Those planning a European vacation this summer just received a big gift from the people of Italy.

Since April, the Euro (FXE) has fallen by 10%. That $1,000 Florence hotel suite now costs only $900. Mille grazie!

You can blame the political instability on the Home of Caesar, which has not had a functioning government since March. The big fear is that the extreme left would form a coalition government with the extreme right that could lead to its departure from the European Community and the Euro. Think of it as Bernie Sanders joining Donald Trump!

In fact, Italy has had 61 different governments since WWII. It changes administrations like I change luxury cars, about once a year. Welcome to European debt crisis part 27.

I can't remember the last time markets cared about what happened in Europe. It was probably the first Greek debt crisis in 2011. This month, 10-year Italian bond yields have rocketed from 1% to 3%. But they care today, big time.

Given the reaction of the global financial markets, you could have been forgiven for thinking that the world had just ended.

U.S. Treasury Bond yields (TLT) saw their biggest plunge in years, off 15 basis points to 2.75%. The Dow Average ($INDU) collapsed by $500 to $24,250, with interest sensitive banks such J.P. Morgan Chase (JPM) and Bank of America (BAC) delivering the worst performance of the day.

Even oil prices collapsed for an entirely separate set of reasons - so far, the best performing commodity of 2018. The price of Texas Tea pared 10% in a week.

Saudi Arabia looks like it is about to abandon the wildly successful OPEC production quotas that have been boosting oil prices for the past year, and there are concerns that Iran will withdraw from the nuclear non-proliferation treaty. The geopolitical premium is back with a vengeance.

So, if the Italian developments are a canard why are we REALLY going down?

You're not going to like the answer.

It turns out that rising inflation, interest rates, oil and commodity prices, the U.S. dollar, U.S. national debt, budget deficits, and stagnant wage growth are a TERRIBLE backdrop for risk in general and stocks specifically. And this is all happening with the major indexes at the top end of recent ranges.

In other words, it was an accident waiting to happen.

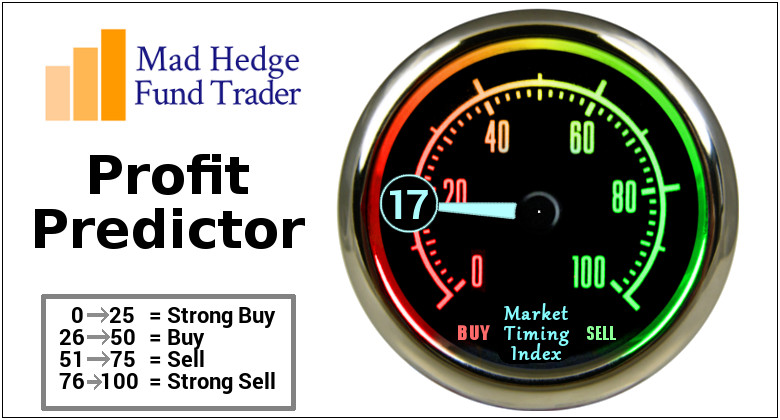

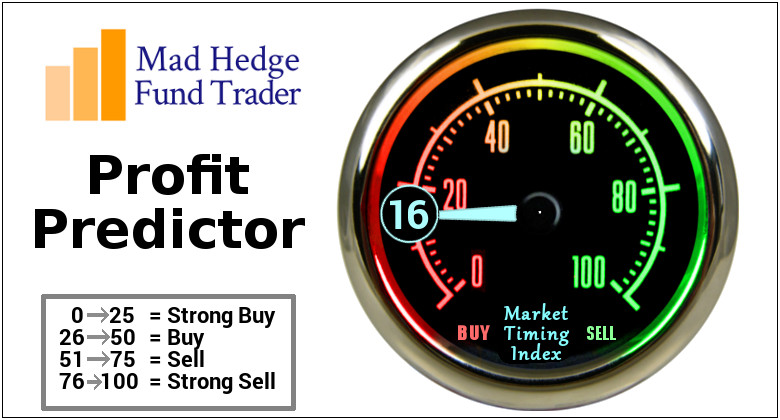

Traders are extremely nervous, global uncertainty is high, the seasonals are awful, and Washington is s ticking time bomb. If you were wondering why I was issuing so few Trade Alerts in May these are the reasons.

This all confirms my expectation that markets will remain in increasingly narrow trading ranges for the next six months until the mid-term congressional elections.

Which is creating opportunities.

If you hated bonds at a 3.12% yield from two weeks ago, you absolutely have to despise them at 2.75% today. That's why I added outright bond put options today to my model trading portfolio.

Stocks are still wildly overvalued for the short term, so I'll keep my short position there. As for oil (USO), gold (GLD), and the currencies, I don't want to touch them here.

So watch for those coming Trade Alerts. I'm not dead yet, just resting.

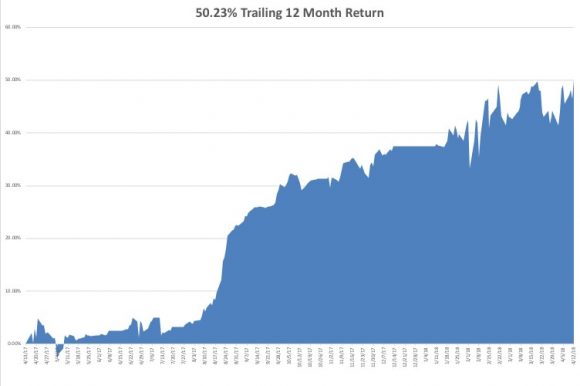

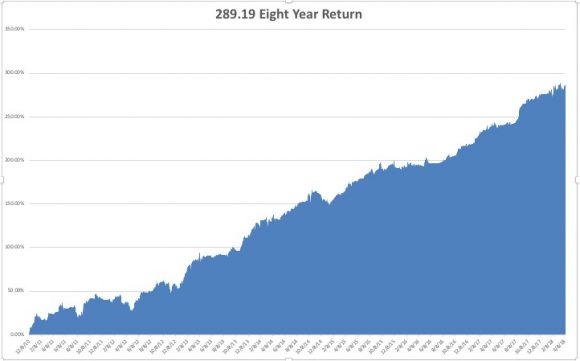

Waiting for My Shot