This is a classic example of if it looks like a duck and quacks like a duck, it’s definitely not a duck….it’s a giraffe.

In stock market parlance, that means we have just suffered an eight-month correction which is now over. Look at the charts and a correction is nowhere to be found. The largest pullback we have seen in the past year has been a scant 12% dip right before the presidential election.

If that’s all the pain we have to suffer to be rewarded with an 80% gain, I’ll take that all day long.

Instead, what we have seen has been a series of sector-specific rolling corrections that were masked by the indexes that were steadily grinding up.

During this time, the best quality stocks endured pretty dramatic hits, like Netflix (NFLX) (-21%), Apple (AAPL) (-26%), Advanced Micro Devices (AMD) (-25%), NVIDIA (NVDA) (-28%), and Roku (ROKU) (-40%).

Stocks sold off hard after Q1 earnings. They are doing the same now with Q2 earnings. That ends on Tuesday after the close when the 800-pound gorilla of them all announces on Wednesday, April 28.

After that, we could be in for another leg in the bull market that could take us up by 10% by the summer.

Some 85% of all companies are now beating forecasts handily. But half are seeing shares fall after the announcement. That shows how professional the market is getting. So, if you eliminate the earnings announcement, you eliminate the share falls?

This is all in the face of economic growth predictions of lifetime proportions. Analysts are now looking for 43% earnings growth in Q2, 55% in Q3, and 75% in Q4. These are WWII-type numbers.

And the Fed put is still good at the bank. Jerome Powell is promising no rate rises until 2023 on an almost daily basis.

It all sets up a continuing pattern of sideways “time” corrections like we’ve just seen followed by frenetic legs up to new highs. This could go on for years.

It worked last time.

The coming week should be quite a blockbuster. It is only the fifth time in history that the five largest stocks in the S&P 500 accounting for 25% of the market cap all report in the same week. These are Apple (AAPL), Amazon (AMZN), Microsoft (MSFT), Facebook (FB), and Alphabet (GOOGL).

That’s going to leave a mark! Biden’s rumored proposal that high-end earners will see doubled capital gains taxes knocked 500 points of the Dow in seconds. The new tax would apply to Americans earning a net income of $1 million or more. Never mind that congress would have to approve the move first, as Trump found out to his chagrin. It’s a trial balloon that was shot down immediately. Trump had planned to cut capital gains to a 15% rate and run a bigger deficit.

It would only apply to Americans who own stocks and never sell. Guess why? To avoid taxes, dummy!

US Stock Funds take in a record $157 billion in March. That beats the record $144 billion that came in during February. Warning: these massive cash flows are consistent with short-term market tops. Vanguard and iShares index funds took in far and away the most money. The Global X US Infrastructure Fund (PAVE) was one of the most popular directed funds.

The labor shortage is on, with companies engaging in mass hiring and paying signing bonuses for low-end jobs. I was awoken by workers putting up a fence next door on a Saturday morning. They’re working weekends to pay back the debts they ran up last year to keep eating. If you are planning any jobs this year, buy the materials now. The country will be out of everything in three months, with current quarter GDP topping a historic 10%.

SPACS have crashed, with the average SPAC down 23% since the February top, and some like Virgin Galactic Holdings off by 50%. Don’t touch these things with a ten-foot pole, as 80% will go under or shut down with no investments. It reminds me of five online pet food companies at the Dotcom Bubble top. It's all a symptom of too much cash flooding the financial system.

Takeover battle for Kansas City Southern (KSU) ensues, with Canadian Nation making a sweeter $33.7 billion offer than Canadian Pacific’s (CP) $30 billion bid. It just shows how valuable railroads really are in a booming economy that urgently needs to move a lot of stuff. Good thing I’m long (UNP). Is the Reading Railroad still available? How about the B&O or the Short Line?

Yellen sets Zero Emissions Target for 2035. That sets up one of the biggest investment opportunities of the century. The trick is to find companies that have viable technologies that can make a stand-alone profit that haven’t already gone up ten times, like Tesla (TSLA). Most of the new EV IPOs aren’t going to make it. This will be a major focus of Mad Hedge research going forward. I hope I live that long!

Existing Home Sales down 12.3% YOY, down 3.7% in March, to 6.03 million units. Prices are up 17.02% YOY, the highest on record. Sales of homes over $1 million are up 108%. Inventory is still the issue, down to only 1.07 million units, off 28% in a year. Truly stunning numbers.

New Home Sales up a ballistic 20.7% YOY in March on a signed contracts basis. This is in the face of rising home mortgage interest rates. The flight to the suburbs continues. Homebuilder stocks took off like a scalded chimp. Buy (LEN), (KBH), and (PHM) on dips.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Mad Hedge Global Trading Dispatch profit reached 9.48% gain during the first half of April on the heels of a spectacular 20.60% profit in March.

I used the dip early in the week to add two more positions in Goldman Sachs (GS) and Union Pacific (UNP). I suffered a day of buyer’s remorse on Thursday when Biden floated his capital gains plan and tanked the Dow by 500 points. Then everything took off like a rocket to new highs on Friday.

That leaves me 80% invested and 20% in cash. The markets went up too fast to get the last match of money in the market.

My 2021 year-to-date performance soared to 53.57%. The Dow Average is up 12.3% so far in 2021.

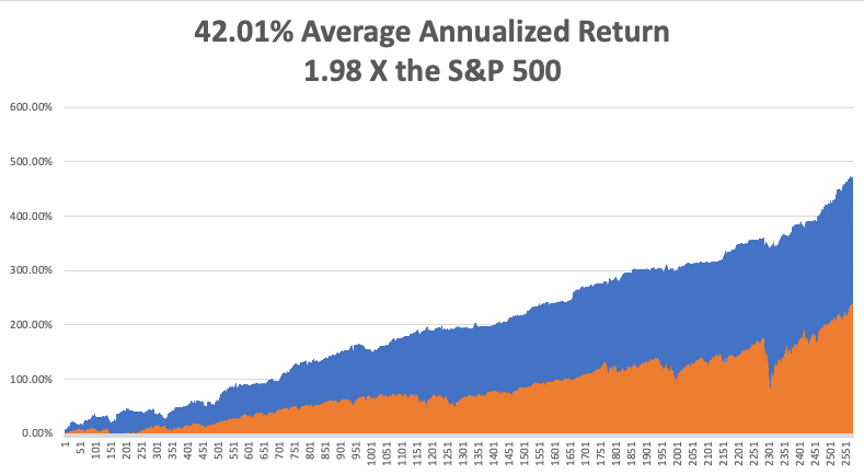

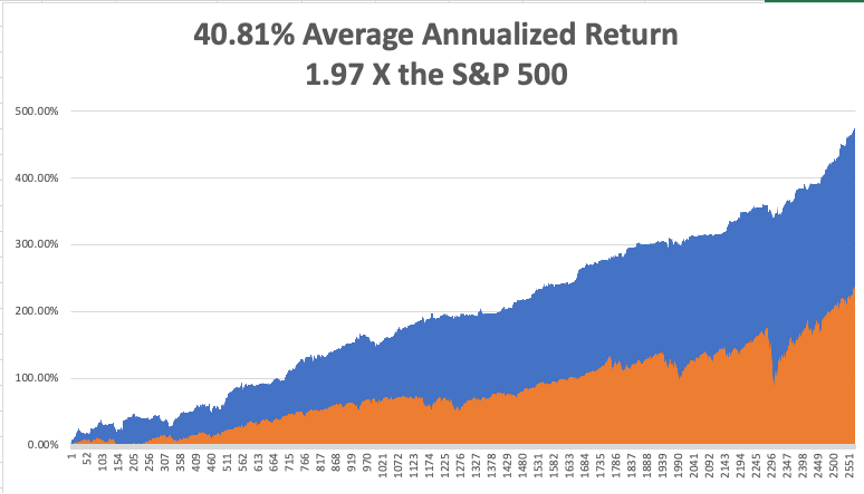

That brings my 11-year total return to 476.12%, some 2.00 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an unbelievable 42.01%, the highest in the industry.

My trailing one-year return exploded to positively eye-popping 132.09%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 31.9 million and deaths topping 570,000, which you can find here.

The coming week will be big on the data front, with a couple of historic numbers expected.

On Monday, April 26, at 8:30 AM, US Durable Goods for March are out. Earnings for Tesla (TSLA) and NXP Semiconductors (NXP) are out.

On Tuesday, April 27, at 9:00 AM, we learn the S&P Case Shiller National Home Price Index for February. We also get earnings for Alphabet (GOOGL), Microsoft (MSFT), and Visa (V).

On Wednesday, April 28 at 2:00 PM, The Fed Open Market Committee releases its Interest Rates Decision. The following press conference is more important. Apple (AAPL), Boeing (BA), and QUALCOMM (QCOM) earnings are out.

On Thursday, April 29 at 8:30 AM, the Weekly Jobless Claims are printed. We also obtain the blockbuster US GDP for Q1. Amazon (AMZN), Caterpillar (CAT, and Merck (MRK) release earnings.

On Friday, April 30 at 8:30 AM, we get US Personal Income and Spending for March. Exxon Mobile (XOM) and Chevron (CVX) release earnings. Berkshire Hathaway (BRK/B) announces the next day. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, after telling you last week why I walked so funny, let me tell you the other reason.

In 1987, to celebrate obtaining my British commercial pilot’s license, I decided to fly a tiny single-engine Grumman Tiger from London to Malta and back.

It turned out to be a one-way trip.

Flying over the many French medieval castles was divine. Flying the length of the Italian coast at 500 feet was fabulous, except for the engine failure over the American airbase at Naples.

But I was a US citizen, wore a New York Yankees baseball cap, and seemed an alright guy, so the Air Force fixed me up for free and sent me on my way. Fortunately, I spotted the heavy cable connecting Sicily with the mainland well in advance.

I had trouble finding Malta and was running low on fuel. So I tuned into a local radio station and homed in on that.

It was on the way home that the trouble started.

I stopped by Palermo in Sicily to see where my grandfather came from and to search for the caves where my great-grandmother lived during the waning days of WWII. Little did I know that Palermo was the worst wind shear airport in Europe.

My next leg home took me over 200 miles of the Mediterranean to Sardinia.

I got about 50 feet into the air when a 70-knot gust of wind flipped me on my side perpendicular to the runway and aimed me right at an Alitalia passenger jet with 100 passengers awaiting takeoff. I managed to level the plane right before I hit the ground.

I heard the British pilot say on the air “Well, that was interesting.”

Giant fire engines descended upon me, but I was fine, sitting on my cockpit, admiring the tree that had suddenly sprouted through my port wing.

Then the Carabinieri arrested me for endangering the lives of 100 Italian tourists. Two days later, the Ente Nazionale per l’Avizione Civile held a hearing and found me innocent, as the wind shear could not be foreseen. I think they really liked my hat, as most probably had distant relatives in New York.

As for the plane, the wreckage was sent back to England by insurance syndicate Lloyds of London, where it was disassembled. Inside the starboard wing tank, they found a rag which the American mechanics in Naples had left by accident.

If I had continued my flight, the rag would have settled over my fuel intake vavle, cut off my gas supply, and I would have crashed into the sea and disappeared forever. Ironically, it would have been close to where French author Antoine de St.-Exupery (The Little Prince) crashed in 1945.

In the end, the crash only cost me a disk in my back, which I had removed in London and led to my funny walk.

Sometimes, it is better to be lucky than smart.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Antoine de St.-Exupery on the Old 50 Franc Note