Going into January 2018, the big banks were highlighted as the pocket of the equity market that would most likely benefit from a rising rate environment which in turn boosts net interest margins (NIM).

Fast forward a year and take a look at the charts of Bank of America (BAC), Citibank (C), JP Morgan (JPM), Goldman Sachs (GS), and Morgan Stanley (GS), and each one of these mainstay banking institutions are down between 10%-20% from January 2018.

Take a look at the Financial Select Sector SPDR ETF (XLF) that backs up my point.

And that was after a recent 10% move up at the turn of the calendar year.

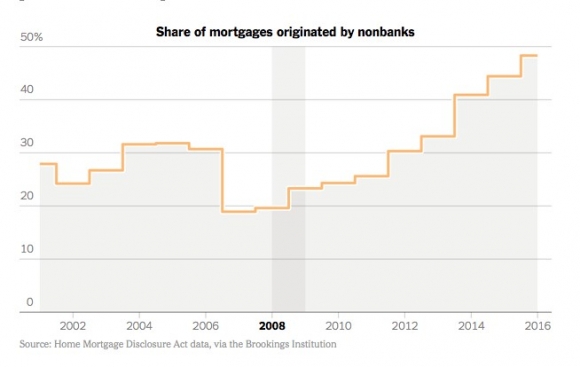

As much as it pains me to say it, bloated American banks have been completely caught off-guard by the mesmerizing phenomenon that is FinTech.

Banking is the latest cohort of analog business to get torpedoes by the brash tech start-up culture.

This is another fitting example of what will happen when you fail to evolve and overstep your business capabilities allowing technology to move into the gaps of weakness.

Let me give you one example.

I was most recently in Tokyo, Japan and was out of cash in a country that cash is king.

Japan has gone a long way to promoting a cashless society, but some things like a classic sushi dinner outside the old Tsukiji Fish Market can’t always be paid by credit card.

I found an ATM to pull out a few hundred dollars’ worth of Japanese yen.

It was already bad enough that the December 2018 sell-off meant a huge rush into the safe haven currency of the Japanese Yen.

The Yen moved from 114 per $1 down to 107 in one month.

That was the beginning of the bad news.

I whipped out my Wells Fargo debit card to withdraw enough cash and the fees accrued were nonsensical.

Not only was I charged a $5 fixed fee for using a non-Wells Fargo ATM, but Wells Fargo also charged me 3% of the total amount of the transaction amount.

Then I was hit on the other side with the Japanese ATM slamming another $5 fixed fee on top of that for a non-Japanese ATM withdrawal.

For just a small withdrawal of a few hundred dollars, I was hit with a $20 fee just to receive my money in paper form.

Paper money is on their way to being artifacts.

This type of price gouging of banking fees is the next bastion of tech disruption and that is what the market is telling us with traditional banks getting hammered while a strong economy and record profits can’t entice investors to pour money into these stocks.

FinTech will do what most revolutionary technology does, create an enhanced user experience for cheaper prices to the consumers and wipe the greedy traditional competition that was laughing all the way to the bank.

The best example that most people can relate to on a daily basis is the transportation industry that was turned on its head by ride-sharing mavericks Uber and Lyft.

But don’t ask yellow cab drivers how they think about these tech companies.

Highlighting the strong aversion to traditional banking business is Slack, the workplace chat app, who will follow in the footsteps of online music streaming platform Spotify (SPOT) by going public this year without doing a traditional IPO.

What does this mean for the traditional banks?

Less revenue.

Slack will list directly and will set its own market for the sale of shares instead of leaning on an investment bank to stabilize the share price.

Recent tech IPOs such as Apptio, Nutanix and Twilio all paid 7% of the proceeds of their offering to the underwriting banks resulting in hundreds of millions of dollars in revenue.

Directly listings will cut that fee down to $10-20 million, a far cry from what was once status quo and a historical revenue generation machine for Wall Street.

This also layers nicely with my general theme of brokers of all types whether banking, transportation, or in the real estate market gradually be rooted out by technology.

In the world of pervasive technology and free information thanks to Google search, brokers have never before added less value than they do today.

Slowly but surely, this trend will systematically roam throughout the economic landscape culling new victims.

And then there are the actual FinTech companies who are vying to replace the traditional banks with leaner tech models saving money by avoiding costly brick and mortar branches that dot American suburbs.

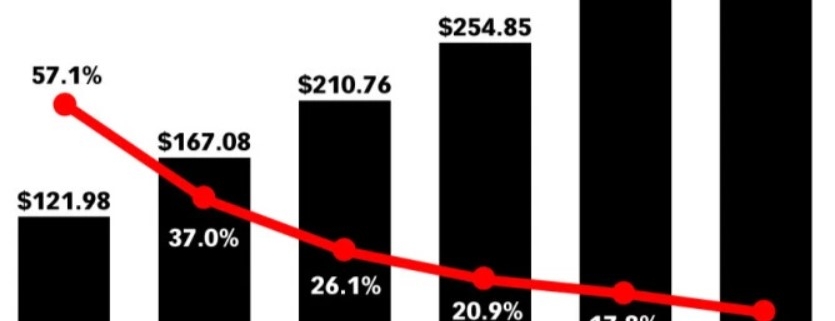

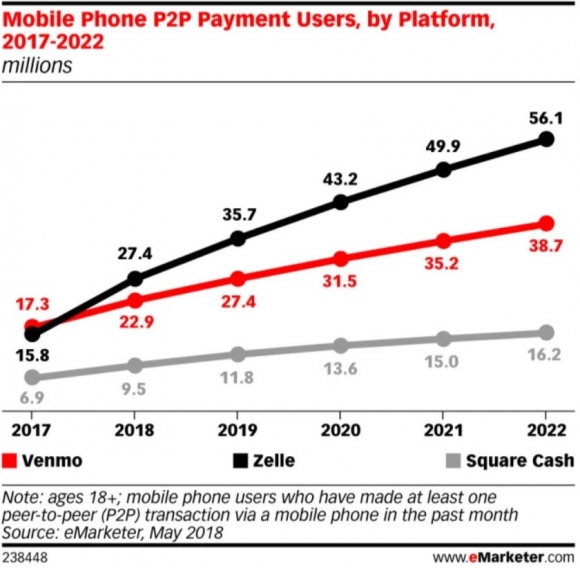

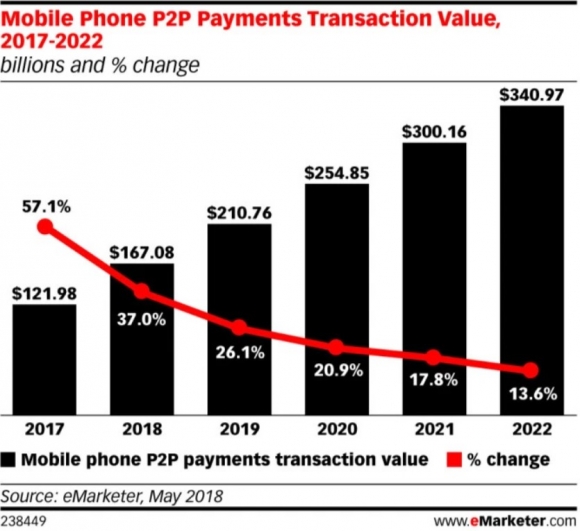

PayPal (PYPL) has been around forever, but it is in the early stages of ramping up growth.

That doesn’t mean they have a weak balance sheet and their large embedded customer base approaching 250 million users has the network effect most smaller FinTech players lack.

PayPal is directly absorbing market share from the big banks as they have rolled out debit cards and other products that work well for millennials.

They are the owners of Venmo, the super-charged peer-to-peer payment app wildly popular amongst the youth.

Shares of PayPal’s have risen over 200% in the past 2 years and as you guessed, they don’t charge those ridiculous fees that banks do.

Wells Fargo and Bank of America charge a $12 monthly fee for balances that dip below $1,500 at the end of any business day.

Your account at PayPal can have a balance of 0 and there will never be any charge whatsoever.

Then there is the most innovative FinTech company Square who recently locked in a new lease at the Uptown Station in Downtown Oakland expanding their office space by 365,000 square feet for over 2,000 employees.

Square is led by one of the best tech CEOs in Silicon Valley Jack Dorsey.

Not only is the company madly innovative looking to pounce on any pocket of opportunity they observe, but they are extremely diversified in their offerings by selling point of sale (POS) systems and offering an online catering service called Caviar.

They also offer software for Square register for payroll services, large restaurants, analytics, location management, employee management, invoices, and Square capital that provides small loans to businesses and many more.

On average, each customer pays for 3.4 Square software services that are an incredible boon for their software-as-a-service (SaaS) portfolio.

An accelerating recurring revenue stream is the holy grail of software business models and companies who execute this model like Microsoft (MSFT) and Salesforce (CRM) are at the apex of their industry.

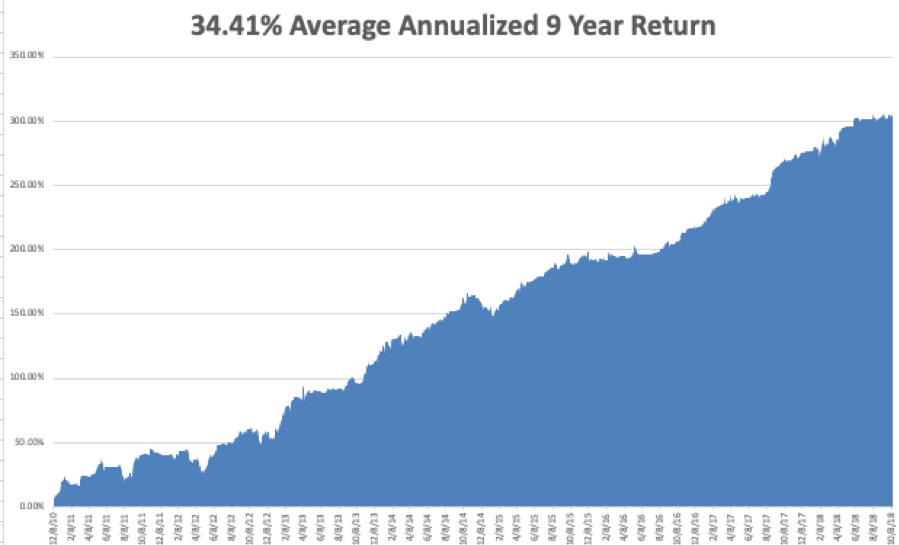

The problem with trading this stock is that it is mind-numbingly volatile. Shares sold off 40% in the December 2018 meltdown, but before that, the shares doubled twice in the past two years.

Therefore, I do not promote trading Square short-term unless you have a highly resistant stomach for elevated volatility.

This is a buy and hold stock for the long-term.

And that was only just two companies that are busy redrawing the demarcation lines.

There are others that are following in the same direction as PayPal and Square based in Europe.

French startup Shine is a company building an alternative to traditional bank accounts for freelancers working in France.

First, download the app.

The company will guide you through the simple process — you need to take a photo of your ID and fill out a form.

It almost feels like signing up to a social network and not an app that will store your money.

You can send and receive money from your Shine account just like in any banking app.

After registering, you receive a debit card.

You can temporarily lock the card or disable some features in the app, such as ATM withdrawals and online payments.

Since all these companies are software thoroughbreds, improvement to the platform is swift making the products more efficient and attractive.

There are other European mobile banks that are at the head of the innovation curve namely Revolut and N26.

Revolut, in just 6 months, raised its valuation from $350 million to $1.7 billion in a dazzling display of growth.

Revolut’s core product is a payment card that celebrates low fees when spending abroad—but even more, the company has swiftly added more and more additional financial services, from insurance to cryptocurrency trading and current accounts.

Remember my little anecdote of being price-gouged in Tokyo by Wells Fargo, here would be the solution.

Order a Revolut debit card, the card will come in the mail for a small fee.

Customers then can link a simple checking account to the Revolut debit card ala PayPal.

Why do this?

Because a customer armed with a Revolut debit card linked to a bank account can use the card globally and not be charged any fees.

It would be the same as going down to your local Albertson’s and buying a six-pack, there are no international or hidden fees.

There are no foreign transaction fees and the exchange rate is always the mid-market rate and not some manipulated rate that rips you off.

Ironically enough, the premise behind founding this online bank was exactly that, the originators were tired of meandering around Europe and getting hammered in every which way by inflexible banks who could care less about the user experience.

Revolut’s founder, Nikolay Storonsky, has doubled down on the firm’s growth prospects by claiming to reach the goal of 100 million customers by 2023 and a succession of new features.

To say this business has been wildly popular in Europe is an understatement and the American version just came out and is ready to go.

Since December 2018, Revolut won a specialized banking license from the European Central Bank, facilitated by the Bank of Lithuania which allows them to accept deposits and offer consumer credit products.

N26, a German like-minded online bank, echo the same principles as Revolut and eclipsed them as the most valuable FinTech startup with a $2.7 Billion Valuation.

N26 will come to America sometime in the spring and already boast 2.3 million users.

They execute in five languages across 24 countries with 700 staff, most recently launching in the U.K. last October with a high-profile marketing blitz across the capital.

Most of their revenue is subscription-based paying homage to the time-tested recurring revenue theme that I have harped on since the inception of the Mad Hedge Technology Letter.

And possibly the best part of their growth is that the average age of their customer is 31 which could be the beginning of a beautiful financial relationship that lasts a lifetime.

N26’s basic current account is free, while “Black” and “Metal” cards include higher ATM withdrawal limits overseas and benefits such as travel insurance and WeWork membership for a monthly fee.

Sad to say but Bank of America, Wells Fargo, and the others just can’t compete with the velocity of the new offerings let alone the software-backed talent.

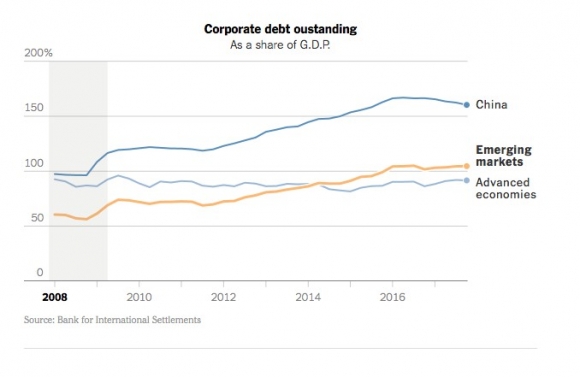

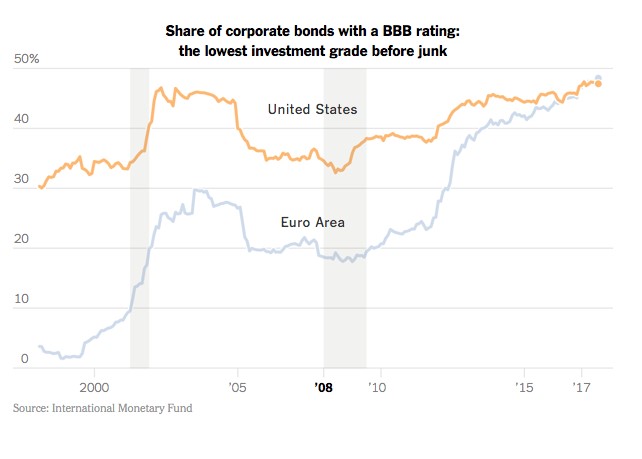

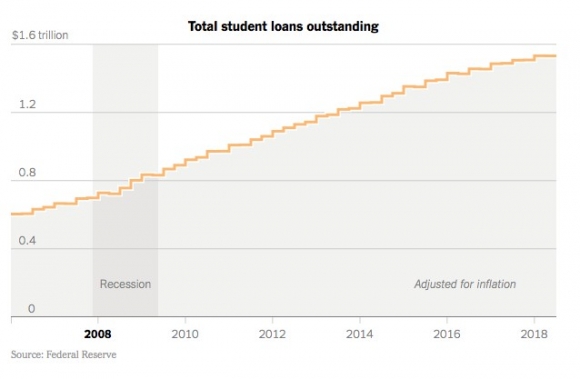

We are at an inflection point in the banking system and there will be carnage to the hills, may I even say another Lehman moment for one of these stale business models.

Online banking is here to stay, and the momentum is only picking up steam.

If you want to take the easy way out, then buy the Global X FinTech ETF (FINX) with an assortment of companies exposed to FinTech such as PayPal, Square, and Intuit (INTU).

The death of cash is sooner than you think.

This year is the year of FinTech and I’m not afraid to say it.