Mad Hedge Technology Letter

August 28, 2018

Fiat Lux

Featured Trade:

(SPOTIFY STILL HAS SOME UPSIDE),

(SPOT), (AMZN), (AAPL), (P)

Mad Hedge Technology Letter

August 28, 2018

Fiat Lux

Featured Trade:

(SPOTIFY STILL HAS SOME UPSIDE),

(SPOT), (AMZN), (AAPL), (P)

Investors sulking about Spotify’s (SPOT) inability to make money do not get the point.

Yes, the job of every company to be in the black, but the No. 1 responsibility for a modern tech company is to grow, and grow fast.

Tech investors pay for growth, period.

As investors have seen from Netflix, companies can always raise prices after seizing market share because of the stranglehold on eyeballs inside a walled garden.

That potent formula has been the bread and butter of powerful tech companies of late.

Spotify is a captive of the music industry, of which it is entirely dependent for its source of goods, in this case songs.

At the same time, the music industry has fought tooth and nail to destroy the likes of Spotify, which benefits immensely from distributing the content it creates.

History is littered with failed music streaming services outgunned in the courtroom. Pandora (P) is the biggest public name out there whose share price has tanked over the long haul.

The music industry will battle relentlessly to exterminate Spotify and force up the royalties these Internet giants must pay as their main input.

But that does not mean Spotify is a bad company or even a bad stock.

Every company has its share of pitfalls. Throw in the mix that Amazon (AMZN) and Apple (AAPL) have music streaming services that do not even need to make a profit, and you will understand why some might be wary about putting new money to work in music streaming business stocks.

The primary reason that Spotify shares will outperform for the foreseeable future is because it is the preeminent music streaming platform.

Also, there is favorable latitude to make way toward the goal of monetization, and ample space to improve gross margins.

Global streaming revenue growth has gone ballistic as the migration to mobile and cord cutting has exacerbated the monetization prospects of the music industry.

Streaming revenue was a shade under $2 billion in 2013, and continued to post a growth trajectory of more than 40% each year since.

As it stands now, total global streaming revenue registered just a tick under $7 billion per year in 2017, and that was an improvement of 41.1% from 2016.

There are no signs of yielding as more avid music fans push into the music streaming space.

Social media platforms have helped publicize popular artists’ content.

Music is effectively a strong part of youth culture, which will eventually see the youth integrate a music streaming app into their daily lives for the rest of their adult lives.

The choice among choices is Spotify in 2018.

The company was dogged by many years of famous artists removing their proprietary content from the platform citing unfavorable terms.

A prime example was in 2009 when Lady Gaga’s hit song “Poker Face” only received $167 in royalty payments from Spotify for the first million streams. This highlighted the rock-solid position Spotify has curated inside the music industry.

Individual artists’ fight against Spotify has been dead on arrival from the outset, but the benefits and exposure from cooperating with the company far outweigh the drawbacks.

Eventually, almost all artists have relented and reinstalled their music on Spotify. They depend on alternative moneymaking avenues to compensate for lack of royalties, which is mainly live music.

That is why it costs an arm and a leg to go see Taylor Swift in living flesh now, and why those summer festivals dotted around America such as Coachella command premium ticket prices.

How does Spotify make money?

It earns its crust of bread through paid subscriptions but lures in eyeballs using an ad-supported free version of its platform.

Naturally, the paid version is ad-less, and this subscription is around $5 to $15 per month.

In the second quarter, Spotify’s paid subscription volume surpassed 83 million, a sharp uptick of 40% YOY.

Ad-supported users came in at more than 101 million, even under the damage that General Data Protection Regulation (GDPR) did to western tech companies.

The ad-supported subscribers rose 23% YOY, and the paid version expects between 85 million to 88 million paid subscribers in the third quarter.

Many of the new paid subscribers are converts from its free model.

Spotify is poised to increase revenue between 20%-30% for the rest of the year.

The rise of Spotify's developing data division could extract an additional $580 million of revenue in 2023, making up 2% of total revenue.

Remember that Spotify’s reference price set by the New York Stock Exchange (NYSE) was $132 in April 2018. The parabolic move in the stock on the verge of eclipsing $200 undergirds the demand for high-quality tech companies.

When Spotify did go public, the robust price action was with conviction, making major investors - such as China’s Tencent, which possess a 9.1% stake and Tiger Global Management, which owns 7.2% - happy stakeholders.

In the last quarter’s earnings report, Spotify CFO Barry McCarthy reiterated the company’s goal to push gross margins from the mid-20% range to “gross margins in the 30% to 35% range.”

A jump in gross margins would go a long way in making Spotify appear more profitable, and that is the imminent goal right now.

The path to real profitability is still a long way down the road and small victories will offer short-term strength to the share price.

If Spotify can retrace to around the $185, that would serve as a perfect entry point into a stock that has given investors few chances in which to participate.

July and August have only offered meager entry points into this stock, one around the $180 level in August, and another around $170 in July.

Spotify enjoyed a great first day of being public after its unorthodox IPO ending the day at $149. The momentum has continued unabated while Spotify has posted all the growth targets investors come to expect from companies of this ilk.

Bask in the glow of the growth sweet spot Spotify finds itself in right now.

The long-term narrative of this stock is intact for a joyous ride upward, and only whispers of Amazon and Apple meaningfully attempting to monetize this segment could derail it.

For the time being, the music part of Amazon and Apple are just a side business. They have other priorities, such as Apple’s battle to avoid being exterminated from communist China, and Amazon’s integration of Whole Foods and new-fangled digital ad business.

________________________________________________________________________________________________

Quote of the Day

“Ever since Napster, I’ve dreamt of building a product similar to Spotify,” – said cofounder and CEO of Spotify Daniel Ek.

Global Market Comments

August 27, 2018

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD),

(AAPL), (TLT), (SPY),

(BIDDING MORE FOR THE STARS),

(SPY), (INDU), (AAPL), (AMZN)

The stock market has turned into the real estate market, where everyone is afraid to sell their shares for fear of being unable to find a replacement. Will it next turn into the Bitcoin market?

Risk assets everywhere are now facing a good news glut.

My 2019 market top target of 28,000 for the Dow Average is rushing forward with reckless abandon.

Today's price action really gives you the feeling of an approaching short-term blow-off market top.

A few years ago, I went to a charity fundraiser at San Francisco's priciest jewelry store, Shreve & Co., where the well-heeled men bid for dates with the local high society beauties, dripping in diamonds and Channel No. 5.

Amply fueled with champagne, I jumped into a spirited bidding war over one of the Bay Area's premier hotties, whom shall remain nameless. Suffice to say, she is now married to a tech titan and has a sports stadium named after her.

Obviously, I didn't work hard enough.

The bids soared to $23,000, $24,000, $25,000.

After all, it was for a good cause. But when it hit $26,000, I suddenly developed a severe case of lockjaw.

Later, the sheepish winner with a severe case of buyer’s remorse came to me and offered his date back to me for $24,000. I said, “No thanks.” He then implored, “$23,000, $22,000, $21,000?"

I passed.

The altitude of the stock market right now reminds me of that evening.

If you rode the S&P 500 (SPX) from 667 to 2,790 and the Dow Average (INDU) from 7,000 to 25,790, why sweat trying to eke out a few more basis points, especially when the risk/reward ratio sucks so badly, as it does now?

Here we are eight months into the year, and my top picks for the year have gone ballistic. Amazon (AMZN) has doubled off its February low of $1,000, and Apple (AAPL) shares have soared from $150 to $217. Today, an analyst raised his forecast to $245.

As my late mentor, Morgan Stanley’s Barton Biggs, always used to tell me, “Always leave the last 10% for the next guy.”

I realize that many of you are not hedge fund managers, and that running a prop desk, mutual fund, 401k, pension fund, or day trading account has its own demands.

But let me quote what my favorite Chinese general, Deng Xiaoping, once told me: "There is a time to fish, and a time to hang your nets out to dry.

You don't have to chase every trade.

At least then I'll have plenty of dry powder for when the window of opportunity reopens for business. So, while I'm mending my nets, I'll be building new lists of trades for you to strap on when the sun, moon, and stars align once again.

Mad Hedge Technology Letter

August 27, 2018

Fiat Lux

Featured Trade:

(WHY ALIBABA IS THE FIRST STOCK TO BUY WITH THE OUTBREAK OF TRADE PEACE),

(BABA), (GOOGL), (AMZN), (YELP), (MSFT), (MU), (ZTE), (HUAWEI)

According to the government agency, China Internet Network Information Center, the Chinese Internet community has surpassed 802 million, which only represents a 57.7% penetration rate, miles behind the 89% penetration rate in America.

The gargantuan scale of the Chinese Internet world means China has three times as many Internet users than America, and this is a big deal.

The additional 30 million added to the Chinese Internet ecosphere in the first half of 2018 shows the scale in which local Chinese tech companies are playing with and use to their clear-cut advantage.

Ostensibly, most business strategies in China revolve around scaled tactics as the backbone to operations.

There is even more room to expand in the Middle Kingdom and one clear victor sits atop the parapet looking at the riffraff below and that is Chinese Internet conglomerate Alibaba (BABA).

Alibaba, led by Chinese Internet pioneer Jack Ma, posted its highest-performing growth quarter in the past four years.

Total quarterly revenue ballooned an incredible 61% YOY to $11.8 billion, highlighting the dominant position Alibaba possesses in the Chinese e-commerce landscape.

If you want to know what Amazon (AMZN) is going to do next watch Alibaba.

Profit margins were somewhat sacrificed in the process because of M&A activity that saw Alibaba move into the physical supermarket business snapping up 35 Hema supermarket locations then reinvesting into the business. Echoes of Whole Foods?

Alibaba did not stop there, funneling another $3 billion into food delivery app ele.me, which plans to merge its operations with Yelp (YELP) lookalike app Koubei.

If you thought Silicon Valley moves at a rapid pace, the Chinese Internet space moves faster than lighting.

Alibaba last year dipped into the retail segment as well pocketing a department store chain with 29 stores along with 17 shopping malls.

Alibaba is the closest replica the world has to Amazon and thus is an ideal barometer of the health of the overall Chinese consumer and a peek under the complicated hood that is the Chinese economy.

Alibaba also provides onlookers at how China and its Internet behemoths are coping with the global trading war that has invaded the news headlines from its outset.

The short answer to all this is that China is coping quite well and by no means is ready to back down.

Indeed, there will be peripheral pressures exerted from the fringes, but the core engines remain intact and Chairman Xi can fall asleep in his Beijing abode more than peacefully.

A reason for the stalemate between the two governments is that both are quietly confident they have the levers in place to absorb whatever Molotov cocktails the other has to throw at them.

Investors would be mad to dismiss China’s capabilities after experiencing a mesmerizing economic rise enriching hundreds of millions of Chinese nationals that can be found comfortably living in western megacities in luxury real estate often with a real estate portfolio dotted around the world.

Alibaba’s management made it known on the earnings report that it is not worried much about the trade war because it is largely focused on the domestic Chinese consumer, which has been one of the best economic stories of the past decade.

The overseas expansion unfolding under Alibaba’s tutelage is away from the western world and predominantly focused on Southeast Asia and Eastern Europe where cheap, value-for-money hardware and software allows citizens at these income levels to participate in the e-commerce game.

These individuals can’t afford iPhones on a salary of peanuts. And Alibaba has targeted the undeveloped world as a potential lever of substantial growth.

The regulatory harshness of the west has shut out Huawei and ZTE from its shores. Australia followed suit as well, banning the two telecom companies even though it enjoys a better relationship with Beijing than Europe or North America.

China has already planned a workaround because the engines driving the Chinese tech miracle are semiconductor companies such as Micron (MU), which sells boatloads of DRAM memory chips to Chinese tech companies that flood the world with smartphones and other gadgets.

Beijing has already formulated a plan to circumvent American chips by tapping Korean, European, and Japanese chips to replace the current American supply that could vanish at any time.

Shenzhen-based chip company HiSilicon fully owned by Huawei is responsible for supplying Huawei with chips and is the biggest local designer of integrated circuits in China.

This is what the future of China looks like when China can finally build up the adequate supply necessary to achieve its plans to dominate global technology, America, and the world.

But the plan is still in the process of playing out. The awkwardness was highly visible when the administration’s ban of selling U.S. manufactured components to telecommunications company ZTE resulted in the company almost shutting down until a last-second change of heart by the administration.

The near-death experience will invigorate ZTE to muster its own local supply of chips to avoid the unreliable foreign supply and a deja vu feeling.

American chip companies won’t be able to enjoy the Chinese market for long as all these negative experiences for Chinese companies has forced Chinese tech companies to search and secure a guaranteed chip supply.

At the same time, Chinese local smartphone players have gone from 0 to 60 in no time with companies that barely existed a few years ago, such as Oppo, Vivo coming into the fore along with Huawei picking up 43% of the global smartphone market.

This is bad news for Apple as local competitors are learning fast and furious how to build premium smartphones via re-engineering the current technology or through forced technology transfers.

These companies subsequently offer these phones at the lowest possible price point. And at some point in the near future Apple could be expendable if Chinese smartphones start to display the type of quality the best phones show.

Chinese domestic consumption and investment comprise 90% of the GDP growth in China and are propped up by three robust trends including real wage growth boosting the middle-class population, high savings rate that of which Americans would be jealous, and easy access to credit vehicles.

When I was recently in the Middle Kingdom, it was highly evident that as the generations became younger, their quality of life was higher than their parents.

The opposite is happening in America with millennials earning demonstrably less than their parents’ generation while the American middle class is shrinking at an accelerated pace.

Beijing knows this and hopes to wait things out as it feels time is a positive variable for China and not America.

It is true that if this trade war took place in 20 years in the future, China would be in a stronger strategic position to extract whatever concessions it desires because even though Chinese growth is slowing, it is still growing at 6.5%.

And if you don’t believe what I just said then just look at Alibaba’s cloud division, which grew 93% YOY opening artificial intelligence-based data centers around Europe to battle Amazon (AMZN) and Microsoft (MSFT).

Europe was once Elysian Fields for American tech companies, but with European regulators going after American tech and China encroaching on European turf, the future looks a lot less certain for the FANGs there than ever before.

Alibaba’s operating margins dipped 10% YOY but the slide will be returned to shareholders in the future in the form of high-quality revenue and is worth the investment into the most innovative ideas of tomorrow.

I did not even mention the large stake Alibaba has in Ant Financial, which operates the ubiquitous digital payment app Alipay.

It would be analogous to Amazon if it owned Visa.

Alibaba is one of the best tech companies in the world headed by a former Chinese English language teacher in Hangzhou.

If America becomes too difficult or expensive with which to do business, Alibaba and Chinese tech will just recalibrate their strategy to deeper infiltrate the confines of Southeast Asia and the rest of the undeveloped world.

Any price war on undeveloped soil favors the Chinese as they have mastered scale better than anyone on the planet.

The stellar Alibaba numbers also mean the trade war has no end in sight as each player thinks they have the upper hand. But it also means the tech giants from both countries will come out unscathed and will lead their country’s respective equity markets higher for the foreseeable future.

________________________________________________________________________________________________

Quote of the Day

“Technology is nothing. What's important is that you have a faith in people, that they're basically good and smart, and if you give them tools, they'll do wonderful things with them,” – said Apple cofounder and former CEO Steve Jobs.

Global Market Comments

August 24, 2018

Fiat Lux

Featured Trade:

(AUGUST 22 BIWEEKLY STRATEGY WEBINAR Q&A),

(BIDU), (BABA), (VIX), (EEM), (SPY), (GLD), (GDX), (BITCOIN),

(SQM), (HD), (TBT), (JWN), (AMZN), (USO), (NFLX), (PIN),

(TAKING A BITE OUT OF STEALTH INFLATION)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader August 22 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader.

As usual, every asset class long and short was covered. You are certainly an inquisitive lot, and keep those questions coming!

Q: How do you think the trade talks will resolve?

A: There will be no resolution this next round of trade talks. China has sent only their most hawkish negotiators who believe that China has done nothing wrong, so don’t expect results any time soon.

Also, because of the arrests in Washington, China is more inclined to just wait out Donald Trump, whether that’s 6 months or 6 1/2 years. They believe they have the upper hand now, sensing weakness in Washington, and in any case, many of the American requests are ridiculous.

Trade talks will likely overhang the market for the rest of this year and you don’t want to go running back into those China Tech plays, like Alibaba (BABA) and Baidu (BIDU) too soon. However, they are offering fantastic value at these levels.

Q: Will the Washington political storm bring down the market?

A: No, it won’t. Even in the case of impeachment, all that will happen is the market will stall and go sideways for a while until it’s over. The market went straight up during the Clinton impeachment, but that was during the tail end of the Dotcom Boom.

Q: Is Alibaba oversold here at 177?

A: Absolutely, it is a great buy. There is a double in this stock over the long term. But, be prepared for more volatility until the trade wars end, especially with China, which could be quite some time.

Q: What would you do with the Volatility Index (VIX) now?

A: Buy at 11 and buy more at 10. It’s a great hedge against your existing long portfolio. It’s at $12 right now.

Q: Are the emerging markets (EEM) a place to be again right now or do you see more carnage?

A: I see more carnage. As long as the dollar is strong, U.S. interest rates are rising, and we have trade wars, the worst victims of all of that are emerging markets as you can see in the charts. Anything emerging market, whether you’re looking at the stocks, bonds or currency, has been a disaster.

Q: Is it time to go short or neutral in the S&P 500 (SPY)?

A: Keep a minimal long just so you have some participation if the slow-motion melt-up continues, but that is it. I’m keeping risks to a minimum now. I only really have one position to prove that I’m not dead or retired. If it were up to me I’d be 100% cash right now.

Q: Would you buy Bitcoin here around $6,500?

A: No, I would not. There still is a 50/50 chance that Bitcoin goes to zero. It’s looking more and more like a Ponzi scheme every day. If we do break the $6,000 level again, look for $4,000 very quickly. Overall, there are too many better fish to fry.

Q: Is it time to buy gold (GLD) and gold miners (GDX)?

A: No, as long as the U.S. is raising interest rates, you don’t want to go anywhere near the precious metals. No yield plays do well in the current environment, and gold is part of that.

Q: What do you think about Lithium?

A: Lithium has been dragged down all year, just like the rest of the commodities. You would think that with rising electric car production around the world, and with Tesla building a second Gigafactory in Nevada, there would be a high demand for Lithium.

But, it turns out Lithium is not that rare; it’s actually one of the most common elements in the world. What is rare is cheap labor and the lack of environmental controls in the processing.

However, it’s not a terrible idea to buy a position in Sociedad Química y Minera (SQM), the major Chilean Lithium producer, but only if you have a nice long-term view, like well into next year. (SQM) was an old favorite of mine during the last commodity boom, when we caught a few doubles. (Check our research data base).

Q: How can the U.S. debt be resolved? Or can we continue on indefinitely with this level of debt?

A: Actually, we can go on indefinitely with this level of debt; what we can’t do is keep adding a trillion dollars a year, which the current federal budget is guaranteed to deliver. At some point the government will crowd out private borrowers, including you and me, out of the market, which will eventually cause the next recession.

Q: Time to rotate out of stocks?

A: Not yet; all we have to do is rotate out of one kind of stock into another, i.e. out of technology and into consumer staple and value stocks. We will still get that performance, but remember we are 9.5 years into what is probably a 10-year bull market.

So, keep the positions small, rotate when the sector changes, and you’ll still make money. But, let's face it the S&P 500 isn’t 600 anymore, it’s 2,800 and the pickings are going to get a lot slimmer from here on out. Watch the movie but stay close to the exit to escape the coming flash fire.

Q: What kind of time frame does Amazon (AMZN) double?

A: The only question is whether it happens now or on the other side of the next recession. We can assume five years for sure.

Q: More upside to Home Depot (HD)?

A: Absolutely, yes. The high home prices lead to increases in home remodeling, and now that Orchard Hardware has gone out of business, all that business has gone to Home Depot. Home Depot just went over $204 a couple days ago.

Q: Do you still like India (PIN)?

A: If you want to pick an emerging market to enter, that’s the one. It’s a Hedge Fund favorite and has the largest potential for growth.

Q: What about oil stocks (USO)?

A: You don’t want to touch them at all; they look terrible. Wait for Texas tea to fall to $60 at the very least.

Q: What would you do with Netflix (NFLX)?

A: I would probably start scaling into buy right here. If you held a gun to my head, the one trade I would do now would be a deep in the money call spread in Netflix, now that they’ve had their $100 drop. And I can’t wait to see how the final season of House of Cards ends!

Q: If yields are going up, why are utilities doing so well?

A: Yields are going down right now, for the short term. We’ve backed off from 3.05% all the way to 2.81%; that’s why you’re getting this rally in the yield plays, but I think it will be a very short-lived event.

Q: Do you see retail stocks remaining strong from now through Christmas?

A: I don’t see this as part of the Christmas move going on right now; I think it’s a rotation into laggard plays, and it’s also very stock specific. Stocks like Nordstrom (JWN) and Target (TGT) are doing well, for instance, while others are getting slaughtered. I would be careful with which stocks you get into.

Good luck and good trading

John Thomas

CEO & Publisher

Diary of a Mad Hedge Fund Trader

Global Market Comments

August 23, 2018

Fiat Lux

Featured Trade:

(WHY THE DOW IS GOING TO 120,000),

(X), (IBM), (GM), (MSFT), (INTC), (DELL),

($INDU), (NFLX), (AMZN), (AAPL), (GOOGL),

(THE MAD HEDGE CONCIERGE SERVICE HAS AN OPENING),

(TESTIMONIAL)

For years, I have been predicting that a new Golden Age was setting up for America, a repeat of the Roaring Twenties. The response I received was that I was a permabull, a nut job, or a conman simply trying to sell more newsletters.

Now some strategists are finally starting to agree with me. They too are recognizing that a ganging up of three generations of investment preferences will combine to drive markets higher during the 2020s, much higher.

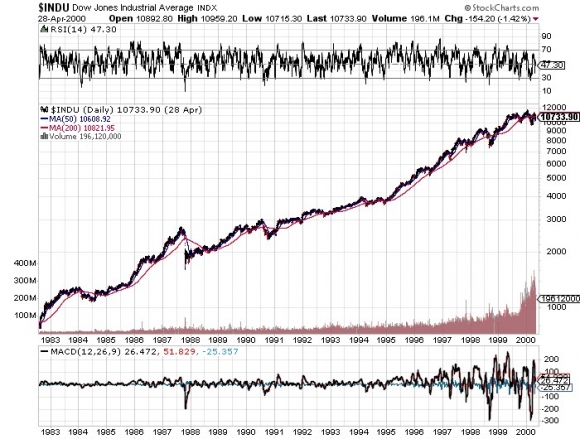

How high are we talking? How about a Dow Average of 120,000 by 2030, up another 465% from here? That is a 20-fold gain from the March 2009 bottom.

It’s all about demographics, which are creating an epic structural shortage of stocks. I’m talking about the 80 million Baby Boomers, 65 million from Generation X, and now 85 million Millennials. Add the three generations together and you end up with a staggering 230 million investors chasing stocks, the most in history, perhaps by a factor of two.

Oh, and by the way, the number of shares out there to buy is actually shrinking, thanks to a record $1 trillion in corporate stock buybacks.

I’m not talking pie in the sky stuff here. Such ballistic moves have happened many times in history. And I am not talking about the 17th century tulip bubble. They have happened in my lifetime. From August 1982 until April 2000 the Dow Average rose, you guessed it, exactly 20 times, from 600 to 12,000, when the Dotcom bubble popped.

What have the Millennials been buying? I know many, like my kids, their friends, and the many new Millennials who have recently been subscribing to the Diary of a Mad Hedge Fund Trader. Yes, it seems you can learn new tricks from an old dog. But they are a different kind of investor.

Like all of us, they buy companies they know, work for, and are comfortable with. During my Dad’s generation that meant loading your portfolio with U.S. Steel (X), IBM (IBM), and General Motors (GM).

For my generation that meant buying Microsoft (MSFT), Intel (INTC), and Dell Computer (DELL).

For Millennials that means focusing on Netflix (NFLX), Amazon (AMZN), Apple (AAPL), and Alphabet (GOOGL).

That’s why these four stocks account for some 40% of this year’s 7% gain. Oh yes, and they bought a few Bitcoin along the way too, to their eternal grief.

There is one catch to this hyper-bullish scenario. Somewhere on the way to the next market apex at Dow 120,000 in 2030 we need to squeeze in a recession. That is increasingly becoming a topic of market discussion.

The consensus now is that an impending inverted yield curve will force a recession sometime between August 2019 to August 2020. Throwing fat on the fire will be a one-time only tax break and deficit spending that burns out sometime in 2019. These will be a major factor in U.S. corporate earnings growth dramatically slowing down from 26% today to 5% next year.

Bear markets in stocks historically precede recessions by an average of seven months so that puts the next peak in top prices taking place between February 2019 to February 2020.

When I get a better read on precise dates and market levels, you’ll be the first to know.

To read my full research piece on the topic please click here to read “Get Ready for the Coming Golden Age.”

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.