While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 16, 2019

Fiat Lux

Featured Trade:

(WHY US BONDS LOVE CHINESE TARIFFS),

(TLT), (TBT), (SOYB), (BA), (GM)

(THE BEST TESTIMONIAL EVER)

Mad Hedge Technology Letter

May 16, 2019

Fiat Lux

Featured Trade:

(WHY YOU SHOULD AVOID INTEL)

(INTC), (QCOM), (ORCL), (WDC)

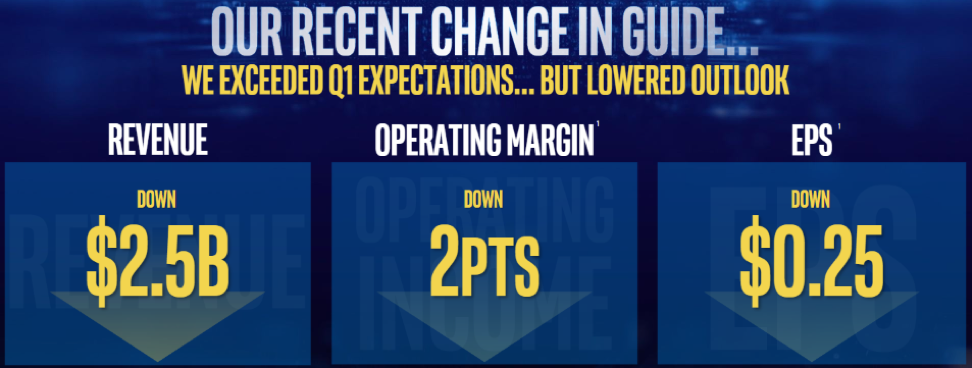

In the most recent investor day, current CEO of Intel (INTC) Bob Swan dived into the asphalt of failure below confessing that the company would have to guide down $2.5 billion next quarter, 25 cents, and operating margins would shrink by 2 points.

This is exactly the playbook of what you shouldn’t be doing as a company, but I would argue that Intel is a byproduct of larger macro forces combined with poor execution performance.

Nonetheless, failure is failure even if macro forces put a choke hold on a profit model.

Swan admitted to investors his failure saying “we let you down. We let ourselves down.”

This type of defeatist attitude is the last thing you want to hear from the head honcho who should be brimming with confidence no matter if it rains, shines, or if a once in a lifetime monsoon is about to uproot your existence.

In Swan’s spiffy presentation at Intel’s investors day, the second bullet point on his 2nd slide called for Intel to “lead the AI, 5G, and Autonomous Revolution.”

But when the company just announces that its 5G smartphone products are a no go, investors might have asked him what he actually meant by using this sentence in his presentation.

The vicious cycle of underperformance leads back to Intel seriously losing the battle of hiring top talent, and purging important divisions is indicative of the inability to compete with the likes of Qualcomm (QCOM).

Assuaging smartphone chip revenue isn’t the only slice of revenue cut from the chip industry, but to take a samurai sword and gut the insides of this division as a result of being uncompetitive means losing out on one of the major money makers in the chip industry.

Then if you predicted that the PC chip revenue would save their bacon, you are duly wrong, with global PC sales falling 4.6% in the first quarter, after a similar decline in the fourth quarter of 2018, according to analyst Gartner Inc.

The broad-based weakness means that revenue from Intel’s main PC processor business will decline or be unchanged during the next three years, which leads me to question leadership in why they did not bet the ranch on smartphone chips when the trend of mobile replacing desktop is an entrenched trend that a 2-year old could have identified.

The cocktail of underperformance stems from slipping demand which in turn destroys profitability mixed with intensifying competition and the ineptitude of its execution in manufacturing.

In fact, the guide down at investor day was the second time the company guided down in a month, forcing investors to scratch their heads thinking if the company is fast-tracked to a one-way path to obsoletion.

If Intel is reliant on its data centers and PC chip business to drag them through hard times, they might as well pack up and go home.

Missing the smartphone chip business is painful, but if Intel dare misses the boat for the IoT revolution that promises to install sensors and chips in and around every consumer product, then that would be checkmate.

Adding benzine to the flames, Intel’s enterprise and government revenue saw the steepest slide falling 21% while the communications service provider segment declined 4%.

The super growth asset is the cloud and with Intel’s cloud segment only expanding 5%, Intel has managed to turn a high growth area into an anemic, stale business.

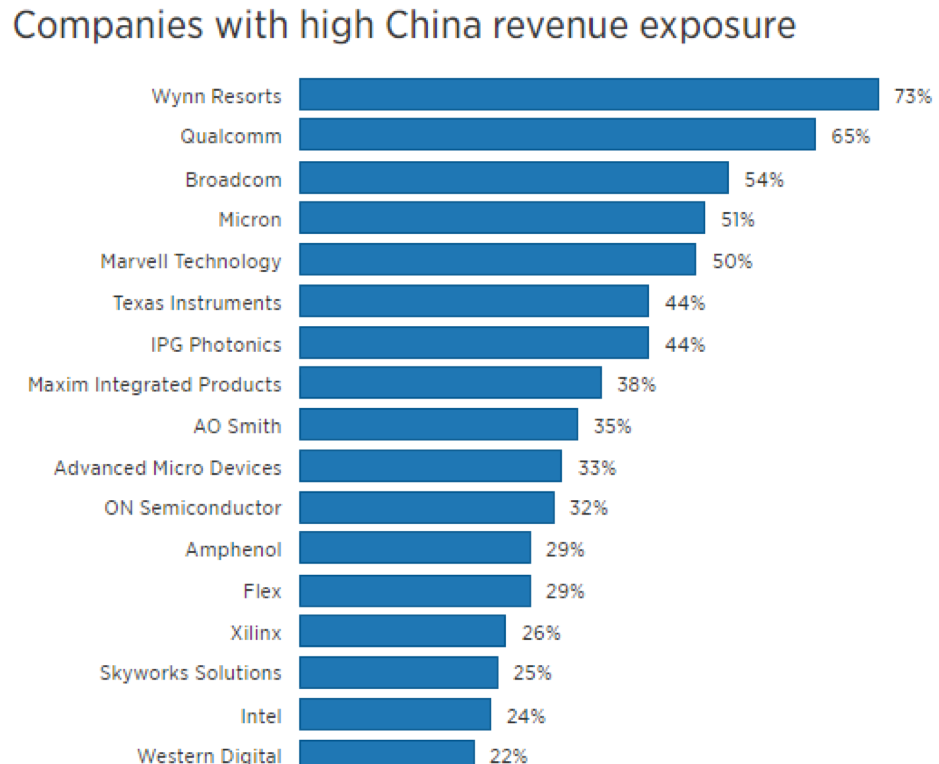

Then if you stepped back a few meters and understood that going forward Intel will have to operate in the face of a hotter than hot trade war between China and America, then investors have scarce meaningful catalysts to hang their hat on.

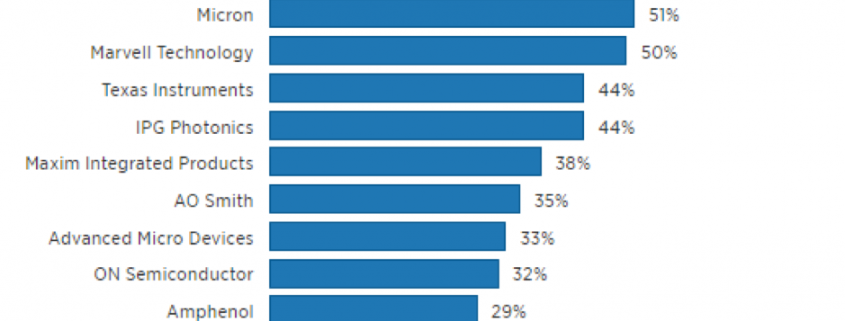

Swan said the company saw “greater than expected weakness in China during the fourth quarter” boding ill for the future considering Intel derives 24% of total revenue from China.

Investors are fearing that Intel could turn into additional collateral damage to the trade war that has no end in sight, and chips are at the vanguard of contested products that China and America are squabbling over.

Oracle (ORCL), without notice, shuttered their China research and development center laying off 900 Chinese workers in one fell swoop, and Intel could also be forced to cut off limbs to save the body as well.

The narrative coming out of both countries will not offer investors peace of mind, and a primary reason why the Mad Hedge Technology Letter has avoided the chip space in 2019.

It’s hard to trade around the most volatile area in tech whose global revenue is becoming less and less certain because of two governments that have deep-rooted structural problems with each other’s trade policies.

Today’s tech letter is another rallying cry for buying software companies with zero exposure to China in order to shelter capital from the draconian stances of two tech sectors that are at odds with each other.

Let me remind you that Intel and Western Digital (WDC) were on my list of five tech stocks to avoid this year, and those calls that I made 6 months before are looking great in hindsight.

“I do not fear computers. I fear a lack of them.” - Said American writer and former professor of biochemistry at Boston University Isaac Asimov.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Hot Tips

May 15, 2019

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) Mark Cuban’s Biggest Positions are Netflix and Amazon. Maybe yours should be too. The billionaire has an uncanny ability to call the long-term direction of technology. Click here.

2) Drones are Attacking Saudi Oil Fields. A classic case of technology turning back to bite you, used by a 14th-century society. Buy oil (USO) on the dips as geopolitical risk ramps up. Click here.

3) US Birthrate Falls to 32-Year low, only 3.79 million in 2018, and 2% down from the previous year. They’re not making Americans anymore. We all know this leads to depressions. Look what happened to Japan. Click here.

4) The US is Evacuating its Embassy in Baghdad, in the usual prelude to war. But oil is focused more on the coming recession today. Click here.

5) US Retail Sales Crater, in March while Industrial Production is off 0.5%. Why is the data suddenly turning recessionary? It isn’t even reflecting the heightened trade war yet. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(SPECIAL CHINA ISSUE)

(WHY CHINA IS DRIVING UP THE VALUE OF YOUR TECH STOCKS)

(QCOM), (AVGO), (AMD), (MSFT), (GOOGL), (AAPL), (INTC), (LSCC)

(TRUE COST OF THE CHINA TRADE WAR)

(EXPE), (TRIP), (GOOGL), (CTRP)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 15, 2019

Fiat Lux

(SPECIAL CHINA ISSUE)

Featured Trade:

(WHY CHINA IS DRIVING UP THE VALUE OF YOUR TECH STOCKS)

(QCOM), (AVGO), (AMD), (MSFT), (GOOGL), (AAPL), (INTC), (LSCC)

Reduce the supply on any commodity and the price goes up. Such is dictated by the immutable laws of supply and demand.

This logic applies to technology stocks as well as any other asset. And the demand for American tech stocks has gone global.

Who is pursuing American technology more than any other? That would be China.

Ray Dalio, founder and chairman of hedge fund Bridgewater Associates, described the first punch thrown in an escalating trade war as a “tragedy,” although an avoidable one.

Emotions aside, the REAL dispute is not over steel, aluminum, which have a minimal effect of the US economy, but rather about technology, technology, and more technology.

China and the U.S. are the two players in the quest for global tech power and the winner will forge the future of technology to become chieftain of global trade.

Technology also is the means by which China oversees its population and curbs negative human elements such as crime, which increasingly is carried out through online hackers.

China is far more anxious about domestic protest than overseas bickering which is reflected in a 20% higher internal security budget than its entire national security budget.

You guessed it: The cost is predominantly and almost entirely in the form of technology, including CCTVs, security algorithms, tracking devices, voice rendering software, monitoring of social media accounts, facial recognition, and cloud operation and maintenance for its database of 1.3 billion profiles that must be continuously updated.

If all this sounds like George Orwell’s “1984”, you’d be right. The securitization of China will improve with enhanced technology.

Last year, China’s communist party issued AI 2.0. This elaborate blueprint placed technology at the top of the list as strategic to national security. China’s grand ambition, as per China’s ruling State Council, is to cement itself as “the world’s primary AI innovation center” by 2030.

It will gain the first-mover advantage to position its academia, military and civilian areas of life. Centrally planned governments have a knack for pushing through legislation, culminating with Beijing betting the ranch on AI 2.0.

China possesses legions of engineers, however many of them lack common sense.

Silicon Valley has the talent, but a severe shortage of coders and engineers has left even fewer scraps on which China’s big tech can shower money.

Attempting to lure Silicon Valley’s best and brightest also is a moot point considering the distaste of operating within China’s great firewall.

In 2013, former vice president and product spokesperson of Google’s Android division, Hugo Barra, was poached by Xiaomi, China’s most influential mobile phone company.

This audacious move was lauded and showed China’s supreme ability to attract Silicon Valley’s top guns. After 3 years of toiling on the mainland, Barra admitted that living and working in Beijing had “taken a huge toll on my life and started affecting my health.” The experiment promptly halted, and no other Silicon Valley name has tested Chinese waters since.

Back to the drawing board for the Middle Kingdom…

China then turned to lustful shopping sprees of anything tech in any developed country.

Midea Group of China bought Kuka AG, the crown jewel of German robotics, for $3.9 billion in 2016. Midea then cut German staff, extracted the expertise, replaced management with Chinese nationals, then transferred R&D centers and production to China.

The strategy proved effective until Fujian Grand Chip was blocked from buying Aixtron Semiconductors of Germany on the recommendation of CFIUS (Committee on Foreign Investment in the United States).

In 2017, America’s Committee on Foreign Investment and Security (CFIUS), which reviews foreign takeovers of US tech companies, was busy refusing the sale of Lattice Semiconductor, headquartered in Portland, Ore., and since has been a staunch blockade of foreign takeovers.

CFIUS again in 2018 put in its two cents in with Broadcom’s (AVGO) attempted hostile takeover of Qualcomm (QCOM) and questioned its threat to national security.

All these shenanigans confirm America’s new policy of nurturing domestic tech innovation and its valuable leadership status.

Broadcom, a Singapore-based company led by ethnic Chinese Malaysian Hock Tan, plans to move the company to Delaware, once approved by shareholders, as a way to skirt around the regulatory issues.

Microsoft (MSFT) and Alphabet (GOOGL) are firmly against this merger as it will bring Broadcom intimately into Apple’s (APPL) orbit. Broadcom supplies crucial chips for Apple’s iPads and iPhones.

Qualcomm will equip Microsoft’s brand-new Windows 10 laptops with Snapdragon 835 chips. AMD (AMD) and Intel (INTC) lost out on this deal, and Qualcomm and Microsoft could transform into a powerful pair.

ARM, part of the Softbank Vision Fund, is providing the architecture on which Qualcomm’s chips will be based. Naturally, Microsoft and Google view an independent operating Qualcomm as healthier for their businesses.

The demand for Qualcomm products does not stop there. Qualcomm is famous for spending heavily on R&D — higher than industry peers by a substantial margin. The R&D effort reappears in Qualcomm products, and Qualcomm charges a premium for its patent royalties in 3G and 4G devices.

The steep pricing has been a point of friction leading to numerous lawsuits such as the $975 million charged in 2015 by China’s National Development and Reform Commission (NDRC) which found that Qualcomm violated anti-trust laws.

Hock Tan has an infamous reputation as a strongman who strips company overhead to the bare bones and runs an ultra-lean ship benefitting shareholders in the short term.

CFIUS regulators have concerns with this typical private equity strategy that would strip capabilities in developing 5G technology from Qualcomm long term. 5G is the technology that will tie AI and chip companies together in the next leg up in tech growth.

Robotic and autonomous vehicle growth is dependent on this next generation of technology. Hollowing out CAPEX and crushing the R&D budget is seriously damaging to Qualcomm’s vision and hampers America’s crusade to be the undisputed torchbearer in revolutionary technology.

CFIUS’s review of Broadcom and Qualcomm is a warning shot to China. Since Lattice Semiconductor (LSCC) and Moneygram (MGI) were out of the hands of foreign buyers, China now must find a new way to acquire the expertise to compete with America.

Only China has the cash hoard to take a stand against American competition. Europe has been overrun by American FANGs and is solidified by the first mover advantage.

Shielding Qualcomm from competition empowers the chip industry and enriches Qualcomm’s profile. Chips are crucial to the hyper-accelerating growth needed to stay at the top of the food chain.

Implicitly sheltering Qualcomm as too important to the system is an ink-drenched stamp of approval from the American government. Chip companies now have obtained insulation along with the mighty FANGs. This comes on the heels of Goldman Sachs (GS) reporting a lack of industry supply for DRAM chips, causing exorbitant pricing and pushing up semiconductor companies’ shares.

All the defensive posturing has forced the White House to reveal its cards to Beijing. The unmitigated support displayed by CFIUS is extremely bullish for semiconductor companies and has been entrenched under the stock price.

It is likely the hostile takeover will flounder, and Hock Tan will attempt another round of showmanship after Broadcom relocates to Delaware as an official American company paying American corporate tax. After all, Tan did graduate from MIT and is an American citizen.

The chip companies are going through another intense round of consolidation as AMD (AMD) was the subject of another takeover rumor which lifted the stock. AMD is the only major competitor with NVIDIA (NVDA) in the GPU segment.

The cash repatriation has created liquid buyers with a limited amount of quality chip companies. Qualcomm is a firm buy, and investors can thank Broadcom for showing the world the supreme value of Qualcomm and how integral this chip stalwart is to America’s economic system.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.