I am writing this to you from the airport in Vilnius, Lithuania, which is under construction. The airport is packed because people are flying all planes to Paris to catch the closing ceremony of the 2024 Olympics. There is also the inflow of disappointed Taylor Swift fans returning from three concerts in Vienna, Austria that had been canceled due to terrorist threats. Some 150,000 tickets had to be refunded.

It is hard to focus on my writing because every 30 seconds, a beautiful woman walks by.

And I am told at my age I am not supposed to learn. I should know better.

Well, that was some week!

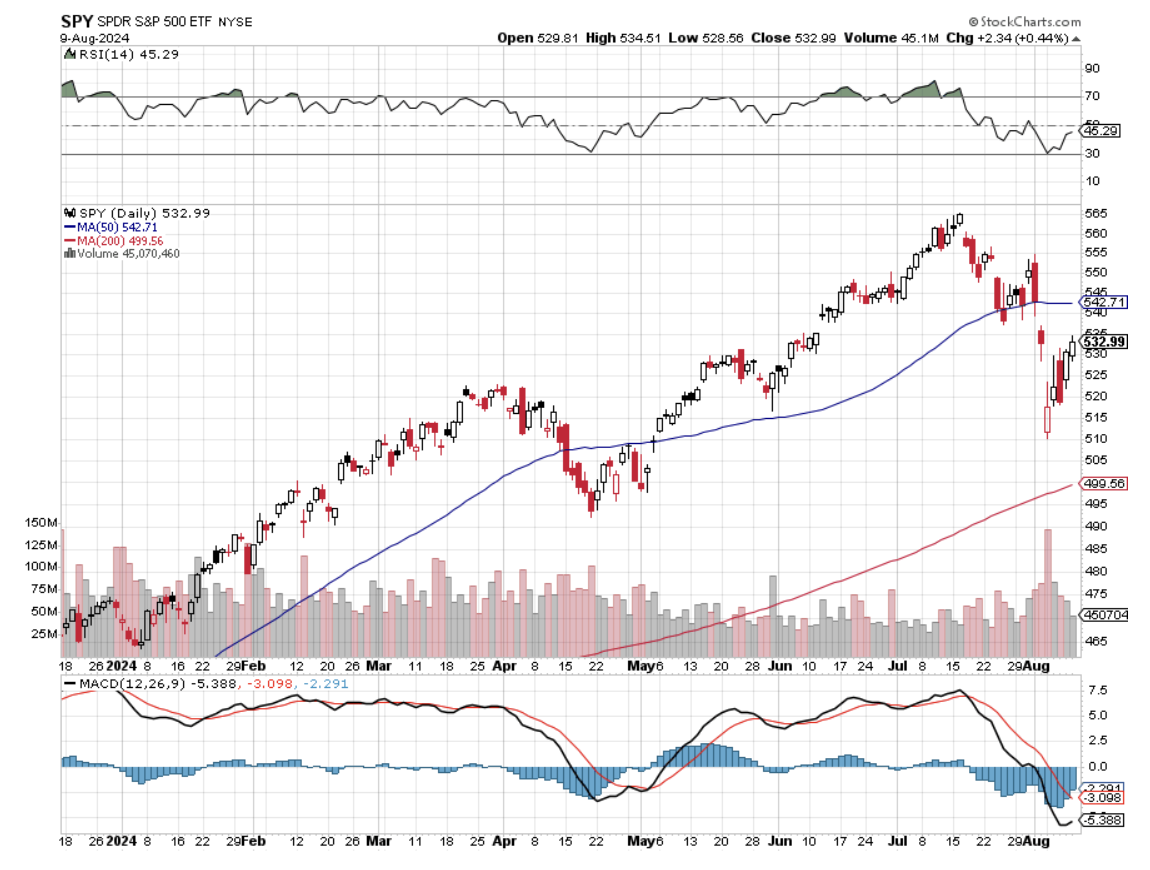

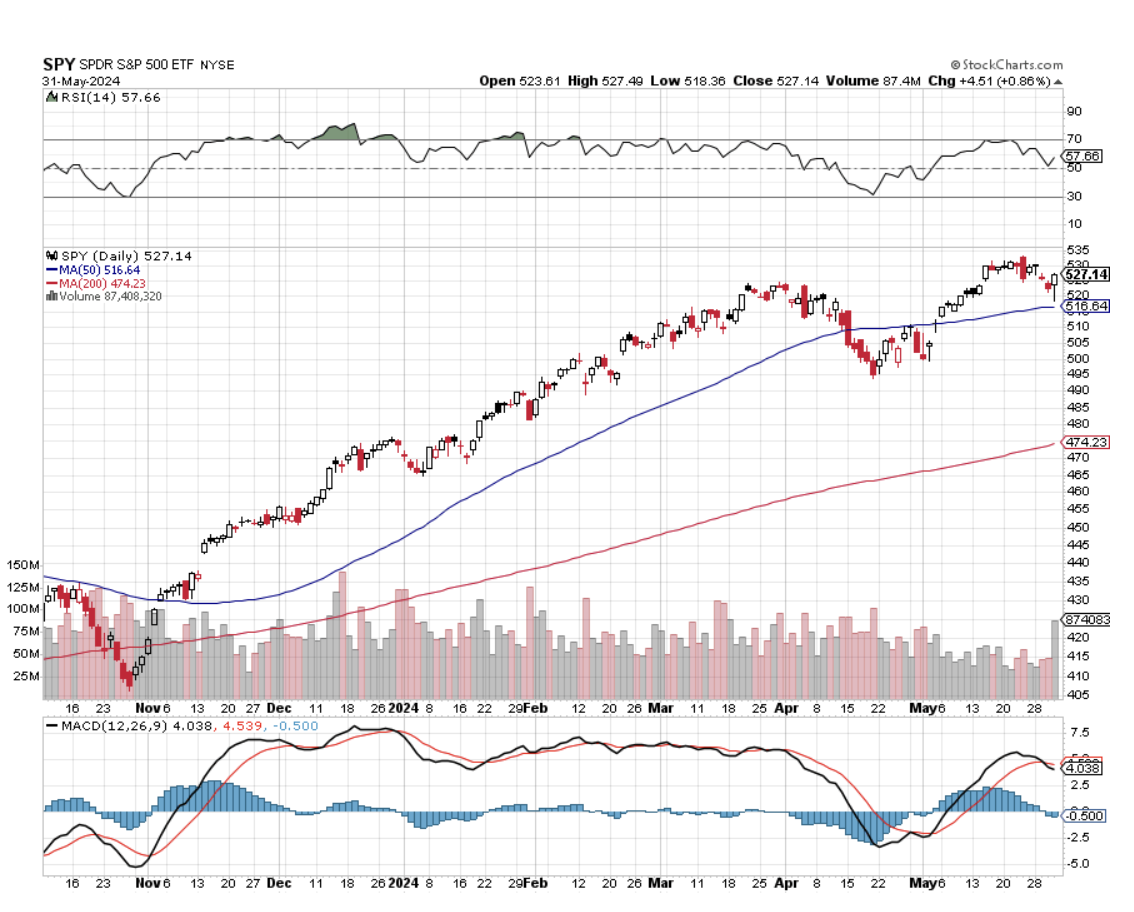

If you had taken a ten-day cruise to Alaska, you would wonder what all the fuss was about, for last week the stock market was basically unchanged. The worst day in two years, down 3%, followed by the best, up 2 ½% amounts to a big fat nothing burger.

It all reminds me of one of those advanced aerobatics classes I used to take. I was busier than a one-armed paper hanger, sending out some 13 trade alerts in all.

And while the volatility is certainly not over, it is probably at least two-thirds over, meaning that we can step out for a cup of coffee and NOT expect a 1,000 move in the Dow Average by the time we get back.

Is the Bottom IN?

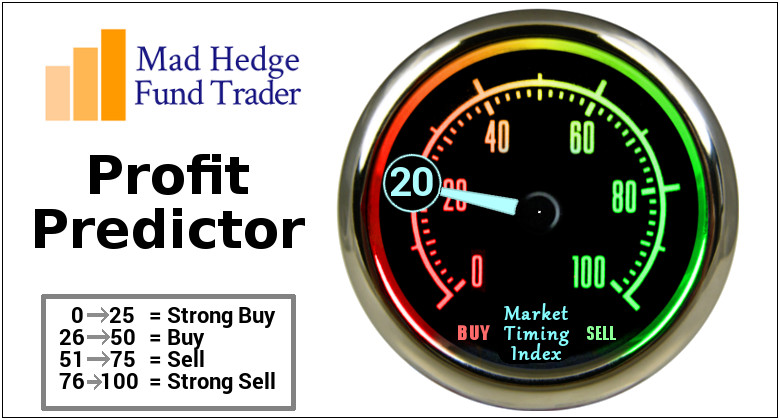

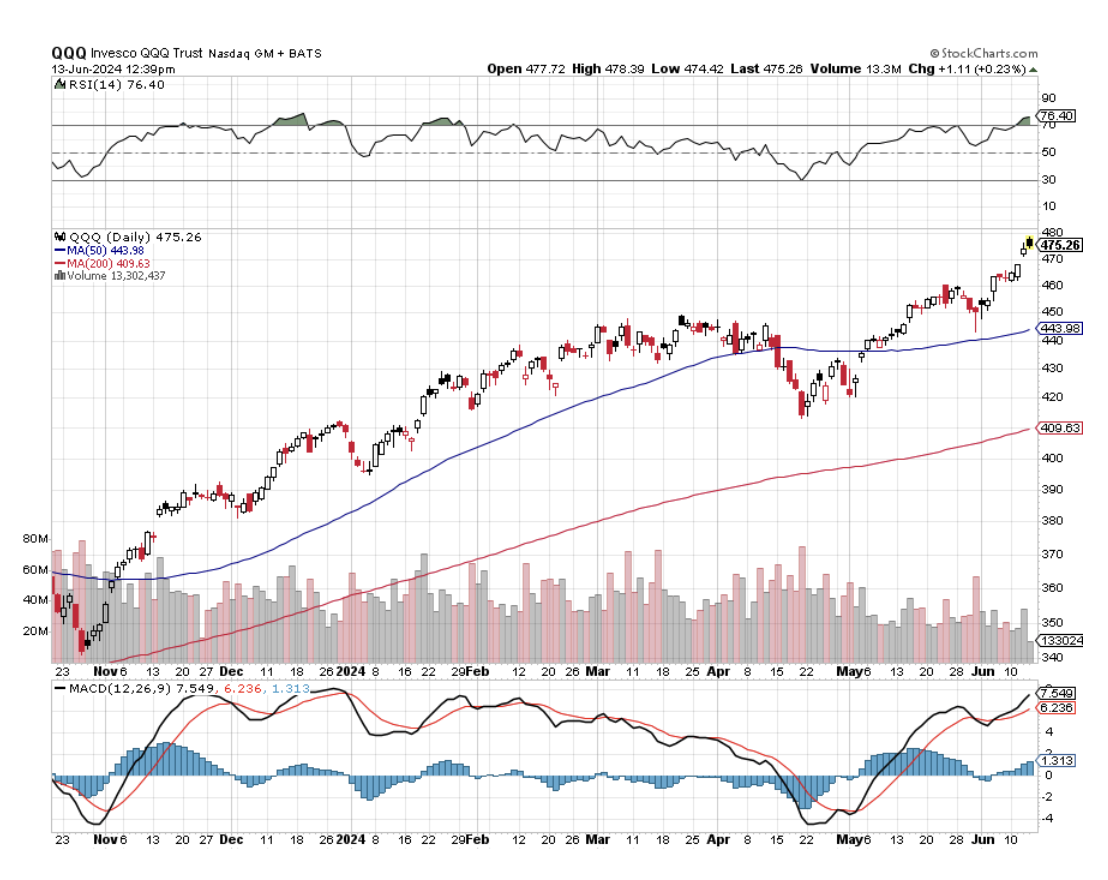

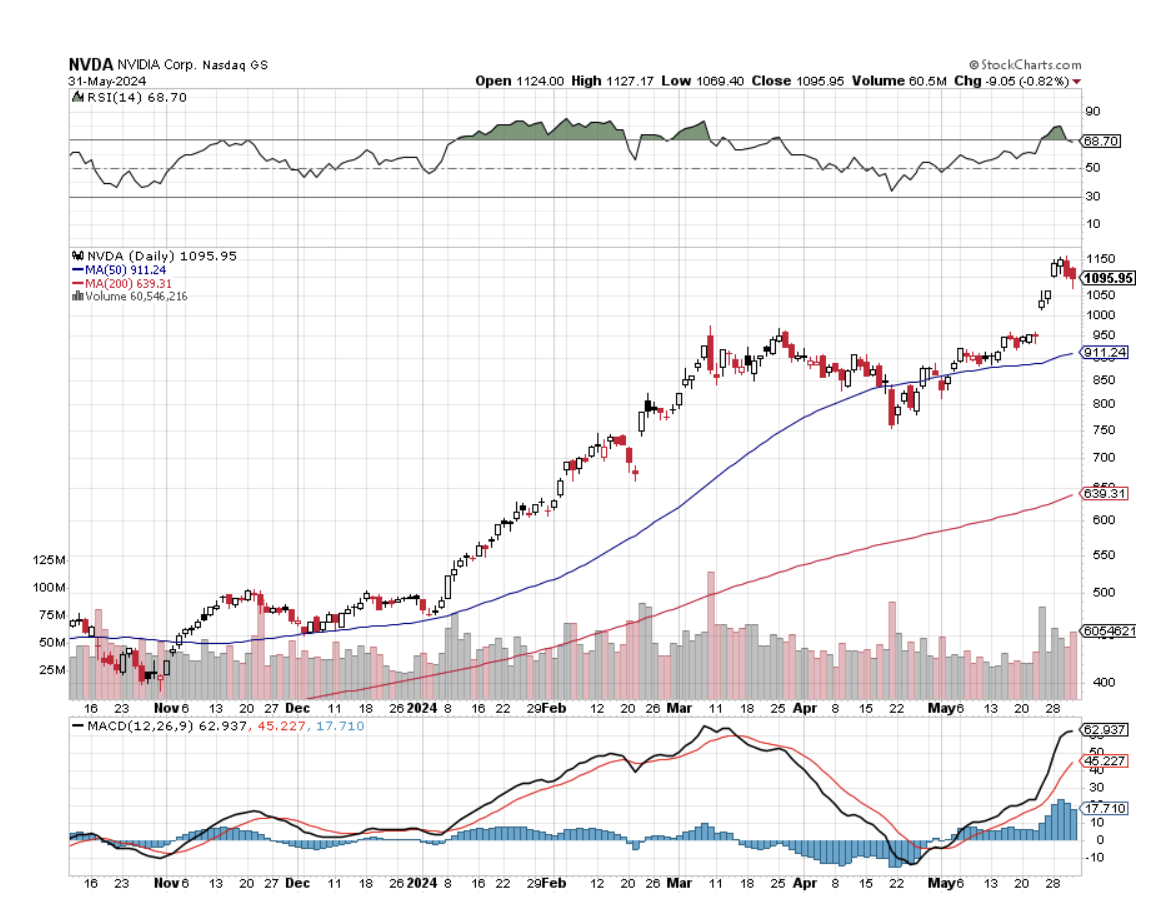

I don’t think so. The valuation disparity between big tech and value is still miles wide. Uncertainty reaches a maximum just before the US presidential election. A bottom for the year is coming, but not quite yet. When it does, it will be the buying opportunity of the year. Watch this space! And watch (ROM) and (TQQQ) too.

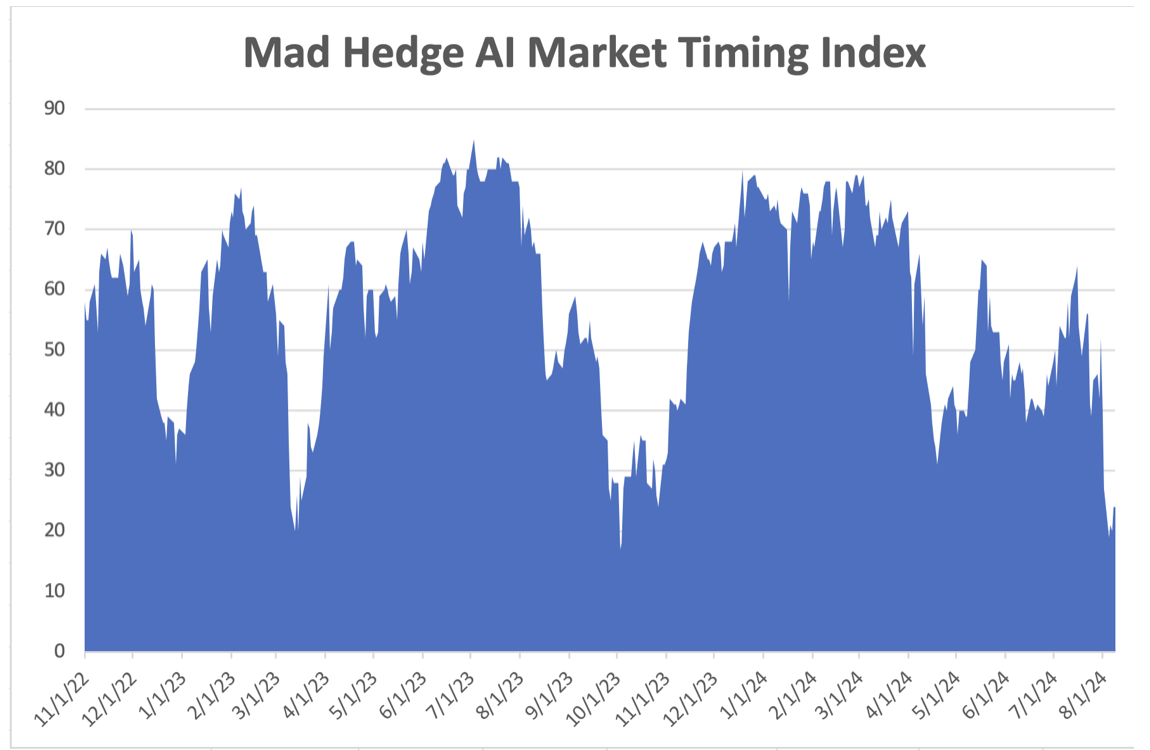

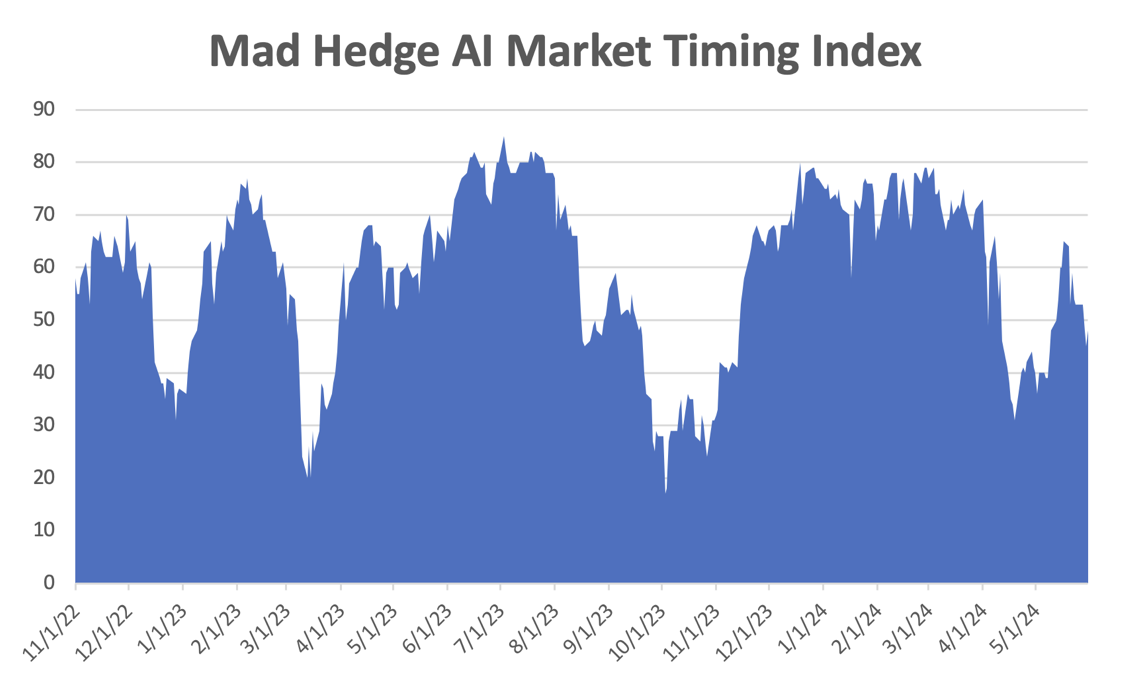

The average drawdown per year since 2020 stands at 15%, so with our 10% haircut, the worst is over. What will remain in high volatility? After staying stuck at $12 for most of 2024 and then spiking to $65 in two days, the $20 handle should remain for the foreseeable future.

That is a dream come true and a license to print money for options traders because the higher options prices effectively double the profit per trade. So, expect a lot of trade alerts from the Mad Hedge Fund Trader going forward. That is, until the ($VIX) returns to $36, then the potential profit triples.

Up until July, I had been concerned that the market might not sell off enough to make a yearend rally worth buying into. There was still $8 trillion in cash sitting under the market buying even the smallest dips.

The Japanese took care of that in a heartbeat with a good old-fashioned financial crisis. In hours trillions of dollars’ worth of yen carry trades unwound, creating an unprecedented 14% move UP in the Japanese currency and a 26% move DOWN in the Japanese stock market.

Suddenly, the world was ending. Or at least the financial media thought it was.

Some hundreds of hedge funds probably went under as their leverage is so great at 10X-20X. But we probably won’t know who until the redemption notices go out at yearend.

It couldn’t happen to a nicer bunch of people.

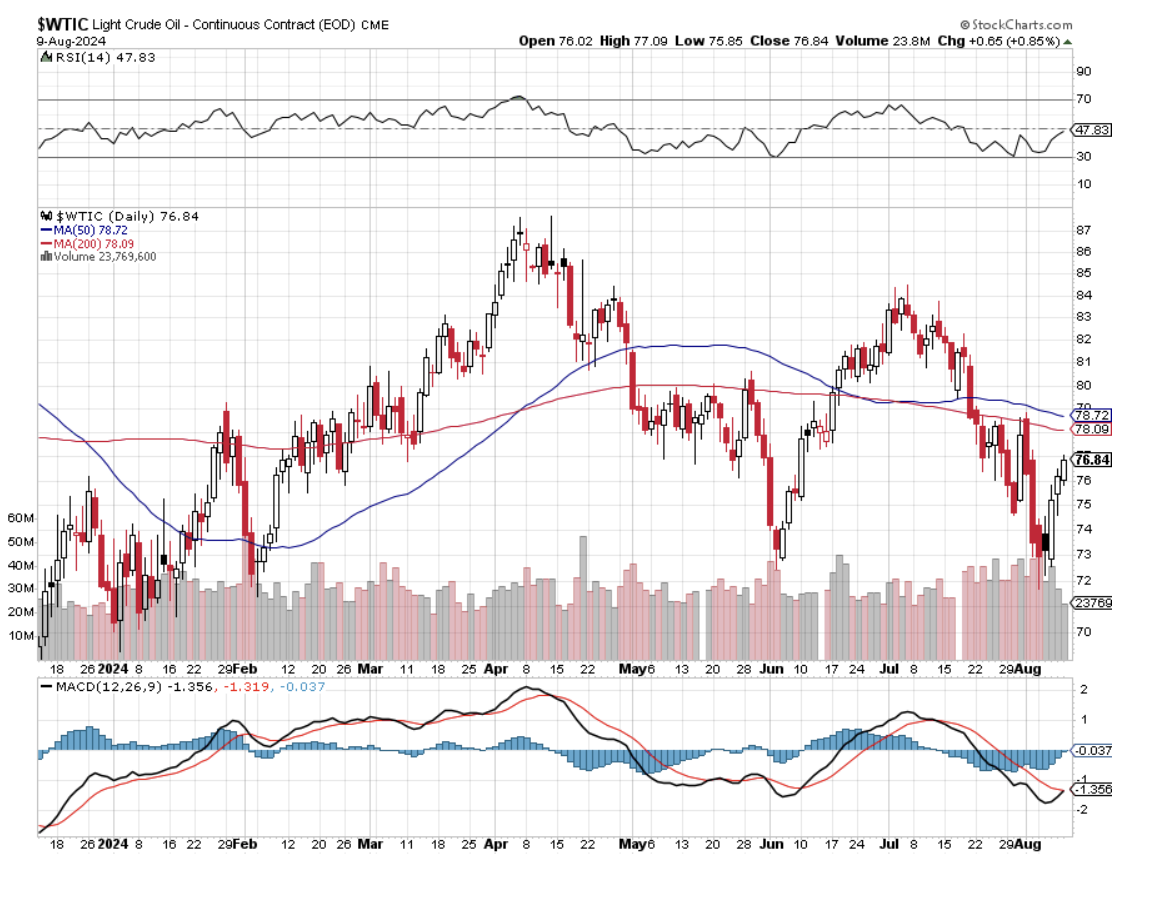

Don’t expect the Fed to take any emergency action, such as a surprise 50 basis point rate cut, to help us out. Things are just not bad enough. The headline Unemployment Rate is still a low 4.3%. Corporate profits are at all-time highs. We are nowhere near a credit crisis or any other threats to the financial system. The US still has the strongest major economy in the world.

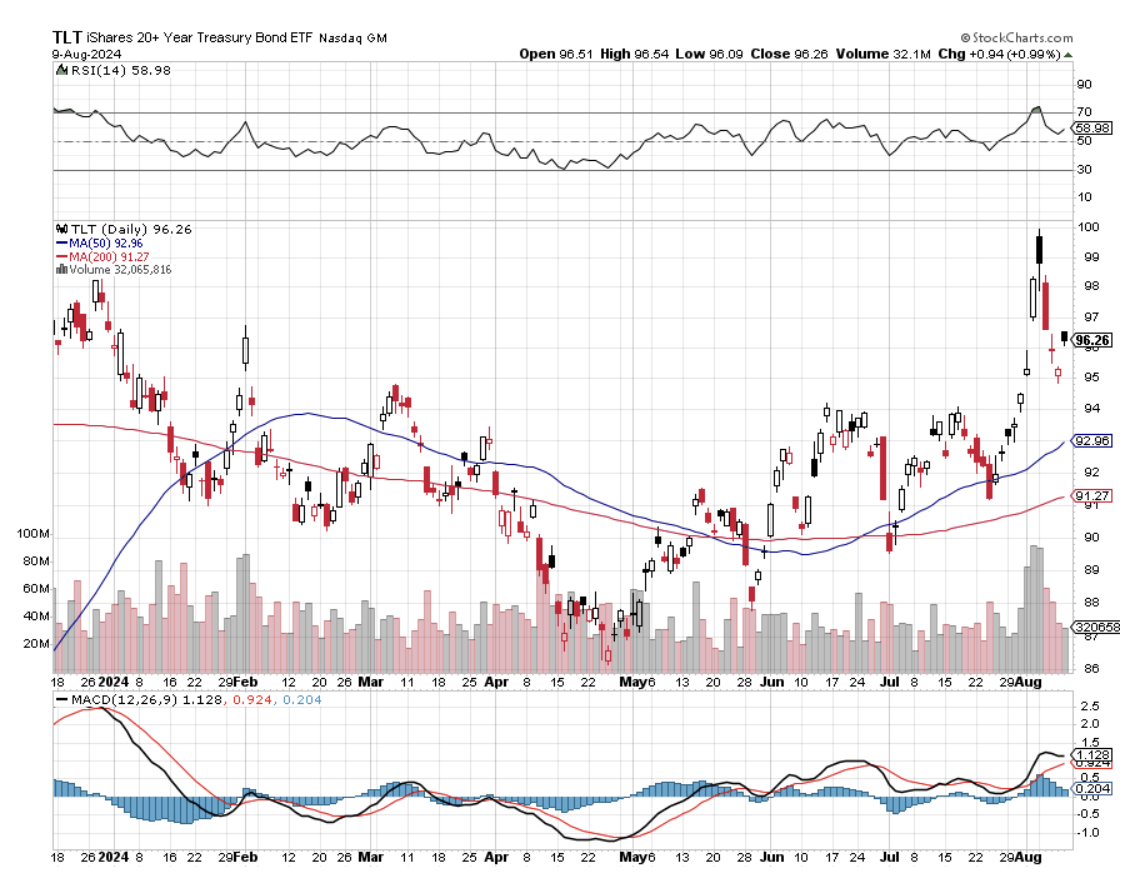

Of course, if you followed my advice and went heavy into falling interest rate plays, as I have been begging you to do for months, last week was your best of the year. The United States US Treasury Bond Fund (TLT) rocketed to a year high at $100. Junk bonds (JNK), REITS (CCI), BB-rated loan ETFs (SLRN), and high-yield stocks (MO) went up even more.

It's still not too late to pile into yield plays because the Fed hasn’t actually cut interest rates YET.

Volatility Index ($VIX) Hits Four-Year High at $65, the most since the 2020 pandemic. That implies a 2% move in the S&P 500 (SPX) every day for the next 30 days, which is $103.42 (SPX) points or $774 Dow ($INDU) points. No doubt, massive short covering played a big role with traders covering shorts they sold in size at $12. Spikes like this are usually great long-term “BUY” signals.

$150 Billion in Volatility Plays were Dumped on Monday. Volatility-linked strategies, including volatility funds and equities trend-following commodity trading advisers (CTAs), are systematic investment strategies that typically buy equities when markets are calm and sell when they grow turbulent. They became heavy sellers of stocks over the last few weeks, exacerbating a market rout brought on by economic worries and the unwind of a massive global carry trade.

Weekly Jobless Claims Drop to 233,000, sparking a 500-point rally in the market. It’s a meaningless report, but traders are now examining every piece of jobs data with a magnifying glass.

Commercial Real Estate Has Bottomed, which will be great news for regional banks. Visitations are up big in Manhattan, with Class “A” properties gaining the most attention. New leasing is now exceeding vacations.

Warren Buffet Now Owns More T-Bills than the Federal Reserve. The Omaha, Nebraska-based conglomerate held $234.6 billion in short-term investments in Treasury bills at the end of the second quarter. That compared with $195.3 billion in T-bills that the Fed owned as of July 31. The Oracle of Omaha wisely unloaded $84 billion worth of Apple at the market top.

No Recession Here says shipping giant Maersk. U.S. inventories are not at a level that is worrisome says CEO Vincent Clerc, as fears of a recession in the world’s largest economy mount. Chinese exports have helped drive overall container demand in the most recent quarter reported a decline in year-on-year underlying profit to $623 million from $1.346 billion in the second quarter and a dip in revenue to $12.77 billion from $12.99 billion.

A Refi Boom is About to Begin. Mortgage rates in the high fives are now on offer. Over 40% of existing mortgages have rates of over 6%. It’s all driven by the monster rally in the bond market this week which took the (TLT) to $100 and ten-year US Treasury yields down to 3.65%.

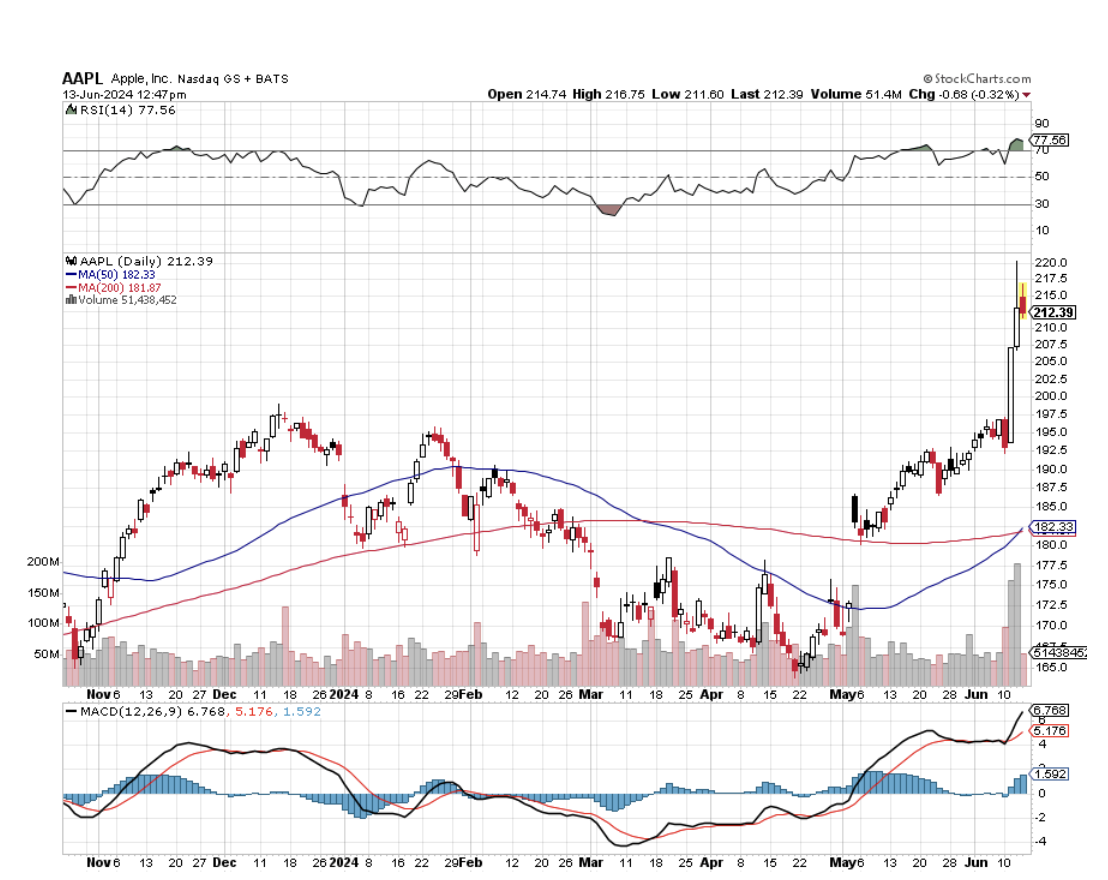

Google (GOOG) Gets Hit with an Antitrust Suit, a Federal judge ruling that the company has a monopoly in search, with a 92% market share. The smoking gun was the $20 billion a year (GOOG) paid Apple (AAPL) to remain their exclusive search engine. Apple is the big loser here, which I just sold short.

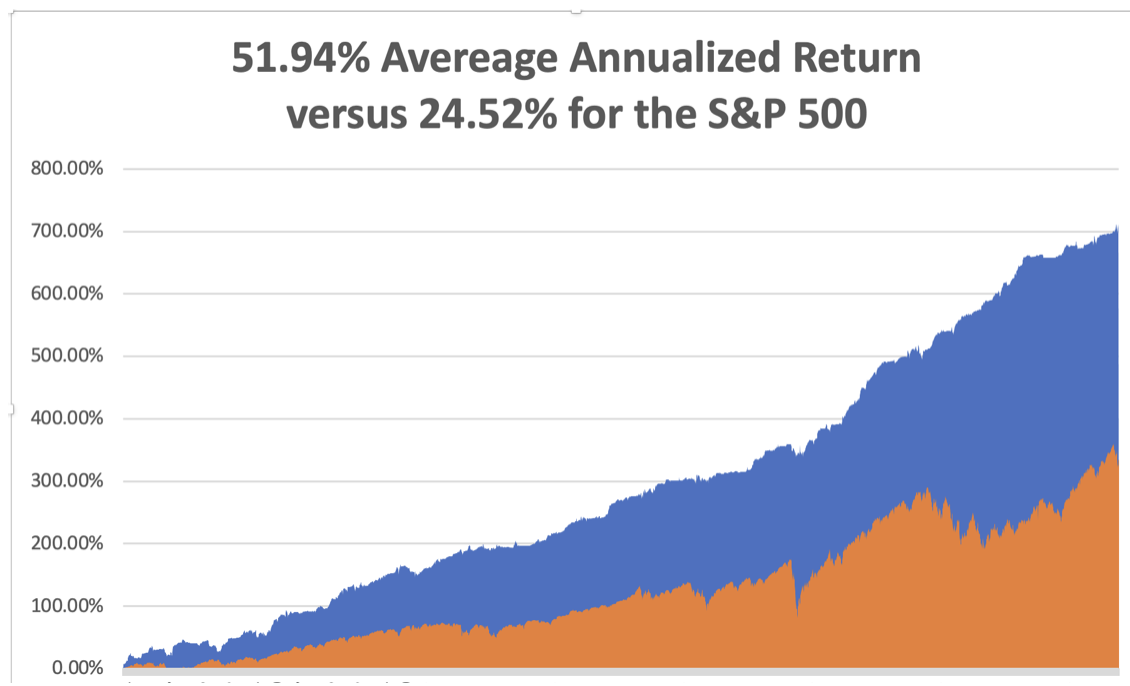

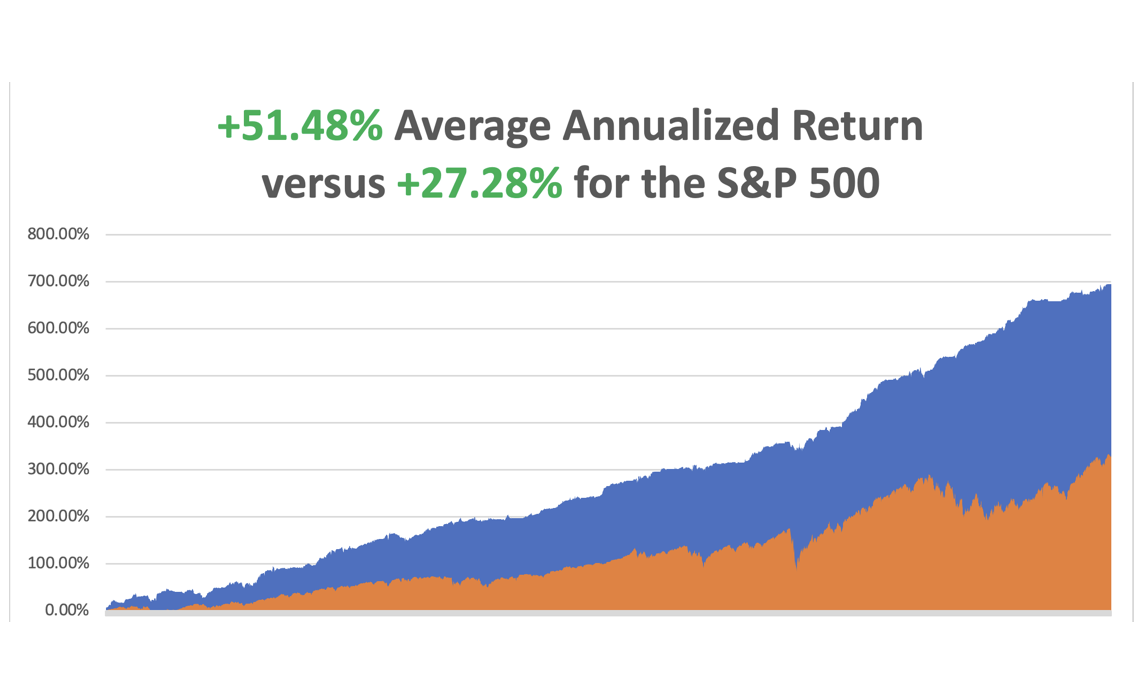

In July we ended up a stratospheric +10.92%. So far in August, we are up by +2.51% My 2024 year-to-date performance is at +33.45%. The S&P 500 (SPY) is up +7.34% so far in 2024. My trailing one-year return reached +51.92.

That brings my 16-year total return to +710.08. My average annualized return has recovered to +51.94%.

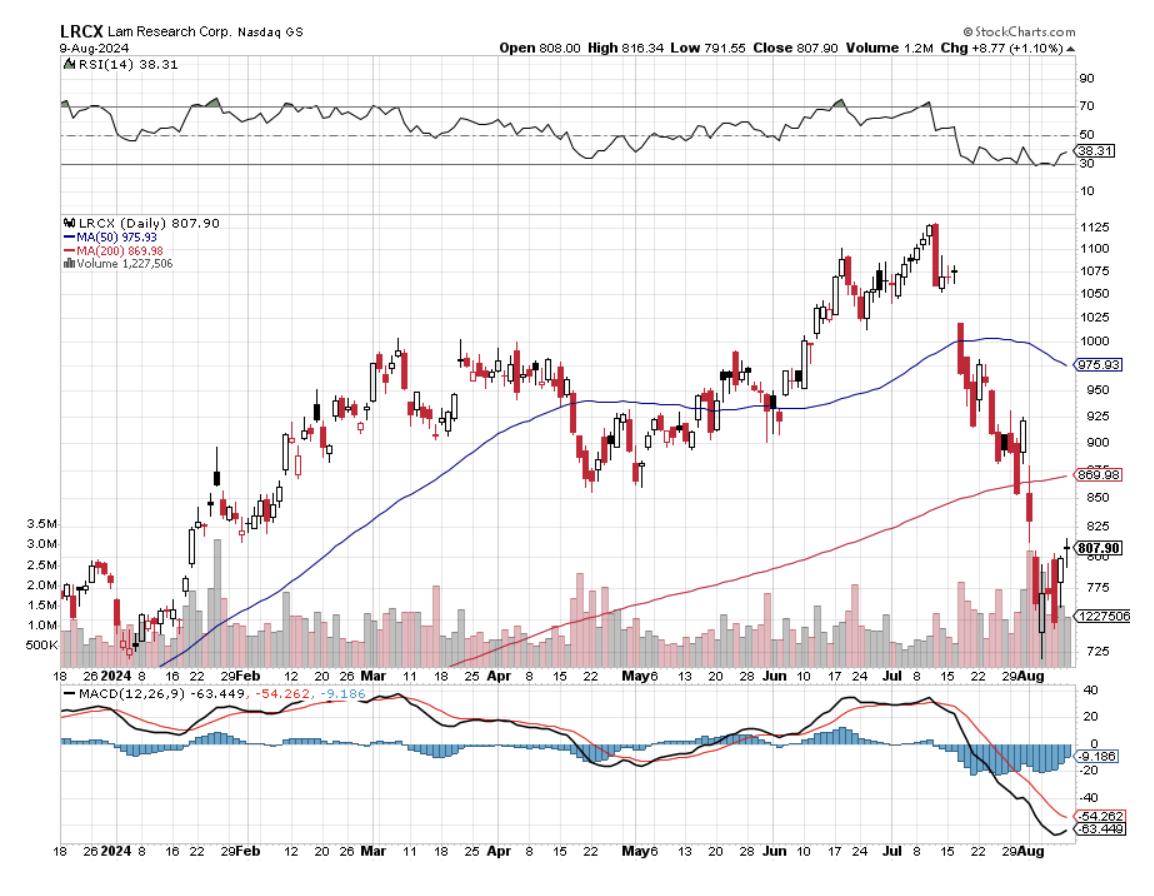

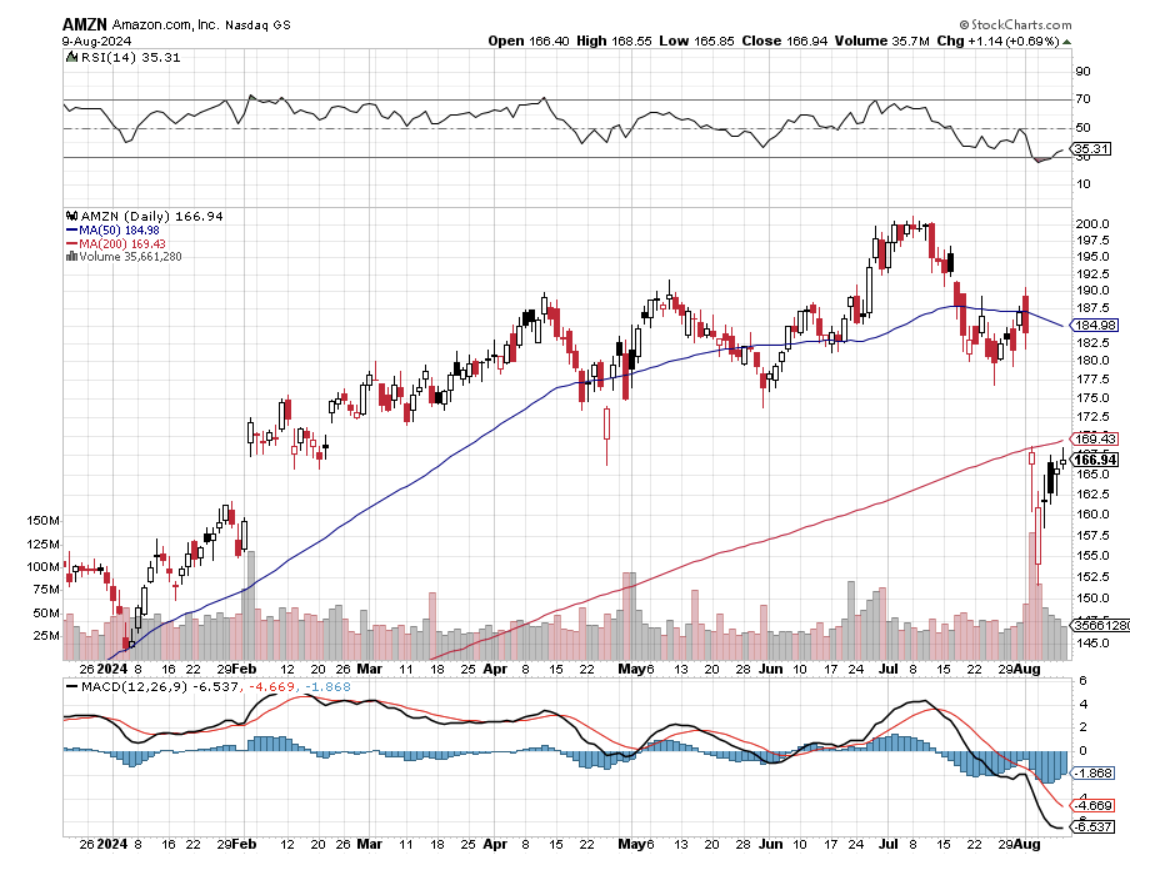

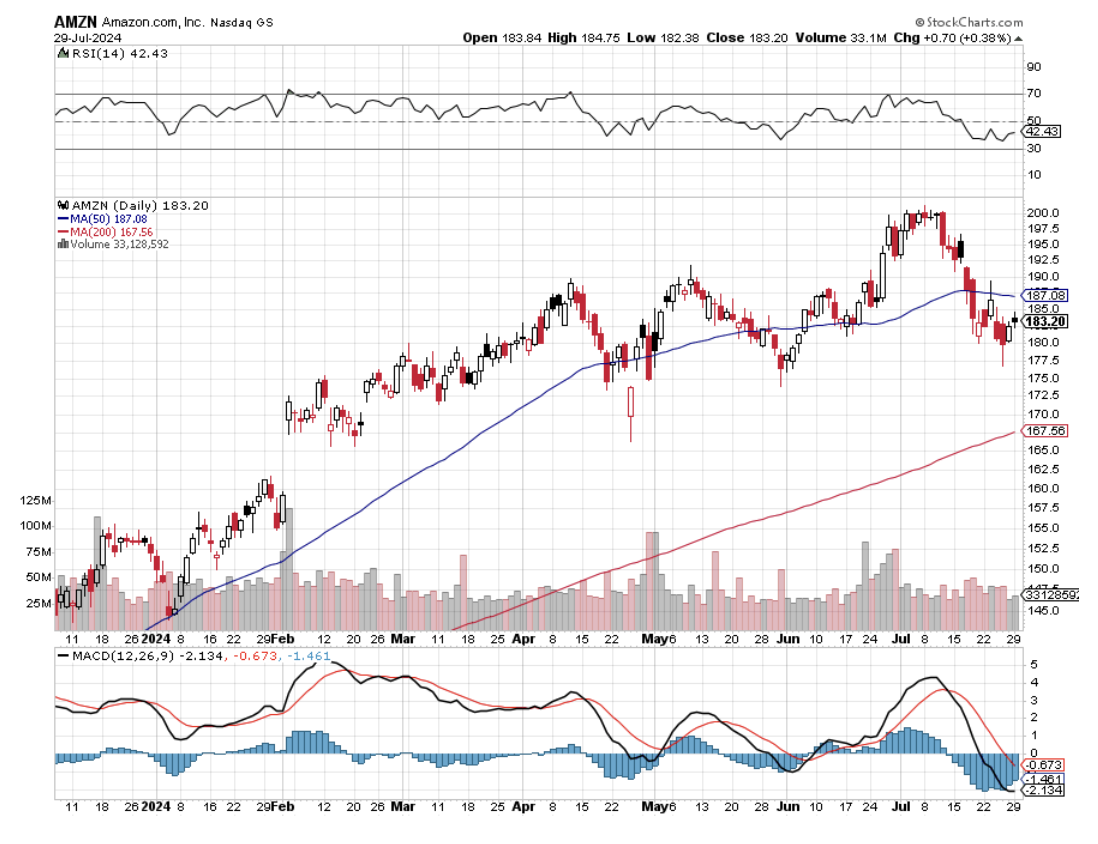

I used the market crash to stop out of three STOP LOSS positions in (CAT), (AMZN), and (BRK/B). When the ($VIX) hit $65 I then made all the losses back when I piled on four new technology longs in (NVDA), (TSLA), (AAPL), and (META). After the Dow Average ($INDU) rallied 2,000 points and volatility was still high I then pumped out short positions in (TSLA), (DHI), (DE), (AAPL), and (JPM). I stopped out of my position in (DE) at breakeven.

This is in addition to existing longs in (GLD) and (DHI), which I will likely run into the August 16 option expiration.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 48 of 66 trades have been profitable so far in 2024, and several of those losses were really break-even. That is a success rate of 72.73%.

If you were wondering why I was sending out so many trade alerts out last week it is because we were getting months’ worth of market action compressed into five days. Make hay while the sun shines and strike while the iron is hot!

Try beating that anywhere.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, August 12 at 8:30 AM EST, the Consumer Inflation Expectations is out.

On Tuesday, August 13 at 9:30 AM, the Producer Price Index is published.

On Wednesday, August 14 at 8:30 AM, the new Core Inflation Rate is printed.

On Thursday, August 15 at 8:30 AM, the Weekly Jobless Claims are announced. Retail Sales are also printed.

On Friday, August 16 at 8:30 AM, Building Permits are disclosed. We also get the University of Michigan Consumer Sentiment. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, with the overwhelming success of the Oppenheimer movie, I thought I’d review my long and fruitful connection with America’s nuclear program.

When the Cold War ended in 1992, the United States judiciously stepped in and bought the collapsing Soviet Union’s entire uranium and plutonium supply.

For good measure, my client George Soros provided a $50 million grant to hire every Soviet nuclear engineer. The fear then was that starving scientists would go to work for Libya, North Korea, or Pakistan, which all had active nuclear programs. They ended up here instead.

That provided the fuel to run all US nuclear power plants and warships for 20 years. That fuel has now run out and chances of a resupply from Russia are zero. The Department of Defense attempted to reopen our last plutonium factory in Amarillo, Texas, a legacy of the Johnson administration.

But the facilities were deemed too old and out of date, and it is cheaper to build a new factory from scratch anyway. What better place to do so than Los Alamos, which has the greatest concentration of nuclear expertise in the world?

Los Alamos is a funny sort of place. It sits at 7,320 feet on a mesa on the edge of an ancient volcano so if things go wrong, they won’t blow up the rest of the state. The homes are mid-century modern built when defense budgets were essentially unlimited. As a prime target in a nuclear war, there are said to be miles of secret underground tunnels hacked out of solid rock.

You need to bring a Geiger counter to garage sales because sometimes interesting items are work castaways. A friend almost bought a cool coffee table which turned out to be part of an old cyclotron. And for a town designing the instruments to bring on the possible end of the world, it seems to have an abnormal number of churches. They’re everywhere.

I have hundreds of stories from the old nuclear days passed down from those who worked for J. Robert Oppenheimer and General Leslie Groves, who ran the Manhattan Project in the early 1940s. They were young mathematicians, physicists, and engineers at the time, in their 20’s and 30’s, who later became my university professors. The A-bomb was the most important event of their lives.

Unfortunately, I couldn’t relay this precious unwritten history to anyone without a security clearance. So, it stayed buried with me for a half century, until now.

Some 1,200 engineers will be hired for the first phase of the new plutonium plant, which I got a chance to see. That will create challenges for a town of 13,000 where existing housing shortages already force interns and graduate students to live in tents. It gets cold at night and dropped to 13 degrees F when I was there.

I was allowed to visit the Trinity site at the White Sands Missile Test Range, the first visitor to do so in many years. This is where the first atomic bomb was exploded on July 16, 1945. The 20-kiloton explosion set off burglar alarms for 200 miles and was double to ten times the expected yield.

Enormous targets hundreds of yards away were thrown about like toys (they are still there). Half the scientists thought the bomb might ignite the atmosphere and destroy the world but they went ahead anyway because so much money had been spent, 3% of US GDP for four years. Of the original 100-foot tower, only a tiny stump of concrete is left (picture below).

With the other visitors, there was a carnival atmosphere as people worked so hard to get there. My Army escort never left me out of their sight. Some 78 years after the explosion, the background radiation was ten times normal, so I couldn’t stay more than an hour.

Needless to say, that makes uranium plays like Cameco (CCJ), NextGen Energy (NXE), Uranium Energy (UEC), and Energy Fuels (UUUU) great long-term plays, as prices will almost certainly rise and all of which look cheap. US government demand for uranium and yellow cake, its commercial byproduct, is going to be huge. Uranium is also being touted as a carbon-free energy source needed to replace oil.

At Ground Zero in 1945

What’s Left of a Trinity Target 200 Yards Out

Playing With My Geiger Counter

Atomic Bomb No.3 Which was Never Used on Tokyo

What’s Left from the Original Test

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader