Global Market Comments

March 11, 2020

Fiat Lux

Featured Trade:

(A NOTE ON ASSIGNED OPTIONS, OR OPTIONS CALLED AWAY),

(AAPL), (BA), (UAL), (CCL), (WYNN), (FB)

Global Market Comments

March 11, 2020

Fiat Lux

Featured Trade:

(A NOTE ON ASSIGNED OPTIONS, OR OPTIONS CALLED AWAY),

(AAPL), (BA), (UAL), (CCL), (WYNN), (FB)

I almost got to take a shower today.

However, whenever I got close to the bathroom, I'd get an urgent call from a concierge member, Marine buddy, Morgan Stanley retiree, fraternity brother from 50 years ago, or one of my kids asking me which stocks to buy at the bottom.

It’s been that kind of market.

I refer them to the research piece I sent out last week, “Ten Long Term LEAPs to Buy at the Bottom” for a quick and dirty way to get into the best names in a hurry (click here for the link).

I have been doing the same, and as a result, I have one of the largest trading portfolios in recent memory. When the Volatility Index is above $50, it is almost impossible to lose money as long as you remember to buy the 1,000 dips and sell the 1,000 point rallies.

In the run-up to every options expiration, which is the third Friday of every month, there is a possibility that any short options positions you have may get assigned or called away.

If that happens, there is only one thing to do: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit for your position instantly.

Most of you have short option positions, although you may not realize it. For when you buy an in-the-money vertical option spread, it contains two elements: a long option and a short option.

The short options can get “assigned,” or “called away” at any time, as it is owned by a third party, the one you initially sold the put option to when you initiated the position. Whenever you have sold short an option, you run an assignment risk.

You have to be careful here because the inexperienced can blow their newfound windfall if they take the wrong action, so here’s how to handle it correctly.

Let’s say you get an email from your broker saying that your call options have been assigned away. I’ll use the example of the Microsoft (MSFT) December 2019 $134-$137 in-the-money vertical BULL CALL spread.

For what the broker had done in effect is allow you to get out of your call spread position at the maximum profit point 8 days before the December 20 expiration date. In other words, what you bought for $4.50 last week is now with $5.00!

All have to do is call your broker and instruct them to exercise your long position in your (MSFT) December 134 calls to close out your short position in the (MSFT) December $137 calls.

This is a perfectly hedged position, with both options having the same expiration date, the same amount of contracts in the same stock, so there is no risk. The name, number of shares, and number of contracts are all identical, so you have no exposure at all.

Calls are a right to buy shares at a fixed price before a fixed date, and one options contract is exercisable into 100 shares.

To say it another way, you bought the (MSFT) at $134 and sold it at $137, paid $2.60 for the right to do so, so your profit is 40 cents, or ($0.40 X 100 shares X 38 contracts) = $1,520. Not bad for an 18-day limited risk play.

Sounds like a good trade to me.

Weird stuff like this happens in the run-up to options expirations like we have coming.

A call owner may need to buy a long (MSFT) position after the close, and exercising his long December $134 call is the only way to execute it.

Adequate shares may not be available in the market, or maybe a limit order didn’t get done by the market close.

There are thousands of algorithms out there which may arrive at some twisted logic that the puts need to be exercised.

Many require a rebalancing of hedges at the close every day which can be achieved through option exercises.

And yes, options even get exercised by accident. There are still a few humans left in this market to blow it by writing shoddy algorithms.

And here’s another possible outcome in this process.

Your broker will call you to notify you of an option called away, and then give you the wrong advice on what to do about it. They’ll tell you to take delivery of your long stock and then most additional margin to cover the risk.

Either that, or you can just sell your shares on the following Monday and take on a ton of risk over the weekend. This generates a ton of commission for the brokers but impoverishes you.

There may not even be and evil motive behind the bad advice. Brokers are not investing a lot in training staff these days. It doesn’t pay. In fact, I think I’m the last one they really did train.

Avarice could have been an explanation here but I think stupidity and poor training and low wages are much more likely.

Brokers have so many legal ways to steal money that they don’t need to resort to the illegal kind.

This exercise process is now fully automated at most brokers but it never hurts to follow up with a phone call if you get an exercise notice. Mistakes do happen.

Some may also send you a link to a video of what to do about all this.

If any of you are the slightest bit worried or confused by all of this, come out of your position RIGHT NOW at a small profit! You should never be worried or confused about any position tying up YOUR money.

Professionals do these things all day long and exercises become second nature, just another cost of doing business.

If you do this long enough, eventually you get hit. I bet you don’t.

Global Market Comments

February 18, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE TRADE ALERT DROUGHT)

(SPY), (TLT), (MSFT), (BA), (TSLA), (MGM)

Like it or not, we have a trade alert drought on our hands.

I just ran the numbers on 200 potential trades in stocks, bonds, foreign exchange, commodities, precious metals, and real estate, and there was not a single one that was worth executing.

They all had one thing in common: for taking huge risks, there were only paltry profits on offer. Even with a 90% success rate, I would still lose money.

And here is the problem. Massive quantitative easing from the US Federal Reserve is keeping the prices of all assets artificially high. But fears of a global Coronavirus pandemic are keeping all prices capped. The spread between the bid and the offer is only 3%. That is not enough to make an honest living, nor even a dishonest one.

I’ve seen all this before. The US in 1974, Tokyo in 1989, NASDAQ in 1999 presented similar trading dilemmas. The outcome is always the same. Prices always go up much longer than expected and then are followed by horrific crashes. Only when the last dollar is sucked in do trends change.

So, for right now, I would rather do nothing than something. We are in a contest to see who can make the most money with the fewest drawdowns, not to see who can strap on the most trades. The latter makes your broker rich, not you.

Cash is a position, it is an opinion, and it has option value. A dollar at a market top is worth $10 at a market bottom. Opportunity cost is not to be underestimated.

For the time being, everything depends on the Coronavirus. It is universally believed that the Chinese data is wildly inaccurate, possible by tenfold. The risks to the markets are similarly underestimated by US investors.

That became screamingly clear to me after returning from a trip halfway around the world where my temperature was taken every time I crossed a border and planes had to be sterilized before boarding

So, the smart game here is to be patient and learn some discipline. Wait for the market to come to you. This is a year when it will be incredibly difficult to make money and extremely easy to lose it.

All trade alert droughts end. Whether it will be sooner or later is anyone’s guess.

China is planning massive stimulus, to get the economy back on track. GDP could drop from 6% to 0% and maybe -6% thanks to the Coronavirus. A borrowing stampede is underway as shut down companies seek to address hemorrhaging cash flow.

Tesla (TSLA) exploded again to the upside, up 10% at the opening. The company has become a good news factory. The German government stepped in to subsidize a massive Gigafactory there. I won’t touch the stock here, but my long terms target is still $2,500.

Tesla finally took my advice and launched a $2 billion common stock offering at these lofty prices. It should be $5 billion. They can retire all their debt, including the convertible bonds, and with no dividend they can operate at a zero cost of capital. Elon Musk is taking $10 million of the deal. He took $100 million of the last offering. Buy (TSLA) on dips. Losses pile up for the short-sellers. Tesla always does the right thing after trying everything else out first.

The Fed’s Jay Powell cheers the economy but warned that the Coronavirus could become a factor. He also cautioned about a federal deficit that will top $1 trillion this year.

With the economy growing at a 2.2% annual rate, it’s below the Obama era growth. Did anyone notice that he said he would trim back QE by reigning in the repo program initiated last fall? Risk in the stock market is now extremely high.

Apple (AAPL) and Microsoft (MSFT) are now 10% of the entire stock market and are wildly overbought. Such incredible concentration is a typical sign of a topping market. Virtually all the stocks Mad Hedge has been recommending for the last decade are at new all-time highs. Be careful what you wish for.

Household Debt soared hitting a 12-year high. It’s up $601 billion to $14 trillion. It’s pedal to the metal for consumer spending, another classic market-topping indicator. What happens when the bill comes due and interest rates rise?

MGM (MGM) canceled guidance as the Coronavirus upends their business. High-end Chinese gamblers won’t show up to lose gobs of money at the gaming tables if they can’t get here. The epidemic has put the whole gaming industry into turmoil. Call me after new virus cases peak in China. Avoid (MGM).

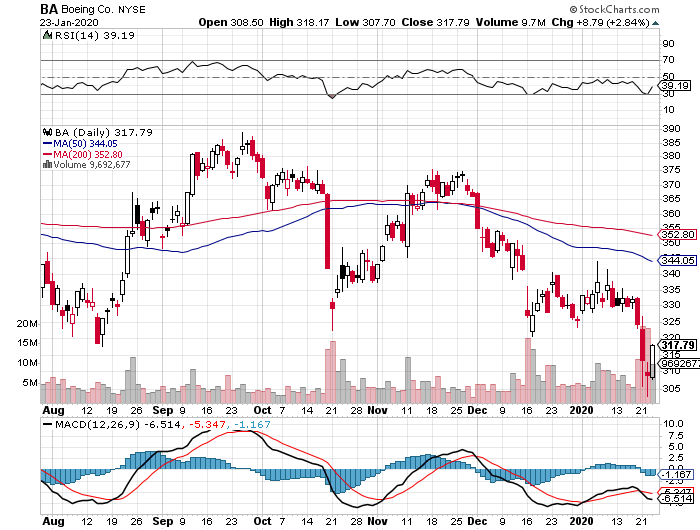

Boeing had no net deliveries of aircraft in January, the first time since 1962, but the stock rose anyway. That tells me the bottom is firmly in. Buy (BA) on dips. When will the suffering of one of America’s best-run companies, accounting for 3% of GDP, end?

Despite the fact that we may be facing the end of the world, the Mad Hedge Trader Alert Service managed to maintain new all-time highs. I came out of my last position in Boeing (BA) to beat the ex-dividend day and a possible call on my short February $280 calls.

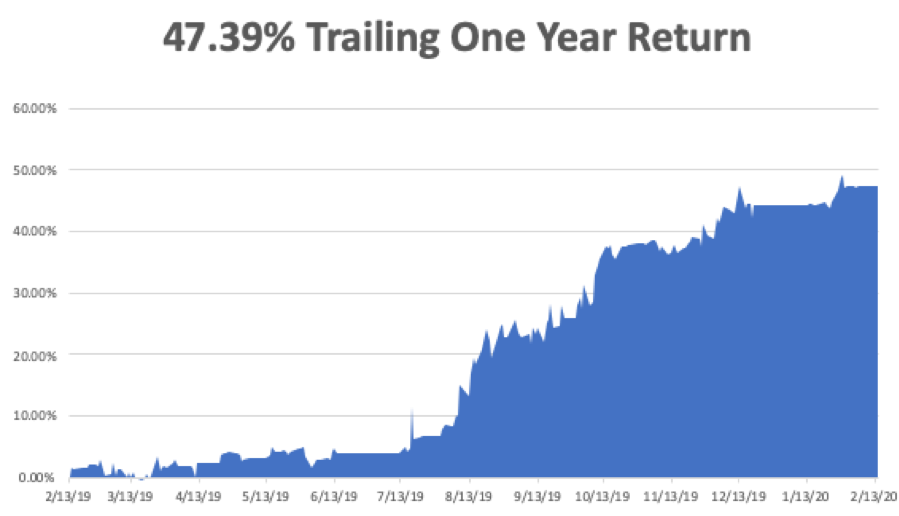

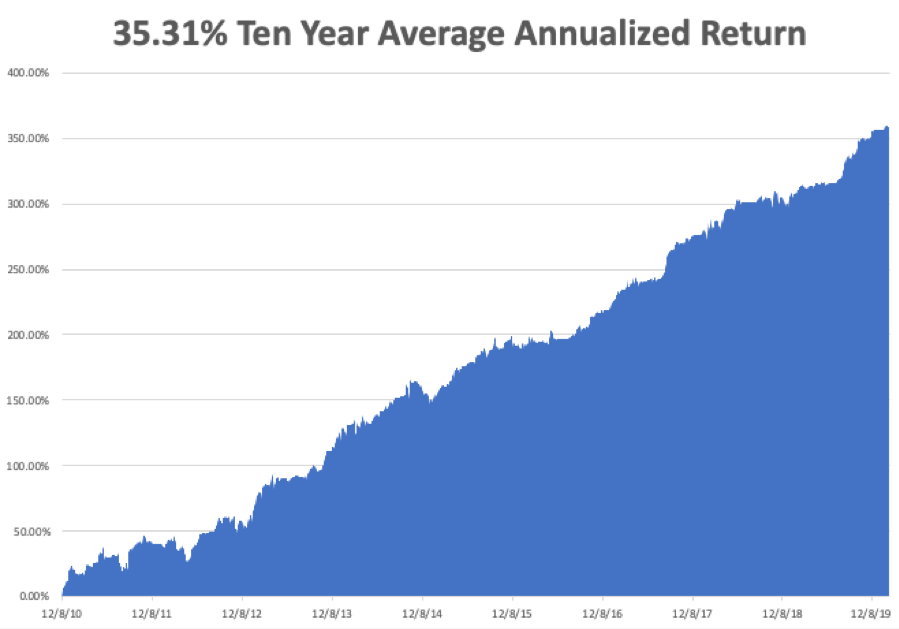

My Global Trading Dispatch performance rose to a new high at +359.00% for the past ten years. February stands at -0.04%. My trailing one-year return is stable at 47.39%. My ten-year average annualized profit ground back up to +35.31%.

All eyes will be focused on the Coronavirus still, with deaths over 1,800. The weekly economic data are virtually irrelevant now. However, some important housing numbers will be released.

On Tuesday, February 18 at 8:30 AM, the NY State Manufacturing Index for February is released.

On Wednesday, February 19, at 9:30 PM, January Housing Starts are out.

On Thursday, February 20 at 8:30 AM, Weekly Jobless Claims come out. The February Philadelphia Fed Manufacturing Index is announced.

On Friday, February 21 at 10:30 AM, January Existing Home Sales are printed. The Baker Hughes Rig Count follows at 2:00 PM.

As for me, I’ll be driving back from Lake Tahoe, where I spent the long weekend catching up on the markets. There was virtually no snow, amazing for February, but great hiking.

Since I will be dropping 7,200 feet from Donner Pass and I have the new expended range Model X, I will be able to make it the 220 miles home on a single charge.

In two years, I’ll be able to make the 440-mile round trip on a single charge when the new Tesla Cyber truck comes out. Of course, people will think I’m nuts and my kids have refused to be seen in the cutting edge vehicle, but when did that ever stop me?

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

February 14, 2020

Fiat Lux

Featured Trade:

(FEBRUARY 12 BIWEEKLY STRATEGY WEBINAR Q&A)

(SQ), (TSLA), (FB), (GILD), (BA), (CRSP), (CSCO), (GLD)

(FEYE), (VIX), (VXX), (USO), (LYFT), (UBER)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader February 12 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: What do you think about Facebook (FB) here? We’ve just had a big dip.

A: We got the dip because of a double downgrade in the stock from a couple of brokers, and people are kind of nervous that some sort of antitrust action may be taken against Facebook as we go into the election. I still like the stock long term. You can’t beat the FANGs!

Q: If Bernie Sanders gets the nomination, will that be negative for the market?

A: Absolutely, yes. It seems like after 3 years of a radical president, voters want a radical response. That said, I don't think Bernie will get the nomination. He is not as popular in California, where we have a primary in a couple of weeks and account for 20% of total delegates. I think more of the moderate candidates will come through in California. That's where we see if any of the new billionaire outliers like Michael Bloom or Tom Steyer have any traction. My attitude in all of this is to wait for the last guy to get voted off the island—then ask me what's going to happen in October.

Q: When should we come back in on Tesla (TSLA)?

A: It’s tough with Tesla because although my long-term target is $2,500, watching it go up 500% in seven months on just a small increase in earnings is pretty scary. It’s really more of a cult stock than anything else and I want to wait for a bigger pullback, maybe down to $500, before I get in again. That said, the volatility on the stock is now so high that—with the short interest going from 36% down to 20%—if we get the last of the bears to really give up, then we lose that whole 20% because it all turns into buying; and that could get us easily over $1,000. The announcement of a new $2 billion share offering is a huge positive because it means they can pay off debt and operate with free capital as they don’t pay a dividend.

Q: Is Square (SQ) a good buy on the next 5% drop?

A: I would really wait 10%—you don't want to chase trades with the market at an all-time high. I would wait for a bigger drop in the main market before I go aggressive on anything.

Q: What about CRISPR Technology (CRSP) after the 120% move?

A: We’ve had a modest pullback—really more of a sideways move— since it peaked a couple of months ago; and again, I think the stock either goes much higher or gets taken over by somebody. That makes it a no-lose trade. The long sideways move we’re having is actually a very bullish indication for the stock.

Q: If Bernie is the candidate and gets elected, would that be negative for the market?

A: It would be extremely negative for the market. Worth at least a 20% downturn. That said, according to all the polling I have seen, Bernie Sanders is the only candidate that could not win against Donald Trump—the other 15 candidates would all beat Trump in a 1 to 1 contest. He's also had one heart attack and might not even be alive in 6 months, so who knows?

Q: I just closed the Boeing (BA) trade to avoid the dividend hit tomorrow. What do you think?

A: I’m probably going to do the same, that way you can avoid the random assignments that will stick you with the dividend and eat up your entire profit on the trade.

Q: When do you update the long-term portfolio?

A: Every six months; and the reason for that is to show you how to rebalance your portfolio. Rebalancing is one of the best free lunches out there. Everyone should be doing it after big moves like we’ve seen. It’s just a question of whether you rebalance every six months or every year. With stocks up so much a big rebalancing is due.

Q: I have held onto Gilead Sciences (GILD) for a long time and am hoping they’ll spend their big cash hoard. What do you think?

A: It’s true, they haven’t been spending their cash hoard. The trouble with these biotech stocks, and why it's so hard to send out trade alerts on them, is that you’ll get essentially no movement on them for years and then they rise 30% in one day. Gilead actually does have some drugs that may work on the coronavirus but until they make another acquisition, don’t expect much movement in the stock. It’s a question of how long you are willing to wait until that movement.

Q: Is it time to get back into the iPath Series B S&P 500 VIX Short Term Futures ETN (VXX)?

A: No, you need to maintain discipline here, not chase the last trade that worked. It’s crucial to only buy the bottoms and sell the tops when trading volatility. Otherwise, time decay and contango will kill you. We’re actually close to the middle of the range in the (VXX) so if we see another revisit to the lows, which we could get in the next week, then you want to buy it. No middle-of-range trades in this kind of market, you’re either trading at one extreme or the other.

Q: Could you please explain how the Fed involvement in the overnight repo market affects the general market?

A: The overnight repo market intervention was a form of backdoor quantitative easing, and as we all know quantitative easing makes stocks go up hugely. So even though the Fed said this wasn't quantitative easing, they were in fact expanding their balance sheet to facilitate liquidity in the bond market because government borrowing has gotten so extreme that the public markets weren’t big enough to handle all the debt; that's why they stepped into the repo market. But the market said this is simply more QE and took stocks up 10% since they said it wasn't QE.

Q: What about Cisco Systems (CSCO)?

A: It’s probably a decent buy down here, very tempting. And it hasn't participated in the FANG rally, so yes, I would give that one a really hard look. The current dip on earnings is probably a good entry point.

Q: Should we buy the Volatility Index (VIX) on dips?

A: Yes. At bottoms would be better, like the $12 handle.

Q: When is the best time to exit Boeing?

A: In the next 15 minutes. They go ex-dividend tomorrow and if you get assigned on those short calls then you are liable for the dividend—that will eat up your whole profit on the trade.

Q: Do you like Fire Eye (FEYE)?

A: Yes. Hacking is one of the few permanent growth industries out there and there are only a half dozen listed companies that are cutting edge on security software.

Q: What are your thoughts on the timing of the next recession?

A: Clearly the recession has been pushed back a year by the 2019 round of QE, and stock prices are getting so high now that even the Fed has to be concerned. Moreover, economic growth is slowing. In fact, the economy has been growing at a substantially slower rate since Trump became president, and 100% of all the economic growth we have now is borrowed. If the government were running a balanced budget now, our growth would be zero. So, certainly QE has pushed off the recession—whether it's a one-year event or a 2-year event, we’ll see. The answer, however, is that it will come out of nowhere and hit you when you least expect it, as recessions tend to do.

Q: Would you buy gold (GLD) rather than staying in cash?

A: I would buy some gold here, and I would do deep in the money call spreads like I have been doing. I’ve been running the numbers every day waiting for a good entry point. We’re now at a sort of in between point here on call spreads because it’s 7 days to the next February expiration and about 27 days to the March one after that, so it's not a good entry point this week. Next week will look more interesting because you’ll start getting accelerated time decay for March working for you.

Q: When are you going to have lunch in Texas or Oklahoma?

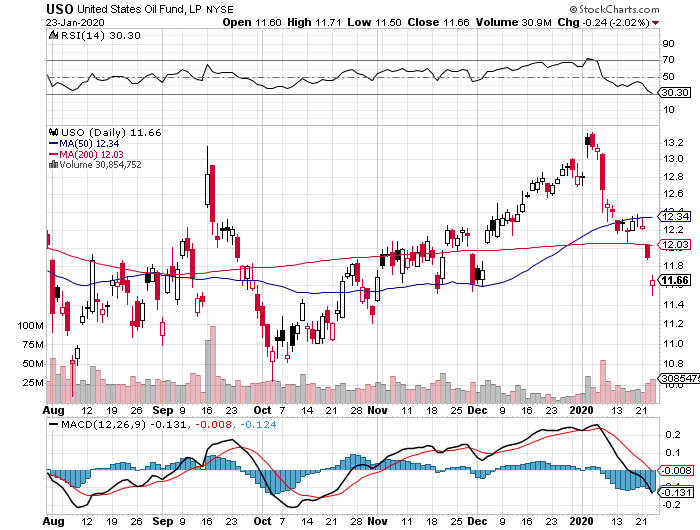

A: Nothing planned currently. Because of my long-term energy views (USO), I have to bring a bodyguard whenever I visit these states. Or I hold the events at a Marine Corps Club, which is the same thing.

Q: Would you use the dip here to buy Lyft (LYFT)? It’s down 10%.

A: No, it’s a horrible business. It’s one of those companies masquerading as a tech stock but it isn’t. They’re dependent on ultra-low wages for the drivers who are essentially netting $5 an hour driving after they cover all their car costs. Moreover, treating them as part-time temporary workers has just been made illegal in California, so it’s very bad news for the stocks—stay away from (LYFT) and (UBER) too.

Q: Is the Fed going to cut interest rates based on the coronavirus?

A: No, interest rates are low enough—too low given the rising levels of the stock market. Even at the current rate, low-interest rates are creating a bubble which will come back to bite us one day.

Q: Household debt exceeded $14 trillion for the first time—is this a warning sign?

A: It is absolutely a warning sign because it means the consumer is closer to running out of money. Consumers make up 70% of the economy, so when 70% of the economy runs out of money, it leads to a certain recession. We saw it happen in ‘08 and we’ll see it happen again.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

February 5, 2020

Fiat Lux

Featured Trade:

(A NOTE ON OPTIONS CALLED AWAY),

(MSFT), (TLT), (BA), (GOOGL), (SPY)

Global Market Comments

January 24, 2020

Fiat Lux

Featured Trade:

(LAST CHANCE TO ATTEND THE FRIDAY, FEBRUARY 7 PERTH, AUSTRALIA STRATEGY LUNCHEON)

(JANUARY 22 BIWEEKLY STRATEGY WEBINAR Q&A),

(BA), (IBM), (DAL), (RCL), (WFC),

(JPM), (USO), (UNG), (KOL), (XLF),

(SEE YOU IN TWO WEEKS)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader January 22 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Are you concerned about a kitchen sink earnings report on Boeing (BA) next week?

A: No, every DAY has been a kitchen sink for Boeing for the past year! Everyone is expecting the worst, and I think we’re probably going to try to hold around the $300 level. You can’t imagine a company with more bad news than Boeing and it's actually acting as a serious drag on the entire economy since Boeing accounts for about 3% of US GDP. If (BA) doesn’t break $300, you should buy it with both hands as all the bad news will be priced in. That's why I am long Boeing.

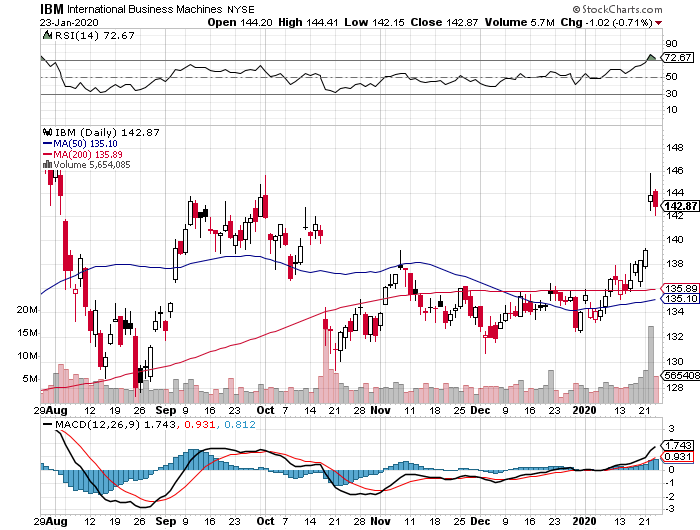

Q: Do you think IBM is turning around with its latest earnings report?

A: They may be—They could have finally figured out the cloud, which they are only 20 years late getting into. They’ve been a lagging technology stock for years. If they can figure out the cloud, then they may have a future. They obviously poured a lot into AI but have been unable to make any money off of it. Lots of PR but no profits. People are looking for cheap stuff with the market this high and (IBM) certainly qualifies.

Q: Will the travel stocks like airlines and cruise companies get hurt by the coronavirus?

A: Absolutely, yes; and you’re seeing some pretty terrible stock performance in these companies, like Delta (DAL), the cruise companies like Royal Caribbean Cruises (RCL), and the transports, which have all suffered major hits.

Q: Will the Wells Fargo (WFC) shares ever rebound? They are the cheapest of the major banks.

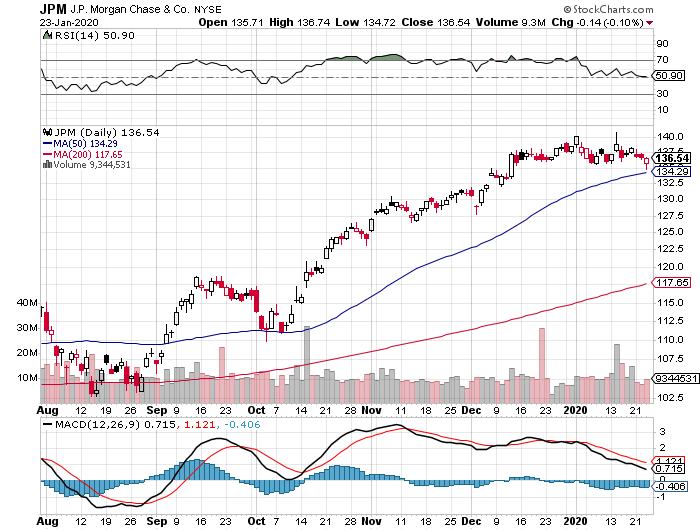

A: Someday, but they still have major management problems to deal with, and it seems like they’re getting $100 million fines every other month. I would stay away. There are better fish to fry, even in this sector, like JP Morgan (JPM).

Q: Will a decrease in foreign direct investment hurt global growth this year?

A: For sure. The total CEO loss of confidence in the economy triggered by the trade war brought capital investment worldwide to a complete halt last year. That will likely continue this year and will keep economic growth slow. We’re right around a 2% level right now and will probably see lower this quarter once we get the next set of numbers. To see the stock market rise in the face of falling capital spending is nothing short of amazing.

Q: Do you think regulation is getting too cumbersome for corporations?

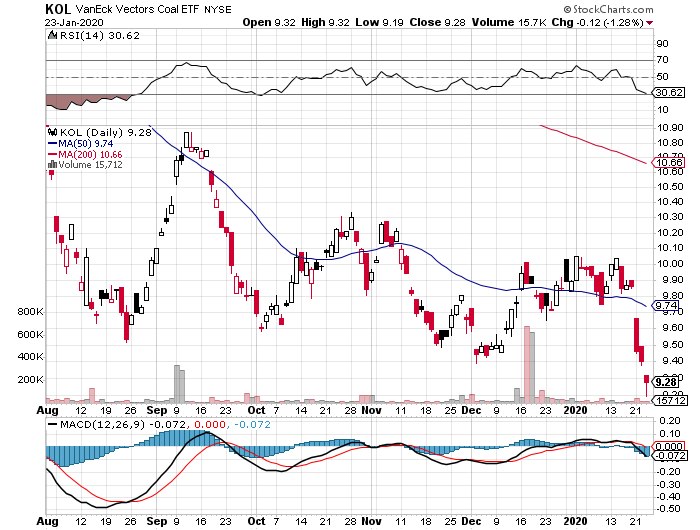

A: No, regulation is at a 20-year low for corporations, especially if you’re an oil (USO), gas (UNG) or coal producer (KOL), or in the financial industry (XLF). That’s one of the reasons that these stocks are rising as quickly as they have been. What follows a huge round of deregulation? A financial crisis, a crashing stock market, and a huge number of bankruptcies.

Global Market Comments

January 10, 2020

Fiat Lux

Featured Trade:

(FRIDAY, FEBRUARY 7 PERTH, AUSTRALIA STRATEGY LUNCHEON)

(JANUARY 8 BIWEEKLY STRATEGY WEBINAR Q&A),

(VIX), (VXX), (TSLA), (SIL), (SLV),

(WPM), (RTN), (NOC), (LMT), (BA), (EEM)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.