Below please find subscribers’ Q&A for the May 10 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV.

Q: Why is the market down on such great inflation data?

A: Yes, a 4.9% annualized inflation rate is a big improvement from 9.1% nine months ago. The market only cares about the debt ceiling debacle right now. I’ve been teaching people about the stock market for about 55 years, and I can tell you that all investors have one great fear, and it's not the fear of losing money—that they can handle. It’s the fear of looking stupid. And if they load the boat with stock now, and the US government defaults and the market drops 25%, they will look really stupid. This is not a black swan. It has probably been the most advertised market negative in history. We’ve known about the debt default since December when the Democrats chose not to raise the debt ceiling because they thought they could gain a political advantage by letting the Republicans fumble the issue, and they are reaping such advantages by the bucketload. So, even though everyone knows that this will be settled, it has settled 98 consecutive times in the last 106 years, and they don’t want to do anything before a deal. And by the way, this was only put into place during WWI to meter the rate of government borrowing during the war, so I would say it’s lost its purpose. However, it's hard to make any changes at all in the government these days. What that does do, is create big gaps up in the market when they are resolved, and big gaps down when they are not resolved. That’s why we’re doing nothing.

Q: Do you like regional banks here—are they a buy? And do you like the Schwab LEAPS?

A: Yes on the Charles Schwab LEAPS (SCHW), because you have two years for that to work out. With regional banks as a stock buy here, you’re really buying a lottery ticket because if they do get attacked by short sellers, you get wiped out practically overnight (as has happened 4 times.) On the other hand, if the US Treasury or the FCC makes selling bank shares or lending bank shares illegal, then you’ll have the regional banks just roar, because the sellers will be gone. There are too many better things to do than to make a high-risk trade on bank shares, especially after the debt ceiling is resolved.

Q: Is Apple (APPL) trade a long?

A: Yes, on any pullback. I think big tech leads for the next 10 years once we get out of our current quagmire. So it’s a question of how much pain you’re willing to take in the meantime. My target for Apple this year is $200.

Q: iShares 20 Plus Year Treasury Bond ETF (TLT) is up today; would it be worth selling out of the money call spreads with the same expiration date as our long position?

A: No, it is not. At $104, it’s not a great short, or otherwise, I’d do it myself. When we get up to $109, then you want to go short like with the $114 puts or $115 puts. But down here if you’re shorting say, the $109s, and we go to $109 the next day or week, then you get stopped out. Remember any shorts of bonds here is now a long-term counter-trend trade—you’re betting that your position expires in the money before a long-term trend to the upside reasserts itself. So no, that’s why I’m not doing any shorts right here. Also, we’re not low enough to buy it yet. You get down to $101 or $102, I’ll look at buying call spreads, but here in the middle is never a good place to trade.

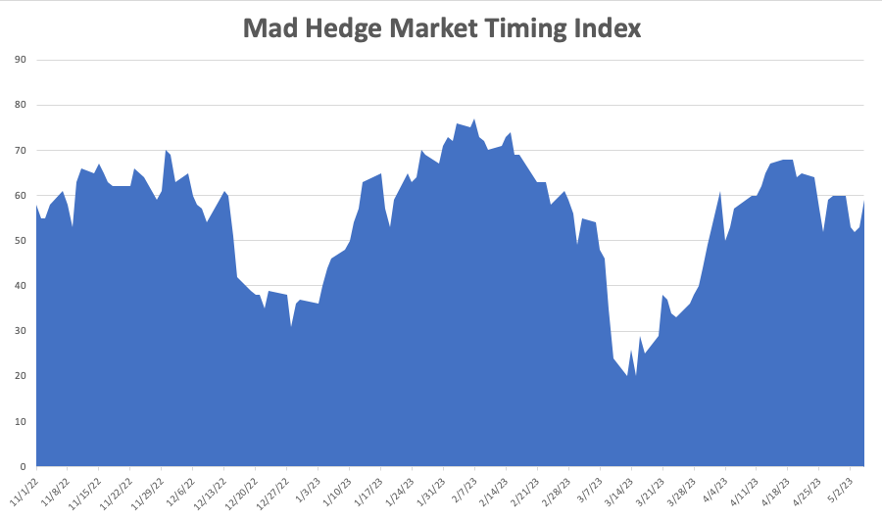

Q: Are you still expecting a correction in May?

A: May isn’t over yet. When they say “Sell in May and go away,” they don’t tell you if it’s May 1st or May 30th, so I’m happy where I am. There’s no law that says you have to get every trade of the year. I think doing nothing is the best solution right now, especially with a 62% profit already in the bank this year.

Q: Is it too late for bank LEAPS?

A: I would say, on a two-year view, no. I’m looking for these shares to double in two years, so a bet that it’s unchanged or higher right now is a pretty good bet, I would say—especially if it gives you a 100% return in one or two years. So yes, all the big bank LEAPS are still good, and with small banks, too much is unknown right now for a highly leveraged bet in that sector.

Q: What do you mean when you say one-year LEAPS is a call spread?

A: When I say one year LEAP, I mean at the money, and then short the next strike higher, and that gives you the maximum leverage. Something like 20:1 leverage when you go that aggressive. But now is the time to be aggressive; that's when these LEAPS are all on sale.

Q: Near-term iShares 20 Plus Year Treasury Bond ETF (TLT) move?

A: Sorry to say, sideways. That's why I'm doing nothing. I’m waiting for the market to tell me what to do. If it goes down, I want to buy it, if it goes up, I want to sell it, if it goes sideways, I want to go on vacation—very simple trading strategy.

Q: What about commercial real estate?

A: I don’t want to touch it, and the Real Estate Investment Trusts (REITs) on those have been horrible. Maybe later in the year when the REITs are at bankruptcy levels, it might be worth a buy. But you have to be careful on your REITs; there are good REITs and there are bad REITs, and you don’t want to be anywhere near the commercial ones. With things like cell phone towers, assisted care living facilities—you know, dedicated LEAPS in safe areas would be a good place. And the yields, by the way, are very high, if they pay.

Q: If the US defaults, what would you buy?

A: Everything, because everything will be at a low for the year; so that’s an easy one. By the way, when we got the banking crisis in March, I adopted an everything strategy then: buy all big banks and brokers—and it turned out to be the best trade of the year. The same is going to happen with the debt default.

Q: How long will it take for the regional bank construction to play out?

A: I think the regional banks have completely separated themselves out from the big banks. You only want to own the big banks because you get big returns on those, and the risk/reward ratio is overwhelmingly in favor of big banks, unlike with small banks. Therefore, you only buy the big banks in that situation. If you feel like buying a lottery ticket on your local bank because it’s down 80%, go ahead and do so, but remember that's what it is—a lottery ticket, with a big payoff if you win.

Q: Bitcoin has recently been weak off its top. Do you expect another leg up in Bitcoin prices?

A: I do not. Bitcoin was the perfect asset to have when we had a huge oversupply of cash and a shortage of assets. Now, is the opposite: we have an oversupply of assets and a shortage of cash, and that may remain true for another 10 years or so. So, if you have Bitcoin, I’d be unloading any positions you have now and falling down on your knees, thanking goodness you were able to recover this much of your loss. The other problem is you now have a lot of the intermediaries going bankrupt or shut down by the SEC or the US Treasury. So, that is an additional risk, which you don’t have buying JP Morgan (JPM), for example, or the Australian dollar (FXA), or oil (USO), or copper (FCX). It’s just so far out there on the risk/reward basis. Only large institutions and miners are in the market now—most individuals have been scared away for life.

Q: Would you buy PayPal (PYPL) on the dip? The earnings were terrible.

A: Yes, I would. It is now discounting a recession. If you don't get a recession, you get a big recovery in PayPal.

Q: Do you think that a Ukraine-Russia war will end soon?

A: I would doubt that the Russia-Ukraine war lasts more than a year, and when it ends, it will create the biggest global economic stimulus since the Marshall Plan. Also, American companies will be at the front of the line on the reconstruction deals because we supplied a lot of the weapons and intelligence. Looking at the Marshall Plan in modern terms: $17 billion in 1947 money would be on the order of a $1 trillion today—you basically have to rebuild an entire country. And guess who’s good at building countries? We are. We have all the big engineering companies to do it. Buy Caterpillar (CAT) for sure. By the way, I’ll be spending my summer vacation working on the Ukraine War for the US Marine Corps and NATO. At least the Belgians have better food.

Q: What do you think about pharmaceuticals like Eli Lilly (LLY)?

A: We’ve been recommending them in the Mad Hedge Biotech & Health Care letter for literally years. They’re absolutely kicking butt with their weight loss drug Mounjaro—to the extent that there are shortages of supplies, a black market, and big price increases coming, so it’s all about the weight loss boom. I hate to think of what the combined overweightness of America is, but it’s got to be somewhere in the millions of tons (and I am one of the guilty parties myself.)

Q: There's talk that EVs put out a lot of sulfur that increases climate change issues. What do you think?

A: Absolutely not true, as there is no sulfur in an EV. I don't know where they would come out of an electric engine running on a lithium battery. It’s just another bit of fake news coming out of the oil industry, which is pretty much around us all day, every day. You just have to get used to that. Conventional international combustion engines do emit a lot of sulfur in the form of sulfur dioxide and the big three have been sued over this for at least 50 years.

Q: When will the debt ceiling negotiations end?

A: There are two indicators you look for in predicting the end of a debt ceiling crisis (the last one of which was 12 years ago): #1. When the government announces it can’t send out social security checks anymore because they have no more money, and #2. A big drop in the stock market that scares all the billionaires, cuts their wealth, and makes them threaten to withdraw funding from the politicians who are blocking this thing. Another big indicator is when the Department of Defense announces they have no more money to pay military salaries. Almost all military presence in the United States is in red states and is a major support for economies. And the reason is that's where land was cheapest during WWI, which was when we did a very rapid buildup in the number of military bases. So, watch for those indicators and look for a massive rally when this happens. The US government is basically a giant recycling machine. It takes money off the coast, where all the wealth and taxes are paid, and spends it inland, where all the infrastructure and military have to be paid for. The only military spending on the coasts is in Hawaii, cyber warfare in California, and shipbuilding on the east coast. Anything that interferes with the process of moving money off the coasts and inland is doomed to fail for sure. That’s my one-minute analysis on the cash flows inside the US economy.

Q: I read that the clarity of Lake Tahoe is the best ever. Is this true?

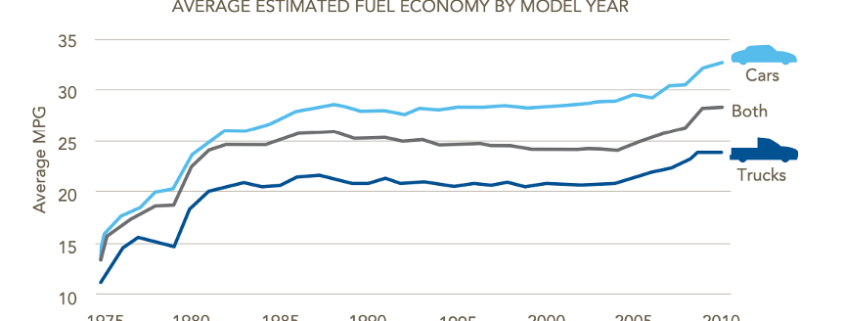

A: Yes, it is. It is an example of a major effort to save the environment that succeeded, but you had to live 70 years to see it. The biggest factor was improving gas mileage for cars. The average fuel economy for new model cars has increased from 12 miles per gallon in 1950 to 35 today. Notice that cars have gotten a lot smaller too. That cuts by two-thirds the carbon dioxide going into the atmosphere which can combine with nitrogen to make nitric acid which fell into the lake. Several big development projects were stopped in their tracks. So was a planned freeway around the lake. Some 17 golf courses are now banned from using fertilizer. Sewage is now piped out of the valley instead of into the lake. A record 70 inches of rainfall this year helped dilute the water. Finally, an ill-conceived freshwater shrimp farming industry ended when the shrimp all starved to death when the lake became too clear, eliminating their poop from the picture. There is now a campaign to clean garbage off the bottom which I help fund. We even found “Fredo’s” body from The Godfather! As a result, the lake clarity has improved from 50 feet in 1970 to 115 feet, the same as when Mark Twain first visited Lake Tahoe in 1861.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Want to Know What Happens Next?