Global Market Comments

January 25, 2021

Fiat LuxFeatured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or HERE COMES THE SUPERHEATED ECONOMY),

(SPY), ($INDU), (TLT), (TBT), (TSLA)

Tag Archive for: (TSLA)

The US economy is in the worst condition in a century. The U6 Unemployment rate stands at 20 million today. Main streets everywhere are boarded up. Millions of businesses have gone under. Some 4,500 people a day are dying from a dreaded virus.

All of this means that you should rush out and buy and stocks, as many as possible, with both hands, and by the bucket load. It’s time to take out that home equity loan and pour it into stocks, damn the torpedoes.

For things are about to get better for the US economy, a whole lot better, better beyond anyone’s wildest imagination, and for you individually.

Speaking to CEOs, fund managers, and hedge fund strategists, it is clear that most are wildly underestimating the strength of the 2021 recovery. People haven’t really added up all the stimulus and quantitative easing that is about the hit, which could reach $20 trillion. The total market value of US stock markets is only $51 trillion.

I hate to engage in some simplistic calculations here, but if you increase the amount of capital going into the economy by nearly 50% in two years, stocks just might go up by nearly 50% in two years. It’s no more complicated than that.

In fact, economic conditions are about to improve so fast that the Federal Reserve may have to break its promise about not raising interest rates for three years and instead start nudging them up by the end of 2021.

Needless to say, this is terrible news for the bond market (TLT), where I am lining up to go from a double to a triple short.

You are already starting to see other analysts ratchet up their overcautious yearend S&P 500 target. By November, they may reach my own outsized goal of 4,800, bringing in a total gain in stocks of 35%.

All of this explains why stocks just absolutely refuse to go down, even a little bit. Each one-day decline seems to be met with a wall of buying. The memo is out: you absolutely have to get into this market, whether you are an individual, hedge fund, institution, or outright bet the ranch gambler.

Of course, if you think I’m so bullish because I made 90% on my money since the April bottom, you’d be right.

Just keep your discipline and observe the basic rules of trading: 1) Don’t buy a position that is so big that it can’t handle a normal 10% correction, 2) Don’t accumulate a position that is so big that you can’t sleep at night, 3) No calling John Thomas in the middle of the night and asking “I have a 3X position in this and their trading down in Asia, what should I do?”

If you have to ask the question, your position is too big.

Biden’s economic plan boosts growth forecasts, according to Goldman Sachs. Prospects have jumped from 6.4% to 6.6%, the highest in a half-century, on the back of a massive Covid-19 package.

Treasury Secretary Janet Yellen says “GO BIG” or go home to the Senate Finance Committee. She was there to get confirmation and push for Biden’s $1.9 trillion stimulus package. Markets are underestimating the extent of the stimulus headed our way, which could reach $10 trillion in addition to another $10 trillion in quantitative easing. Buy dips.

Index Funds are getting trashed, substantially trailing the S&P 500, as single-story stocks dominate the market. It’s become a stock pickers market in the extreme, with no more obvious example that (TSLA), up 1,000% in 9 months. Small caps, IPOs, and cyclical are getting all the action, leaving the (SPX) in the dust.

Tesla delivered its first Chinese Model Y, which will add 250,000 units to sales in 2021. It’s all part of Elon’s quest to take over the global automobile market. He plans to boost sales from 500,000 last year to 20 million in a decade. If so, the stock today still looks cheap. But is the quality the same?

Tesla Q4 registrations soar by 63%, in California, its largest market. It’s due to the runaway success of the Model Y small SUV. The stock is taking a long-overdue rest with a sideways “time” correction. It’s still true that if you buy the stock, you get the car for free.

Weekly Jobless Claims are still sky-high at 900,000. It’s a decline on the week but still horrifically high. The stock market may be starting to notice, with stocks moving sideways for two weeks.

Existing Home Sales soared to a 15-year high, up an amazing 22% YOY in December to a seasonally adjusted 6.76 million units. In the meantime, inventories hit all-time lows at only 1.9 months as they can’t build them fast enough. Sales of $1 million-plus homes are up an incredible 94%. The hottest markets were in Austin, TX, Tampa, FL, and Phoenix, AZ. New York was the worst, followed by San Francisco. The market is on fire and could continue for another decade. Pending tax breaks from the new tax bill will give homeownership another big push.

US Housing Starts jump 5.8%, to 1.7 Million units. Single-family homes are up 12% YOY, driven by the pandemic. Notice the enormous supply/demand gap which assures that home prices will keep rising for years. Rising mortgage interest rates so far have had no effect.

US Manufacturing PMI hits 14-Year high, according to Markit, their index jumping from 57.1 to 59.1. The performance would have been better if it weren’t for rampant parts shortages nationwide. It’s another argument for the long-term bull case.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Mad Hedge Global Trading Dispatch shot out of the gate with an immediate 7.25%so far in January. That is net of a 4% loss on a Tesla short which I added one day too soon. Given the great heights of the market, I have trimmed my book to just a long in Tesla and a Short in US Treasury bonds.

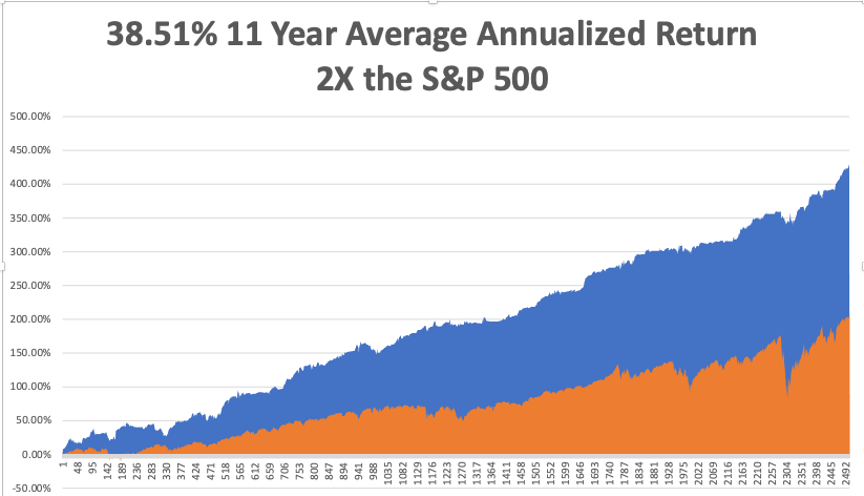

That brings my eleven-year total return to 430.30% double the S&P 500 over the same period. My 11-year average annualized return now stands at a nosebleed new high of 38.80%. My trailing one-year return exploded to 74.44%, the highest in the 13-year history of the Mad Hedge Fund Trader. We have earned 90% since the March low.

The coming week will be a big one for big tech earnings.

We also need to keep an eye on the number of US Coronavirus cases at 25 million and deaths at 420,000, which you can find here. We are now running at a staggering 4,500 deaths a day.

When the market starts to focus on this, we may have a problem.

On Monday, January 25 at 9:30 AM EST, we get the Chicago Fed National Activity Index for December. Phillips (PSX) and Kimberly Clark (KMB) report.

On Tuesday, January 26 at 10:00 AM, we learned the new S&P Case Shiller National Home Price Index. Microsoft (MSFT), Johnson & Johnson (JNJ), and American Express (AMEX) report.

On Wednesday, January 27 at 10:00 AM, US Durable Goods for December are published. Apple (AAPL), Facebook (FB) and Tesla (TSLA) report.

On Thursday, January 28 at 9:30 AM, the first look at US GDP for Q4 is announced. McDonald’s (MCD), American Airlines (AA), and Visa (V) report.

On Friday, January 29 at 9:30 AM, US Personal Income and Spending for December is published. Ely Lilly (LLY) and Caterpillar (CAT) report. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, I have never been big on the “meme” thing, but you have to love the one that has been circulating about Bernie Sanders. Suddenly, he showed up on every transit system in the country. Clearly, the country was dying for a laugh. I include several pictures below. Hopefully, I won’t end up like him someday.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

January 15, 2021

Fiat LuxFeatured Trade:

(BETTER BATTERIES HAVE BECOME BIG DISRUPTERS)

(TSLA), (XOM), (USO)

Global Market Comments

January 14, 2021

Fiat LuxFeatured Trade:

(WHAT THE HECK IS ESG INVESTING?),

(TSLA), (MO)

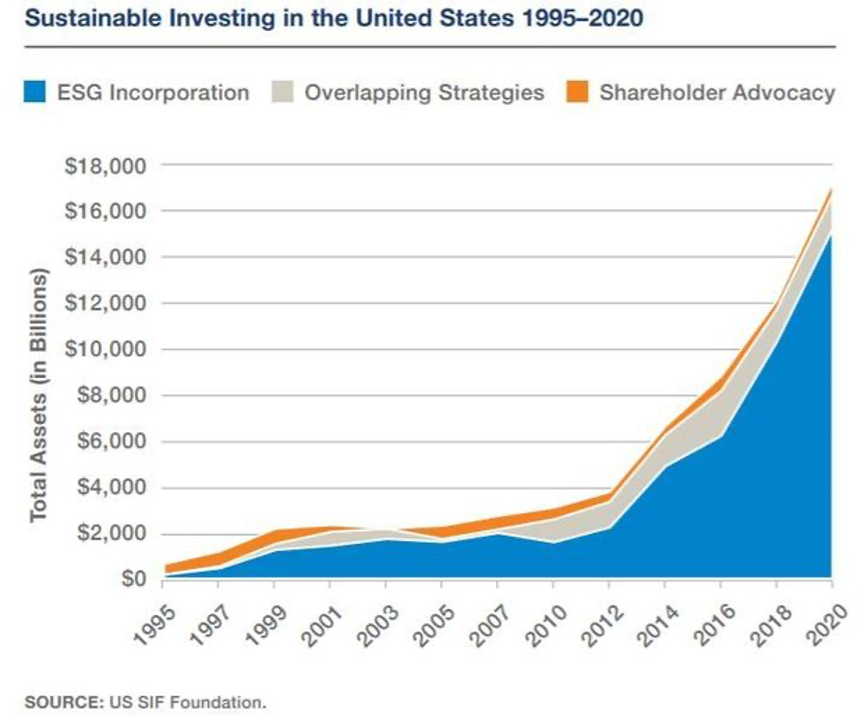

Looking at the New Year equity allocations, it’s truly astonishing how much money is pouring into ESG investing. Maybe it was another year of blistering head worldwide that did it. It now accounts for one-third of all US equity investment.

Last year, BlackRock, one of the largest fund managers in the country, made a major new commitment to ESG investment by rolling out several new ETFs. I thought I’d better take him seriously, as his firm is one of the largest money managers in the world with $7 trillion in assets.

So what the heck is ESG investing?

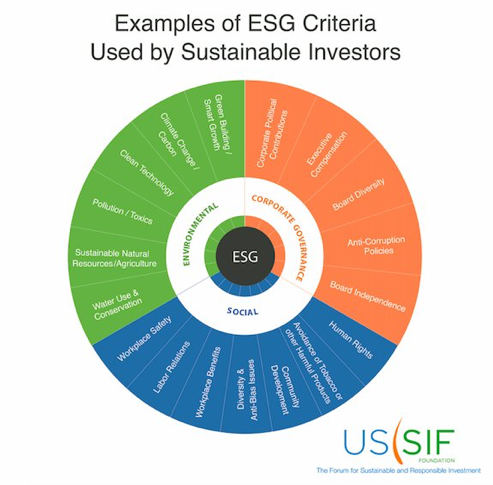

Environmental, Social, and Governance investing (ESG) seeks to address climate change in any way, shape, or form possible. Its goal is to move the economy and capital away from carbon-based energy forms, like oil (USO), natural gas (UNG), and coal (KOL), to any kind of alternative.

I am always suspicious of investment themes that are politically correct and ideologically directed, as they usually end in tears. I can’t tell you how many people I know who invested their life savings in solar companies to save the world, like Solyndra, Sungevity, American Solar Direct, and Suniva, only to get wiped out when they went under.

As laudable as the goals of these companies may have been, they were unable to deal with collapsing prices, Chinese dumping, and the harsh realities of doing business in a cutthroat competitive world.

As a venture capital friend of mine once told me, “Technology is a bakery business”. If you can’t sell your products immediately, you go broke. Technology always drops prices dramatically and if you can’t stay ahead of the curve you don’t stand a chance.

Still, what I believe is not important. The fastest growing group of new investors in the market today are Millennials, and they happen to take ESG investing very seriously.

There does seem to be a method to BlackRock’s madness. Over the past year, ESG-influenced funds have grown from 1% to 3.6% of total investment. Other major fund families like Vanguard have already jumped on the bandwagon.

ESG can include a panoply of activities, including recycling, climate change mitigation, carbon footprint reduction, water purification, green infrastructure, environmental benefits for employees, and greenhouse gas reduction. There are many more.

There is even an ESG rating system for funds and companies produced by firms like Refinitiv, which scores 7,000 companies around the world based on their environmental sensitivity. Companies like United Utilities Group PLC, the UK’s largest water company, get an A+, while China’s Guangdong Investment Ltd, which supplies water and energy to Hong Kong, gets a D-.

It goes without saying that companies from emerging nations tend to score very poorly. So do manufacturing companies relative to service ones, and energy companies versus non-energy ones.

The ESG concept began in 2005, when UN Secretary General Kofi Annan wrote to 50 global CEOs urging them to take climate change seriously. A major report by Ivor Knoepfel followed a year later entitled “Who Cares Wins.” The report made the case that embedding environmental, social and governance factors in capital markets makes good business sense and leads to more sustainable markets and better outcomes for societies. The snowball has been rolling ever since.

Themed investing is not new. “Sin” stocks have long been investment pariahs, including alcohol and tobacco companies. As a result, these companies trade at permanently low multiples. The newest investment ban is on firearms-related companies.

ESG investment may be about to get a major tailwind. The laws of supply and demand have oil prices disappearing up their own exhaust pipe. Overproduction by US fracking companies has caused supply gluts that will lead to chronically lower prices. The US happens to have a new 200-year supply of oil and gas, thanks to the fracking revolution.

Saudi Arabia just floated their oil monopoly, Saudi ARAMCO, raising a record $26 billion. When Saudi Arabia wants to get out of the oil and gas business, so should you. It’s not because they can’t think of new ways to spending money that they’re unloading it.

That’s why I have been advising followers to avoid energy investments like the plague for the past decade. My recent trade alerts for oil have been on the short side. It’s just a matter of time before alternatives rule the world.

Who is the greenest company in America? That would be electric car and autonomous driving firm Tesla (TSLA). Perhaps ESG investing helps explain the tripling of the share price since June.

What is the top-performing listed stock of the last 30 years? Tobacco company Altria Group (MO), the old Philip Morris.

It’s proof that investment shaming doesn’t always work.

Global Market Comments

January 12, 2021

Fiat Lux

Featured Trade:

(MAD HEDGE 2020 PERFORMANCE ANALYSIS),

(SPY), (TLT), (TBT), (TSLA), (GLD),

(SLV), (V), (AAPL), (VIX), (VXX)

(TESTIMONIAL)

When a Marine combat pilot returns from a mission, he gets debriefed by an intelligence officer to glean whatever information can be obtained and lessons learned.

I know. I used to be one.

Big hedge funds do the same.

I know, I used to run one.

Even the best managers will follow home runs with some real clangors. Every loss is a learning experience. If it isn’t, investors will flee and you won’t last long in this business. McDonald’s beckons.

By subscribing to the Mad Hedge Fund Trader, you get to learn from my own half-century of mistakes, misplaced hubris, arrogance, overconfidence, and sheer stupidity.

So, let’s take a look at 2020.

It really was a perfect year for me during the most adverse conditions imaginable, a pandemic, Great Depression, and presidential election. I made good money in January, went net short when the pandemic hit in February, and played the big bounce in technology stocks that followed.

Right at the March crash bottom, I sent out lists of 25 two-year option LEAPS (Long Term Equity Participation Securities). Many of these were up ten times in months. I then used a Biden election win as a springboard for a big run with domestic recovery stocks and financials.

One client turned $3 million into $40 million last year. He owes me a dinner and my choice on the wine list. (Hmmmmm. Lafitte Rothschild 1952 Cabernet Sauvignon with a shot of Old Rip Van Winkle bourbon as a chaser?). I usually get a few of these every year.

See, that’s all you have to do to bring in a big year. Piece of cake. It’s like falling off a log. But then I’ve been practicing for 50 years.

In the end, I managed to bring in a net return of 66.5% for all of 2020. That compares to a net return for the Dow Average of 5.7%.

My equity trading in general brought in 71.94% in profits, with 216 trade alerts, and were far and away my top performing asset class. This was the best year for trading equities since the 1999 Dotcom bubble top.

Of course, the best single trade of the year was with Tesla (TSLA), with 18 trades bringing in a 10.55%. I dipped in and out during the 10-fold increase from the March low to yearend.

Readers were virtually buried with an onslaught of inside research about the disruptive electric car company. It’s still true if you buy the stock, you get the car for free, as I have done three times.

Some 26 trades in Apple (AAPL) brought in a net 5.94%. It did get stopped out a few times, hence the lower return.

The second most profitable asset class of the year was in the bond market, with 58 trades producing a 31.16% profit. Virtually all of these trades were on the short side.

I sold short the United States Treasury Bond Fund from $180 all the way down to $154. I called it my “rich uncle” trade of the year, writing me a check every month and sometimes several a month. This is the trade that keeps on giving in 2021. Eventually, I see the (TLT) falling all the way to $80.

I did OK with gold (GLD), making 4.88% with eight trades in the SPDR Gold Shares ETF. Gold rose steadily until August and then fell for the rest of the year. I picked up another 1.77% on two silver trades (SLV).

It was not all a bed of roses.

Easily my worst asset class of the year was with volatility, selling short the iPath Series B S&P 500 VIX Short Term Volatility ETN (VXX). I was dead right with the direction of the move, with the (VIX) falling from $80 to $20. But my timing was off, with time decay eating me up. I lost 7.29% on six trades.

Two trades in credit card processor Visa (V) cost me 4.37%. I had a nice profit in hand. Then right before expiration, rumors of antitrust action from the administration emerged, a spate of bad economic data was printed, and an expensive acquisition took place.

I call this getting snakebit when unpredictable events come out of the blue to force you out of positions. Visa shares later rose by an impressive 22% in two months.

I lost another 0.99% on my one oil trade of the year with the United States Oil Fund (USO), buying when Texas tea was at negative -$5.00 and stopping out at negative $15.00. Oil eventually fell to negative -$37.00.

Go figure.

I didn’t offer any foreign exchange trades in 2020. I got the collapse of the US dollar absolutely right, but the moves were so small and so slow they could compete with what was going on in equities and bonds.

However, I played the weak dollar in other ways, with bullish calls in commodities and bearish ones in bonds. It always works.

Anyway, it’s a New Year and we work in the “You’re only as good as your last trade” business. 2021 looks better than ever, with a 5% profit straight out of the gate during the first five trading days.

It really is the perfect storm for equities, with $10 trillion about to hit the US economy, most of which will initially go into the stock market.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

January 11, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or A WEEK FOR THE HISTORY BOOKS),

($INDU), (TSLA), (TBT), (TLT), (JPM), (WFC)

A man came at me with a crowbar last week.

I drove into Reno to buy some used backpacks for my Boy Scout troop and parked my Tesla in a nice residential neighborhood. Out of nowhere, a man ran down the street at me screaming profanities, crowbar in hand.

He shouted that I was from Antifa and that I had hired people to invade the Capitol Building to make President Trump look bad.

I reached into my car for my own crowbar. Then the local residents interceded, separating us. The man turned around and walked away, fuming.

“Who the heck was that?” I asked.

“He has mental issues,” said a neighbor. “We’ve had many problems with him before.”

Another said “He’s a Trump supporter. He saw your Tesla and thought you were a liberal.”

Wow! Looks like the nation has a very long way to heal.

Last year, the US defense budget amounted to $622 billion. When the greatest threat to congress in the nation’s history presented itself, it was antique chairs piled against the door that provided the best defense. Maybe we should ditch some big-ticket nuclear missiles and buy more chairs.

Of course, once the insurrection started on Wednesday, I was inundated with international calls from investors asking if they should pull all their money out of the US. I answered “NO” and that it was in fact time to double down. Those who did made a killing.

Ask any professional money manager what his reaction to a coup d’état in Washington would be, their response definitely would NOT be to run out and buy a ton of Tesla (TSLA). Yet, that was exactly the perfect thing to do, the stock soaring an astonishing $135, or 18% in two days. I have many followers who did exactly that and they made millions.

All I can say is that if a market gets hit with an insurrection, and exploding pandemic, and a crashing economy and only goes down 400 points and then bounces back the next day, you want to buy the hell out of it.

I’m talking about going on margin and taking a second mortgage on your home and pouring it into stocks. You might even consider going to a loan shark and borrowing at 18% because you can easily make double that in the right stocks.

After the Biden win and the Georgia sweep, there is now more rocket fuel pouring into the stock market than ever. Call it the “Biden blank check”. Estimates of new spending and subsidies about to hit the market now go up to $10 trillion. Let me list some of them:

*$2 trillion in enforced savings by locked up American consumers.

*Credit card balances have collapsed to multi-year lows, making available hundreds of billions in spending power.

*Trillions of Money market balances sitting on the sidelines yielding zero

*$908 billion stimulus package passed in the closing days of 2020

*A further $2 trillion stimulus package to pass shortly, including $2,000 checks for all 150 million US taxpayers.

*Add another $2 trillion infrastructure budget

*$1 trillion in student loan forgiveness for 10 million borrowers at $10,000 each

*Enormous subsidies for any alternative energy companies and Tesla cars

*The return of the deductibility of $1 trillion worth of state and local real estate taxes (known as (SALT)).

MUCH OF THIS CASH MOUNTAIN IS GOING STRAIGHT INTO THE STOCK MARKET!

It all sets up a stock market that has the potential to have “extreme” moves to the upside, according to my friend, Fundstrat’s Tom Lee.

All you need to retire early is someone to point you in the right direction, into the right sectors and the right stocks. Actually, I happen to know just the right person who can do that and that would be me!

Storming of the Capital shut down markets. After the initial crash, markets flatlined as the entire country dropped what they were doing and glued themselves to a TV, their jaws hanging open. The Dow dove 400 points, bonds and the US dollar stabilized, Tesla and oil took big hits, and gold and silver took off. The electoral college vote has been suspended, gunfights broke out on the house floor, and several explosive devices placed. Trump incited his followers to attack the capitol and they did exactly that. Washington DC is now subject to a 6:00 PM curfew for two weeks. Is this the beginning of the 2024 presidential election? It’s the worst day in Washington since the British burned it in 1814.

Democrats took Georgia, giving them Senate control and a blank check on spending for at least two years. Trump clearly blew the election for his party. My 3X short in bonds soared as the market crashed. Banks rocketed on a 10-basis point leap in interest rates. Infrastructure plays went ballistic. The US dollar faded. Add another couple of percentage points of US GDP growth for 2021.

Tesla Shorts posted biggest loss in history, setting on fire a staggering $38 billion in short positions. Many of these were financed by big oil looking to put Tesla out of business. The short interest in the stock has plunged from 37% to 5%. Did I mention that Tesla was the biggest Mad Hedge long of 2020? I’ve been buying it since it was a split-adjusted $3.30 a share in 2010 against a Friday close of $880, a gain of 290X. Elon Musk is now the richest man in the world and he’s only just getting started!

Tesla met its 500,000-unit 2020 target, far in excess of analyst forecasts. Q4 came in at a surprise 180,570 units. The firm’s 2021 target is 1.1 million units. The market Cap is about to touch $1 trillion, more than all of the global car industry combined. The Model 3 is doing the heavy lifting. Model Y production in Shanghai is about to ramp up and Berlin is to follow. If Tesla can mass-produce their solid-state batteries, they’ll attain a global monopoly in the car industry with 25 million units a year and a share price of $10,000.

A Saudi surprise production cut, a million barrels a day, sent oil over $50. But with demand that weak, how long can the rally last? The market is entering short-selling territory. I bet you didn’t use much gas today commuting from your bedroom to your home office. Use the rally to unload what energy you have left. Sell the (XLE) on rallies.

Bitcoin topped $42,000, more than doubling in a month, and exceeded $1 trillion as an asset class. A Biden-run economy means more money creation which has to find a home. My friend’s pizza purchase for 8 Bitcoin a decade ago is now worth $320,000. I hope it was good!

The Nonfarm Payroll came in at a loss of 140,000, giving more credence to the Q1 double-dip scenario and far worse than expected. The headline Unemployment Rate came in unchanged at 6.7%, Leisure & Hospitality lost a mind-blowing 498,000 and an incredible 3.9 million since January. Private Education lost 63,000 and Government 45,000. Professional & Business Services gained 161,000. The real U-6 Unemployment Rate is a very high 11.6%.

The bond crash has only just begun, with the (TLT) down $8 on the week. The risk/reward is the worst of any financial asset anywhere. I am maintaining my triple short position. Massive government borrowing will be a death knell for fixed income investors.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Mad Hedge Global Trading Dispatch closed out a blockbuster 2020 with a blockbuster 10.20% in December, taking me up to an eye-popping 66.64% for the year. I’m up 81% since the March low. In 2021, I shot out of the gate with an immediate 5.93% profit for the first four trading days of the year.

That brings my eleven-year total return to 428.48% double the S&P 500 over the same period. My 11-year average annualized return now stands at a nosebleed new high of 38.51%. My trailing one-year return exploded to 72.57%, the highest in the 13-year history of the Mad Hedge Fund Trader. We have earned 89% since the March low.

The coming week will be a slow one on the data front after last week's fireworks. We also need to keep an eye on the number of US Coronavirus cases at 22 million and deaths 370,000, which you can find here.

When the market starts to focus on this, we may have a problem.

On Monday, January 11 at 11:00 AM EST, US Inflation Expectations are released, which will increasingly become an area of interest.

On Tuesday, January 12 at 4:30 PM, API Crude Inventories are published.

On Wednesday, January 13 at 8:30 AM, the US Inflation Rate for December is announced.

On Thursday, January 14 at 8:30 AM, the Weekly Jobless Claims are published. We also get November Housing Starts.

On Friday, December 15 at 8:30 AM, December Retail Sales are printed. Q4 earnings seasons starts, with JP Morgan Chase (JPM) and Wells Fargo (WFC) reporting. At 2:00 PM we learn the Baker-Hughes Rig Count.

As for me, I’ll be taking my old Toyota Highlander down to the dealer in Reno. Squirrels moved into the engine and ate the wiring, knocking out the heater and the fan. All part of the cost of living in a mountain paradise. However, you have to share it with the critters.

I’ll also be investing in some pepper spray.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

January 8, 2021

Fiat Lux

Featured Trade:

(JANUARY 6 BIWEEKLY STRATEGY WEBINAR Q&A),

(TSLA), (SQM), (GLD), (SLV), (GOLD), (WPM), (TLT), (FCX), (IBB), (XOM), (UPS), (FDX), (ZM), (DOCU), (VZ), (T), (RTX), (UT), (NOC),

(FXE), (FXY), (FXA), (UUP)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.