Global Market Comments

May 26, 2022

Fiat Lux

Featured Trade:

(WHY TECHNICAL ANALYSIS IS A DISASTER)

(THE COOLEST TOMBSTONE CONTEST)

(SJB), (JNK), (HYG)

Global Market Comments

May 26, 2022

Fiat Lux

Featured Trade:

(WHY TECHNICAL ANALYSIS IS A DISASTER)

(THE COOLEST TOMBSTONE CONTEST)

(SJB), (JNK), (HYG)

Global Market Comments

September 17, 2021

Fiat Lux

Featured Trade:

(WHY TECHNICAL ANALYSIS IS A DISASTER)

(THE COOLEST TOMBSTONE CONTEST)

(SJB), (JNK), (HYG)

Global Market Comments

November 24, 2020

Fiat Lux

FEATURED TRADE:

(WHY TECHNICAL ANALYSIS IS A DISASTER)

(THE COOLEST TOMBSTONE CONTEST)

(SJB), (JNK), (HYG)

Global Market Comments

November 13, 2019

Fiat Lux

Featured Trade:

(HOW TO HANDLE THE FRIDAY, NOVEMBER 15 OPTIONS EXPIRATION),

(TAKE A RIDE IN THE NEW SHORT JUNK ETF),

(SJB), (JNK), (HYG),

(THE COOLEST TOMBSTONE CONTEST)

Stocks will drop sharply in the coming year. It will most likely happen when the Democratic candidate takes a substantial lead over the president, which recent by-elections have shown is likely.

What could be better than an ETF that benefits from both falling bonds AND stocks?

It just so happens that there is such an animal.

When you look at the profusion of new ETFs being launched today, you find that they almost always correspond with market tops.

The higher the market, the greater the demand for the underlying, and the more leverage traders bay for it. The resulting returns for investors are usually disastrous.

But occasionally, a blind squirrel finds an acorn, and if you fire buckshot long enough, you hit a barn.

That’s why I am getting interested in the new ProShares Short High Yield ETF (SJB). After riding the bull move in junk all the way up with (JNK), (HYG), I have recently turned negative on the sector.

Junk bonds have moved too far too fast. Current spreads for junk paper are now only 200 basis points over equivalent term Treasury bonds, and investors at these levels are in no way being compensated for their risk.

If the stock market starts to roll over in 2018, then the junk bond market will follow it in the elevator going down to the ladies' underwear department in the basement.

Keep in mind that when shorting the junk market, you run into the same problem you have with the (TBT), a leveraged short ETF for the Treasury bond market.

Buy the (JNK) and you are short a 5.75% coupon which, with the management fees, works out to a monthly cost of more than 50 basis points. That is a big nut to cover.

So timing for entry into this fund will be crucial

Global Market Comments

January 25, 2019

Fiat Lux

Featured Trade:

(JANUARY 9 BIWEEKLY STRATEGY WEBINAR Q&A),

(TSLA), (EDIT), (NTLA), (CRSP), (SJB), (TLT), (FXB), (GLD),

(THE PRICE OF STARDOM AT DAVOS)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader January 23 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Would you buy Tesla (TSLA) right now?

A: It’s tempting; I’m waiting to see if we take a run at the $250-$260 level that we saw at last October’s low. If so, it’s a screaming buy. Tesla is one of a handful of stocks that have a shot at rising tenfold in the next ten years.

Q: CRISPR stocks are getting killed. I know you like the science—do you have a bottom call?

A: What impacted CRISPR stocks was the genetic engineering done on unborn twins in China that completely freaked out the entire industry and killed all the stocks. That being said, CRISPR has a great long-term future. They will either become ten-baggers or get taken over by major drug companies. The first major CRISPR generated cure will take place for childhood blindness later this year. The ones you want to own are Editas (EDIT), Intellia Therapeutics (NTLA), and CRISPR Therapeutics (CRSP).

Q: Do you ever reposition a trade and add contracts?

A: I very rarely double up. I’d rather go on to a new trade with different strike prices. A bad double up can turn a small loss into a big one. Sometimes I will do a “roll down,” or buy back one spread for a loss to earn back that loss with a spread farther in-the-money.

Q: For us newbies, can you please explain your trading philosophy regarding purchasing deep in the money call spreads and how that translates to risk management?

A: I did a research piece in Global Trading Dispatch yesterday on deep in-the-money call spreads, and today on deep-in-the-money put spreads. The idea is to have a position where you make money whether the market goes up, down, or sideways. Your risk is defined, and you always have time decay working for you, writing you a check every day. Here are the links: Vertical Bull Call Spread and Vertical Bear Put Spread.

Q: What’s the risk reward of floating rate corporate debts?

A: Number one: interest rates go down—if we go into recession, rates will fall. That wipes out the principal value of the security. Number two: with corporate debts, you run the risk of the corporation going bankrupt or having their business severely impacted in the next recession and their credit rating cut. It’s far safer to invest in a bank deposits yielding 2-2.5% right now. Some smaller banks are offering certificates of deposit with 4% yields.

Q: What are your thoughts on the British pound (FXB)?

A: I think Brexit will fail eventually and the pound will increase 25%; so play from the long side on the (FXB). It would be economic suicide for Britain to leave the EC and eventually people there will figure this out. If the Brexit vote were held today, it would lose and that may be how they eventually get out of this.

Q: Is it a bear market for bonds (TLT)?

A: Yes, it’s back on again. I expect we will visit $112 in the (TLT) sometime this year, down from the current $121. That brings us back up to the 3.25% yield on the ten-year US Treasury bond. That is down nine points from here, so it’s certainly worth taking a bite out of.

Q: What’s the best time to buy the ProShares Short High Yield (SJB)?

A: At the top of the next equity market run. It rose a whopping 10% during the December stock market meltdown so that gives you a taste of what can happen. Junk bonds are called “junk” for a reason.

Q: How do you see gold (GLD)?

A: Take profits now and buy back on the next dip. If we dip 5%-10% in gold, that would be a good entry point for a larger move later on in the year. To get a real move in gold, we need to see real inflation and that will eventually come. Another stock market crash will also gain you another 10% in gold.

Q: When will the government shutdown end?

A: I think it will go a lot longer than anyone realizes because Trump needs a deal worse than the Democrats do. Trump is basically saying pay for my wall or I’ll keep shooting another of MY supporters in the head every day. The Democrats can wait a really long time in that circumstance. Trump’s standing in the polls has also collapsed to new lows. By the way, the Chinese are using the same approach in the trade talks so that could be a long wait as well.

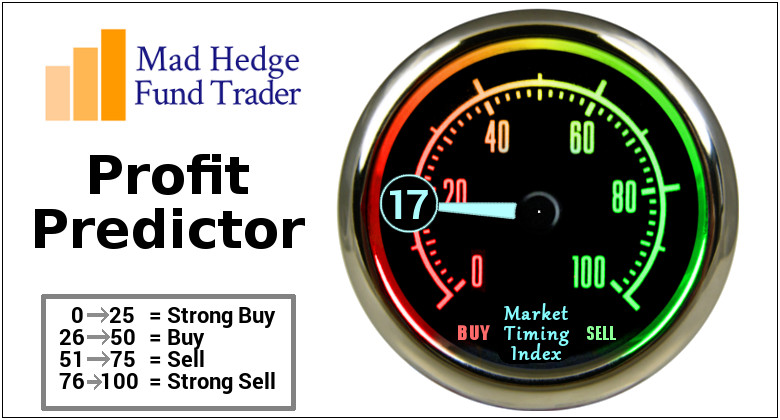

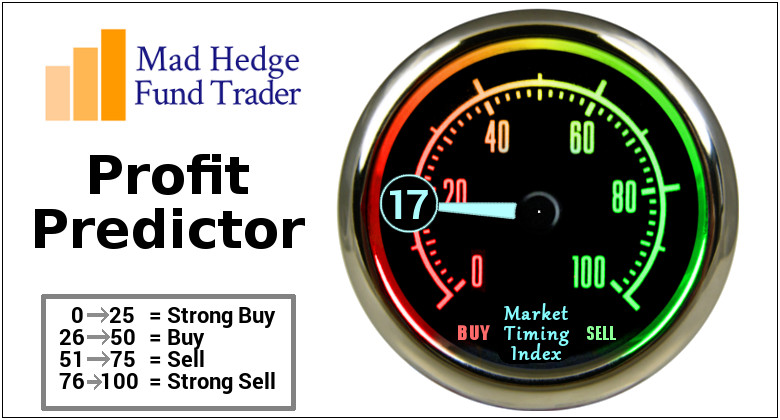

Q: There’s been a big shift in the MHFT Profit Predictor in the last 30 days—does this mean we should not be adding any positions?

A: Absolutely; this is a terrible place to be adding any new positions. The index went from 2 to 57 which shows you how valuable it is at calling market bottoms. Now we are at the top end of the middle of the range. All markets are now dead in the middle of very wide trading ranges which means the best thing you can do is take profits on existing positions, which I have been doing. Or watch Duck Dynasty and Pawn Stars replays. As for me, I am an Antiques Roadshow guy.

Q: What percentage should you be invested in the market now?

A: I’ve gone from 60% to 30% and have only 3 weeks left on my remaining position. I’m looking to go 100% cash as long as we’re stuck in the middle of this range. Better to sit on your hands than chase a high risk/low return trade.

Did I mention that we have had the best start to a New Year in a decade?

When you look at the profusion of new ETF?s being launched today, you find that they almost always correspond with market tops.

The higher the market, the greater the demand for the underlying, and the more leverage traders pay for it. The resulting returns for investors are disastrous.

But occasionally a blind squirrel finds an acorn, and if you fire buckshot long enough, you hit a barn.

That?s why I am getting interested in the ProShares Short High Yield ETF (SJB). After riding the bull move in junk all the way up with (JNK), (HYG), I have recently turned negative on the sector.

Junk bonds have moved too far too fast. Current spreads for junk paper are now only 200 basis points over equivalent term Treasury bonds, and investors at these levels are in no way being compensated for their risk.

If the stock market starts to roll over this summer, then the junk bond market will follow it in the elevator going down to the ladies underwear department in the basement.

Keep in mind that when shorting the junk market, you run into the same problem you have with the (TBT), a leveraged short ETF for the Treasury bond market.

Buy the (SJB) and you are short a 6.74% coupon, which works out to a monthly costs of more than 50 basis points. That is a big nut to cover. So timing for entry into this fund will be crucial.

Is Shorting Junk Bonds the Way to Go??

Is Shorting Junk Bonds the Way to Go??Probably the best Trade Alert of 2015 that I wrote up, but never sent out, was for the ProShares Short High Yield ETF (SJB). That is a bet that makes money when the prices for junk bonds fall.

Back in May, it was clear to me that junk bond prices had hit ?LALA land.? Yields were only 200 basis points above similar maturity Treasury bonds.

Risk was being wildly mispriced. Investors were taking on a whole lot of principal risk, but were barely compensated for it.

It was a classic reach for yield. This only ends in tears.

The reason I didn?t pull the trigger is that when you sell short any kind of bond or equity, you become liable for paying the interest or the dividend. In the high yield junk realm at the time, that meant forking out 5% per annum.

That?s a big nut to cover in order to make a profit. To end up in the green on a position like this, your timing has to be perfect. Paying that kind of carry, you pretty much want prices to stat falling immediately.

As it turned out, holding firm at the time was the right thing to do. While I nailed the high for the year, Junk bonds (HYG), (JNK) declined, but not by much. Then in August, they fell like a ton of bricks.

Here we are seven months later in a completely different world.

All of the trades that prospered mightily from quantitative easing are being unwound in a hurry.

It seems like investors are only just waking up to the implications of the demise of an aggressive monetary policy that met its demise 14 months ago. It?s a bit like closing the barn door after the horses have bolted.

However, it took this week?s imminent interest rate rise from the Federal Reserve to really bring matters to a head.

Junk bonds are now yielding 9.0%, while energy related paper is well into double digits. The talk is that as many as 25% of energy junk bonds will default (click here for ?Here Comes the Final Bottom in Oil? ).

Two junk bond funds have gone under, refusing to honor redemption requests from owners. Prices are in free fall. It all has the flavor of a final capitulation.

Which means that I am finally stating to get interested in junk bonds.

This is the problem with this market. Junk bonds are the last holdout of old fashioned traders. No two issues look alike, so they can?t be commoditized. That means they can?t be subject to automated online trading. High frequency traders never touch them.

If you want to trade in junk bonds, you have to call around to other traders and investors and ask if they have any interest. You keep calling until you find someone willing to take the other side of your trade.

Needless to say, this is a tedious and time-consuming process. It is a lot like the trading world I first joined in the 1970?s.

Another problem is that Dodd Frank has banned the big banks and brokers from taking positions in this paper like they used to. That means there is no final supplier of liquidity, so it is worse than it has ever been.

It is a good rule of thumb that the junk bond yield roughly reflects the market?s default expectations. So the present 9% yield means investors expect approximately 9% of the paper to default.

And here is where you make the money.

Markets tend to wildly overshoot with their expectations. In 2009 junk bonds carried a 25% yield. The actual default rate that followed was only 2%.

Markets then spent five year repricing this reality into these securities. As a result, junk bonds were one of the best investments you could have made back then.

They were the subject of regular strong ?BUY? recommendations by the Mad Hedge Fund Trader. They eventually more than doubled in value. That?s a lot for a bond.

While today?s 9% is nowhere near 25%, we are also in nothing like a 2009 financial collapse. Call the current volatility a correction, a bout of nervousness, a setback, or even a frisson. End of the world stuff it isn?t.

Which leads me to believe that at 9%, you are being fairly compensated for your risk.

You wanted to reach for yield? Now there is some yield to reach for.

9% covers a multitude of sins.

Is It Time to Put Junk Bonds on You Shopping List?

Is It Time to Put Junk Bonds on You Shopping List? When you look at the profusion of new ETF?s being launched today, you find that they almost always correspond with market tops. The higher the market, the greater the demand for the underlying, and the more leverage traders bay for it. The resulting returns for investors are disastrous.

But occasionally a blind squirrel finds an acorn, and if you fire buckshot long enough, you hit a barn. That was the case a year ago when the corn ETF was launched (CORN), after five months of stagnant performance by the grain. I smelled a bargain for my readers, piled them into the ETF the day it launched, and caught a quick double in six weeks, just as the Russian fires were igniting.

That?s why I am getting interested in the new ProShares Short High Yield ETF (SJB). After riding the bull move in junk all the way up with (JNK), I have recently turned negative on the sector. Junk bonds have moved too far too fast. Current spreads for junk paper are now only 300 basis points over equivalent term Treasury bonds, and investors at these levels are in no way being compensated for their risk.

If the stock market starts to roll over this summer, as I expect, then the junk bond market will follow it in the elevator going to down to the ladies underwear department in the basement. Keep in mind that when shorting the junk market, you run into the same problem you have with the (TBT), a leveraged short ETF for the Treasury bond market. Buy the (SJB) and you are short a 6% coupon, which works out to a monthly costs of 50 basis points. That is a big nut to cover. So timing for entry into this fund will be crucial.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.