When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

May 4, 2020

Fiat Lux

Featured Trade:

(AMAZON’S BIG DISAPPOINTMENT)

(AMZN), (MSFT)

It is a basic concept of life that people will risk their lives for economic gain.

This is what the protests are about that have erupted all over the U.S. and will continue as families run out of food in the kitchen pantry.

Back in the world of the stock market where tech stocks have benefited from the Fed backstopping equities, Amazon (AMZN) reminded us that just because business is booming in volume, profitability can be a completely different story.

Amazons’ earnings disappointed after many analysts believed the quarter would be untouchable.

The company that my friend Jeff Bezos built became inundated with too many orders that almost broke their supply chain.

Amazon’s share price got ahead of itself which was up 34% on the year through last Thursday and only a beyond perfect earnings beat on the bottom and top line would propel the stock to newer highs.

The stock cratered by 8% after investors had time to digest the report.

Profitability came in significantly lower with Wall Street anticipating earnings per share of $6.25 and Amazon only producing $5.01.

The most important number in the earnings report was $4 billion which is the amount of additional expenses next quarter caused by the COVID-19 phenomenon.

The productivity headwinds in Amazon’s facilities were meaningful as the company spent on social distancing, allowing for the ramp-up of new employees and investments in personal protective equipment (PPE) for employees.

In addition, setting up an Amazon fulfillment center in the age of COVID-19 encompassed cleaning and sanitizing facilities, higher wages for Amazon’s hourly teams, and hundreds of millions of dollars to develop COVID-19 testing capabilities.

Amazon also needed to allocate another $400 million of costs related to increased reserves for accounts that participated in price gouging as Amazon third-party sellers tried to rip off buyers by jacking up prices to take advantage of the shortage in some products.

Amazon said they suspended more than 10,000 sellers from its platform for violating policies against price gouging.

The sudden spike in costs will result in an operating loss of $1.5 billion to an operating income of $1.5 billion based on its expectation of spending $4 billion on coronavirus-related costs.

The ultimate problem for Amazon’s eCommerce division was that “essential items” didn’t harvest the bumper type of premium that other products can command.

Not only did they suffer at the margins, but they also had to extend the shipping period from one to four days, and then further on non-essential items.

Groceries were the segment that saw explosive growth, but everyone knows that supermarkets have slim margins.

Amazon had to increase grocery delivery capacity by more than 60% and expanded in-store pickup at Whole Foods stores from 80 stores to more than 150 stores.

Amazon’s best of breed execution was utterly swamped by the health phenomenon.

It got so bad that Amazon had to restrict selected products that were coming into the warehouses and focus on essential products.

A big chunk of the new costs will come in the form of hiring an additional 175,000 new employees.

Inflated costs were the bombshell of Amazons’ earnings but looking down the road, the future looks bright.

Amazon is the only platform that can systematically service customers at scale and effectiveness during the crisis which will breed increased customer loyalty and faster adoption of e-commerce, despite higher costs in the near term.

Work-from-home dynamics are here to stay translating into significant Amazon market share gains and a longer Amazon growth runway.

This is also the first stage of Amazon developing a protective gear strategy for staff and customers as a potential point of competitive advantage.

Sterility of packages and products could be the new x-factor going forward and Amazon will likely lead in developing this new packaging and contactless delivery style.

This leads me to believe that the coronavirus is a springboard into the revenues of healthcare for big tech enabling unlimited resources with an industry offering unlimited low-hanging fruit.

Big tech is the only solution out there to America’s dysfunctional healthcare system, and Amazon could become the leader in setting off a new deflationary decade in healthcare costs.

Amazon and Microsoft are the best companies in the country and any pullbacks should be met with a torrent of fresh buying.

To visit Amazon’s webpage, click here and to see why Microsoft is the best tech company not named Amazon, then please click here.

Today I would like to make a recommendation on a stock that does have weekly options. And I want to suggest a weekly covered call.

The stock is Clovis Oncology, Inc. (CLVS).

CLVS was a former high flyer trading as high as $100 per share.

It now trades for less than $10 per share. But, I do believe it has put in a bottom.

My suggestion is to buy CLVS at the market, which is $7.58 as I write this.

Then sell to Open (10) May 8th - $8 Call for every 100 shares you buy.

You should be able to sell them for $.35 per every option.

Based on the nominal portfolio, limit the share buy in to 500 shares or 3.8% of the portfolio.

Assuming you buy 500 shares, you would sell 5 of the May 8th $8 Calls.

If the calls are assigned this Friday, the return will be 10.2% for 5 days.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 4, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE NEXT BOTTOM IS THE ONE YOU BUY),

(SPY), (SDS), (TLT), (TBT), (F), (GM), (TSLA), (S), (JCP), (M)

It was only a year ago that I was driving around New Zealand with my kids, admiring the bucolic mountainous scenery, with Herb Albert and the Tijuana brass blasting out over the radio. Believe me, the tunes are not the first choice of a 15-year-old.

Today, it is all a distant memory, with any kind of international travel now unthinkable. For me, that is like a jail sentence. It is all a reminder of how well we had it before and how bleak is the immediate future.

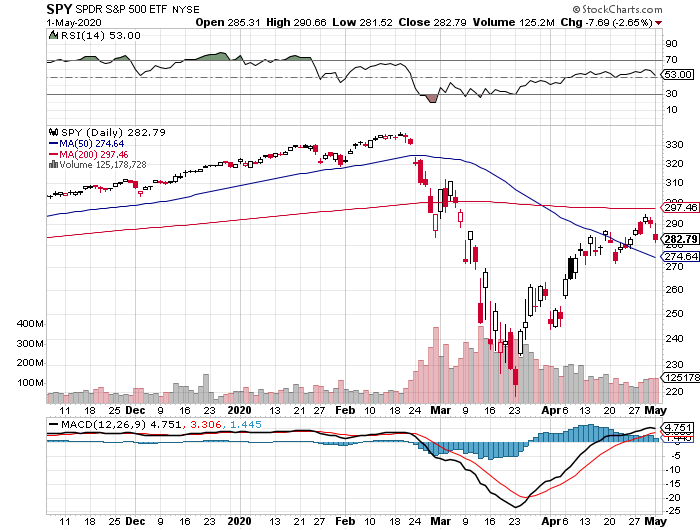

Stock traders have certainly been put through a meat grinder. The best and worst months in market history were packed back to back, down 39% and then up 37%. At the March 23 low, the Dow average had fallen by 11,400 in a mere six weeks. Those who lived through the 1929 crash have lost their bragging rights, if there are any left.

However, like my college professor used to say, “Statistics are like a bikini bathing suit. What they reveal is fascinating, but what they conceal is essential.”

Most of the index gains were achieved by just five FANG stocks. Virtually all of the gains were from “stay at home” companies taking in windfalls from cutting-edge online business models. The “recovery” had a good week, and that was about it.

The other obvious development is that if any business was in trouble before the health crisis, you can safely write them off now. That includes retailers like Sears (S), JC Penny’s (JCP), Macy’s (M), almost all brick-and-mortar clothing sellers, and the small and medium-sized energy industry.

The worst economic data points since the black plague are about to hit the tape. Some 30 million in newly unemployed is nothing to dismiss, and that number grows to 40 million if you include discouraged workers.

That is 25% of the workforce, the same as peak joblessness during the great depression. But $14 trillion in QE and fiscal stimulus is about to hit the market too.

Which brings us to the urgent question of the day: What to do now?

It’s a vexing issue because this is not your father’s stock market. This is not even the market we’d grown used to only six months ago. All I can say is that the virology course I took 50 years ago today is worth its weight in gold.

I think you would be mad not to count a second Covid-19 wave into your calculations. This could occur in weeks, or in months, after the summer respite. This makes a second run at the lows a sure thing. I don’t think we’ll make it, but a loss of half the recent gains is entirely possible.

That takes us back down to a Dow Average of 21,000, or an S&P 500 (SPX) of 2,400.

If you are a long term investor looking to rebuild your retirement nest egg, there are only two sectors left in the market, Tech and Biotech & Healthcare. Looking at anything else is both risky and speculative. So, if we do get another meltdown, these are the only areas you should target.

If I am wrong, the market will probably bounce along sideways in a narrow range for months. That is a dream scenario if you pursue a vertical bull and bear call and put option spread strategy that I have been offering up to followers for the past decade.

Pending Home Sales Were Down a Staggering 20.8% in March and off 16.3% YOY. The worst is yet to come. The West, the first into shelter-in-place, was down a monster 26.8%. Prices still aren’t moving because nobody can buy or sell. The way homebuilder stocks like (LEN) and (KBH) are trading, I’d say your home will be worth a lot more in a year when the huge demographic push resumes. I’m not selling.

The 60,000 peak in deaths proposed by the administration only weeks ago is now looking wildly optimistic. Their worst-case scenario of 200,000 deaths, the announcement of which set the March 23 bottom of the Dow Average at 18,200, is now likely.

It will take place when the epidemic peaks in the southern and midwestern states that never sheltered in place or went in late and are coming out early. That second wave may well create a second bottom in stock prices, and that is the one you jump into and buy with both hands.

US Corona Deaths topped 66,000 last week, more than we lost after a decade of the Vietnam War. Total cases exceed one million.

Bank of America sees negative 30% GDP this quarter annualized, so says CEO Brian Moynihan. His economists expect negative 9% in Q3 and plus 30% in Q4. Suffice it to say, this is the ultra-optimistic case. Q4 doesn’t include the millions of businesses that will disappear because the Paycheck Protection Plan is failing so badly. Most government aid will take three to six months to hit the economy.

US GDP crashed 4.8% in Q1, the worst quarter since the depths of the 2008 Great Recession. Q2 will be far worse. We are now officially in recession, which should last 3-4 quarters. But is it already in the price? Next week’s April Nonfarm Payroll report should be a real humdinger.

Ford (F) lost $5 billion in Q2, and there is no guidance about the future. Avoid (F) on pain of death. Late to electric, they may not make it this time. They’re still in the buggy whip business.

Weekly Jobless Claims topped 3.8 million, bringing the six-week total to a staggering 30 million, more than those lost at the peak of the Great Depression. Florida, California, and Georgia led with applications. This implies a U-6 Unemployment rate of 25% with next week’s April Nonfarm Payroll Report. And the Dow Average is up 37% since March 23?

The Bond Market crashed on a Trump threat to default on US Treasury bonds, of which China owns $900 billion. It’s Trump’s retaliation for the Middle Kingdom spawning the Coronavirus, which he calls the “Chinese virus.” The (TLT) dropped three points on the news. Good thing I am triple short a market that is about to get crushed by massive government borrowing.

A glut of imported autos is parked at sea, steaming in circles, awaiting a recovery in the US economy. They are no doubt finding company with imported oil tankers. So many unwanted cars coming in the land-based storage areas were overflowing. It’s tough to see (F) and (GM) recovering from this. Keep buying made in the USA (TSLA) on dips, which is headed to $2,500 a share.

When we come out on the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates at zero, oil at $0 a barrel, and many stocks down by three quarters, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade.

My Global Trading Dispatch performance had one of the best weeks in years, up a blistering +8.05%. We are now only 6.67% short of a new all-time high. The 100 new subscribers who came in the previous week are sitting pretty and must think I’m some sort of guru.

My aggressive triple weighting in short bond positions came in big time when Trump threatened to default on US debt. My shorts in the S&P 500 (SPY) helped. I took profits on my last long there the previous week. (SDS), another short play, clawed back some losses.

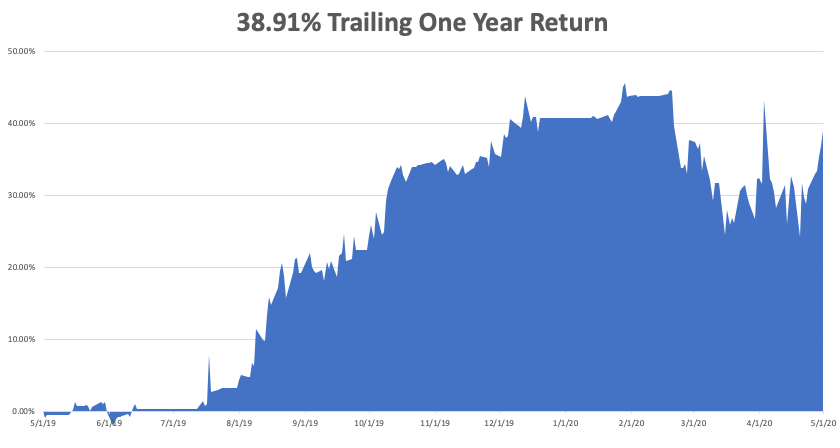

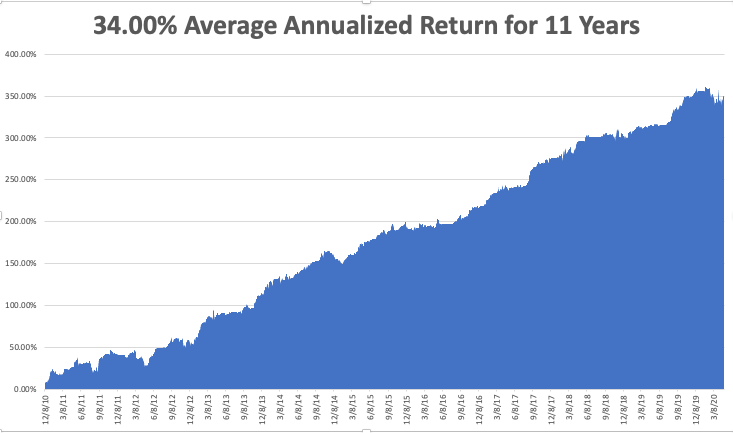

We closed out up a blockbuster +4.55% in April and May is up +2.11%, taking my 2020 YTD return up to only -1.75%. That compares to a loss for the Dow Average of -18.20% from the February top. My trailing one-year return returned to 38.91%. My ten-year average annualized profit returned to +34.00%.

This week, Q1 earnings reports continue and so far, they are coming in much worse than the most dire forecasts. We also get the monthly payroll data, which should be heart-stopping to say the list.

The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find here.

On Monday, May 4 at 9:00 AM, the US Factories Orders for March are out and are expected to be disastrous. Berkshire Hathaway (BRK/B) and Eli Lilly (LLY) report.

On Tuesday, May 5 at 11:00 AM, the US Crude Oil Stocks are published and will be another bomb. Netflix (NFLX) and Coca-Cola (KO) report.

On Wednesday, May 6, at 7:15 AM, API Private Sector Employment Report is released. Lan Research (LRCX) and Electronic Arts (EA) announce earnings.

On Thursday, May 7 at 8:30 AM, another horrible Weekly Jobless Claims are out. Bristol Myers Squibb (BMY) reports.

On Friday, May 8, the April Nonfarm Payroll Report is printed, the worst unemployment rate since the Great Depression. AbbVie (ABBV) reports.

As for me, to battle cabin fever, I am setting up a tent in my back yard and staying there tonight, just to change the scenery. The girls need one more campout to qualify for camping merit badge, an important Eagle Scout one, and this will qualify.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.