There are disturbing rumors circulating that North Korean dictator, Kim Jung-un, either has the Coronavirus or is dead.

With North Korea firing several short-range missions again and three years’ worth of high-level US negotiations having come to absolutely nothing, the prospect of another Korean War is back on the table.

The big question for these traders is how to trade it, or better yet, make money from it.

I was copiloting a Boeing Stratofortress B-52 bomber during the mid-1970s, and our mission was to bomb North Korea. In the back, we carried four thermonuclear weapons.

Since we had bolted steel blast shields to the inside of our cockpit windshield, we were flying entirely on instruments. It was a three-hour flight to our target from Anderson Air Force Base in Guam.

Ten minutes before we reached our destination, we received an order to abort, and we turned the great lumbering birds back to our Pacific island base. After we returned from our seven-hour ordeal, we headed straight for Guam’s spectacular Tarague Beach, which only those with base access could access.

It was 1975, and this was a training mission that took place every Monday to Thursday. On Friday, we carried a load of conventional bombs and dropped them on a gunnery range in Western Australia, to practice air-to-air refueling each way.

We knew the North Koreans were tracking us on radar every step of the way. The message was very clear: Be good, or we’ll fly the extra ten minutes.

Some 45 years, these training missions are still going on.

Except for one thing: next time, there may not be an order to abort. The bombers will fly the last ten minutes. The Second Korean War will be on.

Donald Trump desperately needs a foreign policy win to get us to stop talking about the Corona epidemic. Thousands of Americans are still dying every day. He has to project strength.

Kim Jong-un has to keep his country in a permanent state of war to remain in power, and they don’t retire former leaders to pleasant bucolic golf clubs. In other words, he, too, has to project strength.

Given this calculus, it’s hard not to see a Second Korean War starting sometime in the future.

A carrier battle group from the Seventh fleet is already on station in the Yellow Sea. In ten days, it may be joined by a Nimitz class supercarrier, the USS Carl Vinson battle group, out of San Diego.

The Implications of a Second Korean War for your investment portfolio is potentially vast. But over the long term, they may not be as bad as you think.

Look at the performance of the markets going into America’s last two major wars, and you’ll get some idea of what’s coming.

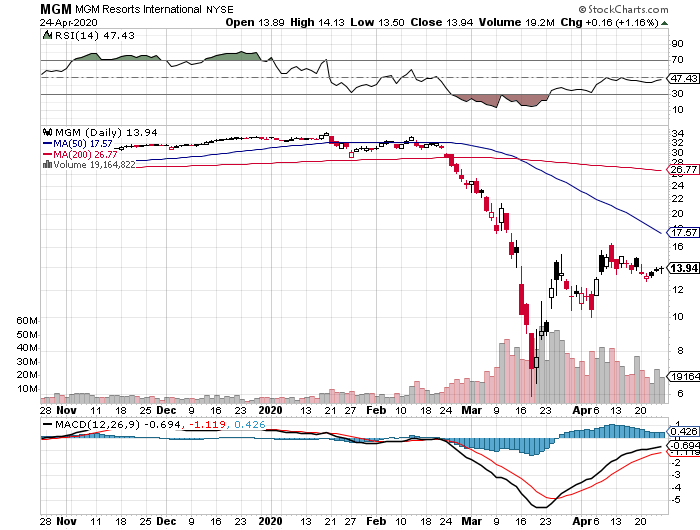

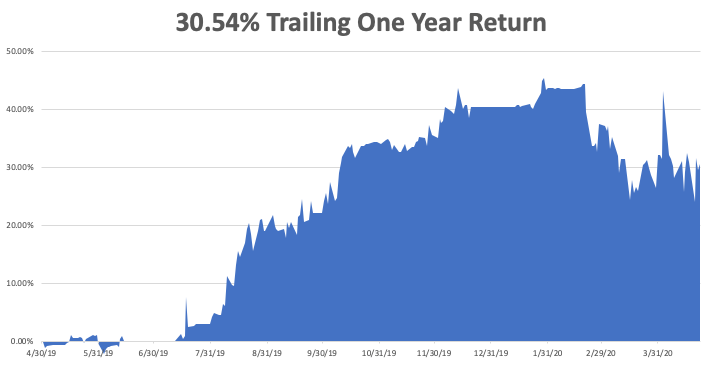

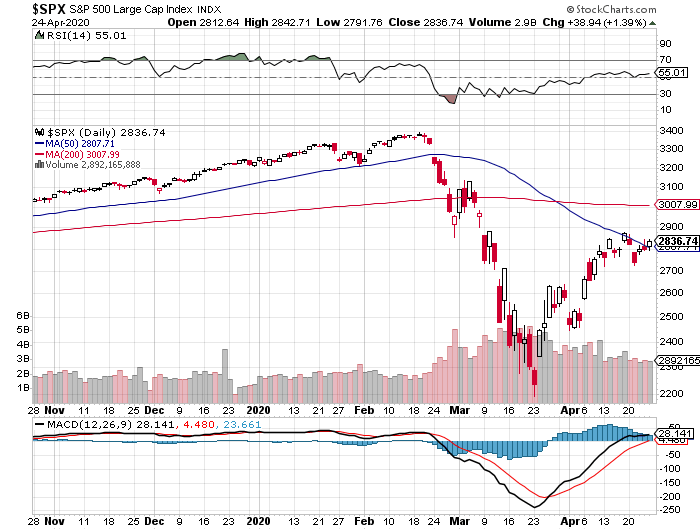

When Saddam Hussein first invaded Kuwait in July of 1990, the initial market reaction was to sell off sharply, with the S&P 500 (SPX) diving some 20% (see charts below).

President George H.W. Bush endlessly threatened the Iraqis to leave, or else, while relentlessly carrying out one of the largest military buildups in Middle Eastern history.

I know because I participated as a Marine Corps pilot.

But then, a funny thing happened. Gradually convinced that the war would take place, the market started to grind up.

When the “Shock and Awe” US attack took place the following February, stocks rocketed some 30%, and never went down.

However, it was a different time. The US was far more dependent on Middle Eastern oil in those days. And for the US economy, it was the eve of the Dotcom Boom.

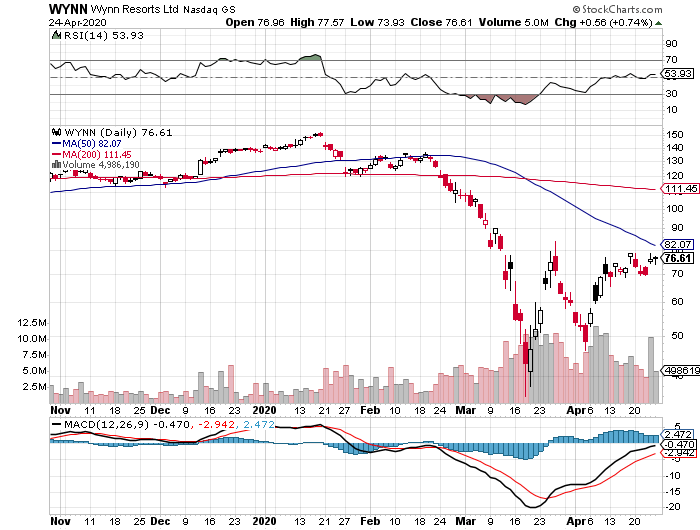

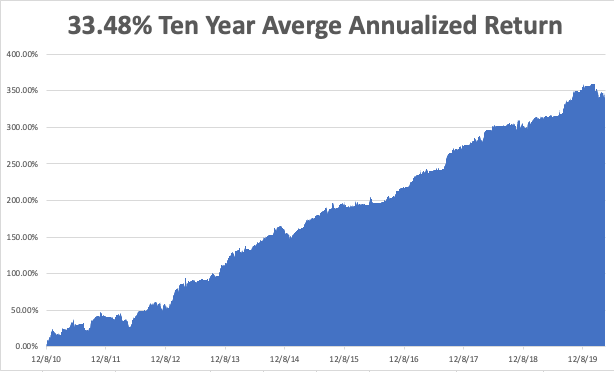

The Second Gulf War was a similar story, as the market was still in the throes of the Dotcom Bust.

We got the ritual 10% selloff during the military buildup. When the war commenced, we saw one of the sharpest rallies in market history, some 20% in a month. Stocks continued to gain until the Great Recession kicked in six years later.

So the pattern seems to be clear. The saber rattle is worse than the war. Hang on to your stocks and you will do well. If you get nervous, just turn off the TV and go play golf.

Over the longer term, a lot will depend on how long the Second Korean War will last.

A quick, decisive victory will be hugely market positive. Get four carrier groups in place and North Korea’s defensive capability will be gone in a day.

First, cruise missiles will take out their radar, then anti-aircraft installations, then their aircraft and communications.

Good luck running a 1.8-million-man army with motorcycle messengers. North Korea lacks a national network of towers to support cell phones.

Here’s the thing that most people don’t realize about the North Korean Army. Not a single individual has combat experience. We, on the other hand, have lots.

Much of the North Korean weaponry is World War II surplus, given to them by the Russian, Chinese, and surrendering Japanese. The imposing missiles you see on TV on parade days are all dummies.

Yes, the North Koreans have 100 nuclear weapons. But they have no functional delivery system. Any attempt to move them will bring their immediate destruction. And we know where they all live.

The 500,000-man South Korean army can provide a blocking action at the demilitarized zone to prevent a land invasion, while we take apart the North’s defenses piecemeal.

There are also 28,500 US troops in South Korea to provide logistics and support for a sustained air war.

In a sense, this is a war for which we have been preparing for 70 years.

Here will be the price.

The North Koreans have 10,000 long-range artillery dug into mountains just north of the demilitarized zone within range of Seoul, a city with a population of 10 million.

I know because I’ve seen them.

I was one of the first western journalists to visit North Korea in 1974. Somewhere in the NBC archives, there is a reel of shaky 8 mm footage to confirm this.

It might take 1-2 weeks of B-52 raids using conventional weapons to degrade this threat. There’s no doubt the North Koreans will cause substantial damage in the meantime.

But it would be worth the cost.

A unified Korea would be a hugely stabilizing development for Asia. Good for the US, not so good for China.

It would also allow the use of the greatly save on its defense budget, now that money needs to be spent elsewhere. Every allocation of American military resources I have seen over the past 50 years had a Korean War contingency to it. Not needing it anymore is worth $50 billion a year.

This is the dream scenario.

The nightmare scenario has the war dragging out for years and Chinese and Russian involvement, as with the first Korean War. It could go on for 18 years, as with our current war in Afghanistan.

The backbreaking cost of the second Iraq War, some $3 trillion, was a contributing factor to the Great Recession when stocks fell 52%.

Winning the war will be the easy part. Peace will be much heavier lift, for it means we immediately inherit 25 million starving people in the North.

How our relations with China fare during all of this is anyone’s guess.

Long term, this is all very market and risk positive. How big the bumps will be along the way is anyone’s guess as well.

The First Gulf War

The Second Gulf War