While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

January 9, 2020

Fiat Lux

Featured Trade:

(WEDNESDAY, FEBRUARY 5 MELBOURNE, AUSTRALIA STRATEGY LUNCHEON)

(CAPTURING SOME YIELD WITH CELL PHONE REITS),

(CCI), (AMT), (SBAC),

(JNK), (SPG), (AMLP), (AAPL), (VZ), (T), (TMUS), (S)

Come join me for lunch at the Mad Hedge Fund Trader’s Global Strategy Update, which I will be conducting in Melbourne, Australia on Wednesday, February 5, 2020 at 12:30 PM.

An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period.

I’ll be giving you my up-to-date view on stocks, bonds, currencies commodities, precious metals, energy, and real estate.

I also hope to provide some insight into America’s opaque and confusing political system. And to keep you in suspense, I’ll be throwing a few surprises out there too.

Tickets are available for $232.

I’ll be arriving at 12:30 PM and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a downtown five-star hotel the details of which will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research.

To purchase tickets for the luncheons, please click here.

I am constantly bombarded with requests for high-yield, low-risk investments in this ultra-low interest rates world.

While high-yield energy Master Limited Partnerships LIKE (AMLP) can offer double-digit returns, they carry immense risks. After all, if the prices of oil drop to $5-$10 a barrel, replaced by alternatives as I eventually expect, all of these instruments will get wiped out.

You can earn 5%-8% from equity-linked junk bonds. However, their fates are tied to the future of the stock market at a 20-year valuation high against flat earnings.

You might then migrate to Real Estate Investment Trusts (REITs) like Simon Property Group (SPG), which acts as a pass-through vehicle for investments in a variety of property investments. However, many of these are tied to shopping malls and the retail industry, the black hole of investment today.

So where is the yield-hungry investor to go?

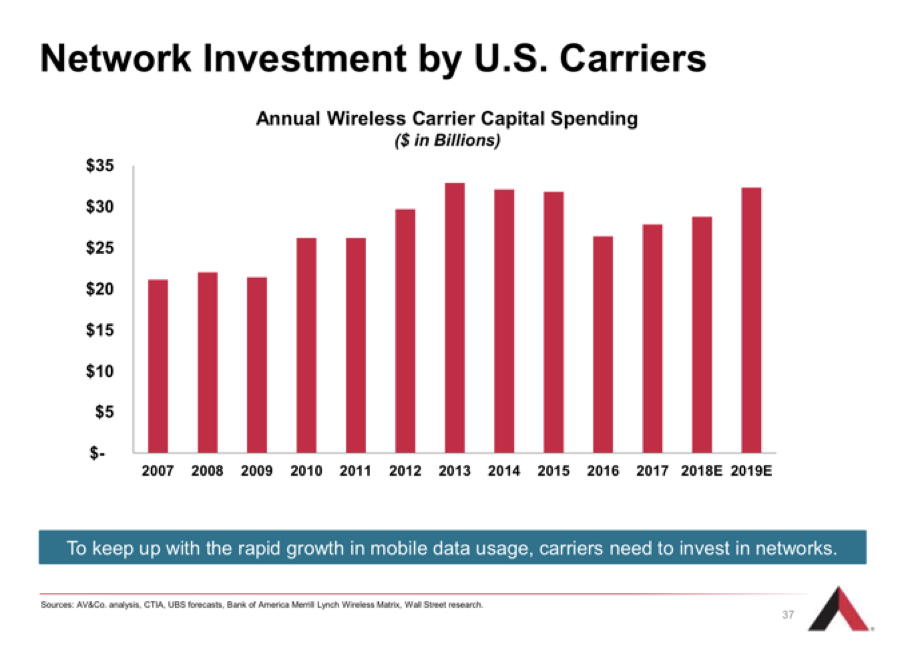

You may have heard about something called 5G. This refers to the rollout of fifth-generation wireless technology that will increase smartphone capabilities tenfold. Whole new technologies, like autonomous driving and artificial intelligence, will get a huge boost from the advent of 5G. Apple (AAPL) will launch its own 5G phone in September.

5G, like all cell phone transmissions, rely on 50-200-foot steel towers strategically placed throughout the country, frequently on mountain peaks or the tops of buildings. With demand from the big phone carriers soaring, there is a construction boom underway in cell phone towers. There just so happens to be a class of REITs that specializes in investment in this sector.

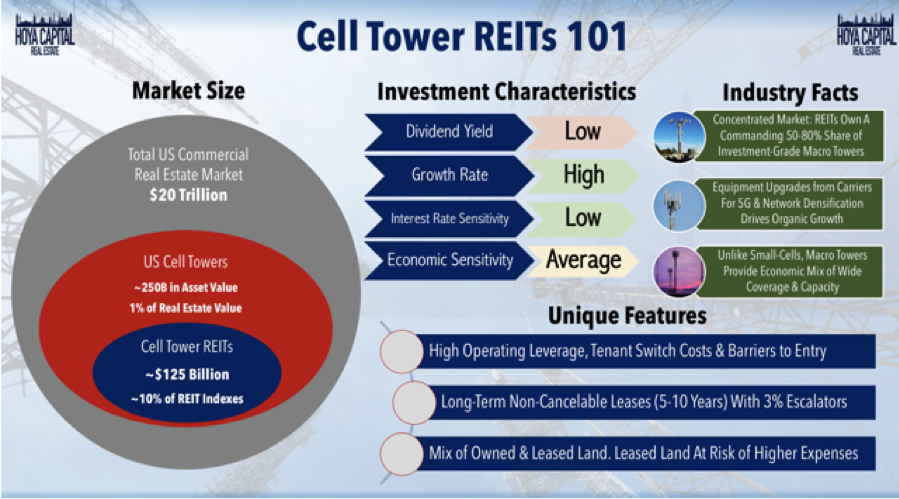

Cells Phone REITs constitute a $125 billion market and make up 10% of the REIT indexes. They own 50%-80% of all investment-grade towers. They are all benefiting from a massive upgrade cycle to accommodate the 5G rollout. These REITs own or lease the land under the cell towers and then lease them to the phone companies, like Verizon (VZ), AT&T (T), T-Mobile (TMUS), and Sprint (S) for ten years with 3% annual escalation contracts.

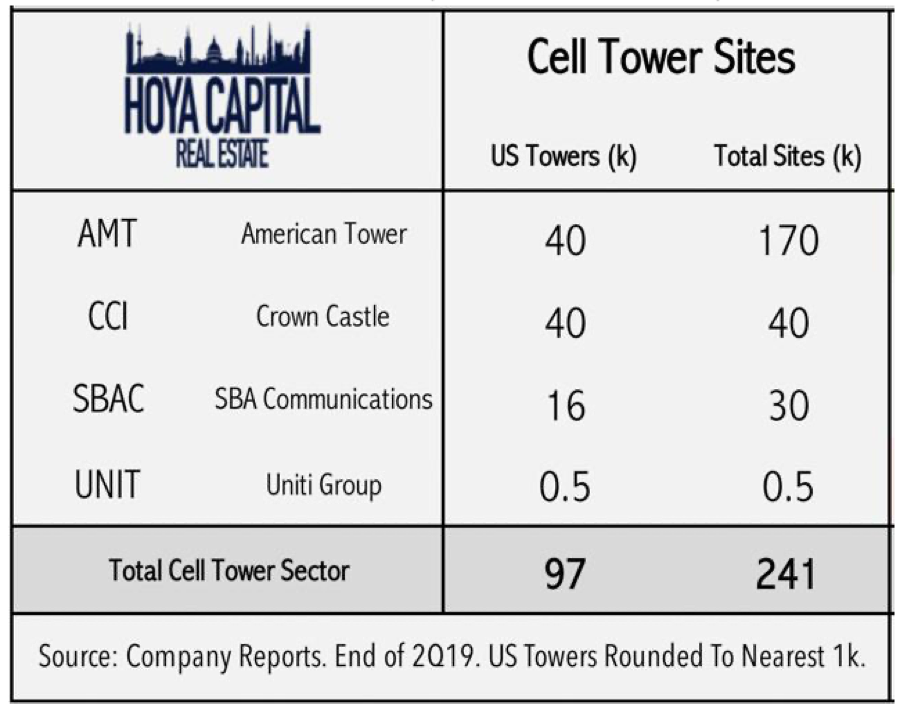

American Tower (AMT) is far and away the largest such REIT, with 170,000 towers, has provided an average annual return over the past ten years, and offers a fairly safe 1.65% yield. They are currently expanding in Africa. Even during the 2008 crash, (AMT) still delivered an 8% earnings growth.

SBA Communications (SBAC) is the runt of the sector with only 30,000 towers. However, it has a big presence in Central and South America and is seeing earnings grow at a prolific 80% annual rate. (SBAC) is offering a 1.48% yield at today’s prices.

Crown Castle International (CCI) is in the middle with 40,000 large towers and 65,000 small ones. 5G signals travel only a 1,000 meters, compared to several miles for 4G, requiring the construction of tens of thousands of small towers where (CCI) is best positioned. (CCI) offers a hefty 3.39% yield.

Small cell towers are roughly the size of an extra-large pizza box and will soon be found on every urban street corner in the US. AT&T (T) has estimated that there is a need for over 300,000 small cell phone towers in the US alone.

So, if you’re looking for a sea anchor for your portfolio, a low-risk, high-return investment that won’t see a lot of volatility, Cell phone REITs may be your thing. Buy (CCI) on dips.

Can you hear me now?

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Technology Letter

January 8, 2020

Fiat Lux

Featured Trade:

(THE TOP IS NOT IN FOR TECH STOCKS))

(AAPL), (FB), (GOOGL)

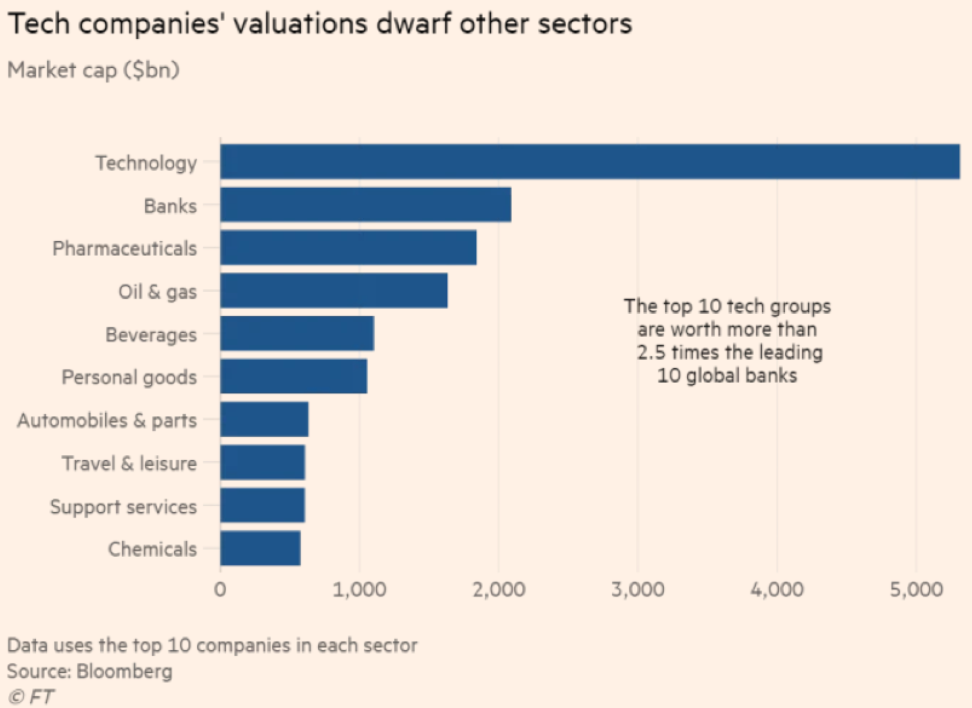

Tech shares are pricey, but that doesn’t mean they can’t get more expensive.

Strength often begets strength.

Let’s take for instance Apple (AAPL) – it delivered investors 86% in 2019 and that was their best performance in the past 10 years.

This was on the heels of a tumultuous 2018 where Apple sank 6%.

Many of the best of brightest of the tech industry beat the S&P last year, which itself gained 29%.

And as Apple leapfrogged into the software as a service business, they find themselves shunning China hardware revenue that got themselves into the 2018 mess.

Apple is betting that the confines of stateside consumer culture will offer greener pastures.

Overall, the market is pricing in a lukewarm 2020 for tech earnings boding well for the elite tech stocks that celebrated touchdown after touchdown in 2019.

Surpassing low expectations could be another rewind back to Q4 2019 which was a time that offered tech shares a platform to surge to all-time highs.

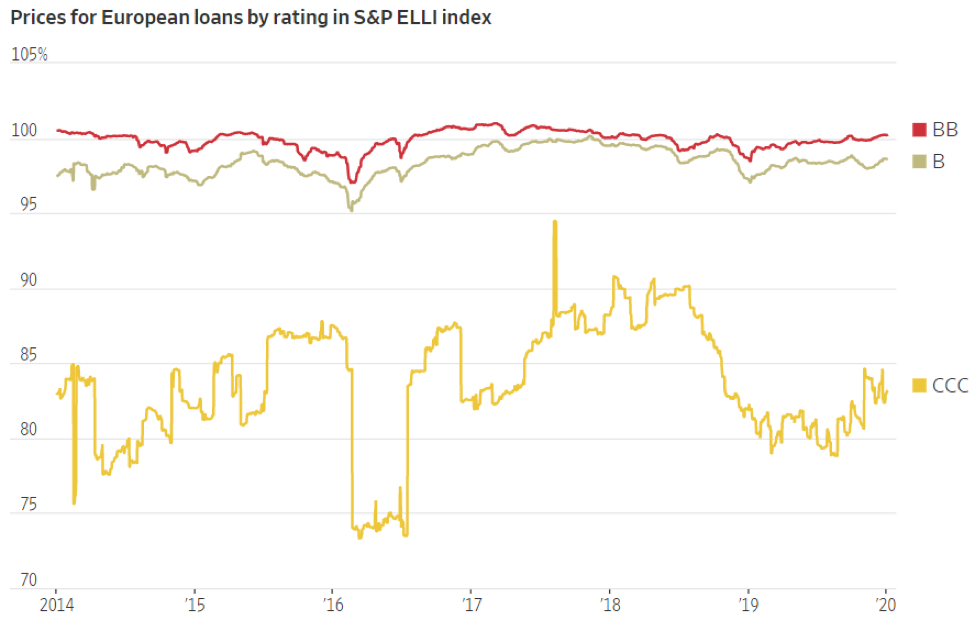

The worrying development for 2020 is that poorer-rated tech corporations won’t have the same access to cheap debt as they did in 2018 or even 2019.

The chapter of loose credit is about to close stymying loss-making tech companies who thought they could use subsidies to achieve success.

The prices of CCC-rated European bonds have declined immensely in the past year showing investors' lack of appetite for the riskier part of the corporate debt market.

Venture capitalists aren’t going to foot the bill for the next big thing in Silicon Valley at this point in the economic cycle unless the unit economics are too good to be true.

The story of 2020 will be the intensification between the haves and have nots in tech.

This is the case of the market putting a premium on time-honored tech brands and bulletproof balance sheets that they have cultivated.

On a broader level, the Fed who has presided over a $600 billion expansion in their balance sheet in the last four months offers yet another tailwind to tech shares in the short-term.

The Fed’s decision in the last few months to re-start large-scale asset purchases will help keep a foot under tech shares in early 2020 and responds like a de facto QE.

If you thought 2019 was a bad year for Uber and Lyft, then wait until this year plays itself out.

The gig economy stocks are in the direct firing line with nowhere to run and other non-sensical profit models will find it costly to search for debt alternatives in which to service their visions.

If the tech sector does become a war of attrition between the FANGs staving off one another by acquiring inorganic growth, then marginal tech players will get squeezed because they don’t have the capital bazookas to compete with the likes of Facebook (FB) and Google (GOOGL).

This is the year that we could see a slew of fringe tech companies go bust as debt markets sour on false narratives of future profits and equity markets turn against them.

The feast versus famine theme is also aligned with 5G, with many of the same cast of characters such as Apple, Alphabet posed to usurp revenue when this new technology finally becomes pervasive in consumer culture.

The Apple refresh cycle will dust off its playbook for another blockbuster rollout later this year when Apple debuts its much-awaited 5G phone.

Much of the share appreciate in Apple of late can be attributed to the anticipation of the new iPhone and the fresh infusion of revenue that branches off from it.

The applications that result from the new 5G Apple phone is seen as a luscious force multiplier to many 3rd party companies as well.

Chip stocks will be counted on as the ones lifting the tech foundations and just looking at shares in China, demonstrations of frothiness are running wild throughout their markets.

The Chinese government, to counteract the trade war, has been on a mission to flood its tech sector with unlimited capital as a catchup mechanism to overcome its inferior domestic chip industry.

Will Semiconductor, a supplier of integrated circuit products for telecommunications and electronics for cars, delivered a 390% performance in 2019 ranking it as the best performer in the Chinese stock market.

Luxshare Precision Industry and GoerTek, suppliers of consumer electronics products supplying Apple, and GigaDevice Semiconductor, producing flash chips, weren’t too shabby either each eclipsing at least 193% last year.

Even though 5G construction isn’t fully operational, I can attest that revenue creation for the companies involved are in full swing.

Investors must narrow their pickings to the biggest and financially resilient; this is not the time to expose oneself to the ugly trepidations of the mood-sensitive tech market.

For investors who can balance the delicate relationship of risk and surgical maneuvering, this year will end positive.

“Technological progress has merely provided us with more efficient means for going backwards.” – Said English writer and philosopher Aldous Leonard Huxley

Global Market Comments

January 8, 2020

Fiat Lux

Featured Trade:

(WEDNESDAY FEBRUARY 4 SYDNEY STRATEGY LUNCHEON)

(CALIFORNIA GOES WHOLE HOG ON SOLAR),

(FSLR), (SPWR), (TAN)

As of January 1, 2020, it is illegal to build a home in California without solar panels.

Furthermore, dozens of cities have gone as far as banning natural gas appliances like ovens, heaters, and burners.

It is the most ambitious solar initiative anywhere in the world today. Those who invest in backup storage batteries like the Tesla Powerwall, will receive additional cash incentives.

It’s not like solar is new in the Golden State. It boasts over one million homes with installed panels out of a total housing stock of 16 million. It is all part of a grand plan for the state to obtain 100% of its electric power from alternative sources by 2030.

The new measures are expected to add $9,500 to the cost of new home construction. Builders are expected to eat most of it.

However, it will cut utility bills by $19,000 over the 30-year life of a solar system. And that is at today’s prices. California homeowners have already suffered two back-to-back 15% price increases over the past two years. With northern California’s utility PG&E (PGE) in bankruptcy, more stiff price hikes are expected.

You would think that the news would set the share prices of American solar companies, like First Solar (FSLR) and SunPower (SPWR), on fire.

They haven’t.

That's because solar prices are joined at the hip with conventional energy sources.

When oil is cheap, solar share prices die a horrible death. When oil is dear, everybody and his brother wants to pile into everything alternative, be it solar panels, storage batteries, windmills, electric cars, and high mileage hybrid cars like the Prius.

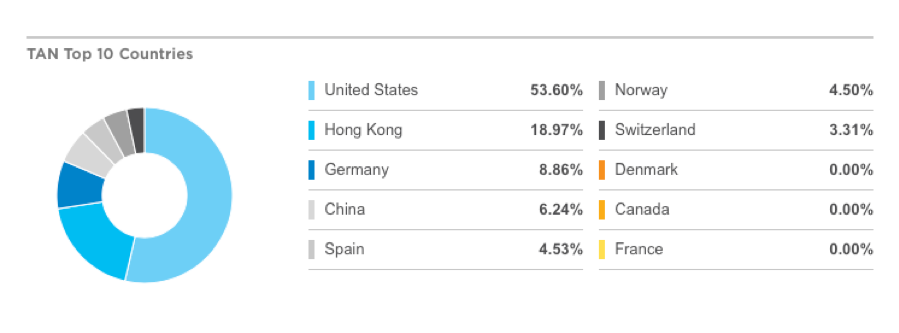

The sole exception has been the Invesco Solar ETF (TAN). It has a globally diversified portfolio that invests in countries with much higher electricity prices than hours, thanks to local regulation and taxes. Only 53% of its investments are in the US, with a hefty 19% in Hong Kong alone, of all places.

The last two years have produced a new reason to go off the grid. Ferocious wildfires in the Golden State that have killed hundreds have led to total statewide blackouts from PG&E whenever wind speeds exceed 40 miles an hour.

Unless you want to keep throwing out all your frozen food every few weeks, the only way to move forward is with a solar-powered battery backup system. It’s just a matter of time before high-end homes can only be sold with 48 hours of backup power. The same logic applies to the hurricane-ravaged east and Gulf coasts. It’s especially an issue today with up to 25% of Bay Area residents working from home.

No juice, no job.

As for me, I am in the process of doubling up my own solar system, taking it up to a gargantuan 23,114 kWh, with three Tesla Powerwalls thrown in for good measure.

But then I have a Tesla P110D Model X that eats up 1,000 kWh a month. All of my appliances are electric except the gas burner because my traditional chef can’t cook without it and the water heater, because I want to have 200 gallons of water at all times in case an earthquake hits. I am turning into my own mini electric power utility, and I am not alone.

I have been encouraged by my experience with my first solar system, which I installed five years ago. It has worked flawlessly, since it has no moving parts. The installer promised me a six-year breakeven against my $500 a month power bill. I covered my cost in four years, thanks to soaring power prices.

And who has the highest electricity prices in the United States? That would be Hawaii, where all fuels have to be imported from great distances. Hawaiians have to pay a massive 66 cents a kilowatt. California only has to pay a peak rate of 55 cents a kilowatt, also among the highest in the country. Drive along Honolulu Interstate H1 today and all you see are solar panels.

Aloha!

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.