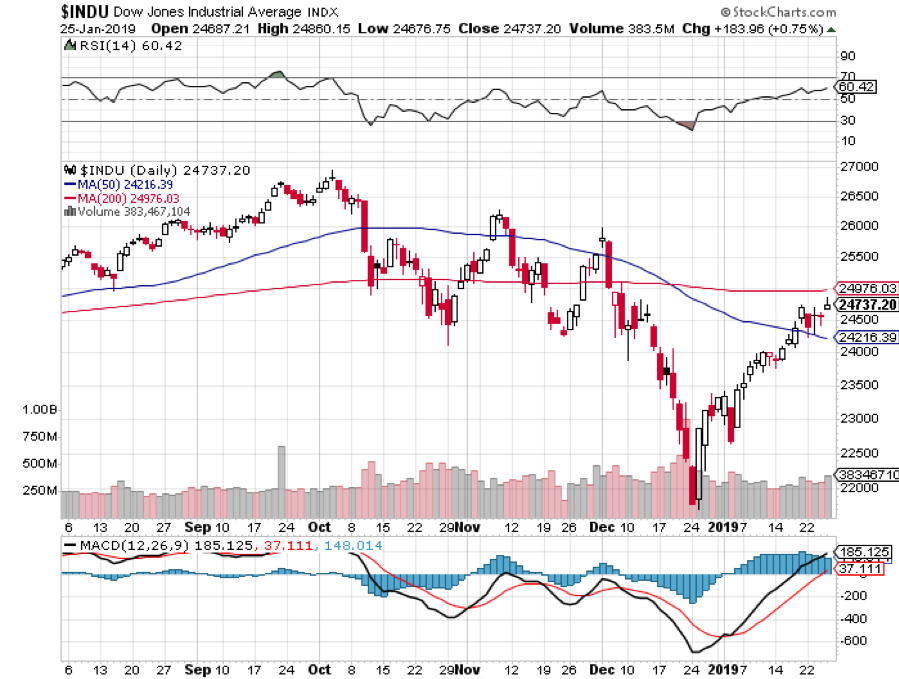

After an almost 40% swan dive, Apple has found solid footing at these levels for the time being. 40% seems to be the magic number. Declines ALWAYS end at 40% with Apple.

About time!

It’s been an erratic last few months for the company that Steve Jobs built and this last earnings report will go a long way to somewhat stabilize the short-term share price.

The miniscule earnings beat telegraphs to investors that the bad news has been sucked out.

That is what Tim Cook wants the investor community to think.

But is he right?

I would argue that the bad news is over for the short-term but could rear its ugly head again later – it all rides on China’s shoulders.

Let’s take a look at the numbers.

Chinese revenue was down 27% YOY locking in $13.17 billion in quarterly revenue compared to $17.96 billion the prior year.

There is no two ways about this – it’s an awful number and a hurtful manifestation of the Chinese economy decelerating.

The unrelenting pressure of the geopolitical trade war has handcuffed Beijing’s drive to deleverage its balance sheet and steer its economy to a more consumption-supportive model.

China is lamentably back to its traditional ways - the old economy - infusing $2.2 trillion into its balance sheet along with cutting the reserve ratio for state banks hoping to incite economic growth.

Positive short-term catalyst but negative long-term consequences.

This is why I urged Apple lovers to stay away from this stock earlier because of the uncertainty of its current strategic position.

It makes no sense to place an indirect on the current Washington administration navigating a China soft landing.

As it stands, most of Apple’s supply chain is in China and moving it out will be done in piecemeal which is happening behind the scenes and will cause massive job loss in China further hurting the Chinese economy.

The ratcheting up of tensions signals the untenable end of American tech supply chains in China and no new foreign investment will pour into China.

Maybe even never.

I wholeheartedly blame CEO of Apple Tim Cook for not foreseeing this development.

That is what he is paid to do.

Then there is the issue of iPhone sales in China.

Chinese citizens aren’t buying iPhones because of three reasons.

The cohort of wealthy Chinese who can afford a $1,000 iPhone might think twice if they want to be seen outside with a product from a country that is becoming adversarial. Apple has incurred hard-to-quantify brand damage to its once pristine brand in a land that once worshipped the company.

The refresh cycle has elongated because Apple manufactures great smartphones and iPhone holders are waiting it out on the sidelines two or even three iterations down the road to upgrade because that is when they can unearth the relative value of the product.

Lastly, local Chinese smartphone markers have greatly enhanced their products because of a function of time and borrowed Western technology. It is now possible to buy a smartphone that offers around 80% of performance and functionality of an iPhone but for less than half the price.

The customers on the fence who once viewed iPhones as a must-buy are now migrating to the local Chinese competitor because they are a relatively good deal.

I can surmise that these three headwinds are just beginning and will become more entrenched over time.

If the trade war becomes worse, the brand damage will accelerate. iPhones are becoming incrementally better which will delay new iPhone upgrades unless something revolutionary comes out that requires customers to upgrade to be a part of the new technology.

And sadly, Chinese competition is catching up quicker than Apple can innovate and that will not stop.

However, the silver lining is that the worst-case scenario won’t happen in the next quarter and the market won’t get wind of this until the second half of the year.

Instead of a meaningful sell-off because of this earnings report, Cook chose to front-run the weakness by reporting the hideous performance at the beginning of January.

Cook knew he needed to come clean with the negative news and the reformulated projections that were re-laid a few weeks ago were the same ones that Apple barely beat by one cent on the bottom line by posting EPS of $4.18 and marginally on the top line by $420 million.

I am in no way saying that this was a great earnings report – it wasn’t.

Apple mainly delivered on the mediocrity that they discussed a few weeks ago lowering the bar to the point where it would be a failure of epic proportions if Apple couldn’t beat significantly revised down earnings.

Then the outlook for the next quarter wasn’t as bad as people thought, but that doesn’t mean it was good.

When you start playing the game of not as bad as the market thought – it is a slippery slope to head down and halfway to the CEO getting sacked down the road.

I mentioned before that the macro headwinds came 2 years too early for Cook and pegging 60% of company revenue to a smartphone which has trended towards mass commoditization is a bad bet.

Cook has been painstakingly slow rewriting Apple as a service company which is his current get-out-of-jail-free card dangling in front of him like a juicy carrot.

iPhone gross margin is now 34.3% which is lower than the other Apple products whose margins are 38%.

Their flagship product isn’t as profitable on a per-unit basis as it once was highlighting the necessity for refreshing the product lines with not just new iterations but game-changing products.

The type of products that Steve Jobs used to mushroom popularity would suffice.

Gross margins will continue to come down as the smartphone market is saturated and customers won’t buy iPhones now unless they receive a drastic price reduction.

The result is that Apple no longer publishes iPhone unit sales to conceal the worst number for their most important and volume-heavy product.

A little too late if you tell me and irresponsible to investor transparency if you ask me.

Apple Pay, Apple Music, and iCloud storage eclipsed $10.9 billion demonstrating a 19% YOY increase.

This shows that this company still has strengths, but don’t forget that services are still less than 15% of total revenue even though they are the fastest growth part of their portfolio.

Cook isn’t doing enough to supercharge the content and services at Apple.

The top line number was $84.3 billion, a 5% YOY decline in revenue – a YOY decline hasn’t happened in 18 years and this is deeply troublesome.

Let me explain why Cook is the center of the problem.

The underlying issue is Cook doesn’t know what product should be next for Apple.

Apple dabbled with the Apple TV which didn’t pan out.

Then the autonomous vehicle unit just closed down sacking 200 employees.

And the content side of it hasn’t been developed fast enough relative to the slowing down of iPhone sales which is why you can blame Cook for being reactive instead of proactive.

It’s not like he can claim that his head was in the sand and couldn’t take note of what Netflix was doing and had gotten into that original content game sooner.

The hesitation is exactly what worries me with Cook. Cook is a great operations guy and can take an existing product, beef up margins, shave down expenses, streamline execution and boost top and bottom line profits.

Cook is being painfully exposed now that he is out of his comfort zone and must aggressively move in a direction that doesn’t have a red carpet laid out for him.

Even though the pre-earnings red flag raised many questions, Cook only satisfied these red flags on a short-term basis and Apple still needs to reconfigure its product roadmap for the long term.

If Cook plans to milk more out of the iPhone story, Apple becomes a sell the rallies stock, but the market will give the benefit of the doubt to Apple for a quarter or so.

The 800-pound gorilla in the room is the Chinese economy which could go into a hard landing if the stimulus fails to deliver economic respite or if the trade war tensions are exacerbated.

At the bare minimum, the waterfall of downgrades should be over for the time being, but this will come to the fore in a quarter or so when Apple will need to shine light on its plans moving forward.

I wouldn’t bet the ranch on Cook being innovative.

It looks like Apple will start to trade in a range.

It’s hard to believe any bad news superseding what came out at the beginning of this month in the short-term, but at the same time, there are no idiosyncratic catalysts to cause this stock to bullishly break out.

We are at an inflection point in Cook’s career and he is finding out that it's not as easy to be Apple as it used to, and mammoth decisions are on the horizon that must be addressed or possibly become the next IBM.

If you ask me, I’ve been calling on Apple to replace Cook for a while with Jack Dorsey as the signal caller, I still believe this is the only way to stay in the heavyweight division of tech titans five years from now.

Such is the competitive nature of the tech landscape these days.