This might be one of the most important newsletters you will ever read.

Economies are mainly defined by seismic revolutions, for example, the industrial revolution that cut down simple, archaic jobs to machinery.

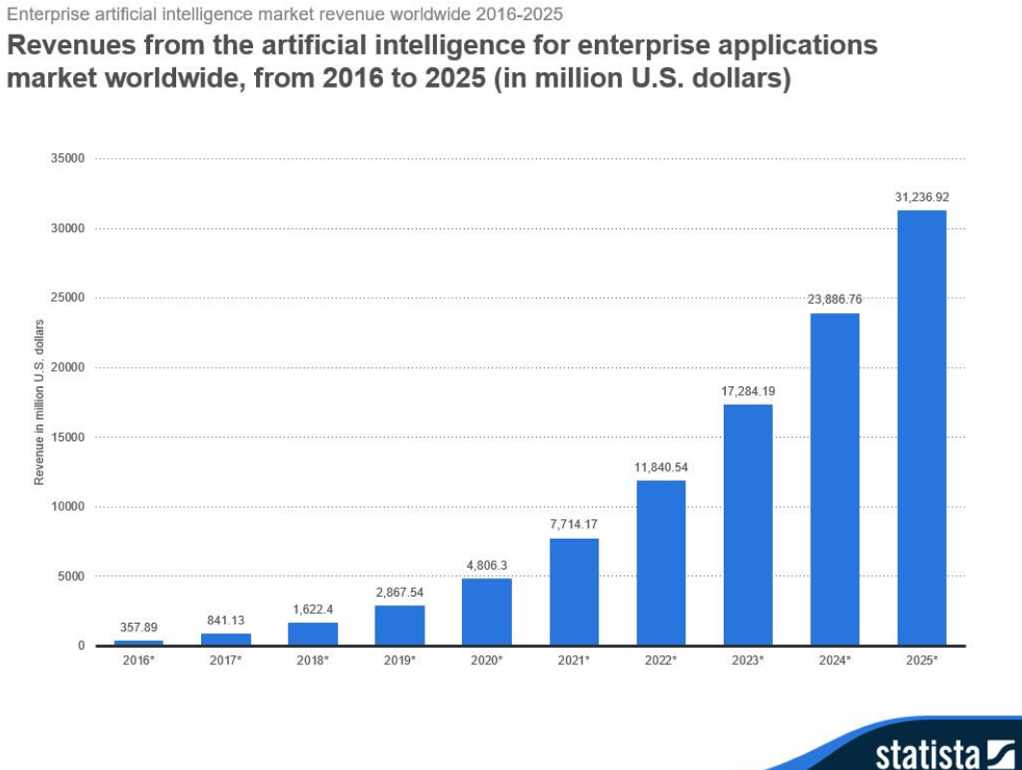

As we are on the verge of shuttering the technological revolution that brought us a party bag of treats like the internet, search engines, smartphones and the personal computer, we must brace ourselves for what is next.

Industry 4.0 is the concept of dazzling smart factories augmented by machines connected to a cloud network and software that processes the operations within the system.

The productivity enhancement will boost performance as machines will be able to visualize and surgically solve problems by applying the software that powers it.

Data exchange in manufacturing technologies which include cyber-physical systems (CPS), the Internet of things (IoT), the Industrial Internet of Things (IIOT), and cognitive computing are concepts that will define Industry 4.0.

As income inequality rears its ugly head and becomes center to what politicians run campaigns on, the world must brace for yet another tsunami of unrivaled job loss on levels that we have never seen before.

The social upheaval that economic chaos will create and offer investors monumental investment opportunities.

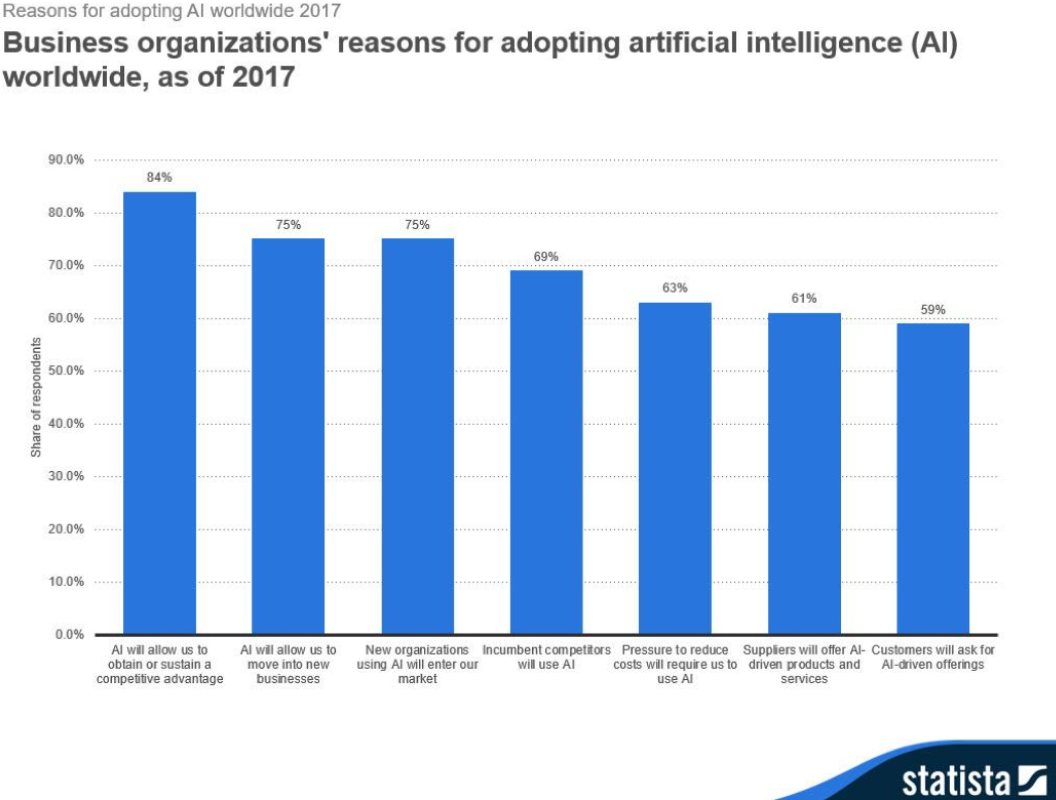

One of the manifestations of technological evolution is the optimization of business processes through automation, meaning less people are involved in the value creation process.

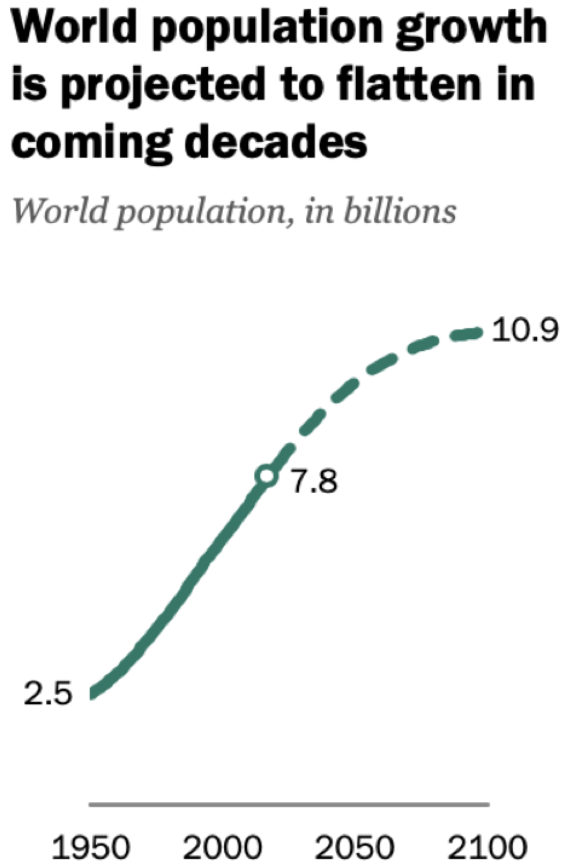

The global population is on the verge of mushrooming from 7.7 billion people in 2019 to 10.9 billion in 2100.

If you think overpopulation and sharing the world’s resources are a problem in 2019, then wait until 2050 when more people are squeezed out of revenue windfalls.

This effectively means the global middle class will accelerate its demise as the job market will bifurcate into a narrow sliver of clear winners and mostly losers and not the muddied version of what we have now.

The first Industrial Revolution also delivered uncertainty that hung over the whole job market, but the world was diverse enough and had ample resources to absorb the negative impact.

The global overpopulation is connected to the economy in the sense that most babies will be born outside of developed industrial economies and the world will see a fiercer rush to gain access to jobs in places such as London, Frankfurt, New York, Tokyo, and Silicon Valley.

The net effect of A.I. could be debated all day, specifically whether the absolute progress made in the development of industry and the products that revolve around it outweigh the torrent of human suffering that it will cause to billions of people who are not employable in that job market.

With exponential computational power to apply A.I., existing behavior will change in society and new cultures will be created because of it.

Economic value will not correlate to the amount of people like it once was, countries like Japan have dived headfirst into automating as much as possible with the best in class technology in robotics.

The world which we know it in 2019 is in the last legs of a nostalgic phase with baby boomers clinging on to what they know growing up in the 1950s.

Soon, that will be eradicated and Millennials will pour what they know and the fallacies they support into the system that is supported by algorithms and machine learning as the first human generation to be technology natives.

We are on the cusp of transformative shifts in the world.

In the next 25 years, technology will start migrating into the chambers of neuroscience.

Technology has discovered that more than 99.99% of human behavior happens at an unconscious level and that the unconscious brain is 10 times faster than the conscious brain.

While at any point of time, the conscious brain can focus only on one task, the unconscious can easily execute infinitely more.

The aspects of human behavior that the rational world has pinpointed is the conscious mind which is an ill-suited representative of human behavior.

The mechanics of the unconscious brain is stuff out of science fiction in 2019 but that will slowly change.

Consciousness has no understanding of what is happening in one’s own unconscious.

Science will be required to squeeze out a mechanism to discern the type of data humans can produce to mold this future subset of technology.

Modern qualitative techniques must be developed to be able to extract data from this important pool of knowledge.

Corporations are at the forefront of this trend and tech power brokers such as Co-Founder and CEO of Facebook Mark Zuckerberg hopes to one day install a chip into consumers' brain so that consumers can access the global network from the brain.

A scary thought but a thought gaining traction, nonetheless.

Ideally, the morally attuned stakeholders carry out the process of benefitting humankind instead of enriching a select few.

That will also be a battle that will define the next generation.

Increased focus on the unconscious processes will cause headaches for companies and there will likely be a numerical cost placed on the data it generates after companies like Facebook (FB) and Google (GOOGL) ran wild with abusing free personal data for decades.

Monitoring and managing the unconscious processes of consumers and employees will be hard at first and then society must assess if this violates privacy or not.

Unconsciousness works best when humans are sleeping or resting.

How can companies capture data on how well someone is using her unconscious brain?

This will befuddle tech companies until there is a solution.

Paradigm shifting scientific discoveries and human innovations have emanated from unconscious processes of the human brain in the past.

We still understand little about how powerful this data could become.

The current emergence of AI will be rooted purely in consciousness and the data that revolves around it, but the problem is that this data isn’t entirely accurate.

In capturing absolutes about complicated topics with current machine learning techniques, it doesn’t synthesize the fact that many areas of the human world deal in many shades of grey.

That is why A.I. is not that good today.

The next big find is if a company doubles down on the unconscious processes and that leads to groundbreaking discoveries in the understanding of accurate human behavior and thought.