I often get asked why I am still working after 55 years in the stock market.

With five customers calling me this morning to thank me for saving their retirement funds, you might understand why.

It is now clear that in retrospect and with the wisdom of 20/20 hindsight, corporate America flipped the switch on the economy, shutting it off and sending all hiring and investment to a grinding halt. They wanted to wait and see how business would fare under the new Trump regime. We didn’t see this in the data until February.

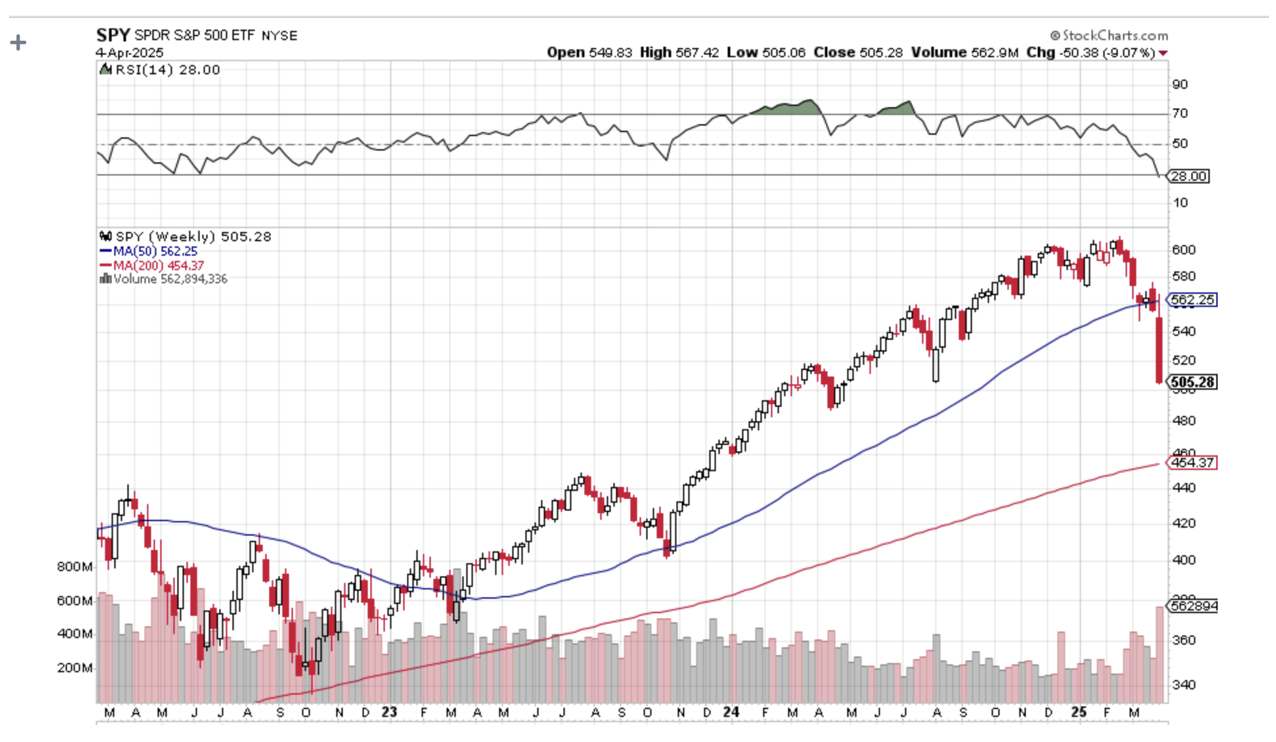

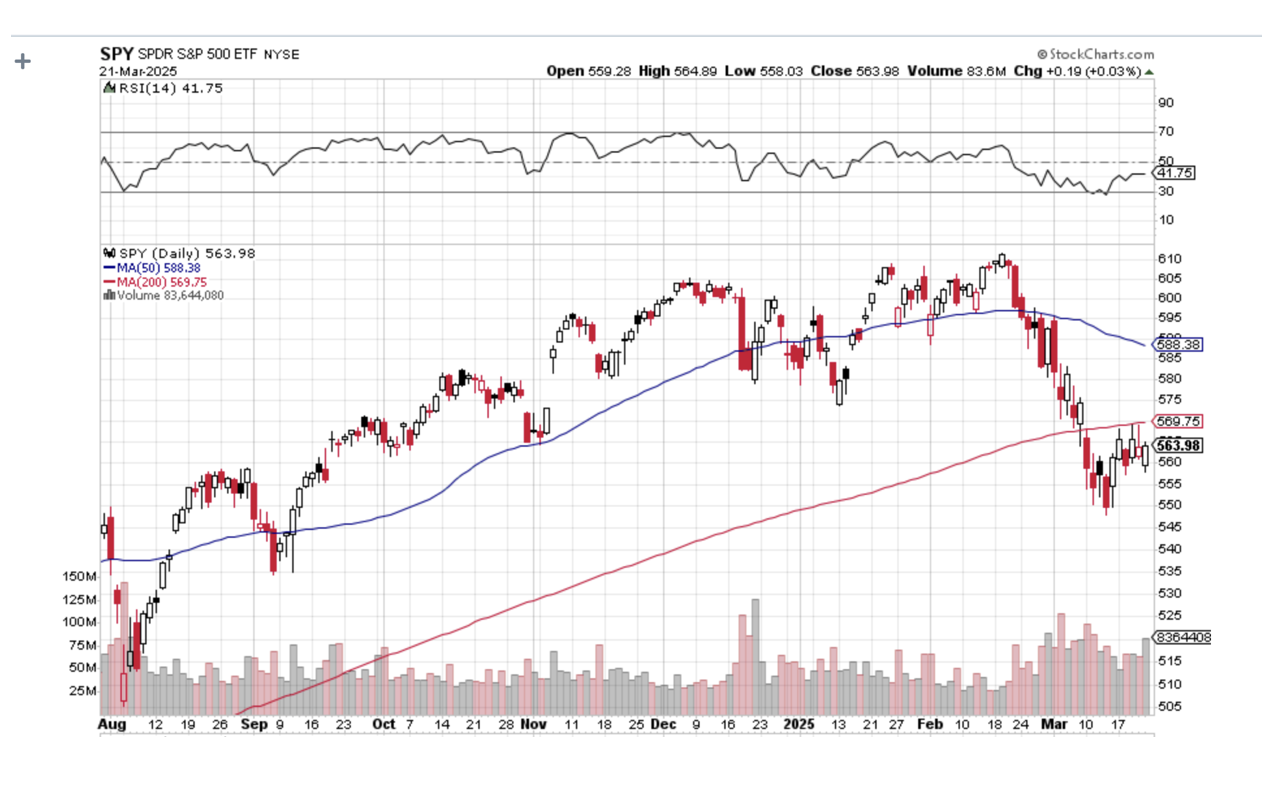

That’s when I started shouting from the rooftops that we were already in a recession and bear market and that you should sell everything, especially big tech stocks. If you waited until August for the data to confirm this, the move-down will be over.

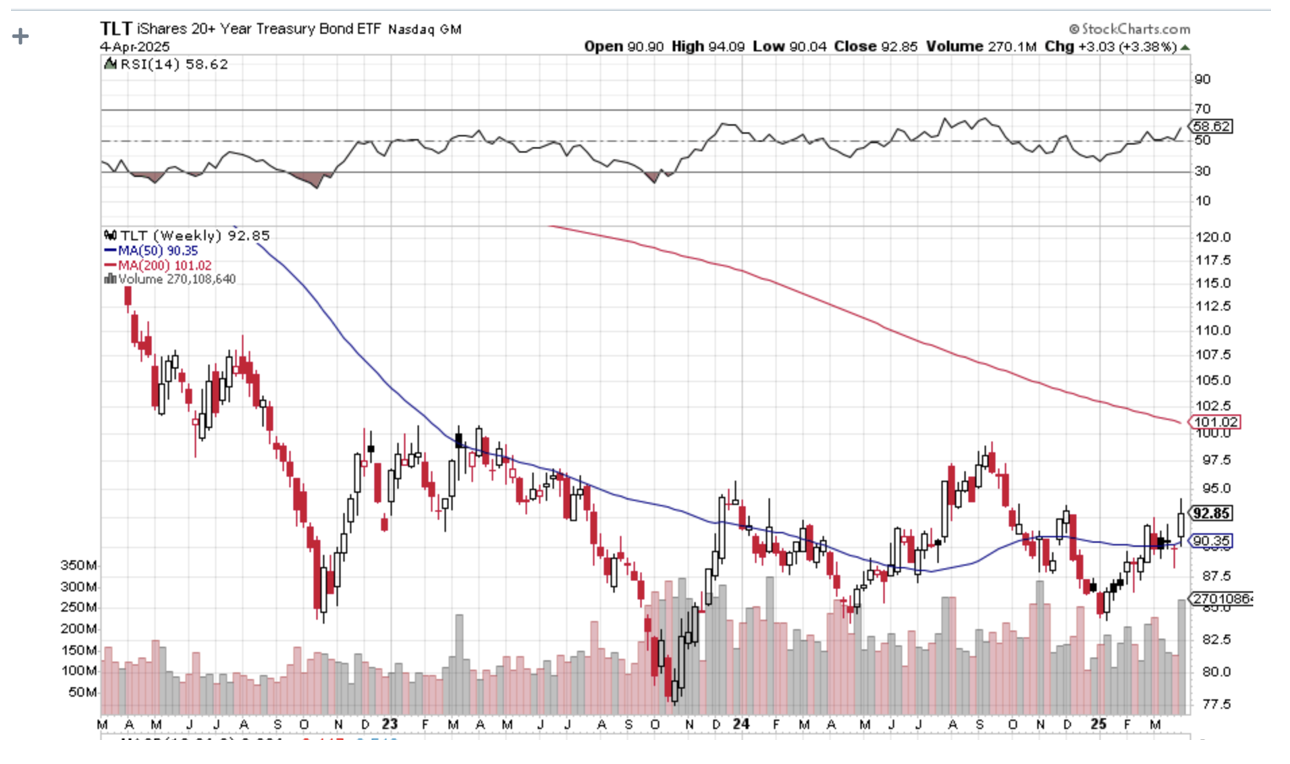

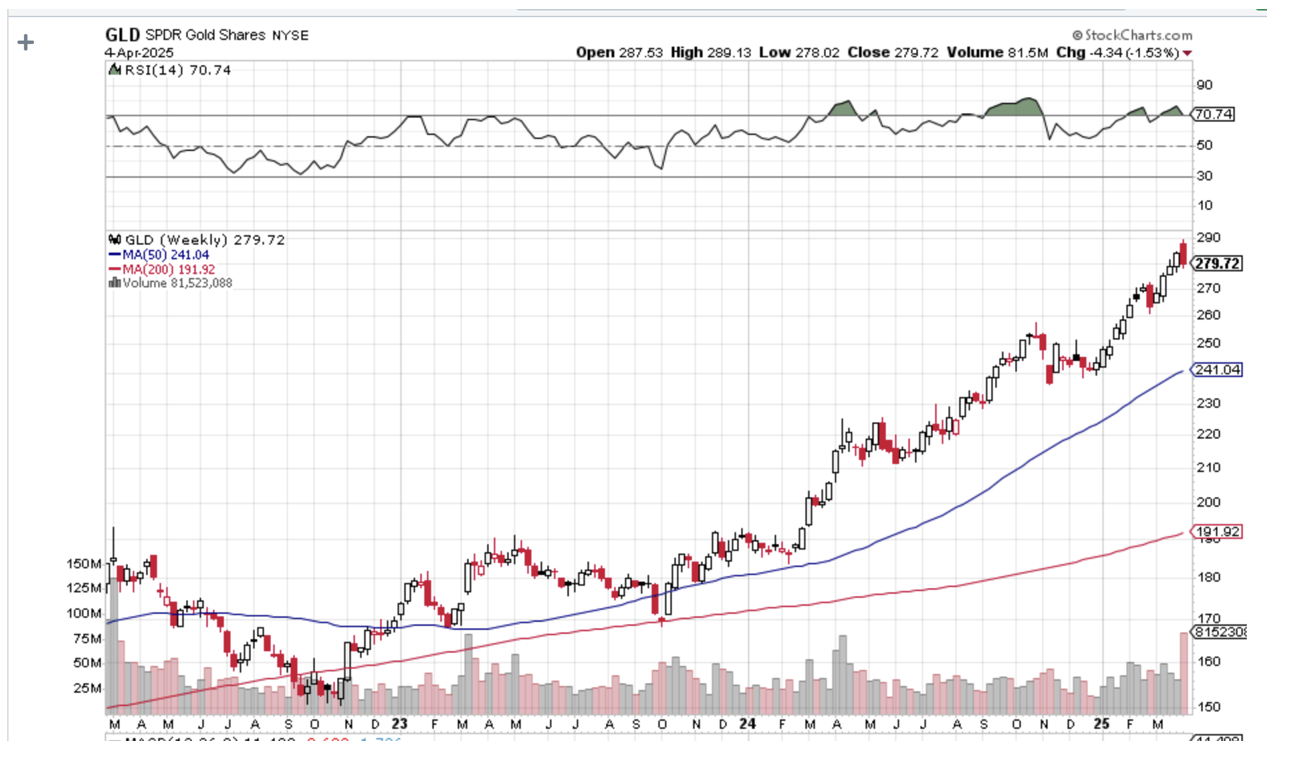

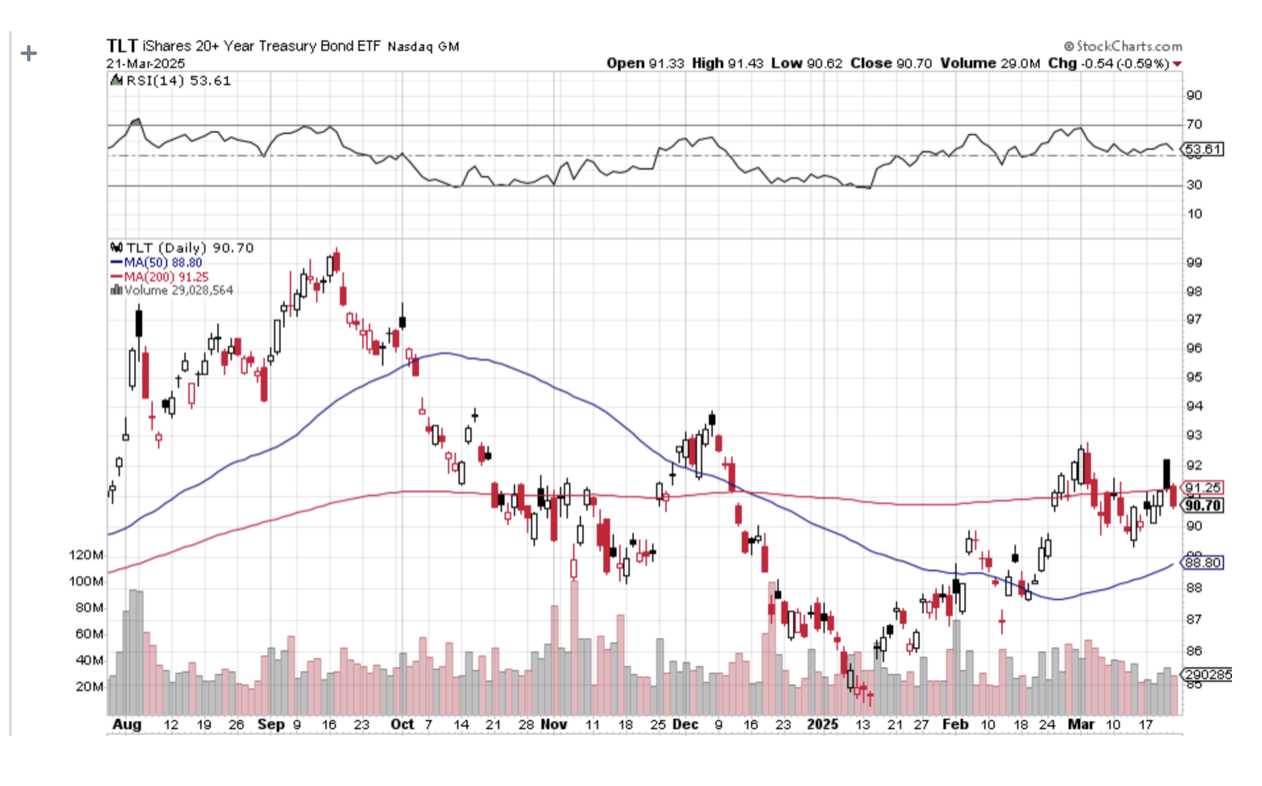

T-bills, bonds, and gold were the only safe places to park your money. Gold just delivered the best quarter since 1986, up 19%. That month I took my short positions up to 80%, a 17-year high for the Mad Hedge Fund Trader.

Those now look like very wise decisions, with markets suffering their worst two-day crash since 1987, and the bad news has only just started. Option implied volatiles are at five-year highs, and risk positions everywhere are going to hell in a handbasket. Tariff-driven inflation could spike to 10% by next year.

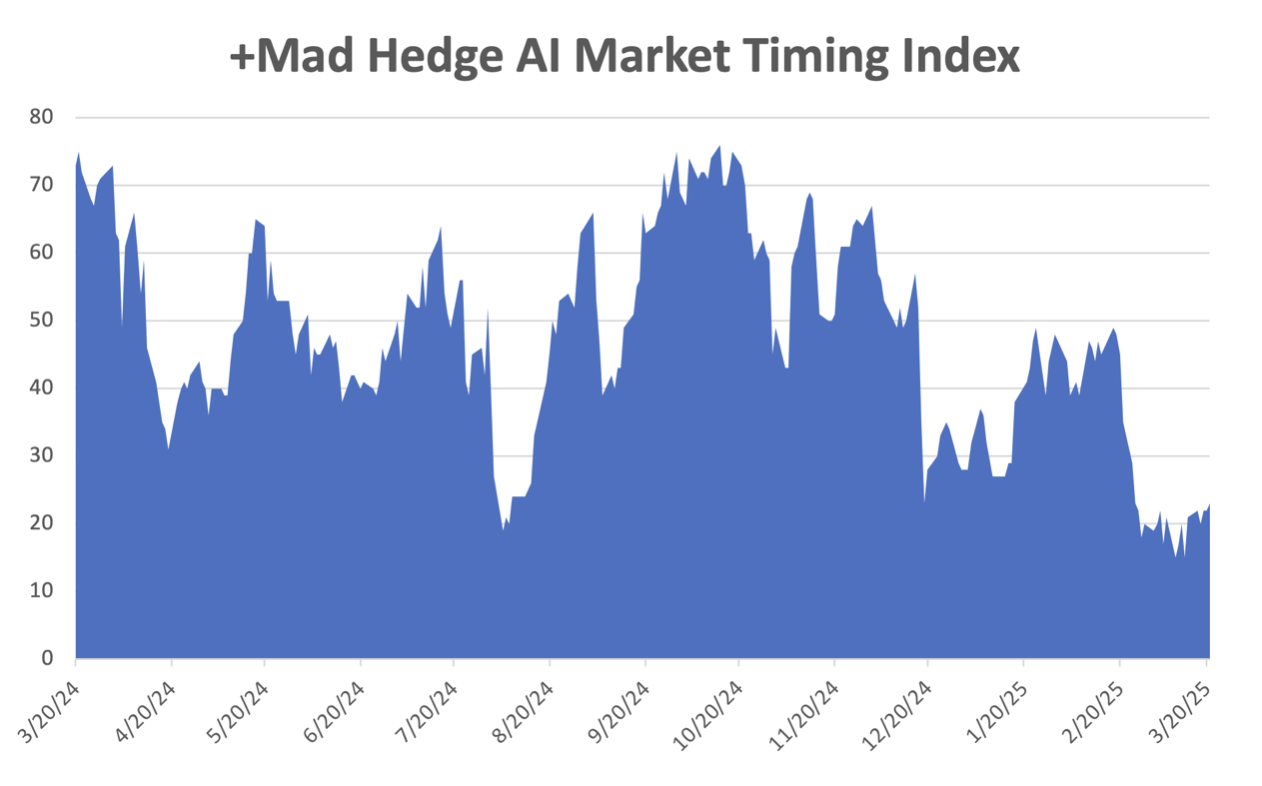

Even securities unrelated to stocks, like junk bonds (JNK), down $6 points in two weeks, were getting thrown out with the bathwater because of margin calls. The Mad Hedge AI Market Timing Index is at a five-year low at a reading of 4. Q1 saw the fastest reversal in market momentum in 38 years.

I even heard an expression new to me: “Hate selling”. That refers to a global disengagement from investment in the US and the return of capital to better-performing foreign markets and currencies. Trump is attacking their countries.

The global nature of the selloff is most disturbing, with every country seeking its stock markets rolling over all at once. That presages a global recession.

Analysts across Wall Street are tearing up their playbooks for 2025 and setting new downside targets as fast as they can like I did in February.

Instead of the $500 billion tax increase I expected tariffs would deliver, we got $1 trillion. The worst forward guidance from corporations since the Great Depression starts next week. Retaliatory 34% tariffs from China hit today, and those from Europe will come soon. Trump has promised retaliation.

That forces me to adjust my downside target for the S&P 500 from $5,000 to $4,500. That is a 26.6% selloff from the February top, or 11% more downside from here. How do we get there? Simply assign the 2019 earnings multiple low of 18 and multiply it by S&P 500 earnings pared back by the trade war from $270 to $250. That gets you to $4,500 in months, if not weeks (18 X $250).

No help is that we entered this crash with valuation highs that have only been seen in 1999 and 1929. The higher the high, the lower the lows that follow.

In fact, there is no bottom to this market.

This forecast is based on historical data and assumes that markets are rational and orderly. But as we all know too well, markets can be anything but rational and orderly once the panic selling and margin calls begin.

Of course, a tweet on social media about negotiations could trigger a massive short-covering rally at any time. In reality, the stock market has been negotiating on behalf of Europe and China quite successfully. The further stocks fall, the greater the pressure on Trump to fold.

Tariffs advertised at the White House announcement left our trading partners scratching their heads because they were completely bogus and were a large multiple of the true tariffs. The person who came up with these cockamamie figures remains anonymous, as they used an arbitrary, obscure formula made up from scratch that had never been seen before by the economic community.

For example, the White House claimed the tariff charged by Vietnam was 90%, when in fact it is 5.5%. The claimed tariff for Taiwan was 64%, while the actual one is 1.7%.

The White House numbers supposedly included a factor for non-tariff barriers. I happen to be an expert in these because Japan was notorious for its non-tariff barriers in the 1970s. For example, import documents have to be submitted in Japanese. Hey, I speak Japanese. All they had to do was ask me! How did they quantify this?

That’s anyone’s guess.

The saddest thing is that this new bear market was not caused by surprise external events as in all others in the past century, but is totally voluntary and self-inflicted. It is actually caused by the false assumptions of conspiracy theorists. But these days, it is the conspiracy theorists who have the upper hand.

Why do we suddenly need an emergency jobs program now, when the country is operating at full employment? Many of those skills needed to man the jobs Trump is trying to take back from China, such as in textiles, clothing, shoes, and toys, haven’t existed in the US for generations. Nor does the machinery.

Some three-quarters of the US trade deficits are offset by a monster surplus in services run up by the likes of Meta (META), Alphabet (GOOGL), Microsoft (MSFT), Oracle (ORCL), and Salesforce (CRM). And if you didn’t already know, the future is in services, not in manufacturing.

I don’t know about you, but I don’t lose a lot of sleep at night worrying about our trade deficit with Vietnam. Trump took what was a great economy and destroyed it in an effort to remake it in his own image. Is this crazy experiment with 20% of your retirement funds cost so far? How about 50%?

No wonder the Republican Party is panicking! Recent elections have shown unprecedented swings by voters away from them, fearful of their 401Ks.

How many factories will return to the US as a result of the tariffs? My bet is none. There will be many announcements but no actual action, as with the first Trump administration.

Labor costs are $5 an hour in Mexico and China, versus $25-$75 an hour in America. We keep the high-paying, high-value-added jobs and send the cheap, dangerous, highly energy-consuming, and high-polluting ones abroad. Foreigners get rich and earn the money to buy our services.

Their government then takes the excess funds and buys US Treasury bonds (China still has $760 billion worth) and finances our deficits with ever-depreciating paper. It is one big mutually enriching cycle. That’s why globalization has worked for 85 years.

The best thing for companies is to now sit on their hands and do nothing and wait out the next four years until a future administration eliminates the tariffs. That’s much cheaper than spending $20 billion on a new factory here which might become useless in four years.

What is a stock market worth that is walled off from the rest of the world that's in recession? Maybe half or less the February peak value, but I’m only guessing.

It might be much worse.

Keep all cash positions in 90-day T-bills and keep all hedges of existing equity portfolios also at a maximum until the stock market can find its own bottom. I’d rather miss the first 10% move and buy on the way up than catch a falling knife right now.

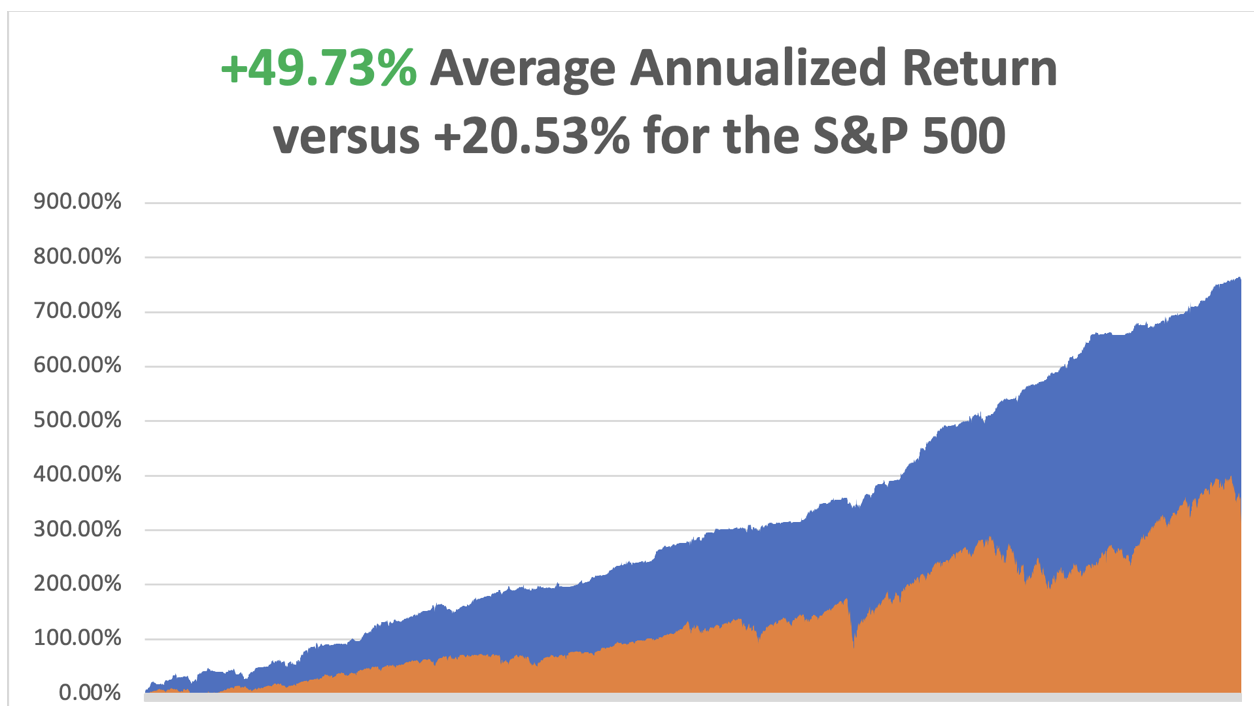

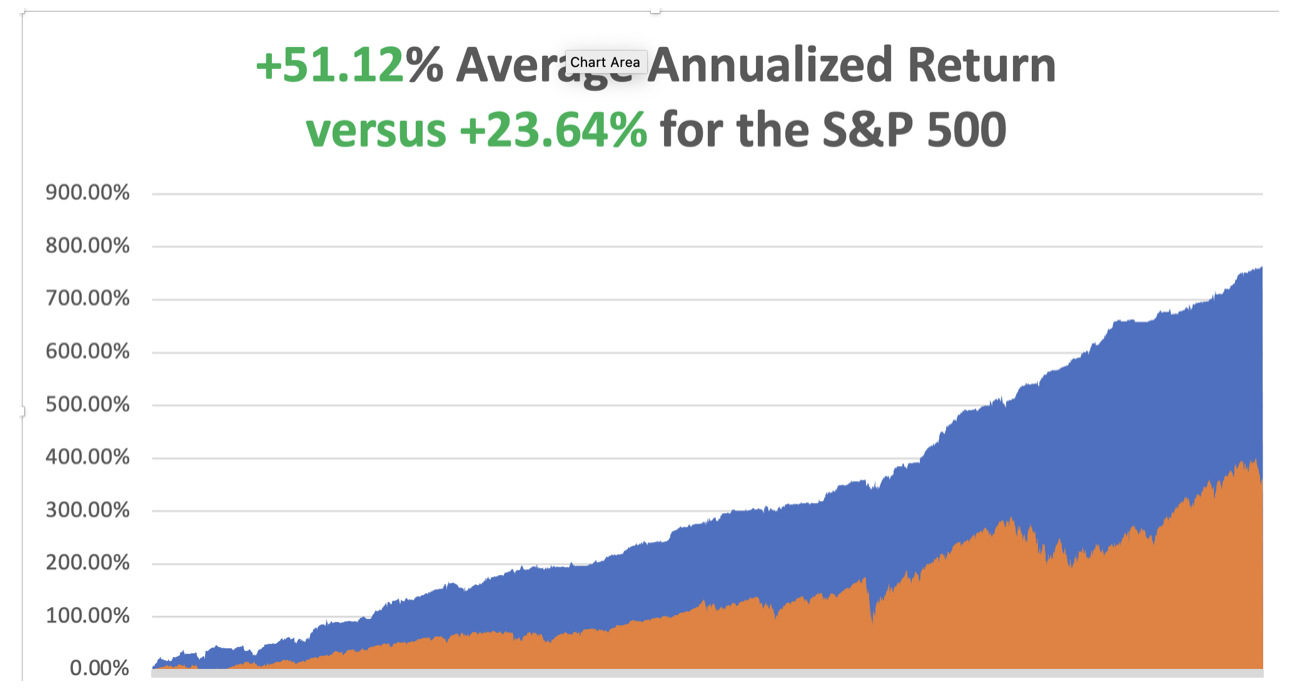

April is now down -7.25% so far due to the explosion in implied volatilities in our hedged positions. A lot of the Friday options prices made no sense and may reflect broker efforts to increase margin requirements. That takes us to a year-to-date profit of +6.58% so far in 2025. My trailing one-year return stands at a spectacular +74.93%. That takes my average annualized return to +49.73% and my performance since inception to +758.47%.

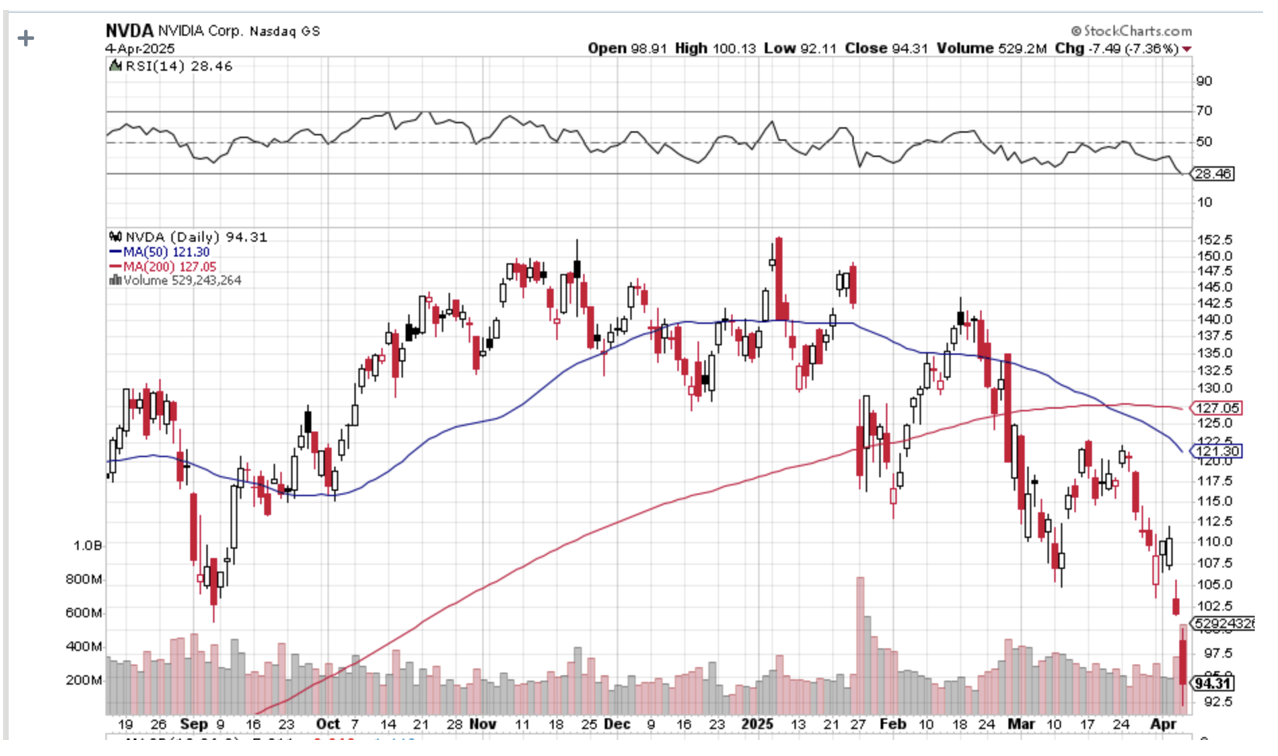

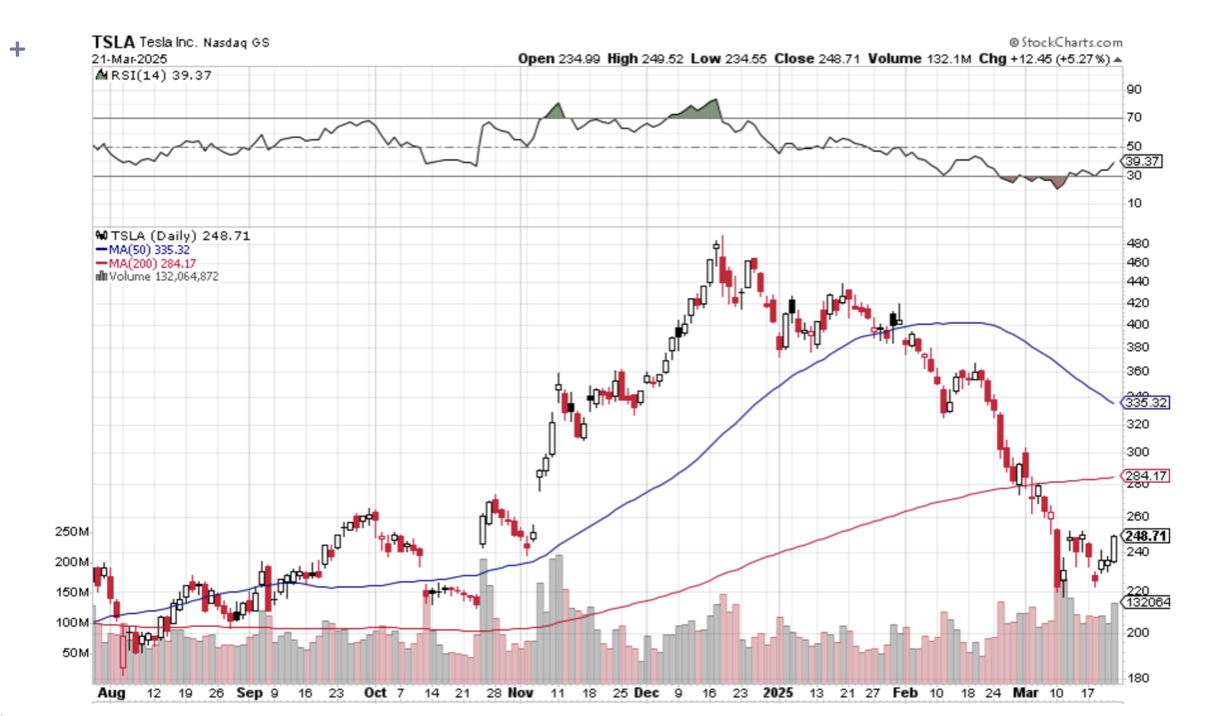

It has been another busy week for trading. I used the meltdown to add very deep in-the-money longs in (COST), (NVDA), and (NFLX). I stopped out of an existing (NVDA) long as we approached the upper strike price. I kept my very deep in-the-money long in (TSLA). I also kept my (GLD) long as a hedge.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

Trump Announces Worst-Case Scenario Tariffs, tanking stocks and crypto, with big technology stocks taking the biggest hits. “RISK OFF” assets like gold, silver, bonds, and foreign currencies are soaring. The Dow Average could suffer a 1987-style crash on Monday. Volatility will explode. Duties on Chinese goods were raised to 34%, Europe 20%, and Southeast Asian countries up to 45%. All countries have been hit with high tariffs to avoid transshipments. Retaliation from the world is on the way. It’s another nail in the economy’s coffin, which is now almost certainly in recession. S&P 500 at 5,000 here we come. Is this the day the great depression started? Some $2 trillion in market capitalization was lost today.

Tariffs to Push All Home Prices Higher, as much as 5%, as homebuilders wind down new construction because of higher costs. Drywall comes from Mexico, lumber from Canada, and 10% of the workforce are immigrants. It could explain the recent improvement in existing home sales.

Jobless Claims Hit Three-Year High. Continuing claims, a proxy for the number of people receiving benefits, increased to 1.9 million in the week ended March 22, slightly higher than economists expected. Those applications have been hovering just under that level for several months now. Meanwhile, initial claims dipped last week, to 219,000, according to Labor Department data released Thursday.

Auto Loan Defaults Hit 21-Year High, with 6.5% of subprime borrowers at least 60 days overdue on payments. It is the largest default rate since data began collection in 1994. Yet another recession indicator.

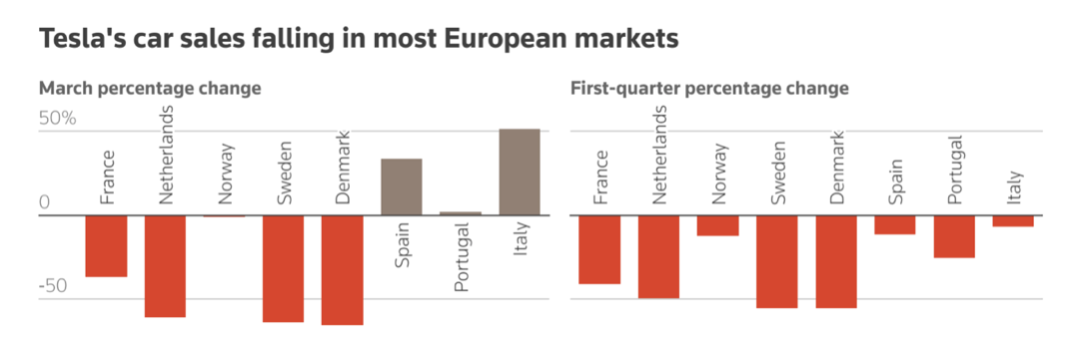

Tesla Sales Fall off a Cliff, down 13% on the quarter, its weakest performance in nearly three years, as backlash to CEO Elon Musk's embrace of far-right politics grows and as consumers seek out newer models from rival electric-vehicle makers. The EV maker's stumbling sales indicate that the one-time leading brand is reeling from the fallout of the company not refreshing its vehicle lineup in years, and Musk's foray into politics in the United States and Europe. The company posted weak sales in numerous European markets and China, even as more consumers are opting for EVs. Sell (TSLA) on rallies.

Global Sentiment is collapsing, over trade wars and recession fears. Business sentiment among big Japanese manufacturers worsened in the three months to March, a central bank survey showed on Tuesday, a sign escalating trade tensions were already taking a toll on the export-reliant economy. Auto exports to the US are a major support for the Japanese economy, which is an American ally. A global contagion is afoot.

US Dollar Declines as a Reserve Currency, in the last quarter of 2024 while the percentage of actual dollars held as reserve ticked up, IMF data showed on Monday. Dollar-equivalent amounts dropped also among holdings in euro, pound sterling, yuan, yen, Swiss franc, and Australian and Canadian dollars, with only the latter showing a tick up in the percentage of holdings, the IMF's Currency Composition of Official Foreign Exchange Reserves (COFER) data showed. The end of American exceptionalism means a cheaper greenback.

Vaccine Stocks Get Nailed, as the FDA moves the eliminate the vaccine establishment. Expect stocks to fall and disease to rise. The Food and Drug Administration's top vaccine official, Peter Marks, has been forced to resign, the most high-profile exit at the regulator as the Trump administration undertakes an overhaul of federal health agencies.

Gold Stocks in Comex Warehouses Hit Record highs, due to the risk of import tariffs curtailing shipments to the United States from other countries. Latest data from Comex, part of CME Group, shows gold stored in its warehouses in the United States at an all-time high of 43.3 million troy ounces worth $135 billion at current prices compared with 17.1 million in November. Spot gold prices surged past $3,100 per ounce to a fresh record high on Monday. Bullion is up 19% so far this year after rising 27% in 2024. Buy (GLD) on dips.

On Monday, April 7, at 8:30 AM EST, the Used Car Prices are announced.

On Tuesday, April 8, at 8:30 AM, the NFIB Business Optimism Index is released.

On Wednesday, April 9, at 1:00 PM, the FOMC Minutes are published.

On Thursday, April 10, at 8:30 AM EST, the Weekly Jobless Claims are disclosed. We also get the Consumer Price Index and Inflation Rate.

On Friday, April 11, at 8:30 EST, the Producer Price Index for March is printed. We also get the University of Michigan Consumer Sentiment. At 2:00 PM, the Baker Hughes Rig Count is printed.

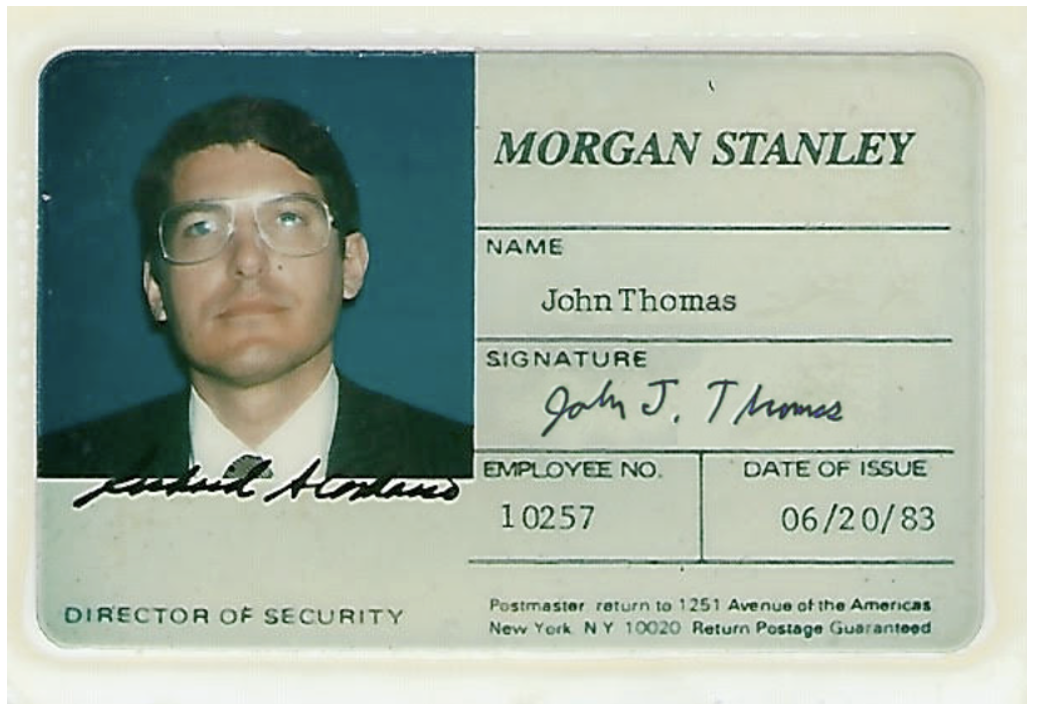

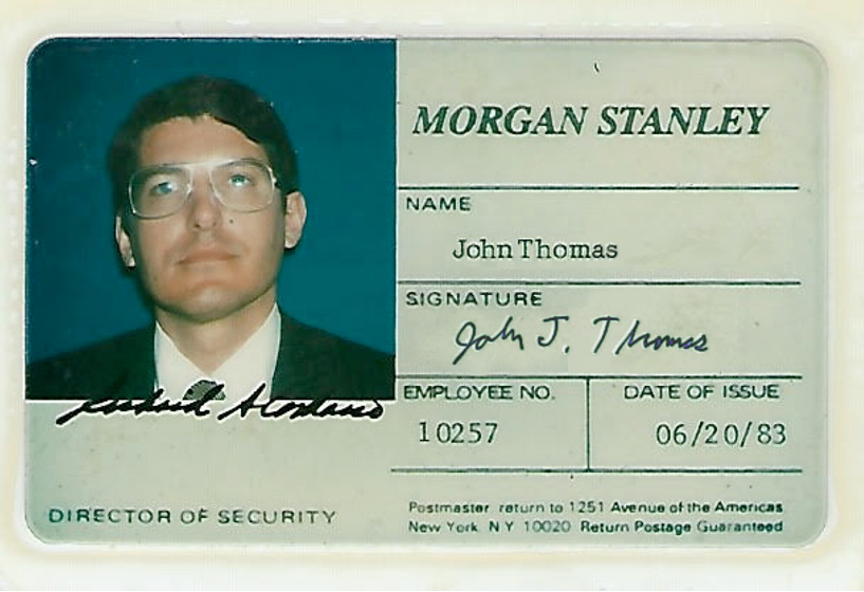

As for me, with the 38th anniversary of the 1987 crash coming up this year, when shares dove 20% in one day, I thought I’d part with a few memories.

I was in Paris visiting Morgan Stanley’s top banking clients, who back then were making a major splash in Japanese equity warrants, my particular area of expertise.

When we walked into our last appointment, I casually asked how the market was doing (Paris is six hours ahead of New York). We were told the Dow Average was down a record 300 points. Stunned, I immediately asked for a private conference room so I could call the equity trading desk in New York to buy some stock.

A woman answered the phone, and when I said I wanted to buy, she burst into tears and threw the handset down on the floor. Redialing found all transatlantic lines jammed.

I never bought my stock, nor did I find out who picked up the phone. I grabbed a taxi to Charles de Gaulle airport and flew my twin Cessna as fast as the turbocharged engines took me back to London, breaking every known air traffic control rule.

By the time I got back, the Dow had closed down 512 points. Then I learned that George Soros asked us to bid on a $250 million blind portfolio of US stocks after the close. He said he had also solicited bids from Goldman Sachs, Merrill Lynch, JP Morgan, and Solomon Brothers, and would call us back if we won.

We bid 10% below the final closing prices for the lot. Ten minutes later, he called us back and told us we won the auction. How much did the others bid? He told us that we were the only ones who bid at all!

Then you heard that great sucking sound.

Oops!

What has never been disclosed to the public is that after the close, Morgan Stanley received a margin call from the exchange for $100 million, as volatility had gone through the roof, as did every firm on Wall Street. We ordered JP Morgan to send the money from our account immediately. Then they lost the wire transfer!

After some harsh words at the top, it was found. That’s when I discovered the wonderful world of Fed wire numbers.

The next morning, the Dow continued its plunge, but after an hour managed a U-turn, and launched on a monster rally that lasted for the rest of the year. We made $75 million on that one trade from Soros.

It was the worst investment decision I have seen in the markets in 53 years, executed by its most brilliant player. Go figure. Maybe it was George’s risk control discipline kicking in?

At the end of the month, we then took a $75 million hit on our share of the British Petroleum privatization because Prime Minister Margaret Thatcher refused to postpone the issue, believing that the banks had already made too much money.

That gave Morgan Stanley’s equity division a break-even P&L for the month of October 1987, the worst in market history. Even now, I refuse to gas up at a BP station on the very rare occasions I am driving a rental internal combustion engine from Enterprise.

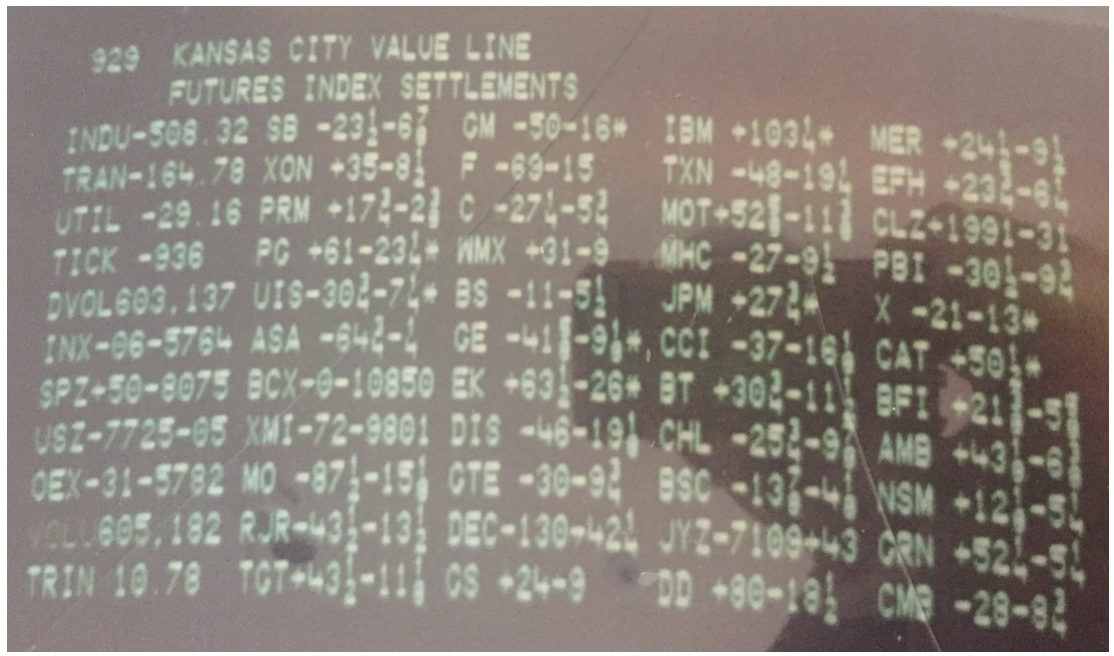

My Quotron Screen on 1987 Crash Day

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader