Modern tech has an unseen dark side to it.

Coders relish the opaqueness surrounding the industry infatuated with developing the next big thing to take Silicon Valley by storm.

There is nothing opaque about the Mad Hedge Technology Letter.

I grind out recommendations and you follow them. Period. End of story.

To put it mildly, the letter has gotten off to a flying start since its inception in February 2018, and there is no looking back, only looking forward.

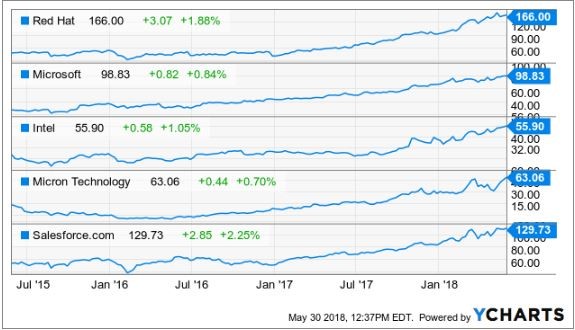

Micron (MU), Red Hat (RHT), Microsoft (MSFT), and Intel (INTC), just to name a few, have been solid recommendations standing up to all the nonsense and mayhem permeating throughout the periodically irrational markets.

Have you noticed lately when you open up the morning paper while sipping on a steaming mug of Blue Bottle Coffee, that almost every story is about technology?

It's not a mistake. I swear.

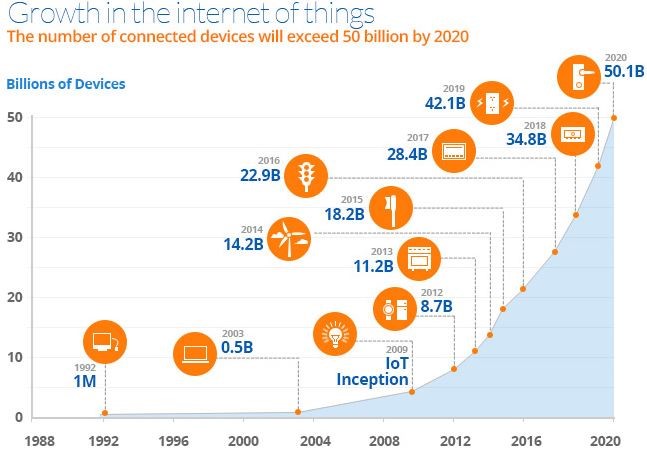

Technology is permeating into the nooks and crannies of our society and the leaders of this movement are laughing all the way to the bank.

One of those aforementioned pioneers is no other than local lad, Salesforce CEO and perennial Facebook basher Marc Benioff.

I recommended Salesforce at $110 and it was one of the first positions in the Mad Hedge Technology portfolio.

You can't blame me.

I saw this stock pick from a million miles away and I will explain why.

Salesforce set ambitious targets that nobody thought were realistic at the time.

How high in the sky does Benioff want to build his castles?

By 2022, Marc Benioff set out sales targets of a colossal $20 billion per year.

Then Benioff gushed that Salesforce would pass the $40 billion mark, done and dusted by 2028 and $60 billion by 2034.

Remember that tech CEOs are incentivized to forecast ludicrous sales targets because it lures in the unknowledgeable investor.

Unknowledgeable or pure genius, it does not matter, Salesforce is an emphatic buy.

Salesforce is the ultimate growth stock.

In 2016, annual revenue came in at $6.67 billion, which is about the same size as a middle level semiconductor company.

They followed that up with $8.38 billion in 2017, demonstrating the parabolic shaped trajectory of the company.

At the end of fiscal year 2017, Salesforce announced that it expects revenue of around $12.60 billion in 2019.

The latest earnings report, Benioff disclosed full year guidance of $13.13 billion.

This puts Salesforce in the running to achieve its lofty aspirations.

Apparently, the castles Benioff is building aren't in the sky after all.

Theoretically, if Benioff expands the business into a $16 billion to $16.5 billion business by 2019, Salesforce will have a more than likely chance to pass the $20 billion mark by the end of 2020, a full two years than initially thought.

Salesforce will have ample wiggle room on the way to $20 billion if it is 2022 for which it aims.

Why am I rambling on about revenue?

It's the only metric that Salesforce investors value.

The company registered two straight years of less than $200 million in profits then followed it up with a less than stellar 2016 where it lost almost $50 million.

Don't expect any dividends from this neck of the woods anytime soon especially after acquiring MuleSoft, an integration software company, for $6.5 billion last quarter.

This purchase will add another $315 million of annual revenue to Salesforce's quest of eclipsing its future sales targets. This was after MuleSoft made $296.5 million in 2017 before it became a part of Marc Benioff's stable.

Benioff has proved a shrewd dealmaker, taking advantage of cheap capital to add suitable parts to his business.

Since 2016, Benioff has snapped more than 50 niche software companies that he rebrands as Salesforce products and sells them as add-on products.

This is further evidence that any funds available will be allocated toward reinvestment into products and services deeming any future dividend inconceivable, especially with the elevated revenue targets to surpass.

As for the business. Do we still need to talk about it?

Rip-roaring growth was seen across the board with total revenue increasing 25%.

Investors should stay away from any cloud company that is growing less than 20%.

Market intelligence firm International Data Corporation (IDC) voted Salesforce as the No. 1 client relationship management (CRM) platform for the fifth consecutive year.

It is the industry leader in sales, marketing, service, and increased market share in 2017, more than its closest competitors.

Larry Ellison must be tearing his hair out as Oracle's (ORCL) share price has been excommunicated to purgatory indefinitely.

Oracle is a company that I have been pounding on the tables to stay away from.

The Mad Hedge Technology Letter seldom recommends legacy companies that are still legacy companies.

Driving past his former estate, emanating from a sparkling perch in Incline Village overlooking Lake Tahoe, my neighbor gives me the goose bumps.

The property was later sold for $20.35 million. All told, Larry has around $100 million invested in real estate dotted around Incline Village. I sarcastically mentioned to him last time we bumped into each other to call me immediately when his $90 million estate in Kyoto, Japan, hits the market.

Oracle's position in the pecking order is a telltale sign of the inability to land the creme de la creme government contracts that ostensibly fall into Amazon (AMZN), Alphabet (GOOGL), and Microsoft's lap.

And it's not surprising that Larry is spending more time tending to his vast array of glittering luxury properties around the world rather than running Oracle.

Oracle is like a deer caught in the headlights and Marc Benioff is at the wheel.

On the Forbes 500 rankings, Salesforce has moved up almost 200 spots.

This position will rise as Salesforce is under contract booking a further $20.4 billion of commitments driven by its subscription services offering cloud products.

On the domestic contract front, it was much of the same for Salesforce, which inked premium deals with the U.S. Department of Agriculture, Kering, and sports apparel giant Adidas.

International companies such as Philips and Santander UK are expanding their relationships with Salesforce. A firm nod of approval.

Salesforce has been voted in the top three of most innovative companies for the past eight years by reputable Forbes magazine. The list was started in 2011, and it has never dropped out of the top three.

The gobs of innovation are the main logic behind the top five financial institutions expanding their relationship with Salesforce by an extra 70%.

Once companies start using the CRM platform, they become mesmerized with the premium add-ons that help companies run more efficiently.

Benioff has been a huge proponent of artificial intelligence (A.I.) and is an outsized catalyst to product enhancement gains.

Salesforce has taken Einstein, it's A.I. platform, and allowed all the applications to run through it.

The integration of Einstein has resulted in more than 2 billion correct predictions per day paying homage to the quality of A.I. engineering on display.

Instead of hiring a whole team of in-house data scientists, Salesforce is A.I. functionality by the bucket full and it is easy to use on its platform.

In some cases, incorporating Salesforce's A.I. into the business has bolstered other companies' top line by 15%.

Often, Salesforce's A.I. tools are declarative meaning the technology can identify solutions without a fixed formula.

Benioff has choreographed his strategy perfectly.

He is betting the ranch on unlocking data from legacy companies that migrate to his platform.

MuleSoft will help in this process of extracting value, then A.I. will supercharge the data, which is being unlocked.

What does this mean for Salesforce?

Higher revenue and more clients leading to accelerated growth. The share price has powered on north of $130, and after I recommended it at $110, I am convinced this stock will surge higher.

Salesforce is an absolute no-brainer buy on the dip.

Growth Means Shiny New Office Buildings

_________________________________________________________________________________________________

Quote of the Day

"If we become leaders in Artificial Intelligence, we will share this know-how with the entire world, the same way we share our nuclear technologies today." - said current President of Russia, Vladimir Vladimirovich Putin.