Global Market Comments

July 30, 2019

Fiat Lux

Featured Trade:

(THE IDIOT’S GUIDE TO INVESTING),

(TSLA), (BYND), (JPM)

(THE SECRET FED PLAN TO BUY GOLD),

(GLD), (GDX), (PALL), (PPLT),

Global Market Comments

July 30, 2019

Fiat Lux

Featured Trade:

(THE IDIOT’S GUIDE TO INVESTING),

(TSLA), (BYND), (JPM)

(THE SECRET FED PLAN TO BUY GOLD),

(GLD), (GDX), (PALL), (PPLT),

Global Market Comments

July 29, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, OR THE BAD OMENS ARE THERE),

(INTC), (GOOGL), (AMZN), (JPM), (FXB),

(PLAYING THE SHORT SIDE WITH VERTICAL BEAR PUT SPREADS), (TLT)

The Omens are there.

I am normally a pretty positive guy.

But I was having a beer at Schwarzee at the base of the Matterhorn the other day, just having completed the climb up to the Hornli Hut at 10,758 feet. I carefully watched with my binoculars three helicopters circle the summit of the mountain, around the Solvay Hut.

These were not sightseeing tours. The pilots were taking great risks to retrieve bodies.

I learned at the Bergfuhrerverein Zermatt the next day that one of their men was taking up an American client to the summit. The man reached for a handhold and the rock broke loose, taking both men to their deaths. The Mountain Guide Service of Zermatt is a lot like the US Marine Corps. They always retrieve their dead.

It is an accident that could have happened to anyone. I have been over that route many times. If there was ever an omen of trouble to come, this was it.

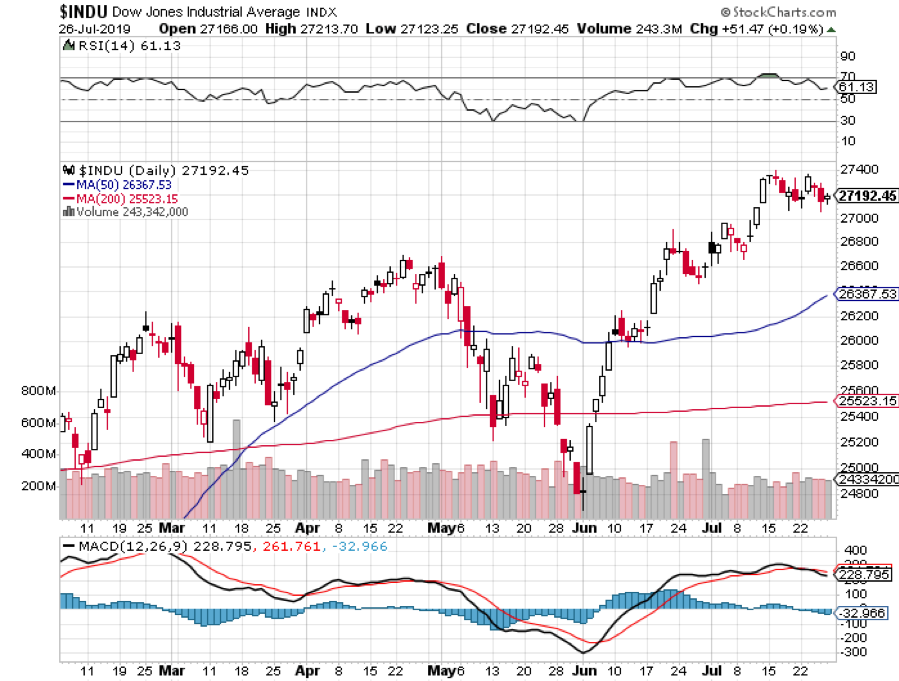

The markets are sending out a few foreboding warnings of their own. Friday’s Q2 GDP report came in at a better than expected 2.1%, versus 3.1% in Q1.

Yet the Dow Average was up only a meager 51.47 points when it should have gained 500. It is an old market nostrum that if markets can’t rally on good news, you get the hell out of Dodge. Zermatt too.

It is the slowest US growth in two years. The trade war gets the blame, with falling exports offsetting healthy consumer spending. With the $1.5 trillion tax cut now spent, nothing is left but the debt. 2020 recession fears are running rampant, so paying all-time highs for stock prices is not a great idea.

You might be celebrating last week’s budget deal which heads off a September government shutdown. But it boosts the national debt from $22 to $24 trillion, or $72,000 per American. As with everything else with this administration, a short-term gain is achieved at a very high long-term cost.

Boris Johnson, the pro-Brexit activist, was named UK prime minister. It virtually guarantees a recession there and will act as an additional drag on the US economy. Global businesses will accelerate their departure from London to Paris and Berlin.

The end result may be a disunited kingdom, with Scotland declaring independence in order to stay in the EC, and Northern Ireland splitting off to create a united emerald island. The stock market there will crater and the pound (FXB) will go to parity against the greenback.

The European economy is already in a downward spiral, with German economic data flat on its back. GDP growth has shrunk from 2.0% to 0.7%. It seems we are not buying enough Mercedes, BMWs, and Volkswagens.

Yields on ten-year German bunds hit close to an all-time low at -0.39%. The Euro (FXE) is looking at a breakdown through parity. The country’s largest financial institution, Deutsche Bank, is about to go under. No one here wants to touch equities there. It’s all about finding more bonds.

Soaring Chip Stocks took NASDAQ to new high. I have to admit I missed this one, not expecting a recovery until the China trade war ended. Chip prices are still falling, and volume is shrinking. We still love (AMD), (MU), and (NVDA) long term as obviously do current buyers.

Existing Home Sales fell off a cliff, down 1.7% in June to a seasonally adjusted 5.27 million units. Median Home Prices jumped 4.7% to $287,400. A shortage of entry-level units at decent prices get the blame. Ultra-low interest rates are having no impact.

JP Morgan (JPM) expects stocks to dive in Q3, driven by earnings downgrades for 2020. Who am I to argue with Jamie Diamond? Don’t lose what you made in H1 chasing rich stocks in H2. Everyone I know is bailing on the market and I am 100% cash going into this week’s Fed meeting up 18.33% year-to-date. I made 3.06% in July in only two weeks.

Alphabet (GOOGL) beat big time, sending the shares up 8% in aftermarket trading. Q2 revenues soared 19% YOY to an eye-popping $39.7 billion. It’s the biggest gain in the stock in four years, to $1,226. The laggard FANG finally catches up. The weak first quarter is now long forgotten.

Amazon (AMZN) delivered a rare miss, as heavy investment spending on more market share offset sales growth, taking the shares down 1%. Amazon Prime membership now tops 100 million. Q3 is also looking weak.

Intel (INTC) surged on chip stockpiling, taking the stock up 5% to $54.70. Customers in China stockpiled chips ahead of a worsening trade war. Q3 forecasts are looking even better. Sale of its 5G modem chip business to Apple is seen as a huge positive.

I've finally headed home, after a peripatetic six-week, 18-flight trip around the world meeting clients. I bailed on the continent just in time to escape a record heatwave, with Paris hitting 105 degrees and London 101, where it was so hot that people were passing out on the non-air conditioned underground.

Avoid energy stocks. The outcry over global warming is about to get very loud. I’ll write a more detailed report on the trip when I get a break in the market.

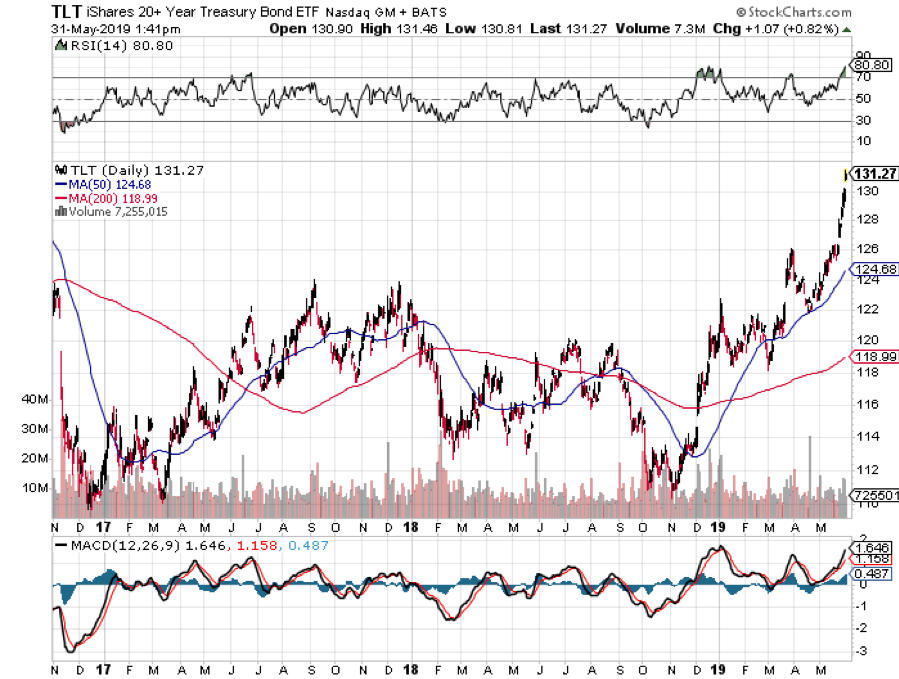

My strategy of avoiding stocks and only investing in weak dollar plays like bonds (TLT), foreign exchange (FXA), and copper (FCX) performed well. After spending a few weeks out of the market, it’s amazing how clear things become. The clouds lift and the fog disperses.

My Global Trading Dispatch has hit a new high for the year at +18.33% and has earned a robust 3.09% so far in July. Nothing like coming out of the blocks for an uncertain H2 on a hot streak. I’m inclined to stay in cash until the Fed interest rate decision on Wednesday.

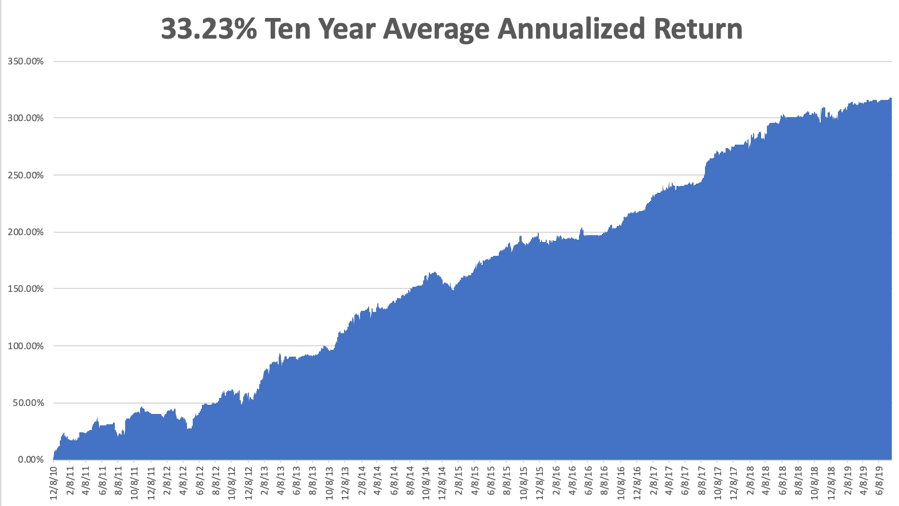

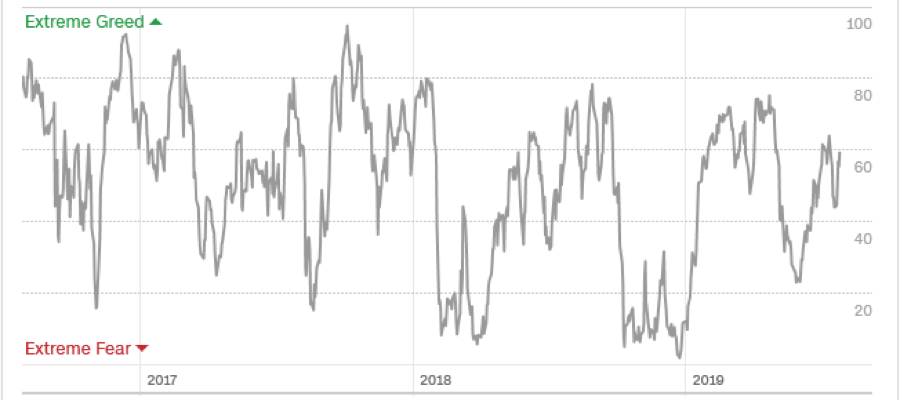

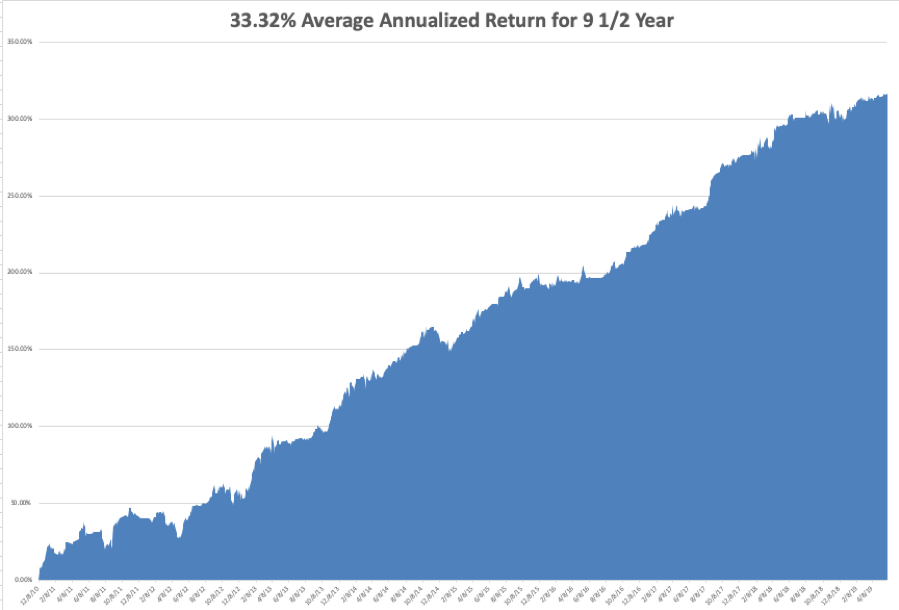

My ten-year average annualized profit bobbed up to +33.23%. With the markets now in the process of peaking out for the short term, I am now 100% in cash with Global Trading Dispatch and 100% cash in the Mad Hedge Tech Letter. If there is one thing supporting the market now, it is the fact that my Mad Hedge Market Timing Index has pulled back to a neutral 60. It’s a Goldilocks level, not too hot and not too cold.

The coming week will be a big one on the data front, with one big bombshell on Wednesday and the Payroll data on Friday.

On Monday, July 29, the Dallas Fed Manufacturing Index is out.

On Tuesday, July 30, we get June Pending Home Sales. A new Case Shiller S&P National Home Price Index is published. Look for YOY gains to shrink.

On Wednesday, July 31, at 8:30 AM, learn the ADP Private Employment Report. At 2:00 PM, the Fed interest rate decision is released and an extended press conference follows. If they don’t cut rates, there will be hell to pay.

On Thursday, August 1 at 8:30 AM, the Weekly Jobless Claims are printed.

On Friday, August 2 at 8:30 AM, we get the July Nonfarm Payroll Report. Recent numbers have been hot so that is likely to continue.

The Baker Hughes Rig Count follows at 2:00 PM.

As for me, by the time you read this, I will have walked the 25 minutes from my Alpine chalet down to the Zermatt Bahnhoff, ridden the picturesque cog railway down to Brig, and picked up an express train through the 12-mile long Simplon Tunnel to Milan, Italy.

Then I’ll spend the rest of the weekend winging my way home to San Francisco in cramped conditions on Air Italy. Yes, I had to get a few more cappuccinos and a good Italian dinner before coming home.

Now, on with the task of doubling my performance by yearend.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

June 3, 2019

Fiat Lux

Featured Trade:

(MONDAY, JUNE 24 MELBOURNE, AUSTRALIA STRATEGY LUNCHEON)

(MARKET OUTLOOK FOR THE WEEK AHEAD, OR WHAT A WASTE OF TIME!),

(SPY), ($INDU), (JPM), (MSFT), (AMZN), (TSLA)

“Sell in May and go away” has long suffered from the slings and arrows of non-believers, naysayers, and debunkers.

Not this time.

Looking at the trading since April 30, we have barely seen an up day. Since then, the Dow Average has plunged 1,900 points from a 26,700 high, a loss of 7.1%. We are now sitting right at my initial downside target of the 200-day moving average.

The Dow has now given up virtually all its 2019 gains, picking up only 2.0%. In fact, the market is dead unchanged since the end of 2017. If you have been an index investor for the past 17 months, your return has been about zero. In other words, it has been a complete waste of time.

There are a lot of things I would have preferred to do rather than invest in index funds for the past year and a half. I could have hiked the Pacific Crest Trail….twice. I might have taken six Cunard round-the-world cruises and met several rich widows along the way. I might even have become fluent in Italian and Latin. Such is the value of 20-20 hindsight.

You would have done much better investing in the bond market, which has exploded to a new two-year high, taking the ten-year US Treasury yield down to a once unimaginable 2.16%. During the same period, the (TLT) has gained 11 points, or 9.0% plus another 3.0% worth of interest. You did even better if you invested in lower grade credits.

Which leads us to the big question: Will stocks bottom out here, or are we in for a full-on retrace to the December lows?

Unfortunately, recent events have conspired to point to the latter.

The United States has now declared trade wars against all neighbors and allies around the world: China, Mexico, Europe, and Canada. On Friday, it announced 25% punitive tariffs against Mexico before NAFTA 2.0 was even ratified before Congress, thus rendering it meaningless. Businesses are dropping like flies.

As a result, GDP forecasts have been falling off a cliff, down from 3.2% in Q1 to under 1% for Q2. The administration’s economic policy seems to be a pain now, and more pain later. It is absolutely not what stock investors want to hear.

If you are a business owner now, what do you do with the global supply chain being put through a ringer? Sit as firmly on your hands as possible and do nothing, waiting for either the policy or the administration to change. Stock investors don’t want to hear this either. The fact that stock markets entered this cluster historically expensively is the fat on the fire.

Having hummed the bear national anthem, I would like to point out that stocks could rally from here. We enter a new month on Monday. There will be plenty of opportunities to make amends and the G-20 meeting which starts on June 20. This should provide a backdrop for a rally of at least one-third of the recent losses, or about 600 points.

But quite honestly, if that happens, I’ll be a seller. The economy is doing the best impression of going down the toilet that I can recall, and that includes 2008. Only this time, all the injuries are self-inflicted.

As the trade war ramped up, China moved to ban FedEx (FDX) and restrict rare earth exports (REMX) to the US essential for all electronics manufacture. Most modern weapons systems can’t be built without rare earths. The big question in investors' minds becomes “Is Apple next?”

The OECD cut its global growth forecast from 3.9% to 3.1% for 2019 because of you know what. Stock markets are now down for their sixth week as the 200-day moving average comes within striking distance.

There was more bad news for real estate with April Pending Home Sales down 1.5%. If rates this low can’t help it, nothing will. Where are those SALT deductions?

The bear market in home prices continued in March with the Case Shiller CoreLogic National Home Price Index showing a 3.7% annual price gain, down 0.2%. Home price in San Francisco is posting negative numbers. When will those low-interest rates kick in?

The bond market says the recession is already here with ten-year interest rates at 2.16%, a new 2019 low. German bunds hit negative -0.21%. JP Morgan (JPM) CEO Jamie Diamond says the trade war could cause real damage to the US economy.

US Capital Goods fell out of bed in April, down 0.9%, in another important pre-recession indicator. No company with sentient management wants to expand capacity ahead of an economic slowdown.

Despite all the violence and negativity, the Mad Hedge Fund Trader managed to crawl to new all-time highs last week, thanks to some very conservative positioning on the long side in the right names.

Those would include Microsoft (MSFT), Amazon (AMZN), and Tesla (TSLA). All of these names were down on the week, but the vertical bull call spreads were up. You see, there is a method to my madness!

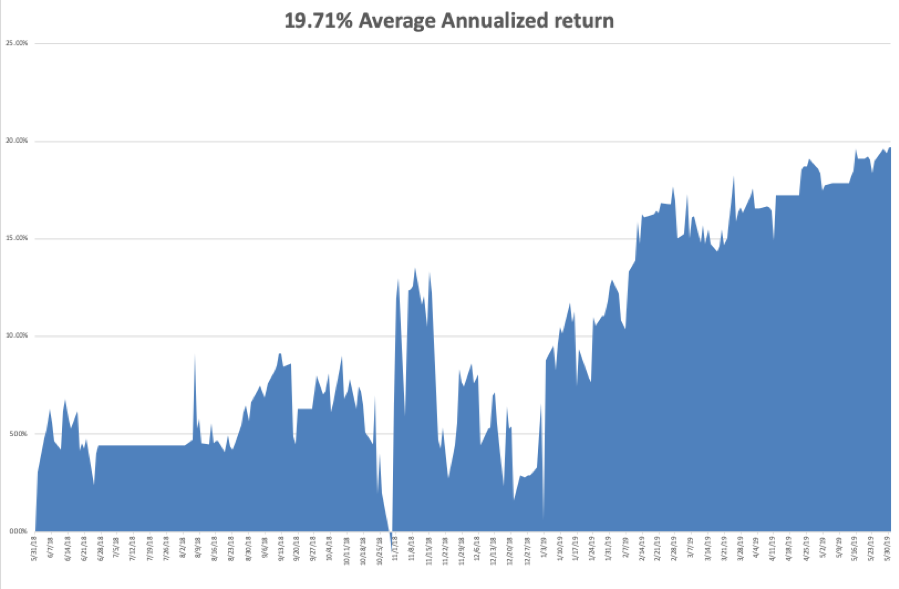

Global Trading Dispatch closed the week up 16.30% year-to-date and is up 0.51% so far in May. My trailing one-year declined to +19.71%.

The Mad Hedge Technology Letter did fine, making money on longs in Microsoft (MSFT) and Amazon (AMZN). Some 10 out of 13 Mad Hedge Technology Letter round trips have been profitable this year.

My nine and a half year profit jumped to +316.55%. The average annualized return popped to +33.32%. With the trade war with China raging, I am now 70% in cash with Global Trading Dispatch and 80% cash in the Mad Hedge Tech Letter.

I’ll wait until the markets enjoy a brief short-covering rally before adding any short positions to hedge my longs.

The coming week will be a big one with the trifecta of big jobs reports.

On Monday, June 3 at 7:00 AM, the May US Manufacturing PMI is out.

On Tuesday, June 4, 9:00 AM EST, the April US Factory Orders are published.

On Wednesday, June 5 at 5:15 AM, the May US ADP Employment Report of private hiring trends is released.

On Thursday, June 6 at 5:30 AM, the April US Balance of Trade is printed. At 8:30 Weekly Jobless Claims are published.

On Friday, June 7 at 8:30 AM, we learn the May Nonfarm Payroll Report is announced which lately has been incredibly volatile.

As for me, I am going to be leading the local Boy Scout troop on a 20-mile hike with a 2,500-foot vertical climb in the Oakland Hills. Hey, you never know when Uncle Sam is going to come calling again. I need to stay boot camp-ready at all times.

At least I can still outpace the eleven-year-olds. I’ll be leaving my 60-pound pack in the garage so it should be a piece of cake.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

April 1, 2019

Fiat Lux

Featured Trade:

(THE NEXT TECH BUBBLE TOP HAS STARTED)

(LYFT), (PIN), (UBER), (AAPL), (JPM), (FB)

Don't go chasing rainbows.

That is what the current tech IPO environment is hinting.

Even though market conditions are frothy, that doesn't mean I'm calling a market top today, hardly so.

I predicted that Lyft (LYFT) would storm out of the gate like a bull on ecstasy, and I was vindicated when the stock flirted intraday with the $87 mark.

The scarcity value of these gig economy companies is hard to quantify.

Examples Uber unduly promise ambition and innovation leading to hopes of a possible air transport service and sharing network that I would need to see to believe.

The built-up expectations smell of over-promising and under-delivering, the majority won’t be able to deliver merely half of what their manifestos promulgate

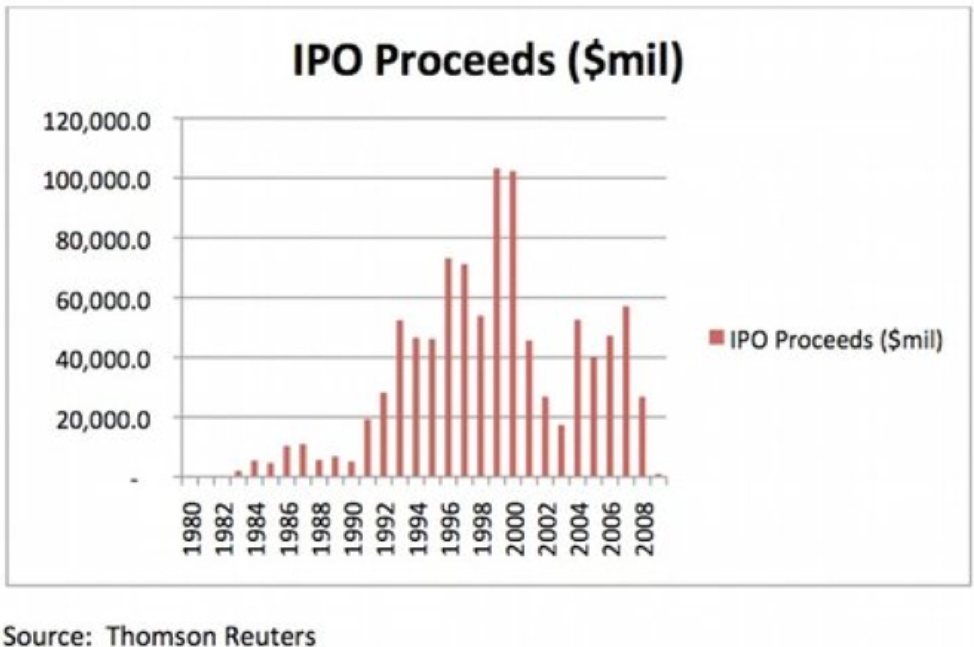

As I put my analyst hat on, the 2019 IPO frenzy coming online has some of the same fingerprints of the infamous dot com bust of 2001.

The two main trends symbolic of the last time the tech industry disentangled were overly generous valuation, pricing in revenue expansion of 80% for the next five years when the leader of the pack Microsoft (MSFT) only grew at 50%.

A tantalizing clue was the utterly deficient cash flow generated back then.

The underlying premise revolved around putting the network effect on a pedestal irrespective of understanding that the network effect should have caused cash flow to accelerate which was conspicuously absent.

Losing money and losing a lot of it does lead to paralysis, examples were rife, for instance, priceline.com losing $30 on each air ticket sold.

Even more hard to fathom was that Priceline was stretching itself to the limits on the open market filling ticket orders because of a dearth of inventory steepening losses.

Priceline gushed about a unique business model of collecting excess ticket inventory that airlines couldn't sell at low cost and reskinning them to a digital audience hoping to take advantage of this price dispersion.

But in reality, this wasn’t always the case.

Priceline was on a suicide mission and expanding from 50 employees to 300 employees based upon misleading growth was madness.

In a nutshell, investors bypassed pragmatic arithmetic and were lifted by the fumes of exuberance that had manifested around the euphoria of the tech bubble.

Lyft is not revolutionary, they are a broker which occupy a low position in the spectrum of tech intellectual property.

Exploiting drivers, compensating them per hour, and letting them figure out their own cost structures for car insurance, fuel costs, and opportunity cost while offering zero benefits is a court battle waiting to happen in California.

And if your response was the way they craft value is by way of a proprietary app, well, Google, Apple, or even Netflix can produce the same type of app and quality of app in a few weeks with their legendary phalanx of top-tier engineering talent.

To Lyft’s credit, they have at least collected the treasure trove of data the app has compiled which is extraordinarily valuable.

The top of the tech bubble means that big tech is overreaching into any revenue they can get their hands on like a heroin addict yearning for the next syringe.

The environment has transformed into an eerily zero-sum game, such as Apple (AAPL) cooperating with JPMorgan Chase (JPM) to create Apple pay, and then instantly flipping around to compete with JPMorgan Chase in the credit card space with Apple Pay being an accomplice.

Big tech has sown the seeds of discord by quietly attempting to trample on any analog business they can get near.

Leveraging the network effect of billions of users in a proprietary walled garden to extract the incremental dollar for a new service is impossible to compete with for analog companies without a similar embedded on-demand audience.

Lyft co-founder and CEO Logan Green mentioned in an interview that in the next five year, he plans to deploy a subscription service coined as transportation-as-a-service like a software-as-a-service option which cloud platforms sell.

A fight to the bottom with Uber will cause major disruption in the pricing mechanisms of the subscription service and could force Lyft to earn less revenue per ride than the current pricing system.

Investors need to remember that Uber is bigger than Lyft and possessed more ammunition.

At the end of the day, the race to the bottom is never good for profitability or sustainability, and Lyft has yet to provide any substantial clues on how they will navigate through this quagmire.

My guess is that Lyft will have to do a deal with the devil of sorts to slang its branded broker app onto the cresting wave of Waymo as Waymo motors ahead and starts to materially monetize its self-driving program.

Remember that Alphabet already has a small stake in Lyft and these two could partner up with Alphabet dictating terms.

Lyft cannot compete with the holy grail of tech - self-driving technology – they are way down the tech value chain.

If we look at the bigger picture, the broader market has been riding the coattails of Federal Reserve Chairman Jerome Powell’s 180-degree turn from winter’s statement that interest rate tightening was on “autopilot.”

Now, there is only a 27% chance given by the market that the Fed will raise rates at all in 2019.

The market responded with strength begetting strength allowing the bull run to continue and even whispers of a possible rate cut later this year.

Sentiment will not change until we get to the point when earnings can’t surpass the expectation which have been lowered substantially.

I bet this won’t happen until late this year or next year.

This is inning 8 or 9 of the bull crusade, the closer is warming up in the bullpen.

Lyft’s opening day gallop is just one of the side effects from a market that is toppy.

Global Market Comments

March 22, 2019

Fiat Lux

Featured Trade:

(I HAVE AN OPENING FOR THE MAD HEDGE FUND TRADER CONCIERGE SERVICE),

(MARCH 20 BIWEEKLY STRATEGY WEBINAR Q&A),

(BA), (FCX), (IWM), (JNJ), (FXB), (VIX), (JPM)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader March 20 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: What do you make of the Fed’s move today in interest rates?

A: By cutting short their balance sheet unwind early and ending quantitative tightening (QT) early, it amounts to two surprise interest rate cuts and is hugely “RISK ON”. In effect, they are injecting $2.7 trillion in new cash into the financial system. New highs in stocks beckon, and technology stocks will lead. This is a game changer. In a heartbeat, the world has moved from QT to QE, and we already know what that means for socks. They go up.

Q: Why buy Boeing shares (BA) ahead of a global recession?

A: It’s an 18-day bet that I’ve made in the options market. The US economic data is already indicating recession. The data will continue to worsen and that will continue until we go into a recession. But that’s not happening in 18 trading days. Also, we’re getting into Boeing down 20% from the top so our risk is minimal.

Q: Why are we in an open Russell 2000 (IWM) short position?

A: We now have three long positions— 40% on the long side with the Freeport McMoRan (FCX) double position. It’s always nice to have something on the other side to hedge sudden 145-point declines like we have today. Ideally, you want to be hedged at all times. But it’s hard to fund good companies to sell short in a bull market.

Q: Do you need some euphoria to get the Volatility Index (VIX) to the $30-$60 level?

A: No, you don’t need euphoria. You need fear and panic. The (VIX) is a good “fear index” in that it rises when markets are crashing and falling when markets are slowly rising. And for that reason, I’m not buying (VIX) right now. With a sideways to slowly rising market, we could see the $9 handle again before this move is over.

Q: What should be the exit on the Russell 2000 (IWM)?

A: One choice is taking 80% of the maximum profit when you hit it—that’s where the risk-reward tips against you if you keep the position. The other option is to be greedy and run it all the way into expiration, taking the full profit. It depends on your risk tolerance. Remember, we hit the 80% profit three times in March only to stop out of positions for a loss. The market just doesn’t seem to want to let you take the whole 100%.

Q: Why are all your expirations on April 18?

A: That’s when the monthly options expire; therefore, they have the most liquidity of any other option expiration. If you go with the weeklies before or after the monthlies, the liquidity declines dramatically, which can be very frustrating. Since I used to cover only the largest clients, we could only trade in monthlies because we needed the size.

Q: Will Johnson and Johnson (JNJ) survive all those talcum powder lawsuits?

A: They’ve been going on for 10 years—you’d think they’d know by now if they have asbestos in their talcum powder or not. I highly doubt this will get anywhere; they’ll probably win everything on appeal.

Q: What do you anticipate on Brexit?

A: I think eventually Brexit will fail; we’ll have a referendum which will get voted down, Britain will rejoin Europe, and the British pound (FXB) will go to $1.65 to the dollar where it was when Brexit hit three years ago, up from $1.29 today. It would be economic suicide for Britain to leave Europe, as they would have to compete against Europe, the US, and China alone, and they are slowly figuring that out. Demographic change alone over three years would guarantee that another referendum fails.

Q: My partner owns JP Morgan (JPM). Do you still say banks are not a good place to be?

A: Yes. Fintech is eating their lunch. If they couldn't go up with interest rates moving up in the right direction, they certainly won’t be doing better now that interest rates are going down. Legacy banks are the new buggy whip industry.

Q: Why are commodities (FCX) increasing with a coming recession?

A: They are a hard asset and do better in inflation. Also, they’re stimulating their economy in China and we aren't—commodities do better in that situation as China is the world’s largest buyer of commodities, as do all Chinese investments.

Q: Would you buy Biogen (BIIB) on the dip? Its down 30% today.

A: Canceling their advanced phase three trials for the Alzheimer drug Aducanumab is the worst-case scenario for a biotech company. Some $12 billion in prospective income is down the toilet and many years of R&D costs are a complete write-off. Avoid (BIIB) until the dust settles.

Mad Hedge Technology Letter

January 17, 2019

Fiat Lux

Featured Trade:

(WHY FINTECH IS EATING THE BANKS’ LUNCH),

(WFC), (JPM), (BAC), (C), (GS), (XLF), (PYPL), (SQ), (SPOT), (FINX), (INTU)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.