“Spotify is a platform: it could be expanded to other types of content.” – Said CEO of Spotify Daniel Ek

Mad Hedge Technology Letter

May 7, 2019

Fiat Lux

Featured Trade:

(THE LURKING DANGERS BEHIND FACEBOOK)

(FB), (WFC), (NFLX)

The current business model of social media is dead, and the future model seems in doubt – that was the take away from world's largest social media platform at F8 that I attended, its annual developer conference.

Co-founder and CEO Facebook (FB) Mark Zuckerberg stated at the event that “in our digital lives, we also need both public and private spaces,” an impromptu call to action to migrate users into a new private digital world with Facebook dictating the terms.

The sushi must really be hitting the fan for Zuckerberg to announce his future vision of social media, and the writing is on the wall for his current social media experiment, that is, if he continues along at the same rate.

The projected $5 billion fine incurred by Facebook from the Federal Trade Commission over its privacy handling of personal data is peanuts for the social media company, but this could be the first of numerous fines doled out by regional and national regulatory bureaus that span from the Bay Area to Vietnam.

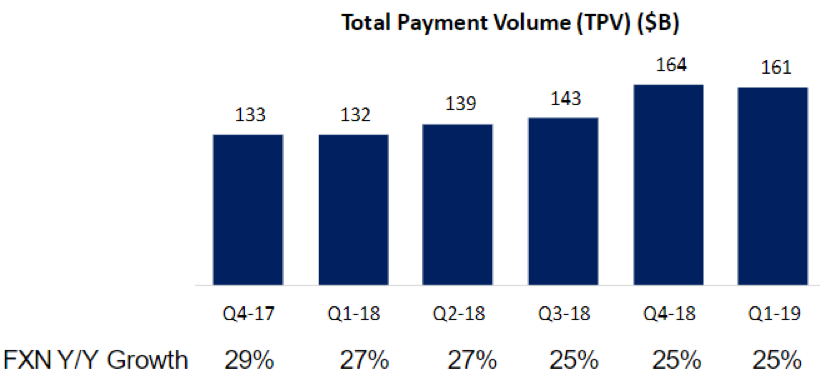

Facebook is a company that made over $55 billion in revenue last year and the $5 billion would amount to less than 10% of annual sales.

From that $55 billion, Facebook earned profits of over $22 billion, and this $22 billion is what the regulatory battles are about, along with the co-founder’s tenacious defense of deploying his users as free content.

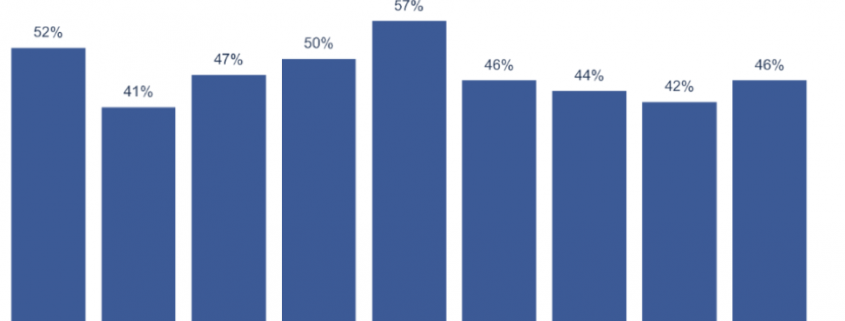

The firm has continued to post operating margins of over 40% and delivered margins of 46% last quarter, a sequential rise of 4% in Q4 2018.

The Oracle of Omaha better known as Warren Buffet cited necessitating accountability for CEOs that drive a company into a government bailout especially banks.

He advocated that these executives and their spouses should be stripped of their net worth if they damage shareholder value.

The comments were directed at the way Wells Fargo’s (WFC) former CEO Tim Sloan crippled Wells Fargo and has since been sidelined during the long bull market in equities.

At some point, Zuckerberg could confront similar ructions because of his efforts at perverting democracy that has caused innumerable damage to American democracy and global society, and I am certain his legion of lawyers are already hatching a plan to tackle this thorny predicament.

If you ponder about his announcement in a zero-sum environment, it makes no sense for Facebook to pivot to “private” messages.

This leads me to believe his words are smoke and mirrors so that Facebook can perpetuate its duopoly and force digital ad players to continue to drink from the same Kool-Aid.

As before, Zuckerberg still believes this game of cat and mouse is a half-baked marketing fix.

This is why many of his trusted disciples such as former executive Chris Cox left under a shroud of mystery citing “artistic differences” in terminating his tenure at Facebook.

It is clear to many that Facebook is barreling straight into an even more frightening future.

What does the announcement mean from a business perspective?

Zuckerberg will continue to purge anyone that disagrees with him, even trusted lieutenants, and continue to integrate the family of apps into one big platform that includes Facebook, Instagram, and WhatsApp messenger.

These three will become one and thus, Zuckerberg’s ad machine rolls on like the dystopian action film Mad Max.

Let me remind you, these drastic measures boil down to Facebook doing everything they can to keep content costs down.

If they, for example, have to go the same route as Netflix (NFLX) - overpaying for the best actors and directors to generate premium content, the stock would halve the next day.

And that is what Zuckerberg is desperately hoping to avoid after the 30% dip in shares in 2018 because of regulatory headwinds.

Combining the three apps would be impossible to regulate at a time that regulation is rearing its ugly head.

Zuckerberg is intentionally upping the ante and accruing more risk in the hope that Facebook can outmuscle its way through in one piece.

The ad industry is crying out for something new, but as long as Zuckerberg’s claws are firmly into the meat of the digital ad budgets for most companies, he gets to decide how the industry develops because he knows the ad dollars will stick.

In the future, your private chats won’t be private because Zuckerberg will be mining the data for ad dollar revenue.

No matter what he says, nothing will change unless Facebook goes in an entirely new direction which would inhibit sales.

Until the fines become material, let’s say 70% of annual revenue or something of that nature, a $5 billion hit to the bottom line will not persuade the management to transform their practices.

Expect less privacy, and WhatsApp and Instagram to be heavily monetized through ad promotion and data mining even though Zuckerberg pledging his company won’t hold user data “longer than necessary.”

As for Facebook itself, Zuckerberg can’t throw his baby out with the bathwater and will hope to minimize its deceleration by bundling it with the growth trajectory of WhatsApp and Instagram.

Instead of major structural changes, Zuckerberg continues to beat around the bush saying, “You should expect that we’re not going to store your data in countries where there's weak data protection.”

This is not the crux of the problem and shows Zuckerberg is still paying lip service and not ponying up to reality.

Attaching Facebook and its dying model is not an attractive strategy leading to a slew of executive resignations.

I believe this could all end in calamity for Zuckerberg as he figures piling on more risk onto the elevated risk levels is the right decision making Warren Buffet’s point for him about CEO’s accountability.

Should Zuckerberg refund shareholders if his flight turns into a suicide mission then claims to be an unwitting victim?

And how does he even refund democracy with his apps causing major unrest to society such as killings that occur because of the distribution of fake news on his platforms?

Making a hot potato hotter might work for the short term and if ad dollars stream into WhatsApp and Instagram, Zuckerberg will claim victory.

But at some point, the potato will scald his hands so bad that it will drop.

Your private chats will be the content at the fulcrum of his data broker empire since his “digital town square” approach isn’t working anymore.

The company is utterly incentivized to figure out how to continue this ad revenue carnival because 93% of total revenue last quarter came from digital ads which is up from the prior year when it constituted 89%.

It all sounds like a big brother apocalyptical novel, which we are in, scarily, in putting out this dialogue before the firestorm starts, Facebook wants to normalize, and front runs the craziness of selling your private chat data before it becomes a national issue.

Will regulators shut this down or will they be naïve and turn a blind eye?

“Our philosophy is that we care about people first.” – Said Co-Founder and CEO of Facebook Mark Zuckerberg

Mad Hedge Technology Letter

May 6, 2019

Fiat Lux

Featured Trade:

(PAYPAL GOES FROM STRENGTH TO STRENGTH)

(PYPL), (SQ), (GOOGL), (LYFT)

It’s time to revisit one of my favorite tech picks for 2019 that is a constant trade alert candidate.

The attention is warranted with the stock performance delivering a tidal wave of euphoria rising around 30% in the first half of 2019.

I expected PayPal to have a great year, but I didn’t expect them to perform better than Square who are growing from a lower install base.

PayPal’s overperformance signals to the wider business establishment how important a broad install base can be that can tap the network effect to reel in profits.

This is how once legacy dinosaurs can reinvent themselves in months.

The lack of entry points is a concern prodding investors to chase the stock if they want a piece of the action.

This is one of the drastic side effects of PayPal’s meteoric rise that has been buttressed by dovish Fed policy.

Investors are literally praying to the skies for any softness in tech earnings reports because for the best of the bunch, there have been no moderate pullbacks of note since last winter.

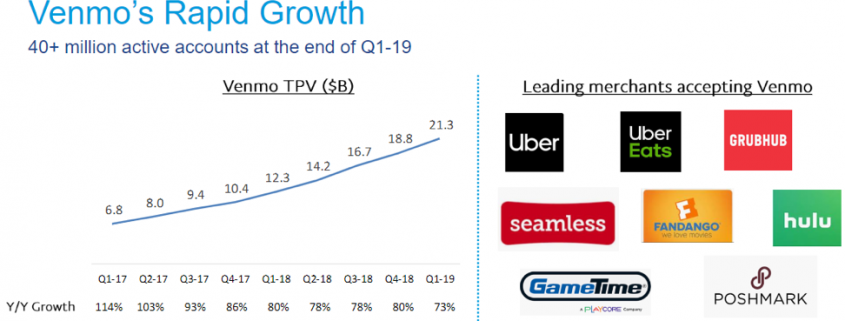

PayPal did offer a slight data point that might be construed as disappointing when total payment volume (TPV) of $161 billion was slightly lower than the consensus of $163 million for the quarter.

It’s slim pickings for the bear camp with not much to feast on in an otherwise pretty solid earnings report.

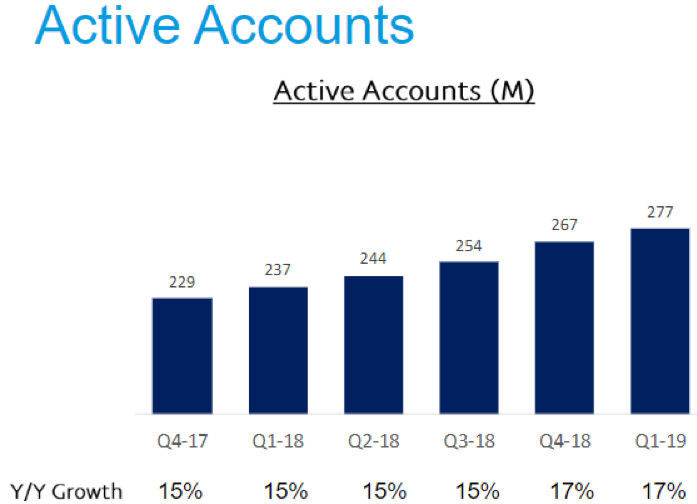

As PayPal expanded by 9.3 million new active accounts, bringing its total up to 277 million, management has super charged this legacy fintech company into an outright renaissance.

Doing even more to shed the tag of a legacy company, PayPal invested half a billion dollars at $47 per share into the upcoming Uber IPO signaling possibilities that their payment software could at some point integrate into Uber’s network down the road.

Alphabet (GOOGL) has shown that if you get in early with these Silicon Valley unicorns, synergistic effects are plenty with Alphabet lapping up revenue charging Lyft (LYFT) for providing digital ad capabilities on top of the appreciating value of their investment stake.

And if you remember that way back, PayPal was tied to eBay before it was spun out.

Better to attach future hopes and dreams to a leading visionary and innovator instead of a legacy e-commerce platform.

Illustrating the tough task of turning around eBay, eBay clocked in negative TPV growth of 4% in the past quarter.

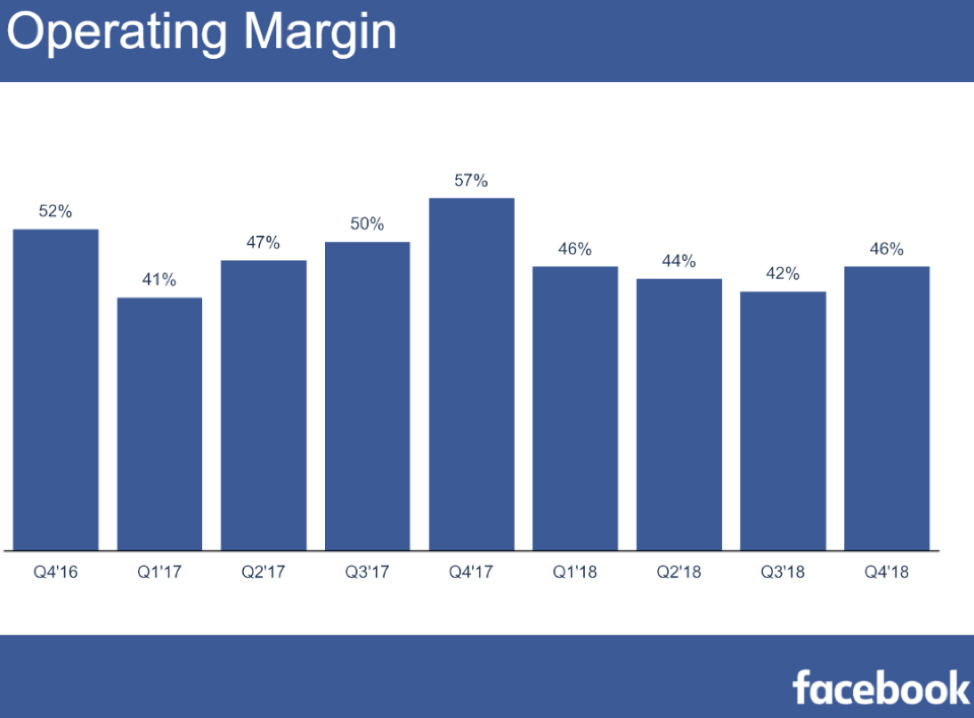

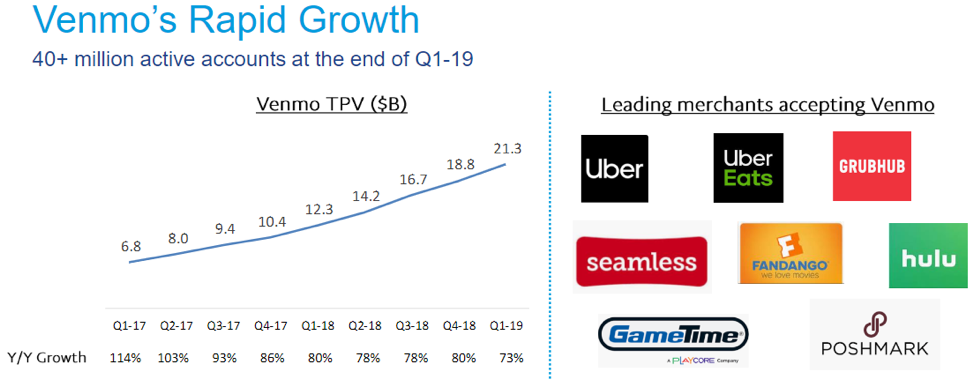

PayPal offered us more detail into active-account numbers for its Venmo peer-to-peer service with more than 40 million people using Venmo for at least one transaction in the last 12 months.

Venmo processed $21 billion in TPV last quarter, mushrooming by 73%, while the core PayPal platform’s TPV grew 41% to $42 billion.

The success paved the way to raise its full-year EPS outlook from $2.94 to $3.01 ensuring that its prior forecast on revenue and TPV will be met.

PayPal previously guided lower with an expected $2.84 to $2.91 in adjusted EPS and $17.75 billion to $18.1 billion in revenue.

When we tally up all the positive points, it’s hard to ignore the 12% YOY increase in revenue to $4.13B and the more impressive 37% YOY rise in EPS growth signaling the company is applying its giant scale to maximum effect.

Customer engagement of 37.9 payment transactions per active account rose 9% YOY while the TPV which came in lower than consensus was still growth of 22% YOY.

I love that PayPal has migrated towards the heart of innovation while being a legacy fintech company.

Venmo and the Venmo card are rapidly infiltrating the center of consumer’s daily financial lives wielded for groceries, gas, and restaurants.

In February, PayPal introduced a limited-edition rainbow card which became the fastest adopted Venmo card.

I want to reiterate how the proof is in the pudding with Venmo volume increasing 73% to approximately $21B in the quarter.

Not only does this legacy fintech have super growth drivers, they have become quasi venture capitalists applying a horde of capital to snap up attractive assets.

An example is a $750 million investment in the e-commerce and payments leader in Latin America called MercadoLibre which creates a network effect to PayPal’s core business in the region.

If the steady drip of news wasn’t good enough, PayPal announced a partnership with Instagram to process payments when customers are shopping on Instagram in the U.S.

Management is convincingly delivering the goods with 110 basis points of operating margin expansion.

PayPal’s flawless performance is a great model in how to survive the volatile times of rapid tech shifts, and the best way to alter a model to reduce existential threats.

The company has growth drivers, have migrated capital into growth tech, are innovating with the best of them, and management is executing surgically taking advantage of a massive install base.

Buy on any weakness, entry points are few and far between.

“The big problem retailers are facing is the world is moving to mobile.” – Said CEO of PayPal Dan Schulman

Mad Hedge Technology Letter

May 2, 2019

Fiat Lux

Featured Trade:

(APPLE’S HOME RUN)

(AAPL), (CRM), (GOOGL)

The company that Steve Jobs built is an earnings thoroughbred with money growing out of their ears.

Apple’s earnings report was real confirmation that Apple’s pivot into a services company is overshadowing its drop in iPhone revenue.

They even elevated forward guidance for next quarter.

Being an economic bellwether that it is, the earnings success could point to more bullish momentum for not only the tech sector but the broader market.

The tech strength showing up in the squiggly figures of the sector’s earnings report indicates that the expected earnings recession will be more of a pause rather than a dip that was first expected.

The next bout of bullish strength that permeates through the market will take many tech stocks to higher highs.

The numbers backed up this premise with Q2 2018 revenue from the services category comprising 20% of total revenue in Q2 2019—a rubber stamp of confidence that this isn’t a false dawn after service sales only comprised of 16% of total revenue the prior year.

The death of the smartphone is upon us with most people who can afford a premium one already using one as we speak with no intentions for a quick refresh.

Apple’s strategy of selling expensive iPhones to Chinese nationals is over with iPhone sales getting slaughtered by 17% to about $31 billion—an accelerated decline for a product that has been hamstrung by smartphone rivals in China offering better phones for lower prices.

The $11.5 billion from its services division and the end result of registering revenue in the high end of its $55-59 billion projection for the quarter is a stark shift from the underperformance of 2018 when Chinese iPhones sales were so bad that they stopped reporting the segment altogether.

The $58 billion of quarterly revenue was still a drop of 5% YOY which included $31 billion in iPhone sales, a shell of its former self when they generated $37.5 billion in iPhone sales the same quarter in 2018.

The disruption in handing off the baton to the services brigade caused outsized ructions inside the company causing the stock to plummet 20% last winter.

Wearables put the cherry on top of the sundae expanding at a rate close to 50% during the quarter with AirPods and Apple Watch leading the charge as best sellers.

Apple plans to inject $75 billion on share repurchases and it also approved a 75-cent dividend per share, a 5% increase.

These repurchases could boost Apple’s stock by up to 7% per year offering investors another compelling reason to hold this stock long-term.

The upgraded dimensions of Apple’s business model could finally give investors peace of mind as they wean themselves from Chinese iPhone sales.

Moving forward, the relationship between American tech and the Chinese consumer will be contentious at best, and battling with Huawei on its turf is not a sensible strategy.

Highlighting this weakness were the Greater Chinese revenue registering only $10.2 billion in sales, down from the Q2 2018 tally of $13 billion.

On the positive side, the Chinese weakness is already baked into the pastry ceding way for the services narrative to move to the forefront.

Generating more incremental revenue from its existing base of 1.4 billion Apple accounts is the order of the day.

I initially believed Apple would make major headway in the services segment and foresaw services composing about 25% of total revenue.

However, I didn’t believe they would be able to achieve this for a few years, and the surprise to investors is the velocity of change to the upside in its services business.

Adding the new magazine subscription for $9.99 to its platform is another feather in their cap even though it doesn’t transform the industry.

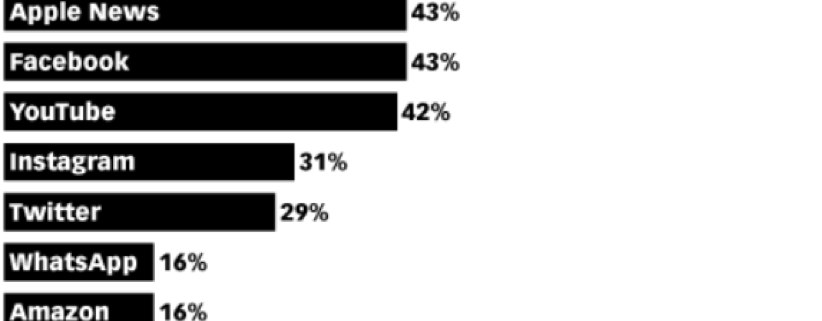

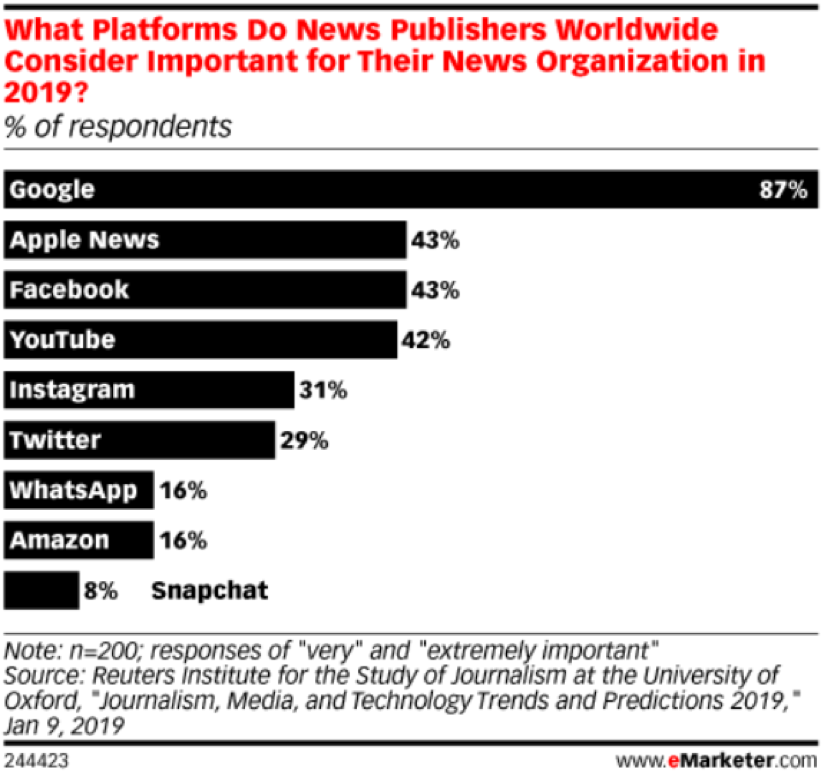

Respondents to emarketer.com made it widely known that Apple as a platform was the second most important platform for news publishers behind Google offering a great opportunity to carve out more income from their new news app.

Apple is still in dire need of attractive video options for its content basket and assets on the market are plenty from live sports, shows, movies, and video games.

My money would be on Cook to prefer video games as a viable growth driver because it resonates deeply with younger audiences from abroad and avoids the polarity of controversial content which societies are increasingly sensitive to.

Another option would be to dive headfirst into the enterprise software business moving towards a Salesforce (CRM) model selecting cloud companies à la carte to integrate into a business cloud.

Many Apple device holders already wield their devices for their own online businesses, and this would represent a solid growth driver if they could make their services more business-friendly.

What can we expect moving forward?

In short, less iPhone sales and more service revenue as a proportion of total revenue.

If Apple can carefully choreograph its downshift of iPhones sales that doesn’t destroy overall revenue and profitability, they will successfully manage in transforming the company into a hybrid service company.

I believe that Apple’s services will contribute around 30% of total revenue by 2020 and this is a big deal that will buoy the stock.

Ultimately, these are happier times for Apple as their bet on services isn’t getting bogged down, eclipsing expectations, and will cement their status as a sure-fire $1 trillion market cap company.

Bravo!

“I think the iPhone is the best consumer product ever. That's what I feel about it. And it's become so integrated and integral to our lives, you wouldn't think about leaving home without it.” – CEO of Apple Tim Cook

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.