I have spent all weekend sitting by the phone, waiting for the call from Washington D.C. to re-activate my status as a Marine combat pilot.

Failure of the administration to reach a new NAFTA trade agreement by the Friday deadline makes such a conflict with Canada inevitable.

And while you may laugh at the prospect of an invasion from the North, the last time this happened Washington burned. You can still see the black scorch marks inside the White House today.

This is all a replay for me, when in 1991, I enjoyed an all-expenses paid vacation courtesy of Uncle Sam. That’s when I spent a year shuttling American fighter pilots from RAF Lakenheath to forward bases at Ramstein, Aviano, Cyprus, and Dharan, Saudi Arabia.

It may seem unlikely that our nation’s military would require the services of a decrepit 66-year-old. However, in my last conflict I ran into another draftee who was then 66. It seems that the Air Force then had a lot of F-111 fighter bombers left over from Vietnam that no one knew how to fly.

That’s the great thing about the military. It never throws anything away. Not even me. The life of our remaining B-52 Stratofortress bombers at their final retirement in 2050 will be 100 years.

Perhaps Canada will decide that discretion is the better part of valor, and simply wait for the World Trade Organization to declare the Trump tariffs illegal, which they obviously all are.

That would then force the administration to withdraw from the organization the U.S. created at the end of WWII to regulate fair trade and go rogue. But then what else is new?

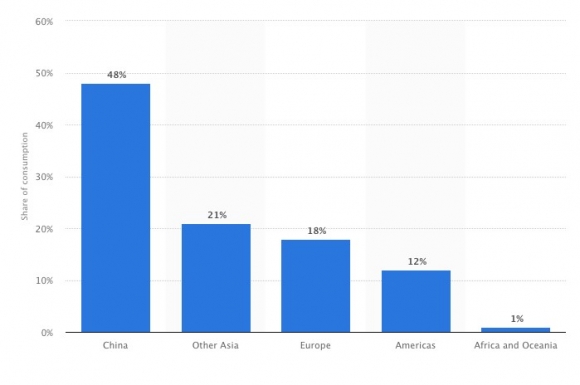

And while there was immense media time devoted to the NAFTA talks, which only oversees trade with partners with around $2 trillion each, China, the 800-pound gorilla, is still lurking out there. It has a $12.2 trillion GDP and Trump is imposing tariffs on another $200 billion of their imports there today.

The corner that Trump has painted himself into is that he has made himself SO unpopular abroad, insulting virtually everyone but Russia, that no leader is willing to risk doing a deal with him lest they get kicked out of office.

I certainly felt this in Europe this summer where the discussion was all about Trump all of the time. When you insult a nation’s leader you insult everyone in that country. I haven’t received that kind of treatment since the Vietnam War was running hot and heavy in 1968.

I’ll tell you, I’d much rather be flying combat missions over enemy territory without a parachute than trading a market like we had last week. For months now, it has been utterly devoid of low risk/high return entry points for all asset classes.

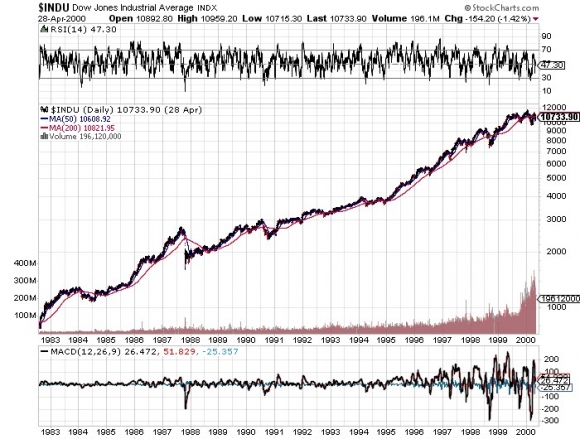

It’s been a slow-motion melt-up virtually every day against the most horrific news backdrop imaginable. Such is the wonder of massive global excess liquidity. It Trumps everything.

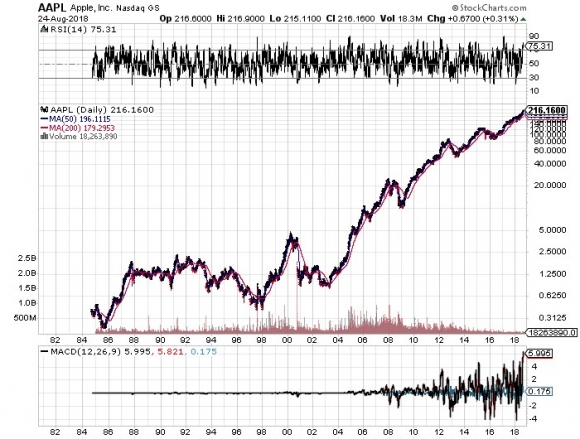

NASDAQ topped 8,000, proving that if you aren’t loaded to the gills with technology stocks, as I have been pleading all year, you are out of your freaking mind. If you don’t own Apple, you are doubly screwed.

I doubt that such data is available, but I bet the illiterate and the uneducated have been beating more literate types in performance by a huge margin.

The unresponsiveness to news isn’t the only thing afflicting this market. As the summer coughs and sputters its way to a close, we enter September, notorious as the most horrific trading month of the year. And we are launching into it with the Mad Hedge Market Timing Index stuck in the 70s, overbought territory, for weeks now.

Blockbuster earnings, the principal impetus for rising share prices in 2018, are now firmly in the rearview mirror, and won’t make a reappearance for another month. Then they die completely in 2019.

Perhaps this is why my long volatility position in the (VXX) is doing moderately well, even though the indexes have been hitting new all-time highs, with the S&P 500 briefing kissing $292. I rather practice my golf swing rather than try to outtrade this market, even though I don’t play golf.

Other than NAFTA, there was little to trade off of last week. Apple (AAPL) shares continue to break new records, hitting an incredible $228, in front of their big iPhone launch this month. Trump announced he was freezing wages on 1 million-plus federal employees next year. That will solve their tax problems for sure.

Coca-Cola (KO) bought British owned Costa for $5 billion, where I regularly breakfast while traveling abroad, in the hopes that perhaps its 501st new drink launch this year will be successful.

Amazon (AMZN) is within sofa change of becoming the next $1 trillion market cap company, making the parents of founder Jeff Bezos the most successful angel investors in history, worth $30 billion.

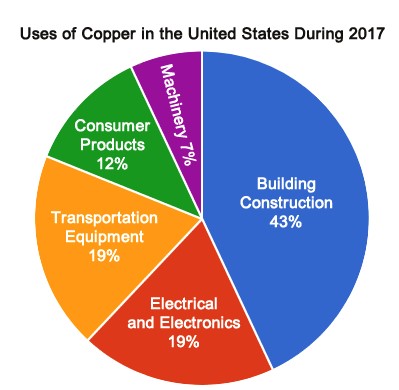

U.S. auto sales are in free fall. Car company shares (GM), (F) continued their slide as they are pummeled on every side by administration economic policies. One has to ask the question of how long the American economy can survive after losing a major leg like this one. Home sales, another vital component, are also suddenly awful.

Trump attacked big tech. The market yawned.

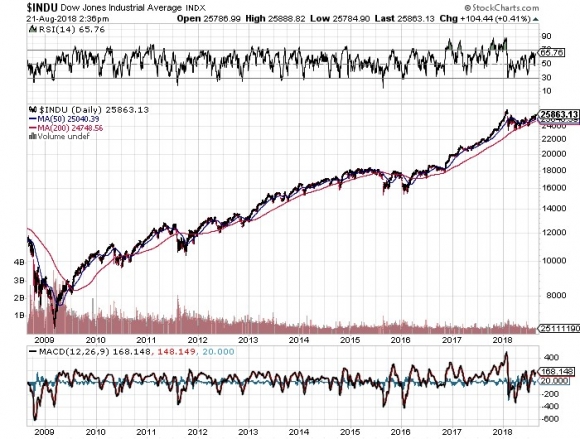

With the Mad Hedge Market Timing Index at 71 and bounces around in the 70s all week, I am not inclined to reach for trades here. All three of my current positions are making money, my longs in Microsoft (MSFT) and volatility (VXX) and my short in the U.S. Treasury bond market (TLT).

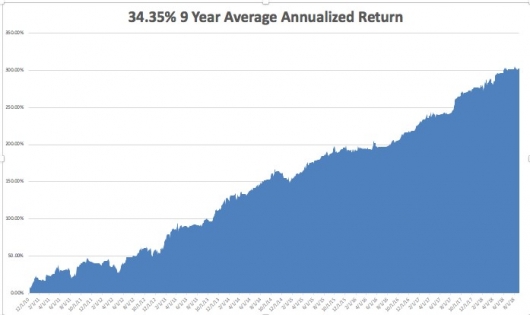

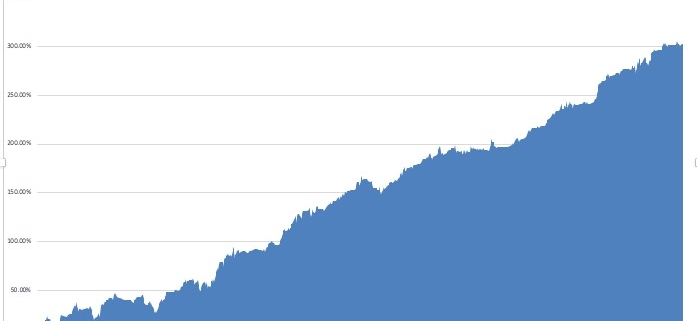

August finally brought in a performance burst in the final days, leaving us with a respectable return of 2.13%. My 2018 year-to-date performance has clawed its way back up to 25.30% and my nine-year return appreciated to 303.48%. The Averaged Annualized Return stands at 34.35%. The more narrowly focused Mad Hedge Technology Fund Trade Alert performance is annualizing now at an impressive 28.59%.

This coming week housing statistics will give the most important insights on the state of the economy.

On Monday, September 3, there was a national holiday, Labor Day.

On Tuesday, September 4, at 9:45 AM the PMI Manufacturers Index is out. August Construction Spending is out at 10:00 AM.

On Wednesday, September 5 at 7:00 AM, we learn MBA Mortgage Applications for the previous week.

Thursday, September 6 leads with the Weekly Jobless Claims at 8:30 AM EST, which saw a rise of 3,000 last week to 213,000. Also announced at 9:45 AM are the August PMI Services Index.

On Friday, September 7 the Baker Hughes Rig Count is announced at 1:00 PM EST.

As for me, the high point of my weekend was the funeral services for Senator John McCain. Boy, the Squids really know how to put on a ceremony. I suspect it may market a turning point for our broken American politics.

In the meantime, King Canute sits in his throne at the seashore ordering the tide not to rise.

Good luck and good trading.