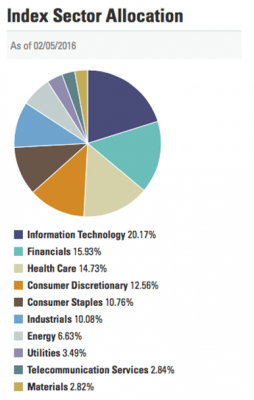

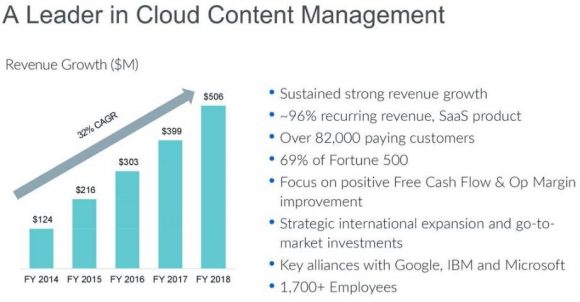

The cloud segment of technology is hotter than hot, and as this sector starts to trade at a big premium, investors will have to look further down the chain of command to find a reasonable deal.

An up-and-coming cloud service Box (BOX) has gone undiscovered and is in position to seize a larger share of the cloud market moving forward.

The firm is led by CEO Aaron Levie who dropped out of my old alma mater USC in 2005 to start a cloud company with acting CFO and childhood friend Dylan Smith.

Last quarter was record-setting for Box, and it had a number of significant six- and seven-digit deals. Keep in mind Box's revenues are paltry compared to the behemoths that run this industry.

The platform has seen gradual success from all corners of the business world with various businesses from insurance claims processors to wealth advisors who use Box as a back-end platform.

Health care is another industry deploying the Box platform to aid and develop cloud services for patients.

In a general sense, the beauty of the cloud is the propensity to adapt to any company that is willing to go digital.

Even though many legacy companies are not natively digital, the cloud can twist and contort to fit the customers' needs.

Levie raised some compelling arguments for the continued tech momentum stating that imminent regulation in Europe through General Data Protection Regulation (GDPR) will act as a "broader tailwind in compliance and security efforts."

Box also announced a "readiness (GDPR) package" revealing that tech companies have been planning for the regulation overhaul up to 18 months in advance.

Even though mass media sensationalism would lead investors to believe the threat of regulation is about to blindside this whole sector, the unrest has been bubbling up for quite some time allowing tech companies ample time to get their houses in order.

Box actually sees the genesis of GDPR as a critical part of the cloud adoption process.

As dinosaur systems become outdated, a sense of safety reinforced by strong cybersecurity protection, strong privacy rules, and content compliance will nudge companies to head for the cloud like a drunk sailor to a pub.

Legacy platforms are the most susceptible to cyber-criminals and rogue hackers.

The analog defense is no match for sophisticated cyber-espionage, and GDPR will be another "driving force" behind the macro-migration shift to the cloud, just based on the security aspect alone.

Another pearl of wisdom offered by Box is that the bulk of clients requiring cloud products are integrating Microsoft Office 365.

This software acts as a lynchpin to any cloud service.

I must confess that I am writing this story on Microsoft Office 365 now, and most businesses cannot function without the dizzying array of Excel, PowerPoint, and Word.

Box has a strong relationship with Microsoft and has incisive insight into the synergies the cloud industry spins off.

The integration of Office 365 has complemented the Azure cloud with tighter cohesiveness.

The school of thought is the collective cloud industry is a $50 billion per year market and growing, offering smaller firms healthy growth levers to advance at the same time that the Microsofts (MSFT) and Amazons (AMZN) overperform.

At the Sohn Investment Conference in New York, Chamath Palihapitiya, a venture capitalist and former Facebook executive, extolled Box as a great way to play Artificial Intelligence (AI).

The shares spiked almost 13% upon his adulation.

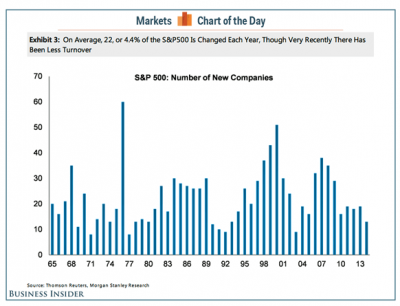

A recent completed survey showed 66% of business leaders feel the pace of digitization must pick up in their own offices.

The speed of innovation is something that keeps most CEOs up at night. Wake up tomorrow and it is possible their core products could be outdated or disrupted by a new Amazon threat.

That is the world we live in now.

Only 42% of CIOs admitted they have a digital strategy. And of those digital strategies, they are mostly digital second or third, not digital first, blueprints.

In the same PricewaterhouseCoopers (PwC) survey, companies conceded that only 40% of IT teams are able to pursue the newest innovations with adopting specific operational needs in mind.

The micro-environment harbors the same bullishness as the macro-factors.

Box is hitting all the right notes.

Revenue is advancing at a 24% per year clip, and annual revenue surpassed the half a billion mark.

Box has indicated it expects to cross the $1 billion annual revenue threshold sometime in mid- to late 2021, giving the company more than three years to double revenue.

Recent reports support Box's growth trajectory.

About 60% of revenue derives from firms that employ more than 2,000 workers, highlighting Box's propensity to emphasize enterprise cloud development instead of small individual users.

Working with larger companies gives Box the opportunity to cross-sell more powerful add-ons, delivering a net expansion rate of 14%.

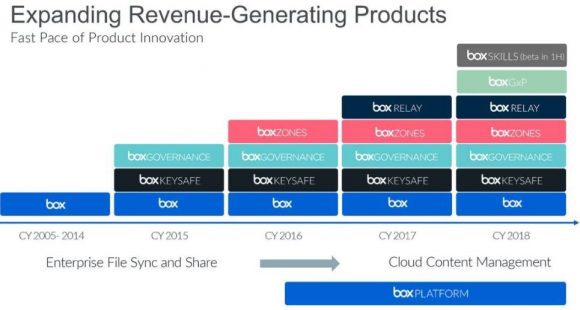

Migrating to a new cloud platform is incredibly sticky boosting retention rates. Box's churn rate is flourishing with a best of breed 4% per year. The key to expediting cloud success is quickening its pace of new product rollout.

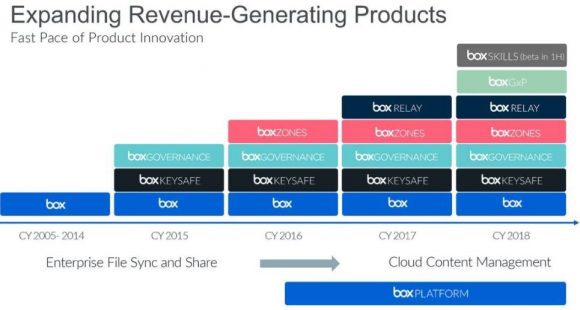

Box attempts to give exactly what customers need with a spate of new concoctions.

Box GxP is a new product calibrated around life science companies. The Box GxP compliance is up to date with FDA regulations. And, Box has the ability to retire legacy ECM (Enterprise Content Management) systems.

This new service has experienced solid traction around the world as we head toward a world where legacy software becomes obsolete.

The second new offering is Box Skills, still in beta mode, which is a part of Box's artificial intelligence strategy.

Box is platform neutral allowing in-house architecture to support partnerships with Google, Microsoft, Amazon, and IBM to nail down third-party cloud tools that Box customers need.

Box Skills is a framework that brings the best machine learning innovation to content securely stored in Box.

This is managed through artificial intelligence, which automatically contextualizes images through detection protocols. Text recognition is automated for the benefit of the user, too.

Audio intelligence renders text transcripts and detects topics that can be searched in Box to locate an audio file by words or topic.

Video intelligence offers transcription, topic detection, and facial recognition allowing users to jump around video files in a non-linear fashion.

Palihapitiya effectively gave Box a free commercial to the tech investing world. His bull thesis for Box squarely centers around its AI innovations, specifically Box Skills.

The last new service to market is Box Transform, which is the advanced consulting arm of Box.

The goal of Transform is to arrange a concierge-like Box advisor that can help companies accelerate digital transformation throughout an organization while unlocking efficiencies and productivity for employees.

This service originated from Box's consulting advanced professional services team and will give Box another growth lever. Companies such as Red Hat and Intel have made the consultant- and support-side of the business a robust part of their organizations.

Impeding growth is the cutthroat competition in this space with Amazon, Microsoft, and Google (GOOGL).

However, margins remain strong at 75.5% last quarter, and Box expects margins to slightly dip around 74% this year.

Box has found a warm welcome for its newer products, deriving almost 70% of its new deals from fresh cloud offerings.

Partners are also a big source of new deals comprising more than half the deals over $100,000.

Specifically, IBM (IBM) made up a swath of its larger deals. In a sense, competitors are not really competitors.

They are frenemies. They compete against each other yet innovate and do deals together.

The core growth is supplemented by existing customers that are the best source of extra marginal revenue.

In short, once firms are firmly lodged on a platform, they buy everything on that platform.

Enter a supermarket, and odds are if goods are purchased, the receipt will be from the entered supermarket.

Box is entirely leveraged toward mid-sized and large enterprise business. That is where it makes its money.

The emphasis on large players boosts the ACV (Average Contract Value), which is regarded as a sacrosanct metric for Box.

The amount of data created in 2017 was more data created in the past 5,000 years. In the next five years, data volume with grow by 800%.

Box has continually positioned itself as the firm that can extract a staggering amount of unrealized value locked away in the nooks and crannies of legacy models.

Box is a great long-term hold as these diminutive cloud assets become more valuable by the day.

_________________________________________________________________________________________________

Quote of the Day

"Television won't be able to hold onto any market it captures after the first six months. People will soon get tired of staring at a plywood box every night." - said Darryl F. Zanuck, co-founder of Twentieth Century-Fox Film Corp.