I am pleased to announce that the The Mad Day Trader is now for sale, my first major upgrade to your service. While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Day Trader will exploit money-making opportunities over a ten minute to three day window. It is

Come join John Thomas for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting on the Greek island of Mykonos in the Aegean Sea on Thursday, August 1, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period. I?ll be giving

Buried in the recently passed Dodd-Frank financial reform bill are massive financial rewards for turning in your boss. The SEC is hoping that multimillion dollar rewards amounting to 10%-30% of sanction amounts will drive a stampede of whistle-blowers to their doors with evidence of malfeasance and fraud by their employers. If such rules were in

The coming Fourth of July celebration brings back memories of my late wife?s campaign to become an American citizen, who originally came from Japan. Part of the process required a verbal quiz about US history and government. Our family spent a year energetically prepping her, with nightly grilling?s over dinner about the most obscure details

Global Market Comments June 28, 2011 Fiat Lux (NOTICE TO SUBSCRIBERS TAKING OFF FOR EUROPE)

My tux and white dinner jacket are packed, the hotels are booked, and the limo is waiting outside. The Cessna is fully fueled and the flight plan filed. I am taking off for my annual European Strategy Luncheon Tour. Along the way I will be meeting with other hedge fund managers, senior government officials, CEO?s

Global Market Comments June 27, 2013 Fiat Lux Featured Trade: (UPDATED 2013 STRATEGY LUNCHEON SCHEDULE), (THE BITTER MEDICINE FOR THE STATES), (THE FALLING MARKET FOR KIDS), (HOLLYWOOD CASHES IN ON WALL STREET TROUBLES)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Updates, which I will be conducting throughout Europe during the summer of 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period. I?ll be giving you my up to date view on stocks, bonds,

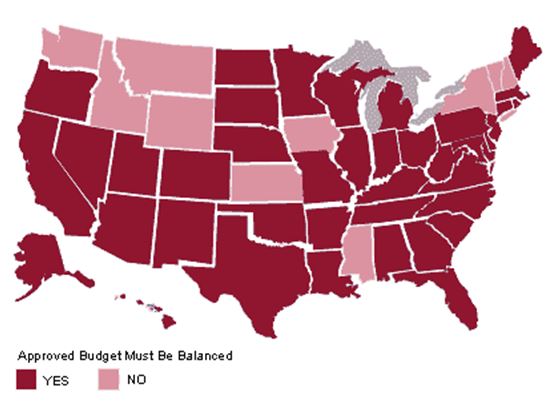

On a map, it appears that the United States is made up of 50 states. The fiscal reality is that we have 20 Portugal?s, 15 Italy?s, 10 Ireland?s, 3 Greece?s, and 2 Spain?s. In the aftermath of the Great Recession, state GDP?s saw the sharpest drop since 1981. States shoveled money out of the economy

Until the 19th century, children used to provide income and security for their parents as they worked on the family farm. That dynamic continued when industrialization brought families into the cities and kids into the factories. Since then, children have been a great short. A hundred years of state mandated education and child labor laws

I have done many things in my life: hedge fund manager, pilot, cowboy, journalist, stockbroker, mountain climber, translator, guide, etc, etc. etc. Now add technical consultant to Hollywood to the list. According to the New York Times, Simon Baker, star of the TV show ?The Mentalist?, is using the Diary of a Mad Hedge Fund

Global Market Comments June 26, 2013 Fiat Lux Featured Trade: (JULY 8 LONDON STRATEGY LUNCHEON), (MEET MAD DAY TRADER JIM PARKER AT THE JULY 2 NEW YORK LUNCH), (WHERE THE ECONOMIST "BIG MAC" INDEX FINDS CURRENCY VALUE), (FXF), (FXE), (FXA), (CYB) (ANOTHER MIRACLE FROM TESLA), (TSLA), (SCTY) CurrencyShares Swiss Franc Trust (FXF) CurrencyShares Euro Trust

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in London on Monday, July 8, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period. I?ll be giving you my up to date view on stocks, bonds,

Jim Parker, who runs our Mad Day Trader Service, will be making a last minute appearance at my New York strategy luncheon on July 2. There you can ask him any questions you want about his new short term trade mentoring program, which goes on sale on Monday. You can buy his service as a

My former employer, The Economist, once the ever tolerant editor of my flabby, disjointed, and juvenile prose (Thanks Peter and Marjorie), has released its ?Big Mac? index of international currency valuations. Although initially launched as a joke three decades ago, I have followed it religiously and found it an amazingly accurate predictor of future economic

Tesla has announced a new battery swapping service that will enable drivers to get a full charge for their all-electric Model S-1 sedans in 90 seconds. The service will be available at strategically located charging stations around the country, and will cost $60, about the cost of an equivalent full tank of gas. The swap

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Seminar, which I will be conducting in New York, NY on Tuesday, July 2, 2013. An excellent three-course lunch will be provided. A PowerPoint presentation will be followed by an extended question and answer period. I?ll be giving you my up to

In these frenetic, violent, take no prisoners markets I managed to grab a few precious minutes with Mad Day Trader, Jim Parker.? Jim uses a dozen proprietary short-term technical and momentum indicators to give some much-needed guidance in these trying times. It?s all about the bond market, says Jim. Sell every rally until proven otherwise.

Global Market Comments June 24, 2013 Fiat Lux Featured Trade: (JUNE 26 GLOBAL STRATEGY WEBINAR), (JULY 12 AMSTERDAM STRATEGY LUNCHEON), (THE BEST FINANCIAL BOOK EVER), (A DAY WITH TOM FRIEDMAN OF THE NEW YORK TIMES)

Come join John Thomas for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Amsterdam, The Netherlands, on Friday, July 12, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period. I?ll be giving you my up to date view

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.