When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

February 28, 2020

Fiat Lux

Featured Trade:

(THE TRUE COST OF THE CORONAVIRUS)

(COMPQ), (PYPL), (MSFT), (AMZN), (GOOGL)

Global Market Comments

February 28, 2020

Fiat Lux

Featured Trade:

(FEBRUARY 26 BIWEEKLY STRATEGY WEBINAR Q&A),

(VIX), (VXX), (SPY), (TLT), (UAL), (DIS), (AAPL), (AMZN), (USO), (XLE), (KOL), (NVDA), (MU), (AMD), (QQQ), (MSFT), (INDU)

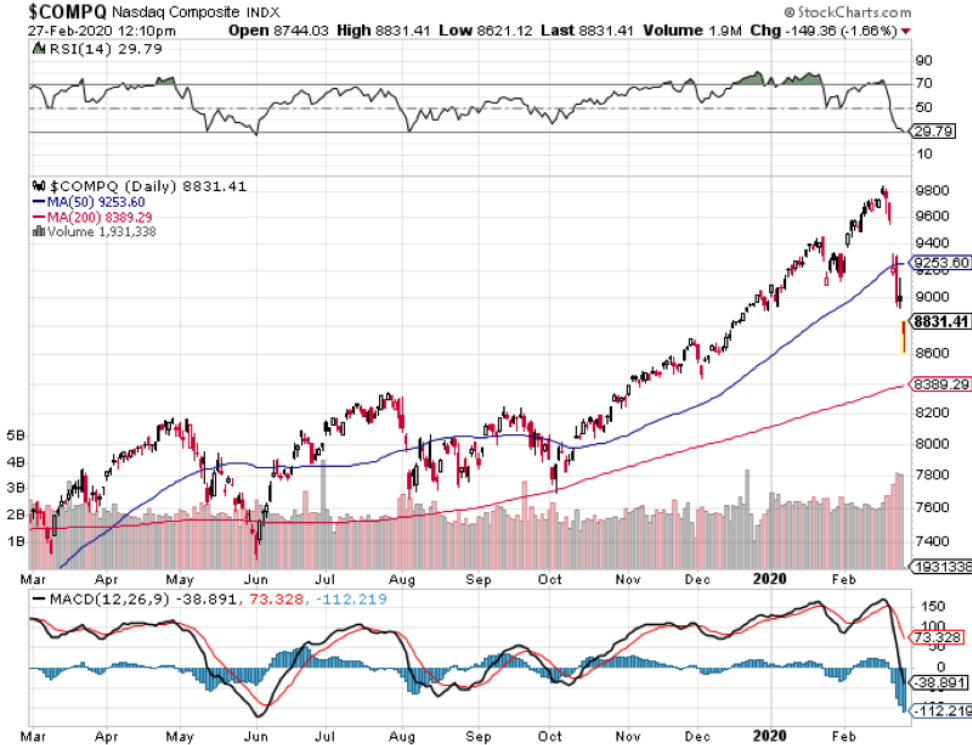

Tech shares are hoping to stage a rebound after the coronavirus-fueled rout that saw the Nasdaq’s 2-day drop by 6.38%, which is its worst since June 2016.

Readers can now pencil in a fresh readjustment to growth expectations of zero to low single digits in tech shares for fiscal year of 2020.

That is why Thursday morning was greeted by another 3% drop at the open - proceed with caution to not get trapped in the proverbial dead cat bounce vortex in the short-term.

A major tech consolidation could take place because let’s get real, the unpredictability is having a major impact on technology companies and uncertainty is a substantial input in heightened risk.

What are the realistic scenarios that are still left on the table?

- Tech firms could slash prices, a deflationary element that promotes deteriorating profit margins seen as a net negative to revenue causing companies to miss revenue targets.

- Unsold inventory could lead to working capital issues crushing balance sheets for the smaller tech firms.

- Loss-making enterprise confront solvency issues if debt repayment hardship ripples through finance departments and could be a serious threat to credit markets as a whole.

Firms trading on the Nasdaq will slash price targets and profit estimates that could uncoil another leg down in the Nasdaq index.

In fact, it has already happened as PayPal (PYPL), Microsoft (MSFT), and Apple (AAPL) issued revenue warnings saying they do not expect to meet their revenue goals because of the coronavirus.

On an operational level, softness is what I see when delving into the semantics of Amazon (AMZN) whose ranking algorithm demotes product sellers who go out of stock.

The coronavirus has crippled supply chains, and to avoid a lack of stock, sellers are raising prices to slow sales, while planning to move production to other countries.

This is on top of the backbreaking supply problems that companies face because of the ill-effects of the trade war.

If the Amazon algorithm punishes the seller, once stock is replenished, they must overspend on advertising to climb back to the top of product searches.

The surveys I have taken out with Amazon sellers in the last few days show a precarious situation where sellers are stretched to the limit relying on numerous uncertain variables that are completely out of their control,

Even if the local government allows Chinese factories to restart, it will be understaffed while workers from other provinces self-quarantine.

The third-party marketplace accounts for more than half of Amazon’s retail sales with a robust base of manufacturers and sellers in China.

Google (GOOGL) and Microsoft are accelerating efforts to shift hardware production to Southeast Asia amid the worsening coronavirus outbreak, opening factories in Vietnam and Thailand as well.

Google is set to begin production of the Pixel 4A smartphone and also plans to manufacture its next-generation flagship smartphone called the Pixel 5 in Vietnam.

Google is also on the verge of building factories in Thailand for "smart home" related products, including voice-activated smart speakers like the Nest Mini.

Google and Microsoft’s plans are a giant shift away from their prior generation-long China manufacturing strategy and the coronavirus has only supported a strategy to remove China as a core manufacturing hub.

It is getting so bad in China that they are evaluating the feasibility and cost implications to uninstall some production equipment and ship it from China to Vietnam, literally packing up and taking their show on the road.

The have already initiated the process by asking a key sourcing contact to convert an old Nokia factory in the northern Vietnamese province of Bac Ninh to handle the production of Pixel phones.

Data center server production was also rerouted to Taiwan last year.

The coronavirus threat is only speeding up the move into South East Asia and Google and Microsoft hope to avoid the geopolitical risk in the region.

Remember that all of this rejigging of production will add costs and only the biggest can absorb mega hits to the balance sheets.

As for the coronavirus, business is becoming more complicated as the ban on Chinese nationals and flights from China could build barriers to business, and now South Korea has joined the list.

Korea’s Samsung Electronics, the world's largest smartphone maker, has operated a smartphone supply chain in northern Vietnam for years but still relies on some components made in China.

While there are many moving parts, the average investor needs to wait on optimal entry points.

Japan announced school shutdowns for a month and tech shares have only priced in the coronavirus eventually entering the U.S., but if there are mass shutdowns of American cities and schools, then tech shares will see another stinging sell-off.

The contagion could eventually lead to the Olympics in Tokyo being canceled, high-profile corporate management getting infected, and the Chinese economy being sidelined for most of 2020.

All of these events are highly negative to the global economy which is why potential risks have exploded through the roof in such a short time.

Slinging mud at the wall will not work in times like this, but this does have the makings of a once-in-a-year entry point into tech shares.

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader February 26 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: There’s been a moderation of new coronavirus cases in China. Is this what the market needs to find a bottom?

A: Absolutely it is; of course, the next risk is that cases keep increasing overseas. The final bottom will come when overseas cases start to disappear, and that could be a month or two off.

Q: How low will interest rates go after the coronavirus?

A: Well, interest rates already hit new all-time lows before the virus became a stock market problem. The virus is just giving it a turbocharger. Our initial target of 1.32% for the ten-year US Treasury bond was surpassed yesterday, and we think it could eventually hit 1.00% this year.

Q: What is the best way to know when to buy the dip?

A: When the Volatility Index (VIX) starts to drop. If you can get the volatility index down to the mid-teens and stay there, then the market will stabilize and start to rise fairly sharply. A lot of the really high-quality stocks in the market, like United Airlines (UAL), Walt Disney (DIS), Apple (AAPL) and Amazon (AMZN), have really been crushed by this selloff. So those are the names people are going to look at for quality at a discount. That’s going to be your new investment theme, buying quality at a discount.

Q: Do recent events mean that Boeing (BA) is headed down to 200?

A: I wouldn't say $200, but $280 is certainly doable. And if you get to $280, then the $240/$250 call spread all of a sudden looks incredibly attractive.

Q: What does a Bernie Sanders presidency mean for the market?

A: Well, if he became president, we could be looking at like a 50-80% selloff—at least a repeat of the ‘09 crash. However, I doubt he will get elected, or if elected, he won’t have control of congress, so nothing substantial will get done.

Q: Is this the beginning of Chinese (FXI) bank failures that will cause an economic crisis in mainland China?

A: It could be, but the actual fact is that the Chinese government is doing everything they can to rescue troubled banks and companies of all types with short term emergency loans. It’s part of their QE emergency rescue package.

Q: Can you explain what lower energy prices mean for the global economy?

A: Well, if you’re an oil consumer (USO), it’s fantastic news because the price of gas is going down. If you’re an oil producer (XLE), like for people in the Middle East, Texas, Louisiana, Oklahoma, and North Dakota, it’s terrible news. And if you’re involved anywhere in the oil industry, or own energy stocks or MLPs, you’re looking at something like another great recession. I have been hugely negative on energy for years. I’ve seen telling people to sell short coal (KOL). It’s having a “going out of business” sale.

Q: Should I aggressively short Tesla (TSLA) here? Surely, they couldn’t go up anymore.

A: Actually, they could go up a lot more. I would just stay away from Tesla and watch in amazement—there’s no play here, long or short. It suffices to say that Tesla stock has generated the biggest short-selling losses in market history. I think we’re up to about $15 billion now in short losses. Much smarter people than us have lost fortunes trying in that game.

Q: Was that an Amazon trade or a Google trade?

A: I sent out both Amazon and an Apple trade alert this morning. You should have separate trade alerts for each one.

Q: Are chips a long term buy at today’s level?

A: Yes, but companies like NVIDIA (NVDA), Micron Technology (MU), and Advanced Micro Devices (AMD) may be better long-term buys if you wait a couple of weeks and we test the new lows that we’ve been talking about. Chips are the canary in the coal mine for the global economy, and we have not gotten an all-clear on the sector yet. If you’re really anxious to get into the sector, buy a half of a position here and another half 10% down, which might be later this week.

Q: When will Foxconn reopen, the big iPhone factory in China?

A: Probably in the next week or so. Workers are steadily moving back; some factories are saying they have anywhere from 60-80% of workers returning, so that’s positive news.

Q: Are bank stocks a sell because of lower interest rates?

A: Yes, absolutely. If you think the 10-year treasury is running to a 1.00% yield as I do, the banks will get absolutely slaughtered, and we hate the sector anyway on a long-term basis.

Q: What about future Fed rate cuts?

A: Futures markets are now pricing in possibly three more rate cuts this year after discounting no more rate cuts only a few weeks ago. So yes, we could get more interest rates. I think the government is going to pull all the stops out here to head off a corona-induced recession.

Q: Once your options expire, is it still affected by after-hours trading?

A: If you read the fine print on an options contract, they don’t actually expire until midnight on a Saturday night after options expiration day, even though the stock market stops trading on a Friday. I’ve never heard of a Saturday exercise, but you may have to get a batch of lawyers involved if you ever try that.

Q: What’s the worst-case scenario for this correction?

A: Everything goes down to their 200-day moving averages, including Indexes and individual stocks. You’re talking about Apple dropping to $243 and Microsoft (MSFT) to $144, and NASDAQ (QQQ) to 8,387. That could tale the Dow Average (INDU) to maybe 24,000, giving up all the 2019 gains.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“Don't chase a girl, let the girl chase you.” – Said Founder of Softbank Masayoshi Son

“The VIX right here is unsustainably low. I think China has more of a downside surprise. Analyst expectations for earnings are overly aggressive. There are just a few too many things that can go wrong out there,” said Vadim Zlotnikov, chief market strategist at Alliance Bernstein.

Mad Hedge Biotech & Healthcare Letter

February 27, 2020

Fiat Lux

Featured Trade:

(MINING GOLD IN NICHE DRUGS)

(BLUE)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.