Global Market Comments

October 28, 2021

Fiat Lux

Featured Trade:

(WHAT THE HECK IS ESG INVESTING?),

(TSLA), (MO)

Global Market Comments

October 28, 2021

Fiat Lux

Featured Trade:

(WHAT THE HECK IS ESG INVESTING?),

(TSLA), (MO)

Global Market Comments

October 27, 2021

Fiat Lux

Featured Trade:

(A NEW THEORY OF TESLA, or WHY I’M RAISING MY TARGET TO $10,000),

(TSLA)

Global Market Comments

October 25, 2021

Fiat Lux

Featured Trade:

(TESTIMONIAL),

(MARKET OUTLOOK FOR THE WEEK AHEAD, or TAKING A BREAK)

(MS), (GS), (BAC), (TLT), (TSLA), (AAPL), (AMZN), (GOOGL), (FB)

When I ran the international equity trading desk at Morgan Stanley during the 1980s, there was always one guy I was trying to recruit and that was David Tepper at Goldman Sachs. Whenever we did a trade with David, we lost money.

If we sold David a stock it usually took off like a rocket. If we bought a stock from him it plummeted like a stone. Eventually, unable to lure David over with a monster salary, I had to ban trading with him as it was such a loser for us.

David never did get pried away from Goldman until he left to start his own firm, Appaloosa Management, after he was mistakenly passed over for partner two years in a row. After that, he racked up an annualized return of over 40%, near my own results.

But David was doing it with $20 billion in real money, while I was doing it with newsletters. In 2012, David received a $2.2 billion performance bonus from his fund, one of the largest in history. I bet the partners at Goldman are kicking themselves.

So, I thought it timely to check in with David, now the owner of the Carolina Panthers football team, to see what he thought about the market. The S&P 500, the Dow, Ten-year bond yields, and Bitcoin all simultaneously hit all-time highs last week, and we were long all of them.

David was phlegmatic at best. “There are times to make money and there are times to not lose money, and this is definitely time to make money.” However, nothing is cheap. There are no screaming buys here or screaming shorts. He did expect stocks to keep rising through the end of 2021.

Keep in mind that David is a trader just like me and rarely has a view beyond six months. His last 13F filing on June 30 showed that his five largest positions were T-Mobile (TMUS), Amazon (AMZN), Facebook (FB), Google (GOOG), and Uber (UBER). Uber was the only new buy.

David is not alone in his views.

Up 89.20% so far in 2021, I am sitting here dazed, shocked, and pinching myself. This has been far and away my best year in a 53-year career. I know a lot of you made a lot more. I stared down every correction this year, loaded the boat, and won.

It’s not always like this.

So I think we are in for a few weeks of profit-taking, sideways chop, and minimal action. I call this the “counting your money” time. Traders have visions of Ferraris dancing in their eyes. Then once we form a new base, it will become the springboard for a new yearend rally.

I don’t think stocks will fall enough to justify selling here. And you might miss the next bottom.

Until then, I’m thinking of taking up the banjo.

That brings me to the foremost question in your collective minds. Can I top an astonishing 100% profit this year? Only if we get another great entry point with a 5% correction.

I’m sure that when the financial history of our era is written something in the future, this will be known as the week that Bitcoin went mainstream. That was prompted by the SEC approval of the first futures ETF, the ProShares Bitcoin Futures ETF (BITO).

By giving this approval, which had been sought for years, unlocks $40 trillion worth of assets owned by 100 million shareholders managed under the Investment Company Act of 1940 to go into Bitcoin. The possibilities boggle the mind. The consensus year-end target for Bitcoin is now $100,000, or up 65%.

It’s not too late to subscribe at the founder's rate of $995 a year for the Mad Hedge Bitcoin Letter by clicking here. After that, the price goes up….a lot.

Morgan Stanley (MS) Announces Stellar Earnings, with profits at $3.71 billion, up 36.4%. Morgan Stanley Asset Management sucked in an amazing $300 billion so far in 2021, bringing their total assets to $4.5 trillion.

Goldman Sachs (GS) announces blockbuster earnings, and we are laughing all the way to the bank. Profits soared an eye popping 63% to $5.28 billion.

Existing Home Sales soar by 7% in September to a seasonally adjusted 6.29 million units. First time buyers accounted for only 28%, the lowest since 2015. A brief drop in interest rates is the reason. There are only 1.29 million homes for sale, only a 2.4 month supply.

Housing Starts fall by 1.6% in September. Higher materials and labor costs, rising land expenses, and soaring energy costs are the culprit. A pop in interest rates may mean that the slowdown could last through the winter.

Single Family Rents are surging especially for the top end of the market. Nationally, rents rose 9.3% in August year over year, up from a 2.2% year-over-year increase in August 2020, according to CoreLogic. Buy homebuilders on dips like (KBH), (LEN), and (PHM)

If the Rescue Package passes in whatever size, it will trigger a massive new surge in risk prices, including stocks and Bitcoin. Don’t act surprised when it happens. $3.5 trillion, $1.5 trillion who cares? That’s a ton of money to be dumped into the economy ahead of the 2022 elections.

Tesla profits smash records in Q3, reporting a shocking $1.62 billion profit on $13.76 billion in revenues. A 30.5% profit margin blew people away. Imagine how much they’ll earn when they make 25 million cars a year in ten years. Buy (TSLA) on big dips.

Weekly Jobless Claims dive to 290,000, a new post-pandemic low. Delta is in fast retreat. A pre-pandemic normal level of 225,000 is coming within range.

Rising Interest rates are tagging the Real Estate Market, with the 30-year fixed rate hitting 3.23%. Refis are off 7% on the week. The Fed taper is looming large, especially if the 30-year hits 4.0%, which it should, taking affordability down.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

My Mad Hedge Global Trading Dispatch saw a heroic +9.60% gain so far in October. My 2021 year-to-date performance soared to 89.20%. The Dow Average is up 16.60% so far in 2021.

After the recent ballistic move in the market, I am continuing to run my longs and those include (MS), (GS), (BAC), and a short in the (TLT). All are approaching their maximum profit point and we have nothing left but time decay to capture. So, I am going to run these into the November 19 expiration in 14 trading days. It’s like having a rich uncle write you a check once a day.

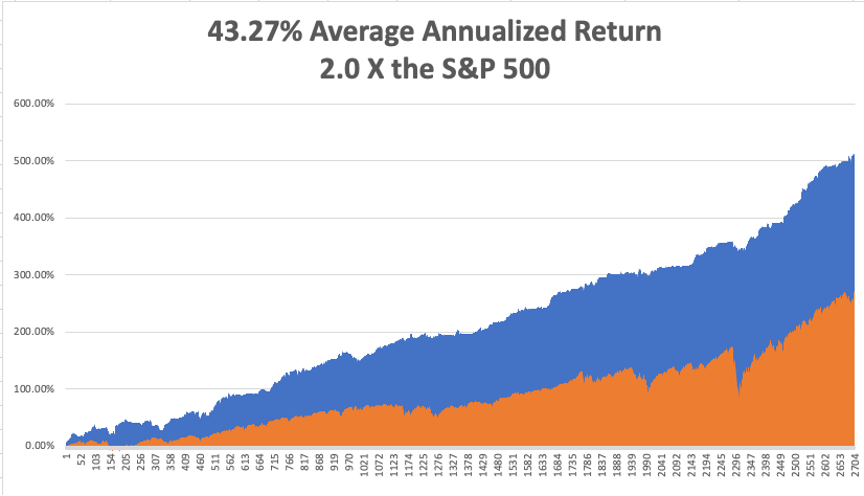

That brings my 12-year total return to 512.75%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return now stands at an unbelievable 43.75%, easily the highest in the industry.

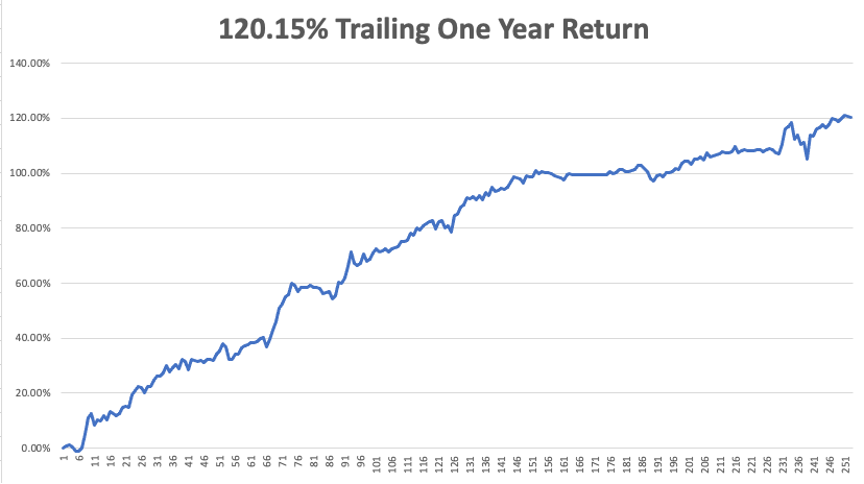

My trailing one-year return popped back to positively eye-popping 120.15%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases approaching 46 million and rising quickly and deaths topping 736,000, which you can find here.

The coming week will be slow on the data front.

On Monday, October 25 at 8:30 AM, the Chicago Fed National Activity Index is out. Facebook (FB) earnings are released.

On Tuesday, October 26 at 10:00 AM, the S&P Case-Shiller National Home Price for August Index is released. Alphabet (GOOGL) and Microsoft (MSFT) earnings are out at 5:00 PM.

On Wednesday, October 27 at 7:30 AM, Durable Goods Orders for September are printed. McDonald’s (MCD) earnings are out.

On Thursday, October 28 at 8:30 AM, Weekly Jobless Claims are announced. The first read on Q3 GDP is announced. Apple (AAPL) and Amazon (AMZN) earnings are out.

On Friday, October 29 at 8:45 AM, the US Personal Income & Spending for September is published. At 2:00 PM, the Baker Hughes Oil Rig Count is disclosed.

As for me, when I went to college in Los Angeles, the local rivalries between universities were intense.

UCLA and USC had a particularly intense rivalry, and I went to both. It was traditional to steal Tommy Trojan’s sword prior to each homecoming game and then paint the statue blue. USC had a mascot, a mixed breed dog called “Old Tire Biter.” Prior to one game, UCLA kidnapped the dog.

At halftime, the kidnappers appeared midfield, tied the dog to a helium-filled weather balloon, and let him waft away somewhere over the city. Enraged USC fans stormed the field only to find that the real dog was hidden in a nearby truck. The dog headed for the stratosphere was actually a stuffed one.

Of course, the greatest prank of all time was carried out by the California Institute of Technology in the 1961 Rose Bowl, which didn’t have a football team, on the Washington Huskies. Washington was famous for its elaborate card tricks, which spelled out team names and various corporate sponsors and images.

On the night before a game, imaginative mathematically-oriented Caltech students snuck into the stadium and changed the instructions on the back of each card packet sitting in the seats. When it came time to spell out an enormous “WASHINGTON”, “CALTECH: displayed instead. The incident was broadcast live on national TV ON NBC.

At Caltech, where I studied math, they are still talking about it today.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

October 14, 2021

Fiat Lux

Featured Trade:

(HOW TO GET A FREE TESLA), (TSLA),

(TESTIMONIAL)

Global Market Comments

October 12, 2021

Fiat Lux

Featured Trade:

(ON THE AIR WITH CASEY STUBBS),

(HOW TO HANDLE THE FRIDAY, OCTOBER 15 OPTIONS EXPIRATION),

(SPY), (GS), (MS), HPM), (BAC), (BLK),

(UNP), (TLT), (C), (BAC), (BRKB)

Inflation is everywhere — at your grocer, coffee shop and the bad news is — it’s likely to stay transitory for quite a while as it transits into even higher prices.

This isn’t the Mad Hedge Agricultural Letter so I will stay in my lane — this letter is about one of the building blocks of technology and specifically Electric Vehicles (EVs) — Lithium Batteries.

Lithium-ion batteries are the most popular type of batteries used in electric cars.

This kind of battery may sound familiar — these batteries are also used in most portable electronics, including cell phones and computers. Lithium-ion batteries have a high power-to-weight ratio, high energy efficiency and good high-temperature performance.

In practice, this means that the batteries hold a lot of energy for their weight, which is vital for electric cars — less weight means the car can travel further on a single charge.

The cost of Lithium-ion batteries is critical to EVs because it comprises about 50% of the total cost of producing an EV.

So what’s the deal with Lithium-ion batteries?

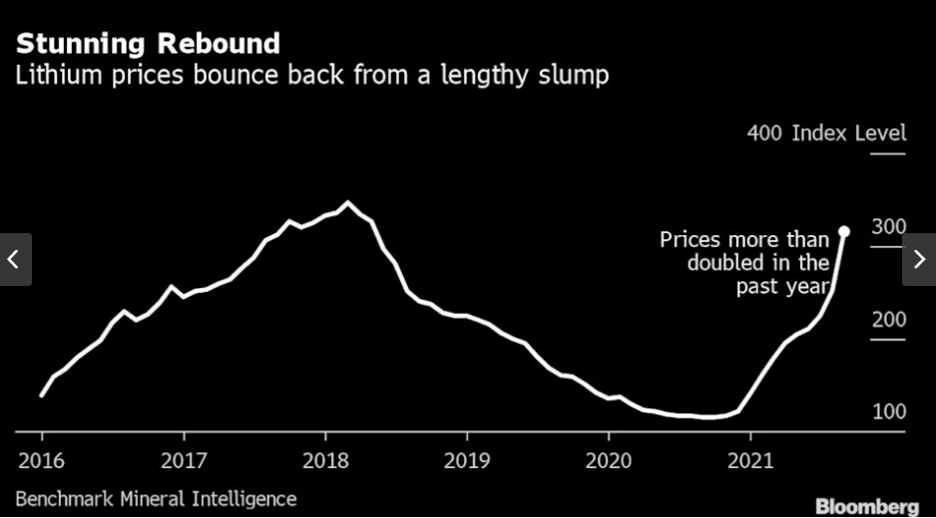

Prices have more than doubled in the past year because demand for the materials used in electric cars and renewable-energy storage has gone bonkers.

Miners cannot issue the supply to satisfy the current demand.

Instead of getting more into the weeds — I will tell you that your new Tesla (TSLA) you’re about to buy will become more expensive, so start budgeting wisely!

Increased costs will be passed onto electric vehicle (EV) manufacturers and not necessarily battery cell manufacturers, thereby potentially leading to a cost increase in EVs in the near future.

The price inflation from lithium is actually derailing a decades-long trend of a fall in lithium-ion battery prices.

Then coupled with a persisting semiconductor shortage (impacting microchip availability) — supply shortages could lead to EV demand destruction as EVs simply fail to come to market in significant quantities or do so at higher prices in limited availability.

Demand destruction is highly likely to accelerate if new lithium projects do not come to market relatively quickly, or miners might simply choose to collude together to keep prices high.

On the supply side, it’s just not guaranteed that miners can keep their costs of exploration, mining, engineering, and executing as low as they did before.

Hiring the proper talent to execute a new mine is facing headwinds like many other businesses in terms of spiking salary costs and lack of engineering talent.

For the EV industry, price points are a sore point because many consumers are on the fence about whether to buy an EV or not.

Simply put, if EVs are too expensive, consumers will just go with a gas guzzler because that’s what they know and they don’t need to deal with waiting hours at a charging station to charge their EV with a gas station across the street.

It’s true that the quality of EVs from Tesla to Mercedes has improved leaps and bounds in the past few years so the quality issue is a non-issue today.

To have a circular and sustainable bull market, EV uptake would need to surpass 50%. Until then, it’s a war of price points.

There’s also a strong possibility that not enough lithium can be mined, and this will keep EV prices high.

Battery makers are also facing higher prices for other key inputs like cobalt and copper.

Instead of doing risky things like short Tesla, which is a dangerous strategy, I would buy a lithium ETF.

The one I recommend is Global X Lithium & Battery Tech ETF (LIT).

The stock is up over 300% in the last 2 years and if this lithium inflation narrative persists, which I highly believe it will, then any substantial drawdowns should be bought.

Global Market Comments

October 8, 2021

Fiat Lux

Featured Trade:

(OCTOBER 6 BIWEEKLY STRATEGY WEBINAR Q&A),

(FCX), (TSLA), (BLK), (MS), (JPM), ($NATGAS), (UNG), (BIDU), (MRNA), (COIN), (ROM), ($BTCUSD), (ETHE), (FB), (DAL), (ALK), (LUV) (MSTR), (BLOK), (V), (NVDA), (SLV), (TLT), (TBT)

Below please find subscribers’ Q&A for the October 6 Mad Hedge Fund Trader Global Strategy Webinar broadcast from the safety of Silicon Valley.

Q: When will Freeport McMoRan (FCX) go up?

A: When the China real estate crisis ends, and they start buying copper again to build new apartment buildings.

Q: Do rising interest rates imply trouble for tech?

A: Yes, they do, but only for the short term. Long term, these things all double on a three-year view; and the next rise up in tech stocks will start when interest rates peak out, probably with 10-year yields at 1.76% or 2.00%. The great irony here is that all the big techs profit from higher rates because they have such enormous cash flows and balances. But that is just how markets work.

Q: I know you’ve been promoting Tesla (TSLA) for a very long time. What do you think about it here?

A: We’ve just gone from $550 to over $800. It actually has been one of the best performing stocks in the market for the past four months. Short term, you want to take profits; long term you want to hold it because it could go up 10 times from the current level. They just broke all their sales records and are the fastest growing car company in the US or Europe.

Q: If Blackrock (BLK) is reliant on interest rates, will the rise in interest rates hurt them?

A: No, it’s the opposite. Rising interest rates are positive for Blackrock because it improves the return on their investments, which they get a piece of; so rising interest rates mean more money and more fees. That's why I own it— it is a rising interest rate play, not a falling interest rate play.

Q: What do you think about Baidu (BIDU)?

A: Stay away from all China trades right now, it’s uninvestable. Not only do I not know what the Chinese are going to do next—they seem to be attacking a new industry every week—but the Chinese don’t even seem to know. This is all new to them; they had been embracing the capitalist model for the last 40 years and they now seem to be backtracking. There are better fish to fry, like Morgan Stanley (MS) and JP Morgan (JPM).

Q: Don’t you have a bear put spread on Baidu (BIDU)?

A: We did have a bear put spread on Baidu, but that's only a very short term, front month trade. It does look like it’s going to make money; but keep in mind those are high-risk trades.

Q: Could Natural Gas (UNG) trigger an economic crisis?

A: Not really. In the US, natgas is only a portion of our total energy needs, about 34%, and that’s mostly in the Midwest and California. The US has something like a 200-year supply with fracking. Plus, we’re on a price spike here—we’ve gone from $2 to $20/btu in Europe, entirely manipulated by Russia trying to get more money on their exports and more political control over Europe. So, it’s a short-term deal, and you can bet a lot of pros are out there shorting natgas like crazy right here. The real issue here is that no one wants to invest in carbon-based energy anymore and that is creating bottlenecks in the energy supply chain.

Q: How long will it take to provide EV infrastructure to mass gas station availability?

A: The EV infrastructure has in fact been in progress for 20 years, if you count the first generation of EV in the late 90s, which bombed. Tesla has been building power stations in the US for 10 years. They have 10,000 chargers now in 1,800 stations and their goal is 20,000 charging stations. In fact, most people already have the infrastructure for EV charging—you just charge them at home overnight, like I do. The only time I ever need a charge is when I go to Lake Tahoe. For gasoline engines, on the other hand, it took 20 years to build infrastructure from 1900 to 1920 to replace horses. Believe it or not, gasoline cars were the great environmental advance of the day, because it meant you could get rid of all the horses. New York City used to have 150,000 horses, and the city was constantly struggling through streets of two-foot-deep manure piles. So that was the big improvement. It only took 100 years to take the next step.

Q: The latest commodity with supply constraints I hear about is cotton. Is this all just a temporary thing and can we expect supply capacity to be back to normal next year? Is this just the failing of a just-in-time model that simply doesn’t work in the age of deglobalization?

A: We are losing possibly one third of our current economic growth due to part shortages, labor shortages, supply chain problems—those all go away next year, and that one third of economic growth just gets postponed into 2022 which means that the economic recovery is extended over a longer period of time, and so is the bull market in stocks, how about that! That’s why I’m loading the boat right here. It’s the first time I've been 100% invested since May.

Q: What do you think about the airlines here?

A: High risk, but high return play for the next year. Delta (DAL) is a play on business travel recovery. Alaska Airlines (ALK) and Southwest(LUV) are a play on a vacation travel return flying return, which has already started—we’re back to pre-pandemic TSA clearances at airports.

Q: Is Facebook (FB) a buy now?

A: No, I want to wait for the dust to settle before I go back in. I think it does recover and go to new highs eventually but will go to lower lows first. Regulation is certainly coming but we don’t know what.

Q: When will the chip shortage end?

A: Two years. My prediction is much longer than anybody else's because people are designing chips into new products like crazy. All predictions for the chip shortage to end in only a year don’t take that into account.

Q: When do we go into the (ROM) ProShares Ultra Technology long play?

A: When interest rates peak out sometime early next year. It’s probably a great entry point for tech; until then they go nowhere.

Q: Does the appetite for financials extend to Canada and their banks with higher dividends?

A: Yes, US and Canadian interest rates tend to move fairly closely so that rising rates here should be just as good for banks in Canada, and you might even be able to get them cheaper.

Q: Do you suggest we buy Altcoin?

A: No, not unless you're a Bitcoin professional like a miner, who can differentiate between all the different Altcoins. You can buy up to 100 different Altcoins on the main exchanges like Coinbase (COIN). In the crypto business, there is safety and size; that means Bitcoin ($BTCUSD) and Ethereum (ETHE), which between them account for about three quarters of all the crypto ever issued. A Lot of the smaller ones have a risk of going to zero overnight, and that has already happened many times. So go with the size—they’re less volatile but they’ll still go up in a rising market. And you should subscribe to our bitcoin letter just to get the details on how that market works.

Q: Target for Bitcoin by Christmas?

A: My conservative target is $66,000, but if we really go nuts, we could go as high as $100,000. That’s the “laser eyes” target for a lot of the early investors.

Q: Suggestions for a Crypto ETF?

A: It’s not out yet but will be shortly. I think that Crypto will run like crazy in anticipation of the Bitcoin ETF that we don’t have yet.

Q: Should I buy Moderna (MRNA) on this dip at 320 down from 400, or is this a COVID revenue flash in the pan that won’t come back?

A: It’ll come back because they’re taking their COVID technology and applying it to all other human diseases including cancer, which is why we got in this thing two years ago. But we may have to find a lower low first. So I would wait on all the drug/biotech plays which right now are getting hammered with the demise of the delta virus.

Q: What’s your favorite ETF right now?

A: Probably the (TBT) Double Short Treasury ETF. I’m looking for it to go up another 30% from here to 24 or 25 by sometime next year.

Q: EVs have been hot this year; Lordstown Motors is down to only $5 from $27 and just got downgraded by an analyst to $2. Should I buy, or is this a dangerous strategy?

A: I would say highly dangerous. This company has been signaling that it’s on its way to bankruptcy essentially all year, so don’t confuse “gone down a lot” with being “cheap” because that’s how you buy stuff on the way to zero.

Q: What about Anthony Scaramucci’s ETF?

A: We will have Anthony Scaramucci as a guest in our December summit. And the ETF is a basket of stocks as diverse as MicroStrategy (MSTR), Blok (BLOK), Visa (V), and Nvidia (NVDA), so you will only get a fraction of the Bitcoin volatility. That means if Bitcoin goes up 100% you might get a 40% or 50% move in the actual ETF.

Q: Do you have a Bitcoin book coming out soon?

A: I do, it should be out by the end of this month. That’s The Mad Hedge Guide to Trading Bitcoin, and it will have all the research I’ve accumulated on trading Bitcoin in the past year.

Q: Why have you only issued one trade alert in Bitcoin?

A: You don’t get a lot of entry points for Bitcoin. You buy the periodic bottoms and then you run them. Dollar cost averaging is very useful here because there are no traditional valuation measures to use, like price earnings multiples or price to book. When it comes time to sell, we'll let you know, but there aren’t a lot of Bitcoin plays outside the Bitcoin exchanges.

Q: Thoughts on silver (SLV)?

A: It’s horribly out of favor now and will continue to be so as long as Bitcoin gets the spotlight. Also, there’s a China problem with the precious metals.

Q: There are 8 or 10 good public Bitcoin and Ethereum ETFs in Canada.

A: That’s true, if you’re allowed to trade in Canada.

Q: Can the US ban Bitcoin like China did?

A: No, if they did, it would just move offshore to the Cayman Islands or some other place outside the world of regulation.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log on to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

October 4, 2021

Fiat Lux

Featured Trade:

(IT WILL JUST TAKE LONGER)

(ROKU), (TSLA), (FB), (AMZN), (AAPL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.