While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

July 22, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, OR BRACE YOURSELF),

(SPY), (TLT), (FXA), (FCX), (MSFT),

(TESTIMONIAL)

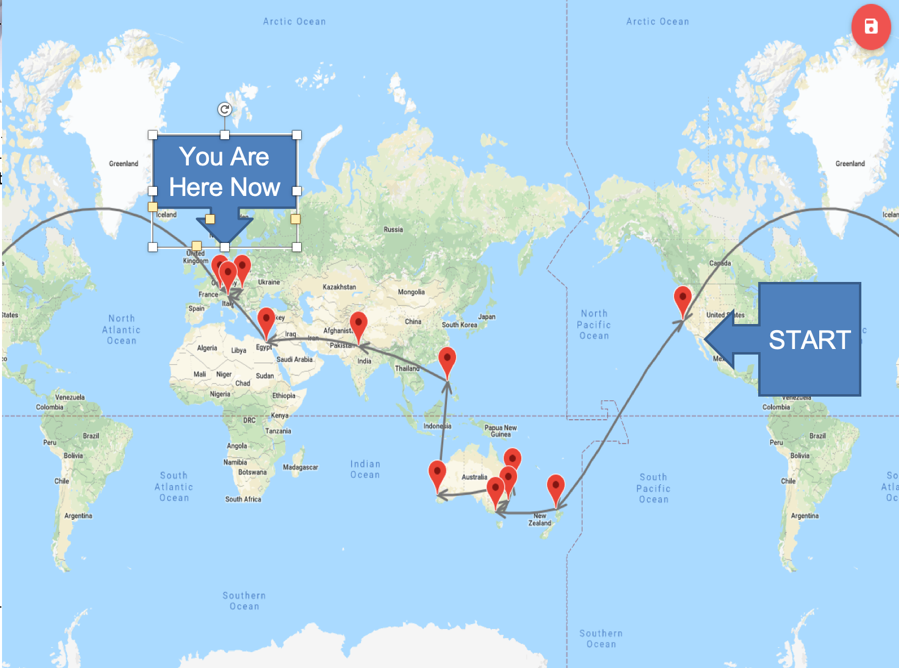

When you have constant jet log, you often have weird dreams. Take this morning, for example.

I dreamed that Fed governor Jay Powell invited me over to his house for breakfast. While he was cooking the bacon and eggs, Donald Trump started to call him every five minutes ordering him to lower interest rates. Jay got so distracted that the bacon caught fire, the house burned down, and we all died.

Fortunately it was only a dream. But like most dreams, parts of it were borrowed from true life.

Brace yourself, this could be the deadest, least interesting, most somnolescent week of the year. Thanks to all of those “out of office” messages we are getting with our daily newsletter mailings, I know that most of you will be out on vacation. Trading desks everywhere are now manned by “B” teams.

Then, the most important data release of the month doesn’t come out until Friday morning. It will be weak, but how weak? Q1 came in at a robust 3.1%. Q2 could be under 1%. The bigger unknown is how much of this widely trumpeted slowdown is already in the market?

Given the elevated levels of stock markets everywhere, most traders will rather be inclined to bet on which of two flies crawls up a wall faster. Such are the dog days of summer.

We here in Europe are bracing for the next ratchet up in climate change, where every temperature record is expected to be broken. It is forecast to hit 92 in London, 106 in Paris, and 94 in Berlin. Still, that's a relief from India, where it was 120. Five more years of global warming and India will lose much of its population as it will become uninhabitable.

I shall have to confine my Alpine climbing to above 8,000 feet where hopefully it can reach the 70s. By the way, the air conditioning in Europe sucks, and the bars always run out of ice early.

While the Fed is expected by all to cut interest rates a quarter point next week, we have suddenly received a raft of strong economic data points hinting that it may do otherwise.

Inflation hit an 18-month high, with the CPI up a blistering 0.3% in June. That’s why bonds (TLT) took a sudden four-point hit. Soaring prices for apparel (the China trade war), used cars, rents, and healthcare costs led the charge. Is this the beginning of the end, or the end of the beginning?

The Empire State Factory Index hits a two-year high, leaping from -8.6 in June to 4.3 in July. No recession here, at least in New York.

Microsoft (MSFT) blew it away, with spectacular Q2 earnings growth, wiping out conservative analyst forecasts. Azure, the company’s cloud business, rose a spectacular 64%. Nothing like seeing your number one stock pick for 2019 take on all comers. Buy (MSFT) on every dip.

An early read on Q2 GDP came in at a sizzling 1.8%. Many forecasts were under 1%, thanks to the trade wars, soaring budget deficits, and fading tax revenues. That’s still well down from the 3.1% seen in Q1. It seems no one told Main Street, where retail sales and borrowing are on fire, according to JP Morgan’s Jamie Diamond.

US Retail Sales rose a hot 0.4% in June, raising prospects that the Fed may not cut interest rates after all. Stocks and bonds both got hit. Don’t panic yet, it’s only one number.

If the Fed only looks at the data above, it would delay a rate cut for another quarter. If they choose that option, the Dow Average would plunge 1,000 points in a week. The market-sensitive Fed knows this too.

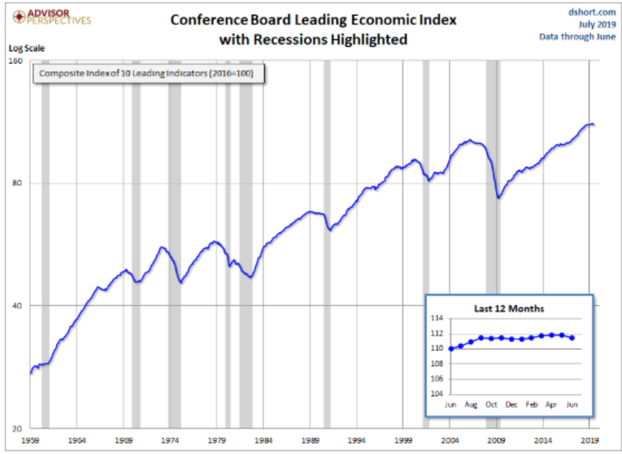

However, the Fed has to be maintaining a laser-like focus on the Conference Board Index of Leading Economic Indicators, which lately have been rolling over like the Bismarck and always presage a recession. For your convenience, I have included a 60-year chart below with the recessions highlighted.

And there were a few soft spots in the numbers as well.

China growth slowed to 6.2%, a 27-year low. Never mind that the real rate is probably only 3%. The slowdown is clearly the outcome of the trade war. That’s what happens when you make war on your largest customer. Markets rallied because it was not worse.

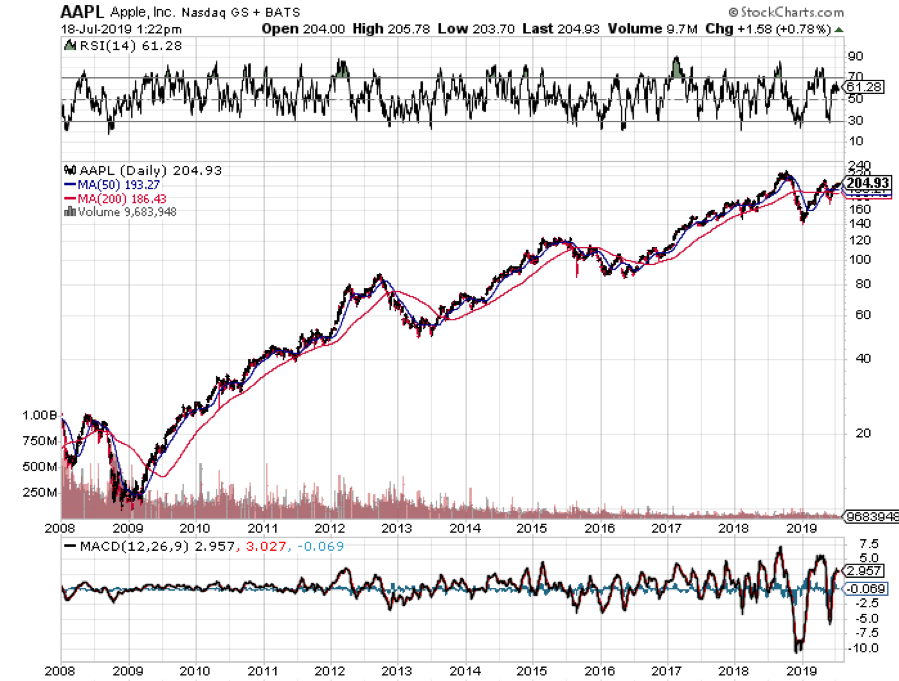

Banks beat on earnings, but stocks yawned, coming off an “OK” quarter. It’s still the sector to avoid with a grim backdrop of sharply falling interest rates. They’re also getting their pants beat by fintech, from which there is no relief.

There is no end to the China trade war in sight, as Trump once again threatened another round of tariff increases. It looks like the trade war will outlast the presidential election, since the Chinese have no interest in helping Trump get reelected. The puzzle is that the stock market could care less.

Trump’s war on technology expanded. First, Facebook (FB) got hit with a $5 fine over privacy concerns. Now Google (GOOGL) is to be investigated for treason for allegedly helping the Chinese military. In the meantime, Europe is going after Amazon (AMZN) on antitrust concerns. If the US isn’t going to dominate technology, who will. Sorry, but this keyboard doesn’t have Chinese characters.

June US Housing Starts fell 0.9%, while permits dove 6%. If builders won’t build in the face of record low interest rates, their outlook for the economy must be grim. Maybe the 36% YOY decline in buying from Chinese has something to do with it.

Oil popped on the US downing of an Iranian drone in the Straits of Hormuz, which I flew over myself only last week on my way to Abu Dhabi. Expect this tit for tat, “Phony War” to continue, making Texas tea (USO) untradeable. In the meantime, the International Energy Agency has cut oil demand forecasts, thanks to a slowing global economy.

My strategy of avoiding stocks and only investing in weak dollar plays like bonds (TLT), foreign exchange (FXA), and copper (FCX) has been performing well. After spending a few weeks out of the market, it’s amazing how clear things become. The clouds lift and the fog disperses.

My Global Trading Dispatch has hit a new high for the year at +17.78% and has earned a respectable 2.54% so far in July. Nothing like coming out of the blocks for an uncertain H2 on a hot streak.

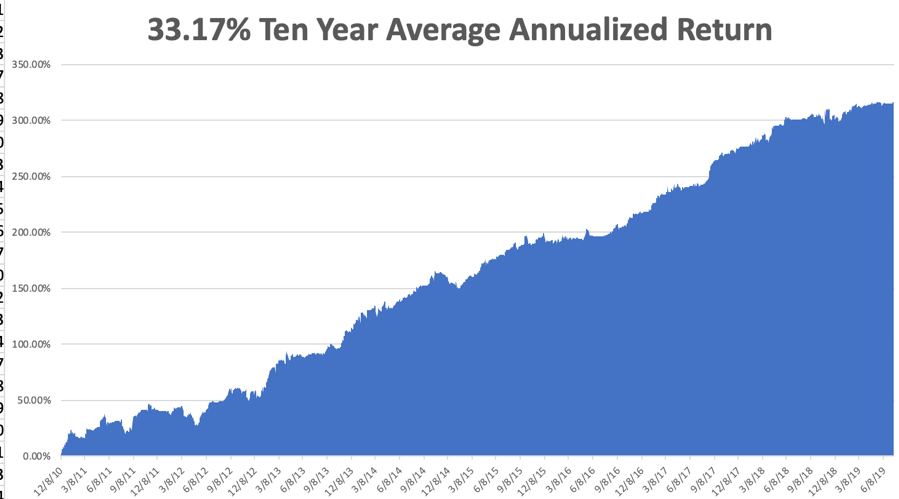

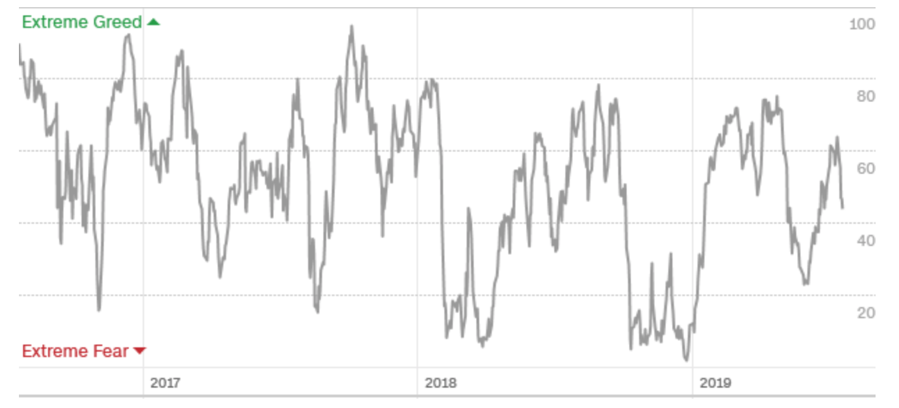

My ten-year average annualized profit bobbed up to +33.12%. With the markets now in the process of peaking out for the short term, I am now 70% in cash with Global Trading Dispatch and 100% cash in the Mad Hedge Tech Letter. If there is one thing supporting the market now, it is the fact that my Mad Hedge Market Timing Index has pulled back to a neutral 44. It’s a Goldilocks level, not too hot and not too cold.

The coming week will be a fairly sedentary one on the data front after last week’s fireworks, except for one big bombshell on Friday.

On Monday, July 22, the Chicago Fed National Activity Index is published.

On Tuesday, July 23, we get a new Case Shiller National Home Price Index. June Existing Home Sales follow.

On Wednesday, July 24, June New Home Sales are released.

On Thursday, July 25 at 8:30 AM EST, the Weekly Jobless Claims are printed. So are June Durable Goods.

On Friday, July 26 at 8:30 AM EST, we get the most important release of the week, the advance release of US Q2 GDP. The numbers are expected to be weak, and anything above 1.8% will be a surprise, compared to 3.1% in Q1. Depending on the number, the market will either be up big, down big, or flat. I can already hear you saying “Thanks a lot.”

The Baker Hughes Rig Count follows at 2:00 PM.

As for me, I’ll be attending a fund raiser tonight for the Zermatt Community band held in the main square in front of St. Mauritius church. If you don’t ski, there isn’t much to do in the winter here but practice your flute, clarinet, French horn, or tuba.

We’ll be eating all the wurst, raclete, beer, and apple struddle we can. As an honorary citizen of Zermatt with the keys to the city, having visited here for 51 years, I get to attend for free.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Market Timing Index

Mad Hedge Technology Letter

July 22, 2019

Fiat Lux

Featured Trade:

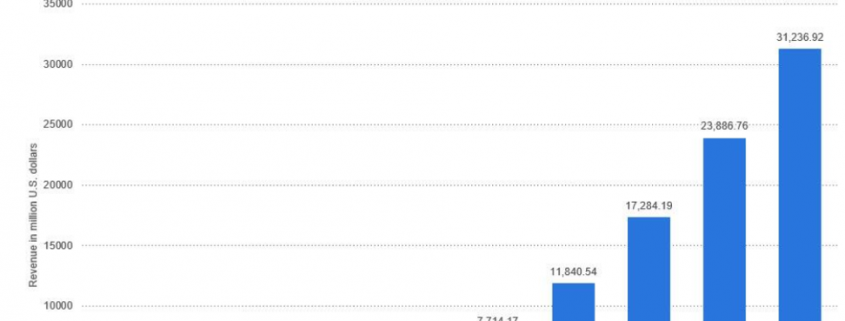

(DOES ARTIFICIAL INTELLIGENCE WORK FOR YOU?),

(TSLA), (AMZN), (FB)

Anti-A.I. physicist Professor Stephen Hawking was a staunch supporter of preserving human interests against the future existential threat from machines and artificial intelligence (A.I.).

He was diagnosed with motor neuron disease, more commonly known as Lou Gehrig's disease, in 1963 at the age of 21 and sadly passed away March 14, 2018 at the age of 76.

Famed for his work on black holes, Professor Hawking represented the human quest to maintain its superiority against quickly advancing artificial acculturation.

His passing was a huge loss for mankind as his voice was a deterrent to A.I.'s relentless march to supremacy. He was one of the few who had the authority to opine on these issues. Gone is a voice of reason.

Critics have argued that living with A.I. poses a red alert threat to privacy, security, and society as a whole. Unfortunately, those most credible and knowledgeable about A.I. are tech firms. They have shown that policing themselves on this front is remarkably unproductive.

Mark Zuckerberg, CEO of Facebook (FB), has labeled naysayers as "irresponsible" and dismissed the threat. After failing to prevent Russian interference in the last election, he is exhibiting the same defensive posture translating into a de facto admission of guilt. His track record of shirking accountability is becoming a trend.

Share prices will materially nosedive if A.I. is stonewalled and development stunted. Many CEOs who stake careers on doubling or tripling down on A.I. cannot see it die out. There is too much money to lose.

The world will see major improvements in the quality of life in the next 10 years. But there is another side to the coin which Zuckerberg and company refuse to delve into...the dark side of technology.

Defective Amazon (AMZN) Alexa recently produced unexplained laughter because of a mistaken command to start laughing. Despite avoiding calamity, these small events show the magnitude of potential chaos capable of haywire A.I. functions. If one day a user attempts to order a box of tissues and Alexa burns down the house, who is liable?

Tesla's (TSLA) CEO Elon Musk has shared his anxiety about robots flipping the script on humans. Musk acknowledges that A.I. and autonomous vehicles are important factors in the battle for new technology.

The winner is yet to be determined as China has bet the ranch with unlimited resources from Chairman Xi.

The quagmire with China has been squarely centered around the great race for technological supremacy.

A.I. is the ultimate X factor in this race and whoever can harness and develop the fastest will win.

Musk has hinted that robots and humans could merge into one species in the future.

Is this the next point of competition among tech companies? The future is murky at best.

Bill Gates noted that robots should be taxed like humans.

This reflects the bubble in which the ultra-elite reside.

This comment implies that humans and robots are at the same level. It shows a severe lack of empathy for the 40% of working Americans who will be replaced by machines over the next 10 years.

The West is comprised of a deeply hierarchical system of winners and losers. Hawking's premise that evolution has inbuilt greed can be found in the underpinnings of America's economic miracle.

Wall Street has bred a culture that is entirely self-serving regardless of the bigger system in which it finds itself.

Most of us are participating in this perpetual money game chase because our system treats it as a natural part of life.

A.I. will help more people do well in this paper chase to the detriment of the majority.

Quarterly earnings performance is paramount for CEOs.

Return value back to shareholders, or face the sack in the morning.

It's impossible to convince anyone that America's capitalist model is deteriorating in the greatest bull market of all time.

Wall Street has an insatiable hunger for cutting-edge technology from companies that sequentially beat earnings and raise guidance.

Flourishing technology companies enrich the participants creating a Teflon-like resistance to downside market risk.

The issue with Professor Hawking's work is that his timeframe is too far in the future.

Professor Hawking was probably correct, but it will take 25 years to prove it.

The world is quickly changing as science fiction becomes reality.

The year 2020 will signal the real beginning of A.I. in tangible form when autonomous fleets flood main streets and is another step in the direction of human's overreliance on machines.

People on Wall Street are a product of the system in place and earn a tremendous amount of money because they proficiently execute a specialized job.

Traders are busy focusing on how to move ahead of the next guy.

Firms building autonomous cars are free to operate as is.

Hyper-accelerating technology spurs on the development of A.I., machine learning, and enhanced algorithms.

Record profits will topple, and investors will funnel investments back into an even narrower grouping of technology stocks after the weak hands are flushed out.

Professor Hawking said we need to explore our technological capabilities to the fullest in order to avoid extinction.

In 2019, exploring these new capabilities still equals monetizing through the medium of products and services.

This is all bullish for equities as the leading companies associated with A.I. have a red carpet laid out in front of them.

And let me remind you that technology is still the least regulated industry on the planet even if sentiment has pivoted this year.

The only solution is keeping companies accountable by a function of law or creating a third-party task force to regulate A.I.

In 2019, the thought of overseeing robots sounds crazy.

However, by 2020, it might be as normal as uncontrollable laughter from your smart home device.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

July 19, 2019

Fiat Lux

Featured Trade:

(DON’T MISS THE JULY 24 GLOBAL STRATEGY WEBINAR)

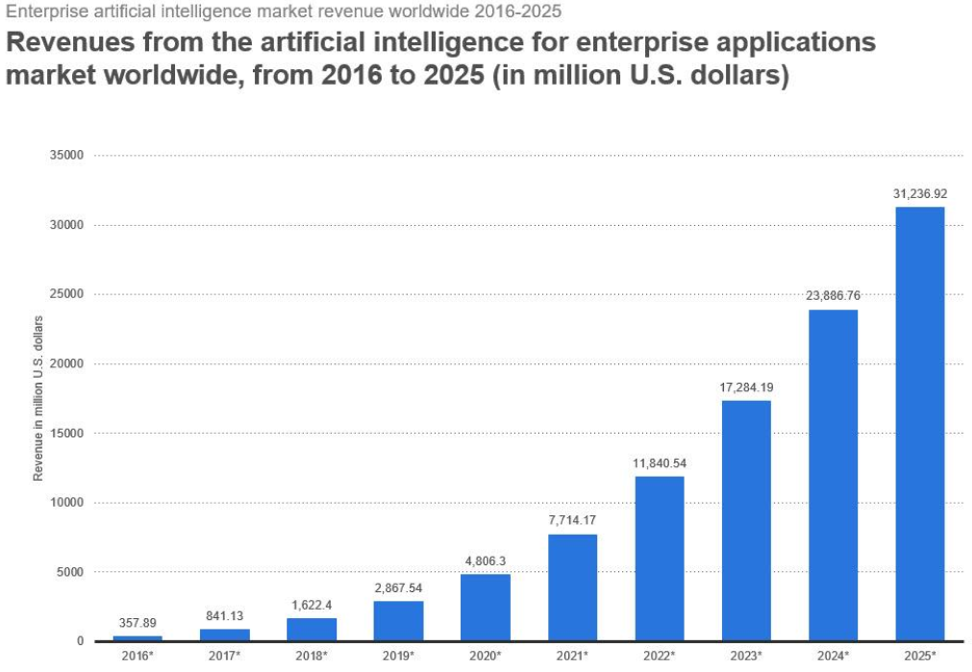

(WHAT’S HAPPENED TO APPLE?), (AAPL)

(STORAGE WARS)

(MSFT), (IBM), (CSCO), (SWCH)

One of the great mysteries of the tech world has at last been answered.

Apple’s brand new spaceship-designed headquarter, one of the world’s most valuable buildings, has finally had a value put on it.

New figures released this week show the tech giant’s circular headquarters in Cupertino, CA was assessed at a breathtaking $3.6 billion by Santa Clara County for property tax purposes. The valuation doesn’t perfectly coincide with its market value — how much it would sell for — but is based off a detailed appraisal of the building, which opened in 2017.

If you include computers, furniture, and even farm equipment to take care of the property’s abundant peach trees, the figure rises to $4.17 billion for the fiscal year that ended in June, the assessor’s office said.

Beyond its giant 2.8 million-square-foot size, Apple Park’s high-end materials, abundant glass, and intricate design make it a standout in Silicon Valley. The building is so big it even has its own weather.

Unfortunately, the share prices of companies that spend billions on flashy new designer headquarters do not have a great history. Ride around Manhattan in an Uber cab and you’ll quickly understand that time has not been kind to the extravagant: the Chrysler Building, the Pan Am Building, and the AT&T building to name just a few.

Citicorp’s HQ, with its horizon-defining slant-edged roof, is still in business, but the stock is still down 75% from its pre-crash high. Is Apple headed in the same direction?

Looking at the share price performance of the past year, which has been zero, you might be forgiven for thinking so. Other tech stocks have risen by 50% or more during the same period.

Apple Park is among the world’s dozen most expensive buildings despite its relatively modest four-storey height.

America’s tallest spire, the 1,776-foot One World Trade Center in New York, cost $3.9 billion to build according to the Port Authority of New York and New Jersey which owns the building and has 3.5 million square feet. Singapore’s Marina Bay Sands resort reportedly topped $5 billion in costs, while Finland’s Olkiluoto 3 nuclear reactor exceeded $6 billion.

Saudi Arabia’s holy city of Mecca is home to two of the most valuable buildings in the world: the $15 billion Abraj Al Bait Towers and the $100 billion Great Mosque of Mecca.

Apple Park was assessed at more than twice the amount of Salesforce Tower, San Francisco’s tallest building, which was valued at $1.7 billion by San Francisco. Salesforce Tower has about half as much office space as Apple Park despite being 57 stories taller.

With property taxes in Santa Clara County running around 1.25%, Apple would owe around $50 million annually.

The building is a manageable expense for Apple’s profit machine. In its most recent quarter, Apple reported a mind-numbing $58 billion in revenue and $11.5 billion in net income.

Apple was Santa Clara County’s largest property taxpayer for the 2017-18 fiscal year, with $56 million in taxes paid.

Investors have been frustrated with Apple’s recent performance, although it did make back most of the 40% hickey it suffered last fall.

Its business plan seems well on track, shifting from a hardware company to one that focuses on software and services. If anything, the shift has been taking place faster than expected, with the cloud, iTunes, Apple Wallet, Apple Care, the App Store, and other services accounting for a growing share of earnings.

All will become clear when the company announces their Q3 earnings on Tuesday, July 30 after the stock market close.

No, I think the problem with Apple is that it is suffering from the China Disease. Employing a million people who produce 225 million iPhones a year, Apple is the preeminent hostage in the US-China trade dispute. That, undoubtedly, has been a dead weight on the shares.

However, after covering this field for half a century, I can tell that trade wars start, trade wars play out, and trade wars end. Unlike other trade wars, this one has a specific end date. That would be on Wednesday, January 20, 2021, or in 18 months, the date of the next presidential inauguration.

As for me, I am waiting to upgrade my current iPhone X until it includes 5G wireless technology early next year. I bet 225 million others are as well. Dump the trade war and Apple shares could rocket up towards my old long-term target of $250 a share in a heartbeat.

By the way, there is one other headquarter that may be about to join the dustbin of history. That would be 725 Fifth Avenue, NY, NY 10022, which has been appraised at a mere $371 million and carries a hefty $100 million in debt. In is now partly owned by the US Justice Department, which will soon sell its stake.

Locals know it as Trump Tower.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.