The Market Outlook for the Week Ahead, or The Best of Times and the Worst of Times

It is truly the best of times and the worst of times. And it's not a stretch to apply Charles Dickens’ line from the Tale of Two Cities to the stock market these days.

On the one hand, stocks have just delivered one of the sharpest rallies in market history, up a staggering 20% in nine weeks. Everyone is swimming in money once again. It is the kind of move that one sees once a generation, and usually presages the beginning of long term bull markets.

On the other hand, the bull market in stocks is nearly ten years old. Some 13 months ago, the market traded at a lofty multiple of 20X, but earnings were growing at an incredible 26% a year. Today, multiples are at a very high 18X, but earnings growth is zero! This only ends in tears.

Furthermore, the low level of interest rates with the ten year US Treasury bond (TLT) at a subterranean 2.65% suggests that we are on the verge of entering a recession. Warning: bonds are always right.

Of course, it is speculation of a ‘beautiful” trade deal with China that has been driving share prices higher on an almost daily basis. Unfortunately, 90% of the deal has already been discounted in the market. We could be setting up the biggest “Sell on the news of all time.”

If instead, we get a delay of 45-90 days while details are hashed out, markets could move sideways for months. That would be death for Volatility Index (VIX) players which have already seen prices collapse this year from $36 to $13. A return visit to the $9 handle is possible. Yes, the short volatility trade is back in size.

Far and away the most important news of the week was that the Fed Pause Lives! Or so the minutes from the January FOMC meeting imply. Lower interest rates for longer offer more benefits than risks. Less heat from the president too.

Perhaps this is response to economic data that has universally turned bad. Durable Goods dove 1.2%, in January in a big surprise. Recession, here we come!

Europe is falling into recession, and they will likely take us with them. February Eurozone Manufacturing PMI fell to 49.2, a three-year low. You obviously haven’t been buying enough Burberry coats, Mercedes, or French wine.

It was a very rough week for some individual stocks.

The Feds subpoenaed Kraft Heinz (KHC), and stock dove 27% over accounting problems. Warren Buffet took a one-day $4 billion hit. What is really in that ketchup anyway besides sugar and red dye number two? Avoid (KHC).

No toys for Mattel (MAT) which saw the worst stock drop in 20 years on the back of poor earnings and worse guidance. Another leading indicator of a weak economy. Barbie isn’t putting out.

It wasn’t all bleak.

Walmart (WMT) delivered online sales up 46% in Q4. Are they the next FANG? Same-store sales jump at the fastest pace in ten years on soaring grocery sales. The Wall family certainly hopes so. Buy (WMT) on dips.

Gold hit a ten-month high, and we are long. The new supercycle for commodities has already started. Get on board before the train leaves the station. Buy (GLD).

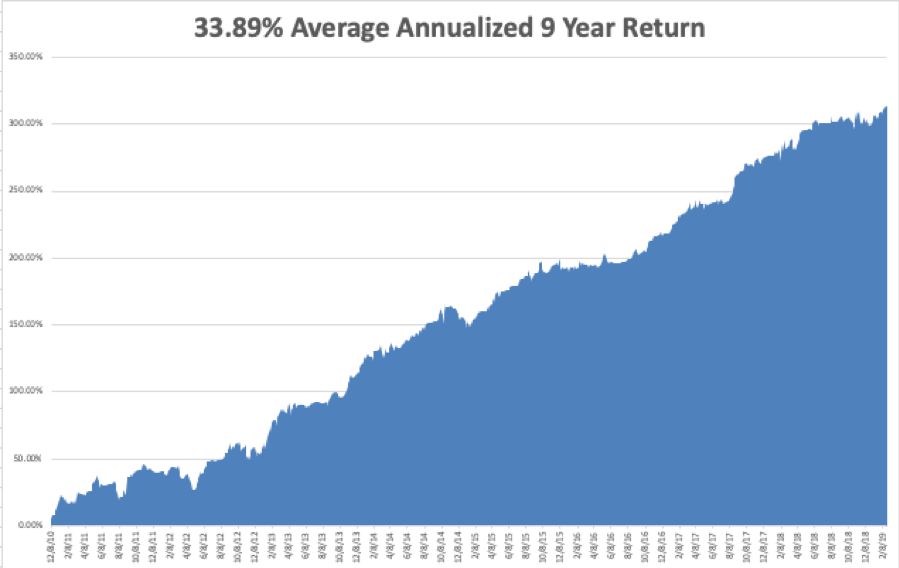

February has so far come in at a hot +4.07% for the Mad Hedge Fund Trader. My 2019 year to date return ratcheted up to +13.55%, boosting my trailing one-year return back up to +27.54%.

My nine-year return clawed its way up to +313.69%, another new high. The average annualized return appreciated to +33.89%.

I am now 80% in cash, 10% long gold (GLD), and 10% short bonds (TLT). We have managed to catch every major market trend this year loading the boat with technology stocks at the beginning of January, selling short bonds, and buying gold (GLD). I am trying to avoid stocks until the China situation resolves itself one way or the other.

It’s real estate week on the data front. An additional data delayed by the government shutdown is trickling out.

On Monday, February 25, at 8:30 AM EST, the Chicago Fed National Activity Index is out.

On Tuesday, February 26, 8:30 AM EST, January Housing Starts are published. At 9:00 the latest Case Shiller Corelogic National Home Price Index is published.

On Wednesday, February 27 at 10:00 AM EST, January Pending Home Sales are updated.

Thursday, February 28 at 8:30 AM EST, we get Weekly Jobless Claims. We also get an updated estimate on Q4 GDP. At 10:00 AM Fed governor Jerome Powell speaks.

On Friday, March 1 at 8:30 AM, we get data on January Personal Spending delayed by the government shutdown. The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I’ll be watching the Academy Awards on Sunday night. As I grew up near Hollywood, have dated movie stars my whole life, and even appeared as an extra in a couple of movies, I have always felt close to this industry.

My first pick for Best Picture is Green Book since I recall traveling through the deep south during this period. It was actually much worse than portrayed by the film. Roma is the favorite, but I thought it was boring. I guess I’m not the politically correct art film type.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader