Featured Trades: (THE 'TAX RATE' FALLACY)

2) The Tax Rate Fallacy. When anyone starts lecturing you that the US has the highest tax rate in the industrialized world, just turn around, walk away, and pretend you never heard of them. This person is either ignorant about this country's taxation system, or is deliberately trying to deceive or mislead you.

According to a report released by the Internal Revenue Service, America's tax collection agency, the top 400 individual tax returns filed in 2009 reported an average gross income of $358 million each. The average amount of tax paid by these individuals came to under 17%, less than half the maximum Federal rate of 35%, which kicks in on annual income over $372,950 (click here for the 2009 tax tables). This explains why Warren Buffet pays a much lower tax rate than his secretary. It really is true that in America, only the poor people pay taxes.

Look at any international comparison of taxes to GDP, and one can always find the United States at the bottom of the table. Low American taxes is one of the main reasons why I moved my company here from England 15 years ago. Take a look at the Fortune 500, where one third of the largest companies pay no tax at all, and many that dominate the top of the list, like the oil majors, pay only token amounts. However, if any politician wants to pander to voters during election time on a tax cutting platform he will only bluster on about 'tax rates', not actual taxes paid.

What the US has that other countries lack is the 100,000 pages of the Internal Revenue Code. It is a 97 year accumulation of deductions, accelerated depreciation rates, tax credits, and other tax breaks that are the end product of intensive lobbying efforts and bribes by special interest groups, corporations, unions, and even religious groups. Take a look at the oil industry again. The oil depletion allowance permits drillers to deduct a substantial portion of the cost of a new well in the first year (click here for its fascinating history). When I first got into the oil and gas business a decade ago, after reading the relevant sections of the tax code, I couldn't understand why everyone wasn't drilling for Texas tea.

I have a very simple solution to the country's budget deficit problem. Hit the reset button. Eliminate the Internal Revenue Code. Just set it on fire. Keep the existing progressive, hockey stick tax rates on income, but eliminate all deductions. And I mean everything; deductions for dependents, home mortgage interest, medical expenses, the works. There are no sacred cows. My revised Form 1040 would have only three lines on it:

Income

Tax Rate

Tax Due

The budget deficit would disappear overnight. Government spending would shrink dramatically, because you could ditch most of the 100,000 who work for the IRS. Some 1.3 million auditors and CPA's would have to hit the road in search of new work too. The amount of money that is wasted on tax collection in this country is truly staggering. This is not some pie in the sky concept. This is how taxation already works in most countries, and they seem to get along just fine.

In fact, the whole scheme might even pay for itself.

I Don't See Any Jobs For Former IRS Agents, Do You?

Featured Trades: (RARE EARTHS), (MCP), (AVARF), (LYSCF)

3) Breaking Up With Rare Earths. I'm sorry to tell you this Rare Earths, but I have decided that it is time for me to move on. When I first met you at the Hard Assets Conference last May, you were the greatest cheap date around. You were thrilled when I took you out to dinner at the Olive Garden, and even complimented me on my blue jeans, even though they were just some rags that I had bought at Old Navy.

To be brutally honest, your tastes have lately become extravagant. You now throw a hissy fit if I take you to a restaurant without a Michelin star. You then turn your nose up at a $300 bottle of Dom Perignon. Is it really necessary to have caviar for an appetizer and desert?

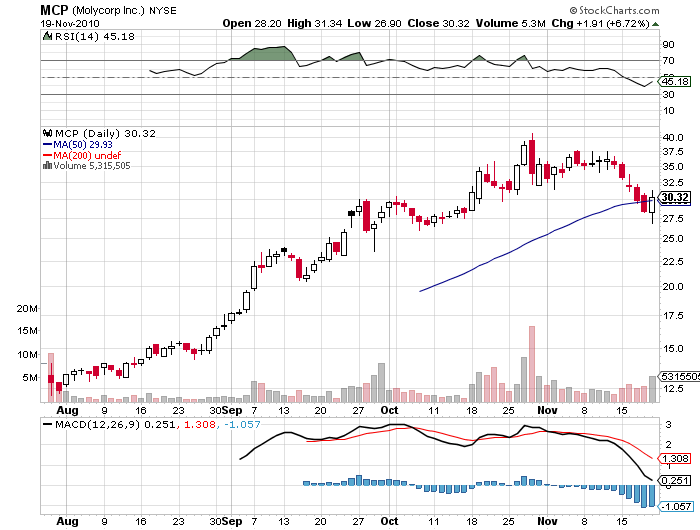

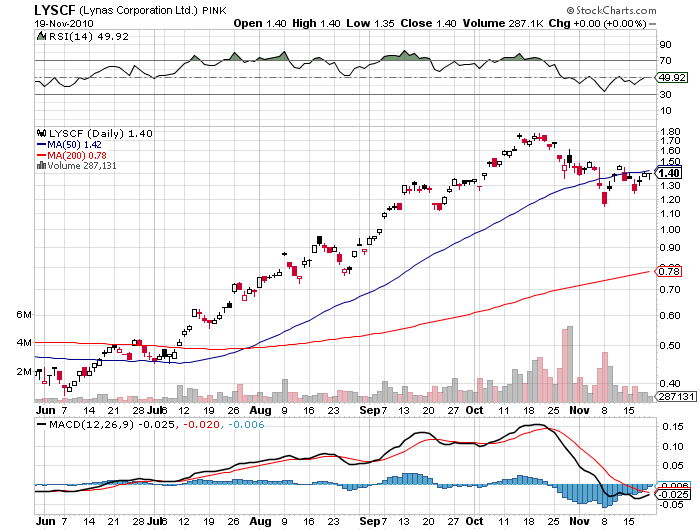

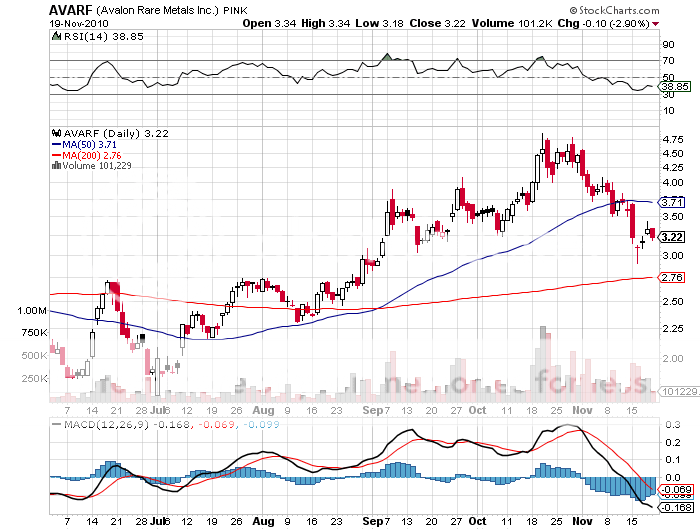

Granted, your performance has been nothing less than spectacular. In six months Molycorp (MCP) has rocked by 230%, Avalon Rare Metals (AVARF) went ballistic by 260%, and Lynas Corp (LYSCF) exploded by 450%. But all good things must come to an end. As attractive as the long term fundamental argument for rare earths may be, the risk reward ratio here is not great. Even the CEO of Molycorp says his company's own product is in a bubble. And he should know.

Sell off 30%, and maybe we can talk about reconciliation. Don't take it personal. It is just a question of price. And remember, we'll always have Paris.

-

-

-

-

We'll Always Have Paris

Featured Trades: (GLD), (SLV), (CCJ)

4) Business is Booming at 'Ruff Times'. Following Howard Ruff for the last 33 years has always been eye opening, if not entertaining. The irascible Mormon is the publisher of Ruff Times (http://www.rufftimes.com / ), one of the oldest investment letters in the business, and one of the original worshipers of hard assets.

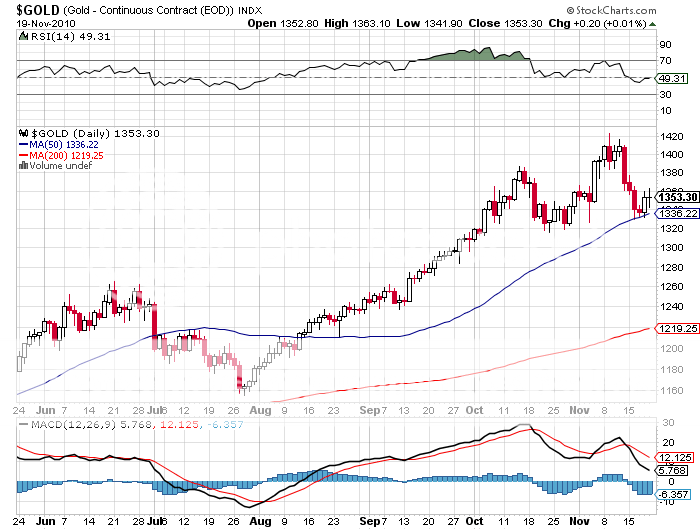

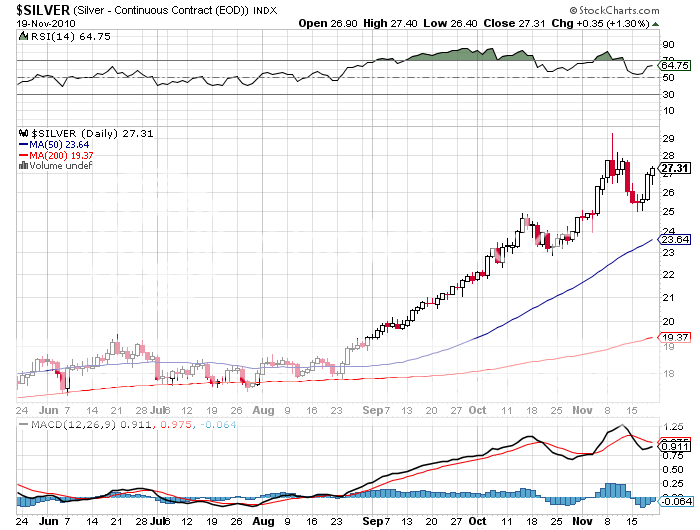

The great thing about the end of the world crowd is that all of their trades are going gangbusters now and we're all still here. Talk about a win-win! He says that any investment denominated in dollars is a mistake, which is in a long term down trend, along with all paper assets. Silver (SLV) is his first choice, which will outperform gold, and eventually top $100 from the current $27. His personal target for the barbarous relic (GLD) is $2,300, but that might prove conservative.

With the Chinese building 100 nuclear power plants over the next ten years, uranium (CCJ) has great potential (click here for my piece). Equities may never come back from their current slide. Don't buy ETF's because they are just another form of paper, and may not actually own the gold or silver they claim. The government is laying the foundation for a massive inflation which will begin soon.

Howard has long been considered card carrying member of the lunatic fringe of the investment world, sticking with hard assets throughout their 20 year bear market during the eighties and nineties, and annually predicting the demise of the federal government. Maybe it's a case of a broken clock being right twice a day, but in recent years I find myself agreeing with Howard more and more. Whether that means I'm now a lunatic too, only time will tell.

-

-

'Bond analysts tend to be smarter than equity analysts,' said Peter Andersen of Congress Asset management.

Featured Trades: (SPX)

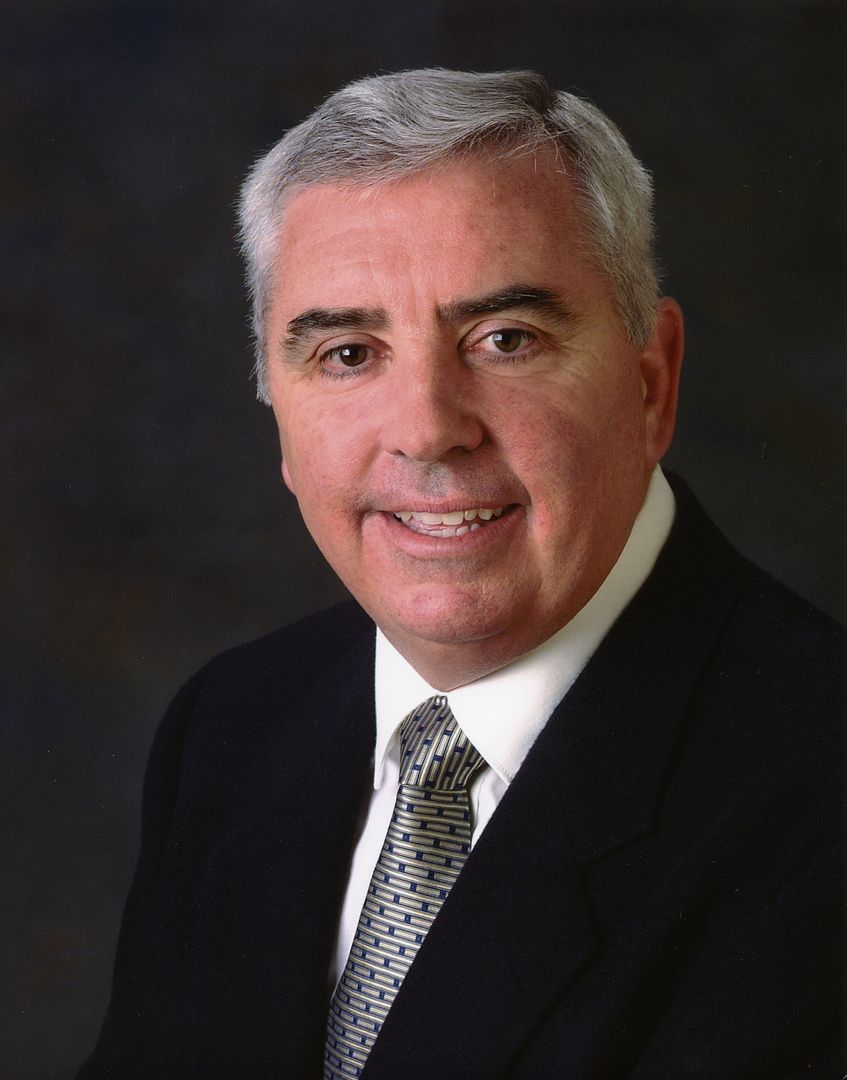

1) Charles Hughes on Hedge Fund Radio. My guest on Hedge Fund Radio this week is star options trader, Charles Hughes, of Legacy Publishing LLC. Charles has developed his own highly profitable and disciplined trading strategy which he markets under the names of the Market Volatility Profits Secrets, The Global PowerTrend System, and The Wealth Building Formula.

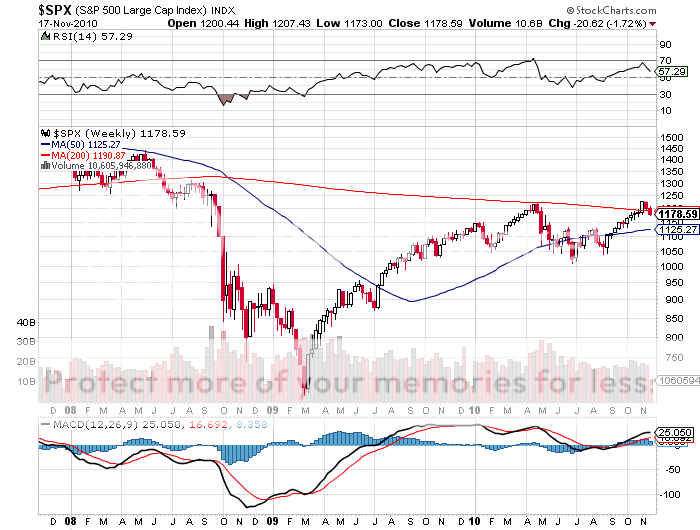

Chuck's proprietary indicators are telling him that we have just entered the greatest bull market for stocks in our lifetime. If the market reverts to the mean and makes up for the recent lost decade, then we should earn 22% a year over the next decade. We have a lot of catching up to do.

Chuck's advisory service offers five different trading strategies which he updates real time at his website. Stop losses and strict risk control insure that 60%-70% of his trades are profitable.

Chuck started out 25 years ago as a 'systems trader' and was soon making so much money in the market that he was able to take early retirement and devote himself full time to trading. Through a long period of trial and error, he has refined his system to deliver the eye popping results that he is getting today.

Chuck has a three step process to identify winners. First, he employs 50 and 100 day exponential moving averages to establish medium term price trends. When the 50 day average is over the 100 day you are in an uptrend. As a backup, he looks at the one month versus the 20 month EMA to give a longer term confirmation. Chuck never likes to trade against the trend.

Second, he subjects his picks to a number of other filters. He narrows his focus to stocks making new 52 week highs. These are companies where buying pressure is overwhelming selling, giving them powerful upside momentum. Another is an up sloping 'On Balance Volume Line' to see where the size money is going. Third, is to pick a good entry point. For this he uses 'Keltner Channels' to illuminate overbought and oversold price levels. A break below a lower Keltner Channel is a major buy signal with a high probability of success. All of this data is easily available through public websites, like www.stockcharts.com .

To pick a winning options trade, a number of additional hurdles must be breached. Chuck favors putting on deep in-the-money call spreads which have lot of intrinsic value, but minimal time value. Durations are four to six months. Deep in-the-money option spreads can profit if the underlying stock increases in price, stays flat, or falls as much as 20%-30% in price at expiration. The deep in the money call spreads work particularly well in today's volatile markets.

Chuck is based in the bucolic coastal village of Carmel, California, which enables him to do some world class hiking whenever he likes. He has become one of the top producing options traders in the industry. In 2009, a year in which many traders got trashed, Chuck brought in a stunning 122% return. That approach enabled him to win the International Championship no less than seven times.

Chuck started out life as an Air Force pilot (C-141's), and later went on to fly for a major US airline. He believes the discipline he learned in the military has been a key to his own personal success in the markets. As a former jarhead pilot who flew in Desert Storm myself, I couldn't agree more.

To learn more about Chuck Hughes and Legacy Publishing, please visit his website at http://www.chuckhughes.com/ . To listen to my interview with chuck Hughes on Hedge Fund Radio in full, please go to my website by clicking here.

2) Note to Los Angeles Based Hedge Fund Managers and Traders. I will be available for a limited number of one-on-one meetings with individual hedge fund managers and traders at their offices during my upcoming visit to Los Angeles on December 3, 2010. This is an opportunity for me to privately consult on your strategy and risk control procedures, praise you for your wisdom, berate you for your ignorance, and possibly offer a few tweaks and changes. If interested, please email John Thomas directly at madhedgefundtrader@gmail.com.

'The commodities are overdone here. But if we get a break next year, I would think that is a great buying opportunity,' said Jeremy Grantham, the legendary founder of money manager Grantham, Mayo, Von Otterloo.

SPECIAL FOREIGN EXCHANGE DOUBLE ISSUE

2011 FORECASTS

Featured Trades: (FXE), (EUO)

Currency Shares Euro Trust ETF

ProShares Ultra Short Euro ETF

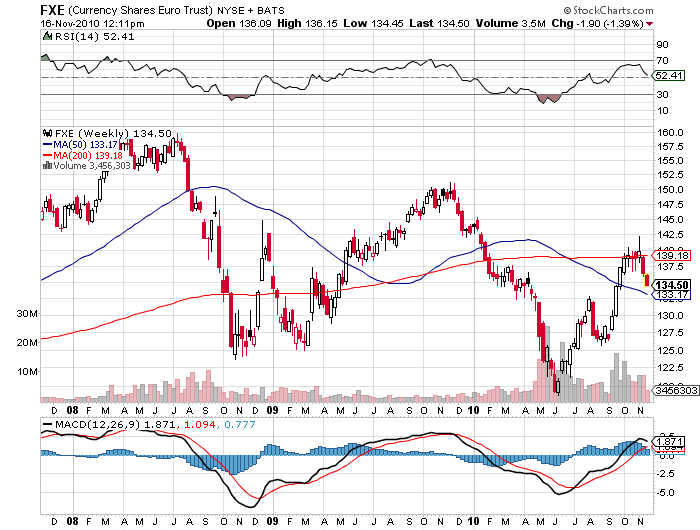

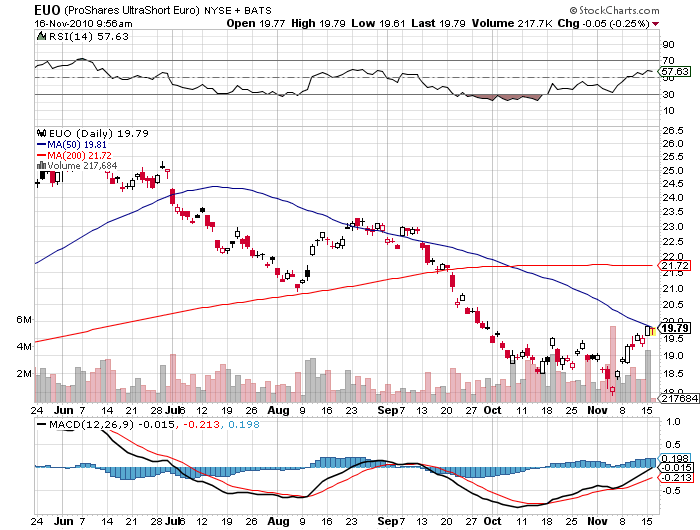

2) Has The Euro Turned? The call that a turn in the dollar was imminent by Brown Brothers Harriman's Mark Chandler is looking more prescient by the day (click here for the call). September and October was all about pricing in Ben Bernanke's quantitative easing, and that is looking pretty much done. The next play in this soap opera will see 'uncertainty' emigrate from the US to Europe, sending the dollar off to the races and the Euro in for rehab. Lindsay Lohan, eat your heart out.

A reemergence of the 'PIIGS' disease, concerns about the deteriorating quality of the lesser sovereign credits in Europe, is now unfolding as the triggering event. US interest rates rising at the long end are adding fuel to the fire, shifting interest rate differentials overwhelmingly in Uncle Buck's favor. It also helps that 95% of traders are bearish on the dollar, the surest indicator you'll ever see that it is about to go the other way. To quote hockey great, Wayne Gretzky, 'You don't want to aim where the puck is, but where it's going to be.' While America's trade deficit remains massive, that shortfall is being overwhelmed by enormous amounts of foreign capital pouring into our stock and bond markets, on which Ben has painted a giant bullseye.

It all adds up to the $1.4250 print we saw on the Euro two weeks ago marking the high. Rallies from here in the European currency are to be sold. Players new to the space can achieve this through buying the (EUO) ETF, a leveraged 200% short bet against the Euro. Looking at the charts and the momentum, we could see a plunge below $1.33 by year end. Analysts are targeting $1.17 sometime next year, which would out the EUO at $24, a tidy 24% potential return. Overshoot could take us as low as $1.10, taking the EUO to $26 and a gain of 37%. Don't go on this date without protection, so keep a stop at $1.42.

The Fat Lady is Singing for the Euro

-

-

-

Follow Wayne Gretzky's Advice on Where to Aim

SPECIAL FOREIGN EXCHANGE DOUBLE ISSUE

2011 FORECASTS

Featured Trades: (FXA)

Currency Shares Australian Dollar Trust ETF

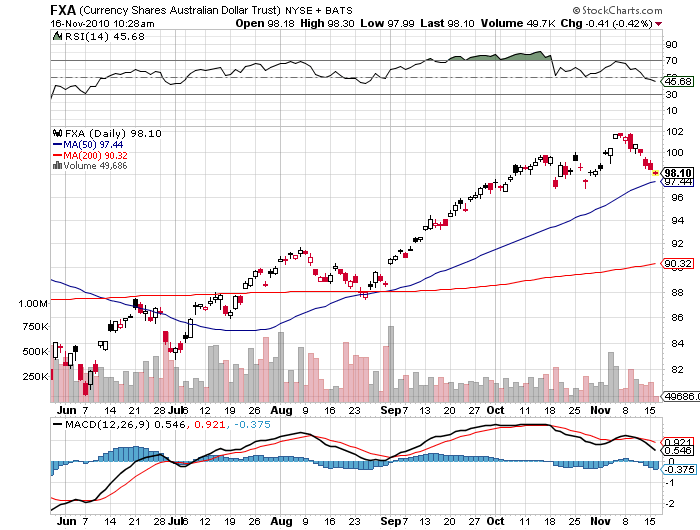

3) Why I'm Singing 'Waltzing Mathilda' in the Shower. If you want to participate in the global carry trade in its purest form, take a look at the Australian dollar. The central bank has been the first and fastest to raise interest rates because of rocketing commodity prices and booming business with China.

They call Australia 'The Lucky Country' for a reason. It has that perfect combination of huge resource and energy exports, a strong economy, rising interest rates, a small population to support, and great looking women.

For a start, you get a nice yield pickup of an annualized 4.75% by strapping on this trade, which is the interest paid on overnight Australian dollar deposits. Leverage up five times as many forex traders do, and that balloons to 23.75%. That's what you make on the spread if this currency goes nowhere. If more investors pile into this trade after you, or if the yield spread widens, then you can count on a substantial capital gain on top of this. Now you know how so many traders earn their bread and butter. If you want to know how the big boys are coining it, this is the way.

There is only one thing wrong with this trade. It has been running for two years now appreciating an eye popping 75% against Uncle Buck, from 58 cents all the way up to 102.50. That gives it something of a 'last year's trade' flavor. There are hundreds of billions of dollars ahead of you from the big hedge funds, so there is a risk you could get shaken out if you get involved here, especially if you use leverage. So I would only start to scale in after a 10%-20% pull back, which we may see sometime in 2011, especially if my strong US dollar scenario pans out. So for now, just keep a pin up of the Aussie on your locker room wall.

-

My Favorite Australian

-

Another Favorite Australian

SPECIAL FOREIGN EXCHANGE DOUBLE ISSUE

2011 FORECASTS

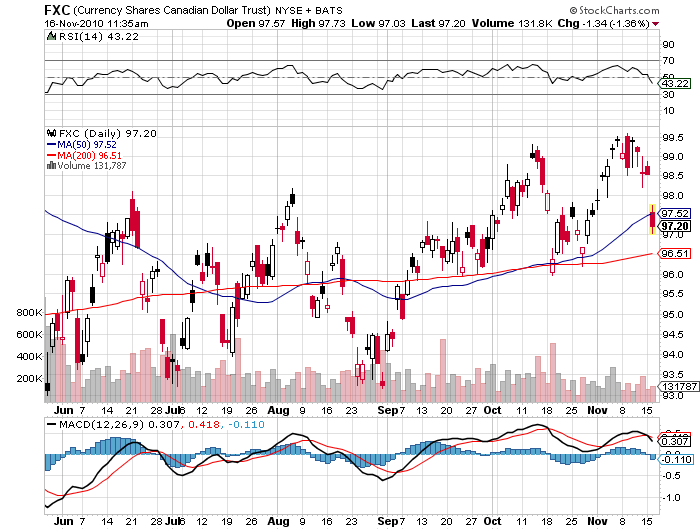

Featured Trades: (FXC)

Currency Shares Canadian Dollar Trust ETF

4) The Loonie Takes Flight. Many of the same arguments that make the Aussie so attractive on a long term basis also apply to the Canadian dollar, which forex traders affectionately call the 'loonie'.

The Bank of Canada has been consistently raising interest rates, the first G-7 country to do so, making it one of the highest yielding currencies out there. Overnight loonie rates are now at an attractive 1%, which beats the daylights out of the 0% you get now with US dollars. The central bank has had to cool off a white hot real estate market, and an economy that has been growing nicely. No double dip up here.

I have been a fan of the Canadian dollar for some time now (click here for the call), expecting that parity was just a matter of time. Canada is a huge commodity exporter, the largest foreign supplier of oil to the US (bet you thought it was OPEC), with a small, hard working, English speaking (well, almost) population. They also do banking the old fashioned way up North, with the government requiring 20% reserves that limits leverage to 5:1, versus the 100:1 seen at the peak with some of our banks. That means they missed the financial crisis, and the soul searching, angst ridden self examination and re-regulation that followed in the US.

There will be more to come, with at least another decade of commodity bull markets to follow, the source of the country's lifeblood. Expect more rate rises, and a strong Canadian currency to follow. However, the loonie shares the same problem with the Aussie in that it is not a new trade. So better to confine it to your watch list for now, and not play until we see a decent 5%-10% dip. Until then, here is a gratuitous picture of my favorite Canadian, Pamela Anderson to study. It's the only one I could find where she has clothes on. And no, I don't know how to sing 'I'm a Lumberjack, and I'm OK.'

My Favorite Canadian

-

-

Another Favorite Canadian