merit badges, including Railroading, Stamp Collecting, and Genealogy (click here for the full list).

The stock market has noticed and several tech companies like Microsoft (MSFT) and Amazon are showing positive gains for 2020. Many legacy companies see share prices still down 80% or more. Sector selection for portfolio mangers has essentially shrunk from 100 to only 2: tech/biotech and healthcare.

Business models are evolving at an astonishing rate. Who knew the yoga instructor in Chicago was much better than the one down the street, thanks to Skype.

Education is now entirely online and much of it may never go back to school. My kids are totally comfortable in this new world. They have been social distancing since I bought them their own iPhones five years ago.

Now, if I can only figure out how to do my own haircut, the third most searched term on Google. It’s longer than at any time since the summer of love in 1967.

These are just a few of the practical impacts of coronavirus. The social changes are equally eye-popping.

While death rates are soaring, crime has fallen by up to 75%. So have deaths from car accidents. Alcohol and domestic abuse have gone through the roof. Drug addiction is plummeting because dealers are afraid to go out on the street.

There are many lessons to be learned from this crash. Too many companies drank the Kool-Aid and assumed business conditions would remain perfect forever.

Let's call a spade a spade. The year 2019 and the first two months of 2020 were the bubble top. All the growth in stock prices then were pure fluff.

That means you didn’t need costly reserves ran on thin margins, borrowed like crazy at artificially low-interest rates, and kept endlessly buying back your own stock and paying generous dividends.

Manufacturers didn’t need inventories, counting on a seamless, global supply chain to keep assembly lines running. “Just in time” has switched to “just-in-case.” Companies are going to have to keep enough inventories in the warehouse to guard against future disease-driven disruptions. This will raise costs and shrink profits.

It’s really hard to see how entire industries are going to come back. Cruise ships were packing guests onboard like sardines in a can to make money. I bet it will be a while before you sit at a crowded casino blackjack table. Want to stand in line at a popular chain restaurant?

Airlines have become the poster boy for the evils of bubblicious management. They flew full most of the time, seating their customers shoulder to shoulder, yet their net profit per fight depended on selling that last economy class seat.

The industry spent $50 billion in dividends and the buyback of shares that are now largely worthless, while senior management laughed all the way to the bank. They were the only industry to actually list a global pandemic as a major risk to their business in their SEC filings.

Now they want a government bailout at your expense.

As for me, I am looking forward to this brave new world. Until then, I’ll be spending my afternoons getting in shape hiking in the High Sierras, long hair and all. I’m the only one up here. Maybe it will scare the mountain lions away.

Global Market Comments

February 14, 2020

Fiat Lux

Featured Trade:

(FEBRUARY 12 BIWEEKLY STRATEGY WEBINAR Q&A)

(SQ), (TSLA), (FB), (GILD), (BA), (CRSP), (CSCO), (GLD)

(FEYE), (VIX), (VXX), (USO), (LYFT), (UBER)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader February 12 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: What do you think about Facebook (FB) here? We’ve just had a big dip.

A: We got the dip because of a double downgrade in the stock from a couple of brokers, and people are kind of nervous that some sort of antitrust action may be taken against Facebook as we go into the election. I still like the stock long term. You can’t beat the FANGs!

Q: If Bernie Sanders gets the nomination, will that be negative for the market?

A: Absolutely, yes. It seems like after 3 years of a radical president, voters want a radical response. That said, I don't think Bernie will get the nomination. He is not as popular in California, where we have a primary in a couple of weeks and account for 20% of total delegates. I think more of the moderate candidates will come through in California. That's where we see if any of the new billionaire outliers like Michael Bloom or Tom Steyer have any traction. My attitude in all of this is to wait for the last guy to get voted off the island—then ask me what's going to happen in October.

Q: When should we come back in on Tesla (TSLA)?

A: It’s tough with Tesla because although my long-term target is $2,500, watching it go up 500% in seven months on just a small increase in earnings is pretty scary. It’s really more of a cult stock than anything else and I want to wait for a bigger pullback, maybe down to $500, before I get in again. That said, the volatility on the stock is now so high that—with the short interest going from 36% down to 20%—if we get the last of the bears to really give up, then we lose that whole 20% because it all turns into buying; and that could get us easily over $1,000. The announcement of a new $2 billion share offering is a huge positive because it means they can pay off debt and operate with free capital as they don’t pay a dividend.

Q: Is Square (SQ) a good buy on the next 5% drop?

A: I would really wait 10%—you don't want to chase trades with the market at an all-time high. I would wait for a bigger drop in the main market before I go aggressive on anything.

Q: What about CRISPR Technology (CRSP) after the 120% move?

A: We’ve had a modest pullback—really more of a sideways move— since it peaked a couple of months ago; and again, I think the stock either goes much higher or gets taken over by somebody. That makes it a no-lose trade. The long sideways move we’re having is actually a very bullish indication for the stock.

Q: If Bernie is the candidate and gets elected, would that be negative for the market?

A: It would be extremely negative for the market. Worth at least a 20% downturn. That said, according to all the polling I have seen, Bernie Sanders is the only candidate that could not win against Donald Trump—the other 15 candidates would all beat Trump in a 1 to 1 contest. He's also had one heart attack and might not even be alive in 6 months, so who knows?

Q: I just closed the Boeing (BA) trade to avoid the dividend hit tomorrow. What do you think?

A: I’m probably going to do the same, that way you can avoid the random assignments that will stick you with the dividend and eat up your entire profit on the trade.

Q: When do you update the long-term portfolio?

A: Every six months; and the reason for that is to show you how to rebalance your portfolio. Rebalancing is one of the best free lunches out there. Everyone should be doing it after big moves like we’ve seen. It’s just a question of whether you rebalance every six months or every year. With stocks up so much a big rebalancing is due.

Q: I have held onto Gilead Sciences (GILD) for a long time and am hoping they’ll spend their big cash hoard. What do you think?

A: It’s true, they haven’t been spending their cash hoard. The trouble with these biotech stocks, and why it's so hard to send out trade alerts on them, is that you’ll get essentially no movement on them for years and then they rise 30% in one day. Gilead actually does have some drugs that may work on the coronavirus but until they make another acquisition, don’t expect much movement in the stock. It’s a question of how long you are willing to wait until that movement.

Q: Is it time to get back into the iPath Series B S&P 500 VIX Short Term Futures ETN (VXX)?

A: No, you need to maintain discipline here, not chase the last trade that worked. It’s crucial to only buy the bottoms and sell the tops when trading volatility. Otherwise, time decay and contango will kill you. We’re actually close to the middle of the range in the (VXX) so if we see another revisit to the lows, which we could get in the next week, then you want to buy it. No middle-of-range trades in this kind of market, you’re either trading at one extreme or the other.

Q: Could you please explain how the Fed involvement in the overnight repo market affects the general market?

A: The overnight repo market intervention was a form of backdoor quantitative easing, and as we all know quantitative easing makes stocks go up hugely. So even though the Fed said this wasn't quantitative easing, they were in fact expanding their balance sheet to facilitate liquidity in the bond market because government borrowing has gotten so extreme that the public markets weren’t big enough to handle all the debt; that's why they stepped into the repo market. But the market said this is simply more QE and took stocks up 10% since they said it wasn't QE.

Q: What about Cisco Systems (CSCO)?

A: It’s probably a decent buy down here, very tempting. And it hasn't participated in the FANG rally, so yes, I would give that one a really hard look. The current dip on earnings is probably a good entry point.

Q: Should we buy the Volatility Index (VIX) on dips?

A: Yes. At bottoms would be better, like the $12 handle.

Q: When is the best time to exit Boeing?

A: In the next 15 minutes. They go ex-dividend tomorrow and if you get assigned on those short calls then you are liable for the dividend—that will eat up your whole profit on the trade.

Q: Do you like Fire Eye (FEYE)?

A: Yes. Hacking is one of the few permanent growth industries out there and there are only a half dozen listed companies that are cutting edge on security software.

Q: What are your thoughts on the timing of the next recession?

A: Clearly the recession has been pushed back a year by the 2019 round of QE, and stock prices are getting so high now that even the Fed has to be concerned. Moreover, economic growth is slowing. In fact, the economy has been growing at a substantially slower rate since Trump became president, and 100% of all the economic growth we have now is borrowed. If the government were running a balanced budget now, our growth would be zero. So, certainly QE has pushed off the recession—whether it's a one-year event or a 2-year event, we’ll see. The answer, however, is that it will come out of nowhere and hit you when you least expect it, as recessions tend to do.

Q: Would you buy gold (GLD) rather than staying in cash?

A: I would buy some gold here, and I would do deep in the money call spreads like I have been doing. I’ve been running the numbers every day waiting for a good entry point. We’re now at a sort of in between point here on call spreads because it’s 7 days to the next February expiration and about 27 days to the March one after that, so it's not a good entry point this week. Next week will look more interesting because you’ll start getting accelerated time decay for March working for you.

Q: When are you going to have lunch in Texas or Oklahoma?

A: Nothing planned currently. Because of my long-term energy views (USO), I have to bring a bodyguard whenever I visit these states. Or I hold the events at a Marine Corps Club, which is the same thing.

Q: Would you use the dip here to buy Lyft (LYFT)? It’s down 10%.

A: No, it’s a horrible business. It’s one of those companies masquerading as a tech stock but it isn’t. They’re dependent on ultra-low wages for the drivers who are essentially netting $5 an hour driving after they cover all their car costs. Moreover, treating them as part-time temporary workers has just been made illegal in California, so it’s very bad news for the stocks—stay away from (LYFT) and (UBER) too.

Q: Is the Fed going to cut interest rates based on the coronavirus?

A: No, interest rates are low enough—too low given the rising levels of the stock market. Even at the current rate, low-interest rates are creating a bubble which will come back to bite us one day.

Q: Household debt exceeded $14 trillion for the first time—is this a warning sign?

A: It is absolutely a warning sign because it means the consumer is closer to running out of money. Consumers make up 70% of the economy, so when 70% of the economy runs out of money, it leads to a certain recession. We saw it happen in ‘08 and we’ll see it happen again.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

January 16, 2019

Fiat Lux

Featured Trade:

(WHAT THE HECK IS ESG INVESTING?),

(TSLA), (MO)

(WILL UNICORNS KILL THE BULL MARKET?),

(TSLA), (NFLX), (DB), (DOCU), (EB), (SVMK), (ZUO), (SQ),

I am always watching for market-topping indicators and I have found a whopper. The number of new IPOs from technology mega unicorns is about to explode. And not by a little bit but a large multiple, possibly tenfold.

Some 220 San Francisco Bay Area private tech companies valued by investors at more than $700 billion are likely to thunder into the public market next year, raising buckets of cash for themselves and minting new wealth for their investors, executives, and employees on a once-unimaginable scale.

Will it kill the goose that laid the golden egg?

Newly minted hoody-wearing millionaires are about to stampede through my neighborhood once again, buying up everything in sight.

That will make 2020 the biggest year for tech debuts since Facebook’s gargantuan $104 billion initial public offering in 2012. The difference this time: It’s not just one company but hundreds that are based in San Francisco, which could see a concentrated injection of wealth as the nouveaux riches buy homes, cars and other big-ticket items.

If this is not ringing a bell with you, remember back to 2000. This is exactly the sort of new issuance tidal wave that popped the notorious Dotcom Bubble.

And here is the big problem for you. If too much money gets sucked up into the new issue market, there is nothing left for the secondary market, and the major indexes can fall by a lot. Granted, probably only $100 billion worth of stock will be actually sold, but that is still a big nut to cover.

The onslaught of IPOs includes home-sharing company Airbnb at $31 billion, data analytics firm Palantir at $20 billion, and FinTech company Stripe at $20 billion.

The fear of an imminent recession starting sometime in 2020 or 2021 is the principal factor causing the unicorn stampede. Once the economy slows and the markets fall, the new issue market slams shut, sometimes for years as they did after 2000. That starves rapidly growing companies of capital and can drive them under.

For many of these companies, it is now or never. They have to go public and raise new money or go under. The initial venture capital firms that have had their money tied up here for a decade or more want to cash out now and roll the proceeds into the “next big thing,” such as blockchain, healthcare, or artificial intelligence. The founders may also want to raise some pocket money to buy that mansion or mega yacht.

Or, perhaps they just want to start another company after a well-earned rest. Serial entrepreneurs like Tesla’s Elon Musk (TSLA) and Netflix’s Reed Hastings (NFLX) are already on their second, third, or fourth startups.

And while a sudden increase in new issues is often terrible for the market, getting multiple IPOs from within the same industry, as is the case with ride-sharing Uber and Lyft, is even worse. Remember the five pet companies that went public in 1999? None survived.

Some 80% of all IPOs lost money last year. This was definitely NOT the year to be a golfing partner or fraternity brother with a broker.

What is so unusual in this cycle is that so many firms have left going public to the last possible minute. The desire has been to milk the firms for all they are worth during their high growth phase and then unload them just as they go ex-growth.

Also holding back some firms from launching IPOs is the fear that public markets will assign a lower valuation than the last private valuation. That’s an unwelcome circumstance that can trigger protective clauses that reward early investors and punish employees and founders. That happened to Square (SQ) in its 2015 IPO.

That’s happening less and less frequently: In 2019, one-third of IPOs cut companies’ valuations as they went from private to public. In 2019, that ratio has dropped to one in six.

Also unusual this time around is an effort to bring in more of the “little people” in the IPO. Gig economy companies like Uber and Lyft have lobbied the SEC for changes in new issue rules that enabled their drivers to participate even though they may be financially unqualified. They were all hit with losses of a third once the companies went public.

As a result, when the end comes, this could come as the cruelest bubble top of all.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.