Every new bull market in technology brings its excesses, and this time is more different.

Today, I'll outline some of the more egregious cases, which you and your money should avoid like the plague.

Spoiler alert: You are better off just parking your money in Apple (AAPL) or Microsoft (MSFT) and then forgetting about it.

The thirst to own a little sliver of technology in the greatest bull market of all time has reached a fever pitch with capital allocating to marginal assets.

Serious investors need to avoid the madness.

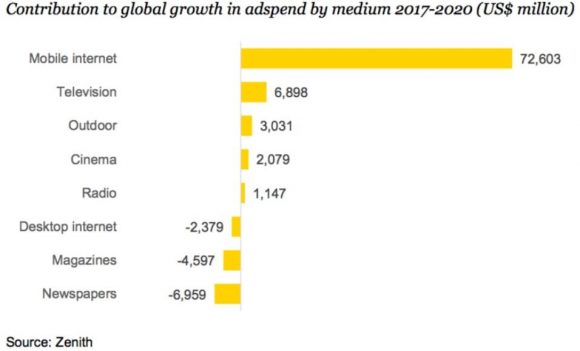

The excess was bred from the realization of how valuable data extraction and generation is to profitability.

The investment climate is reminiscent of the dot-com bubble during the 1990s that spawned companies with no intention of ever turning a profit.

This time, loss-making is blatant.

Ride-share vehicle services such as Uber and Lyft are great at losing money, and passengers would stand aside if prices became exorbitant.

Paying a derisory sum to ride in someone else's car while being chauffeured around is part of the allure of this business model.

The result is an artificially low price for the benefit of consumers amid a vicious price war with competitors.

The biggest problem with these ride-share services is they create nothing.

They are not building a proprietary operating system or creating technology that did not exist before.

Hence, these types of companies execute risky strategies that backfire.

Any technology company that expects to be in the game long term must create something unique and organic that other companies value and cannot copy.

These ride-hailing companies simply use an app on a smartphone, and this smartphone app can be created by any half decent high school app programmer.

Uber lost $4.5 billion in 2017, and that was great news for CEO Dara Khosrowshahi because Uber is losing less than before.

If you thought a tech company glorifying an annual loss of $4.5 billion was strange, then analyzing the state of the ride-share business model for the industry one degree further out on the risk curve will leave you scratching your head.

And by the way, Uber will try to soak your wallet when it launches its initial public offering next year.

Enter dockless ride-sharing bicycles.

Dockless bike-sharing has mushroomed around the world, spreading like wildfire fueled by grotesquely large injections of venture capital.

Ofo, a Chinese firm, initially raised more $1.2 billion and another $866 million from Alibaba (BABA) from a recent round of fundraising. CEO Dai Wei has stated that his company is worth north of $2 billion.

Mobike lured in more than $900 million in venture capital.

China is the epicenter of the bicycle ride-sharing experiment. More than 40 firms have sprouted up creating a bizarre scenario in major Chinese cities because of these companies dumping bicycles on every public street corner.

According to Xinhua News Agency, more than 2.5 million bikes are littered throughout the city by 15 companies in Beijing alone.

Local American firms have jumped on the bandwagon, too, with examples such as LimeBike, based in San Mateo, CA, that raised $12 million from Andreessen Horowitz in 2017, and topped up another $50 million from Coatue Management.

Meanwhile, Spin, the first stationless bikeshare company in the US, raised $8 million led by Grishin Robotics.

More than 40 bike-sharing companies have beat down the price of renting a bicycle to the paltry rate of 1 RMB (renminbi) ($0.15 USD) per 30-minute trip.

The intentional dumping at absurd price levels is not sustainable. The business model is predicated on collecting an initial deposit of $15 before a customer can hop on a bike.

The deposit has proved high risk as some companies have disappeared or gone bust.

Bluegogo, the third leading company in this space, emptied out its headquarters office, locked the doors, and failed to notify employees who claimed their wages had been garnished.

By last count, Bluegogo had distributed roughly 700,000 bicycles, and was estimated to have 20 million users, each paying $15 deposits to use the service.

Bluegogo was considered a legitimate competitor in the space along with Mobike and Ofo.

The $300 million dollars in Bluegogo deposits floated up to money heaven, and the deposits will never be repaid to customers.

Didi Chuxing, China's version of Uber and subsidiary of Tencent and Alibaba (BABA), purchased the bankrupt bike-sharing company, paid the work staff, and slipped them inside its portfolio of emerging tech firms in January 2018.

Mingbike, which failed in Shanghai and Beijing, migrated to emptier pastures in third and fourth tier Chinese cities and sacked 99% of its staff.

All told, $3 billion to $4 billion has been funneled into these bicycle-share monstrosities in the past 18 months.

It gets a lot worse in terms of high risk.

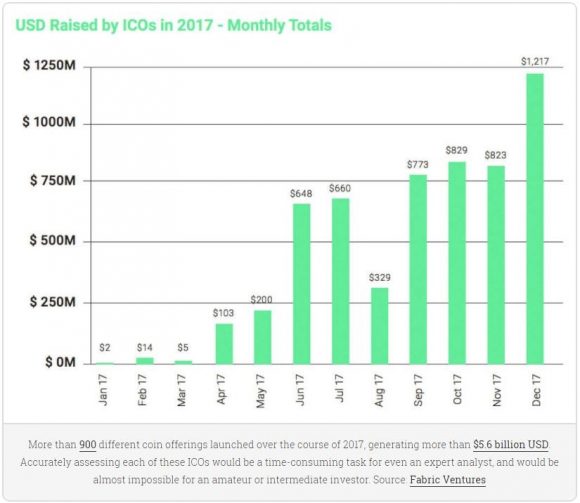

Another frontier of interest that has gone absolutely bananas is the ICO (Initial Coin Offering). ICOs are an unregulated new cryptocurrency venture raising funds by crowdfunding. A certain percentage of coins is sold to early investors in exchange for legal tender or Bitcoin.

This controversial means of raising money is a hotbed for scams galore. Of 1,000 that now exist, maybe 10 are legit.

These criminals are taking advantage of the headline effect of cryptocurrencies, promising every Joe and Jane early retirements and an easy way to provide college funds for children.

It's true that a founder of a cryptocurrency demonstrably benefits financially from leading this new form of payment.

Simply put, these ICOs function as Ponzi schemes with the last one to buy holding the bag when the sushi hits the fan after the founders run for the exits.

These fraudulent ICOs take on some of the characteristics of real Ponzi schemes such as guaranteed profits, promising their blockchain technology will solve all of the world's ills, no detailed roadmap except collecting funds, and lack of an online digital footprint.

Adding to the outsized risk is the confusion of which jurisdiction these companies are in and absence of any proper compliance.

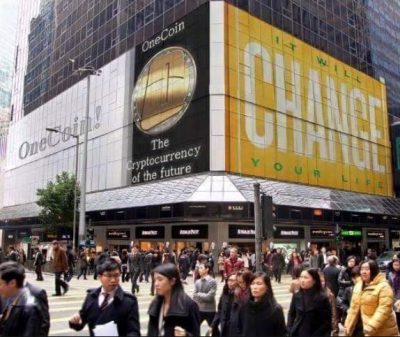

OneCoin was a cryptocurrency promoted by offshore companies OneCoin Ltd (Dubai) and OneLife Network Ltd (Belize), founded by Ruja Ignatova. Many of the shady characters crucial to OneCoin were architects of similar Ponzi schemes, which was a dead giveaway to authorities.

Bulgarian enforcement officials raided and hauled away servers and other sensitive evidence at OneCoin's office in Sofia, Bulgaria, at the request of the prosecutor's office in Bielefeld, Germany.

German police and Europol also busted 14 other companies connected to OneCoin.

OneCoin CEO Ignatova was imprisoned in India for swindling investors after being investigated by Indian authorities in 2017.

The Ministry of Planning and Investment of Vietnam even issued a rebuttal that a forged document OneCoin used as proof to show it was the official licensed cryptocurrency in Vietnam was fake. It stated there was no possibility this document could ever exist.

SEC chairman Jay Clayton recently chimed in after being asked if all ICOs are fraudulent, boldly stating, "Absolutely not."

Uber and Ofo also are not frauds, but that does not mean investors should take a flier on it.

The strength of technology has attracted the marginal character to its doorstep; separating the wheat from the chaff is more important than ever.

These nascent industries can look good in the shop window, and slick advertising campaigns numb our rational decision making, but investors need to stay away at all costs.

The bicycle-sharing industry is a way for cash-rich venture capitalists to hoard data for applications irrespective of operating at a profit. The ICOs are charlatans attracted to the fluid cash flow tech companies command desiring a share in the spoils.

Keep your money in your pockets and wait for my next actionable trade alert.

__________________________________________________________________________________________________

Quote of the Day

"Stay away from it. It's a mirage, basically." - said legendary investor Warren Buffett when asked about cryptocurrency.