While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Technology Letter

April 29, 2019

Fiat Lux

Featured Trade:

(A TESLA ENTRY POINT IS FINALLY OPENING UP)

(TSLA), (LYFT), (UBER)

Global Market Comments

April 29, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, OR ANOTHER LEG UP FOR THE MARKET),

(SPY), (TLT), (DIS), (INTU), (FCX), (MSFT),

(QQQ), (CVX), (XOM), (OXY), (TSLA)

CEO of Tesla Elon Musk touting his company’s ability to deploy robo-taxis in the next 12 months miffed many industry analysts.

Few tech CEOs would have the balls to get on stage and put themselves out there in that type of manner.

But many tech CEOs aren’t Elon Musk.

I believe Musk calling for these bold predictions will help bend the world in his favor, maybe not right away, but before Tesla burns through their horde of cash.

Of course, there is no way in hell he could pull this off today, regulatory hurdles and in-house capability are two severe constraints.

But confidently proclaiming audacious initiatives that become self-fulfilling prophecies is a smart way to align the stars in the way you want.

Musk certainly believes the scent is in the air for the wolves to go in for the killer blow, he just needs a few miracles and a tad bit of luck on his side.

Tesla is now on record hyping up a custom-made robo-taxi capable of running about a million miles using a single battery pack, with all the sensors and computing power for full autonomy, costing less than $38,000 to produce.

They believe this will come out in 2020.

The combination of low vehicle cost, low maintenance cost and an expected powertrain efficiency of 4.5 miles per kWh should make this the lowest cost of ownership and will be the most profitable autonomous taxi on the market.

Using this state of the art robo-taxi to build a ride-sharing service business would effectively mean an Uber or Lyft without drivers.

Tesla would receive 30% of each fare, with the other 70% sent to Tesla owners that would deploy their own cars into the ride-sharing network.

I respect that Musk can feel sentiment behind Tesla's brand slipping away after heavy criticism, personal backlash from a spat with the SEC, and a boatload of competition hoping to smash him in the mouth.

Musk needed to shift the narrative into Tesla’s brand being the most innovative and publicly letting investors know there are more irons in the fire that will entrench Tesla supporters further while giving the Tesla haters more fodder to terrorize Musk.

Tesla is a luxury brand and constructed in the image of Elon Musk - making the impossible possible ethos needed a facelift and Musk gave what his supporters wanted in spades.

His showmanship is not misplaced and is part of who he is. But more importantly, if Tesla makes serious headway in the robo-taxi business in the next 12 months, Musk will be able to stand on the podium to whip up enough support needed to nudge this over the line.

Musk is very much from the mold of build it and they will come, and he has what few other CEOs have – vision.

The vision comes with a pricey premium.

And Musk must nurture this vision and urge believers to keep believing to carry on this act.

I was surprised that one of the most applicable pieces of news in the shareholder letter was something that nobody excavated.

Tesla will build a second-generation Model 3 line in China that projects to be at least 50% cheaper per unit of capacity than the Model 3-related lines in Fremont and at Gigafactory 1.

The cost to produce Model 3's is about to crash all while Tesla is still considered a premium, luxury vehicle.

This will free up space at the Reno Gigafactory and Fremont to focus on the robo-taxi challenge.

The latest news in Shanghai was an explosion at the half-built Gigafactory parking lot, but not much will come of that.

For investors on the sideline, the nadir of Tesla stock is approaching, another more shakeout might give investors the green light for a trade, that is if they aren’t already long-time holders.

Tesla mentioned they had trouble delivering new Teslas to foreign countries because of headwinds putting the logistics in place for the first time.

This one-off write-down will come off the balance sheet in next quarter’s earnings report and more information on the Shanghai Gigafactory will start to filter in aside from its boost to Tesla being able to produce 500,000 cars in 2019 once it comes online.

The Shanghai Gigafactory will unlock substantial value for shareholders once it's fully operational and finishing the construction ahead of time would be a boon.

Part of the plan to go into China results from snapping up more of a battery supply which Musk feels is the Achilles heel right now in Reno.

He continues to fault Panasonic for not delivering enough cells which, in turn, is holding back the power wall business creating a backlog in orders.

Many of the talking heads appearing on major networks were too trigger-happy in tearing Musk to shreds because of the way he speaks in hyperbole.

Musk even came out with another zinger that could pick up traction - an insurance product to marry up with Tesla vehicle purchases because Tesla believed Tesla owners are being price gouged by insurance companies.

As the impact of higher deliveries and cost reduction take full effect, Tesla expects to return to profitability in Q3 and significantly reduce losses in Q2.

Most of the bad news is baked into the stock and there could be another leg-down before this stock starts to look compelling.

Whether you love them or hate them, visionary tech CEOs get a lot of slack because the upside is so lucrative for shareholders.

That is part of why it is excruciating trading the stock led by a moody visionary with a larger-than-life persona, better to buy and hold if you are a Tesla believer.

This is one of those markets where you should have followed your mother’s advice and become a doctor.

I was shocked, amazed, and gobsmacked when the Q1 GDP came in at a red hot 3.2%. The economy had every reason to slow down during the first three months of 2019 with the government shutdown, trade war, and terrible winter. Many estimates were below 1%.

I took solace in the news by doing what I do best: I shot out four Trade Alerts within the hour.

Of course, the stock market knew this already, rising almost every day this year. Both the S&P 500 and the NASDAQ (QQQ) ground up to new all-time highs last week. The Dow Average will be the last to fall.

Did stock really just get another leg up, or this the greatest “Sell the news” of all time. Nevertheless, we have to trade the market we have, not the one we want or expect, so I quickly dove back in with new positions in both my portfolios.

One has to ask the question of how strong the economy really would have been without the above self-induced drags. 4%, 5%, yikes!

However, digging into the numbers, there is far less than meets the eye with the 3.2% figure. Exports accounted for a full 1% of this. That is unlikely to continue with Europe in free fall. A sharp growth in inventories generated another 0.7%, meaning companies making stuff that no one is buying. This is growth that has been pulled forward from future quarters.

Strip out these one-off anomalies and you get a core GDP that is growing at only 1.5%, lower than the previous quarter.

What is driving the recent rally is that corporate earnings are coming in stronger than expected. Back in December, analysts panicked and excessively cut forecasts.

With half of the companies already reporting, it now looks like the quarter will come in a couple of points higher than lower. That may be worth a rally of a few more percentage points higher for a few more weeks, but not much more than that.

So will the Fed raise rates now? A normal Fed certainly would in the face of such a hot GDP number. But nothing is normal anymore. The Fed canceled all four rate hikes for 2019 because the stock market was crashing. Now it’s booming. Does that put autumn rate hikes back on the table, or sooner?

Microsoft (MSFT) knocked it out of the park with great earnings and a massive 47% increase in cloud growth. The stock looks hell-bent to hit $140, and Mad Hedge followers who bought the stock close to $100 are making a killing. (MSFT) is now the third company to join the $1 trillion club.

And it’s not that the economy is without major weak spots. US Existing Home Sales dove in March by 5.9%, to an annualized 5.41 million units. Where is the falling mortgage rate boost here? Keep avoiding the sick man of the US economy. Car sales are also rolling over like the Bismarck, unless they’re electric.

Trump ended all Iran oil export waivers and the oil industry absolutely loved it with Texas tea soaring to new 2019 highs at $67 a barrel. Previously, the administration had been exempting eight major countries from the Iran sanctions. More disruption all the time. The US absolutely DOES NOT need an oil shock right now, unless you’re Exxon (XOM), Chevron (CVX), or Occidental Petroleum (OXY).

NASDAQ hit a new all-time high. Unfortunately, it’s all short covering and company share buybacks with no new money actually entering the market. How high is high? Tech would have to quadruple from here to hit the 2000 Dotcom Bubble top in valuation terms.

Tesla lost $700 million in Q1, and the stock collapsed to a new two-year low. It’s all because the EV subsidy dropped by half since January. Look for a profit rebound in quarters two and three. Capital raise anyone? Tesla junk bonds now yielding 8.51% if you’re looking for an income play. After a very long wait, a decent entry point is finally opening up on the long side.

The Mad Hedge Fund Trader blasted through to a new all-time high, up 16.02% year to date, as we took profits on the last of our technology long positions. I then added new long positions in (DIS), (FCX), and (INTU) on the hot GDP print, but only on a three-week view.

I had cut both Global Trading Dispatch and the Mad Hedge Technology Letter services down to 100% cash positions and waited for markets to tell us what to do next. And so they did.

I dove in with an extremely rare and opportunistic long in the bond market (TLT) and grabbed a quickie 14.61% profit on only three days.

April is now positive +0.60%. My 2019 year to date return gained to +16.02%, boosting my trailing one-year to +21.17%.

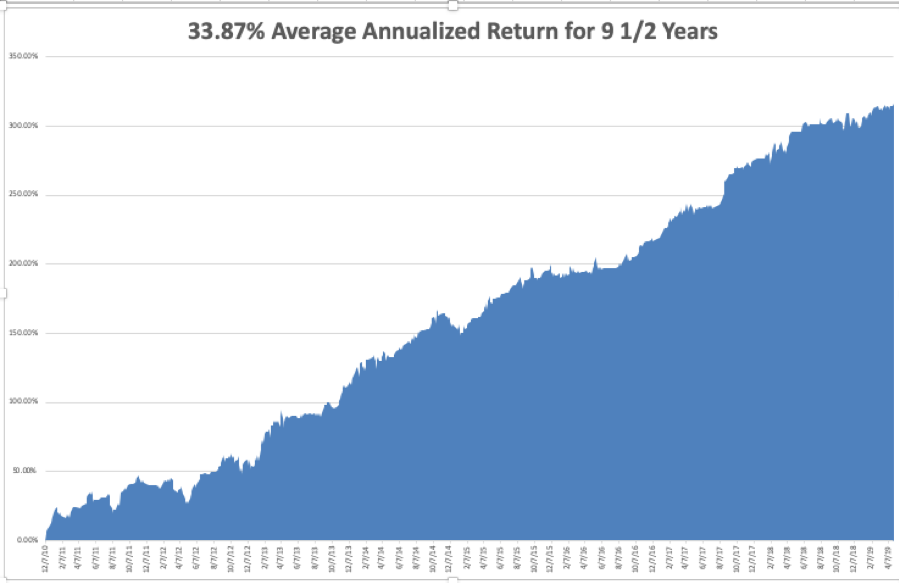

My nine and a half year shot up to +316.16%. The average annualized return appreciated to +33.87%. I am now 80% in cash with Global Trading Dispatch and 90% cash in the Mad Hedge Tech Letter.

The coming week will see another jobs trifecta.

On Monday, April 29 at 10:00 AM, we get March Consumer Spending. Alphabet (GOOGL) and Western Digital (WDC) report.

On Tuesday, April 30, 10:00 AM EST, we obtain a new Case Shiller CoreLogic National Home Price Index. Apple (AAPL), MacDonald’s (MCD), and General Electric (GE) report.

On Wednesday, May 1 at 2:00 PM, we get an FOMC statement.

QUALCOMM (QCOM) and Square (SQ) report. The ADP Private Employment Report is released at 8:15 AM.

On Thursday, May 2 at 8:30 AM, the Weekly Jobless Claims are produced. Gilead Sciences (GILD) and Dow Chemical (DOW) report.

On Friday, May 3 at 8:30 AM, we get the April Nonfarm Payroll Report. Adidas reports, and Berkshire Hathaway (BRK/A) reports on Saturday.

As for me, to show you how low my life has sunk, I spent my only free time this weekend watching Avengers: Endgame. It has already become the top movie opening in history which is why I sent out another Trade Alert last week to buy Walt Disney (DIS).

I supposed that now we have all become the dumb extension to our computers, the only entertainment we should expect is computer-generated graphics with only human voice-overs.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“If something's important enough, you should try. Even if you - the probable outcome is failure.” – CEO of Tesla Elon Musk

"Japan has gone from Paul Volcker to Ben Bernanke overnight," said legendary hedge fund manager, Stan Druckenmiller.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Hot Tips

April 25, 2019

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) Q1 GDP Comes in at a Red Hot 3.2%, despite the government shut down, trade war, and terrible winter. Many estimates were below 1%. Of course, the stock market knew this already, rising almost every day this year. Did stock rally just get another leg up, or this the greatest “Sell the news” of all time? Click here.

2) However, All Asset Prices Moving in the Opposite Direction, with stocks falling and bonds rising on the news. Is THIS the sell the news message? I’m taking profits on my bond longs before the market figures out its wrong. Click here.

3) And Tech Stocks Are Really Not Buying It, in the wake of weak Intel Earnings. Buy (INTC) and other techs on the dip. Click here.

4) Oil Especially Crashes 3%, on Trump tongue wagging, promising he will order the Saudis to increase production, which they won’t. Really, it was extremely overbought and due for a correction. Click here.

5) So Will the Fed Raise Rates Now? A normal Fed would in the face of the hot GDP number. But nothing is normal anymore. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(HOW TO RELIABLY PICK A WINNING OPTIONS TRADE)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.