When I first visited Calcutta in 1976, 800,000 people were sleeping on the sidewalks, I was hauled everywhere by a very lean, barefoot rickshaw driver, and drinking the water out of a tap was tantamount to committing suicide. Some 35 years later, and the subcontinent is poised to overtake China?s white hot growth rate.

My friends at the International Monetary Fund issued a report predicting that India will grow by 6.5% this year. While the country?s total GDP is only a quarter of China?s $6 trillion, its growth could exceed that in the Middle Kingdom as early as 2014.

Many hedge funds believe that India will be the top growing major emerging market for the next 25 years, and are positioning themselves accordingly. Investors are now taking a harder look at the country ETF?s, including India (INP) and China (FXI), which have recently suffered gut churning selloffs.

India certainly has a lot of catching up to do. According to the World Bank, its per capita income is $3,275, compared to $6,800 in China and $46,400 in the US. This is with the two populations close, at 1.3 billion for China and 1.2 billion for India.

But India has a number of advantages that China lacks. To paraphrase hockey great, Wayne Gretzky, you want to aim not where the puck is, but where it?s going to be. The massive infrastructure projects that have powered much of Chinese growth for the past three decades, such as the Three Gorges dam, are missing in India. But financing and construction for huge transportation, power generation, water, and pollution control projects are underway.

A large network of private schools is boosting education levels, enabling the country to capitalize on its English language advantage. When planning the expansion of my own business, I was presented with the choice of hiring a website designer here for $60,000 a year, or in India for $5,000. That?s why booking a ticket on United Airlines or calling technical support at Dell Computer gets you someone in Bangalore.

India is also a huge winner on the demographic front, with one of the lowest ratios of social service demanding retirees in the world. China?s 30-year-old ?one child? policy is going to drive it into a wall in ten years, when the number of retirees starts to outnumber their children.

There is one more issue out there that few are talking about. The reform of the Chinese electoral process at the next People?s Congress could lead to posturing and political instability which the markets could find unsettling. India is the world?s largest democracy, and much of its current prosperity can be traced to wide ranging deregulation and modernization that took place 20 years ago.

I have been a big fan of India for a long time, and not just because they constantly help me fix my computers. In the past, I recommended Tata Motors (TTM), which has since doubled, making it one of my best, all-time single stock picks (click here for ?Take Tata Motors Out for a Spin?). On the next decent dip take a look at the Indian ETF?s (INP), (PIN), and (EPI).

Better to Own This Pyramid

Better to Own This Pyramid

Than This Pyramid

Than This Pyramid

Taxi! Taxi!

Taxi! Taxi!

Global Market Comments

August 12, 2013

Fiat Lux

SPECIAL MYKONOS ISSUE

Featured Trade:

(HOW THE EURO LOOKS FROM MYKONOS),

(FXE), (EUO), (GREK)

CurrencyShares Euro Trust (FXE)

ProShares UltraShort Euro (EUO)

Global X FTSE Greece 20 ETF (GREK)

When I sat down at my table at the Namos Restaurant, I was somewhat puzzled by the handful of sand thrown on every table. Are the Greeks as untidy with their food service as they are with their national accounts? Namos is on the south beach of the Greek island of Mykonos, part of the Cyclades chain of ancient fable, and is said to be the hottest nightclub on the island.

From Your Correspondent in Greece

From Your Correspondent in Greece

The reason for the sand soon became clear. Shortly thereafter, a gaggle of well-sauced, scantily dressed young ladies climbed on top of my table and started dancing. The sand was there to keep them from slipping. And I found out that the Greek meaning of ?hot? is ?loud?. When my table was cleared of dancers, my lobster dinner was delivered, and a group of partiers jumped up to take a picture of it. Welcome to the Land of Homer, Socrates, and Thucydides!

I told the waitress that she looked just like the girl on the 2,400-year-old vase in the Metropolitan Museum of Art in New York. She answered, ?It?s in my DNA.? I replied, ?I bet.? Yes, at nearly 62, I know I?m not supposed to be in places like this. But the inner me still wants to be 26.

The Famous Lobster Dinner

The Famous Lobster Dinner

I traveled to this distant island to deliver another one of my Global Strategy Luncheons. I originally put it up in the store as a joke, thinking that no one would want to visit this bankrupt country.? There is rioting in the streets of the capital, hotels going bankrupt and keeping your deposit, credit card companies are denying charges, and Eurail has banned use of their continental passes.

To my shock and surprise, a dozen tickets sold. Several hedge fund managers from Europe planned their summer vacations around the event, bringing their families. Greece is a favorite getaway for Russian oligarchs looking to beat the Moscow heat and humidity. European Community officials in Brussels are always looking for an excuse to get out of town, at government expense. There was even a hedge fund manager from Athens who was coming off of a spectacular 2012, playing the short side in the stocks and bonds of his home country.

As we poured over our hotel menus, no one could find anything to eat. It was all some kind of weird Asian/Greek fusion. I?m talking sushi with eggplant and feta cheese. Then my Russian guest piped up, ?Why don?t we eat on my boat??, ?You can host lunch for 13 at sea, with no notice?? I asked. ?Of course!? he beamed.

A Table for 12 Please

A Table for 12 Please

Minutes later, two launches appeared at the dockside to take my somewhat excited and expectant guests out into the Aegean Sea. The ?boat? was actually a battleship, a 150-foot long leviathan with three decks, far too large for our small harbor. A quick bridge tour displayed live satellite links, radar, GPS, and enough electronics to be the envy of the US Navy, plus a Bloomberg terminal which the Squids surely lack.

I love doing these things because I always pick up more insightful market intelligence that I am able to dish out. Before I started my presentation, we took turns going around the table, giving views on local market conditions on everything under the sun and a best shot at an outlook.

The really great discovery of the day was an explanation from my Brussels friends as to why it was impossible for the Germans to leave the European Community and the Euro (FXE), (EUO). If Germany returned to the old Deutschemark, it would overnight become the world?s strongest currency, instantly appreciating 200%-300% against what was left of the Euro. Costs for the countries companies would skyrocket.

To survive, they would have to immediately offshore as much production as possible to the lower waged United States and China. Earnings would go through the roof, but the middle class would get wiped out, especially blue-collar workers. With the jobs would go crucial market intelligence and technical innovation. The Fatherland would get hollowed out, remaining just a listing address for firms that made most of their money abroad. Sound familiar?

That means there is no choice for Germany than to continue with the political, economic, and social unification of the continent. If it has to assume the debts of the precarious southern European countries, it is a bargain at the price.

This is easier said that done. The United States offers no real example. The founding fathers were all white, protestant males from identical cultural backgrounds who spoke the same language and accounted for just 5% of the population. Interstate communication took place via horse and rider, and it took three weeks for a message to get from one end of the country to another.

They eventually huddled together in a hot, steamy room in Philadelphia for months in 1776, and didn?t come out until they created a country (you can see a picture of the edifice on the back of a $100 bill).

Few know that a major impetus for the American Revolution was so American debtors could default on burdensome loans to London banks (again, sound familiar?)

Even then, with minimal military experience among them (George Washington had just three years service in what was then the equivalent of the National Guard, and could qualify for a commission in the British Army) there was less than a 5% chance of the nascent government taking on the combined British Army and Navy and winning. The creation of the US is really an historical accident of the 18th century, and couldn?t be repeated today, even in the US.

Switzerland offers a possible pathway for a European future. There, mutually distrustful and suspicious German, French, Italian, and even Latin speaking cantons eventually worked out a loose confederation. But it took 100 years to accomplish. Financial markets won?t be as patient today.

As the lunch wound down, two leggy blondes appeared at our table with two trays of vodka filled shot glasses. Our host toasted The Mad Hedge Fund Trader enterprise, as well as our future success in the markets. I said ?thank you? with a hearty ?nastrovia,? and the launches ferried is back to shore.

The rest of my week in Mykonos was pretty relaxed. I got up at 6:00 am every morning to check the markets, read my email, and to write. By 2:00 pm I was safely in a beach chair, observing the local wildlife, and frequently taking dips in a turquois blue sea.

In a globalized world, the beach attendants in Greece speak English, Italian, and Russian, reflecting the current makeup of the tourist population. The Africans hawking fake Gucci?s and Rolexes are Tanzanian. The young men and women who wander beach chair to beach chair offering cheap massages are all Chinese.

The American and German students who overran the place when I first came here 45 years ago are largely absent. The Yanks are too broke, and the Germans are all visiting America, which is far cheaper and lacking the prejudice they run into here. Creditors are never popular.

Sticking out like a sore thumb were three senior Chinese strolling the beach wearing white bathrobes. It turns out they were working in Athens to soak up billions in high yield Greek debt on behalf of the Bank of China. They thought Mykonos would make an exotic weekend away from the polluted and tumultuous capital.

One day, my frolicking in the waters earned me a coral cut on my foot. Left untreated, these things can infect very rapidly. So I went to the mini market and bought a half bottle of The Famous Grouse Scotch Whiskey. I poured a small amount on the open sore, and drank the rest. It works every time.

Taking a break from my writing, I explored the medieval downtown of Mykonos, a warren of narrow twisting alleyways squeezed between whitewashed stucco buildings. This was originally a lair for pirates who preyed on Mediterranean shipping 500 years ago.

Today, pirates of a more modern variety storm ashore. Hedge fund managers wielding American Express platinum credit cards disembark from the flotilla of private yachts. The top designer brands are well represented here, and they do a brisk business.

They then retire to the old Venetian quarter for a dinner of moussaka and baklava, to be washed down by local ?Fix? beer. Greek wines have improved a lot in recent decades, and there is a lot to be said for a fine Peloponnesian Chardonnay.

My only near death experience on this leg of the trip was the dubious quadracycle I rented. Apparently, the skills of Greek mechanics leave a lot to be desired, as the rickety machine burned oil, had lousy brakes, and spewed out a plume of noxious, blue smoke. After a few hair-raising hours on the island?s narrow, dilapidated roads facing suicidal, curve passing drivers, I happily returned my ride early.

Testing the skills of the Greek medical community as well was not on my agenda.

Life is good.

I Always Wanted to Ride a Harley

I Always Wanted to Ride a Harley

Life is good.

Life is good.

Global Market Comments

August 9, 2013

Fiat Lux

Featured Trade:

(AMBUSH IN AUSTRALIA),

?(FXA), (FXY), (FXE), (YCS), (NLR), (UNG), (GLD), (DBA),

(REPORT FROM MILAN)

CurrencyShares Australian Dollar Trust (FXA)

CurrencyShares Japanese Yen Trust (FXY)

CurrencyShares Euro Trust (FXE)

ProShares UltraShort Yen (YCS)

Market Vectors Uranium+Nuclear Enrgy ETF (NLR)

United States Natural Gas (UNG)

SPDR Gold Shares (GLD)

PowerShares DB Agriculture (DBA)

For a lifetime central bank watcher, like myself, this was one for the record books.

Reserve Bank of Australia, Glenn Stevens, said last week that he welcomed a weak Australia dollar and that it probably had further to fall. To put gasoline on the flames, he added that there was room for the RBA to further lower interest rates, assuring that more weakness in the Aussie was assured.

The Australian dollar didn?t have to be told twice what to do. All bids for the troubled currency immediately vaporized, and it gapped down two full cents to the 90-cent level, a three-year low. When the Aussie broke a crucial support level at parity in the spring, I predicted that 80 cents was in the cards.

That forecast, bemoaned and lambasted at the time, is now looking increasingly likely. This is why I have been warning my Australian friends all year to pay for their summer vacations in advance while their currency was still dear.

What is far more important here is what the RBA moves means for the global economy. It certainly raises the stakes in the international race to the bottom, where every country tries to devalue their way to prosperity. During the Great Depression, this was known at the ?beggar thy neighbor? policy, a term I?m sure you have all heard a lot about. A cheaper currency means your exports now cost less, so customers shift business from your neighbors to you, boosting your economy.

In recent years, the US was winning that game. Then Japan took over the lead in November, with a yen (FXY), (YCS) that has fallen 25% since. Now, Australia has grabbed first place, with a 15% plunge since March. Who is the big loser in all this? Europe, where even the guy who runs the beach mini mart in Mykonos tells me his economy sucks because his currency (FXE) is grotesquely overvalued.

The sad thing is, I don?t think a weaker Aussie will help the Land Down Under very much, if at all. Their problem is not a price one for their commodities, but a demand one. Everything Australia sells is a commodity where prices are set by a global marketplace.

The slowing of China?s economy is the big driver here, as orders for Australia?s exports of iron ore, copper, and coal fall precipitously. Grains (DBA) sales are hurt by America?s bumper crop, which is killing prices. Fukushima demolished uranium exports (NLR). Australian offshore natural gas (UNG), at $16/btu, doesn?t stack up very well against US fracking gas at $3.50. Gold (GLD) is not exactly flying off the shelf either, with prices at one point this year down 33% from the highs.

There is another big factor, which no one but myself seems to me noticing. The slowdown in Chinese commodity demand is not a temporary affair, it is a permanent one. The government there is making every effort to shift the economy away from commodity consuming, metal bashing exports, to a more services oriented one.

This more suitably matches the Middle Kingdom?s own resource base, of which there are few, towards a higher rung in its own development. You will probably start to hear about this from other strategists, gurus, and research houses in about a year. It is momentous in its implications.

The RBA?s move caught many traders off guard, as they had already begun scaling into long Australian dollar positions, looking for an autumn rally. Mad Day Trader, Jim Parker, knew better, and was advising Aussie shorts up to the 94 cent level.

As for me, I?ll be selling every decent Aussie rally for the foreseeable future, until global commodity prices finally bottom, or Australia changes central bank governors, whichever happens first. I bet a lot of Australians right now prefer the latter over the former.

The Thunder Down Under is Fading

The Thunder Down Under is Fading

Milan, Italy appears to be a city entirely populated by fashion models riding bicycles on the city?s frenetic, cobblestone streets. That is one?s first impression coming out of the monolithic Milano Centrale train station, built by Mussolini to reaffirm faith in his state. Despite years of allied bombing during WWII, the building is as imposing as the day it was built.

You Think It?s Easy Fitting into a Size 0?

You Think It?s Easy Fitting into a Size 0?

I am here for a day, transiting from my flight from Mykonos in Greece to the train to Zermatt in Switzerland. There I wind up my trip every year with a stiff dose of penance for my gluttonous ways in the form of daily 10-mile Alpine hikes with a 4,000 foot vertical climb.

Milan?s breathtaking August sales make it a mandatory stop each year. There, you can buy the best designer clothes for 90% off because they are the remnants of last year?s collection. I buy clothes for all my kids, all my friends, and even people I don?t like, because the prices are so irresistible. I?m talking a pair of pants for $5 and shirts for $3. Even the extra suitcase I bought to ship everything back was half off. Note to travelers: Corso Buenos Aires is the street to visit.

Here is another tip to future travelers to the fashion capital of the world. Avoid those romantic sidewalk cafes and eat indoors. The clouds of mosquitoes emanating forth from the sewers will eat you alive. The Italians deal with this by placing Japanese mosquito coils under every table. But they can?t catch them all. Better to eat than be eaten. Indoors is also the de facto Italian no smoking zone as well.

On an extra afternoon to spend in this amazing city. I visited Michelangelo?s Last Supper at Santa Maria della Grazie monastery, looking for evidence of the conspiracy theories long ascribed to this masterpiece.

Strolling though the Galleria, the world?s first shopping mall, I stopped by the famed mosaic of a bull set in the floor to step on his balls. Done correctly, it is a swinging, rotating motion. Local custom says this is good luck. Was this the beginning of proto-feminism in the 18th century?

Yes, that was a McDonald?s shop in the background. The city has since banished it from the Galleria, as it is not representative of Italian culture in this important national landmark. Today, you will find a new Prada shop there, packed with Chinese elbowing each other to pay $4,000 for a handbag they can easily pick up in Shenzhen for $10.

I managed to scoot into the main Brioni store just before closing. There, I watched two Russian Mafia types in their thirties buy a half dozen exquisitely tailored, 200 thread count suits each for $8,000. That?s $96,000 worth of clothes?. for guys!

Alas, they don?t carry an American size 48 long in stock, it would have to be a custom order, so I left with only a couple shirts and some $200 ties in hand. In any case, I happen to know that I can get the identical suit at the Brioni shop Caesar?s Palace in Las Vegas for half, thanks to flaccid Uncle Buck, plus they likely have my size.

The next morning found me in a mad dash back to the train station, my taxi driver artfully weaving in and out of traffic, where I boarded a first class Eurostar train. The engine powered North towards the Italian Alps, passing through the Milan slums. Retracing the route seen in the classic Sinatra prisoner of war escape flick, Von Ryan?s Express. Unlike in Frank?s day, first class cars now include screens showing a Google mapping function showing the scenery ahead?from a viewpoint 200 feet above the train. Cool!

Next stop: Zermatt, Switzerland, and the Matterhorn.

To be continued.

Global Market Comments

August 8, 2013

Fiat Lux

Featured Trade:

(A PERFECT STORM HITS THE GRAIN TRADE),

(POT), (AGU), (DBA), (DE), (CAT),

(WHY YOU SHOULD CARE ABOUT THE IRANIAN RIAL COLLAPSE),

(USO), (UNG), (XLE)

Potash Corp. of Saskatchewan, Inc. (POT)

Agrium Inc. (AGU)

PowerShares DB Agriculture (DBA)

Deere & Company (DE)

Caterpillar Inc. (CAT)

United States Oil (USO)

United States Natural Gas (UNG)

Energy Select Sector SPDR (XLE)

Grain traders have suffered a terrible 2013, a perfect storm of great news for farmers and terrible news for prices. But while farmers can make up for low prices with higher production, no such convenience exists for grain traders.

In January, right out of the gate, the USDA predicted that the US would produce the largest corn crop in history, or some 96 million bushels. That would be the largest since 1936. It now appears that this could be a low-ball figure.

Some private estimated see the total reaching 100 million bushels before the crying is over. Some 63% of the corn crop is now rated good/excellent, well above the five-year average of 58%, and trending northward.

Geopolitics has also conspired to drive prices southward. Egypt, with its burgeoning 83 million population, with a single river (the Nile) and a bleak desert to support it, is far and away the world?s largest wheat importer. A recent coup d??tat on the heels on an economic collapse promises to remove it from the marketplace soon. Buyers without cash are not buyers at all, no matter how dire the need. Only food aid from the US government or the United Nations can step in at this stage to head off mass starvation.

As if the news were not bad enough, the Russian cartel that controls two thirds of the world?s $22 billion a year potash supply, a crucial fertilizer used globally, collapsed last week over a price dispute. Known to chemists like me as Potassium carbonate, potassium sulfate, or potassium chloride, this compound is a key factor in strengthening roots during the growing cycle. One analyst said that the breakup of the cartel is akin to ?Saudi Arabia dropping out of OPEC.?

The move promises to take potash prices down from the 2008 peak of $1,000/tonne to $300 by yearend. Potash stocks crashed worldwide, with lead firm Potash (OT) diving 30%. Agrium (AGU) was down by 15%.

This will enable farmers to buy more fertilizer at cheaper prices next year, driving down the prices on far month futures contracts today. Too bad the Canadian government didn?t allow the sale of Potash (POT) to China go through on national security grounds. The shareholders must be kicking themselves.

The move promises to demolish the entire grade trade for this year. Not only has the Potash industry been hurt, so have agricultural equipment manufacturers, like Deere (DE) and Caterpillar (CAT) and the Powershares Multisector Agricultural Commodity Fund ETF (DBA).

Long gone are the heady days of last year, when scorching temperatures induced by global warming caused grain prices to nearly double. Some nine out of the ten last years have been the hottest in recorded history. Global warming denier-in-chief, Texas governor Rick Perry, saw his state suffer 100 consecutive days of over 100 degree temperature.

For me, these developments put the grain trade off limits for the foreseeable future. The only kind thing to be said here is that this will eventually lead to a final bottom that we can eventually trade off of. That would set up a killer position for the nimble if hot weather returns in 2014.

Potash Crystals

Potash Crystals

I Don?t See Any Grain Buyers Here

I Don?t See Any Grain Buyers Here

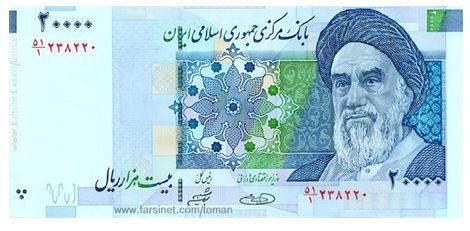

The Iranian Rial (IRR) has just suffered one of the most cataclysmic crashes in the history of the foreign exchange markets. It is off a mind numbing 90% since the beginning of 2011. One dollar now buys 24,834 Rials. Watch out Zimbabwe!

When communications between intelligence agencies suddenly spike, as has recently been the case, I sit up and take note. Hey, do you think I talk to all of those generals because I like their snappy uniforms, do you?

The word is that the despotic, authoritarian regime in Syria is on the verge of collapse, and is unlikely to survive more than a few more months, now that the US is openly supplying weapons to the rebels. The body count is mounting, and the only question now is whether Bashar al-Assad will flee to an undisclosed African country or get dragged out of a storm drain to take a bullet in his head a la Gaddafi. It couldn?t happen to a nicer guy.

The geopolitical implications for the US are enormous.? With Syria gone, Iran will be the last rogue state hostile to the US in the Middle East, and it is teetering. The next and final domino of the Arab spring falls squarely at the gates of Tehran.

Remember that the first real revolution in the region was the street uprising there in 2009. That revolt was successfully suppressed with an iron fist by fanatical and pitiless Revolutionary Guards. The true death toll will never be known, but is thought to be in the thousands. The anti-government sentiments that provided the spark never went away and they continue to percolate just under the surface.

At the end of the day, the majority of the Persian population wants to join the tide of globalization. They want to buy iPods and blue jeans, communicate freely through their Facebook pages and Twitter accounts, and have the jobs to pay for it all. Since 1979, when the Shah was deposed, a succession of extremist, ultraconservative governments ruled by a religious minority, have failed to cater to these desires.

When Syria collapses, the Iranian ?street? will figure out that if they spill enough of their own blood that regime change is possible and the revolution there will reignite. The Obama administration is now pulling out all the stops to accelerate the process. The new Secretary of State, John Kerry, will stiffened his rhetoric and work tirelessly behind the scenes to bring about the collapse of the Iranian economy.

The oil embargo is steadily tightening the noose, with heating oil and gasoline becoming hard to obtain in this oil producing country. Yes, Russia and China are doing what they can to slow the process, but conducting international trade through the back door is expensive, and prices are rocketing. The unemployment rate is 25%.

Iranian banks have been kicked out of the SWIFT international settlements system, a death blow to their trade. That is what the Standard Chartered money laundering scandal last year was all about. Sure, you can sell oil one truckload at a time for cash. Try doing that with 3 million barrels a day of which should fetch $270 million. That?s a lot of Benjamins. Forget the fives and tens.

Let?s see how docile these people remain when the air conditioning quits running because of power shortages. With their currency now worthless, it has become impossible to import anything. This is causing severe shortages of everything under the sun, especially foodstuffs, which in some cases have more than doubled in price in months.

What does the government in Tehran say about all of this? Blame it on the speculators. Sound familiar?

Iran is a rotten piece of fruit ready to fall of its own accord and go splat. The Obama administration is doing everything it can to shake the tree. No military action of any kind is required on America?s part. Think of it as victory on the cheap.

The geopolitical payoff of such an event for the US would be almost incalculable. A successful Iranian revolution will almost certainly produce a secular, pro-Western regime whose first priority will be to rejoin the international community and use its oil wealth to rebuild an economy now in tatters.

Oil will lose its risk premium, now believed by the oil industry to be $30 a barrel. A looming oversupply could cause prices to drop to as low as $30 a barrel. This would amount to a gigantic $1.66 trillion tax cut for not just the US, but the entire global economy as well (87 million barrels a day X 365 days a year X $100 dollars a barrel X 50%).

Almost all funding of terrorist organizations will immediately dry up. I might point out here that this has always been the oil industry?s worst nightmare. Commercial office space in Houston may not do so well either, as imports account for 80% of the oil majors? profits.

At that point, the US will be without enemies, save for North Korea, and even the Hermit Kingdom could change with a new leader in place. A long Pax Americana will settle over the planet.

The implications for the financial markets will be enormous. The US will reap a peace dividend as large, or larger, than the one we enjoyed after the fall of the Soviet Union in 1992. As you may recall, that black swan caused the Dow Average to soar from 2,000 to 10,000 in less than eight years, also partly fueled by the technology boom.

A collapse in oil imports will cause the US dollar to rocket.? An immediate halving of our defense spending to $400 billion or less and burgeoning new tax revenues would cause the budget deficit to collapse. With the US government gone as a major new borrower, interest rates across the yield curve will fall further.

A peace dividend will also cause US GDP growth to reaccelerate from a tepid 2% rate to a more robust 4%. Risk assets of every description will soar to multiples of their current levels, including stocks, junk bonds, commodities, precious metals, and food. The Dow will soar to 30,000, the Euro collapses to parity, gold rockets to $3,000 an ounce, silver flies to $100 an ounce, copper leaps to $6 a pound, and corn recovers $8 a bushel. The 60-year bull market in bonds ends in a crash.

Some 1 million of the armed forces will get dumped on the job market as our manpower requirements shrink to peacetime levels. But a strong economy should be able to soak right up these well-trained and motivated. We will enter a new Golden Age, not just at home, but for civilization as a whole.

Wait, you ask, what if Iran develops an atomic bomb and holds the US at bay? Don?t worry. There is no Iranian nuclear device. There is no real Iranian nuclear program. The entire concept is an invention of Israeli and American intelligence agencies as a means to put pressure on the regime and boost their own budget allocations. The head of the miniscule effort they have was assassinated by Israeli intelligence last year (a magnetic bomb, placed on a moving car, by a team on a motorcycle, nice!). What nuclear infrastructure they have is being decimated by computer viruses as I write this.

If Iran had anything substantial in the works, the Israeli planes would have taken off a long time ago. There is no plan to close the Straits of Hormuz, either. The training exercises in small rubber boats we have seen are done for CNN?s benefit, and comprise no credible threat.

I am a firm believer in the wisdom of markets, and that the marketplace becomes aware of major history changing events well before we mere individual mortals do. The Dow began a 25-year bull market the day after American forces defeated the Japanese in the Battle of Midway in May of 1942, even though the true outcome of that confrontation was kept top secret for years.

If the collapse of Iran was going to lead to a global multi decade economic boom and the end of history, how would the stock markets behave now? They would rise virtually every day, offering no substantial pullbacks for latecomers to get in. That is exactly what they have been doing since mid-November.

Here?s The Next Big Short

Here?s The Next Big Short

Not Worth So Much Today

Not Worth So Much Today

Global Market Comments

August 7, 2013

Fiat Lux

Featured Trade:

(MUSINGS OF A DINOSAUR),

(THE INSIDE STORY ON APPLE?S STEVE WOZNIAK), (AAPL)

Apple Inc. (AAPL)