Global Market Comments

January 22, 2021

Fiat Lux

Featured Trade:

(JANUARY 20 BIWEEKLY STRATEGY WEBINAR Q&A),

(QQQ), (IWM), (SPY), (ROM), (BRK/A), (AMZN), NVDA), (MU), (AMD), (UNG), (USO), (SLV), (GLD), ($SOX), CHIX), (BIDU), (BABA), (NFLX), (CHIX), ($INDU), (SPY), (TLT)

Tag Archive for: (UNG)

Below please find subscribers’ Q&A for the January 20 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Incline Village, NV.

Q: What will a significant rise in long term bond yields (TLT) do to PE ratios in general, and high tech specifically?

A: Well, the key question here is: what is “significant”. Is “significant” a move in a 10-year from 120 to 150, which may be only months off? I don’t think that will have any impact whatsoever on the stock market. I think to really give us a good scare on interest rates, you need to get the 10-year up to 3.0%, and that might be two years off. We’re also going to be testing some new ground here: how high can bond interest rates go while the Fed keeps overnight rates at 25 basis points? They can go up more, but not enough to hurt the stock market. So, I think we essentially have a free run on stocks for two more years.

Q: What about the Shiller price earnings ratio?

A: Currently, it’s 34.5X and you want to completely ignore anything from Shiller on stock prices. He’s been bearish on stocks for 6 years now and ignoring him is the best thing you can do for your portfolio. If you had listed to him, you would have missed the last 15,000 Dow ($INDU) points. Someday, he’ll be right, but it may be when the market goes from 50,000 to 40,000, so again, I haven't found the Shiller price earnings ratio to be useful. It’s one of those academic things that looks great on paper but is terrible in practice.

Q: Do you see any opportunity in China financials with the change of administration, like the (CHIX)?

A: I always avoid financials in China because everyone knows they have massive, defaulted loans on their books that the government refuses to force them to recognize like we do here. So, it’s one of those things where they look good on paper, but you dig deeper and find out why they’re really so cheap. Better to go with the big online companies like Baidu (BIDU) and Alibaba (BABA).

Q: Is it too late to enter copper?

A: No, the high in the last cycle for Freeport McMoRan (FCX) was $50 dollars and I think we’re only in the mid $ ’20s now, so you could get another double. Remember, these commodity stocks have discounted recovery that hasn’t even started yet. Once you do get an actual recovery, you could get another enormous move and that's what could take the Dow to 120,000.

Q: Do you see the FANGs coming back to life with the earnings results?

A: I think it'll take more than just Netflix to do that. By the way, Netflix (NFLX) is starting to look like the Tesla of the media industry, so I’d get into Netflix on the next dip. You could get a surprise, out-of-nowhere double out of that anytime. But yes, FANGs will come to life. They've been in a correction for five months now, and we’ll see—it may be the end of the pandemic that causes these stocks to really take off. So that's why I'm running the barbell portfolio and buying the FANGs on weakness.

Q: Are you recommending LEAPS on gold (GLD) and silver (SLV)?

A: Absolutely yes, go out two years with your maturity, you might buy 120% out of the money. That's where you get your leverage on the LEAPS. Something like a (GLD) January 2023 $210-$220 in-the-money vertical bull call spread and generate a 500% profit by expiration.

Q: Do you foresee a cool off for semiconductors ($SOX) even though there's been recent news of shortages?

A: No, not really. There are so many people trying to get into these it’s incredible. And again, we may get a time correction where we sideline at the top and then break out again to the upside. This is classic in liquidity-driven markets, which is what we have in spades right now. Thanks to 5G, the number of chips in your everyday devices is about to increase tenfold, and it takes at least two years to build a new chip factory. So, keep buying (NVDA), (MU), and (AMD) on dips.

Q: Where are the best LEAPS prospects (Long Term Equity Participation Securities)?

A: That would have to be in technology—that's where the earnings growth is. If you go 20% out of the money on just about any big tech LEAPs two years out, to 2023 those will be worth 500% more at expiration.

Q: What about SPACs (Special Purpose Acquisition Company) now, as we’re getting up to five new SPACs a day?

A: My belief is that a SPAC is a vehicle that allows a manager to take out a 20% a year management fee instead of only 1%. And it's another aspect of the current mania we’re in that a lot of these SPACs are doubling on the first day—especially the electric vehicle-related SPACs. Also, a lot of these SPACs will never invest in anything, but just take the money and give it back to you in two years with no return when they can't find any good investments…. If you’re lucky. There's not a lot of bargains to be found out there by anyone, including SPAC managers.

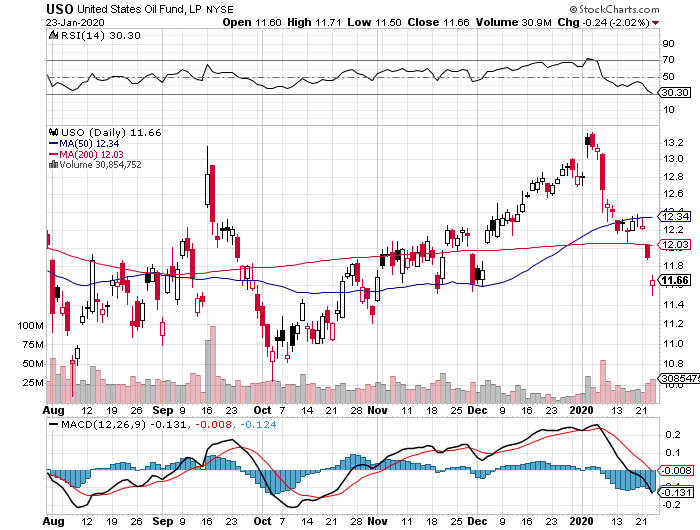

Q: Does natural gas (UNG) fall into the same “avoid energy” narrative as oil?

A: Absolutely, yes. The only benefit of natural gas is it produces 50% less carbon dioxide than oil. However, you can't get gas without also getting oil (USO), as the two come out of the pipe at the same time; so I would avoid natural gas also. Gas and oil are also about to lose a large chunk, if not all, of their tax incentives, like the oil depletion allowance, which has basically allowed the entire oil industry to operate tax-free since the 1930s.

Q: What about hydrogen cars?

A: I don't really believe in the technology myself, and when you burn hydrogen, that also produces CO2. The problem with hydrogen is that it’s not a scalable technology. It’s like gasoline—you have to build stations all over the US to fuel the cars. Of course, it produces far less carbon than gas or natural gas, but it is hard to compete against electric power, which is scalable and there's already a massive electric grid in place.

Q: If you inherited $4 million today, would you cost average into (QQQ), (IWM), or (SPY)?

A: I would go into the ProShares Ultra Technology ETF (ROM), which is double the (QQQ); and if you really want to be conservative, put half your money into (QQQ) or (ROM), and then half into Berkshire Hathaway (BRK/A), which is basically a call option on the industrial and recovery economy. I know plenty of smart people who are doing exactly that.

Q: Is it weird to see oil, as well as green energy stocks, moving up?

A: No, that's actually how it works. The higher oil and gas prices go, the more economical it is to switch over to green energy. So, they always move in sync with each other.

Q: I heard rumors that Amazon (AMZN) is likely to raise Prime’s annual fee by $10-20 a year in 2021. Will that be a catalyst for the stock to go higher?

A: Yes. For every $10 dollars per person in Prime revenue, Amazon makes $2 billion more in net profit. I would say that's a very strong argument for the stock going up and maybe what breaks it out of its current 6-month range. By the way, Amazon is wildly undervalued, and my long-term target is $5,000.

Q: Do you think that the spike in Apple (AAPL) MacBook purchases means that computers will overtake iPhones as the revenue driver for Apple in 2021, or is the phone business too big?

A: The phone business is too big, and 5G will cause iPhone sales to grow exponentially. Remember, the iPhones themselves are getting better. I just bought the 12G Pro, and the performance over the old phone is incredible. So yeah, iPhones get bigger and better, while laptops only grow to the extent that people need an actual laptop to work on in a fixed office. Is that a supercomputer in your pocket, or are you just glad to see me?

Q: Share buybacks dried up because of revenue headwinds; do you think they will come back in a massive wave, giving more life to equities?

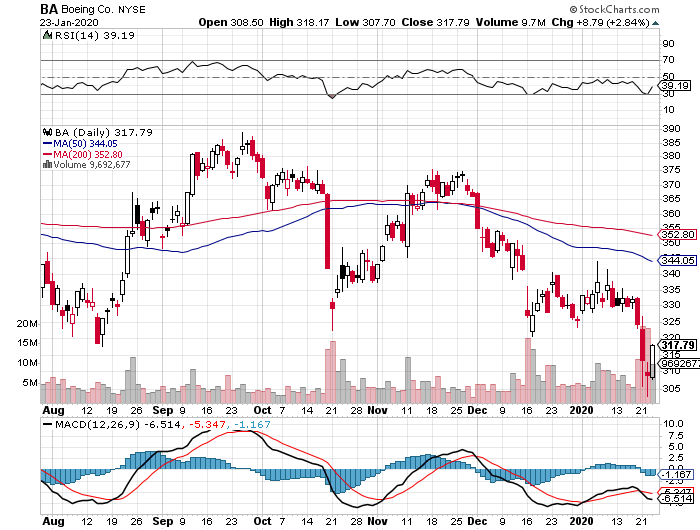

A: Absolutely, yes. Banks, which have been banned from buybacks for the past year, are about to go back into the share buyback business. Netflix has also announced that they will go buy their shares for the first time in 10 years, and of course, Apple is still plodding away with about $100 or $200 million a year in share buybacks, so all of that accelerates. The only ones you won't see doing buybacks are airlines and Boeing (BA) because they have such a mountain of debt to crawl out from before they can get back into aggressive buybacks.

Q: Interest rates are at historic lows; the smartest thing we can do is act big.

A: That’s absolutely right; you want to go big now when we’re all suffering so we can go small later and run a balanced budget or even pay down national debt if the economy grows strong enough. The last person to do that was Bill Clinton, who paid down national debt in small quantities in ‘98 and ‘99.

Q: What do you think about General Motors (GM)?

A: They really seem to be making a big effort to get into electric cars. They said they're going to bring out 25 new electric car models by 2025, and the problem is that GM is your classic “hour late, dollar short” company; always behind the curve because they have this immense bureaucracy which operates as if it is stuck in a barrel of molasses. I don’t see them ever competing against Tesla (TSLA) because the whole business model there seems like it’s stuck in molasses, whereas Tesla is moving forward with new technology at warp speed. I think when Tesla brings out the solid-state battery, which could be in two years, they essentially wipe out the entire global car industry, and everybody will have to either make Tesla cars under license from Tesla—which they said they are happy to do—or go out of business. Having said that, you could get another double in (GM) before everyone figures out what the game is.

Q: Will you update the long-term portfolio?

A: Yes, I promise to update it next week, as long as you promise me that there won’t be another insurrection next week. It’s strictly a time issue. After last year being the most exhausting year in history, this year is proving to be even more exhausting!

Q: Do you see a February pullback?

A: Either a small pullback or a time correction sideways.

Q: Do you think the Zoom (ZM) selloff will continue, or is it done now that the pandemic is hopefully ending?

A: It’s natural for a tech stock to give up one third after a 10X move. It might sell off a little bit more, but like it or not, Zoom is here to stay; it’s now a permanent part of our lives. They’re trying to grow their business as fast as they can, they’re hiring like crazy, so they’re going to be a big factor in our lives. The stock will eventually reflect that.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

May 8, 2020

Fiat Lux

Featured Trade:

(MAY 6 BIWEEKLY STRATEGY WEBINAR Q&A),

(UNG), (UAL), (DAL), (INDU), (SPY), (SDS),

(P), (BA), (TWTR), (GLD), (TLT), (TBT)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader May 6 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: What broker do you use? The last four bond trades I couldn’t get done.

A: That is purely a function of selling into a falling market. The bond market started to collapse 2 weeks ago. We got into the very beginning of that. We put out seven trade alerts to sell bonds, we’re out of five of them now. And whenever you hit the market with a sell, everyone just automatically drops their bids among the market makers. It’s hard to get an accurate, executable price when a market is falling that fast. The important point is that you were given the right asset class with a ticker symbol and the right direction and that is golden. People who have been with my service for a long time learn how to work around these trade alerts.

Q: Is there any specific catalyst apart from the second wave that will trigger the expected selloff?

A: First of all, if corona deaths go from 2 to 3, 4, 5 thousand a day, that could take us back down to the lows. Also, the market is currently expecting a V-shaped recovery in the economy which is not going to happen. The best we can get is a U-shape and the worst is an L-shape, which is no recovery at all. What if everything opens up and no customers show? This is almost certain to happen in the beginning.

Q: How long will the depression last?

A: Initially, I thought we could get out of this in 3-6 months. As more data comes in and the damage to the economy becomes known, I would say more like 6-9, or even 9-12 months.

Q: In natural gas, the (UNG) chart looks like a bullish breakout. Does it seem like a good trade?

A: No, the energy disaster is far from over. We still have a massive supply/demand gap. And with (UNG), you want to be especially careful because there is an enormous contango—up to 50 or 100% a year—between the spot price and the one-year contract price, which (UNG) owns. Once I saw the spot price of natural gas rise by 40% and the (UNG) fell by 40%. So, you could have a chart on the (UNG) which looks bullish, but the actual spot prices in front month could be bearish. That's almost certainly what’s going to happen. In fact, a lot of people are predicting negative prices again on the June oil contract futures expiration, which comes in a couple of weeks.

Q: What about LEAPS on United (UAL) and Delta (DAL)?

A: I am withdrawing all of my recommendations for LEAPS on the airlines. When Warren Buffet sells a sector for an enormous loss, I'm not inclined to argue with him. It’s really hard to visualize the airlines coming out of this without a complete government takeover and wipeout of all existing equity investors. Airlines have only enough cash to survive, at best, 6-8 months of zero sales, and when they do start up, they will have more virus-related costs, so I would just rather invest in tech stocks. If you’re in, I would get out even if it means taking a loss. They don’t call him the Oracle of Omaha for nothing.

Q: Any reason not to do bullish LEAPS on a selloff?

A: None at all, that is the best thing you can do. And I’m not doing LEAPS right now, I’m putting out lists of LEAPS to buy on a selloff, but I wouldn't be buying any right now. You’d be much better off waiting. Firstly, you get a longer expiration, and secondly, you get a much better price if you could buy a LEAP on a 2,000 or 3,000 point selloff in the Dow Average (INDU).

Q: Would you add the 2X ProShares Ultra Short S&P 500 (SDS) position here if you did not get on the original alert?

A: I would, I would just do a single 10% weighting. But don’t expect too much out of it, maybe you'll get a couple of points. And it’s also a good hedge for any longs you have.

Q: What happens if the second wave in the epidemic is smaller?

A: Second waves are always bigger because they’re starting off with a much larger base. There isn't a scientist out there expecting a smaller second wave than the first one. So, I wouldn't be making any investment bets on that.

Q: Pfizer (P) and others seem close to having a vaccine, moving on to human trials. Does that play into your view?

A: No, because no one has a vaccine that works yet. They may be getting tons of P.R. from the administration about potential vaccines, but the actual fact is that these are much more difficult to develop than most people understand. They have been trying to find an AIDS vaccine for 40 years and a cancer vaccine for 100 years. And it takes a year of testing just to see if they work at all. A bad vaccine could kill off a sizeable chunk of the US population. We’ve been taking flu shots for 30 years and they haven’t eliminated the flu because it keeps evolving, and it looks like coronavirus may be one of those. You may get better antivirals for treatment once you get the disease, but a vaccine is a good time off, if ever.

Q: Is this a good time to buy Boeing (BA)?

A: No, it’s too risky. The administration keeps pushing off the approval date for the 737 MAX because the planes are made in a blue state, Washington. The main customers of (BA), the airlines, are all going broke. I would imagine that their 1,000-plane order book has shrunk considerably. Go buy more tech instead, or a hotel or a home builder if you really want to roll the dice.

Q: How can the market actually drop to the lows, taking massive support from the Fed and further injections into account?

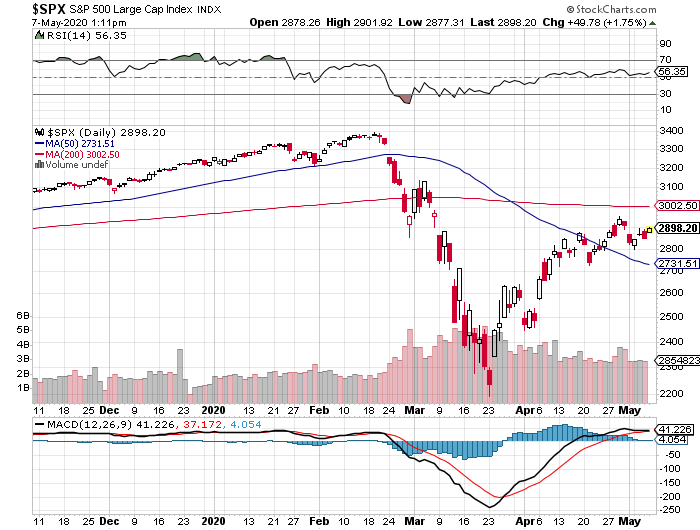

A: I don’t think we will get to new lows, I think we may test the lows. And my argument has been that we give half of the recent gains, which would take us down to 21,000 in the Dow and 2400 in the (SPX). But I've been waiting for a month for that to happen and it's not happening, which is why I've also developed my sideways scenario. That said, a lot of single stocks will go to new all-time lows, such as in retailers (RTF) and airlines (JETS).

Q: Would you stay in a Twitter (TWTR) LEAP?

A: If you have a profit, I would take it.

Q: What about Walt Disney (DIS)?

A: There are so many things wrong with Disney right now. Even though it's a great company for the long term, I'm waiting for more of a selloff, at least another $10. It’s actually rallying today on the earnings report. Around the low $90s I would really love to get into LEAPS on this. I think more bad news has to hit the stock for it to get lower.

Q: Are you continuing to play the (TLT)?

A: Absolutely yes, however, we’re at a level now where I want to take a break, let the market digest its recent fall, see if we can get any kind of a rally to sell into. I’ll sell into the next five-point rally.

Q: Any reason not to do calls outright versus spreads on LEAPS?

A: With LEAPS, because you are long and short, you could take a much larger position and therefore get a much bigger profit on a rise in the stock. Outright calls right now are some of the most expensive they’ve ever been. So, you really need to get something like a $10 or $15 rise in the stock just to break even on the premium that you’re paying. Calls are only good if you expect a very immediate short term move up in the stop in a matter of days. LEAPS you can run for two years.

Q: Is gold (GLD) still a buy?

A: Yes, the fundamental argument for gold is stronger than ever. However, it has been tracking one for one with the stock market lately. That's why I'm staying out of gold—I’d rather wait for a selloff in stocks to take gold down; then I’ll be in there as a buyer.

Q: Should I take profits on what I bought in April and reestablish on a correction?

A: Absolutely. If you have monster profits on a lot of these tech LEAPS you bought in the March/early April lows, then yes, I would take them. I think you will get another shot to buy these cheaper, and by coming out now and coming in later, you get to extend your maturity, which is always good in the LEAPS world.

Q: Would you buy casinos, or is it the same risk as the airlines?

A: I would buy casinos and hotels—they have a greater probability of survival than the airlines and a lot less debt, although they’re going to be losing money for years. I don’t know exactly how the casinos plan on getting out of this.

Q: Should we exit ProShares ultra short 20+ year Treasury Bond Fund (TBT) now?

A: No, that’s more of a longer-term trade. I would hang on to that—you could get from $16 to $20 or $25 in the foreseeable future if our down move in bond continues.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

March 19, 2020

Fiat Lux

Featured Trade:

(INVESTING ON THE OTHER SIDE OF THE CORONA VIRUS),

(SPY), (INDU), (FXE), (FXY), (UNG),

(EEM), (USO), (TLT), (TSLA)

The Coronavirus has just set up the investment opportunity of the century.

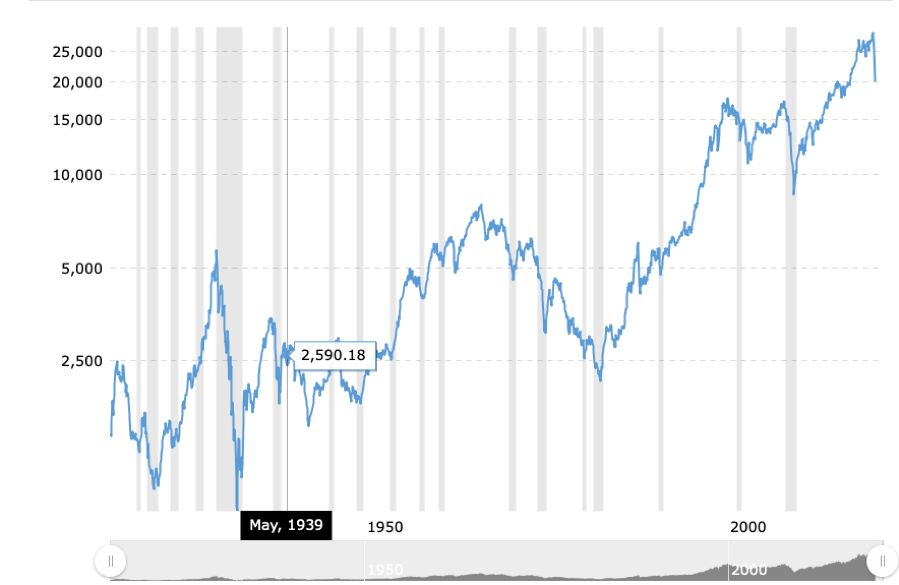

In a matter of three weeks, stocks have gone from wildly overbought to ridiculously cheap. Price earnings multiples have plunged from 20X to 13X, well below the 15.5X long term historical average. The Dow Average is now 5% lower than when Donald Trump assumed the presidency more than three years ago. The world of investing after Coronavirus is looking pretty good.

I believe that as a result of this meltdown, the global economy is setting up for a new Golden Age reminiscent of the one the United States enjoyed during the 1950s, and which I still remember fondly. In other words, when it comes to investing after Coronavirus, we are on the cusp of a new “Roaring Twenties.”

This is not some pie in the sky prediction.

It simply assumes a continuation of existing trends in demographics, technology, politics, and economics. The implications for your investment portfolio will be huge.

For a start, medical science is about to compress 5-10 years of advancement into a matter of months. The traditional FDA approval process has been dumped in the trash. Any company can bring any medicine, vaccine, or anti-viral they want to the market, government be damned. You and I will benefit enormously, but a few people may die along the way.

What I call “intergenerational arbitrage” will be the principal impetus. The main reason that we are now enduring two “lost decades” of economic growth is that 80 million baby boomers are retiring to be followed by only 65 million “Gen Xer’s”.

When the majority of the population is in retirement mode, it means that there are fewer buyers of real estate, home appliances, and “RISK ON” assets like equities, and more buyers of assisted living facilities, healthcare, and “RISK OFF” assets like bonds.

The net result of this is slower economic growth, higher budget deficits, a weak currency, and registered investment advisors who have distilled their practices down to only municipal bond sales.

Fast forward two years when the reverse happens and the baby boomers are out of the economy, worried about whether their diapers get changed on time or if their favorite flavor of Ensure is in stock at the nursing home.

That is when you have 65 million Gen Xer’s being chased by 85 million of the “millennial” generation trying to buy their assets.

By then, we will not have built new homes in appreciable numbers for 20 years and a severe scarcity of housing hits. Residential real estate prices will soar. Labor shortages will force wage hikes.

The middle-class standard of living will reverse a then 40-year decline. Annual GDP growth will return from the current subdued 2% rate to near the torrid 4% seen during the 1990s.

The stock market rockets in this scenario. And this pandemic has just given us a very low base from which to start, making investing after Coronavirus a promising prospect.

Once the virus is beaten, we could see the same fourfold return we saw from 2009 to 2020. That would take us from The Thursday low of 18,917 to 76,000 in only a few years.

If I’m wrong, it will hit 100,000 instead.

Emerging stock markets (EEM) with much higher growth rates do far better.

This is not just a demographic story. The next ten years should bring a fundamental restructuring of our energy infrastructure as well.

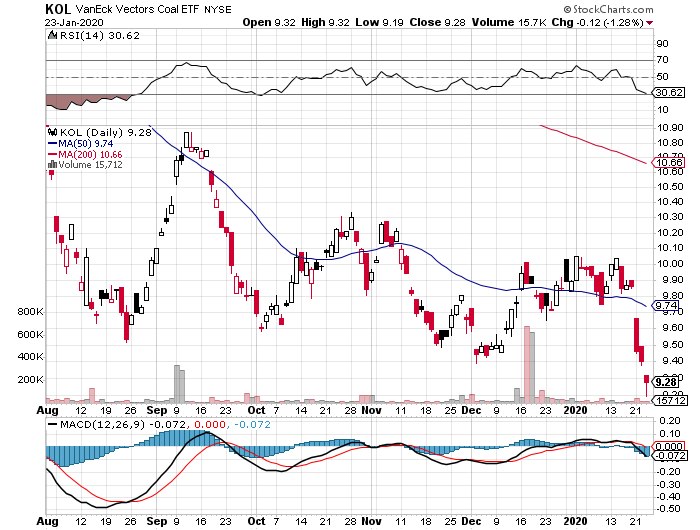

The 100-year supply of natural gas (UNG) we have recently discovered through the new “fracking” technology will finally make it to end users, replacing coal (KOL) and oil (USO), so this sort of energy investing after Coronavirus in particular is looking undoubtedly promising.

Fracking applied to oilfields is also unlocking vast new supplies.

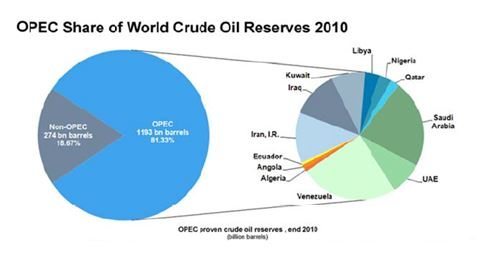

Since 1995, the US Geological Survey estimate of recoverable reserves has ballooned from 150 million barrels to 8 billion. OPEC’s share of global reserves is collapsing.

This is all happening while the use of electric cars is exploding, from zero to 4% of the market over the past decade.

Mileage for the average US car has jumped from 23 to 24.9 miles per gallon in the last couple of years, and the administration is targeting 50 mpg by 2025. Total gasoline consumption is now at a five-year low and collapsing.

Alternative energy technologies will also contribute in an important way in states like California, which will see 100% of total electric power generation come from alternatives by 2030.

I now have an all-electric garage, with a Tesla Model 3 for local errands and a Tesla Model X (TSLA) for longer trips, allowing me to disappear from the gasoline market completely. Millions will follow. Both cars are powered by my rooftop solar system.

The net result of all of this is lower energy prices for everyone.

It will also flip the US from a net importer to an exporter of energy, with hugely positive implications for America’s balance of payments.

Eliminating our largest import and adding an important export is very dollar bullish for the long term.

That sets up a multiyear short for the world’s big energy-consuming currencies, especially the Japanese yen (FXY) and the Euro (FXE). A strong greenback further reinforces the bull case for stocks.

Accelerating technology will bring another continuing positive for investing after Coronavirus.

Of course, it’s great to have new toys to play with on the weekends, send out Facebook photos to the family, and edit your own home videos. But at the enterprise level, this is enabling speedy improvements in productivity that are filtering down to every business in the US, lower costs everywhere.

This is why corporate earnings have been outperforming the economy as a whole by a large margin.

Profit margins are at an all-time high.

Living near booming Silicon Valley, I can tell you that there are thousands of new technologies and business models that you have never heard of under development.

When the winners emerge, they will have a big cross-leveraged effect on the economy.

New healthcare breakthroughs, which are also being spearheaded in the San Francisco Bay area, will make serious disease a thing of the past.

This is because the Golden State thumbed its nose at the federal government 18 years ago when the stem cell research ban was implemented.

It raised $3 billion through a bond issue to fund its own research, even though it couldn’t afford it.

I tell my kids they will never be afflicted by my maladies. When they get cancer in 20 years, they will just go down to Wal-Mart and buy a bottle of cancer pills for $5, and it will be gone by Friday.

What is this worth to the global economy? Oh, about $2 trillion a year, or 4% of GDP. Who is overwhelmingly in the driver’s seat on these innovations? The USA.

There is a political element to the new Golden Age as well. Gridlock in Washington can’t last forever. Eventually, one side or another will prevail with a clear majority.

This will allow the government to push through needed long-term structural reforms, the solution of which everyone agrees on now but nobody wants to be blamed for.

That means raising the retirement age from 66 to 70 where it belongs and means-testing recipients. Billionaires don’t need the maximum $45,480 Social Security benefit. Nor do I.

The ending of our foreign wars and the elimination of extravagant unneeded weapons systems cut defense spending from $755 billion a year to $400 billion, or back to the 2000, pre-9/11 level. Guess what happens when we cut defense spending? So does everyone else.

I can tell you from personal experience that staying friendly with someone is far cheaper than blowing them up.

A Pax Americana would ensue.

That means China will have to defend its own oil supply, instead of relying on us to do it for them for free. That’s why they have recently bought a second used aircraft carrier. The Middle East is now their headache, not ours.

The national debt then comes under control, and we don’t end up like Greece.

The long-awaited Treasury bond (TLT) crash never happens.

The reality is that the global economy will soon spin off profits faster than it can find places to invest them, so the money ends up in bonds instead.

Sure, this is all very long-term, over the horizon stuff. You can expect the financial markets to start discounting a few years hence, even though the main drivers won’t kick in for another decade.

But some individual industries and companies will start to discount this rosy scenario now.

Perhaps this is what the nonstop rally in stocks since 2009 has been trying to tell us.

Needless to say, investing after Coronavirus runs it's course will be a welcome change for both individual investors and the economy as a whole.

Dow Average 100-Year Chart

Another American Golden Age is Coming

Global Market Comments

January 24, 2020

Fiat Lux

Featured Trade:

(LAST CHANCE TO ATTEND THE FRIDAY, FEBRUARY 7 PERTH, AUSTRALIA STRATEGY LUNCHEON)

(JANUARY 22 BIWEEKLY STRATEGY WEBINAR Q&A),

(BA), (IBM), (DAL), (RCL), (WFC),

(JPM), (USO), (UNG), (KOL), (XLF),

(SEE YOU IN TWO WEEKS)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader January 22 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Are you concerned about a kitchen sink earnings report on Boeing (BA) next week?

A: No, every DAY has been a kitchen sink for Boeing for the past year! Everyone is expecting the worst, and I think we’re probably going to try to hold around the $300 level. You can’t imagine a company with more bad news than Boeing and it's actually acting as a serious drag on the entire economy since Boeing accounts for about 3% of US GDP. If (BA) doesn’t break $300, you should buy it with both hands as all the bad news will be priced in. That's why I am long Boeing.

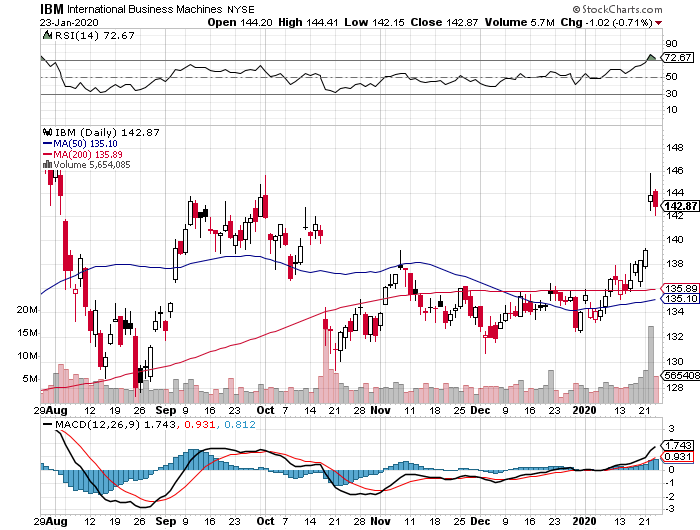

Q: Do you think IBM is turning around with its latest earnings report?

A: They may be—They could have finally figured out the cloud, which they are only 20 years late getting into. They’ve been a lagging technology stock for years. If they can figure out the cloud, then they may have a future. They obviously poured a lot into AI but have been unable to make any money off of it. Lots of PR but no profits. People are looking for cheap stuff with the market this high and (IBM) certainly qualifies.

Q: Will the travel stocks like airlines and cruise companies get hurt by the coronavirus?

A: Absolutely, yes; and you’re seeing some pretty terrible stock performance in these companies, like Delta (DAL), the cruise companies like Royal Caribbean Cruises (RCL), and the transports, which have all suffered major hits.

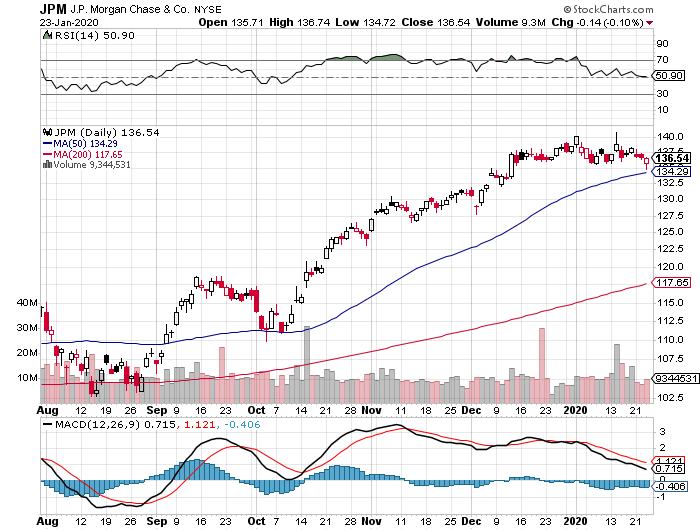

Q: Will the Wells Fargo (WFC) shares ever rebound? They are the cheapest of the major banks.

A: Someday, but they still have major management problems to deal with, and it seems like they’re getting $100 million fines every other month. I would stay away. There are better fish to fry, even in this sector, like JP Morgan (JPM).

Q: Will a decrease in foreign direct investment hurt global growth this year?

A: For sure. The total CEO loss of confidence in the economy triggered by the trade war brought capital investment worldwide to a complete halt last year. That will likely continue this year and will keep economic growth slow. We’re right around a 2% level right now and will probably see lower this quarter once we get the next set of numbers. To see the stock market rise in the face of falling capital spending is nothing short of amazing.

Q: Do you think regulation is getting too cumbersome for corporations?

A: No, regulation is at a 20-year low for corporations, especially if you’re an oil (USO), gas (UNG) or coal producer (KOL), or in the financial industry (XLF). That’s one of the reasons that these stocks are rising as quickly as they have been. What follows a huge round of deregulation? A financial crisis, a crashing stock market, and a huge number of bankruptcies.

Global Market Comments

January 6, 2019

Fiat Lux

2020 Annual Asset Class Review

A Global Vision

FOR PAID SUBSCRIBERS ONLY

Featured Trades:

(SPX), (QQQQ), (XLF), (XLE), (XLY),

(TLT), (TBT), (JNK), (PHB), (HYG), (PCY), (MUB), (HCP)

(FXE), (EUO), (FXC), (FXA), (YCS), (FXY), (CYB)

(FCX), (VALE), (AMLP), (USO), (UNG),

(GLD), (GDX), (SLV), (ITB), (LEN), (KBH), (PHM)

Global Market Comments

August 9, 2019

Fiat Lux

Featured Trade:

(AUGUST 7 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (XLK), (GLD), (DIS), (TLT),

(FXA), (FXY), (VIX), (VXX), (UNG), (USO)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.