July 31, 2009

Featured Trades: (SPX), (GS), (MS), (KBE)

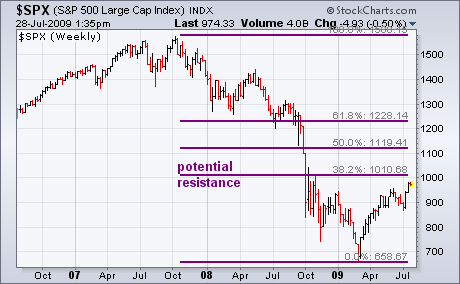

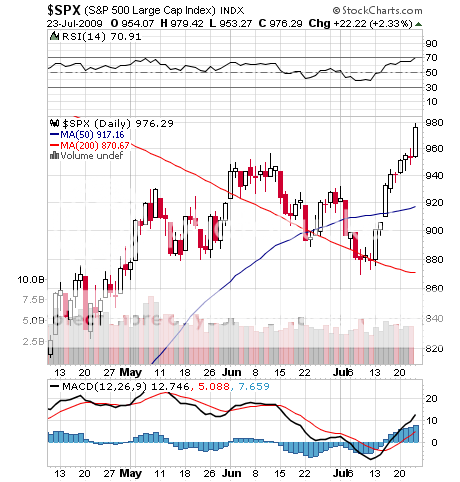

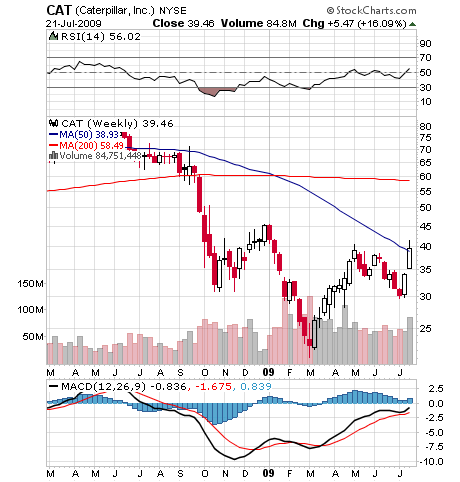

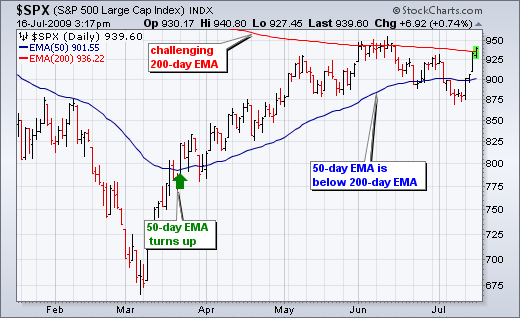

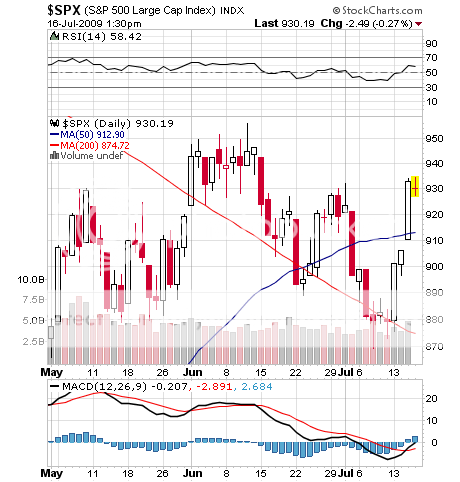

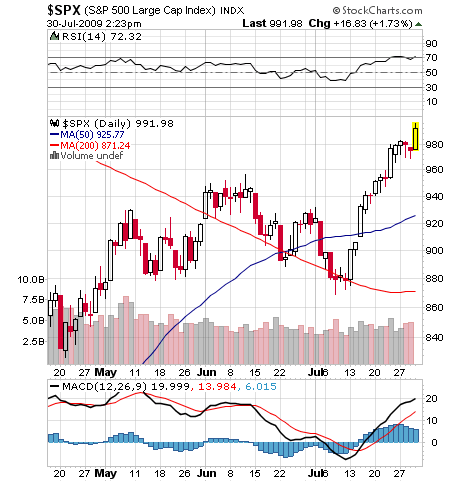

1) I thought PIMCO co-CEO Mohamed El-Erian hit the nail on the head when he said that the July stock market rally was nothing more than a sugar high. Skyrocketing unemployment does not create new demand. We are going nowhere without a real housing recovery, which is impossible with gun shy lenders. What little improvement we are seeing in the economy stems from unsustainable government spending. If you think the last stimulus package was tough to get through congress, wait until the next one. With three quarters of Q2 earnings out now, it is clear that company managements panicked and shed staff like a fur coat in a New York summer. This produced a string of top line disappointments and bottom line surprises. Companies can?t continue this, unless they want to shrink themselves out of existence. They are gaining weight by eating their seed corn. I think that if you want to go long here you are risking 10-15% to make 2-4%. It doesn?t look like a good risk/reward ratio to me. I prefer the inverse. There?s no law that says you have to trade every day of the year, despite what the brokers say. Better to keep your powder dry here with the S&P 500 at 993, and watch the long players inevitably crash and burn.

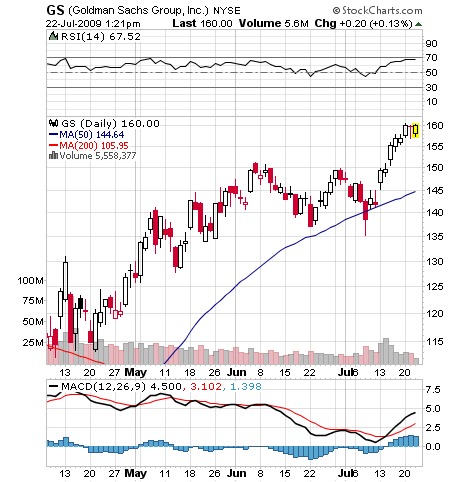

2) Those whose bacon was saved by the Q2 doubling and tripling of bank share stocks, better not count on a repeat in Q3 and Q4. For a start, there isn?t going to be any more government issued adrenaline to ramp prices with TARP?s, TALF?s, ZIRP?s, stress tests, and forced takeovers. The next move in interest rates is going to be a flattening one, cutting into their now hugely profitable margins. Q2 earnings showed that the best performing banks made the largest portion from trading, likely an unrepeatable performance. There is room for only one Goldman Sachs (GS) in the world, maybe two, if you count Morgan Stanley (MS). Wasn?t this the well that poisoned so many of them in the first place? Dare I say that many banks are now overvalued? The quick fingered might even entertain a sector short here in the bank ETF (KBE). For an excellent separation of the wheat from the chaff, take a look at Martin Hutchinson?s work by clicking here .

3) It always irritates the hell out of me when those off Wall Street try to tell those of us on Wall Street how to pay ourselves, contract issues aside. The only reason Phibro?s Andrew Hall is owed $100 million is because he made $500 million for his beleaguered Citigroup (C) parent. C needs more traders like him, not fewer. A 20% performance bonus is the most common of hedge fund compensation arrangements. What Main Streeters don?t get is that in bad years you get paid zero, and in fact, get a due bill, if you throw in the overhead. If C shareholders don?t like the deal, they can hire the guy who is happy to work for 10%, or 5%, or the fixed salary of a postal worker, but they may not like the results. For more on this debate, look at Jason Simpkins piece by clicking here .

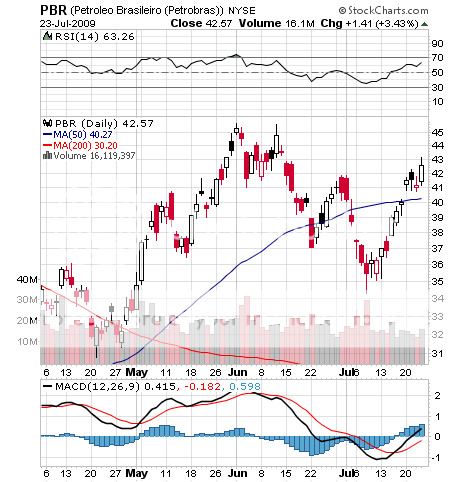

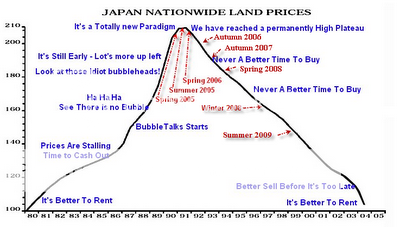

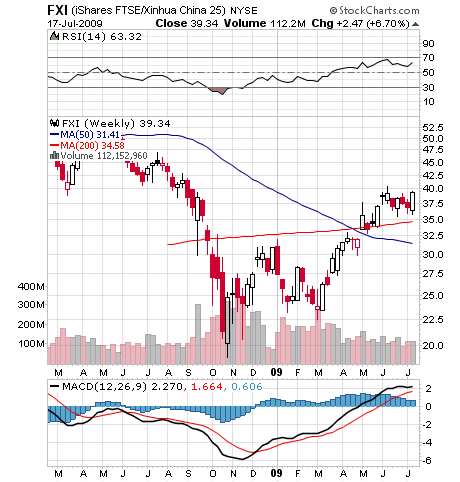

4)China is using the global collapse in asset prices to ramp up their acquisition of foreign companies?? by 13% this year, well up from 2008?s hefty $52 billion total.?? Enterprises like Sinopec, Beijing Automotive, and Haeir have been targeting companies like GM?s Hummer and Opel units, a Japanese department store, and Australian iron ore producer Rio Tinto.?? The goals are twofold: lock up long term supplies of natural resources and food, and access to advanced technology to enhance their competitive position in global markets. These are not small deals. A rumored bid for the largest oil producer in Argentina is thought to be around $14 billion. JP Morgan Chase and Morgan Stanley are making a killing on the fees. The great thing is that they don?t even need a credit card to pull this off. These are all cash deals, funded by the diversion of just a portion of China?s monthly US Treasury purchases. I remember the last foreign takeover binge, when it looked like Japan was going to buy the world. Remember Pebble Beach and Rockefeller Center? They ended up top ticking every market they touched. So sell away. Better to brush up on your Mandarin and start practicing with those chopsticks, because your next boss may come from the Middle Kingdom.

QUOTE OF THE DAY

?When I switched from the Democratic to the Republican parties, people called me a ?transvestocrat,? said Billy Tauzin, current lobbyist with the trade group Pharma, and former Cajun senator from Louisiana.