Take a look at the chart below for the S&P 500, and it is clear that we are gunning for an all time high between 1,550 and 1,600. With the debt ceiling crisis now cancelled, you really have to look hard to find any near term reasons to sell stocks, so we could hit those

If anyone is expecting the Japanese yen to take back the losses it has suffered over the last two months, you can forget about it happening anytime soon, eventually, or in your lifetime. Naysayers have been pointing to this week?s policy meeting at the Bank of Japan as proof that the yen has stumbled in

Global Market Comments January 23, 2013 Fiat Lux Featured Trade: (TRADE ALERT SERVICE BLASTS TO NEW ALL TIME HIGH), (SPY), (IWM), (FCX), (AIG), (FXY), (YCS), (TLT) (CATCHING UP WITH DOWNTON ABBEY)

The Trade Alert Service of the Mad Hedge Fund Trader posted a new all time high today, pushing its two-year return up to 66%. The Dow average booked a miniscule 12% gain during the same time period. The industry beating record was achieved on the back of a spectacular January, which so far had earned

I decided to flee the madness in London for a day and visit some old friends in the countryside, the 8th Earl and Countess of Carnarvon. The late 7th Earl was an early investor in my first hedge fund and I have kept in touch with the family ever since. His grandfather, the 5th Earl

Global Market Comments January 22, 2013 Fiat Lux Featured Trades: (THE DEBT CEILING CRISIS IS CANCELLED), (SPY), (IWM), (FCX), (AIG), (FXY), (YCS),(AAPL), (VIX) (JANUARY 23 GLOBAL STRATEGY WEBINAR)

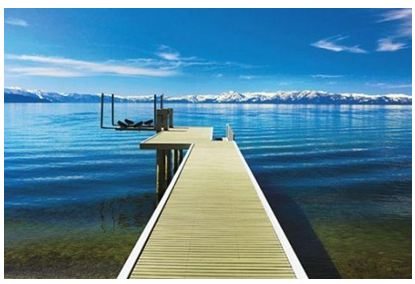

I am sitting here in front of a crackling hot fire at my lakeshore estate in Nevada?s Incline Village. It is a brilliantly clear day, with mallard ducks skimming the surface of Lake Tahoe, and the Canadian geese flying in formation overhead. Snow covered Mount Tallac, some 30 miles to the South, looks so close

Global Market Comments January 18, 2013 Fiat Lux Featured Trades: (ATTENDING MY LAST ELECTRIC NISSAN LEAF RALLY) (SPOILED FOR CHOICE)

It was a typical fall day in San Francisco, the fog wafting in and out through the Golden Gate Bridge. I took the opportunity to attend a company sponsored rally of Nissan Leaf drivers on the Marina Green. These were the fanatics, the diehards, the truly devoted. These were people who were willing to bet

Boy, am I spoiled for choice on what to do this weekend. On the one hand, I have been invited to join the president on the reviewing stand for Monday?s inauguration in Washington DC. On the other, the Maverick?s World Surf competition near California?s Half Moon Bay is on the same day, which has not

Global Market Comments January 17, 2013 Fiat Lux Featured Trades: (APRIL 19 CHICAGO STRATEGY LUNCHEON) (MLP?S ARE ON FIRE), (CVRR), (SXCP), (AMJ), (EEP), (KMP), (TLP) (ALL I WANT TO DO IS RETIRE)

Master Limited Partnerships have been on fire since the beginning of the year. Once the deal on the ?Fiscal Cliff? was done, and these instruments? special tax treatment protected, it was off to the races. These unique and versatile instruments combine the tax benefits of a limited partnership with the liquidity of publicly traded securities.

I have always believed that if you don?t have a sense of humor, then you better get the hell out of this business. Below is a link to a YouTube video entitled ?All I Want to do is Retire? which covers the decline of the brokerage industry over the last 20 years. The video is

Global Market Comments January 16, 2013 Fiat Lux Featured Trades: (VIX), (VXX), (AAPL), (SPY), (IWM), (BA), (TLT), (USO), (FXY), (YCS), (FXE), (YCS), (EUO), (GLD), (SLV)

I?ll give myself a ?B? on this one. Sure, with the Trade Alert Service generating a 14.87% net profit for the year, I was able to bring in double the Dow average, and triple what most hedge funds delivered, including some of the biggest ones. But for once, I did not achieve true greatness. I

From time to time I receive an email from a subscriber telling me that they are unable to get executions on trade alerts that are as good as the ones I get. There are several possible reasons for this: 1) Markets move, sometimes quite dramatically so. 2) Your Trade Alert email was hung up on

I was in a huge hurry last week when I sent out a Trade Alert to buy insurance giant American International Group (AIG), operating from a Chicago hotel suite with a stock market that was flying. Now that I am home, and have single handedly brought Oakland?s crime wave to a juddering halt, I have

I have been relying on David Hale as my de facto global macro economist for decades, and I never miss an opportunity to get his updated views. The challenge is in writing down David?s eye popping, out of consensus ideas fast enough, because he spits them out in such a rapid-fire succession. Since David is

Global Market Comments January 7, 2013 Fiat Lux 2013 Annual Asset Class Review FOR PAID SUBSCRIBERS ONLY Featured Trades: (SPX), (QQQQ), (AAPL), (XLF), (BAC), (EEM),(EWZ), (RSX), (PIN), (FXI), (TUR), (EWY), (EWT), (IDX) (TLT), (TBT), (JNK), (PHB), (HYG), (PCY), (MUB), (HCP) (FXE), (EUO), (FXC), (FXA), (YCS), (FXY), (CYB) (FCX), (VALE), (MOO), (DBA), (MOS), (MON), (AGU), (POT),

I am writing this report from a first class sleeping cabin on Amtrak's California Zephyr. We are now pulling away from Chicago's Union Station, leaving its hurried commuters, buskers, panhandlers, and majestic great halls behind. I am headed for Emeryville, California, just across the bay from San Francisco. That gives me only 56 hours to

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.