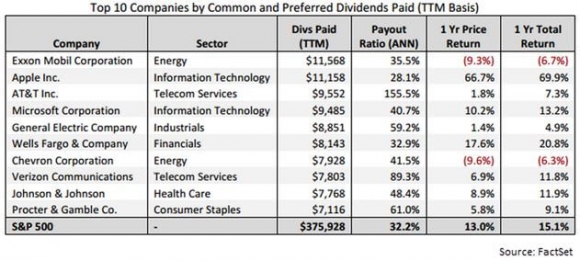

Below, I have listed a portfolio of ten stocks that will almost certainly double in three years. If I am wrong, it will gain 100% in only two years.

But there is a catch. This basket of stocks may have to drop 20%-30% first. It is a cardinal rule of investment that if you want to earn higher returns, you must accept higher volatility as well.

It doesn?t require a rocket scientist to figure out that this is an energy-based portfolio.

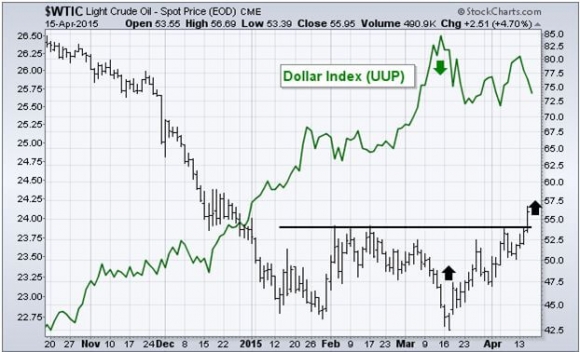

Crude will almost certainly hit its trough in the current quarter, if it hasn?t already. But this python has a couple of pigs that it has to digest first.

As an old oilman, I can tell you that the oil majors have never been able to forecast the price of oil, and that is with all the resources in the world to accomplish this.

This is why they hedge out all their production in the futures market, or with long-term contracts with customers. The oil companies that thought they could predict the price of oil all went out of business a long time ago.

And as a mathematician, I can also tell you that this is an impossible task. There are just too many variables involved. So, don?t even try.

The bottom line is that absolutely no one can pinpoint when and where oil will hit bottom.

Let?s start with the supply side. Thanks to the avalanche of cash that poured into fracking plays at the top of the market last year, US oil production is still rising, some 500,000 barrels a day during the first half of 2015.

This is occurring because once money enters the production pipeline, it stays there forever. Drillers would rather complete a half finished well and sell its output at a loss for a couple of years, rather than shut down construction and lose everything.

However, new projects have fallen precipitously. You see this is the collapse of the number of drilling rigs in use, from a peak of 1,600 last year to only 700 last week.

Then there is the storage issue. Much of this new oil is going straight into storage. As a result, the facilities at Cushing, Oklahoma, will be full in a matter of weeks. Virtually every tanker in the world has already been chartered and is also loaded to the gunnels with Texas tea.

Once all the storage in the world is full to capacity, there is no alternative but to cap wells, or dump new production on the spot market. This could lead to the price Armageddon that so many investors have been worried about.

The peace deal with Iran won?t be a factor. For starters, an agreement is not a sure thing, with religious fundamentalists in both countries attempting to torpedo the deal.

Even if the negotiators are successful, it will take a year for Iran to ramp up its antiquated wells to get more product to market. And by the way, Iran is also thought to be storing oil it couldn?t sell in a fleet of tankers offshore.

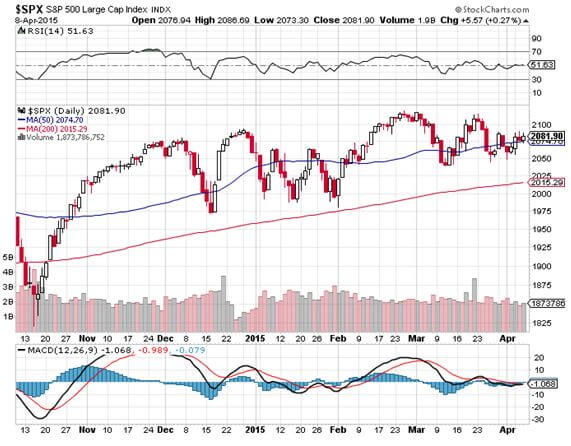

Now, let?s look at the demand side. We only need two letters for this one: QE.

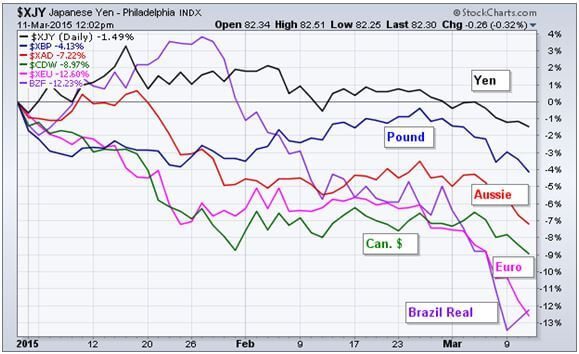

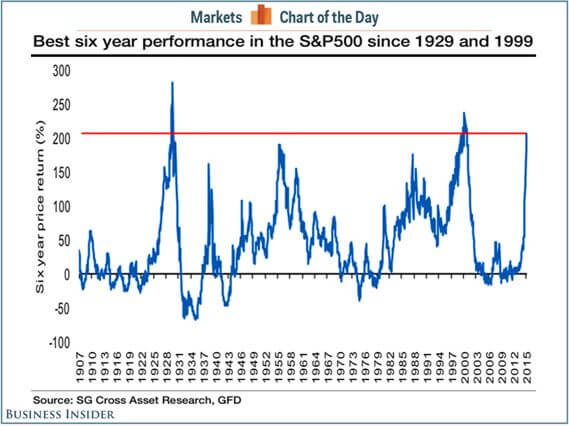

We are a mere 1? months into what is probably a 5-6 year program of quantitative easing in Europe. The Bank of Japan continues to dump massive amounts of cash into its own economy. Even China is easing.

In the meantime, the United States is still basking in the glow of its own just ended hyper aggressive $4 trillion QE strategy. It?s now looking like all of America?s 2015 economic growth will be concentrated in the final three quarters of the year.

This all adds up to a global synchronized economic recovery and much higher oil prices. Personally, I think oil could recover $70 a barrel in 2016, and $100 by 2018.

This is why large, long term institutional investors are happy to look across any potential $30 valley that may occur over the next few months and are loading the boat with energy stocks now.

Maybe you should do the same.