While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 6, 2014

Fiat Lux

Featured Trade:

(THE CORRECTION IS OVER),

(SPY), (TSLA), (BAC),

(TESTIMONIAL)

SPDR S&P 500 ETF (SPY)

Tesla Motors, Inc. (TSLA)

Bank of America Corporation (BAC)

5%. A lousy 5%.

That?s all we managed to clock in the latest correction in the greatest bull market of all time.

It?s not the 6% hickey we had to endure in February, nor as modest as the 4% setback in August. Call it a middling type correction, a kind of correction light. The buyers do still have itchy trigger fingers.

All it took to bring it to an end was a September nonfarm payroll that blew the socks off the forecasts of most analysts, coming in at a positively steroidal 248,000. It?s like they?re finally hiring again.

That is, unless you just graduated from college with a degree in English, Sociology, or Political Science, and are lugging $100,000 in student loans. Coders everywhere are writing their own tickets.

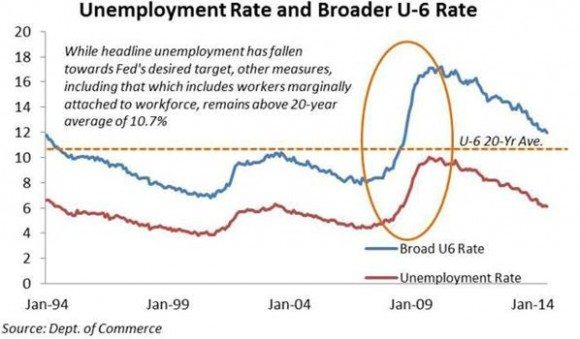

The headline unemployment rate plunged from 6.1% to 5.9%, an eight year low, and the broader U-6 figure is closing in on 10%.

Even more impressive were the back month upward revisions, which were enormous. July was boosted from 212,000 to 243,000, and August was goosed from 142,000 to 180,000.

The hiring was across the board, with professional & business services, retail, health services, and even construction leading the way.

What all of this means is that the freshly updated 4.4% Q2 GDP growth rate isn?t some cockamamie government concoction, but is, in fact real.

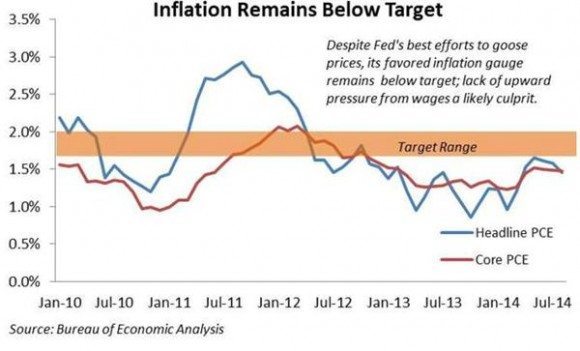

More amazing is that we are seeing these blistering numbers against a background of non-existent inflation, even deflation, if the August -0.1% Consumer Price Index is to be believed.

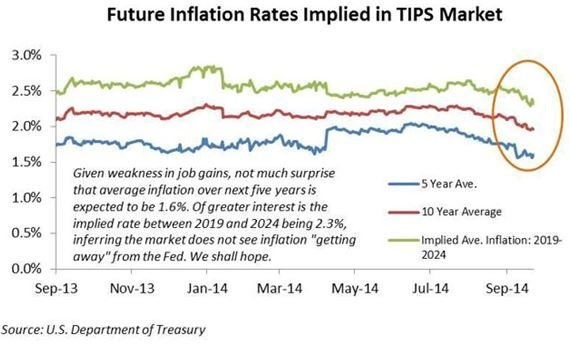

That gives my friend, Federal Reserve governor Janet Yellen, a blank check to keep interest rates lower for longer than anyone believes possible.

Without the inflation bogeyman, you might as well keep rates at zero forever. Personally, I am in the 2016 camp before we start to see interest rate rises.

All this means it is back to the races for the stock market, with an (SPX) bull?s-eye of 2050-2100 now in the cards. However, we?re not going there in a straight line.

I expect more of a sideways wedge formation developing first over the coming month where we see successive higher lows and lower highs. When we reach the apex of the triangle it will be bingo!, and a blast off to new all time highs.

Of course, you can?t go to the races without a program. So make your choices carefully, as the kind of corrections of the type we have just seen often herald sudden sector rotations.

I think financials are the place to be, especially if my prediction that interest rates are bottoming proves correct. That?s why I knocked out a Trade Alert to buy Bank of America (BAC) last week (click here for the editor?s cut). Conveniently, it jumped 5% the next day. I have a pleasant habit of doing that with (BAC).

I am not dishing out a positive view on risk assets because I live in LaLa Land (I only grew up there), am a perma bull, or like drowning myself in the punch bowel (at least not since college). For me, it?s all about the numbers.

Here?s a list of figures to show, not that shares are cheap or how expensive shares are, but how moderately priced they are:

1) With a price earnings multiple of 17X, we are smack in the middle of a 10-25X historic range.

2) The dividend yield for stocks is at 1.9%, compared to only 1.1% at the 2007 top.

3) Cash reserves per S&P 500 share are a rich $443, compared to only $353 seven years ago.

4) Corporate debt to assets is a mere 23% versus 32% 2007.

I could go on and on, but you see my point. This bull market has years to go before it even flirts with becoming truly expensive, unless you own Tesla (TSLA), according to Mr. Elon Musk.

I think the way to trade this market is to reserve the daily newspapers only for lining the bottom of a birdcage, and to hit the mute button on your TV.

That way you won?t hear about the Ebola Virus, ISIL, the Midterm Elections, the war in the Ukraine, and all the other bogus reasons to sell stocks we are bombarded with daily.

Did I mention that the $20 per barrel plunge in the price of oil we have just seen amounts to one of the largest tax cuts in history for the economy?

See, I always write more interesting economic pieces while watching Men in Black. I think the 6,800-foot altitude here at Lake Tahoe helps too.

So Inspiring!

So Inspiring!

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 3, 2014

Fiat Lux

Featured Trade:

(MAD HEDGE FUND TRADER TOPS 35% GAIN IN 2014),

(SPY), (IWM), (TLT), (TBT), (TSLA), (BAC), (FXE),

(OCTOBER 8 GLOBAL STRATEGY WEBINAR),

(A COW BASED ECONOMICS LESSON)

SPDR S&P 500 ETF (SPY)

iShares Russell 2000 (IWM)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

Tesla Motors, Inc. (TSLA)

Bank of America Corporation (BAC)

CurrencyShares Euro ETF (FXE)

It looks we are going to have to start watching the appalling Zombie shows on TV and in the movies. That is so we can gain tips on how to survive the coming Apocalypse that will unfold when the Ebola virus escapes Texas and spreads nationally.

I?m not worried. I?m actually pretty good with a bow and arrow.

Thank you United Airlines!

I happy to report that the total return for my followers so far in 2014 has topped 35%, compared to a pitiful 1% gain for the Dow Average during the same period.

In September, my paid Trade Alert followers have posted a blockbuster 5.01% in gains. This is on the heels of a red-hot August, when readers took in a blistering 5.86% profit.

The nearly four year return is now at an amazing 157.8%, compared to a far more modest increase for the Dow Average during the same period of only 37%.

That brings my averaged annualized return up to 39.7%. Not bad in this zero interest rate world. It appears better to reach for capital gains than the paltry yields out there.

This has been the profit since my groundbreaking trade mentoring service was first launched in 2010. Thousands of followers now earn a full time living solely from my Trade Alerts, a development of which I am immensely proud.

It has been pedal to the metal on the short side for me since the Alibaba IPO debuted on September 19. I have seen this time and again over four decades of trading.

Wall Street gets so greedy, and takes out so much money for itself, there is nothing left for the rest of us poor traders and investors. They literally kill the goose that lays the golden egg. Share prices have nowhere left to go but downward.

Add to that Apple?s iPhone 6 launch on September 8 and the market had nothing left to look for. The end result has been the worst trading conditions in two years. However, my double short positions in the S&P 500 (SPY) and the Russell 2000 (IWM) provided the lifeboat I needed.

The one long stock position I did have, in Tesla (TSLA), is profitable, thanks to a constant drip, drip of leaks about the imminent release of the Model X SUV. The Internet is also burgeoning with rumors concerning details about the $40,000 next generation Tesla 3, which will enable the company to take over the world, at least the automotive part.

Finally, after spending two months touring dreary economic prospects on the Continent, I doubled up my short positions in the Euro (FXE), (EUO).

Those positions came home big time when the European Central Bank adopted my view and implanted an aggressive program of quantitative easing and interest rate cuts. Hint: we are now only one week into five more years of Euro QE!

The only position I have currently bedeviling me is a premature short in the Treasury bond market in the form of the ProShares Ultra Short 20+ Treasury ETF (TBT). Still, I only have a 40 basis point hickey there.

Against seven remaining profitable positions, I?ll take that all day long. And I plan to double up on the (TBT) when the timing is ripe.

Quite a few followers were able to move fast enough to cash in on the move. To read the plaudits yourself, please go to my testimonials page by clicking here. They are all real, and new ones come in almost every day.

Watch this space, because the crack team at Mad Hedge Fund Trader has more new products and services cooking in the oven. You?ll hear about them as soon as they are out of beta testing.

The coming year promises to deliver a harvest of new trading opportunities. The big driver will be a global synchronized recovery that promises to drive markets into the stratosphere by the end of 2014.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011, 14.87% in 2012, and 67.45% in 2013.

Our flagship product,?Mad Hedge Fund Trader PRO, costs $4,500 a year. ?It includes?Global Trading Dispatch?(my trade alert service and daily newsletter). You get a real-time trading portfolio, an enormous research database, and live biweekly strategy webinars. You also get Jim Parker?s?Mad Day Trader?service and?The Opening Bell with Jim Parker.

To subscribe, please go to my website at?www.madhedgefundtrader.com, click on ?Memberships? located on the second tier of tabs.

Waiting for a High Level Contact

Waiting for a High Level Contact

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.