Global Market Comments

April 24, 2018

Fiat Lux

Featured Trade:

(DON'T MISS THE APRIL 25 GLOBAL STRATEGY WEBINAR),

(MONDAY, JUNE 11, FORT WORTH, TEXAS, GLOBAL STRATEGY LUNCHEON)

(WHY INDEXERS ARE TOAST),

(VIX), (VXX), (SPY), (AAPL), (HACK),

Tag Archive for: (SPY)

Hardly a day goes by without some market expert predicting that it's only a matter of time before machines completely take over the stock market.

Humans are about to be tossed into the dustbin of history.

Recently, money management giant BlackRock, with a staggering $5.4 trillion in assets under management, announced that algorithms would take over a much larger share of the investment decision-making process.

Exchange Traded Funds (ETFs) are adding fuel to the fire.

By moving capital out of single stocks and into baskets, you are also sucking the volatility, and the vitality out of the market.

This is true whether money is moving into the $237 billion S&P 500 (SPY), or the miniscule $1 billion PureFunds ISE Cyber Security ETF (HACK), which holds only 30 individual names.

The problem is being greatly exacerbated by the recent explosive growth of the ETF industry.

In the past five years, the total amount of capital committed to ETFs has doubled to more than $3 trillion, while the number of ETFs has soared to well over 2,000.

In fact, there is now more money committed to ETFs than publicly listed single stocks!

While many individual investors say they are moving into ETFs to save on commissions and expenses, in fact, the opposite is true.

You just don't see them.

They are buried away in wide-dealing spreads and operating expenses buried deeply in prospectuses.

The net effect of the ETF industry is to greatly enhance Wall Street's take from their brokerage business, i.e., from YOU.

Every wonder why the shares of the big banks are REALLY trading at new multi-year highs?

I hate to say this, but I've seen this movie before.

Whenever a strategy becomes popular, it carries with it the seeds of its own destruction.

The most famous scare was the "Portfolio Insurance" of the 1980s, a proprietary formula sold to institutional investors that allegedly protected them by automatically selling in down markets.

Of course, once everyone was in the boat, the end result was the 1987 crash, which saw the Dow Average plunge 20% in one day.

The net effect was to maximize everyone's short positions at absolute market bottoms.

A lot of former portfolio managers started driving Yellow Cabs after that one!

I'll give you another example.

Until 2007, every computer model in the financial industry said that real estate prices only went up.

Trillions of dollars of derivative securities were sold based on this assumption.

However, all of these models relied on only 50 years' worth of data dating back to the immediate postwar era.

Hello subprime crisis!

If their data had gone back 70 years, it would have included the Great Depression.

The superior models would have added one extra proviso - that real estate can collapse by 90% at any time, without warning, and then stay down for a decade.

The derivate securities based on THIS more accurate assumption would have been priced much, much more expensively.

And here is the basic problem.

As soon as money enters a strategy, it changes the behavior of that strategy.

The more money that enters, the more that strategy changes, to the point where it produces the opposite of the promised outcome.

Strategies that attract only $10 million market-wide can make 50% a year returns or better.

But try and execute with $1 billion, and the identical strategies lose money. Guess what happens at $1 trillion?

This is why high frequency traders can't grow beyond their current small size on a capitalized basis, even though they account for 70% of all trading.

I speak from experience.

During the 1980s I used a strategy called "Japanese Equity Warrant Arbitrage," which generated a risk-free return of 30% a year or more.

This was back when overnight Japanese yen interest rates were at 6%, and you could buy Japanese equity warrants at parity with 5:1 leverage (5 X 6 = 30).

When there were only a tiny handful of us trading these arcane securities, we all made fortunes. Every other East End London kid was driving a new Ferrari (yes, David, that's you!).

At its peak in 1989, the strategy probably employed 10,000 people to execute and clear in London, Tokyo, and New York.

However, once the Japanese stock market crash began in earnest, liquidity in the necessary instruments vaporized, and the strategy became a huge loser.

The entire business shut down within two years. Enter several thousand new Yellow Cab drivers.

All of this means that the current indexing fad is setting up for a giant fall.

Except that this time, many managers are going to have to become Uber drivers instead.

Computers are great at purely quantitative analysis based on historical data.

Throw emotion in there anywhere, and the quants are toast.

And, at the end of the day, markets are made up of high emotional human beings who want to get rich, brag to their friends, and argue with their spouses.

In fact, the demise has already started.

Look no further than investment performance so far in 2018.

The (SPY) is up a scant 0% this year.

Amazon (AAPL), on the other hand, one of the most widely owned stocks in the world, is up an eye-popping 30%.

If you DON'T own Amazon, you basically don't HAVE any performance to report for 2017.

I'll tell you my conclusion to all of this.

Use a combination of algorithms AND personal judgment, and you will come out a winner, as I do. It also helps to have 50 years of trading experience.

You have to know when to tell your algorithm a firm "NO."

While your algo may be telling you to "BUY" ahead of a monthly Nonfarm Payroll Report or a presidential election, you may not sleep at night if you do so.

This is how I have been able to triple my own trading performance since 2015, taking my 2017 year-to-date to an enviable 20%.

It's not as good as being 30% invested in Amazon.

But it beats the pants off of any passive index all day long.

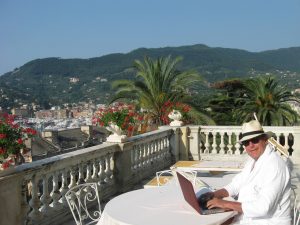

Yup, This is a Passive Investor

Global Market Comments

April 23, 2018

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or HERE COMES THE FOUR HORSEMEN OF THE APOCALYPSE),

(SPY), (GOOGL), (TLT), (GLD), (AAPL), (VIX), (VXX), (C), (JPM),

(HOW TO AVOID PONZI SCHEMES),

(TESTIMONIAL)

Have you liked 2018 so far?

Good.

Because if you are an index player, you get to do it all over again. For the major stock indexes are now unchanged on the year. In effect, it is January 1 once more.

Unless of course you are a follower of the Mad Hedge Fund Trader. In that case, you are up an eye-popping 19.75% so far in 2018. But more on that later.

Last week we caught the first glimpse in this cycle of the investment Four Housemen of the Apocalypse. Interest rates are rising, the yield on the 10-year Treasury bond (TLT) reaching a four-year high at 2.96%. When we hit 3.00%, expect all hell to break loose.

The economic data is rolling over bit by bit, although it is more like a death by a thousand cuts than a major swoon. The heavy hand of major tariff increases for steel and aluminum is making itself felt. Chinese investment in the US is falling like a rock.

The duty on newsprint imports from Canada is about to put what's left of the newspaper business out of business. Gee, how did this industry get targeted above all others?

The dollar is weak (UUP), thanks to endless talk about trade wars.

Anecdotal evidence of inflation is everywhere. By this I mean that the price is rising for everything you have to buy, like your home, health care, college education, and website upgrades, while everything you want to sell, such as your own labor, is seeing the price fall.

We're not in a recession yet. Call this a pre-recession, which is a long-leading indicator of a stock market top. The real thing shouldn't show until late 2019 or 2020.

There was a kerfuffle over the outlook for Apple (AAPL) last week, which temporarily demolished the entire technology sector. iPhone sales estimates have been cut, and the parts pipeline has been drying up.

If you're a short-term trader, you should have sold your position in April 13 when I did. If you are a long-term investor, ignore it. You always get this kind of price action in between product cycles. I still see $200 a share in 2018. This too will pass.

This month, I have been busier than a one-armed paper hanger, sending out Trade Alerts across all asset classes almost every day.

Last week, I bought the Volatility Index (VXX) at the low, took profits in longs in gold (GLD), JP Morgan (JPM), Alphabet (GOOGL), and shorts in the US Treasury bond market (TLT), the S&P 500 (SPY), and the Volatility Index (VXX).

It is amazing how well that "buy low, sell high" thing works when you actually execute it. As a result, profits have been raining on the heads of Mad Hedge Trade Alert followers.

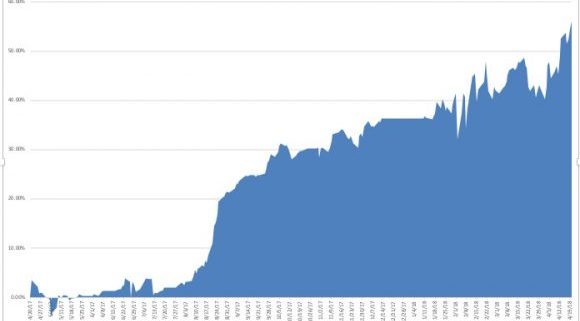

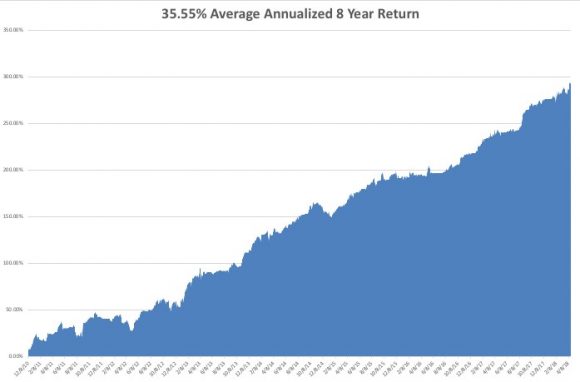

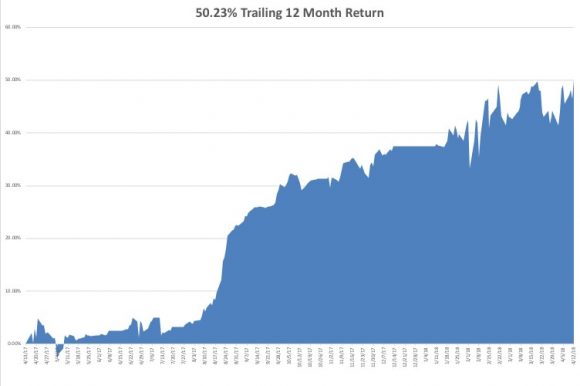

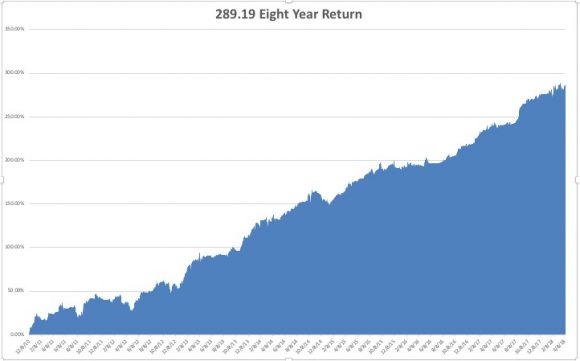

That brings April up to an amazing +12.99% profit, my 2018 year-to-date to +19.75%, my trailing one-year return to +56.09%, and my eight-year performance to a new all-time high of 296.22%. This brings my annualized return up to 35.55% since inception.

The last 14 consecutive Trade Alerts have been profitable. As for next week, I am going in with a net short position, with my stock longs in Alphabet (GOOGL) and Citigroup (C) fully hedged up.

And the best is yet to come!

I couldn't help but laugh when I heard that Republican House Speaker Paul Ryan announced his retirement in order to spend more time with his family. He must have the world's most unusual teenagers.

When I take my own teens out to lunch to visit with their friends, I have to sit on the opposite side of the restaurant, hide behind a newspaper, wear an oversized hat, and pretend I don't know them, even though the bill always mysteriously shows up on my table.

This will be FANG week on the earnings front, the most important of the quarter.

On Monday, April 23, at 10:00 AM, we get March Existing-Home Sales. Expect the Sohn Investment Conference in New York to suck up a lot of airtime. Alphabet (GOOGL) reports.

On Tuesday, April 24, at 8:30 AM EST, we receive the February S&P CoreLogic Case-Shiller Home Price Index, which may see prices accelerate from the last 6.3% annual rate. Caterpillar (CAT) and Coca Cola (KO) report.

On Wednesday, April 25, at 2:00 PM, the weekly EIA Petroleum Statistics are out. Facebook (FB), Advanced Micro Devices (AMD), and Boeing (BA) report.

Thursday, April 26, leads with the Weekly Jobless Claims at 8:30 AM EST, which saw a fall of 9,000 last week. At the same time, we get March Durable Goods Orders. American Airlines (AAL), Raytheon (RTN), and KB Homes (KBH) report.

On Friday, April 27, at 8:30 AM EST, we get an early read on US Q1 GDP.

We get the Baker Hughes Rig Count at 1:00 PM EST. Last week brought an increase of 8. Chevron (CVX) reports.

As for me, I am going to take advantage of good weather in San Francisco and bike my way across the San Francisco-Oakland Bay Bridge to Treasure Island.

Good Luck and Good Trading.

Global Market Comments

April 16, 2018

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or THE WEEK THAT NOTHING HAPPENED),

(TLT), (GLD), (SPY), (QQQ), (USO), (UUP),

(VXX), (GOOGL), (JPM), (AAPL),

(HOW TO HANDLE THE FRIDAY, APRIL 20 OPTIONS EXPIRATION), (TLT), (VXX), (GOOGL), (JPM)

This was the week that American missiles were supposed to rain down upon war-torn Syria, embroiling Russia in the process. It didn't happen.

This was the week that the president was supposed to fire special prosecutor Robert Mueller, who with his personal lawyer is currently reading his private correspondence for the past decade with great interest. That didn't happen either.

It was also the week that China was supposed to raise the stakes in its trade war with the United States. Instead, President Xi offered a conciliatory speech, taking the high road.

What happens when you get a whole lot of nothing?

Stocks rally smartly, the S&P 500 (SPY) rising by 2.87% and the NASDAQ (QQQ) tacking on an impressive 3.45%. Several of the Mad Hedge long positions jumped by 10%.

And that pretty much sums up the state of the market today.

Get a quiet week and share prices will naturally rise, thanks to the power of that fastest earnings growth in history, stable interest rates, a falling dollar, and gargantuan share buybacks that are growing by the day.

With a price earnings multiple of only 16, shares are offering investors the best value in three years, and there is very little else to buy.

This is why I am running one of the most aggressive trading books in memory with a 70% long 30% short balance.

Something else unusual happened this week. I added my first short position of the year in the form of puts on the S&P 500 right at the Friday highs.

And, here is where I am sticking to my guns on my six-month range trade call. If you buy every dip and sell every rally in a market that is going nowhere, you will make a fortune over time.

Provided that the (SPY) stays between $250 and $277 that is exactly what followers of the Mad Hedge Fund Trader are going to do.

By the way, 3 1/2 months into 2018, the Dow Average is dead unchanged at 24,800.

Will next week be so quiet?

I doubt it, which is why I'm starting to hedge up my trading book for the first time in two years. Washington seems to be an endless font of chaos and volatility, and the pace of disruption is increasing.

The impending attack on Syria is shaping up to more than the one-hit wonder we saw last year. It's looking more like a prolonged air, sea, and ground campaign. When your policies are blowing up, nothing beats like bombing foreigners to distract attention.

Expect a 500-point dive in the Dow Average when this happens, followed by a rapid recovery. Gold (GLD) and oil prices (USO) will rocket. The firing of Robert Mueller is worth about 2,000 Dow points of downside.

Followers of the Mad Hedge Trade Alert Service continued to knock the cover off the ball.

I continued to use weakness to scale into long in the best technology companies Alphabet (GOOGL) and banks J.P. Morgan Chase (JPM), and Citigroup (C). A short position in the Volatility Index (VXX) is a nice thing to have during a dead week, which will expire shortly.

As hedges, I'm running a double short in the bond market (TLT) and a double long in gold (GLD). And then there is the aforementioned short position in the (SPY). I just marked to market my trading book and all 10 positions are in the money.

Finally, I took profits in my Apple (AAPL) long, which I bought at the absolute bottom during the February 9 meltdown. I expect the stock to hit a new all-time high in the next several weeks.

That brings April up to a +5.81% profit, my trailing one-year return to +50.23%, and my eight-year average performance to a new all-time high of 289.19%. This brings my annualized return up to 34.70%.

The coming week will be a slow one on the data front. However, there has been a noticeable slowing of the data across the board recently.

Is this a one-off weather-related event, or the beginning of something bigger? Is the trade war starting to decimate confidence and drag on the economy?

On Monday, April 16, at 8:30 AM, we get March Retail Sales. Bank of America (BAC) and Netflix (NFLX) report.

On Tuesday, April 17, at 8:30 AM EST, we receive March Housing Starts. Goldman Sachs (GS) and United Airlines (UAL) report.

On Wednesday, April 18, at 2:00 PM, the Fed Beige Book is released, giving an insider's view of our central bank's thinking on interest rates and the state of the economy. Morgan Stanley (MS) and American Express (AXP) report.

Thursday, April 19, leads with the Weekly Jobless Claims at 8:30 AM EST, which saw a fall of 9,000 last week. Blackstone (BX) and Nucor (NUE) report.

On Friday, April 20, at 10:00 AM EST, we get the Baker Hughes Rig Count at 1:00 PM EST. Last week brought an increase of 8. General Electric (GE) and Schlumberger (SLB) report.

As for me, I'll be heading into San Francisco's Japantown this weekend for the annual Northern California Cherry Blossom Festival. I'll be viewing the magnificent flowers, listening to the Taiko drums, eating sushi, and practicing my rusty Japanese.

Good Luck and Good Trading.

Global Market Comments

April 13, 2018

Fiat Lux

Featured Trade:

(ANNOUNCING THE MAD HEDGE LAKE TAHOE, NEVADA, CONFERENCE, OCTOBER 26-27, 2018),

(APRIL 11 GLOBAL STRATEGY WEBINAR Q&A),

(TLT), (TBT), (GOOGL), (MU), (LRCX), (NVDA) (IBM),

(GLD), (AMZN), (MSFT), (XOM), (SPY), (QQQ)

Below please find subscribers' Q&A for the Mad Hedge Fund Trader April Global Strategy Webinar with my guest co-host Bill Davis of the Mad Day Trader.

As usual, every asset class long and short was covered. You are certainly an inquisitive lot, and keep those questions coming!

Q: Many of your April positions are now profitable. Is there any reason to close out before expiration?

A: No one ever got fired for taking a profit. If you feel like you have enough in hand - like 50% of the maximum potential profit in the position, which we do have in more than half of our current positions - go ahead and take it.

I'll probably run all of our April expirations into expiration day because they are very deep in the money. Also, because of the higher volatility and because of higher implied volatility on individual stock options, you're being paid a lot more to run these into expiration than you ever have been before, so that is another benefit.

Of course, one good reason to take profits now is to roll into another position, and when we find them, that may be exactly what we do.

Q: What do you think will be the impact of the US hitting Syria with missiles?

A: Initially, probably a 3-, 4-, or 500-point drop, and then a very rapid recovery. While the Russians have threatened to shoot down our missiles, in actual fact they can't hit the broad side of a barn. When Russians fired their cruise missiles at Syrian targets, half of them landed in Iran.

At the end of the day, it doesn't really impact the US economy, but you will see a big move in gold, which we're already starting to see, and which is why we're long in gold - as a hedge against all our other positions against this kind of geopolitical event.

Q: Will 2018 be a bull market or a bear market?

A: We are still in a bull market, but we may see only half the returns of last year - in other words we'll get a 10% profit in stocks this year instead of a 20% profit, which means it has to rise 12% from here to hit that 10% up by year-end.

Q: What is your take on the ProShares Ultra Short 20+ Year Treasury Bond Fund (TBT)?

A: I am a big buyer here. I think that interest rates (TLT) are going to move down sharply for the rest of the year. The (TBT) here, in the mid $30s, is a great entry point - I would be buying it right now.

Q: How do you expect Google (GOOGL) to trade when the spread is so wide?

A: It will go up. Google is probably the best-quality technology company in the market, after Facebook (FB). We'll get some money moving out of Facebook into Google for exactly that reason; Google is Facebook without the political risk, the regulatory risk, and the security risks.

Q: Are any positions still a buy now?

A: All of them are buys now. But, do not chase the market on any conditions whatsoever. The market has an endless supply of sudden shocks coming out of Washington, which will give you that down-400-points-day. That is the day you jump in and buy. When you're buying on a 400-down-day, the risk reward is much better than buying on a 400-point up day.

Q: What is "sell in May and go away?"

A: It means take profits in all your positions in May when markets start to face historical headwinds for six months and either A) Wait for another major crash in the market (at the very least we'll get another test of the bottom of the recent range), or B) Just stay away completely; go spend all the money you made in the first half of 2018.

Q: Paul Ryan (the Republican Speaker of the House) resigned today; is he setting up for a presidential run against Trump in 2020?

A: I would say yes. Paul Ryan has been on the short list of presidential candidates for a long time. And Ryan may also be looking to leave Washington before the new Robert Mueller situation gets really unpleasant.

Q: What reaction do you expect if Trump resigns or is impeached?

A: I have Watergate to look back to; the stock market sold off 45% going into the Nixon resignation. It's a different world now, and there were a lot more things going wrong with the US economy in 1975 than there are now, like oil shocks, Vietnam, race riots, and recessions.

I would expect to get a decline, much less than that - maybe only a couple 1,000 points (or 10% or so), and then a strong Snapback Rally after that. We, in effect, have been discounting a Trump impeachment ever since he got in office. Thus far, the market has ignored it; now it's ignoring it a lot less.

Q: Thoughts on Micron Technology (MU), Lam Research (LRCX), and Nvidia (NVDA)?

A: It's all the same story: a UBS analyst who had never covered the chip sector before initiated coverage and issued a negative report on Micron Technology, which triggered a 10% sell-off in Micron, and 5% drops in every other chip company.

He took down maybe 20 different stocks based on the argument that the historically volatile chip cycle is ending now, and prices will fall through the end of the year. I think UBS is completely wrong, that the chip cycle has another 6 to 12 months to go before prices weaken.

All the research we've done through the Mad Hedge Technology Letter shows that UBS is entirely off base and that prices still remain quite strong. The chip shortage still lives! That makes the entire chip sector a buy here.

Q: Can Trump bring an antitrust action against Amazon?

A: No, no chance whatsoever. It is all political bluff. If you look at any definition of antitrust, is the consumer being harmed by Amazon (AMZN)?

Absolutely not - if they're getting the lowest prices and they're getting products delivered to their door for free, the consumer is not being harmed by lower prices.

Second is market share; normally, antitrust cases are brought when market shares get up to 70 or 80%. That's what we had with Microsoft (MSFT) in the 1990s and IBM (IBM) in the 1980s. The largest share Amazon has in any single market is 4%, so no there is basis whatsoever.

By the way, no president has ever attacked a private company on a daily basis for personal reasons like this one. Thank the president for giving us a great entry point for a stock that has basically gone up every day for two years. It's a rare opportunity.

Q: How will the trade war end?

A: I think the model for the China trade war is the US steel tariffs, where we announced tariffs against the entire world, and then exempted 75% of the world, declaring victory. That's exactly what's going to happen with China: We'll announce massive tariffs, do nothing for a while, and then negotiate modest token tariffs within a few areas. The US will declare victory, and the stock market rallies 2,000 points. That's why I have been adding risk almost every day for the last two weeks.

Q: Would you be buying ExonMobil (XOM) here, hoping for an oil breakout?

A: No, I think it's much more likely that oil is peaking out here, especially given the slowing economic data and a huge onslaught in supply from US fracking. We're getting big increases now in fracking numbers - that is very bad for prices a couple of months out. The only reason oil is this high is because Iran-sponsored Houthi rebels have been firing missiles at Saudi Arabia, which are completely harmless. In the old days, this would have caused oil to spike $50.

Q: Would you be selling stock into the rally (SPY), (QQQ)?

A: Not yet. I think the market has more to go on the upside, but you can still expect a lot of inter-day volatility depending on what comes out of Washington.

Q: Do you ever use stops on your option spreads?

A: I use mental stops. They don't take stop losses on call spreads and put spreads, and if they did they would absolutely take you to the cleaners. These are positions you never want to execute on market orders, which is what stop losses do. You always want to be working the middle of the spread. So, I use my mental stop. And when we do send out stop loss trade alerts, that's exactly where they're coming from.

Q: Will the Middle East uncertainty raise the price of oil?

A: Yes, if the Cold War with Iran turns hot, you could expect oil to go up $10 or $20 dollars higher, fairly quickly, regardless of what the fundamentals are. It's tough to be blowing up oil supplies as a great push on oil prices. But that's a big "if."

Hello from the Italian Riviera!

Global Market Comments

April 2, 2018

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or GOODBYE THE QUARTER FROM HELL),

(SPY), (INTC), (AMZN), (CSCO),

(MONDAY, JUNE 11, FORT WORTH, TEXAS, GLOBAL STRATEGY LUNCHEON),

(THE HARD/SOFT DATA CONUNDRUM)

Well, that was some quarter! Call it the quarter from hell.

For as long as most traders and investors can remember, they are losing money so far this year. And they promised us such a rose garden!

The S&P 500 made a valiant, and so far successful effort to hold at the 200-day moving average at $256. We saw an unprecedented four consecutive days of 2% moves.

Yet, with all that tearing of hair, banging of heads against walls, and ulcers multiplying like rabbits, the (SPY) dropped only 5 points since January, off 1.8%, a mere pittance. It's been a whole lot of work and stress for nothing.

So far, the (SPY) has been bracketed by the 50-day moving average on the upside at $272, and the 200-day moving average on the downside. It could continue like this for six more months, forming a very long triangle formation with a year-end upside breakout.

Is the market going to sleep pending the outcome of the November midterm congressional elections?

But here's the catch. We now live in the world of false breakouts and breakdowns, thanks to algorithms. It happened twice in February and March to the upside.

What follows false upside breakouts? How about false downside breakdowns, which may be on the menu for us in April.

My bet is that we'll see one of these soon, taking the (SPY) down as low as $246. Then we'll rocket back up to the middle of the range in another one of those up 100-point days.

What will cause such a catharsis? An escalation of the trade war would certainly do it. Or maybe just a random presidential tweet about anything.

That's why I have been holding fire so far on my volatility shorts and more aggressive longs in stocks.

What will I be buying? Amazon (AMZN), which has essentially an unlimited future. Thank the president for creating a rare 16% selloff and unique buying opportunity with his nonsensical talk about antitrust action.

On what exactly does Amazon have a monopoly? Brilliance?

I also will be taking a look at laggard legacy old tech companies such as Intel (INTC) and Cisco Systems (CSCO). And how can you not like Microsoft here (MSFT)?

Of course, the mystery of the week was the strength in bonds (TLT) taking yields for the 10-year Treasury down to 2.75%. This is in the face of a Treasury auction on Wednesday that went over like a lead balloon.

I think it's all about quarter end positioning more than anything. Some hedge funds have big losses in stocks and volatility trading to cover, and what better way to do it than take profits on bond shorts through buying.

I already have started selling into the rally.

The scary thing about the bond action is that it has accelerated the flattening of the yield curve, with the two-year/10-year spread now only 50 basis points.

It also brings forward the inversion of the yield curve. And we all know what follows that with total certainty: a bear market in stocks and a recession.

The data flow for the coming week is all about jobs, jobs, jobs.

On Monday, April 2, at 9:45 AM, we get the March PMI Manufacturing Index.

On Tuesday morning, we receive March Motor Vehicle Sales, which have recently been weak at 17.1 million units.

On Wednesday, April 4, at 8:15 AM EST, the first of the trifecta of jobs reports comes out with the ADP Employment Report, a read on private sector high.

Thursday, April 5, leads with the Weekly Jobless Claims at 8:30 AM EST, which hit a new 49-year low last week at an amazing 210,000.

At 7:30 AM we get the March Challenger Job Cut Report.

On Friday, April 6, at 8:30 AM EST, we get the Big Kahuna with the March Nonfarm Payroll Report. Last month brought shockingly weak figures.

The week ends as usual with the Baker Hughes Rig Count at 1:00 PM EST. Last week brought a drop of 2.

As for me, I am headed up to Lake Tahoe, Nev., today for spring break to catch the last of the heavy snow. After a record 18 feet in March, Squaw Valley, Calif., has announced that it is keeping the ski lifts open until the end of May.

Good Luck and Good Trading.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.