I received a flurry of inquires the other day when Ben Bernanke mentioned the word ?sterilization? in his recent congressional testimony. And he wasn?t giving advice to the country?s wayward teenaged girls, either. Sterilization refers to a specific style of monetary policy. Sterilized policies seek to manipulate the money markets without changing the overall money

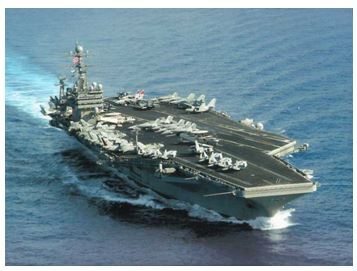

Global Market Comments March 20, 2013 Fiat Lux Featured Trade: (THE RECEPTIONS THE STARS FELL UPON), (NLR), (CCJ), (CORN), (WEAT), (SOYB), (DBA), (BECOME MY FACEBOOK FRIEND), (OIL ISN?T WHAT IT USED TO BE), (USO), (DIG), (DUG) Market Vectors Uranium+Nuclear Enrgy ETF (NLR) Cameco Corporation (CCJ) Teucrium Corn (CORN) Teucrium Wheat (WEAT) Teucrium Soybean (SOYB) PowerShares

My friend was having a hard time finding someone to attend a reception who was knowledgeable about financial markets, White House intrigue, international politics, and nuclear weapons. I asked who was coming. She said Reagan?s Treasury Secretary George Shultz, Clinton?s Defense Secretary William Perry, and former Senate Armed Services Chairman Sam Nunn. I said I?d

If you would like to get a free headline service from The Diary of the Mad Hedge Fund Trader, then please join my 1,448 friends. Every day we are posting headlines along with summaries of the stories on our Facebook page. As soon as you open your own Facebook page, you will receive our latest

Virtually every analyst has been puzzled by the seeming immunity of stock markets to soaring oil prices (USO), (DIG), (DUG) this year. In fact, stocks and crude have been tracking almost one to one on the upside. The charts below a friend at JP Morgan sent me go a long way towards explaining this apparent

Global Market Comments March 19, 2013 Fiat Lux Featured Trade: (BUY STOCKS ON THE CYPRUS DIP), (SPX), (SPY), (INVESTORS WILL WIN THE ETF PRICE WAR), (BIDDING FOR THE STARTS), (THE DEATH OF THE MUTUAL FUND) S&P 500 Large Cap Index (SPX) SPDR S&P 500 (SPY)

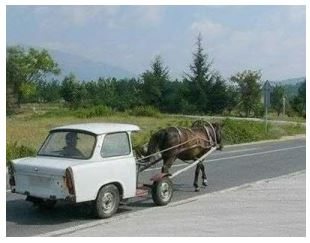

I?ll never forget the last time I was in Cyprus. I landed my twin Cessna 340 and asked for a fill up, hoping to make it back to Rome in one hop. An hour later, a truck dumped three 45-gallon drums of 100LL avgas on the tarmac with a hand pump, and asked to be

Many hedge fund traders are unhappy about the current near monopoly enjoyed by the top three ETF issuers, Black Rock, State Street, and Vanguard, which control 80% of the market. At last count more than 1,300 ETF?s were capitalized at more than $1.4 trillion. The result has been grasping management fees, exorbitant expense ratios, and

A few years ago, I went to a charity fund raiser at San Francisco?s priciest jewelry store, Shreve & Co., where the well-heeled men bid for dates with the local high society beauties, dripping in diamonds and Channel No. 5. Well fueled with champagne, I jumped into a spirited bidding war over one of the

ETF?s are much more attractive than mutual fund competitors, with their notoriously bloated expenses and spendthrift marketing costs. You can?t miss those glitzy, overproduced, big budget ads on TV for a multitude of mutual fund families. You know, the ones with the senior couple holding hands walking down the beach into the sunset, the raging

Global Market Comments March 18, 2013 Fiat Lux Featured Trade: (MARCH 20 GLOBAL STRATEGY WEBINAR), (HAS APPLE BOTTOMED?), (AAPL), (TESTIMONIAL), (SOVEREIGN DEBT WAS A GREAT PLACE TO HIDE), ?(PCY), (LQD) Apple Inc. (AAPL) PowerShares Emerging Mkts Sovereign Debt (PCY) iShares iBoxx $ Invest Grade Corp Bond (LQD)

No one has suffered more than I from my slavish devotion to Apple?s products, its performance, and, oops?. it?s stock. A long position in Steve Jobs? creation remains my only losing position of 2013 (remember the January $525-$575 call spread?). Without the hit I took on that, my Trade Alert Service would be up 33.3%

I am constantly asked where to find safe places to park cash by investors understandably unhappy with the risk/reward currently offered by the markets. Any reach for yield now carries substantial principal risk, the kind we saw, oh say, in the summer of 2007. I have had great luck steering people into the Invesco PowerShares

Global Market Comments March 15, 2013 Fiat Lux Featured Trade: (TAKING PROFITS ON STOCKS), (SPY), (TAKING A BITE OUT OF STEALTH INFLATION), (TESTIMONIAL) SPDR S&P 500 (SPY)

With the (SPY) approaching an all time high, there are just a few pennies to go, I am going to take the money and run on my position in the SPDR S&P 500 (SPY) April, 2013 $145-$150 deep in-the-money bull call spread. At $4.97, there is only 3 cents left in potential profit, and I

When I visited the local Safeway over the weekend, I was snared by some uniformed pre-teens, backed by beaming mothers behind a card table selling Girl Scout cookies. I was a pushover. I walked away with a bag of Thin Mints, Lemon Chalet Creams, Do-Si-Dos, and Tagalongs. I have to confess a lifetime addiction to

Global Market Comments March 14, 2013 Fiat Lux Featured Trade: (2013 STRATEGY LUNCHEON SCHEDULE), (THE ELTON JOHN MARKET), (SPY), (RAMPANT WAGE INFLATION STRIKES CHINA), (FXI), (CYB) SPDR S&P 500 (SPY) iShares FTSE China 25 Index Fund (FXI) WisdomTree Chinese Yuan (CYB)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Luncheons, which I will be conducting throughout the US and Europe over the next five months. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I?ll be giving you my up to date view

I remember 1997 like it was yesterday. Bill Clinton was president, the US government was running a balanced budget, and the Dotcom IPO bubble parties in Silicon Valley were happening almost every day. The Florida Marlins beat the Cleveland Indians in a seven game World Series, where the last game went to a heart stopping

I rely on hundreds of 'moles' around the world whose job it is to watch a single, but important indicator for the world economy. One of them checks for me the want ads in the manufacturing mega city of Shenzhen, China, and what he told me last week was alarming. Wage demands by Chinese workers

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.