Below please find subscribers’ Q&A for the August 16 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Silicon Valley, CA.

Q: Did you hear that Michael Burry was putting on a big short (the guy who made a fortune shorting housing in 2009)?

A: Yes, I heard that, but I never, ever trade-off of those kinds of comments. First of all, I think he’s wrong; and often, what happens in those situations is you hear about them going into the trade, but you never hear about them getting out, which might be tomorrow or next week. Also, there’s a nasty habit of big hedge fund managers telling you the opposite of what they’re actually doing. We hear big hedge fund traders like Bill Ackman getting super bearish at market bottoms, and then a few months later learn that they were buying with both hands, as was the case with the pandemic bottom. Be careful about other people’s opinions—they can be hazardous to your wealth. Just look at the data and the facts. That’s what I do.

Q: Would you buy Snowflake (SNOW) around current prices?

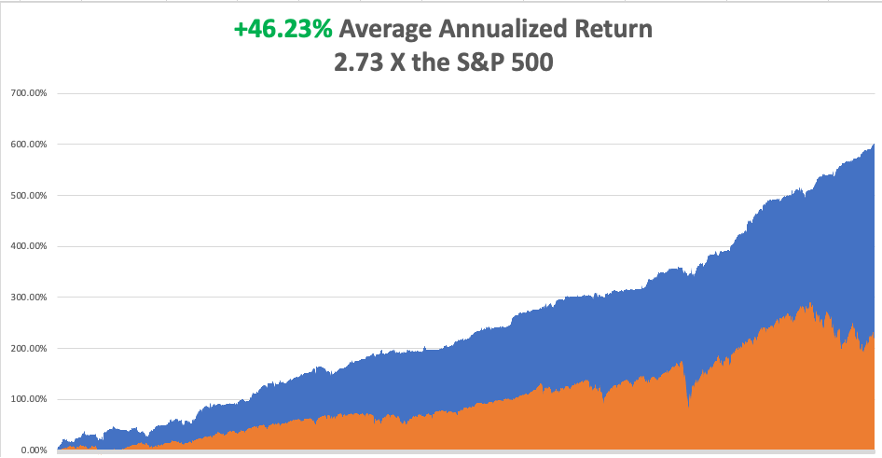

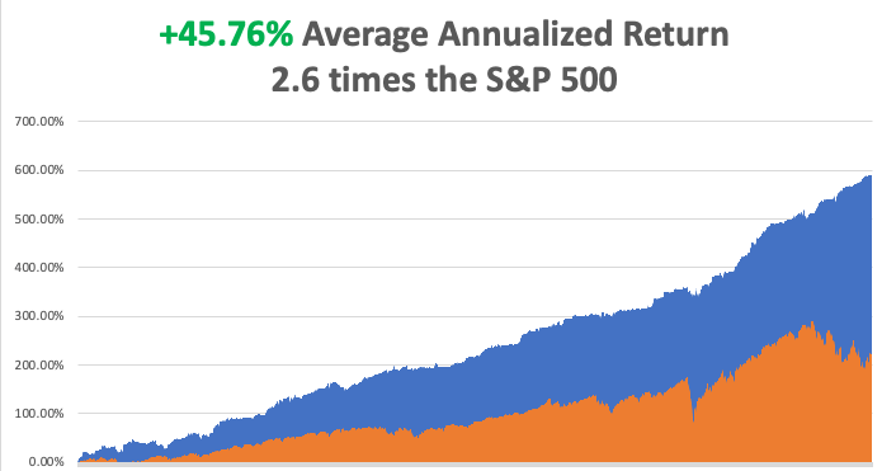

A: Yes—first of all Snowflake is a Warren Buffet favorite, which I always tend to follow. However, Warren can wait 5 years for a stock to work, and you can’t. So, I would wait for a bigger dip before getting into SNOW. So far, we are down 25% from the recent peak. One thing’s for sure, cybersecurity is a long-term winner, as seen by the ballistic move in Palo Alto Networks (PANW) since we started recommending it about 8 years ago.

Q: Why are US consumers so strong, and will that hold up for the rest of 2023?

A: US consumers are so strong because they banked so much money during 10 years of QE and all the pandemic stimulus, that they have a lot saved. They are now happy to spend to make up for the spending they couldn’t do during the pandemic. They’re basically in spending catch-up mode or revenge spending.

Q: How far do you see the iShares 20 Plus Year Treasury Bond ETF (TLT) go?

A: My worst-case scenario has it going to $90 down from $94—that’s a yield of about 4.50%. And that's where a lot of bond investors see fair value, and will start piling in. But as long as the momentum is against it, I’m not touching it. As soon as I am convinced there is a real bottom in the (TLT), I’m going to jump in with both hands and buy long-term LEAPS, where you can get a 100% or 200% return pretty quickly.

Q: Time to buy the Tesla (TSLA) dip?

A: We’re getting close. My guess is you might get a spike down to $200 from the recent $300 high. That’s also going to be LEAPS territory for us because the long-term outlook for this company is spectacular.

Q: What do you think of Freeport McMoRan (FCX), Silver (WPM), and United States Natural Gas Fund (UNG)?

A: I think they are all strong buys; I have LEAPS out on all of them. I think we start to get a big move in the 4th quarter of this year that’ll go well into next year—so big money just sitting on the table begging for you to take it.

Q: What are we to make of the crash of the Chinese Yuan?

A: The Chinese economy is weak and looks like it’s getting weaker. They still have a pandemic hangover. We don’t know what their real pandemic numbers are—they adopted our pandemic policy 2 years after we did, and they’re suffering as a result. They also insist on using their own vaccine, Sinovac, for nationalist reasons which is only 30% effective. But, when the Chinese economy does come back on stream, that’ll be the gasoline on the fire for the global economy, and that’s why we like commodities, industrials, energy, and so on.

Q: What does an 8% mortgage rate mean for the housing sector?

A: It is a disaster. I don’t think prices will drop very much—it’ll just cease all new buying because nobody qualifies for an 8% mortgage. They are going to either be only cash buyers out there or people waiting for the next drop in interest rates, and we’re already seeing that with the mortgage rate at 7.24%. If we do get a move up to 8%, it’ll just be a short-term spike that won’t last very long.

Q: Aren’t high-interest rates pushing rents higher?

A: Yes, absolutely. Since people can’t afford to buy houses, they are renting until they can, which pushes rental prices up and adds to the inflation numbers.

Q: When do you think the tech sector will rebound? It’s had a really bad three weeks.

A: End of August or sometime in September. I think. When people come back from the beach, they’re going to look at the long-term future of these companies and think “holy smokes,” why don’t I own more of these?” And we may even be doing LEAPS at high prices, which I almost never do, but the growth rate in tech next year is looking to be spectacular, and I think if we do a conservative at-the-money, we should at least double our money in a few months, similar to how US Steel (X) LEAPS did.

Q: Is Amazon (AMZN) a buy? They’re starting to develop their pharmacy rather well.

A: Yes, Amazon is on the buy list—it’s already up 50% this year. Jassy, the new CEO, is doing a great job. They also have a massive investment in AI which they can monetize anytime they want, and online pharmacies are a great place to start. They’ve been talking about doing that for at least 10 years.

Q: Are gold (GLD), wheat (WEAT), and precious metals a buy?

A: Yes, those are all strong buys on the dip.

Q: What about Tesla (TSLA) LEAPS?

A: Yes Tesla is definitely a LEAPS candidate $30 down from where it is now.

Q: What about Crown Castle International (CCI)?

A: CCI took a major hit from Verizon, canceling a contract with them (which is their biggest customer), so I want to wait for that to digest before I do anything yet. However, we are definitely approaching “BUY” territory; I think the yield is up to about 6.5% now.

Q: Should I take profits on the next jump up in United States Steel Corporation (X)?

A: Yes, it’s not worth hanging on 16 more months to maturity when there’s only 30% of the profit left. And, if all the takeover bids fail for some reason, the stock goes back to $20, and then your LEAPS becomes worthless. So, I would take profits; 100% profit in 2 months is nothing to turn up your nose at.

Q: How confident are you in (TLT) going to $110 by the end of the year?

A: Very confident; by then we will start seeing more hints of Fed interest rate cuts, inflation should be lower, and Goldman Sachs is in fact forecasting that the first rate cut will happen in March. So you’ll certainly start discounting that in the (TLT) by December. We could see the high in yields and the low in prices at the central bankers conference in Jackson Hole next week.

Q: What do you think about cruise lines and hotels right now?

A: The business is great, they’re all packed. However, during the pandemic, these sectors had to take on massive amounts of debt to keep from going under when their ships were tied up with zero revenue for two years; same with the hotels. So, the balance sheets are terrible in all of these areas including airlines. That’s why I’ve been avoiding them, too many better plays. Don’t go away from your core trades looking for trouble.

Q: When do we finally start seeing the Fed stop raising rates?

A: I think they already have; I think the most recent rate rise was the last one. If I’m wrong, they’ll do one more quarter—it’s totally dependent on the numbers.

Q: Won’t falling rates be bullish for bonds and gold?

A: Yes, that's why we’re buying them; but I’m waiting on the bond LEAPS—I want to see a firm bottom before getting back in there. 2024 will be all about falling interest rates plays.

Q: What’s causing the volatility in the United States Natural Gas Fund (UNG)?

A: A Strike in Australia, collapsing supplies in Europe (where prices are up 40%), and expectation of a global economic recovery in China. Ultimately, it’ll be China that takes this thing up to $10, $12, or $14 for the UNG, but you need them to recover first. That’ll probably happen next year, which is why we have the two-year LEAPS on there.

Q: With junk (JNK), have we seen the high rates?

A: Yes. If not, we’re very close, so it’s worth starting to scale in here.

Q: Should I short Home Depot (HD), as US consumers are holding back on home upgrades?

A: No, you should not short anything because you’re going against a long-term bull market trend that probably continues for another 10 years. So, any shorts should be measured in days and not weeks.

Q: Should I start chasing oil, because it’s been on quite a run, and should I buy Exxon (XOM)?

A: Yes, if we get an economic recovery next year, oil goes over 100 easily and will take all the oil companies up with it.

Q: Is (UNG) a domestic or foreign gas ETF?

A: It’s mostly domestic, and it’s a mix of the top natural gas producers in the US.

Q: Are the BRIC countries going to bring down the dollar?

A: You’ve got to be out of your mind. Would you rather store your money in China and Indonesia or the US? That’s your choice. I know there’s a lot of internet conspiracy theories out there—I get about a question a day on this. It’s Never going to happen; not in my lifetime. But it does attract internet traffic, which is the purpose of putting out these ridiculous stories like a BRIC-engineered digital currency replacing the dollar as a reserve currency. It’s just clickbait.

Q: Why is there a short squeeze in copper?

A: EV production is going from 2 million to 10 million a year in 2030, and every EV needs 200 pounds of copper. By the way, there are now 527 EV models on the market, but only one company makes money doing this, and that’s Tesla (TSLA).

Q: We’ve been waiting for a recession in the US for years, and US consumers are still going strong. What gives? I want rates to drop so I can invest in real estate again.

A: Well, yes. This recession has been predicted for 2 years. The problem is we have a certain political party telling us every day that the economy is the worst it’s ever been when, in actuality, the health of the economy is amazingly strong, and certainly the strongest economy in the world. So, I don't think we get a real recession until well into the 2030s because of massive technological development and a huge demographic tailwind—that’s an absolute winning combination, last seen in the 1990s. Plus, now we have AI accelerating everything. So, look at the numbers; don’t listen to opinions. Opinions can be fatal to your wealth.

Q: Does the use of an adjustable-rate loan make sense for the purchase of a second home?

A: Yes, it does. During the great interest rate spike of the 1980s, I bought my home in New York with an adjustable-rate loan. The initial interest rate was 18%, but when rates dropped to 11%, the value of the home tripled. Not a bad trade—and I bet the same kind of opportunity is out there now, provided you can get another adjustable-rate loan. By the way, in Europe, they only have adjustable-rate loans. The 30-year fixed anomaly only exists in the US and Canada because you have the US government as the unlimited buyer of last resort for 30-year fixed mortgages.

Q: Thoughts on other steel companies and aluminum?

A: I like them all. The country needs 200,000 miles of new long-distance transmission lines to accommodate the electrification of the economy, and those are all made out of aluminum except for the last mile—most people don’t know that. Buy Alcoa (AA).

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader