Global Market Comments

April 23, 2019

Fiat Lux

Featured Trade:

(LAS VEGAS MAY 9 GLOBAL STRAGEGY LUNCHEON)

(APRIL 17 BIWEEKLY STRATEGY WEBINAR Q&A),

(FXI), (RWM), (IWM), (VXXB), (VIX), (QCOM), (AAPL), (GM), (TSLA), (FCX), (COPX), (GLD), (NFLX), (AMZN), (DIS)

Tag Archive for: (AAPL)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader April 17 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: What will the market do after the Muller report is out?

A: Absolutely nothing—this has been a total nonmarket event from the very beginning. Even if Trump gets impeached, Pence will continue with the same kinds of policies.

Q: If we are so close to the peak, when do we go short?

A: It’s simple: markets can remain irrational longer than you can remain liquid. Those shorts are expensive. As long as global excess liquidity continues pouring into the U.S., you’ll not want to short anything. I think what we’ll see is a market that slowly grinds upward until it’s extremely overbought.

Q: China (FXI) is showing some economic strength. Will this last?

A: Probably, yes. China was first to stimulate their economy and to stimulate it the most. The delayed effect is kicking in now. If we do get a resolution of the trade war, you want to buy China, not the U.S.

Q: Are commodities expected to be strong?

A: Yes, China stimulating their economy and they are the world’s largest consumer commodities.

Q: When is the ProShares Short Russell 2000 ETF (RWM) actionable?

A: Probably very soon. You really do see the double top forming in the Russell 2000 (IWM), and if we don’t get any movement in the next day or two, it will also start to roll over. The Russell 2000 is the canary in the coal mine for the main market. Even if the main market continues to grind up on small volume the (IWM) will go nowhere.

Q: Why do you recommend buying the iPath Series B S&P 500 VIX Short Term Futures ETN (VXXB) instead of the Volatility Index (VIX)?

A: The VIX doesn’t have an actual ETF behind it, so you have to buy either options on the futures or a derivative ETF. The (VXXB), which has recently been renamed, is an actual ETF which does have a huge amount of time decay built into it, so it’s easier for people to trade. You don’t need an option for futures qualification on your brokerage account to buy the (VXXB) which most people don’t have—it’s just a straight ETF.

Q: So much of the market cap is based on revenues outside the U.S., or GDP making things look more expensive than they actually are. What are your thoughts on this?

A: That is true; the U.S. GDP is somewhat out of date and we as stock traders don’t buy the GDP, we buy individual stocks. Mad Hedge Fund Trader in particular only focuses on the 5% or so—stocks that are absolutely leading the market—and the rest of the 95% is absolutely irrelevant. That 95% is what makes up most of the GDP. A lot of people have actually been caught in the GDP trap this year, expecting a terrible GDP number in Q1 and staying out of the market because of that when, in fact, their individual stocks have been going up 50%. So, that’s something to be careful of.

Q: Is it time to jump into Qualcomm (QCOM)?

A: Probably, yes, on the dip. It’s already had a nice 46% pop so it’s a little late now. The battle with Apple (AAPL) was overhanging that stock for years.

Q: Will Trump next slap tariffs on German autos and what will that do to American shares? Should I buy General Motors (GM)?

A: Absolutely not; if we do slap tariffs on German autos, Europe will retaliate against every U.S. carmaker and that would be disastrous for us. We already know that trade wars are bad news for stocks. Industry-specific trade wars are pure poison. So, you don't want to buy the U.S. car industry on a European trade war. In fact, you don’t want to buy anything. The European trade war might be the cause of the summer correction. Destroying the economies of your largest customers is always bad for business.

Q: How much debt can the global economy keep taking on before a crash?

A: Apparently, it’s a lot more with interest rates at these ridiculously low levels. We’re in uncharted territory now. We really don't know how much more it can take, but we know it’s more because interest rates are so low. With every new borrowing, the global economy is making itself increasingly sensitive to any interest rate increases. This is a policy you should enact only at bear market bottoms, not bull market tops. It is borrowing economic growth from futures year which we may not have.

Q: Is the worst over for Tesla (TSLA) or do you think car sales will get worse?

A: I think car sales will get better, but it may take several months to see the actual production numbers. In the meantime, the burden of proof is on Tesla. Any other surprises on that stock could see us break to a new 2 year low—that's why I don’t want to touch it. They’ve lately been adopting policies that one normally associates with imminent recessions, like closing most of their store and getting rid of customer support staff.

Q: Is 2019 a “sell in May and go away” type year?

A: It’s really looking like a great “Sell in May” is setting up. What’s helping is that we’ve gone up in a straight line practically every day this year. Also, in the first 4 months of the year, your allocations for equities are done. We have about 6 months of dead territory to cover from May onward— narrow trading ranges or severe drops. That, by the way, is also the perfect environment for deep-in-the-money put spreads, which we plan to be setting up soon.

Q: Is it time to buy Freeport McMoRan (FCX) in to play both oil and copper?

A: Yes. They’re both being driven by the same thing: China demand. China is the world’s largest new buyer of both of these resources. But you’re late in the cycle, so use dips and choose your entry points cautiously. (FCX) is not an oil play. It is only a copper (COPX) and gold (GLD) play.

Q: Are you still against Bitcoin?

A: There are simply too many better trading and investment options to focus on than Bitcoin. Bitcoin is like buying a lottery ticket—you’re 10 times more likely to get struck by lightning than you are to win.

Q: Are there any LEAPS put to buy right now?

A: You never buy a Long-Term Equity Appreciation Securities (LEAPS) at market tops. You only buy these long-term bull option plays at really severe market selloffs like we had in November/December. Otherwise, you’ll get your head handed to you.

Q: What is your outlook on U.S. dollar and gold?

A: U.S. dollar should be decreasing on its lower interest rates but everyone else is lowering their rates faster than us, so that's why it’s staying high. Eventually, I expect it to go down but not yet. Gold will be weak as long as we’re on a global “RISK ON” environment, which could last another month.

Q: Is Netflix (NFLX) a buy here, after the earnings report?

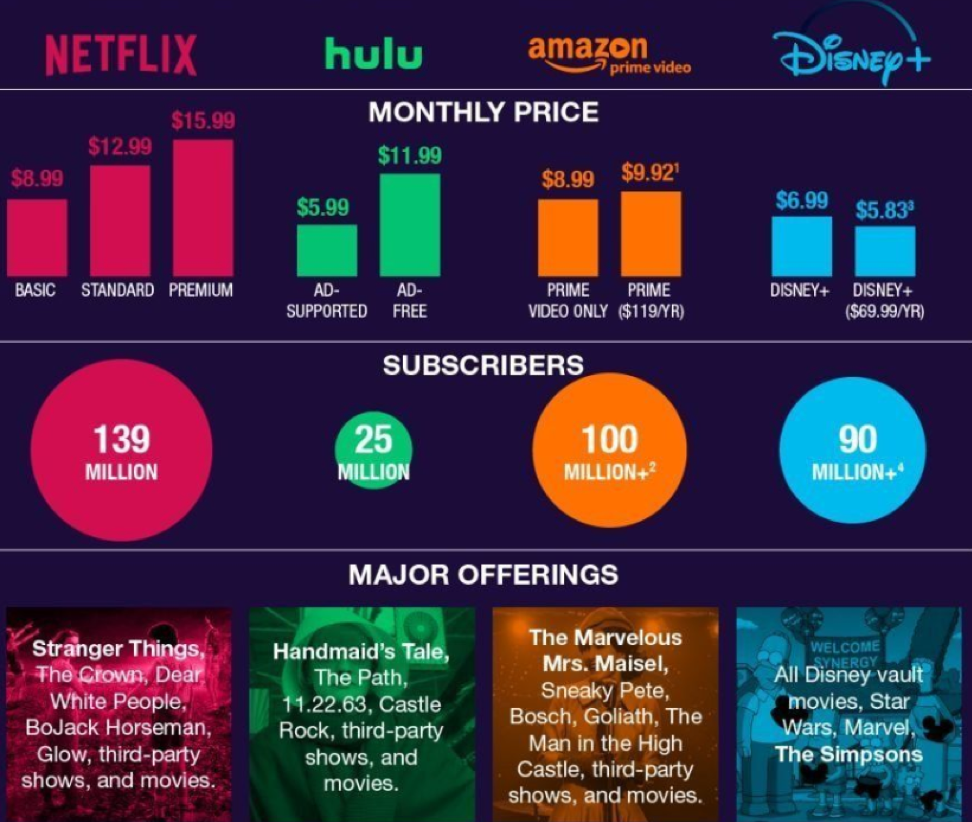

A: Yes, but don't buy on the pop, buy on the dip. They have a huge head start over rivals Amazon (AMZN) and Walt Disney (DIS) and the overall market is growing fast enough to accommodate everyone.

Q: Will wages keep going up in 2019?

A: Yes, but technology is destroying jobs faster than inflation can raise wages so they won’t increase much—pennies rather than dollars.

Q: How about buying a big pullback?

A: If we get one, it would be in the spring or summer. I would buy a big pullback as long as the U.S. is hyper-stimulating its economy and flooding the world with excess liquidity. You wouldn't want to bet against that. We may not see the beginning of the true bear market for another year. Any pullbacks before that will just be corrections in a broader bull market.

Good Luck and Good Trading

John Thomas

CEO & Publisher

Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

April 18, 2019

Fiat Lux

Featured Trade:

(NETFLIX’S WORST NIGHTMARE)

(NFLX), (DIS), (FB), (AAPL)

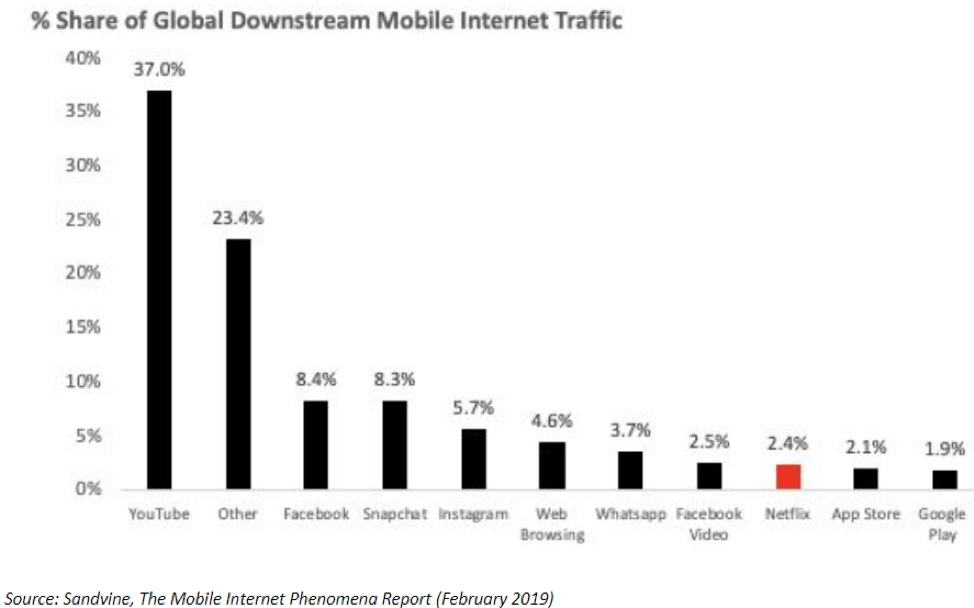

Netflix came out with earnings yesterday and revealed guidance that many industry analysts were dreading.

It appears that Netflix’s relative subscriber growth rate has reached the high-water mark for now.

Competition is rapidly encroaching Netflix’s moat.

In a letter to shareholders, management opined revealing that they do not “anticipate these new entrants will materially affect our growth.”

I am quite bothered by this statement because one would have to be blind, deaf, and dumb to believe that Disney (DIS) or Apple’s (AAPL) new products will not take away meaningful eyeballs from Netflix.

These companies are all competing in the same sphere – digital entertainment.

Papering over the cracks with wishy washy rhetoric was not something I was doing backflips over.

Netflix’s management knew this earnings report had nothing to do with results because everyone wanted to reassess how bad the new entrants would make life for Netflix.

Disney has the content to inflict major damage to Netflix’s business model.

The mere existence of Disney as a rival weakens Netflix’s narrative substantially in two ways.

First, Disney’s entrance into the online streaming game means Netflix will not have a chance to raise subscription prices for the short to medium term.

The last price hike was done in the nick of time and even though management mentioned it followed through “as expected,” losing this financial lever gives Netflix less ammunition going forward and caps EPS growth potential.

Second, another dispiriting factor is the premium for retaining and acquiring original content will skyrocket with more firms jockeying for the same finite amount of actors, producers, directors, and writers.

This particular premium cannot be quantified but firms might try to bid up the cost of certain talent just so the other guy has to foot a bigger bill, this is done in professional sports all the time.

Firms might even take actors off the table with exclusive contracts just to frustrate the supply of content generators.

Uncertainty perpetuates with the future cost of content unable to be baked into the casserole yet, and represents severe downside risk to a stock which trots out an expensive PE ratio of 133.

Growth, growth, and more growth – that is what Netflix has groomed investors to obsess on with the caveat of major strings attached.

This model is highly effective in a vacuum when there are no other players that can erode market share.

Delivering on growth justifies heavy cash burn, and to Netflix’s credit, they have fully delivered in spades.

The strings attached come in the form of steep losses in order to create top of the line content.

Planning to revise down annual cash flow from $3 billion to $3.5 billion in 2019 will serve as a litmus test to whether investors are ready to shoulder the extra losses in the near term.

I found it compelling that Disney Plus will debut at $6.99 per month – add that to the price of Netflix’s standard package of $12.99 and you get a shade under $20.

Disney hopes to dictate spending habits by psychologically grouping Disney and Netflix for both at under $20.

The result of breaching the $20 threshold might push customers into ditching Netflix and sticking with the $6.99 Disney subscription.

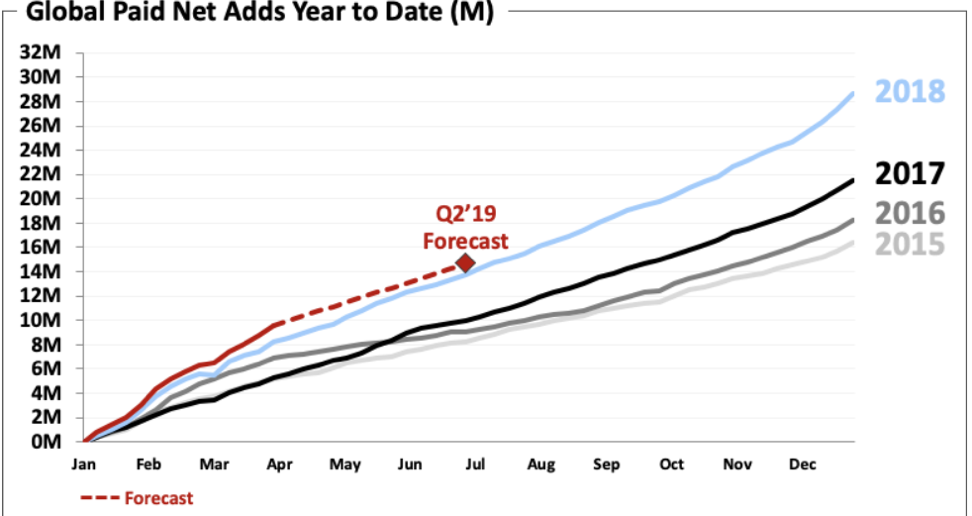

Then there is the thorny issue of Netflix’s growth – the quality and trajectory of it.

The firm issued poor guidance for next quarter projecting total paid net adds of 5.0m, representing -8% YOY with only 300,000 adds in the US and 4.7m for the international segment.

Alarm bells should be sounding in the halls when the most lucrative segment is estimated to decelerate by 8% YOY.

Domestic subscriptions deliver higher margins bumping up the average revenue per user (ARPU).

Contrast this with Netflix’s basic Indian package costing $7.27 or 500 rupees and a mobile package of $3.63 or 250 rupees.

In my opinion, domestically decelerating in the high single digits does not justify the additional annual cash burn of half a billion dollars even if you accumulate millions of more Indian adds at lower price points.

This leads me to surmise that the quality of growth is beginning to slip, and Netflix appears to be running into the same type of quagmire Facebook (FB) is facing.

These models are grappling with stagnating or slowing North American growth and an emerging market solution isn’t the panacea.

The Netflix Indian packages are actually considered expensive by local standards meaning that Netflix’s won’t be able to crowbar in price hikes like they did in America.

On the positive side, Netflix did beat Q1 estimates with paid net adds up 9.6 million with 1.74m in the US and 7.86m internationally, up 16% YOY.

Netflix was able to reach revenue of $4.5B, a company record mostly due to the $2 price hike during the quarter in America.

The letter to shareholders simplifies Netflix’s tactics to investors explaining, “For 20 years, we’ve had the same strategy: when we please our members, they watch more and we grow more.”

What this letter doesn’t tell you is that Disney and the looming battle with Netflix will reshape the online streaming landscape.

In simple economics, an increase of supply caps demand, and don’t get sidetracked by the smoke and mirrors, Disney and Netflix are absolutely fighting for the same eyeballs no matter how much Netflix plays this down.

To highlight an example of how these two are directly competing against each other – let’s take the cast of Monica, Chandler, Rachel, Ross, Joey, and Phoebe – in the hit series Friends.

Netflix acquired the broadcasting rights from Warner Bros, who owns Disney, and it was the most popular show on Netflix.

Warner Bros, knowing that Disney were on the verge of rolling out an online streaming product, renewed Netflix for 2019 at $80 million.

Not only were they hand feeding the enemy in broad daylight, but they handicapped their new products as it is about to debut.

Whoever made that decision must go into the hall of shame of boneheaded online content decisions.

Once 2020 rolls around, Disney will finally be able to slap Friends on Disney Plus where it belongs, and the streaming wars will heat up to a fever pitch.

Ultimately, when Netflix brushes off reality proclaiming that if they please viewers with the same strategy, then everything will be hunky-dory, then I would say they are being disingenuous.

The online streaming industry has started to become more complex by the minute and the “same strategy” that worked wonders in a vacuum before must evolve with the times.

At $360, I would short Netflix in the short to medium term until they prove the headwinds are a blip.

If it goes up to $400, it’s a screaming short because accelerating cash burn, poor guidance, decelerating domestic net adds, and a jolt of new competition aren’t the catalysts that will take shares above the heavenly lands of $400, let alone $450.

Netflix is still a fantastic company though – I’m an avid viewer.

Mad Hedge Technology Letter

April 11, 2019

Fiat Lux

Featured Trade:

(THE MEANS TO A FRIGHTENING END)

(AMZN), (FB), (GOOGL), (AAPL)

Death of websites.

I love doing presentations to small businesses on my free time, partly to stay in touch with the pulse of the Davids who have the unenviable task of fighting uphill against the Goliaths.

It’s bad enough that the tech giants have scaled locally turning one’s local playground into a disadvantage.

The presentation is aptly titled "Content is King... But Only Through One’s Ownership" where the same parallels are explored and unpacked for my audience.

Proprietary Content – must be yours and you must own it on your own turf - your blog, your vlog, your app, and so on, it goes for everything.

Repurposing content on other platforms as a supplement to your own is one thing, but the moment you adopt an enemy platform as your main platform, that’s your coup de grâce.

SMEs (small businesses enterprise) believe it’s plausible to work with the higher ups, but don’t forget they have every incentive to cut you off from the fountain of youth.

One could say the best skill big tech has today is undermining their competition.

Facebook doesn’t allow posting content that criticizes Facebook, have you ever wondered why?

Website innovation has grinded to a halt because of the PageRank algorithm from Google, everybody is making websites the same, a top nav, descriptive text, a smattering of images and a handful of other elements arranged similarly.

Google’s algorithms and the self-regulating nature of their ecosystem have perverted the chance to have a unique online experience.

Most internet users have probably discovered that most websites don’t work well and the execution of them is lousy.

Many companies are not contributing enough resources to build out their site properly, or just don’t have the cash to fund it or a mix of the two.

About 95% of customer service calls originate from the company’s webpage because of payment problems, disfunction, misleading content, or simply because the website is down.

Ask any small business and they will tell you they deal with their domain being down for hours at a time because of some unknown server problem.

Not only is capitalism only working for a small group of Americans, but so are websites, such as massive companies like Amazon.com who have worked wonders with its e-commerce site.

Because the internet and namely websites are the key to building businesses, Silicon Valley is now using the concept of websites and their position as de-facto moderators to prevent others from developing proper websites, killing off the competition.

Alphabet is notorious for ranking their own products at the top of page one of any Google search.

Amazon has followed the same practice by sticking their in-house brands at the top of any Amazon search on Amazon.com.

And remember that none of this can be called “antitrust” because these borderline tactics offer consumers lower prices but that is only because consumers are brainwashed to believe Amazon offers the lowest price.

What if the same products are available for half of Amazon’s in-house brands, would Amazon volunteer to post their in-house brands on the second page, the graveyard of search results?

I would guess no.

Websites used to give businesses a chance, remember in the mid-90s when a website of any ilk was impressive as if someone was walking on water.

What can we expect next?

Amazon, Google, and Apple are taking their shows to artificial intelligence voice platforms.

SMEs could at least throw hail marys on standard internet searches with visual screens, but once content migrates over to voice platforms owned by Silicon Valley, then its game, set, and match.

For instance, a local business such as Joe’s Furniture Moving Business who, with the internet and visual screens, is searchable through search engines and can be even located on Google Maps with a concrete address.

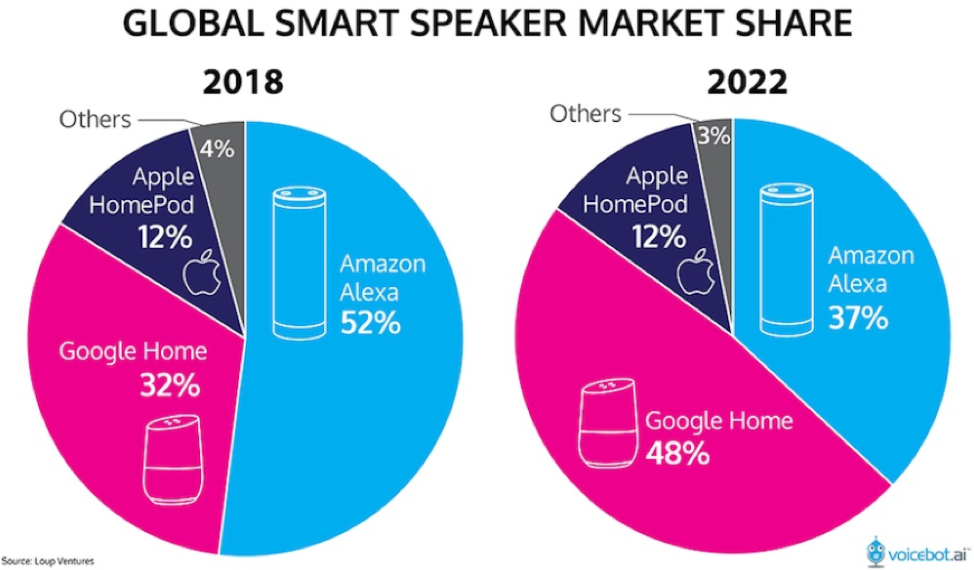

Once we migrate the lions share of content to voice platforms over the next 15 years, Google Home, Apple HomePod, or Amazon Alexa could easily choose to remove Joe’s Furniture Moving Business information because they make more money offering you information of a moving service they own or have a stake in.

The advent of 5G will refine the voice technology and enhance the machine learning techniques needed to complete the migration of content.

Once the world crosses an inflection point where the technology and volume of content on smart speakers outweigh the hassle to use a keyboard or mobile screen, this effectively makes these smart speaker manufacture Gods of the World because they will own the voice-based internet.

They will be the gatekeepers of all global information, business, and development in the world and we will need to satisfy their algorithms to get our own content uploaded on their voice platforms.

And because of the nature of voice, users cannot see what else is out there, users will only hear what these companies tell us offering an outsized opportunity to manipulate the user experience generating more dollars for these powerful platforms.

By the end of 2019, 74 million Americans will be using smart speakers, giving these smart speaker firms adequate data to fine tune their products.

Eventually, all Americans will be forced to use it or will not be able to function, similar to the effects of a laptop, email, and smartphone combination now.

Once these voice platforms become ubiquitous, websites will be deemed irrelevant – consumers will simply have a choice of Google Home, Amazon Alexa, and Apple HomePod and blindly trust what they tell you is in your best interests.

Pick your poison.

That’s right, users won’t control content in about 15 years, a scary thought, and now you understand why these companies will even give their voice A.I. platforms for free if they have to and probably will in the future.

Mad Hedge Technology Letter

April 9, 2019

Fiat Lux

Featured Trade:

(THE LEGACY TECH COMPANY THAT’S WORTH BUYING NOW)

(ADBE), (MSFT), (CRM), (AAPL)

Mad Hedge Technology Letter

April 8, 2019

Fiat Lux

Featured Trade:

(THE BATTLE FOR COFFEE IN CHINA)

(SBUX), (MSFT), (AAPL), (IBM)

If you ask me what you should sample at a Starbucks in China - I would say nothing.

Starbucks has become successful on the back of selling bad tasting coffee to the Chinese.

Even more peculiar, the CEO of Starbucks Kevin Johnson has been captaining the ship since 2017.

After watching Johnson's interview with Bloomberg, I fully believe he is not adequately prepared for what the future beholds.

Let me explain why.

Johnson started at IBM (IBM) in the 80s as an engineer, but he hasn't been an engineer for the last 20 odd years.

In the early 2000s, he became a salesman at Microsoft (MSFT), and his interview revealed that he is still a salesman at heart.

He continued to refer back to his engineering background, yet the know-how he accumulated in the 80s at IBM has little relevance to the “move fast and break things” environment of today.

Johnson was groomed under the tutelage of Microsoft’s Steve Ballmer at Microsoft, a salesman, who almost sunk Microsoft during his tenure.

Anyone who trained under Steve Ballmer is someone that would need to walk across fiery embers to prove his or her viability.

The interview with Bloomberg felt like an inauthentic marketing video, with Johnson regurgitating salesman rhetoric with little substance.

As Starbucks shreds the bear story of naysayers to make new all-time highs, there are serious icebergs ahead because of disruptive technological start-ups.

Starbucks has relied on emerging markets as its growth engine inaugurating 612 stores in China last year, and another 600 will come online before 2022.

Selling bad coffee to Chinese will be more difficult going forward.

The prominent tea drinking nation had no idea what good coffee tasted like 10 years ago.

Even recently, many Chinese thought instant coffee packaged in those convenient stick-shaped packets was high-grade coffee.

The last five years has seen an unmitigated onslaught of Chinese international tourism mainly flowing to Europe, Canada, Australia, and America.

Not only did Chinese shop until their panties dropped, but they began to become more inclined to understand culinary and cultural aspects of foreign cultures like, for instance, how good coffee should taste among other cultural trappings.

Five years ago, Chinese also went to Starbucks to sample the coffee. Now, they go to Starbucks because the interiors are comfortable making it a plausible place for an impromptu business meeting in a downtown or business district location.

Let’s remember that Starbucks could never crack the Italian market because teaching Italians how to make coffee doesn’t sell in Italy.

It took until last September to open the first Starbucks in the cultural center of Milan, Italy, and I can tell you that it’s not a regular, cookie cutter Starbucks.

The Milan Starbucks is billed as a “Reserve Roastery” with marble finishes contributed from the supplier that up until now was only used to build the famed Duomo of Milan and buildings in the surrounding Piazza.

To say this Starbucks is posh is an understatement.

The 25,000-square-foot coffee shop delivers small-batch roastings of exotic coffees from more than 30 countries, and artisanal food from the local culinary rock star, Rocco Princi.

In fact, Starbucks built it into a four-star restaurant with expensive cocktails and the whole shebang.

Understandably, the average revenue per user (ARPU) at the Italian roastery earns 400% more than the average American Starbucks shop.

This is what Starbucks had to do to get their first footprint into Italy, while coffee know-how isn’t up to that level in China, differentiating variables will be harder to discover moving forward as Chinese customers look to handcrafted, artisanal options demanding a superior customer experience.

The generic Starbucks in China sells mediocre black coffee made from inferior beans for $5 per cup, a far cry from the reserve roastery in Milan.

If you get into the creamier, frothy types of drinks, then price points shoot up to $6 or $7.

Meet the current tech disruptor of coffee business in China, Luckin Coffee headed by Chinese tech entrepreneur Qian Zhiya.

Her impressive resume spans from COO of Shenzhou, a car rental app and website, to Co-founder of UCAR, a ride-hailing service spun off from Shenzhou.

During the Bloomberg interview, Kevin Johnson bragged that Starbucks is opening a new Chinese Starbucks every 15 hours.

He forgot to mention Starbucks' local competitor opens a new Luckin Coffee every 8 hours amounting to about 3 per day.

Luckin Coffee's plan is to open 1,950 more stores in the next 18 months.

This has the inklings of a dogfight down to zero with a local upstart, and ask how that turned out for Facebook, Google, or even Amazon in China.

Every FANG except Apple (AAPL) cease to exist in China now, and brewing bad coffee doesn’t create the positive network effect that Apple has in China, effectively delivering an additional 4 million ancillary jobs connected to the iOS system.

The entrenched nature of Apple in China means they cannot be removed without catastrophic job losses to local Chinese triggering massive social unrest.

In the case of Starbucks, every location that folds, employees can walk across the street to join a Luckin Coffee franchise, such is an environment in a zero-sum game.

Qian envisions coffee shops like a tech empire because of her background, and has earmarked fresh capital for product R&D, technology innovation, and business development.

Luckin is hellbent on capturing young office workers with its locations, delivery services, and low prices, operating a no-frills type of Starbucks alternative.

They have undercut Starbucks pricing by offering the same cup of Americano $5 coffee for $3.15.

How about their expansion plans?

Locations will explode to 4,500 by the end of 2019 which will eclipse the number of Chinese Starbucks in mid-2019.

The company has relied on technology, over half of the locations lack physical seating, shrinking space by way of applying kiosk structures as a coffee preparation station before customers access delivery orders through the smartphone app.

Digital payments are common via WeChat or Luckin’s own “coffee wallet,” and over 70% of digital customers are under 30.

Luckin's strategy is a far cry from the plush sofas of Starbucks' home away from home strategy. Distinctively, Luckin does not want customers to lounge around and talk business.

The rise of Luckin Coffee coincides with hamstringing Starbucks' comparable-store sales growth rising just 1%, with a 2% decline in transactions, down from 6% sales growth the prior Q1.

CFO Patrick Grismer did what CEO Kevin Johnson could not, admitting, “we have to acknowledge that competition is intensifying.”

Luckin Coffee burned through more than $100 million in cash in 2018, and like the prototypical tech company, will burn more cash to intensify competition with Starbucks.

I predict they will head further into deeper coffee discounts to snatch market share.

Other possible pain points for Starbucks that Qian could exploit are more subsidized deliveries which could continue for another “3-5 years” but could be extended if need be.

Qian is content with her model, stating she is “in no rush to make a profit,” signaling convenient access to a trove of generous debt instruments.

The best-case scenario in 2019 is that Starbucks' profit margins shrink or stagnate in China, the worst case, they lose significant Chinese market share and tier 1 city franchises continue to cannibalize revenue.

Starbucks' golden years in China are over and you can thank technology for offering a model to compete with them.

If Starbucks' shares continue moving up, it won’t be for much longer.

Global Market Comments

April 3, 2019

Fiat Lux

Featured Trade:

(WHO WILL BE THE NEXT FANG?)

(FB), (AMZN), (NFLX), (GOOGL), (AAPL),

(BABA), (TSLA), (WMT), (MSFT),

(IBM), (VZ), (T), (CMCSA), (TWX)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.