When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

February 24, 2020

Fiat Lux

Featured Trade:

()

(DBX), (ZS)

I have been adamant that 2020 is a time to be cherry-picking the best of the 2nd tier tech stocks like Twitter, eBay, Adobe, and Fortinet.

But investors must be aware that in the 2nd and 3rd tiers of the tech landscape, nothing is guaranteed, and the downside price action and the inflection points can be hard to swallow.

One stock that has been on both sides of the fence is cloud computing company Dropbox (DBX).

Dropbox shares exploded Friday morning up over 23% trending towards their best single-day performance.

Believers think this stock has finally shaken off the cobwebs.

Dropbox has it hard as it competes with the behemoths of Amazon, Google, and Microsoft for the same pie in the Cloud game.

To keep its head above water, they must tread harder than the bigger guns and the lack of traction in the past year doomed them to a -26% share return for investors.

Well, investors have gotten back their losses in one day and could close above its initial-public-offering price of $21 for the first time since September.

My underlying thesis of second-tier tech stocks either sinking or swimming partly has to do with the manner in which they are able to navigate against bigger companies who are in catch-and-kill mode via buyouts.

A highly bullish signal was when management at Dropbox decided to raise its operating-margin and free-cash outlook for 2020 and over the long term.

Superior operating margin was one of the hyped-up metrics that management tried to sell investors post-IPO but they never followed through and the stock cratered.

Dropbox has also revealed that higher margins will not be at the expense of cost cuts affecting the top line and has more to do with superior growth drivers which are always positive.

The new operating margin forecast for Dropbox is between 28% to 30% compared with a prior range of 20% to 22%, and that is a big deal.

There is a nuanced relationship between growth and profitability and Dropbox cannot lose sight of either because if top line misses badly, the operating margin beat is less meaningful.

At the bare minimum, the tone of the earnings report has investors chomping at the bit inciting a massive rally in shares and turning around the narrative for this once beleaguered company.

Many times the negativity can become a self-fulfilling prophecy.

It is difficult to break momentum in software stocks in either direction and now the onus is on Dropbox’s management to prove they can surpass margin forecasts or there could be a reverse 20% drop in the stock.

There are still bears out there who believe this wasn’t enough to convince them to change their mind.

Bears have cited a lack of sustained growth and a tendency to miss on subscriber numbers as the Achilles heel.

Because of the small nature of these companies, volatility goes hand in hand with their price action.

The Mad Hedge Technology Letter prefers to bundle itself with stocks that have more reliable price action.

A perfect example of volatility disturbing a stock would be a cybersecurity company that I have been quite bullish on named Zscaler (ZS).

The cloud security company delivered lighter-than-expected profit guidance for the third quarter and fiscal year and the stock slipped down 15%.

That would never happen to Google or Facebook shares in the same scenario.

Zscaler’s second-quarter report was robust and even had a billings’ beats of 15% year-over-year.

Meanwhile, hints of revenue deceleration and margin contraction in the second half were enough to kill shares in trading.

Traders who can filter through the bluster must time entry points in small-cap tech perfectly otherwise one mistimed word on an earnings report can sink a trade with no chance to exit.

Separating the wheat from the chaff is what we do here at the Mad Hedge Technology Letter.

“Our philosophy is that we care about people first.” – Said Founder and CEO of Facebook Mark Zuckerberg

Global Market Comments

February 24, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE WAKE-UP CALL)

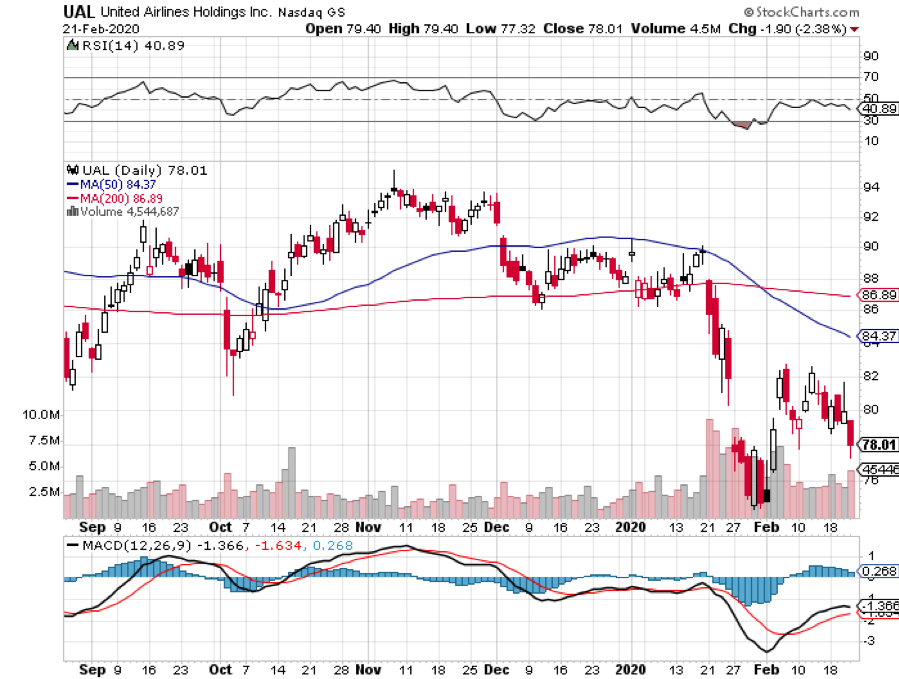

(SPY), (AAPL), (MSFT), (UAL), (CCL), (WYNN), (TLT)

After weeks of turning a blind eye, poo-pooing, and wishfully ignoring the global Coronavirus pandemic, traders are finally getting a wake-up call.

It turns out that the prospect of a substantial portion of the world’s population dying over the next few months cannot be offset by quantitative easing after all.

At least for the short term.

This weekend we learned that all Asian cruises have been cancelled. More factories in South Korea have been shut down for the lack of Chinese parts. Technology conferences in San Francisco have been cancelled. Some 80% of all Chinese flights are grounded.

GM assembly lines in Michigan are slowing, both from missing parts and customers. And we have just learned that a section of Italy near Milan has been quarantined, thanks to a major outbreak there.

I learned the true severity of Corona a week ago when I ended up sitting next to a research doctor who worked for San Francisco-based Gilead Sciences (GILD) on a first-class flight from Melbourne, Australia to San Francisco.

He was returning from Wuhan, China, the epicenter of the virus. Since all flights from China to the US are now banned, he had to route his return home via Australia.

What he told me was alarming.

The Chinese are wildly understating the spread of the Coronavirus by perhaps 90% to minimize embarrassment to the government, which kept the outbreak secret for a full six months.

Bodies are piling up outside of hospitals faster than they can be buried. Police are going door to door arresting victims and placing them in gigantic quarantine centers. Every covered public space in the city is filled with beds and the roads are empty. Smaller cities and villages have set up barriers to bar outsiders.

He expected it would be many months before the pandemic peaked. It won’t end until the number of deaths hits the tens of thousands in China and at least the hundreds in the US.

The frightening close in the S&P 500 (SPY) on Friday and the horrific trading in futures overnight in Asia suggest that the worst is yet to come.

Since the beginning of 2019, we have been limited to mere 5% downturns in the major indexes, creating a parabola of euphoric share prices. This time, we may not get off so lightly.

There is no doubt that Corona will take a bite out of growth this year. The question is how much. Central banks could well dip in for yet another round of QE to save the day.

The bigger question for you and me is whether investors are willing to look through to the other side of the disease and use this dip as an opportunity to buy. If they are, we are looking another 5% draw down. If they aren’t, then we are looking for 10%, or even more.

Then there is the worst-case scenario. If Corona reaches the proportion of the 1918 Spanish flu pandemic where 5% of the world’s population died, then we are looking at a global depression and an 80% stock market crash.

Hopefully, modern science, antibiotics, and rapid response research teams will prevent that from happening. We already have the Corona DNA sequence and several vaccines are already in testing. In 1918, they didn’t even know what DNA was.

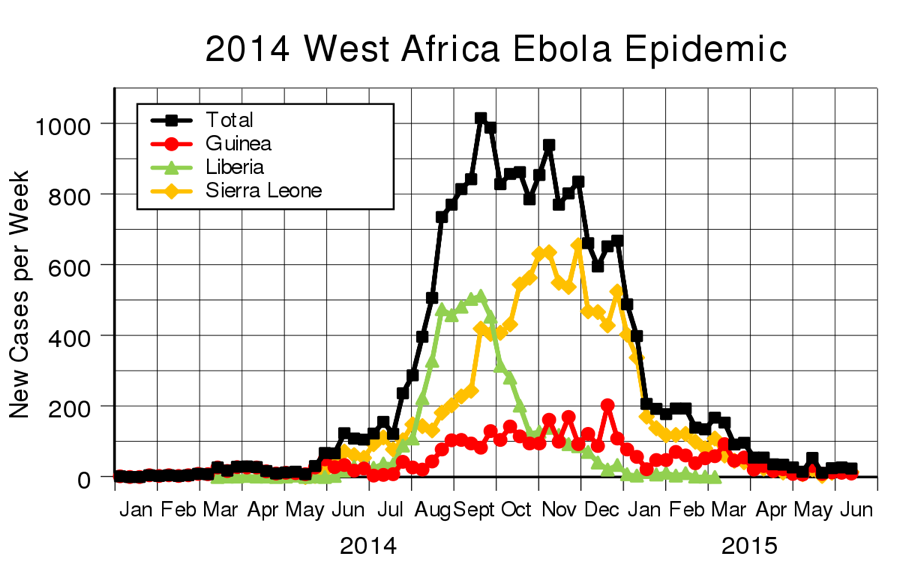

The disease could well be peaking now as the course of the last surprise epidemic, that of Ebola in 2014, suggests (see chart below). Until then, we shall just have to hope and pray.

In addition to praying, I’ll be raising cash and adding hedges just in case providence is out of range.

30-Year Treasury Bond Yields (TLT) hit all-time lows following on from the logic above, calling for a melt-up of all asset prices. Collapsing interest rates doesn’t signal an impending recession but a hyper-acceleration of technology wiping out jobs by the millions and capping any wage growth. I’m looking for 1.00% on the ten-year. Money will remain free as far as the eye can see.

Apple tossed Q2 guidance, giving up most Chinese sales because of the big Coronavirus shutdown. The stores have been closed. The stock dives overnight, down $10. Shutdown of its main production factory at Foxconn didn’t help either. Nintendo is also struggling with production of its wildly popular Switch game. When you lose the leader, watch out for the rest of the market.

Massive Chinese Stimulus should head off any sharp downturn in the economy. Will an interest rate cut and a huge dose of QE be enough to offset the deleterious effects of the Coronavirus? Ask me again in another month.

Expats fled Asia and are not returning until the epidemic is over. My plane on the way home was full of Americans taking families home to avoid the plague. It’s yet another drag on the global economy.

Housing Starts plunged 3.6% in January, while permits hit a 13-year high. It’s all a giant interest rate play fueled by massive liquidity.

US Existing Home Sales faded in January, down 1.3%, to a seasonally adjusted rate of 5.46 million units. Inventories are down to an incredible 3.1 months, near an all-time low. I guess consumers don’t want to rush out and buy a new home if they are about to die of a foreign virus.

The Fed Minutes came out and it looked like the central bank wanted to keep American interest rates unchanged. The January meeting showed a stronger forecast for the economy, so no chance of another interest rate cut here. Even last month, Coronavirus was becoming an issue.

Leading Economic Indicators soared, up 0.8%, versus 0.4%. It’s the highest reading in 2 ½ years. If Coronavirus is going to hurt our economy, it’s not evident in the numbers yet.

The Philly Fed was also red hot, at 36.7. It’s another non-confirmation of the Corona threat.

Despite the fact that we may be facing the end of the world, the Mad Hedge Trader Alert Service managed to maintain new all-time highs. I used the steadily falling prices and sharply rising volatility Index of last week to scale into an aggressive long position from 100% cash.

I bought deep in-the-money call spreads in FANG stocks like (AAPL) and (MSFT) I also picked up additional positions in shares most affected by the Coronavirus, like Carnival Cruise Lines (CCL), United Airlines (UAL), and Wynn Resorts (WYNN), which are all down 25% from recent peaks.

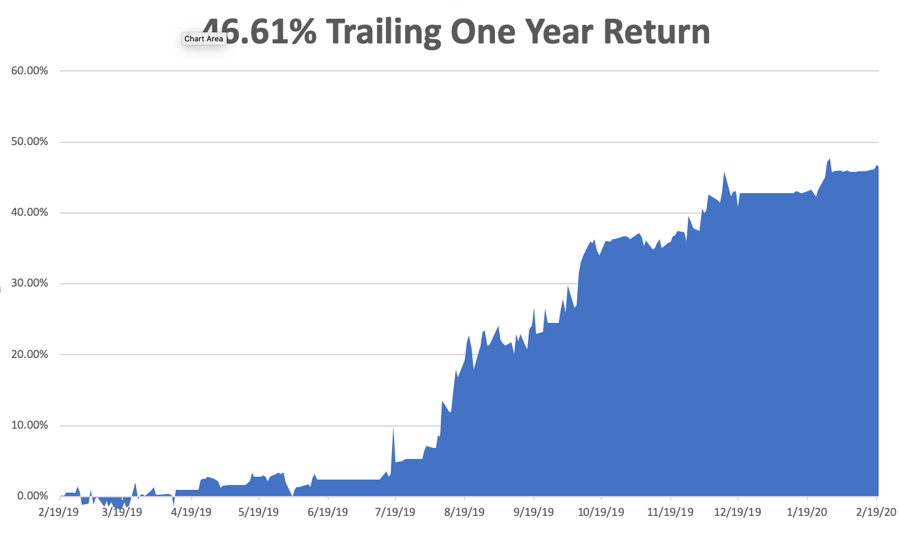

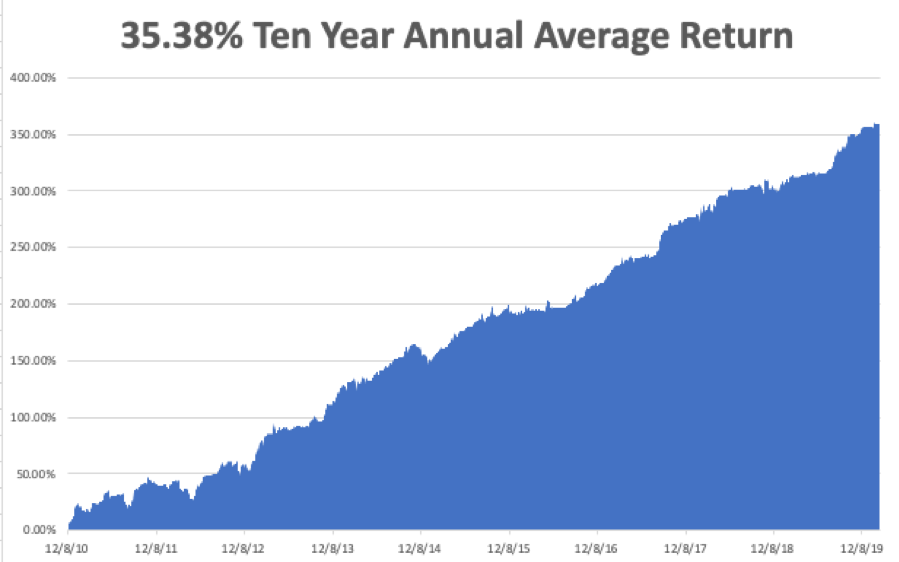

My Global Trading Dispatch performance rose to a new all-time high at +359.73% for the past ten years. February stands at +0.69%. My trailing one-year return is stable at 46.61%. My ten-year average annualized profit ground back up to +35.38%.

All eyes will be focused on the Coronavirus still, with deaths over 2,000. The weekly economic data are virtually irrelevant now. However, some important housing numbers will be released.

On Monday, February 24 at 8:30 AM, the Dallas Fed Manufacturing Index is published.

On Tuesday, February 25 at 8:30 AM, the S&P Case Shiller National Home Price Index for December is out .

On Wednesday, February 26, at 8:00 AM, January New Home Sales are released.

On Thursday, February 27 at 8:30 AM, the government announced the second look at Q4 GDP. Weekly Jobless Claims are also out at 8:30.

On Friday, February 28 at 9:45 AM, the Chicago Purchasing Manager Index is printed.

The Baker Hughes Rig Count follows at 2:00 PM.

As for me, we have just suffered the driest February on record here in California, so I’ll be reorganizing my spring travel plans. Out goes the skiing, in comes the beach trips. Such is life in a warming world.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

"Getting information off the Internet is akin to trying to sweep back the ocean with a broom," said Ray Kurzweil, director of engineering at Google.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Like a lot of stocks today, ZEN is oversold.

Because of this, I am going to suggest you close the position and book a small profit.

Here is how you close the deal.

Sell to Close (1) March 20th - $87.50 call @ $2.90. The 1 call will net $290.

Sell to Close (2) March 28th - $87.50 put @ $3.80. The two puts will net $760.

The credit will be about $1,050 based on the position size I suggested yesterday.

The gain will be about $90 for one day.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.