Mad Hedge Technology Letter

January 8, 2020

Fiat Lux

Featured Trade:

(THE TOP IS NOT IN FOR TECH STOCKS))

(AAPL), (FB), (GOOGL)

Mad Hedge Technology Letter

January 8, 2020

Fiat Lux

Featured Trade:

(THE TOP IS NOT IN FOR TECH STOCKS))

(AAPL), (FB), (GOOGL)

Tech shares are pricey, but that doesn’t mean they can’t get more expensive.

Strength often begets strength.

Let’s take for instance Apple (AAPL) – it delivered investors 86% in 2019 and that was their best performance in the past 10 years.

This was on the heels of a tumultuous 2018 where Apple sank 6%.

Many of the best of brightest of the tech industry beat the S&P last year, which itself gained 29%.

And as Apple leapfrogged into the software as a service business, they find themselves shunning China hardware revenue that got themselves into the 2018 mess.

Apple is betting that the confines of stateside consumer culture will offer greener pastures.

Overall, the market is pricing in a lukewarm 2020 for tech earnings boding well for the elite tech stocks that celebrated touchdown after touchdown in 2019.

Surpassing low expectations could be another rewind back to Q4 2019 which was a time that offered tech shares a platform to surge to all-time highs.

The worrying development for 2020 is that poorer-rated tech corporations won’t have the same access to cheap debt as they did in 2018 or even 2019.

The chapter of loose credit is about to close stymying loss-making tech companies who thought they could use subsidies to achieve success.

The prices of CCC-rated European bonds have declined immensely in the past year showing investors' lack of appetite for the riskier part of the corporate debt market.

Venture capitalists aren’t going to foot the bill for the next big thing in Silicon Valley at this point in the economic cycle unless the unit economics are too good to be true.

The story of 2020 will be the intensification between the haves and have nots in tech.

This is the case of the market putting a premium on time-honored tech brands and bulletproof balance sheets that they have cultivated.

On a broader level, the Fed who has presided over a $600 billion expansion in their balance sheet in the last four months offers yet another tailwind to tech shares in the short-term.

The Fed’s decision in the last few months to re-start large-scale asset purchases will help keep a foot under tech shares in early 2020 and responds like a de facto QE.

If you thought 2019 was a bad year for Uber and Lyft, then wait until this year plays itself out.

The gig economy stocks are in the direct firing line with nowhere to run and other non-sensical profit models will find it costly to search for debt alternatives in which to service their visions.

If the tech sector does become a war of attrition between the FANGs staving off one another by acquiring inorganic growth, then marginal tech players will get squeezed because they don’t have the capital bazookas to compete with the likes of Facebook (FB) and Google (GOOGL).

This is the year that we could see a slew of fringe tech companies go bust as debt markets sour on false narratives of future profits and equity markets turn against them.

The feast versus famine theme is also aligned with 5G, with many of the same cast of characters such as Apple, Alphabet posed to usurp revenue when this new technology finally becomes pervasive in consumer culture.

The Apple refresh cycle will dust off its playbook for another blockbuster rollout later this year when Apple debuts its much-awaited 5G phone.

Much of the share appreciate in Apple of late can be attributed to the anticipation of the new iPhone and the fresh infusion of revenue that branches off from it.

The applications that result from the new 5G Apple phone is seen as a luscious force multiplier to many 3rd party companies as well.

Chip stocks will be counted on as the ones lifting the tech foundations and just looking at shares in China, demonstrations of frothiness are running wild throughout their markets.

The Chinese government, to counteract the trade war, has been on a mission to flood its tech sector with unlimited capital as a catchup mechanism to overcome its inferior domestic chip industry.

Will Semiconductor, a supplier of integrated circuit products for telecommunications and electronics for cars, delivered a 390% performance in 2019 ranking it as the best performer in the Chinese stock market.

Luxshare Precision Industry and GoerTek, suppliers of consumer electronics products supplying Apple, and GigaDevice Semiconductor, producing flash chips, weren’t too shabby either each eclipsing at least 193% last year.

Even though 5G construction isn’t fully operational, I can attest that revenue creation for the companies involved are in full swing.

Investors must narrow their pickings to the biggest and financially resilient; this is not the time to expose oneself to the ugly trepidations of the mood-sensitive tech market.

For investors who can balance the delicate relationship of risk and surgical maneuvering, this year will end positive.

Mad Hedge Technology Letter

December 30, 2019

Fiat Lux

Featured Trade:

(TECH TALENT PUTS THEIR FOOT DOWN ),

(EA), (ADBE), (TSLA), (GOOGL), (TWTR)

Global Market Comments

December 30, 2019

Fiat Lux

Featured Trade:

(WILL SYNBIO SAVE OR DESTROY THE WORLD?),

(XLV), (XPH), (XBI), (IMB), (GOOG), (AAPL), (CSCO), (BIIB)

Mad Hedge Technology Letter

December 27, 2018

Fiat Lux

Featured Trade:

(WHY YOU CANNOT NEGLECT THE CLOUD)

(AMZN), (MSFT), (GOOGL), (AAPL), (CRM), (ZS)

Global Market Comments

December 27, 2019

Fiat Lux

SPECIAL ISSUE ABOUT THE FAR FUTURE

Featured Trade:

(PEAKING INTO THE FUTURE WITH RAY KURZWEIL),

(GOOG), (INTC), (AAPL), (TXN),

Mad Hedge Technology Letter

December 20, 2019

Fiat Lux

Featured Trade:

(THE BIG TECH TRENDS OF 2020)

(AAPL), (GOOGL), (FB), (AMZN), (NFLX)

The year is almost in the rear-view mirror – I’ll make a few meaningful predictions for technology in 2020.

Although iPhones won’t go obsolete in 2020, next year is shaping up as another force multiplier in the world of technology.

Or is it?

A trope that I would like to tap on is the severe shortage of innovation going on in most corners of Silicon Valley.

Many of the incumbents are busy milking the current status quo for what it’s worth instead of targeting the next big development.

Your home screen will still look the same and you will still use the 25 most popular apps

This almost definitely means the interface that we access as a point of contact will most likely be unchanged from 2019.

It will be almost impossible for outside apps to break into the top 25 app rankings and this is why the notorious “first-mover advantage” has legs.

The likes of Google search, Gmail, Instagram, Uber, Amazon, Netflix and the original list of tech disruptors will become even more entrenched, barring the single inclusion of Chinese short-form video app TikTok.

The FANGs are just too good at acquiring, cloning or bludgeoning upstart competitors.

It’s the worst time to be a consumer software company that hasn’t made it yet.

Advertising will find itself migrating to smart speakers

Amazon and Google have blazed a trail in the smart speaker market but ultimately, what’s the point of these devices in homes?

Exaggerated discounting means hardware profits have been sacrificed, and the lack of paid services means that they aren’t pocketing a juicy 30% cut of revenue either.

These companies might come to the conclusion that the only way to move the needle on smart speaker revenue is to infuse a major dose of audio ads to the user.

So if you are sick to your stomach of digital ads like I am, you might consider dumping your smart speaker before you are forced to sit through boring ads.

Amazon’s Alexa will lose momentum

In a way to triple down on Alexa, Amazon has installed it into everything, and this is alienating a broad swath of customers.

Not everyone is on the Amazon Alexa bandwagon, and some would like Amazon’s best in class products and services without involving a voice assistant.

Privacy suspicion has gone through the roof and smart speakers like Alexa could get caught up in the personal data malaise dampening demand to buy one.

Your voice is yours and 2020 could be the first stage of a full onslaught of cyber-attacks on audio data.

Don’t let hackers steal your oral secrets!

Cyber Warfare and AI

Hackers have long been experimenting with automatic tools for breaking into and exploiting corporate and government networks, and AI is about to supercharge this trend.

If you don’t know about deep fakes, then that is another thorny issue that could turn into an existential threat to the internet.

Not only could 2020 be the year of the cloud, but it could turn into the year of cloud security.

That is how bad things could get.

A survey conducted by Cyber Security Hub showed 85% of executives view the weaponization of AI as the largest cybersecurity threat.

On the other side of the coin, these same companies will need to use AI to defend themselves as fears of data breaches grow.

AI tools can be used to detect fraud such as business email compromise, in which companies are sent multiple invoices for the same work or workers duped into releasing financial information.

As AI defenses protect themselves, the sophistication of AI attacks grows.

It really is an arms race at this point with governments and private business having skin in the game.

Facebook gets out of the hardware game because consumers don’t trust them

Remember Facebook Portal – it’s a copy of the Amazon Echo Show.

The only motive to build this was to bring it to market and expect Facebook users to adopt it which backfired.

Facebook will find it difficult convincing users to use more than Facebook and Instagram software apps.

Don’t wait on Facebook to roll out some other ridiculous contraption aimed at stealing more of your data because there probably won’t be another one.

This again goes back to the lack of innovation permeating around Silicon Valley, Facebook’s only new ideas is to copy other products or try to financially destroy them.

China continues to out-innovate Silicon Valley.

The rise of short-form video app TikTok is cementing a perception of China as the home of modern tech innovation, partly because Silicon Valley has become stale and stagnated.

China has also bolted ahead in 5G technology, fintech payment technology, unmanned aerial vehicle (UAV) and is giving America a run for their money in AI.

China’s semiconductor industry is rapidly catching up to the US after billions of government subsidies pouring into the sector.

Silicon Valley needs to decide whether they want to live in a tech world dominated by Chinese rules or not.

Augmented Reality: Is this finally the real deal?

Augmented reality (AR) is still mainly used for games but could develop some meaningful applications in 2020.

Virtual Reality (VR) and AR will play a big role in sectors such as education, navigation systems, advertising and communication, but the hype hasn’t caught up with reality.

One use case is training programs that companies use to prepare new workers.

However, AR applications aren't universally easy or cheap to deploy and lack sophistication.

AR adoption will see a slight uptick, but I doubt it will captivate the public in 2020 and it will most likely be another year on the backburner.

Apple’s New Projects

Apple has two audacious experimental projects: a pair of augmented-reality glasses and a self-driving car.

The car, for now, has no existence outside of a few offices in California and some hires from companies like Tesla.

And, at the earliest, the glasses won’t hit shelves until 2021,

The car is likely to fizzle out and Apple will be forced to double down on digital content and services to keep shareholders happy which is typical Tim Cook.

The 5G Puzzle

Semiconductor stocks have been on fire as investors front-run the revenue windfall of 5G and the applications that will result in profits.

Select American cities will onboard 5G throughout 2020, but we won’t see widespread adoption until later in the year.

5G promises speeds that are five times faster than peak-performance 4G capabilities, allowing users to download movies in five seconds.

With pitiful penetration rates at the start, the technology will need to grow into what it could become.

The force multiplier that is 5G and the high speeds it will grace us with probably won’t materialize in full effect until 2021.

Each of the nine tech developments in 2020 I listed above negatively affects US tech margins and that will follow through to management’s commentary in next year’s earnings and guidance.

Tech shares are closer to the peak and the bull market in tech is closer to the end.

Innovation has ground to a halt or is at best incremental; companies need to stop cloning each other to death to grab the extra penny in front of the steamroller.

Profit margins will be crushed because of heightened regulation, transparency issues, monitoring costs, and the unfortunate weaponizing of tech has been a brutal social cost to society.

Tech is saturated and waiting for a fresh catalyst to take it to the next level, but that being said, tech earnings will still be in better shape than most other industries and have revenue growth that many companies would cherish.

Mad Hedge Technology Letter

December 18, 2019

Fiat Lux

Featured Trade:

(CYBER SECURITY IS STILL A BUY)

(SYMC), (PANW), (CSCO), (FTNT), (AAPL), (MSFT)

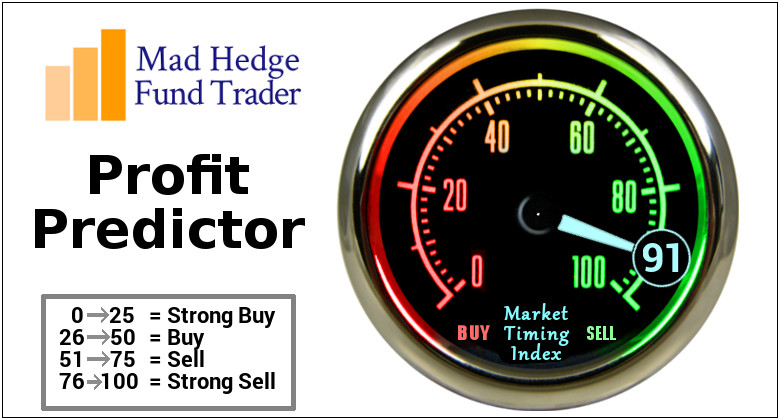

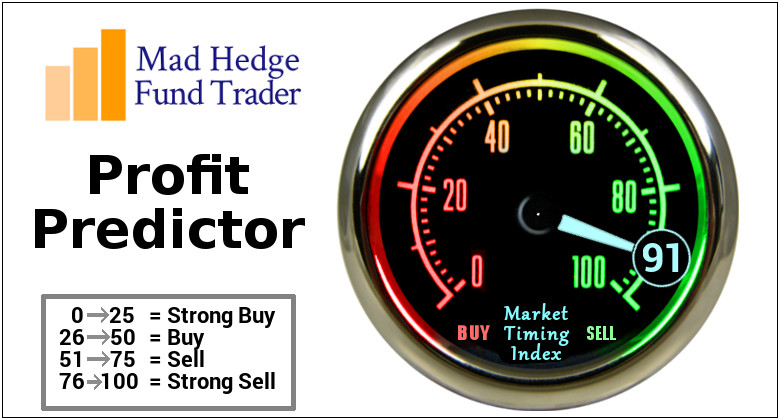

What does the technology sector’s “last gasp up” mean for tech stocks?

At the Mad Hedge Lake Tahoe Conference in late October, I correctly identified that the tech sector would experience a last leg to the price appreciation that has been part of a broader 10-year bull market in American equities.

The past 7 weeks have been nothing short of spectacular for tech shares as not only have the heavy hitters delivered in spades, like Apple (AAPL) and Microsoft (MSFT), but tech growth shares have been released from the penalty box after a short-dated growth scare and joined the rally with zeal.

How long will the “last gasp up” last?

The bar was set exceptionally low in 2019 because senior management spun the trade war acrimony into the accounting calculus effectively offering CFOs a chance to lower expectations to the point of getting away with murder.

Even with earnings’ expectations reset at nadir data points, performance was a mixed bag.

Superior tech companies were able to jump over the pitiful expectations, then if that wasn’t enough, they pushed backwards any inklings of earnings growth by guiding as low as they possibly could.

An archetypal example is Palo Alto Networks (PANW) whose shares dipped more than 8.5% in pre-market trading after issuing their quarterly earnings report.

The company announced sales of $771.9 million with an adjusted EPS of $1.05 topping analysts' estimates.

Why did shares sully?

Palo Alto Networks tanked guidance by telling investors they expect sales between $838 million and $848 million in the second quarter.

The expectation represented a midpoint sales forecast of $843 million, which is lower than the consensus estimates of $845.12 million.

The adjusted EPS in the second quarter is estimated to be $1.11–$1.13, below the consensus earnings forecast of $1.30.

Palo Alto Networks is forecasting sales between $3.44 billion and $3.46 billion with an EPS between $4.9 and $5.0 for next year, compared to analyst projections of $3.46 billion in revenue and an EPS of $5.07 in 2020.

PANW accounts for a big piece of the pie in the cybersecurity trade comprising 16.2% in 2019.

Overall industry growth is strong at 10.4%, and PANW managed to increase its sales by 22.3% to $633.7 million.

This cybersecurity company is one of my favorite tech stalwarts and is as rock-solid as they come for a second-tier tech growth company.

Another trend that dovetails closely with the last gasp up thesis is buying growth.

At this stage in the tech cycle, the low hanging fruit has been plucked and tech companies are increasingly finding it hard to generate organic growth.

Companies are now resorting to inorganic growth with Palo Alto Networks announcing that it will acquire Aporeto for $150 million in an all-cash transaction.

This isn’t just a one-off for PANW, they have acquired four other companies in 2019 to plug into their growth puzzle.

They have also completed the acquisition of an IoT cybersecurity firm Zingbox.

Palo Alto Networks acquired two cloud security startups in July as well - Demisto to gain traction in the AI security segment and Twistlock, the leader in container security.

The other top players in this field are Cisco (CSCO), Fortinet (FTNT) and Symantec (SYMC).

The bullish secular trend in cybersecurity is watertight and comments from Nikesh Arora, CEO of Palo Alto Networks, only reconfirmed the strength in cybersecurity when he said, “As a growing number of organizations move their business to the cloud, developers increasingly rely on cloud-native technologies such as containers and serverless infrastructure to accelerate the development, testing, and deployment of modern applications and services.”

What’s next for investors?

Barring any exogenous shocks, the last gasp up continues and recent macro policy developments have supported this hypothesis as well as the tailwinds of an improving economy.

Palo Alto Networks is part of a high growth segment and many corporates are on record contemplating lower enterprise tech spending heading into 2020.

This sets up another incredibly low bar for cybersecurity companies to hop over next year and I believe the best in show such as PANW, Fortinet, Cisco, and Symantec will pass with flying colors.

The interesting acid test will occur at the end of 2020 when tech firms and sub-segments of tech such, as cybersecurity, release commentary on whether 2021 guidance could signal ensuing risk of being dragged into recessionary turbulence.

A 2021 tech sector recession is certainly not priced into current tech share valuations in this frothy period of asset appreciation.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.