The market finally found something worse than inflation to rattle it: WWIII.

I’m not expecting my call-up papers from the Marine Corps anytime soon. After all, there isn’t a war that is about to happen. In any case, if the defense of the nation relies upon me as a pilot, we are in big trouble.

The market clearly thought otherwise last week, when the Dow swooned 1,200 points in two days. The Friday close was a dog’s breakfast.

It gets worse.

The collapse sets up a perfect “head and shoulders” top which the hedge fund community has been gunning for all year. That beckons eventual lows that will finally bring us into decent LEAPS territory, especially if the Volatility Index (VIX) leaps over $40.

Biden actually has a pretty good strategy going in the Ukraine. By announcing the time and date of the Russian invasion in advance, he boxes Putin into a corner, forcing him to put up or shut up.

It's really all one big chess game, with the two countries attempting to each gain maximum security advantages at minimum cost. Putin would love the Ukraine if he could get it. So did Hitler, Napoleon, and Genghis Khan before him.

Biden hopes to make the price so high it’s not worth it. After all, Hitler, Napoleon, and Genghis Khan didn’t come to good endings.

It’s really meaningless to fight this battle when modern national borders are rapidly dissolving anyway. Modern borders are increasingly being drawn by operating systems, apps, and security suites rather than lines on a map.

Of course, bonds were discounting a completely different scenario, that of peace, prosperity, and booming economies that demand more capital at higher interest rates. Fed members are now playing a game of competitive hawkishness, talking interest rates up and bond prices down.

It all sounds like a great short bond environment to me, which is why I have been running a triple short position since the beginning of the year. The best is yet to come.

So we flipped from being long everything in 2021 to short the works in 2022. That’s just the way markets work now. So, if you can’t stand the heat, get out of the kitchen.

Fed Now Pushing a Half-Point Hike, tanking the markets, and could deliver 100 basis points by July. Competitive hawkishness has broken out at the Fed. Looks like a bond short will be the trade of the year. Who knew? (You did).

Core CPI Comes in Hot at 7.5%, the highest since 1982, and hotter than expected. The news finally took bond prices to new multi-year lows and ten-year yields to 2.0%. One-third of this number is rent, which is rising at a record rate. Wages are up an eye-popping 5% YOY. Used car prices were up massively. Stocks took it on the news. It’s going to get worse before it gets better. The chances of a 50-basis point hike in March.

Real Yields Turn Positive, for the first time in a decade, at least for 30-year US treasury bonds. That is the real inflation-adjusted yield for TIPS, or Treasury Inflation-Protected Securities, which now yield 0.08%. Expect real yields to soar from here. Yes, positive returns for bonds at last!

JGB Yields Approach Five Year High, at 0.25%, so will the Bank of Japan be forced to raise rates for the first time in 21 years to come in line with the market. Quantitative Easing is also ending. Gee, do you think zero rates have worked? It's all part of an accelerating trend for more expensive global money.

Pfizer Hauls in $32 Billion From Covid, and another $22 billion for its antiviral Paxlovid. Still, the stock market is a “What have you done for me lately,” and the shares are off 20% since December.

NVIDIA Cancels ARM Purchase, ending its $66 billion attempt to buy market share. UK regulatory opposition was the issue. Buy (NVDA) on dips. The best-run company in the market has just suffered a 40% selloff.

GM to Ramp Up EV Production Sixfold This Year. Electric Escalade SUVs and trucks are the top priority. But while saying is one thing, doing is another. No mention has been made of how they will obtain the extra chips and batteries. Avoid (GM) a never-ending font of disappointment.

Weekly Jobless Claims Prints at 223,000, well above the post-pandemic low of 188,000 in December. Continuing Claims post at 1,621,000.

Foreclosures are Soaring now that the pandemic relief is over. They were up 29% in January, double YOY levels. Florida leads in this troubled category. The numbers would be higher save for enormous rises in home prices which permit cash out refis.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

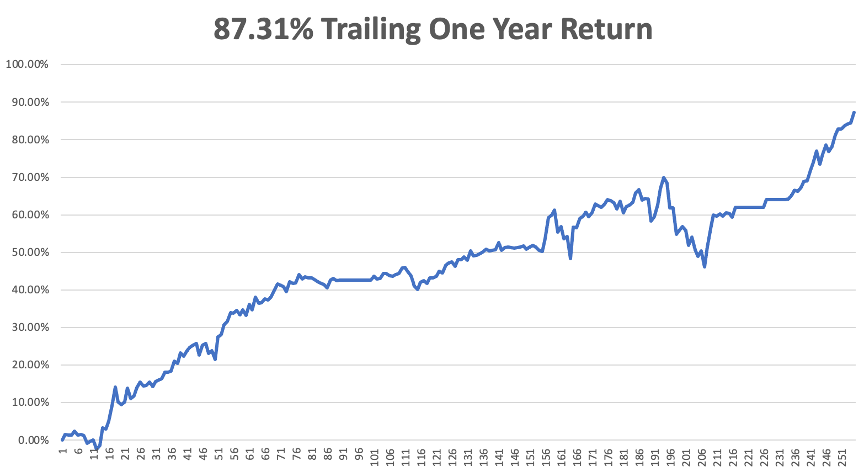

With near record volatility fading fast, my February month to date performance rocketed to a blistering 8.71% in only nine days. My 2022 year-to-date performance has exploded to an unbelievable 23.30%. The Dow Average is down -4.3% so far in 2022. It is the great outperformance on an index since Mad Hedge Fund Trader started 14 years ago.

With 30 trade alerts issued so far in 2022, there was too much going on to describe here. Check your inboxes.

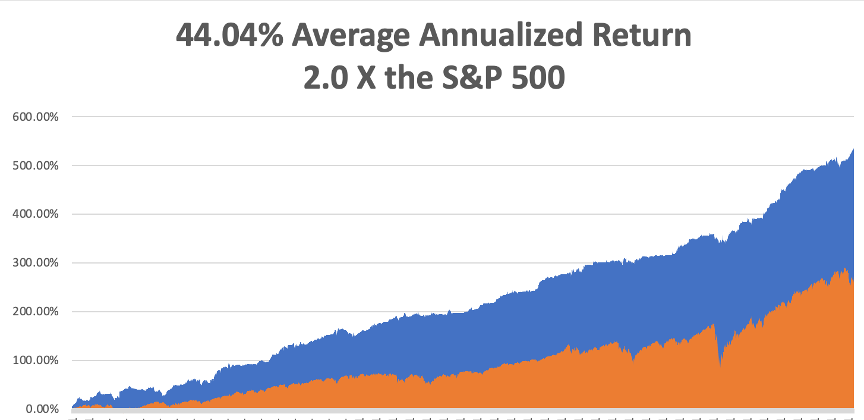

That brings my 13-year total return to 535.86%, some 2.00 times the S&P 500 (SPX) over the same period. My average annualized return has ratcheted up to 44.04% for the first time. How long it will keep rising I have no idea, but as long as it is, I’m not complaining. When you’re hot, you have to be maximum aggressive.

We need to keep an eye on the number of US Coronavirus cases at 78 million and rising quickly and deaths topping 919,000, which you can find here.

On Monday, February 14 at 8:00 AM EST, US Consumer Inflation Expectations are out.

On Tuesday, February 15 at 8:30 AM, the New York Empire State Manufacturing Index is printed.

On Wednesday, February 16 at 8:30 AM, US Retail Sales for January are announced.

On Thursday, February 17 at 8:30 AM, Weekly Jobless Claims are published. Housing Starts and Building Permits for January are announced.

On Friday, February 18 at 7:00 AM, Existing Home Sales for January are disclosed. At 2:00 PM, the Baker Hughes Oil Rig Count are out.

As for me, I made the most unlikely of entries into journalism 50 years ago, thanks to basketball, Mensa, and the kindness of complete strangers.

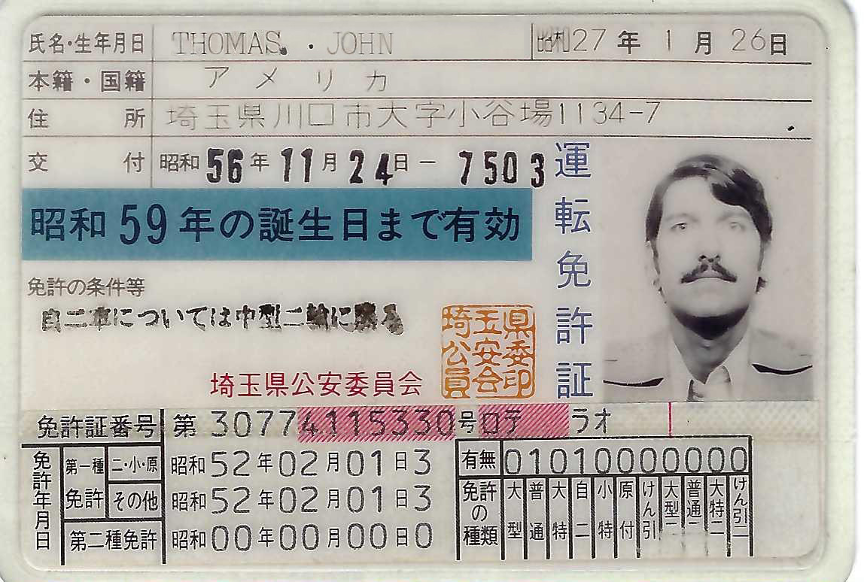

Struggling as a part-time English teacher in Tokyo for Toyota, Sony, and Meiji Shipping, I noticed one day in the Japan Times an ad for a Mensa meeting, the organization for geniuses.

I joined and, after a few meetings, was invited to give a presentation on the subject of my choice at the next meeting. Since I had just obtained a degree in Biochemistry from UCLA, I spoke on the effects of THC (tetra hydro cannabinol) on the human brain. The meeting was exceptionally well attended by detectives from the Tokyo Police Department, as THC was then highly illegal.

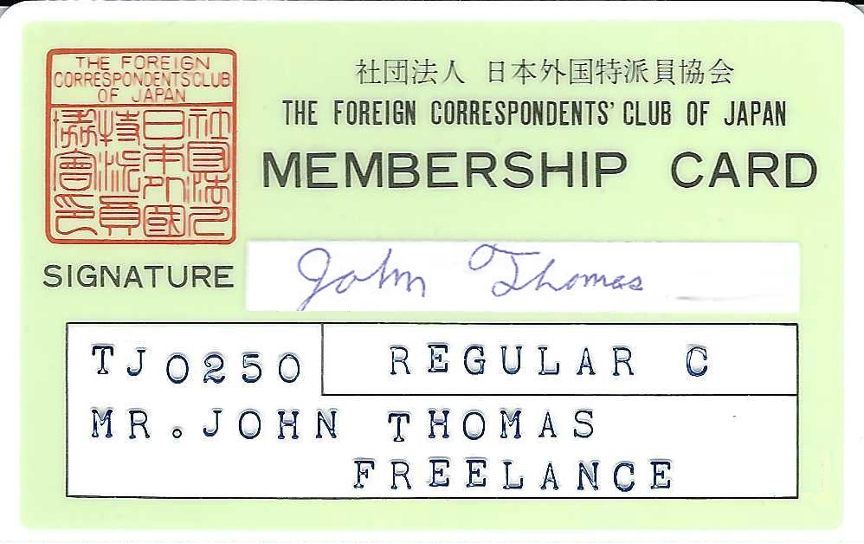

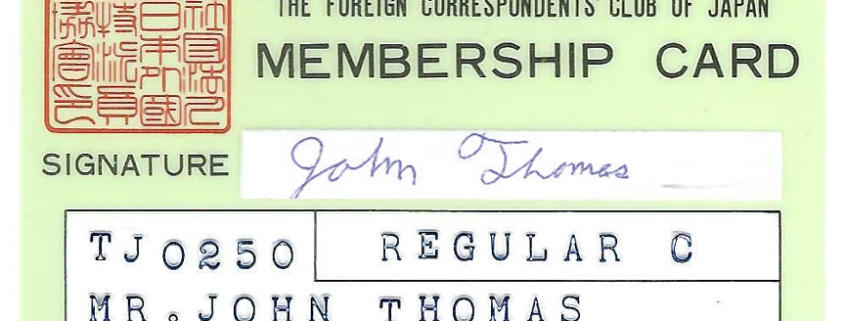

At the end of the meeting, famed Australian journalist Murray Sayle approached me and said he could get me into the Foreign Correspondents Club of Japan. The big attraction was access to the Club’s substantial English language library.

Except for a few well-worn Playboy magazines coming out of the local US Air Force bases, there were almost no English language publications in Japan in those days.

So I joined as a corporate member at 22, the youngest of the 2,000-man club, eating lunch daily with the foreign correspondents on the 20th floor of the Yurakcho Denki Building in central Tokyo. It was just across the street from General Douglas MacArthur’s WWII occupation headquarters.

Many correspondents were holdovers from WWII and had fought their way to Japan on the long island-hopping campaign. Once in Tokyo, they never left, were treated like visiting royalty, paid well, and besieged by beautiful women.

At 6’4” it was only weeks before I was recruited for the club’s basketball team. We played the team from the US Embassy Marine Corps guard, which regularly kicked our butts every week. After all, they had nothing to do all day but play basketball. But they also gave us access to the Tokyo PX where you could get a bottle of Johnny Walker Red for $3.00, versus the local retail price of $100.00.

I managed to eventually get a job at Dai Nana Securities to teach English to the sales staff there. The first oil shock had just taken place and the sole buyers of shares in the world were all in the Middle East.

After two weeks of trying, I met with the president of the company, Mr. Saito, and told him his staff would never learn English. They just lacked the language gene. But if he taught me the stock business, I would sell the shares for him.

He said OK.

Thus, I ensued on a crash course on securities analysis, relying heavily on the firm’s only copies of the 1934 book, Securities Analysis by Benjamin Graham, and his 1949 tome, The Intelligent Investor. I still have a copy of the first research report I wrote on electric tool maker Makita.

It wasn’t long before I became the top salesman at Dai Nana, eventually selling up to 5% holdings in the top 200 Japanese companies to the Saudi Arabia Monetary Authority, the Kuwait Investment Authority, and the Abu Dhabi Investment Authority.

Then the stock market crashed. I lost my job. So, I started asking around the Press Club if anyone had any work. I was broke and nearly homeless.

At the time, most of the correspondents had just returned from covering the Vietnam War. In Japan, they wanted to cover politics, geisha girls, and Emperor Hirohito. Business was at the very bottom of the list. Besides, no one cared what happened in Japan anyway.

It turned out that all the members of the Press Club basketball team were business journalists. There was Mike Tharpe from the Wall Street Journal, Tracy Dalby from the New York Times, and Richard Hanson from the Associated Press, all NCAA college athletes.

Then one team member, The Economist correspondent, Doug Ramsey, asked me if I could write a story about the Japanese steel industry, which was then aggressively dumping product in the US, killing American jobs and creating a political firestorm. Using my stock market contacts, I spent a week diligently researching the subject.

The editors in London loved the story and said they’d take two a week at $75 each. Then the Financial Times heard about me and said they’d also take two a week. All of a sudden, I had a full-time job paying the princely sum of $1,200 a month!

I eventually built up a global syndicate of 40 business publications in ten countries. By 26, I was earning $100,000 a year and published several books. At my peak I accounted for about half of all business news coming out of Japan, along with stringer jobs with the British Broadcasting Corp. in London and NBC in New York.

This was all from a person whose only “C” in college was in English. Officially, I didn’t know how to write back then.

Officially, I still don’t.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader