Global Market Comments February 26, 2020 Fiat Lux SPECIAL GOLD ISSUE Featured Trade: (THE ULTRA BULL ARGUMENT FOR GOLD), (GLD), (GDX), (ABX), (SLV), (PALL), (PPLT) (TESTIMONIAL)

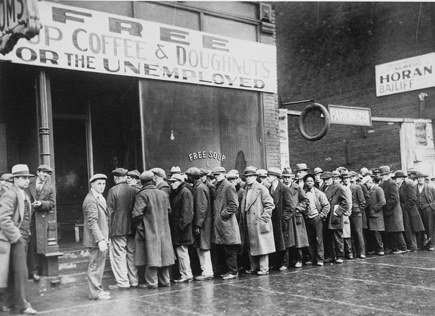

With global stock markets in free fall and interest rates everywhere headed to zero, the outlook for gold has gone from strength to strength. Shunned as the pariah of the financial markets for years, the yellow metal has suddenly become everyone’s favorite hedge. Now that gold is back in fashion, how high can it really

Global Market Comments February 25, 2020 Fiat Lux Featured Trade: (WHY US BOND YIELDS ARE GOING TO ZERO), (TLT), ($TNX) (TESTIMONIAL)

I just checked my trading record for the past three years and discovered that I have executed no less than 61 Trade Alerts selling short bonds and all but one was profitable. It really has been my “rich uncle” trade. However, all good things must come to an end. I have been scanning the horizon

I have been in the money management business for 35 years and really enjoy your service. I just want to say that the way you handled the start of the year which was a combination of exploiting opportunities from an oversold market combined with your overall risk mitigation strategies was not only brilliant but profitable

Global Market Comments February 24, 2020 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or THE WAKE-UP CALL) (SPY), (AAPL), (MSFT), (UAL), (CCL), (WYNN), (TLT)

After weeks of turning a blind eye, poo-pooing, and wishfully ignoring the global Coronavirus pandemic, traders are finally getting a wake-up call. It turns out that the prospect of a substantial portion of the world’s population dying over the next few months cannot be offset by quantitative easing after all. At least for the short

"Getting information off the Internet is akin to trying to sweep back the ocean with a broom," said Ray Kurzweil, director of engineering at Google.

Global Market Comments February 21, 2020 Fiat Lux Featured Trade: (ON EXECUTING MY TRADE ALERTS), (TEN REASONS WHY STOCKS CAN’T SELL-OFF BIG TIME), (SPY)

From time to time, I receive emails from a subscribers telling me that they are unable to get executions on trade alerts that are as good as the ones I get. There are several possible reasons for this: 1) Markets move, sometimes quite dramatically so. That’s why I include a screenshot of my personal trading

Global Market Comments February 20, 2020 Fiat Lux SPECIAL FANG ISSUE Featured Trade: (FINDING A NEW FANG), (FB), (AAPL), (NFLX), (GOOGL), (TSLA), (BABA)

We all love our FANGS. Not only have Facebook (FB), Apple (AAPL), Netflix (NFLX), and Alphabet (GOOGL) been at the core of our investment performance for the past decade years, we also gobble up their products and services like kids eating their candy stash the day after Halloween. Three of the FANGs have already won

Global Market Comments February 19, 2020 Fiat Lux Featured Trade: (HOW TO HEDGE YOUR CURRENCY RISK), (FXA), (FXE), (FXC), (FXB), (UUP)

Global Market Comments February 18, 2020 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or THE TRADE ALERT DROUGHT) (SPY), (TLT), (MSFT), (BA), (TSLA), (MGM)

Like it or not, we have a trade alert drought on our hands. I just ran the numbers on 200 potential trades in stocks, bonds, foreign exchange, commodities, precious metals, and real estate, and there was not a single one that was worth executing. They all had one thing in common: for taking huge risks,

Global Market Comments February 14, 2020 Fiat Lux Featured Trade: (FEBRUARY 12 BIWEEKLY STRATEGY WEBINAR Q&A) (SQ), (TSLA), (FB), (GILD), (BA), (CRSP), (CSCO), (GLD) (FEYE), (VIX), (VXX), (USO), (LYFT), (UBER)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader February 12 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming! Q: What do you think about Facebook (FB) here? We’ve just had a big dip. A: We got the dip because of

Global Market Comments February 13, 2020 Fiat Lux Featured Trade: (I HAVE AN OPENING FOR THE MAD HEDGE FUND TRADER CONCIERGE SERVICE), (MAD HEDGE FUND TRADER CELEBRATES ITS 12-YEAR ANNIVERSARY)

The Diary of a Mad Hedge Fund Trader is now celebrating its 12th year of publication. During this time, I have religiously pumped out 1,500 words a day, or eight double-space typed pages of original, independent-minded, hard-hitting, and often wickedly funny research. I’ve been covering stocks, bonds, commodities, energy, precious metals, real estate, and agricultural

Global Market Comments February 10, 2020 Fiat Lux Featured Trade: (LEARN MORE ABOUT ME THAN YOU PROBABLY WANT TO KNOW), (GOOG), (AMZN), (AMGN) (WHO SAYS THERE AREN’T ANY GOOD JOBS?), (TESTIMONIAL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.