When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

November 29, 2021

Fiat Lux

Featured Trade:

(THE FUTURE LOOKS BRIGHT FOR THIS AD TECH STOCK)

(TWTR), (FB)

Founder Jack Dorsey's stepping down as CEO of Twitter (TWTR) is great news for the stock.

Let’s not beat around the bush — it’s been brewing for some time.

It was only just before the pandemic that he announced his intentions to work remotely from Africa for 6 months.

Who does that?

Part of his job as CEO of a major Silicon Valley company is to deduce the pulse of the industry in real-time, and on the ground while rubbing shoulders with the rest of his kind.

Six-month African Safaris are romantic but don’t cut it when you are a top CEO of a Silicon Valley company and when major hedge funds are relying on advanced expertise to guide the company through a labyrinth of strategic and regulatory issues.

Whether he stepped down by his own will or was effectively forced out by activist shareholders, either way, the future stock price appears prime to shake off the years of mediocrity.

Why does Twitter need change at the helm?

Simply put, the stock has grossly underperformed the broader market for not only the last year but also the past 3 and 8 years.

The stock was trading around $70 in December 2013 and fast forward to today and the stock is around $50.

The underperformance comes under a backdrop of a cyclical bull market in which tech has been the leader with growth constantly reaccelerating.

Not only that, but Twitter also has a unique asset in which it has accrued massive scarcity value because no other technology company has anything like it.

Dorsey has mishandled the operation.

The nail in the coffin was certainly the user growth numbers in which Twitter was only able to grow the user base by 3% last quarter in North America.

Twitter announced earlier this year some major long-term goals in which one of them was to have 315 million monetizable daily active users by the end of 2023.

That number stands at 211 million users reported last quarter and is underwhelming.

Another objective was to surpass annual revenue of $7.5 billion by 2023 and as of last quarter, management said they were still on pace to achieve that, but I do not see that.

I agree they are on pace to hit that revenue target, but Twitter announced a highly disappointing forecast expecting $1.5 billion to $1.6 billion in revenue for the fourth quarter, which will be up 24%.

Twitter will need to maintain revenue growth in the mid-30% to achieve the numbers they promised, and Dorsey has proved that he is prone to botching forecasts.

How many fumbles will management let him get away with?

Granted, Dorsey was forced by activist shareholders to state explicit targets, and true, they were ambitious from the start.

However, much of the nudge in the backside stems from Dorsey largely underachieving as a CEO especially during the golden years of ad tech.

Investors saw when Founder and CEO of Facebook (FB) Mark Zuckerberg was able to release animal spirits for his ad technology platform and it’s fair to question why Dorsey can’t do the same for his company.

Even though harsh, comparing your company to Facebook is not everyone’s cup of tea, but Twitter is in the same exact industry as Facebook deploying the same exact products, so they can’t really complain about comparing.

In the last 10 years, Facebook has returned shareholders 17X their investment and Zuckerberg was agile enough to rotate from a stale Facebook platform to a booming Instagram platform.

The last major Twitter forecast called for a long-term target of 40% to 45% adjusted EBITDA margin.

For the fourth quarter, Twitter is looking for operating income in the $130 million to $180 million range. That would be down 29% the prior year.

Profitability per unit is decelerating.

As it stands, I do not envision Dorsey achieving his 2023 targets if he stayed and on top of that, changes to the iOS system have made ad targeting more difficult to extract the necessary monetizable data.

In an environment where data visibility is reducing, and other regulatory changes could be coming down the pipeline, the shareholders most likely felt they needed a change at the top.

Dorsey is by and large the legacy of what was left over after Twitter was created, and many investors know, it’s hard to kick out these tech CEOs that usually possess super-voting shares which makes it so they must vote themselves out to leave as CEO.

Dorsey didn’t have that level of moat around his position and eventually, the underperformance caught up to him.

Twitter will insert Parag Agrawal, the company’s chief technology officer, as new CEO in hopes of supercharging revenue, user, and margin growth that shareholders have been patiently waiting for.

If Agrawal can fix Twitter, then Twitter is easily an $80 stock.

Remember that Dorsey is still the CEO of Square and hasn’t been shy in expressing his passion for cryptocurrencies, and it’s likely there that he will finally be unshackled from the annoyance of running Twitter and get to focus on his favorite company.

Honestly, he hasn’t seemed interested in Twitter for a while, so it’s a win–win for both companies.

“Once things start moving, Uber will, too.” – Said Current CEO of Uber Dara Khosrowshahi when asked about the fallout from the coronavirus

Global Market Comments

November 29, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD,

or NOW IT’S THE OMICRON VARIANT)

(TSLA), (NVDA), (VIX), (SPX), (JPM)

Rioting in Holland and Austria, protests in France, the new lockdowns prompted by the new Omicron Variant of the Covid virus had only one message for American Investors: SELL!

The end result was the biggest down day in 15 months, with the Dow exceeding a 1,000-point bruise at the lows, not bad for a half-day holiday session.

While the market was bidless for most stocks, that wasn’t true for the best quality fastest growers. Tesla (TSLA) gave up only 3%, Microsoft 2.4%., and NVIDIA (NVDA) 3.5%. I tried to buy several at the close and failed, even though I kept raising my bid.

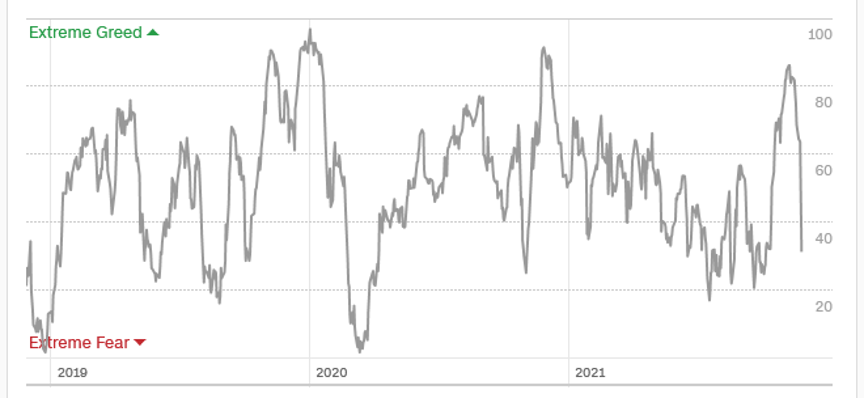

We also saw one of the sharpest declines in the history of the Mad Hedge Market Timing Index, from an overbought 85 to a bargain basement 31 in mere days.

This is exactly what the market needed.

I went into last week 100% in cash because I was leery of a market that traded sideways on declining volume after a historic run. In fact, we needed some kind of selloff before the market could go higher.

As I never tire of telling followers, cash is a position and has option value. A dollar at a market top is worth $10 at a market bottom. I had to endure only 50 market corrections before I figured this out, wishing I had cash at the bottom.

At the Friday low, stocks had sold off 1,850 points, or exactly 5.0% from the November 8 high. Heard that number before?

Before stock could rise, they had to fall first. The fears over Omicron are complete nonsense. It will not affect the US economy or stock markets one iota. Some 90% of the US population is now immune to Covid. There is no evidence that Omicron can overcome vaccines. When the variant comes here, and you can’t stop it, it will only kill anti-vaxers, as it did in Europe.

The fact is that the US continues to grow at a prolific 7% rate, with no sign of slowing in sight. As the port congestion fades, supply chains will repair and the inflation that is incited will fade. US companies are making more money than ever.

We still have a second reopening trade on for 2022. In a year, the economy will be booming, we will be at full employment, inflation will have faded, the pandemic will be over, and stocks will be at new all-time highs.

While some of next year’s performance has been pulled forward into 2021, much of it remains in the future.

So, when next time we take another run at a Volatility Index (VIX) of $29, I’ll be in there with guns blazing picking up all the usual suspects.

Global Stock on Pandemic Fears Smashes Markets, with Dow futures down 800 and ten-year yields off 13 basis points. New mandatory lockdowns in Austria and Holland have triggered rioting. It’s just another less than 5% correction.

The farther we go down now, the more we can go up in December and January. America’s 90% immunity will hold at bay any variants. There is no evidence this new one can’t be stopped by vaccines. Africa is another story. I went into this 80% cash. Wait for the selling to burn out in a day or two then use the high volatility to add front-month call spreads and LEAPS in your favorites.

Biden Appoints Jay Powell for a second time in a major lurch to the middle by the president. It’s the opening shot in the 2022 mid-term elections. I’ll approve your Fed governor if you pass my social safety net. It turned out to be impossible to find anyone more dovish than Jay Powell. The stock market loves it, especially interest rate-sensitive financials. The yearend rally continues.

Another $1.75 trillion Social Spending Bill passes the House, but most won’t see the light of day in the Senate. At best, maybe a few hundred million in spending gets through. Expect to hear a lot about socialism and deficits. No market impact here.

New Home Sales lag, up only 0.8% in October versus 1.4% expected. Some 6.34 million units were shifted. Only 1.25 million homes are for sale, down 12% YOY, representing only a 2.4-month supply.

The median price for a home rose to $353,900, up 13.1% YOY, but local markets like Phoenix and Seattle are seeing far greater gains. Million-dollar homes are seeing the greatest gains, with institutional investors pouring into the market to lock in historic low-interest rates.

Rents soar by 36% in New York and Florida against a national average of 13% in October is another sign of reopening and a return to normal.

Biden Taps the SPR, releasing some 50 million barrels, or two days’ worth of consumption. The president is throwing the gauntlet down at OPEC. Oil rallied on the news, as it was not more. This is largely a symbolic gesture and will have a minimal impact on gasoline prices. Now that the US is a net energy exporter it should close down the SPR as it is simply a subsidy for a dying fuel source that is going to zero and a bribe for Texas and Louisiana voters.

Weekly Jobless Claims plunge to a 52-year low, to 199,000. People are finally coming out of hiding and going back to work. It makes the upcoming November Nonfarm Payroll Report pretty interesting. Mark it on your calendar.

Tesla sales are on fire in California, the largest market in the US. The newest small SUV Model Y is leading the charge. No other company is close to mass production of a competitor yet. Tesla has a 5% market share in the Golden State ranking it no five among all car sales. A $7,500 tax credit that started last week is a big tailwind, but you have to tax taxes to benefit. Buy (TSLA) on dips, a Mad Hedge 380 bagger. My target is $10,000, 8X from here.

The Ports Log Jam is breaking. 24-hour shifts at Los Angeles and Long Beach, which handle 40% of all US unloadings, are making a big difference. Once the supply chain problems go away, so will inflation.

My Ten Year-View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

With the pandemic-driven meltdown on Friday, my November month-to-date performance plunged to -10.74%. My 2021 year-to-date performance took a haircut to 77.82%. The Dow Average is up 14.05% so far in 2021.

I used a spike on bond prices to add a 20% position in bonds and the Friday dive to go long JP Morgan (JPM), so I am 70% in cash. I will be using any further volatility spikes to add positions in the coming week.

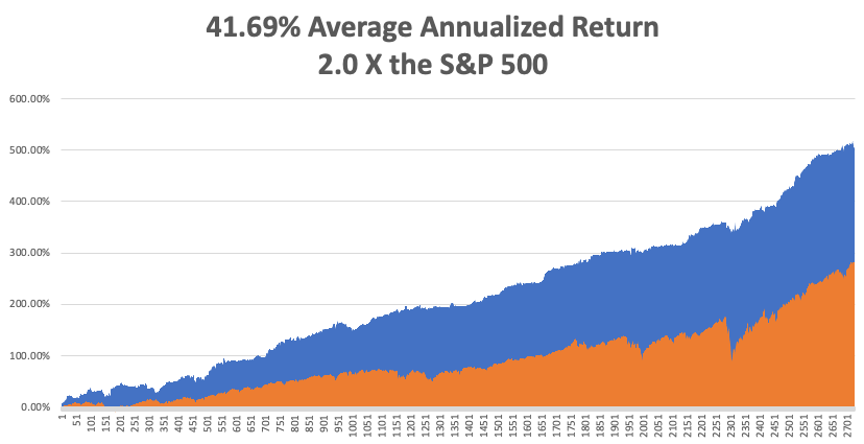

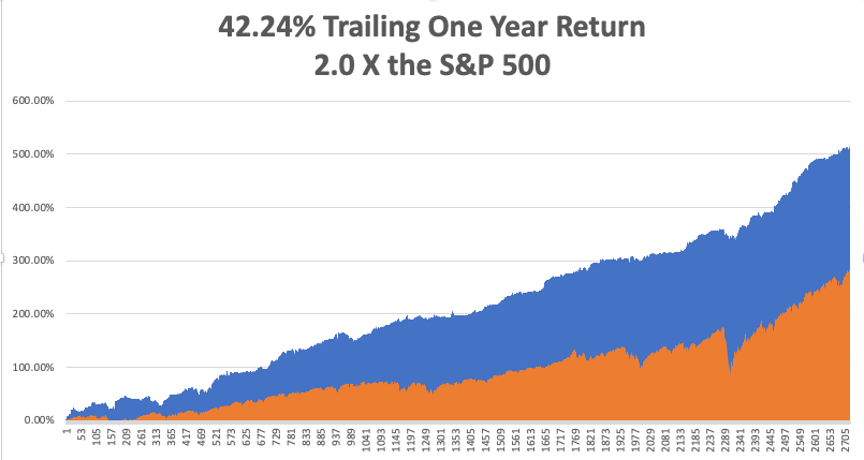

That brings my 12-year total return to 500.37%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return has ratcheted up to 41.69% easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 48.2 million and rising quickly and deaths topping 780,000, which you can find here.

The coming week will be all about the inflation numbers.

On Monday, November 29 at 7:00 AM, Pending Homes Sales for October are released.

On Tuesday, November 30 at 6.45 AM, the S&P Case Shiller National Home Price Index is announced.

On Wednesday, December 1 at 5:15 AM, the ADP Private Employment Report is printed.

On Thursday, December 2 at 8:30 AM, the Weekly Jobless Claims are disclosed.

On Friday, December 3 at 8:30 AM EST, the November Nonfarm Payroll Report is published. At 2:00 PM, the Baker Hughes Oil Rig Count is out.

As for me, with all the recent violence in the Middle East, I am reminded of my own stint in that troubled part of the world. I have been emptying sand out of my pockets since 1968, when I hitchhiked across the Sahara Desert, from Tunisia to Morocco.

During the mid-1970s, I was invited to a press conference given by Yasser Arafat, founder of the Al Fatah terrorist organization and leader of the Palestine Liberation Organization, at the Foreign Correspondents Club of Japan. His organization then rampaged throughout Europe, attacking Jewish targets everywhere.

Japan recognized the PLO to secure their oil supplies from the Persian Gulf, on which they were utterly dependent.

It was a packed room on the 20th floor of the Yurakucho Denki Building, and much of the world’s major press was represented, as the PLO had few contacts with the west.

Many placed cassette recorders on Arafat’s table in case he said anything quotable. Then Arafat ranted and raved about Israel in broken English.

Mid-sentence, one machine started beeping. A journalist jumped up to turn his tape over. Suddenly, four bodyguards pulled out Uzi machine guns and pointed them directly at us.

The room froze.

Then a bodyguard deftly set his Uzi down on the table flipped over the offending cassette, and the remaining men stowed their weapons. Everyone sighed in relief. I thought it was interesting that the PLO was using Israeli firearms.

The PLO was later kicked out of Jordan for undermining the government there. They fled Lebanon for Tunisia after an Israeli invasion. Arafat was always on the losing side, ever the martyr.

He later shared a Nobel Prize for cutting a deal with Israel engineered by Bill Clinton in 1993, recognizing its right to exist. He died in 2004.

Many speculated that he had been poisoned by the Israelis. My theory is that the Israelis deliberately kept Arafat alive because he was so incompetent. That is the only reason he made it until 75.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

November 26, 2021

Fiat Lux

Featured Trade:

(I HAVE AN OPENING FOR THE MAD HEDGE FUND TRADER CONCIERGE SERVICE),

(SOME SAGE ADVICE ON ASSET ALLOCATION)

Well, it’s happened once again.

This time, I have two concierge members who have given me notice that they are cashing in their chips and retiring at the end of the year.

One used my trade alerts on LEAPS to turn $100,000 to $1.5 million, fundamentally changing his life. He is buying a mansion on a golf course in Florida and will still have enough money left over to pay for three college educations.

Instead of keeping a laser eye on the Mad Hedge Market Timing Index, he’ll be closely monitoring his golf handicap.

He confided to me that my service enabled him to retire 15 years ahead of schedule.

Another is moving to a beachfront home in Kauai island in Kawaii and will supplement his retirement with a brand new 50-foot yacht. The channel in front of his house is a favorite for migrating pods of humpback whales (I used to buzz them with my plane).

They both promised to send me postcards.

That creates a fabulous opportunity for you as I now have a rare two Concierge slots to offer to my subscribers where I limit the service to only ten clients at any one time.

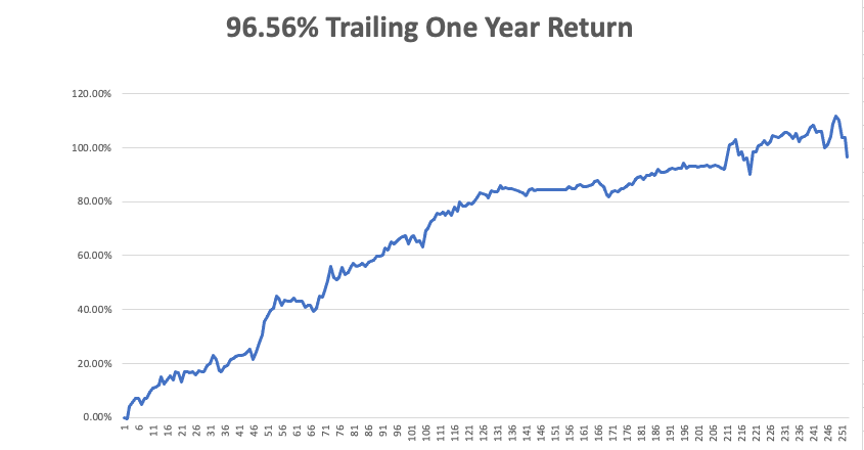

With a 96.56% trailing one-year return, clients are beating down the door to join my Concierge service.

Ten baggers we earned over the past years in my calls on Tesla (TSLA), Nvidia (NVDA), Moderna (MRNA), and Zoom (ZM) were the final clincher.

The goal is to provide high net-worth individuals with the extra degree of assistance they may require in managing diversified portfolios. Tax, political, and economic issues will all be covered.

It is also the ideal service for the small and medium-sized hedge fund that lacks the resources to support their own in-house global strategist full time.

The service includes the following:

1) A risk analysis of your own personal portfolio with the goal of focusing your investment in the highest return sectors for the long term.

2) A monthly phone call from John Thomas to update you on the current state of play in the global financial markets.

3) Personal meetings with John Thomas anywhere in the world once a year to continue our in-depth discussions, ever the pandemic ends.

4) You get my personal cell phone number so I can act as your investment 911.

5) Early releases of strategy letters and urgent trading information.

6) More detailed recommendation on LEAPS, or two-year call options on the best high growth names.

The cost for this highly personalized, bespoke service is $10,000 a year.

To best take advantage of Mad Hedge Fund Trader Executive Service, you should possess the following:

1) Be an existing subscriber of the Mad Hedge Fund Trader who is already well aware of our strengths and limitations.

2) Have a liquid net worth of over $500,000.

3) Possess a degree of knowledge and sophistication of financial markets. This is NOT for beginners.

To subscribe to Mad Hedge Fund Trader Concierge Service, please email Filomena at customer support at support@madhedgefundtrader.com and put “Concierge Candidate” in the subject line.

I look forward to hearing from you.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Asset allocation is the one question that I get every day, which I absolutely cannot answer.

The reason is simple: no two investors are alike.

The answer varies whether you are young or old, have $1,000 in the bank or $1 billion, are a sophisticated investor or an average Joe, in the top or the bottom tax bracket, and so on.

This is something you should ask your financial advisor, if you haven’t fired him already, which you probably should.

Having said all that, there is one old hard and fast rule, which you should probably dump.

It used to be prudent to own your age in bonds. So, if you were 70, you should have had 70% of your assets in fixed income instruments and 30% in equities.

Given the extreme overvaluation of all bonds today, I would completely ignore this rule and own no bonds whatsoever.

This is especially true of long-term government bonds, which are yielding negative interest rates in Europe and Japan, and only 1.10% in the US.

Instead, you should substitute high dividend-paying stocks for bonds. You can get 5% a year or more in yields these days, and get a great inflation hedge, to boot.

You will also own what everyone else in the world is trying to buy right now, high-yield US stocks.

You will get this higher return at the expense of higher volatility. So just turn the TV off on the down days so you won’t get panicked out at the bottom.

That is, until we hit the next recession. Then all bets are off. That may be next year, or not.

I hope this helps.

John Thomas

The Diary of a Mad Hedge Fund Trader

Under or Over 70?

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.