As the biotechnology world is ever-evolving, with several companies going public every few months, let me share some of the most promising names that recently emerged.

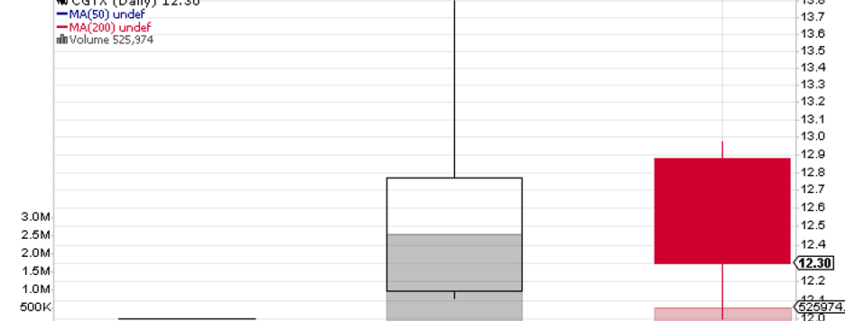

The first is Cognition Therapeutics (CGTX), a company working on treatments for Alzheimer’s disease and macular degeneration.

Its most promising candidate is an Alzheimer’s treatment called CT1812, which is currently under Phase 2 trials. Looking at the timeline, CGTX expects to release topline data by 2023.

With the expected growth of the aging population, focusing on treating various forms of Alzheimer’s is a promising direction for Cognition Therapeutics.

In fact, the global market for this neurodegenerative disease is projected to grow from $2.9 billion in 2018 to a whopping $10.5 billion by 2025.

So far, the major competitors of Cognition Therapeutics in this area include Biogen (BIIB), Eli Lilly (LLY), AbbVie (ABBV), Novartis (NVS), and Takeda (TAK).

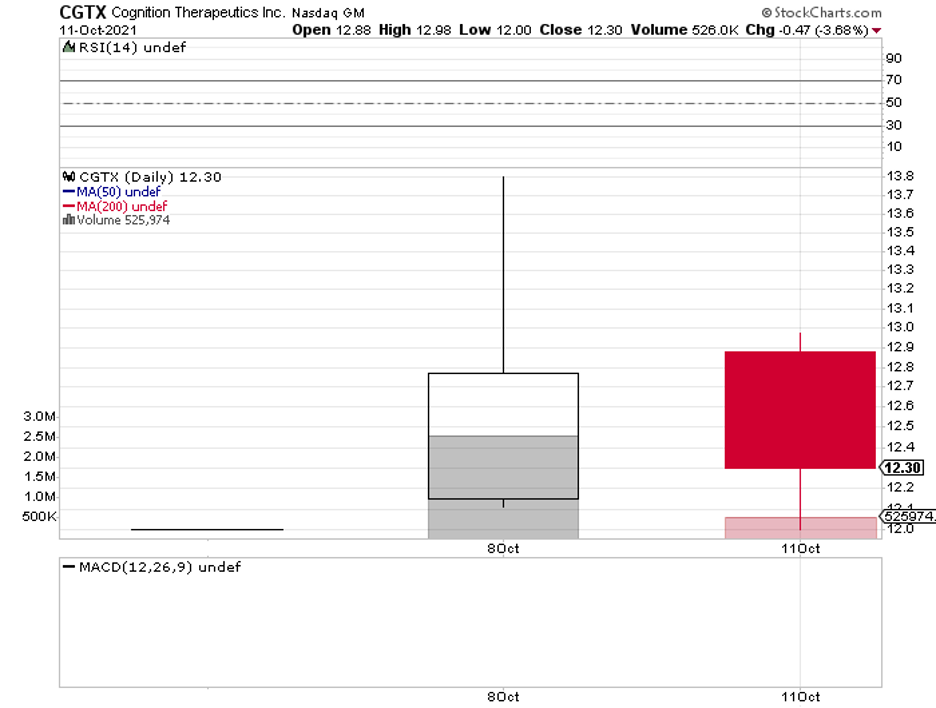

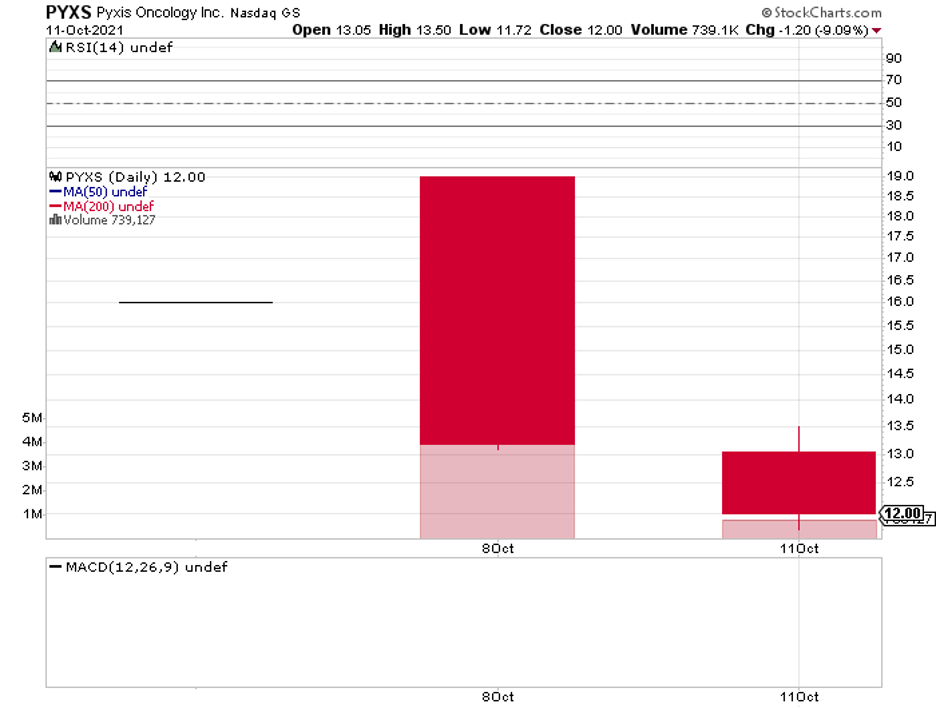

The second promising biotech company is Pyxis Oncology (PYXS), which is a spinoff from Pfizer (PFE).

Pyxis is focused on developing next-generation treatments targeting difficult-to-treat types of cancer.

Basically, the company’s goal is to create therapies that can directly kill tumor cells. It also wants to get rid of the underlying problems that lead to the uncontrollable spread of tumors and the weakening of the immune system.

To do this, Pyxis has come up with novel antibody drug conjugate (ACT) candidates and other monoclonal antibody (mAb) pipelines.

Its lead candidate is called ADC PYX-201, a potential treatment for non-small cell lung cancer and breast cancer.

The goal of ADC PYX-201 is to target actively multiplying tumors while boosting the immune response of the patient’s body. Pyxis plans to submit it as a non-small cell lung cancer treatment candidate by mid-2022.

If approved, then ADC PYX-201 will be under patent protection until 2037.

This holds great potential for Pyxis’ cashflow, as the market for non-small cell lung cancer worldwide is anticipated to rise from $6.2 billion in 2016 to over $12 billion by 2025.

With this potential of ADC treatments, Pyxis can expect competition from the likes of AstraZeneca (AZN), Gilead Sciences (GILD), GlaxoSmithKline (GSK), and ImmunoGen (IMGN).

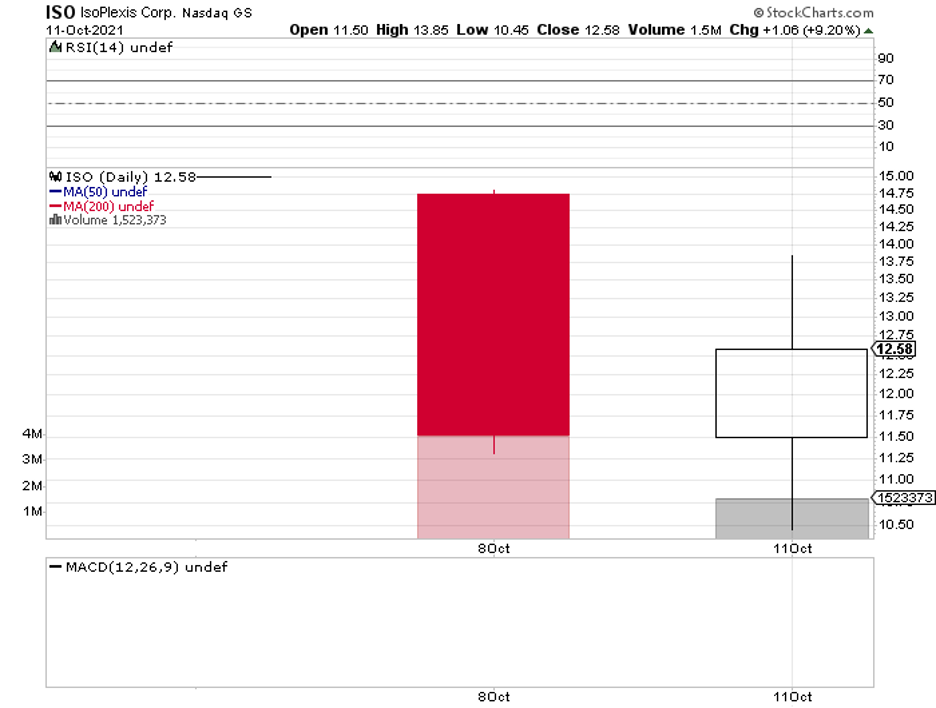

The last name on today’s list is IsoPlexis Corporation (ISO).

This company is the first to focus on dynamic proteomics and single-cell biology in an effort to develop “walk-away automation” products that aid in shortening the therapeutic development timelines by acquiring “multiplexed proteomics with very low sample volumes that reflect in vivo biology to clarify lead candidates.”

In layman’s terms, IsoPlexis is working on a technology that aims to identify every protein in the body to speed up the development of new therapies for rare diseases.

This is a lucrative business, with IsoPlexis targeting at least $34 billion in the total addressable market.

Considering that IsoPlexis is a pioneer in this field, it is possible for it to gain the lion’s share of the segment and position itself as an undisputed leader for years.

More importantly, IsoPlexis can use its patented technology, “Proteomic Barcoded,” to expand the use cases to cover other lucrative markets.

For example, IsoPlexis can apply its technology to cancer immunology and targeted oncology by predicting the progression of cancer cells in the body.

Adding cell therapies to the company’s pipeline is also a very realistic possibility since its technology can be utilized to create CAR-T cell therapies as well.

In fact, IsoPlexis’ approach is already being used in developing treatments for leukemia and melanoma.

Another profitable avenue for IsoPlexis’ technology is the vaccines sector.

Since the development of vaccines requires profiling the responses of the respiratory and immune systems, the company’s data would accelerate the entire process.

So far, the major rivals of IsoPlexis in this space include Thermo Fisher Scientific (TMO) and Bio Rad Laboratories (BIO).

While all these biotech companies offer promising products and technologies, they’re all still in the early stages of development.

This makes them high-risk investments and are likely suitable for those who are willing to invest in the long term.

For those who want to see movement faster and sooner, it might be best to watch these stocks from the sidelines.