Global Market Comments February 4, 2013 Fiat Lux Featured Trade: (GOLDILOCKS DELIVERS A NONFARM PAYROLL), (SPY), (SPX), (DOW), (FEBRUARY 6 GLOBAL STRATEGY WEBINAR), (LOOK AT THAT YEN!), (FXY), (YCS)

Does it get any better than this? First, the hometown San Francisco Giants win the World Series in a four game sweep. Then the San Francisco 49er?s play in the Super Bowl. Finally, I win the World Series/Super Bowl of investing by capturing an absolutely pyrotechnic 21% year to date performance, boosting me once again

All of those years spent living in rabbit hutch sized apartments, getting hand packed by white gloved railway men into rush hour train cars, and learning an impossible language, are finally paying off. I have to tell you, I really have to think hard to recall a plunge in a major currency that has been

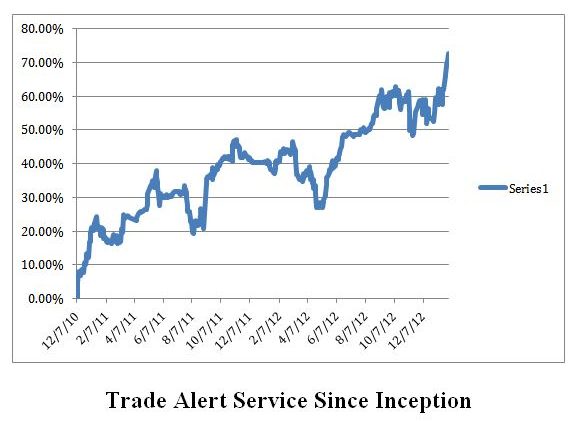

The Trade Alert Service of the Mad Hedge Fund Trader posted a 16.75% profit in January, an all time monthly high. The 26-month total return has punched through to 71.80%, compared to a miserable 10% return for the Dow average. That raises the averaged annualized return to 33.13%, elevating to the top of the hedge

?I have to admit that it was with some trepidation that I joined Supreme Court Justice, Sonia Sotomayor, for lunch this week in San Francisco. I have friends in the New York federal prosecutors office who warned me that she was tough as nails and a complete bitch, first as a prosecutor herself, and later

Global Market Comments January 31, 2013 Fiat Lux Featured Trade: (WHERE?S THE CRASH?) (TAKING FORD OUT FOR A SPIN), (F), (CHENIERE ENERGY GETS THE GREEN LIGHT), (LNG), (UNG), (THE TECHNOLOGY NIGHTMARE COMING TO YOUR CITY)

That was the questions traders were scratching their heads and asking this morning in the wake of this morning?s shocking Q4, 2012 GDP figure. While most analysis were expecting the government to report a more robust 1%-2% number we got negative -0.1%, the worst since 2009. With growth flipping from a positive 3.1% figure in

I have been trying to buy this stock for a month. Not because I like their pedestrian cars (except the new, muscular, retro Mustang), but because it is one of the great turnaround stories in business history. Today?s earnings announcement gives us that window. It delivered over $3 billion in profits during Q4, 2012. But

I have been pounding the table on the attractions of Cheniere Energy (LNG) since last spring. Yesterday, the stock hit a new all time high of $21.50. There is never any guarantee that a government agency will not do something idiotic. Last year it didn?t, thankfully. The Federal Energy Regulatory Commission (FERC) granted the final

I tell people at my strategy luncheons that living in the San Francisco Bay area is like living in the future. There is an explosion of high tech innovation going on here, and we locals often find ourselves the guinea pigs for the latest hot products. However, sometimes the future is not such a great

Global Market Comments January 30, 2013 Fiat Lux SPECIAL HIGH YIELD FOREIGN STOCK ISSUE Featured Trade: (TRADE ALERT SERVICE POSTS FIVE CONSECUTIVE ALL TIME HIGHS). (SPY), (IWM), (FCX), (AIG), (TLT), (FXY), (YCS), (REACH FOR YIELD WITH HIGH DIVIDEND FOREIGN STOCKS), (FTE), (SAN), (BCE), (ECH), (VE), (AWC)

The Trade Alert Service of the Mad Hedge Fund Trader posted a new all time high today, pushing its two-year return up to 72.67%. The Dow average booked a miniscule 13% gain during the same time period. The industry beating record was achieved on the back of a spectacular January, which so far had earned

With the increase of globalization, investing in foreign stocks can be a smart move. Many Americans have low exposure to foreign equities in their portfolio believing that US stocks are safer and more reliable. However, investing in foreign stocks can help to decrease risk, diversify your portfolio, give you access to emerging markets, and deliver

Global Market Comments January 29, 2013 Fiat Lux Featured Trade: (BONDS ARE BREAK DOWN ALL OVER), (TLT), (TBT), (MUB), (LQD), (HCN), (JNK), (AMJ), (REPORT FROM THE INAUGURATION)

It looks like the Great Bond Reallocation of 2013 is real. The Treasury bond market is getting absolutely hammered this morning, the ten-year yield breaching 2.00%. That smashes the 1.40%-1.90% band, which has imprisoned the bond market for the past year. The immediate trigger was the release of absolute blowout December durable goods figures this

I am writing this report from the steps of the Capital Building in Washington DC, scratching my notes on the back of a commemorative program with a golf pencil, absolutely freezing my buns off. I am wearing all the warm clothes I own, including my Marine Corps olive winter weight double knit wool officer?s trousers.

Global Market Comments January 28, 2013 Fiat Lux Featured Trade: (THE RACE TO THE BOTTOM FOR CURRENCIES MEANS A RACE TO THE TOP FOR STOCKS), (SPX), (SPY), (EWG), (DWJ), (FXY), (YCS), (FXE), (RUBBING SHOULDERS WITH ?THE 1%? AT INCLINE VILLAGE)

Even the Old Hands, like myself, are somewhat amazed by the strength of the global equity markets this month. The S&P 500 has risen 11 out of the last 12 trading days, and is up almost every day this month. It has been the best January in 18 years. The first week saw the biggest

If you really want to get a read on how ?the 1%? are faring these days, take a ski vacation to the tony hamlet of Incline Village on the pristine shores of Nevada?s Lake Tahoe. Each morning, I trekked to Starbucks, one of the few local sources for the Wall Street Journal and the New

Global Market Comments January 24, 2013 Fiat Lux Featured Trade: (SPX 1,600, HERE WE COME!), (SPX), (SPY), ($INDU), (TLT), (VIX), (USO) (WHY THE YEN WILL NEVER RECOVER), (FXY), (YCS)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.