Below please find subscribers’ Q&A for the Mad Hedge Fund Trader October 30 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Would you buy Square (SQ) around here?

A: I don’t want to buy anything around here—that’s why I’m 90% cash. Would I buy Square on a market selloff? Absolutely, it's one of our favorite fintech stocks for the long term. The fintech stocks are eating the lunch of the legacy banks at an accelerating rate.

Q: What's the best yield play currently, now that bonds have gone so high?

A: High-quality REITs—especially cell tower REITs. We’re going to get a significant increase in the number of cell towers, thanks to 5G, and there are REITs specifically dedicated to cell phone towers. An example is Crown Castle (CCI), which has a generous 3.45% dividend yield. The worst REITs are the mall-based like Simon Property Group (SPG).

Q: PG&E (PGE) has just had a huge selloff of 50%. Should I buy it now or is it a potential zero?

A: I wouldn’t touch PG&E at all—They’re already in bankruptcy, and they are now accepting responsibility for starting another eight fires this week, including the big Kincaid fires. You could have the state government take over the company and wipe out all the shareholders— the liabilities are just growing by the second, so I would turn my attention elsewhere. Don’t reach for new ways to get in trouble.

Q: Regarding Boeing (BA), it looks like you caught the bottom on the last dip—should I buy it here or wait for another dip?

A: Wait for another dip. The company seems to have an endless supply of bad news. That said, if we visit $325 a share one more time, I would buy it again. We caught about a $10 dollar move in Boeing to the upside. Keep buying the dips. The bad news story on this is almost over.

Q: Do you think the earnings season will be better than expected? If so, which sectors do you think will outperform?

A: It’s always better than expected because they always downgrade right before earnings, so everything is a surprise to the upside. Some 80% of all stocks surprise to the upside every quarter. And what would I be buying on dips? Big Tech. Especially things like Apple (AAPL), Facebook (FB), Alphabet (GOOGL), and Microsoft (MSFT) —that is where the only reliable longer-term growth is in the economy. If you want to buy cheap companies on dips, go for Biotech (IBB) and Health Care (XLV), which have gone up almost every day since we launched the Biotech letter a month ago. To subscribe to the Mad Hedge Biotech and Healthcare Letter, please click here.

Q: What does it mean that the Chile APEC summit is cancelled? What is Trump going to do now for signing on the trade deal?

A: There may not be a trade deal. It's another postponement and could be another trigger for a long-overdue selloff in the market. We've basically been going up nonstop now for 2½ months, and almost everyone's market timing indicators are saying extreme overbought territory here, including ours.

Q: Will there be a replay of this webinar posted?

A: Yes, we always post these on the website a couple of hours after it airs. Some 95% of our viewers watch the recordings, especially those overseas in weird time zones like Australia and India. You need to be logged in to access it. Just go to www.madhedgefundtrader.com, log in, go to My Account, then Global Trading Dispatch, then click on the Webinars button. It’s there in all its glory.

Q: Does Invesco DB US Dollar Index Bullish Fund ETF (UUP) make sense (the dollar basket)?

A: No, I'm staying out of the currency market because there are no clear trends right now and there are much clearer trends in other asset classes, like stock and bonds.

Q: How do you see General Electric (GE)?

A: There are a lot of people shouting accounting fraud like Harry Markopolos, the whistleblower on Bernie Madoff. Sure, they had a good today, up a buck, but their problems are going to take a long time to fix. So, don't think of this as a trading vehicle, but rather a long-term investment vehicle.

Q: Could the Saudi Aramco IPO push the price of oil up?

A: You can bet they're going to do everything humanly possible to get the price of oil (USO) up and to get this IPO off their hands—that's why you shouldn't buy the IPO. The Saudis are desperate to get out of the oil business before prices go to zero and are pouring money into alternative energy and technology through Masayoshi Son’s Vision Fund. When you have the chief supplier of oil rigging the price, you don’t want to be anywhere near the distributor and that’s Saudi Aramco.

Q: What about selling the (SPG) (Simon Property) REIT?

A: It’s kind of too late to sell, but what you might think of doing is selling short just one deep out-of-the-money put, just to bring in a small amount of income. These things don’t crash, they grind down; so, it could be a good naked put shorting situation, but only on a very small scale. If you want to play REITs on the long side, look at the Vanguard Real Estate ETF (VNQ), which pays a handy 3.12% dividend. Guess what its largest holdings are? 5G cell tower REITs.

Q: Is General Motors (GM) a buy on the union detent?

A: Only for a trade, but not much; the auto industry is the last thing you want to buy into going into a recession, even just a growth recession.

Q: Have we topped out on Apple (AAPL) for the year at $250?

A: If we did, it’s probably just short term. Remember their 5G phone is coming out next September and I expect the stock to go to $300 dollars just off of that. Any dips in Apple won’t last more than a month or two.

Q: Could we get another leg up for the end of the year?

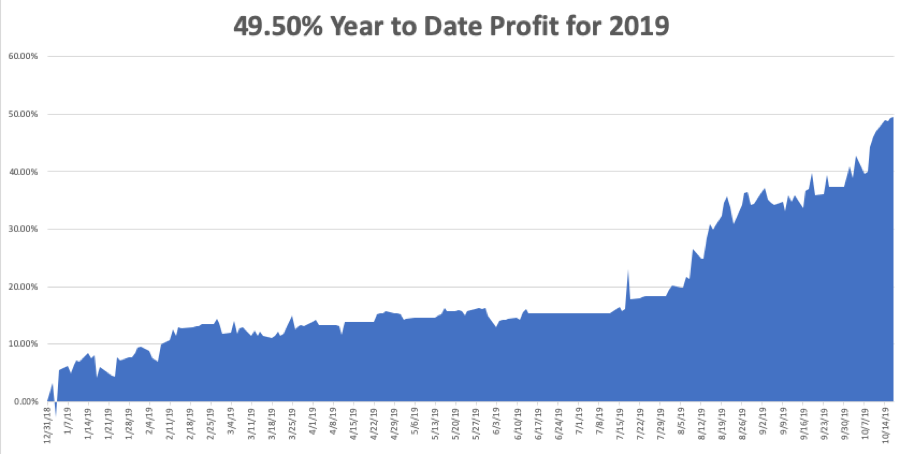

A: Yes, not much, maybe another 5% from here, and I wouldn't do that until we get another 5% drop in the market first which should happen sometime in November. If that happens, then you’ll have a shot at making another 10% by the end of the year, which is exactly what I plan on doing for myself. That would take our 2019 performance from 50% to 60%.

Q: Is the Fed’s printing infinite money going to lead to runaway inflation crashing the value of the dollar?

A: Yes, but it may take us a couple of years to get to that point. So far, no sign of inflation, except inflation of things you want to buy, like healthcare, a college education, and so on. For anything you want to sell, like your labor or service, the prices are collapsing. That’s the new inflation, the type that screws you the most.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader