Mad Hedge Technology Letter

May 8, 2020

Fiat Lux

Featured Trade:

(WHY TECH IS THE BIG BAILOUT WINNER)

(EA), (ATVI), (TWLO), (UBER), (LYFT)

Mad Hedge Technology Letter

May 8, 2020

Fiat Lux

Featured Trade:

(WHY TECH IS THE BIG BAILOUT WINNER)

(EA), (ATVI), (TWLO), (UBER), (LYFT)

Today, we got a convincing signal that trillions of stimulus dollars are being diverted into one asset class – tech shares.

That’s right, even though main street has not participated in the V-shaped recovery that tech shares have basked in, tech’s profit engines have gotten through largely unscathed.

The earnings that have streamed out this week validate the big buying into tech shares and today’s price action was mouthwatering.

We had names like cloud communications platform Twilio (TWLO) rise 40% in one day, ride-sharing platform Lyft (LYFT) was up 21%, and Uber (UBER) another 11%.

Outperformance of 5% seemed pitiful today in an asset class that has gone truly parabolic.

Another sub-sector that can’t be held down is video games.

The rampant usage of video games dovetails nicely with the theme of tech companies who have triumphed the coronavirus.

There is nothing more like a stay-at-home stock than video game maker Electronic Arts (EA) who beat expectations during its March quarter.

The company reported adjusted earnings of $1.31 per share during its fiscal fourth quarter, topping consensus estimates at 97 cents a share.

Revenue also beat totaling $1.21 billion surpassing estimates by $.03 billion.

EA Sports has identified Apex Legends as their new growth asset and this free game is having a Fortnite-like growth effect.

Apex Legends was the most downloaded free-to-play game in 2019 on the PlayStation 4 system.

The full ramifications of Covid-19’s impact on EA’s business, operations, and financial results is hard to quantify for the long term and this has been a broad trend with many tech companies pulling annual guidance.

I can definitely say that the year 2020 is experiencing a video games renaissance.

On the downside, EA is heavy into sports video games, and cancellations of sports seasons and sporting events could impact results, given its popular sport simulation titles like FIFA and Madden NFL.

EA Sport’s competitor Activision Blizzard (ATVI) is positioned to reap the benefits by reimagining mainstay title Call of Duty Warzone and users have already hit 60 million players in just 2 months.

The result is accelerating momentum entering the second quarter from the dual tailwinds of strong execution and premium franchises following last year's increased investment.

With physical entertainment venues like movie theaters, live sports, and music venues closed, home entertainment services have pocketed the increased engagement.

Nintendo is another gaming company whose fourth-quarter profit soared 200% due to surging demand for its Switch game console, and that title Animal Crossing: New Horizons shifted a record 13.4 million units in its first six weeks.

Activision is riding other hit game franchises like World of Warcraft, Overwatch, and Candy Crush – to visit their roster of blockbuster games, please click here.

These blockbuster titles are carrying this subsector at a time when the magnifying glass is on them to provide the entertainment people crave at home.

Shares of EA and Activision Blizzard are overextended after huge run-ups and another gap up from better than expected earnings reports.

If there is a dip, then that would serve as an optimal entry point.

The lack of vaccine means that gaming will see elevated attention until there is a real health solution.

If there is a second wave that hits this fall, then pull the trigger on these video game stocks.

To visit Electronic Art’s website, please click here.

Mad Hedge Technology Letter

May 6, 2020

Fiat Lux

Featured Trade:

(THE GOLDEN AGE OF BIG TECH HAS ONLY JUST BEGUN)

(AMZN), (MSFT), (AAPL), (FB), (GOOGL), (ZM)

The tech market is telling us that the effects of coronavirus on the U.S. economy have accelerated the Golden Age of Big Tech pulling it forward to 2021.

You know, Big Tech is having their time in the sun when unscrupulous personal data seller Facebook is experiencing 10 times growth with its live camera product Portal video during the health crisis.

That is the type of clout big tech has accumulated in the era of Covid-19 and investors will need to focus on these companies first when putting together a high-quality tech portfolio.

Every investor needs upside exposure to a group of assets that is locked into the smartphone ecosphere.

There are no excuses.

Smartphones, although not a new technology, is now a utility, and the further away from the smartphone revenue stream you get, business is nothing short of catastrophic minus healthcare.

The health scare has ultimately justified the mammoth valuations of over $1 trillion that Apple, Microsoft, and Amazon command.

The next stop is easily $2 trillion and then some.

Consumers are so much more digitized in this day and age weaving in a tapestry of assets such as the iPhone at Apple, advertising at Facebook, and search ads at Google.

Can the coronavirus keep the digital economy down?

Green shoots are certainly popping up with regular consistency.

Facebook and Google have said that digital advertising has “stabilized.”

Apple, Amazon, Netflix, Facebook, and Google each reported financial results in the past week with profits and revenue that, while hit by the closure of the economy, still outperformed relative to the broader market.

Investors already priced in that Apple's iPhone sales temporarily disappeared, that Google's and Facebook's advertising revenue dropped and that Amazon is spending big to keep warehouse workers safe.

Forward expectations can only go north at this point reflecting a giant bull wave of buying that has benefited tech stocks.

Other top tier companies not in the FANG bracket have also gone gangbusters.

Zoom has turned into an overnight sensation now replacing all face-to-face meetings, sparking competition with Microsoft's Teams video chat and Google Meet.

The market grab that big tech has partaken in will position them as the major revenue accumulators for the next 25 years.

Unsurprisingly, Apple was the canary in the coal mine by calling out a dip in iPhone sales and manufacturing in China earlier in the year.

While iPhone's sales did fall, down nearly 7%, to $28.9 billion, its revenues from services and wearables, two categories that have been rising steadily for years, jumped 16.5% and 22.5% respectively.

Chip giant Qualcomm said phone shipments will likely drop about 30% around the globe in the June quarter while Apple rival Samsung, said phone and TV sales will "decline significantly" because of the coronavirus.

Google’s YouTube has grown 33% while the video giant keeps us entertained and Microsoft’s Xbox Game Pass subscription service notched more than 10 million subscribers.

Facebook said nearly 3 billion people use its collection of chat apps representing an 11% jump from a year ago.

Everywhere we turn, relative outperformance is evident which in turn minimizes the absolute underperformance in year to year growth.

The market is looking through and putting a premium on the relative outperformance.

Many are coming to the realization that the economy and population will live with the virus until there is a proper vaccine, meaning an elongated period of time where consumers are overloading big tech with higher than average usage.

President Trump’s chief economic adviser Larry Kudlow is projecting that the U.S. economy next year could see “one of the greatest economic growth rates.”

I would adjust that comment to say that big tech is tipped to be the largest winner of this monster rebound in 2021 putting the rest of the broader market on its back.

This is quickly turning into two economies – tech and everybody else.

The eyeballs won’t necessarily translate into a waterfall of revenue right away because of the nature of all the free services that they provide.

But at the beginning of 2021, a higher incremental portion of consumer’s salaries will be directed towards big tech and the fabulous paid services they offer.

Actions speak louder than words and Berkshire Hathaway’s Warren Buffett unloading billions in airline stocks is an ominous sign indicating that parts of the U.S. economy won’t come back to pre-virus levels.

The biggest takeaway in Buffet’s commentary is that he elected to not sell tech stocks like his big position in Apple validating my thesis that any investor not already in big tech will flood big tech with even more capital after being burnt in retail, energy, hotels, and airlines.

Then, when you consider the ironclad nature of tech’s balance sheets, even in the apocalyptical conditions, they will profit and rip away even market share from the weak.

It’s to the point where any financial advisor who doesn’t recommend big tech as the nucleus of their portfolios is most likely underperforming the wider market.

As the U.S. economy triggers the reopening mechanisms and we enter into the real meat and bones of the reopening, data will recover significantly signaling yet another leg up in tech shares.

Hold onto your hat!

Mad Hedge Technology Letter

May 1, 2020

Fiat Lux

Featured Trade:

(MICROSOFT KNOCKS IT OUT OF THE PARK)

(MSFT), (AMZN), (FB), (GOOGL)

Armed with the best management and stickiest tech products in the U.S., Microsoft (MSFT) has shown why every tech investor needs to own shares.

We just took profits from deep-in-the-money MSFT bull call spread and I’d be looking to get back into this name on any and every dip.

This tech company is unstoppable and the data underpinning their greatness reaffirms my point of view.

Microsoft said that 2 years of digital transformation has happened in the past 2 months.

The health crisis has shown that consumers cannot function without Microsoft and that will help fend off the regulatory monkey off their back.

Microsoft announced $35 billion in quarterly sales when analysts forecasted just $33.76 billion.

Tech companies have had to reduce their future projections as the health scare has done great damage to consumer demand with many pulling guidance completely.

Overall, tech companies were locked in for a 5% earnings decline which was the best out of any industry, but they are coming in higher than that.

Even more impressive, Microsoft’s management disclosed that COVID-19 had “minimal net impact on the total company revenue.”

That was really all you need to know about Microsoft who possesses services that consumers can never get rid of.

Everything else is just a cherry on top.

To get into the weeds a little, Azure cloud-computing business and Teams collaboration software, have become mainstay products as workers are forced to stay home and their companies need computing power and tools to support them.

Many of those products are bundled with ones that may not fare as well, however — for instance, Microsoft combines revenue from on-premises server sales with its Azure business.

The “Intelligent Cloud” segment that includes Azure rose to $12.28 billion in sales from $9.65 billion a year ago, beating the average analyst prediction of $11.79 billion.

“Productivity & Business Solutions,” which comprises mostly of the cloud software assets, including LinkedIn, grew to $11.74 billion from $11.52 billion a year ago, beating analyst predictions of $11.53 billion.

The most important nugget awaiting the masses was forward guidance.

Microsoft expects continued demand across Windows OEMs, Surface and Gaming to shift to remote work play and learn from home.

The outlook assumes this benefit remains through much of Q4, though growth rates may be impacted as stay-at-home guidelines ease.

Reduced advertising spend levels will impact search and LinkedIn and the commercial business.

A robust position in durable growth markets means Microsoft expect consistent execution on a large annuity base with continued usage and consumption growth.

LinkedIn will suffer from the weak job market and increased volatility in new, longer lead-time-deal closures.

A sign of strength and a pristine balance sheet was when Microsoft signaled that they could absorb higher costs by saying, “a material sequential increase” in capital-expenditure spending in the current quarter will “support growing usage and demand for our cloud services.”

Even best tech companies have mostly been trimming capex and freezing hiring in anticipation of weaker revenue targets.

I knew when Google announced 13% annual sales growth and Facebook saying that ad revenue “stabilized” meant that Microsoft would only do better.

The tech market had priced Microsoft doing quite positively which is why shares did not rocket by 8%.

Microsoft is not a one-trick pony like Google and Facebook either and simply doesn’t need a potential vaccine to boost sales moving forward.

They preside over a vast empire of diversified assets with even a growth lever in streaming platform YouTube.

Even if LinkedIn and the hiring that fuels it will suffer, the rest of its portfolio will keep churning out revenue in literally any type of economic environment.

Lastly, the tech market has been utterly cornered by policymakers who, according to the IMF, have thrown $14 billion of liquidity with a chunk of that following through into big tech shares.

The level of propping up from the Fed cannot be understated and their behavior feels as if there is no way anyone could ever be underweight Microsoft because of the Fed’s unlimited balance sheet.

On top of that, we are getting a steady stream of positive health reports in the form of antiviral medication Remdesivir and who knows when the next positive announcement will come.

To cap it off -they are led by the best CEO in the U.S. Satya Nadella, who is an expert on the cloud, and this company has to either be the best or second-best company in the country along with Amazon.

With the May 15 options expiration only ten trading days away, there is a heightened probability that your short options position gets called away.

We have the good fortune of having a large number of deep in-the-money call and put options spreads about to expire at their maximum profit points, five to be precise.

If that happens, there is only one thing to do: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit for your position with less risk. You just won the lottery, literally.

Most of you have short option positions, although you may not realize it. For when you buy an in-the-money put option spread, it contains two elements: a long put and a short put. The long put you own, but the short put can get assigned, or called away at any time and delivered to its rightful owner.

You have to be careful here because the inexperienced can blow their newfound windfall if they take the wrong action, so here’s how to handle it.

All you have to do was call your broker and instruct him to exercise your long position in your May puts to close out your short position in the May puts.

Puts are a right to sell shares at a fixed price before a fixed date, and one option contract is exercisable into 100 shares.

Sounds like a good trade to me.

Weird stuff like this happens in the run-up to options expirations.

A put owner may need to sell a long stock position right at the close, and exercising his long Put is the only way to execute it.

Ordinary shares may not be available in the market, or maybe a limit order didn’t get done by the stock market close.

There are thousands of algorithms out there which may arrive at some twisted logic that the puts need to be exercised.

Many require a rebalancing of hedges at the close every day which can be achieved through option exercises.

And yes, puts even get exercised by accident. There are still a few humans left in this market to blow it.

And here’s another possible outcome in this process.

Your broker will call you to notify you of an option called away, and then give you the wrong advice on what to do about it.

This generates tons of commissions for the broker but is a terrible thing for the trader to do from a risk point of view, such as generating a loss by the time everything is closed and netted out.

Avarice could have been an explanation here but I think stupidity and poor training and low wages are much more likely.

Brokers have so many ways to steal money legally that they don’t need to resort to the illegal kind.

This exercise process is now fully automated at most brokers but it never hurts to follow up with a phone call if you get an exercise notice. Mistakes do happen.

Some may also send you a link to a video of what to do about all this.

If any of you are the slightest bit worried or confused by all of this, come out of your position RIGHT NOW at a small profit! You should never be worried or confused about any position tying up YOUR money.

Professionals do these things all day long and exercises become second nature, just another cost of doing business.

If you do this long enough, eventually you get hit. I bet you don’t.

Mad Hedge Technology Letter

April 24, 2020

Fiat Lux

Featured Trade:

(WHERE THE ACTION WILL BE IN TECH)

(MSFT), (AMZN), (APPL), (GOOGL), (FB)

Today’s tech newsletter might be the most important one you will ever read.

It’s my job to pinpoint exactly what is going on in tech and disburse this information in a way that readers can take advantage of.

The tech market is all about striking when the iron is hot.

The five largest stocks in the S&P 500, Microsoft, Amazon, Apple, Google, and Facebook have accrued a combined valuation that surpasses the valuations of the stocks at the bottom 350 of the index.

This means that if you weren’t in tech the past few years, chances are that your portfolio significantly underperformed the broader market.

Even in August 2018, many active managers could have thrown in the towel and said the late economic cycle was way too frothy for their taste and time to take profits.

Little did they know that betting against it would equate to self-firing themselves because to retrieve the same type of performance would have meant staying in tech through the coronavirus scare.

Many in the trading community would even go as far as to say to wait for the bear market, then big tech would get hammered first and deepest because of their lofty valuations.

These tech companies were in for a rude awakening and shares had to consolidate, right?

Well, anyone who doesn’t live under a rock is seeing the exact opposite happen with Amazon, Microsoft, and Apple valuated above $1 trillion and still soaring as we speak.

This goes to show that betting against something because they are “too expensive” or “too cheap” is a fool’s game.

Just take oil that many retail investors bought because they came to the conclusion that oil could never go below zero.

Then playing oil through an ETF with massive contango means that the index is likely to go down even if the price of oil is up.

Not only do investors bear insanely high risk in these trading vehicles, but also a systemic risk of oil ETFs blowing up.

Oil is cheap, and it can get cheaper, while tech is expensive and can get a lot more expensive.

Until there are structural changes, there is no point to bet on a sudden reversal out of thin air.

Betting against things that an individual perceives as unsustainable and secretly hoping that they cannot continue to go on is probably the worst strategy that I have ever heard of in my life.

The reality is that these things are sustainable and tech shares will keep moving higher uninterrupted until they don’t.

Active managers are the ones who set market prices and they help the momentum accelerate in tech with full knowledge that if they miss out, there is likely no other solution to hit yearend targets.

What active manager doesn’t want their year-end bonus?

Even analyze the value investors who in a normal world would not even consider tech companies because they avoid the traditional “growth” profile.

Funnily enough, these “value” investors have Microsoft in their portfolios now even though it is not even close to a value stock.

So what has Microsoft accomplished recently?

CEO of Microsoft Satya Nadella has rebuilt a company Microsoft that is now equal in value to The Financial Times Stock Exchange 100 Index, the share index of the 100 companies listed on the London Stock Exchange with the highest market capitalization.

That’s right, one American company is just as valuable as the top 100 public companies in England.

An even broader view of tech would give us an even more stunning snapshot of tech showing that the Top 5 tech stocks are now worth more than the entire developed stock market outside the U.S. such as Europe, Canada, Japan, Hong Kong combined.

Then take into consideration that these companies are on the cusp of penetrating high margin industries like medicine and healthcare which will translate into another golden decade of accelerating revenue and elevated profits relative to the rest of the S&P index.

The U.S. is a place where unfettered capitalism is promoted and implemented, and tech’s outperformance manifests itself by underscoring the winner-takes-all mentality.

Americans like winners and the rules are no different in corporate America.

These 5 tech names have contributed 23% of the gains in the past month and until they falter, there will be no tech sell-off.

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader April 22 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Will Trump louse up the recovery by bringing people back to work too soon?

A: Absolutely, that’s a risk. Georgia is reopening in a couple of days, which is purely a political decision because all of the scientists have advised against it. If that creates a secondary Corona wave, which we will know in a few weeks, then no one else is going to reopen early and the depression instantly goes from a three-month one to a six or nine-month one. Nobody wants tens of thousands of deaths on their hands. If we do reopen early, it could create a secondary spike in cases and deaths that hit around the Fall, right before the election. That is absolutely what the administration does not want to see, but they’re pursuing a course that will almost guarantee that result, so I wouldn’t be traveling to the Midwest anytime soon. Actually, I'm not going to be traveling anywhere because all the planes are grounded. Trump’s strategy is that Corona will magically go away in the summer, and those are his exact words.

Q: What is the Fed's next move?

A: I don't think they will go to negative interest rates. The disruptions to the financial system would be too widespread. Nobody is having a problem borrowing money right now unless they are in the housing market and that is totally gridlocked. Probably, the best thing is to expand QE and keep buying more fixed income instruments. They are essentially buying everything now, including mortgage-backed securities, junk bonds, securitized student loan debt, and everything except stocks. Today, we heard that the FHA is now buying defaulted mortgages which account for 6% of all the home mortgages out there, so that should help a lot in bringing the 30-year mortgage rate back in line with the 10-year, which would put it in the mid twos. So, more QE is the most likely thing there.

Q: What do you think of Remdesivir from Gilead Sciences (GILD)? Is it a buy at current levels?

A: We recommended this six months ago with our Mad Hedge Biotech & Healthcare Letter and got a spectacular result (click here for the link). This is a broad-spectrum antiviral that worked against MERS and SARS. We think it’s one of many possible treatments for the Coronavirus but it is not a vaccine. Buying the stock here is downright scary, up 30% since January. We love biotech for the long term, but this is a terrible entry point for Gilead. If it drops suddenly 10-20% on this selloff, then maybe.

Q: You seem very confident we’re going lower again. I’m reminded of the December selloff of 2018 where we saw a very quick recovery and a lot of people were shut out.

A: The difference then is that we didn’t have a global pandemic which has killed 47,000 Americans and may kill another 47,000 or more before it's all over. And I think it’s going to take a lot longer for the government to reopen the economy than they think. And corporate share buybacks, the main driver of the bull market of the past decade, are now completely absent.

Q: You seem to prefer spreads to LEAPS. Is that the only strategy you use?

A: I’m not putting long term LEAPS (Long Term Equity Participation Securities) in the model portfolio because they have two years to expiration, and I don’t want to tie up our entire trading portfolio in a two-year position. So, we are doing front months in the model trading portfolio, but every week I’m sending out lists of LEAPS for people to buy on the dips. Of course, you should go out to 2022 to minimize your risks and you should only buy them on the down 500 or 800-point days. Put a bid in on the bid side of the market (the low side of the market), and if you get a sudden puke out, a margin call, or an algorithm, you will get hit with these things at really good prices. That is the way to do long term LEAPS.

Q: Why do you think the true vaccine is a year off?

A: If you took Epidemiology 101, which I did in college, you'll learn that when you have a very large number of cases, the mutation rate vastly accelerates. My doctor here in Incline Village tested blood samples he took in northern Nevada in December and found that there were two Coronavirus variants, two different mutations. So, if there are only two, we would be really lucky. The problem is that these diseases mutate very quickly, and by the time you get a vaccine working, the DNA of the virus has moved on and last year’s vaccine doesn’t work anymore. That’s why when you get a flu shot, it includes flu variants from five different outbreaks around the world every year, and I’ve been getting those for 40 years, so I already have the antibodies for 200 different flu variations floating around my system as antibodies. Maybe that’s why I never get sick. They have been trying to get an AIDS vaccine for 40 years, and a cancer vaccine for 100 years, with no success, and it would be a real stretch for us to get a real working vaccine in a year. The best we can hope for is antivirals to treat the symptoms and make the disease more survivable.

Q: Long tail risk for long term portfolios?

A: The time to buy your long-term tail risk hedges, or the ledges of long term extremely unlikely events, was in January. That’s when they were all incredibly cheap and they were being thrown away with the trash. Now you have to pay enormous amounts for any long-term portfolio hedges. It's kind of like closing the barn door after the horses have bolted, so nice idea, but maybe we’ll try it again in another ten years.

Q: Should I buy gold options two months out or through gold LEAPS?

A: I would do both. Buying gold two months out will probably make more money faster, but for LEAPS—let’s say you bought a $2,000-$2,100 LEAPS two years out—the return on that could be 500-1000%, so it just depends on how much risk you were willing to take. I would bet that the LEAPS selling just above the all-time highs at $1,927 are probably going really cheaply because people will assume we won't get to new all-time highs for a while and they’ll sell short against that, so that may be your play. You can get even better returns on buying LEAPS on the individual gold stocks like Newmont Mining (NEM) and Barrick Gold (GOLD).

Q: How soon until we take a profit on a LEAPS spread?

A: Usually if you have 80% of the maximum potential profit, that’s a good idea. You typically have to hang out for a whole year to capture the last 20% and you’re better off buying something else unless you have an idea on how to spend the money first—then you can sell it whenever you have a profit that you are happy with. I know a lot of you who bought the 2-year LEAPS in March on our advice already have enormous profits where you’ve made 500% or more in four weeks. If you bought the 2021 LEAPS, I would roll out of those here and then buy the two-year LEAPs on the next selloff to protect yourself against a second Corona wave. Take some good profits, roll that money into longer two-year LEAPS.

Q: There seems to be a real consensus we will retest the lows. Is it possible that the low we recently had was actually a retest of the 2018 lows?

A: We actually got well below the 2018 lows, and with all of the stimulus out there now, I don’t see us going back to 18,000 in the Dow (INDU), 2,200 in the SPY, unless things get worse— dramatically worse, like a sudden spike in cases coming out of the Midwest (that’s almost a certainty) and the south. They opened their beaches and essentially created a breeding ground for the virus to then return to all the states from the visiting beachgoers. So, everyone’s got their eyes on this combined $14 trillion of QE and stimulus and they don’t want to sell their stocks now, so I don’t see a retest of the lows in that situation. I would love it if we did, then that would be like LEAPS heaven, loading up on tech LEAPS at the bottom. But even if we go retest the lows, the tech stocks aren’t going back to the lows—too many buyers are under the market.

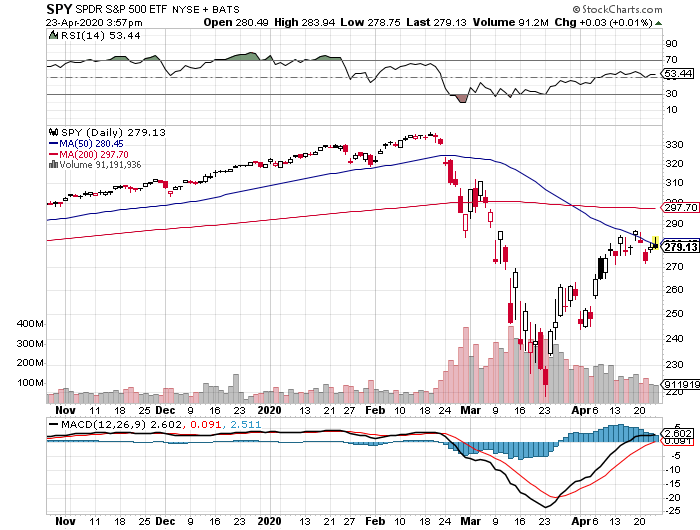

Q: Are you using the 200-day moving average as a top?

A: That’s just one of several indicators; it’s almost a coincidence that the 200-day is right around 300 in the (SPY)’s, but also we have earnings multiples at 100-year highs—that’s another good one. And margin requirements have been greatly increasing. Any kind of leverage has been stripped out of the system, you can’t get leverage (even if you’re a well-known hedge fund) because all lenders are gun-shy after the meltdown last month, so you’re not going to be able to get that kind of leverage for a long time. And you can also bet all the money in the world that companies are not buying their stocks back, and that was essentially the largest net buyer of stocks for the last decade in the market, some $7 trillion worth. So, without companies buying back stocks, especially in the airlines, $300 in the (SPY) could be our top for the next month, or for the next six months.

Q: With Goldman Sachs forecasting four times the worst case of the 2008 great recession, will stocks not retest the market?

A: No. Remember, the total stimulus in 2009 was only $787 billion. We’re already at $6 trillion and $8 trillion in QE so we have more than ten times the stimulus that we had in 2009; so that should offset Goldman’s worst-case scenario. And they’re probably right.

Q: Why are you not shorting oil here?

A: The (USO) was at $50 three months ago, it’s now at $2. I don’t short things that have just gone from $50 to $2. And even though there’s no storage at this price, you want to be building storage like crazy, and it doesn’t take very long to build a big oil storage tank. Another outlier out there is that the US government could step in and buy 20 million barrels to top up the strategic petroleum reserve (SPR). Buying it for free is probably not a bad idea and then sell it next time we go to $20, $30, or $40 a barrel. The other big thing is that the government is mad not to impose punitive import duties on all foreign oil. Any other administration would have already done that long ago because oil prices are destroying the oil industry. But a certain president seems to have an interest in building hotels in the Middle East, and I think that’s why we don’t have import duties on Saudi oil—pure conflict of interest.

Q: Will Coronaviruses be weaker or stronger?

A: We just don’t know. This is a virus that has been in existence for less than a year; most diseases have been around for hundreds of years and we’ve been researching them forever, this one we know essentially nothing. Best case is that it goes the route of the Spanish Flu, which mutated into a less virulent form and just went away. The Black Plague from the Middle Ages did the same thing.

Q: Thoughts on food inflation going forward?

A: Food prices are collapsing and that’s because all of the distribution chains for food are broken. Farmers are having to plow food under in the field, like corn (CORN), soybeans (SOYB), and fruit, because there is no way to get it to the end-user or to the food bank. Food banks are struggling to get a hold of some of this food before it’s destroyed. I know the one in Alameda County, CA is calling farmers all over the west, trying to get truckloads of just raw food sent into the food banks. But those food banks are very poorly funded operations and don't have a lot of money to spend. In California, we have the national guard handing out food at the food banks but there is not enough—they are running out of food. Long term, agriculture is a big user of energy. They should benefit from low oil prices, but it doesn’t do any good if they can’t get their product to the market. Look at any food price and you can see it’s in free fall right now caused by the global deflation and the depression. By the way, the same thing happened in the Great Depression in the 1930s.

Q: Would you short Shopify (SHOP)?

A: No. Shopify is essentially the mini Amazon (AMZN) and has a great future; they are basically having a Black Friday every day. It’s also too late to buy it unless we have a big dip.

Q: Would you include Palladium (PALL) in your precious metals call?

A: No. Palladium especially went into this very expensive, and they are dependent on the car industry for catalytic converters, which has just fallen from a 16 million unit per month to 5 million on the way to zero. Don’t go with the alternative white metals at this time.

Q: What’s your favorite 10 times return stock?

A: Tesla, if you can get it at $500. It’s already delivered me two ten-time returns, and I’m going to go for another tenfold return on a five-year view.

Good Luck and Stay Healthy

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.